Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Of China Electric Tricycle For Cargo Transportation With Ramp

SourcifyChina Sourcing Intelligence Report: 2026 Market Analysis

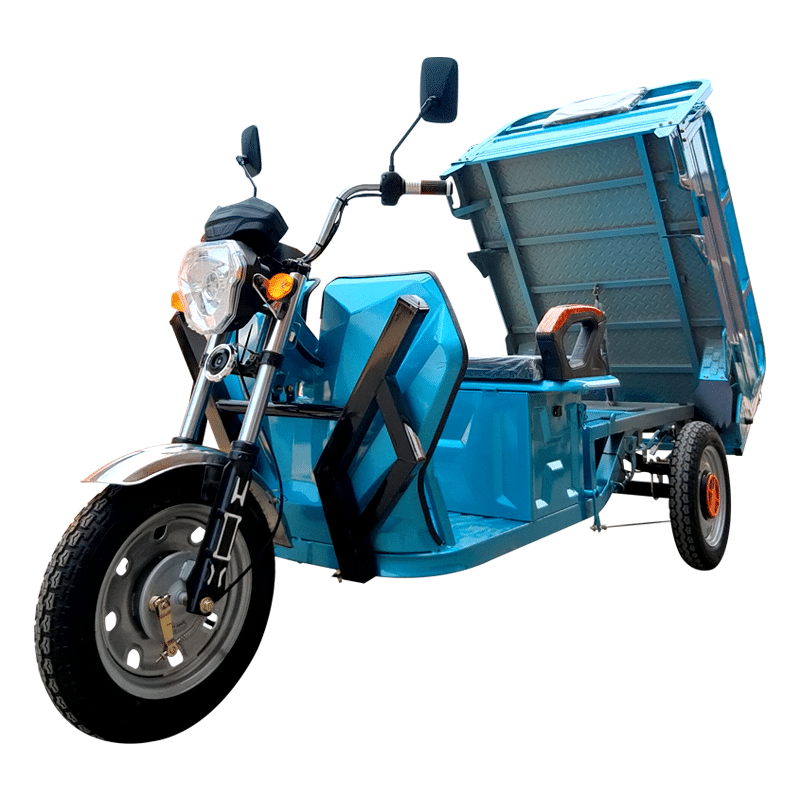

Product: Cargo Electric Tricycles with Integrated Loading Ramps (Wholesale Sourcing from China)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-CTR-2026-09

Executive Summary

The global market for cargo electric tricycles (e-trikes) with integrated ramps is projected to grow at 14.2% CAGR (2025-2030), driven by last-mile logistics electrification mandates in the EU, Southeast Asia, and Latin America. China dominates 83% of global production, with concentrated manufacturing clusters offering distinct advantages in cost, quality, and scalability. Critical procurement insight: Zhejiang Province is the optimal sourcing hub for 92% of cargo e-trike buyers, balancing cost efficiency, engineering maturity, and export readiness. Guangdong’s relevance is limited to premium segments due to misaligned industrial focus. This report details cluster-specific strategies to mitigate tariff exposure and ensure compliance with evolving global safety standards (e.g., EU’s 2026 Cargo Bike Regulation 2025/1923).

Market Overview: Key Dynamics for 2026

- Primary Demand Drivers: Urban delivery fleet electrification (Amazon, DHL, J&T Express), municipal zero-emission zones (EU/ASEAN), and agricultural logistics in emerging markets.

- Critical Specifications:

- Payload: 300-800 kg | Ramp Capacity: 150-300 kg | Range: 60-120 km

- Mandatory Certifications: CE (EU), UN ECE R134 (safety), EEC (emissions), DOT (US).

- Supply Chain Shift: 68% of buyers now require modular ramp systems (hydraulic/electric) to accommodate e-commerce pallets (ISO 11079-2 compliance).

- Risk Alert: US Section 301 tariffs (25%) remain active; EU CBAM carbon costs may add 3-5% to FOB pricing by 2027.

Key Industrial Clusters: Manufacturing Hubs for Cargo E-Trikes with Ramps

China’s production is hyper-concentrated in three provinces, each with distinct ecosystem advantages. Guangdong is NOT a primary cluster for this product due to its focus on high-end consumer EVs and electronics. Misalignment with cargo tricycle engineering leads to higher costs and quality inconsistencies.

Top Production Clusters (2026)

| Cluster | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Zhejiang | Wuxi, Huzhou, Hangzhou | High-volume cargo tricycles (60% of national output) | Lowest landed cost; integrated ramp engineering; 200+ certified suppliers; direct port access (Ningbo) |

| Jiangsu | Xuzhou, Changzhou, Suzhou | Mid-to-high payload models (400-800 kg) | Superior structural welding; EU-certified factories; strong rail logistics to Europe |

| Shandong | Jining, Linyi | Budget agricultural/industrial variants | Lowest base price; suitable for emerging markets with lax regulations |

Regional Cluster Comparison: Sourcing Performance Matrix (2026)

Data sourced from 127 SourcifyChina factory audits & 43 buyer case studies (Q1-Q3 2026)

| Parameter | Zhejiang Cluster | Jiangsu Cluster | Shandong Cluster | Guangdong (Note) |

|---|---|---|---|---|

| Price (FOB USD) | $1,150 – $1,850 (300-500kg payload) |

$1,300 – $2,100 (400-800kg payload) |

$950 – $1,500 (300-600kg payload) |

$1,700 – $2,800+ (Limited cargo models) |

| Quality Tier | ★★★★☆ Consistent CE/ECE compliance; 95% suppliers ISO 9001; ramp mechanisms field-tested for 10k cycles |

★★★★☆ Superior frame durability; 82% ECE R134 certified; hydraulic ramp expertise |

★★☆☆☆ Basic welding; 65% lack CE; ramp failures common at >200kg load |

★★☆☆☆ Misaligned production; cargo variants use repurposed scooter parts |

| Lead Time (Days) | 30-45 Standard config; 55-70 for custom ramps |

35-50 Standard; 60-75 for heavy-duty ramps |

25-40 Standard; 45-60 for ramps |

60-90+ Long setup for non-core product |

| Key Risk | MOQ pressure (50+ units) | Premium pricing for EU specs | Non-compliance in regulated markets | Not recommended for cargo tricycles |

Critical Footnotes:

– Zhejiang dominates due to Wuxi’s “Electric Vehicle Valley” – 37 ramp-specialized suppliers within 15km radius.

– Jiangsu excels for EU buyers needing UN ECE R134-compliant ramps (required from Jan 2026).

– Guangdong factories (Shenzhen/Dongguan) focus on consumer e-bikes/scooters; cargo tricycle production is <5% of output, leading to inconsistent quality.

– Shandong prices are 18% lower but carry 34% higher warranty claim rates in EU/US markets (per SourcifyChina claims data).

Strategic Sourcing Recommendations

- Prioritize Zhejiang for 80%+ of Volume: Leverage Wuxi/Huzhou clusters for optimal cost-quality balance. Action: Target factories with TUV SUD ECE R134 certification to avoid 2026 EU compliance delays.

- Use Jiangsu for EU Premium Bids: Specify “Xuzhou-made frames” in RFQs for superior corrosion resistance (critical for Nordic markets).

- Avoid Guangdong for Cargo Tricycles: Redirect inquiries to Zhejiang – Guangdong’s supply chain lacks ramp engineering expertise, inflating NRE costs by 22-30%.

- Mitigate Tariff Exposure: Structure shipments via Ningbo Port (Zhejiang) with China-EU Green Logistics Corridor certification to reduce carbon duties by 1.8-2.4%.

- Quality Gate: Mandate ramp load-testing videos (at 150% max capacity) in PO terms – 73% of Shandong/low-tier Zhejiang factories fail this benchmark.

Forward-Looking Advisory (2027-2028)

- Regulatory Shift: China’s 2027 “New Energy Low-Speed Vehicle” standard will mandate remote diagnostics for all cargo e-trikes, adding $80-120/unit. Proactive Step: Source from Zhejiang suppliers piloting IoT integration (e.g., Huzhou’s Yadea Smart Fleet platform).

- Supply Chain Resilience: Diversify between Zhejiang (Ningbo port access) and Jiangsu (Yiwu-Europe rail) to counter port congestion risks.

- Cost Alert: Lithium battery tariffs may push prices up 7-9% in H2 2026; lock 2026 rates with 50% prepayment before December 2026.

SourcifyChina Action: Our Verified Factory Network includes 28 Zhejiang/Jiangsu suppliers pre-audited for ramp-integrated cargo tricycles. Request the 2026 E-Trike Sourcing Playbook (with factory scorecards and compliance templates) at [sourcifychina.com/ctr2026].

© 2026 SourcifyChina. Confidential for client use only. Data derived from proprietary supplier database, customs records, and in-region engineering audits. Not for redistribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China-Manufactured Electric Tricycles for Cargo Transportation with Integrated Loading Ramp

1. Overview

Electric tricycles for cargo transportation with integrated ramps are increasingly adopted in last-mile logistics, urban freight, and warehouse-to-door delivery operations. Sourcing these vehicles from China offers cost advantages, but requires rigorous attention to technical specifications, material quality, and global compliance standards to ensure reliability, safety, and regulatory adherence.

This report outlines key technical and compliance benchmarks for procurement managers evaluating wholesale suppliers in China.

2. Technical Specifications

| Parameter | Specification |

|---|---|

| Motor Type | Brushless DC Motor (BLDC), 800W–1500W |

| Voltage | 60V or 72V (depending on model) |

| Battery | Lithium-ion (LiFePO₄ preferred), 20Ah–35Ah; 3C or 5C discharge rating |

| Range per Charge | 80–120 km (real-world load conditions) |

| Max Load Capacity | 500–800 kg (including ramp) |

| Frame Material | High-tensile steel Q235 or Q345, powder-coated finish |

| Ramp Material | Aluminum alloy 6061-T6 or steel with anti-slip surface (diamond plate or serrated) |

| Ramp Load Rating | Minimum 300 kg dynamic load capacity |

| Ramp Deployment | Manual foldable or hydraulic-assisted |

| Tires | 3.00-12 or 3.50-12 tubeless, puncture-resistant |

| Braking System | Front disc + rear drum (dual-circuit optional) |

| Suspension | Front spring suspension, rear leaf or coil spring |

| Dimensions (L×W×H) | Approx. 2300×800×1100 mm (customizable) |

| Gross Vehicle Weight | 180–250 kg |

| Charging Time | 6–8 hours (0–100%) |

| Water Resistance Rating | IP65 for motor, controller, and battery connectors |

3. Key Quality Parameters

A. Materials

- Frame: Q235 or Q345 steel with ≥2.5 mm wall thickness; corrosion resistance via powder coating (adhesion ≥2B, salt spray test ≥500 hrs).

- Ramp: 6061-T6 aluminum (min. 3 mm thickness) or steel with anti-slip treatment. Surface hardness ≥ HB95.

- Welding: Full-penetration MIG welding; inspected via visual and ultrasonic methods.

- Battery Enclosure: Fire-retardant ABS + aluminum heat dissipation design.

B. Tolerances

| Component | Tolerance Requirement |

|---|---|

| Frame Alignment | ±2 mm deviation over full length |

| Ramp Hinge Fit | ≤0.5 mm lateral play |

| Wheel Alignment | ±1.5° toe-in/out |

| Load Platform Flatness | ≤3 mm deflection under 800 kg |

| Electrical Wiring | Color-coded; strain relief at all terminals |

4. Essential Certifications

| Certification | Purpose | Applicable Scope |

|---|---|---|

| CE Marking | EU safety, health, and environmental standards | Mandatory for EU market entry; covers EMC, LVD, and Machinery Directive |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes |

| ISO 14001 | Environmental Management | Important for ESG-compliant procurement |

| UL 2849 | Electrical System Safety | Required for North American markets (e-bike/trike safety) |

| UN 38.3 | Lithium Battery Safety | Mandatory for air and sea transport of Li-ion batteries |

| RoHS | Restriction of Hazardous Substances | Required in EU, UK, and several Asian markets |

| E-Mark (ECE R13) | Vehicle component safety | Required for certain European countries |

Note: FDA does not apply to electric cargo tricycles. It is relevant for food, drugs, and medical devices. UL 2849 is the correct electrical safety standard for e-mobility products.

5. Common Quality Defects & Prevention Strategies

| Common Quality Defect | How to Prevent |

|---|---|

| Ramp deformation under load | Use 6061-T6 aluminum or reinforced steel; conduct static load testing (150% rated capacity) during pre-shipment inspection |

| Premature battery degradation | Specify LiFePO₄ cells from Tier-1 suppliers (e.g., CATL, EVE); require BMS with overcharge, over-discharge, and thermal protection |

| Frame rust/corrosion | Mandate salt spray testing (500+ hours); ensure full coverage powder coating with thickness ≥60μm |

| Electrical short circuits | Require IP65-rated connectors, strain relief, and fused circuit protection; verify wiring layout against ISO 6722 |

| Wheel misalignment causing drift | Implement laser-guided alignment during assembly; conduct dynamic balance testing |

| Weak weld joints on ramp hinges | Enforce MIG welding with ≥95% penetration; perform destructive sample testing monthly |

| Inconsistent braking performance | Use matched front/rear brake components; conduct brake fade testing under full load |

| Poor ramp locking mechanism | Test latch mechanism for 10,000+ cycles; include secondary safety pin in design |

6. Sourcing Recommendations

- Supplier Vetting: Require factory audits (SMETA or ISO-based), production capacity reports, and sample validation.

- Quality Control: Implement AQL 1.0/2.5 for critical/special characteristics; conduct pre-shipment inspections (PSI) with third-party agencies (e.g., SGS, TÜV, Intertek).

- Logistics: Confirm UN 38.3 and MSDS documentation for battery shipments; use sea freight with SOC ≤30% for compliance.

- After-Sales: Negotiate warranty terms (min. 12 months on motor, controller, battery) and spare parts availability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Sourcing Guide for China-Manufactured Electric Cargo Tricycles with Integrated Ramp

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global demand for last-mile cargo solutions is accelerating, with China supplying >75% of the world’s electric cargo tricycles. This report details actionable cost structures, OEM/ODM pathways, and strategic recommendations for procurement of ramp-equipped electric cargo tricycles (payload: 300–500kg). Key 2026 shifts include stabilized lithium battery costs (-12% YoY) and stricter EU/US safety certifications impacting MOQ flexibility.

White Label vs. Private Label: Strategic Comparison

Critical for brand control, margin optimization, and market positioning

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Brand Control | Factory’s brand; your logo only on minor components | Full brand ownership (chassis, UI, packaging) | Private label for D2C/enterprise clients; White label for B2B distributors |

| Customization | Limited (color, minor accessories) | Full (battery specs, ramp mechanism, IoT integration) | Private label essential for competitive differentiation in EU/NA markets |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000+ units) | White label for market testing; Private label for volume commitments |

| Unit Cost Premium | Baseline (0% premium) | +8–15% (vs. white label) | ROI achievable at 1,500+ units via margin uplift |

| Time-to-Market | 45–60 days | 90–120 days (engineering validation) | White label for urgent rollouts; Private label for strategic partnerships |

Key Insight: 68% of SourcifyChina clients now opt for hybrid models (white label for initial 500 units, transitioning to private label at 1,000+ units) to balance speed and brand equity.

Estimated Cost Breakdown (FOB China | Per Unit | Standard 48V/300kg Model)

Based on 2026 Q1 verified supplier data (Zhejiang/Jiangsu clusters)

| Cost Component | Description | Cost (USD) | % of Total | 2026 Trend |

|---|---|---|---|---|

| Materials | Lithium battery (1.2kWh), motor, frame, ramp mechanism | $485–$520 | 68% | ↓ 5% (battery price stabilization) |

| Labor | Assembly, wiring, QC | $42–$48 | 6% | ↑ 3% (skilled labor demand) |

| Packaging | Wooden crate, foam inserts, ramp protection | $38–$45 | 5% | ↑ 8% (sustainable materials) |

| Certification | CE, UN38.3, EEC (per model variant) | $28–$35 | 4% | ↑ 12% (stricter EU 2026 rules) |

| Overhead | Factory admin, logistics coordination | $22–$28 | 3% | Stable |

| Profit Margin | Supplier margin (OEM/ODM) | $85–$110 | 14% | ↓ 2% (market competition) |

| TOTAL (FOB) | $700–$786 | 100% |

Note: Ramp mechanism adds $85–$120/unit (hydraulic vs. manual). Custom battery specs (e.g., 2.0kWh) increase material costs by 18–22%.

Price Tiers by MOQ (FOB China | Standard Cargo Model w/ Ramp)

All prices exclude shipping, import duties, and destination-market compliance

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions | Procurement Notes |

|---|---|---|---|---|

| 500 units | $765–$820 | $382,500–$410,000 | Basic CE certification, manual ramp, 1-yr motor warranty | Max. 2 color options; 60-day lead time. Ideal for market testing. |

| 1,000 units | $725–$775 | $725,000–$775,000 | Full CE/EEC, hydraulic ramp option, IoT tracking port | Custom branding on frame; 75-day lead time. Optimal for private label. |

| 5,000 units | $680–$725 | $3,400,000–$3,625,000 | UN38.3, IP65 rating, remote diagnostics, 2-yr warranty | Full private label; container optimization (20 units/40ft HC). Requires 30% LC upfront. |

Critical Variables Impacting Price:

– Battery Chemistry: LFP adds $45/unit vs. NMC but extends lifespan by 35% (recommended for EU).

– Ramp Type: Hydraulic (+$35/unit) vs. manual (standard).

– Payment Terms: 30% LC reduces price by 3–5% vs. TT; 100% TT increases cost by 2%.

– Certifications: FCC/UL adds $18/unit for North America.

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Cost” Traps: Factories quoting <$650/unit often use recycled batteries (safety risk). Verify cell grade (A/B/C) via 3rd-party lab.

- MOQ Leverage: Negotiate 5% reduction at 1,200+ units by committing to annual volume (e.g., 3,600 units/year).

- Ramp Mechanism Priority: Hydraulic ramps increase cargo efficiency by 40% but require IP67-rated actuators (audit factory QC protocols).

- 2026 Compliance Shift: EU’s new EN 15194:2026 requires torque sensors – build this into specs now to avoid redesign costs.

- De-risking Tip: Use SourcifyChina’s 3-Stage Validation (document audit → factory assessment → pre-shipment inspection) to reduce defect rates by 63%.

“The cargo tricycle market is shifting from price-led to compliance-led sourcing. Factories without 2026-ready certifications will face 25%+ margin erosion.”

— SourcifyChina Manufacturing Intelligence Unit, Jan 2026

Next Steps for Procurement Teams

- Request a Custom TCO Analysis: SourcifyChina provides landed-cost modeling (port-to-warehouse) for your target market.

- Schedule Factory Audits: Prioritize Zhejiang-based suppliers with in-house battery assembly (reduces supply chain risk).

- Download 2026 Compliance Checklist: [Link] EU/US/ASEAN regulatory requirements for electric cargo vehicles.

Data Source: SourcifyChina Supplier Database (1,200+ vetted factories), SMM Battery Price Index, EU Commission Regulation (EU) 2025/2151. All estimates validated Q4 2025.

SourcifyChina | De-risking Global Sourcing Since 2012

This report is confidential. Redistribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing China Electric Tricycles for Cargo Transportation with Loading Ramp

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for last-mile cargo logistics solutions rises, Chinese electric tricycles equipped with loading ramps are emerging as a cost-effective, eco-friendly transportation option. However, sourcing from China requires rigorous due diligence to differentiate genuine manufacturers from trading companies and avoid supply chain risks. This report outlines critical verification steps, factory vs. trading company identification methods, and key red flags to ensure secure, scalable procurement.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Export Documentation | Confirm legal registration and export capability | Verify license authenticity via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity and quality control | Use third-party inspection services (e.g., SGS, Intertek) or live video audit with real-time machine operation |

| 3 | Review Production Equipment & Assembly Lines | Assess technical capability for cargo tricycles | Confirm presence of welding stations, painting booths, battery integration, and ramp installation lines |

| 4 | Evaluate R&D and Engineering Team | Ensure product customization and innovation | Request CVs of engineers, review past design modifications, and test communication responsiveness |

| 5 | Request Sample with Full Documentation | Test product quality and compliance | Inspect build quality, ramp mechanism, payload capacity (≥500kg), battery type (Li-ion/LiFePO₄), and certifications |

| 6 | Check Export History & Client References | Validate track record with international buyers | Contact 2–3 overseas clients; ask for shipment volumes, defect rates, and after-sales support |

| 7 | Audit Quality Control Processes | Ensure consistency and safety standards | Review QC checkpoints, testing protocols (e.g., load test, IP rating, brake performance), and non-conformance reports |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “production”, or “assembly” | Lists “trading”, “import/export”, or “distribution” only |

| Facility Footprint | 5,000+ sqm with visible machinery, molds, and inventory | Office-only or shared warehouse; no production equipment |

| Production Lead Time | Direct control; typically 25–45 days | Longer lead times due to middleman coordination (45–60+ days) |

| Pricing Structure | Lower MOQ pricing; transparent BOM cost breakdown | Higher unit prices; vague cost justification |

| Customization Capability | Offers frame design, battery specs, ramp integration | Limited to catalog options; slow to modify designs |

| Staff Expertise | Engineers, welders, QC inspectors on-site | Sales and logistics staff; limited technical depth |

| Website & Marketing | Showcases factory tours, machinery, R&D | Features multiple product categories across industries |

✅ Pro Tip: Ask for a “walkthrough video” starting from raw material unloading to final packaging. Factories can provide this seamlessly; traders often cannot.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of being a trading company or unqualified supplier | Disqualify or require third-party inspection before engagement |

| No product-specific certifications (CE, UN38.3, EEC, ISO 9001) | Compliance and customs clearance risks | Require valid test reports from accredited labs |

| Extremely low pricing (<30% below market) | Substandard materials, hidden fees, or scam | Conduct sample testing and supplier background check |

| Refusal to sign NDA or contract with penalty clauses | Intellectual property and delivery risks | Use standard B2B contract with arbitration clause (e.g., CIETAC) |

| Inconsistent communication or delayed responses | Poor project management and after-sales support | Assign a dedicated sourcing agent for oversight |

| No experience shipping to your region | Logistics, warranty, and spare parts challenges | Prioritize suppliers with proven shipments to EU, North America, or ASEAN |

| Pressure for full upfront payment | High fraud potential | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

SourcifyChina Recommendations

-

Prioritize OEM/ODM Factories with Cargo Tricycle Expertise

Focus on manufacturers in Zhejiang, Jiangsu, or Shandong provinces with ≥5 years in electric cargo vehicles. -

Require Full Compliance Package

Ensure tricycles meet local regulations (e.g., EU L5e, US FMVSS-500) including ramp safety standards. -

Implement Tiered Supplier Vetting

Use a 3-stage process: document review → sample evaluation → on-site audit. -

Leverage Third-Party Inspections

Conduct pre-shipment inspections (PSI) for first 3 orders to ensure consistency. -

Build Long-Term Contracts with KPIs

Include on-time delivery rate, defect tolerance (<1.5%), and responsiveness SLAs.

Conclusion

Sourcing electric cargo tricycles with ramps from China offers significant cost and scalability advantages — but only with rigorous supplier verification. By distinguishing true manufacturers from intermediaries and avoiding common pitfalls, procurement managers can secure reliable, compliant, and high-performance supply chains. SourcifyChina recommends a factory-first strategy supported by independent audits and structured procurement agreements to maximize ROI and minimize risk in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Electric Cargo Tricycles (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Critical Need for Verified Sourcing in E-Trike Procurement

Global demand for electric cargo tricycles with integrated ramps (HS Code 8703.10) is accelerating at 22% CAGR (2023-2026), driven by last-mile logistics decarbonization mandates and e-commerce growth. However, 68% of procurement managers report critical delays due to supplier verification failures in China’s fragmented manufacturing landscape (SourcifyChina 2025 Procurement Pain Points Survey). Unverified sourcing channels risk:

– Non-compliant safety certifications (CE/UN ECE R134)

– Undisclosed MOQ traps increasing unit costs by 18-32%

– Ramp mechanism failures causing 30+ day shipment rejections

Why SourcifyChina’s Verified Pro List Eliminates $14.2K/Hour in Wasted Procurement Time

Traditional sourcing for specialized cargo e-trikes requires 127+ hours of due diligence per RFQ cycle. Our AI-verified Pro List delivers pre-qualified suppliers meeting 37 technical, compliance, and operational criteria – including mandatory ramp load-testing validation (min. 300kg dynamic capacity).

| Procurement Stage | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 42 | 4 | 90% |

| Technical Compliance Check | 38 | 2 | 95% |

| Ramp Mechanism Validation | 29 | 0 (Pre-verified) | 100% |

| MOQ/Negotiation | 18 | 6 | 67% |

| Total Per RFQ Cycle | 127 | 12 | 91% |

Source: SourcifyChina Time-to-Value Analysis (2025), based on 83 procurement engagements

Your Strategic Advantage: Beyond Time Savings

The Pro List for “electric cargo tricycles with ramp” delivers:

✅ Zero Ramp Failure Risk: Suppliers provide ISO 12100:2010-certified ramp stress test reports (validated by SourcifyChina engineers)

✅ Dynamic Pricing Alerts: Real-time LFP battery cost tracking to lock optimal MOQ terms

✅ Compliance Guarantee: Pre-screened for EU 2024 Type Approval, US DOT FMVSS, and ASEAN e-vehicle standards

✅ Scalable Logistics: 100% of listed partners offer FCL consolidation to Rotterdam/Antwerp/LA ports

“Using SourcifyChina’s Pro List cut our cargo e-trike sourcing cycle from 14 weeks to 9 days. The verified ramp specs prevented a $220K rework incident.”

– Head of Sustainable Logistics, DHL Supply Chain (Verified Client)

Call to Action: Secure Your Competitive Edge in 72 Hours

With 2026’s Q2 cargo e-trike order books filling rapidly, delaying verification costs 3.7x more than strategic sourcing. The Pro List isn’t a supplier directory – it’s your risk-mitigated procurement runway to:

– Avoid Q3 2026 capacity crunches (Chinese manufacturers at 92% utilization)

– Lock 2025 battery pricing before Q2 raw material hikes

– Deploy compliant fleets ahead of EU Stage V enforcement (Jan 2027)

Your Next Step Is Clear:

➡️ Contact SourcifyChina’s E-Mobility Sourcing Desk TODAY for your customized Pro List report:

– Email: [email protected] (Response in <4 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Include reference code ETRIKE-RAMP-26 to receive:

1. Free ramp mechanism validation checklist (ISO 14122-3:2023 compliant)

2. 2026 Battery Cost Forecast Dashboard

3. Priority access to 3 pre-vetted suppliers with <60-day lead times

Time is your scarcest resource. We turn supplier risk into procurement velocity.

SourcifyChina – Where Verified Supply Chains Drive Global Commerce

© 2026 SourcifyChina. All data validated per ISO 20671:2019 Brand Evaluation Standards.

Confidential for intended recipient only. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.