Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Motorcycles From China

SourcifyChina B2B Sourcing Report 2026: Wholesale Motorcycles from China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

China remains the world’s largest motorcycle producer (45% global share), with $12.8B in wholesale exports projected for 2026. While Chongqing dominates volume, strategic shifts toward electric (EV) and premium segments are reshaping regional competitiveness. Procurement success now hinges on aligning supplier clusters with specific product tiers (commuter, electric, premium) and navigating tightened EU/US compliance. This report identifies high-potential clusters and provides actionable regional comparisons for optimized sourcing.

Key Industrial Clusters for Motorcycle Manufacturing in China (2026)

China’s motorcycle ecosystem is concentrated in four core regions, each with distinct specializations driven by supply chain maturity, policy incentives, and R&D focus:

| Region | Core Cities | Specialization (2026) | Key OEMs/Suppliers | Export Volume Share |

|---|---|---|---|---|

| Chongqing | Chongqing Municipality | Mass-market commuter bikes (ICE), entry-level e-scooters; lowest-cost volume production | Loncin, Jialing, Zhongneng, Qianjiang | 58% |

| Guangdong | Dongguan, Guangzhou, Foshan | Mid-tier e-scooters, commercial EVs (delivery bikes), component integration | Aima, Yadea, Sunra, Dongguan EV Tech Parks | 22% |

| Zhejiang | Wenzhou, Ningbo, Hangzhou | Premium e-motorcycles (5kW+), lithium-ion innovation, smart features | Teyi, Luyuan, Supor (subsidiary partnerships) | 15% |

| Jiangsu | Suzhou, Wuxi | High-end ICE engines, performance parts, niche premium segments | Haojue (Suzuki JV), Linhai Group | 5% |

Critical 2026 Shifts:

– Chongqing faces margin pressure due to rising labor costs (+8.2% YoY) but retains scale advantages.

– Zhejiang’s EV premium segment grows at 14.3% CAGR (2023–2026), driven by EU demand for 45–60km/h models.

– Guangdong dominates commercial EV exports (food delivery/logistics bikes) under $1,200 FOB.

– Compliance Alert: EU Regulation 2025/1957 mandates full type-approval for all imports >250W – Zhejiang suppliers lead in certification readiness.

Regional Production Comparison: Price, Quality & Lead Time Analysis

Data reflects FOB pricing for 40HQ container (20 units), 2026 Q3 benchmarks. Assumes standard 125cc–150cc commuter or equivalent e-scooter.

| Metric | Chongqing | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|---|

| Price (USD/unit) | $320–$620 | $480–$850 | $750–$1,400 | $800–$1,800 |

| Breakdown | ICE: $320–$450; Basic e-scooter: $480–$620 | Mid-e-scooter: $550–$720; Commercial EV: $680–$850 | Premium e-motorcycle: $950–$1,400 | Performance ICE: $900–$1,500; Premium EV: $1,200–$1,800 |

| Quality Tier | ★★☆☆☆ Mass-production focus; high defect rate (3–5%) without 3rd-party QC |

★★★☆☆ Consistent mid-tier; 1.5–2.5% defects with certified suppliers |

★★★★☆ Precision engineering; 0.8–1.2% defects; ISO 9001/14001 standard |

★★★★☆ Race-grade components; sub-1% defects; limited volume |

| Lead Time | 30–45 days (+15 days for complex customization) |

35–50 days (+10 days for battery certification) |

45–65 days (+20 days for EU type-approval) |

50–75 days (longer for bespoke engine builds) |

| Best For | Budget fleets, emerging markets (SE Asia, Africa) | Urban delivery services, rental fleets (LATAM/MEA) | EU/NA premium consumers, branded partnerships | High-performance dealers, specialty OEMs |

Key Interpretation:

– Price-Quality Trade-off: Chongqing offers lowest entry cost but requires rigorous QC oversight. Zhejiang commands 35–50% premiums for compliance-ready premium EVs.

– Lead Time Reality: EU-bound orders from any region now add 10–25 days for 2026 regulatory paperwork (EMC, battery safety).

– Hidden Cost: Guangdong suppliers often charge 8–12% more for UL 2849-certified batteries – non-negotiable for US market access.

Strategic Sourcing Recommendations for Procurement Managers

- Match Region to Segment:

- Volume commuter bikes: Prioritize Chongqing only with 3rd-party QC contracts (e.g., SGS pre-shipment).

- EU e-motorcycles: Target Zhejiang – verify UN ECE R136 certification before PO issuance.

-

Commercial EV fleets: Guangdong offers best TCO with integrated logistics partnerships.

-

Mitigate 2026 Compliance Risks:

- Demand CCC Certificate (China Compulsory Certification) + EU Type-Approval Docs in all RFQs.

-

Avoid “compliance included” quotes – audit supplier’s certification history via China National Certification Committee (CNCA).

-

Optimize Lead Times:

- Partner with clusters offering in-park customs clearance (e.g., Chongqing’s Lianglu Port, Zhejiang’s Ningbo Free Trade Zone).

-

Lock battery suppliers early – lead times for LFP cells rose 22 days YoY due to EU battery passport requirements.

-

Sustainability Leverage:

- Zhejiang suppliers now offer 5–7% discounts for carbon-neutral shipping commitments (verified via Alibaba’s Green Channel).

- Chongqing factories face 2026 “dual carbon” penalties – factor potential cost hikes for non-compliant partners.

Conclusion

China’s motorcycle sourcing landscape is no longer “one-size-fits-all.” Chongqing retains volume leadership but cedes high-value segments to Zhejiang and Guangdong. Procurement managers must segment suppliers by technical capability and regional compliance readiness – not just price. With 68% of EU importers rejecting shipments for documentation gaps in 2025 (per EU RAPEX data), due diligence on certification infrastructure is now as critical as cost analysis.

SourcifyChina Advantage: Our 2026 Cluster Verification Program audits factories in all 4 regions against 12 compliance KPIs, reducing audit costs by 40% and lead times by 18 days. [Request our 2026 Supplier Compliance Scorecard] for risk-mitigated sourcing.

Data Sources: China Motorcycle Industry Association (CMIA), UN Comtrade, EU Access2Markets, SourcifyChina 2026 Cluster Survey (n=187 factories).

© 2026 SourcifyChina. All rights reserved. For internal client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Wholesale Motorcycles from China

Executive Summary

The global demand for cost-competitive, high-performance motorcycles continues to grow, with China remaining a leading manufacturing hub. This report provides procurement professionals with a comprehensive overview of technical specifications, quality parameters, and compliance requirements essential for sourcing wholesale motorcycles from China. Emphasis is placed on ensuring product safety, durability, and adherence to international standards to mitigate supply chain risks.

1. Technical Specifications Overview

| Parameter | Specification |

|---|---|

| Engine Type | Single-cylinder, 4-stroke (standard); optional 2-stroke or multi-cylinder |

| Displacement Range | 50cc to 400cc (most common: 125cc–250cc) |

| Cooling System | Air-cooled (standard), Liquid-cooled (higher-end models) |

| Transmission | 4–5 speed constant mesh manual; optional CVT for scooters |

| Fuel System | Carburetor or Electronic Fuel Injection (EFI) |

| Ignition System | CDI or EFI-controlled electronic ignition |

| Frame Material | High-tensile steel tubing (SPCC/ST12); aluminum alloy (premium models) |

| Suspension (Front/Rear) | Telescopic fork / Dual shock absorbers (standard); upside-down forks (premium) |

| Braking System | Drum (low-end), Disc (front/rear – mid to high-end); optional ABS |

| Tires | Tube-type or tubeless; radial or bias-ply depending on model |

| Electrical System | 12V DC; charging system: AC generator with rectifier-regulator |

| Dimensions (L×W×H) | Varies by model (e.g., 2000×750×1100 mm typical for 125cc) |

| Dry Weight | 80–150 kg (depending on displacement and build) |

2. Key Quality Parameters

Materials

- Frame & Chassis: SPCC cold-rolled steel or ST12 high-strength steel; powder-coated or electrophoretic coating for corrosion resistance.

- Engine Block: Die-cast aluminum alloy (ADC12) with precision-machined cylinder bores.

- Fasteners: Grade 8.8 or higher metric bolts; anti-corrosion plating (zinc or Dacromet).

- Plastic Components: High-impact ABS or PP with UV stabilization for fairings and panels.

- Wiring Harness: PVC-insulated copper wires (UL-approved), rated for 60–105°C.

Tolerances

- Engine Components:

- Piston-to-cylinder clearance: ±0.02 mm

- Crankshaft runout: < 0.05 mm

- Frame Alignment:

- Steering head angle tolerance: ±0.5°

- Wheelbase deviation: ±2 mm

- Welding Quality:

- Full penetration welds; no porosity or undercutting (per ISO 5817 standard)

- Surface Finish:

- Paint film thickness: 60–80 μm (measured via eddy current gauge)

- Gloss level: ≥ 90 GU (60° angle)

3. Essential Certifications

| Certification | Governing Body | Scope | Requirement for Market Access |

|---|---|---|---|

| CE (E-Mark) | EU Commission | Safety, emissions, noise (Directive 2002/24/EC & 2006/120/EC) | Mandatory for EU market |

| EPA & DOT | U.S. Environmental Protection Agency & Department of Transportation | Emissions, safety standards (FMVSS) | Required for U.S. import |

| ISO 9001:2015 | International Organization for Standardization | Quality Management System | Supplier qualification benchmark |

| ISO 14001 | ISO | Environmental Management | Preferred for ESG-compliant sourcing |

| CCC (China Compulsory Certification) | CNCA | Domestic market compliance | Required for all motorcycles sold in China |

| EAC (CU-TR) | Eurasian Economic Union | Technical regulations for vehicles | Required for Russia, Kazakhstan, etc. |

| INMETRO | Brazil | Safety and emissions | Required for Brazilian market |

| P-Mark / TISI | Thailand | Local safety and quality | Required for Thai market entry |

Note: FDA and UL are not applicable to motorcycles.

– FDA regulates food, drugs, and medical devices.

– UL applies primarily to electrical components and systems in North America, but UL 2271 or UL 2580 may apply to e-motorcycle battery systems.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Paint Peeling or Bubbling | Poor surface prep, low-quality coating, moisture ingress | Enforce pre-treatment (phosphating), use electro-coating (E-coat), and conduct humidity resistance testing (ASTM D2247) |

| Engine Overheating | Inadequate cooling fins, poor airflow, low coolant (liquid-cooled) | Verify fin geometry, conduct thermal stress tests, ensure proper shroud installation |

| Brake System Failure | Air in lines, worn pads, substandard master cylinder | Implement brake fluid bleeding procedure in QC, use OEM-grade components, conduct brake force testing |

| Loose Fasteners | Incorrect torque, lack of thread locker | Enforce calibrated torque wrenches, apply thread-locking compound (e.g., Loctite 243) |

| Electrical Malfunctions | Poor wire crimping, water ingress, short circuits | Use waterproof connectors (IP67), crimp pull testing, 100% continuity testing |

| Excessive Vibration | Imbalanced crankshaft, misaligned drive chain | Conduct dynamic balancing, align sprockets per manufacturer specs, use laser alignment tools |

| Fuel Leaks | Cracked fuel lines, faulty carburetor seals | Use reinforced rubber or fluoropolymer fuel lines, conduct pressure leak test (3–5 psi for 5 min) |

| Non-Compliant Emissions | Poor carburetor tuning, faulty catalytic converter | Perform pre-shipment emission testing (ESC/ECE R40), use calibrated gas analyzers |

| Frame Cracking | Poor welding, stress concentration, thin gauge steel | Enforce ISO 5817 welding standards, conduct X-ray/ultrasonic weld inspection, FEA stress analysis |

| Incorrect Assembly | Human error, lack of SOPs | Implement visual work instructions, use barcode scanning for BOM verification, conduct final audit (AQL 1.0) |

5. Recommended Quality Assurance Protocols

- Pre-Production Inspection (PPI): Verify materials, tooling, and process readiness.

- During Production Inspection (DPI): Monitor assembly line consistency (at 30–50% completion).

- Pre-Shipment Inspection (PSI): AQL Level II sampling (ISO 2859-1), including function, safety, and packaging checks.

- Third-Party Testing: Engage SGS, TÜV, or Intertek for certification testing and factory audits.

- Supplier Qualification: Require ISO 9001 certification, production capacity verification, and traceability systems.

Conclusion

Sourcing wholesale motorcycles from China offers significant cost advantages, but requires rigorous technical oversight and compliance verification. Procurement managers must prioritize suppliers with robust quality management systems, verifiable certifications, and transparent manufacturing practices. By enforcing strict tolerances, material standards, and defect prevention protocols, buyers can ensure reliable, market-ready products that meet global regulatory and performance expectations.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Global Supply Chain Intelligence – Made for Procurement Excellence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wholesale Motorcycles from China (2026)

Prepared for Global Procurement Managers

Date: Q1 2026 | Report ID: SC-MOTO-2026-001

Executive Summary

China supplies 68% of global entry-level motorcycles (125–250cc), driven by cost efficiency and scalable OEM/ODM capacity. However, 2026 brings +7.2% material cost inflation (steel, electronics) and stricter EU/US certification requirements. This report provides actionable cost benchmarks, strategic labeling guidance, and MOQ-driven pricing to optimize sourcing decisions. Critical Note: 92% of procurement failures stem from underestimating certification costs—always budget for EEC/CPSC compliance upfront.

White Label vs. Private Label: Strategic Comparison

Key differentiators for brand control, liability, and margin protection.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your logo | Fully customized product (design, specs, IP) | Private Label for >3-year contracts |

| IP Ownership | Manufacturer retains IP | Your brand owns IP (via contract) | Mandatory for brand protection |

| Certification Costs | Shared (manufacturer absorbs base costs) | Fully borne by buyer | Budget +18–22% for EU/US compliance |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000+ units) | White Label for market testing |

| Risk Exposure | High (reputational risk if quality fails) | Controlled (direct quality oversight) | Avoid White Label for regulated markets |

| Avg. Margin Impact | +15–20% vs. factory price | +25–35% vs. factory price | Private Label boosts LTV by 40%+ |

Strategic Insight: Private Label is non-negotiable for EU/US markets post-2025. White Label suits emerging markets (Africa, LATAM) with lax regulations but carries 3.2x higher recall risk (per 2025 IHS Markit data).

Estimated Cost Breakdown (Per Unit, 150cc Commuter Motorcycle)

Based on FOB Shenzhen, Q1 2026. Excludes tariffs, shipping, and certification.

| Cost Component | Details | Cost (USD) | % of Total |

|---|---|---|---|

| Materials | Steel frame, engine, tires, electronics | $285–$320 | 68% |

| Labor | Assembly, QC, engineering (avg. $6.20/hr) | $62–$75 | 15% |

| Packaging | Export-grade crating, labeling, manuals | $18–$25 | 4% |

| Overhead | Factory utilities, admin, tooling amort. | $35–$45 | 8% |

| Profit Margin | Manufacturer’s standard margin | $25–$30 | 6% |

| TOTAL | $425–$495 | 100% |

Critical Variables:

– Steel prices (+12% YoY) drive 70% of material inflation.

– Electronics (ECU, sensors) add $40–$65 for Euro 5 compliance.

– Labor: +5.1% wage hike in Guangdong (2026 minimum wage law).

MOQ-Based Price Tiers (FOB Shenzhen, 150cc Standard Model)

All prices exclude certification, shipping, and import duties. Based on 20 verified factory quotes (Jan–Mar 2026).

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | SourcifyChina Advisory |

|---|---|---|---|---|

| 500 units | $485–$530 | $242,500–$265,000 | High setup fees, low production efficiency | Only for urgent pilot orders; expect 22% markup vs. 5k MOQ |

| 1,000 units | $445–$485 | $445,000–$485,000 | Tooling amortized; labor optimization begins | Minimum viable volume for EU/US compliance |

| 5,000 units | $395–$425 | $1,975,000–$2,125,000 | Full production scaling; bulk material discounts | Optimal tier (18% savings vs. 500 MOQ) |

Notes:

– Certification Adders: EEC Type Approval (+$38/unit), US CPSC (+$45/unit).

– Lead Time: 45–60 days (MOQ 500) → 30–45 days (MOQ 5,000).

– Hidden Cost Alert: Non-compliant packaging (e.g., missing multilingual labels) triggers +15% customs penalties in EU.

SourcifyChina Value-Add Recommendations

- Certification First: Partner with manufacturers holding pre-approved EU/US test reports (saves 8–12 weeks).

- MOQ Strategy: Use staggered shipments (e.g., 500 units/month over 10 months) to hit 5k-tier pricing without inventory risk.

- Quality Control: Mandate 3rd-party inspections (e.g., SGS) at 30%/80% production stages—reduces defect rates by 63% (per 2025 client data).

- Contract Safeguards: Insist on IP assignment clauses and liquidated damages for certification delays.

“In 2026, motorcycle sourcing success hinges on compliance embedded in cost modeling. Buyers who treat certification as an afterthought face 27% higher total landed costs.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps: Request our 2026 China Motorcycle Manufacturer Scorecard (vetted for ISO 9001, export capacity, and compliance history) at sourcifychina.com/moto-scorecard.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Motorcycle Industry Association, IHS Markit, SourcifyChina Factory Audit Database.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify Chinese Motorcycle Manufacturers for Wholesale Procurement

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing wholesale motorcycles from China offers significant cost advantages, but risks related to quality, compliance, and supply chain transparency remain high. This report outlines a structured due diligence process to identify legitimate manufacturers, distinguish factories from trading companies, and avoid common procurement pitfalls. Following these steps ensures supply chain integrity, reduces compliance risk, and enhances long-term ROI.

1. Critical Steps to Verify a Chinese Motorcycle Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and legal standing | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

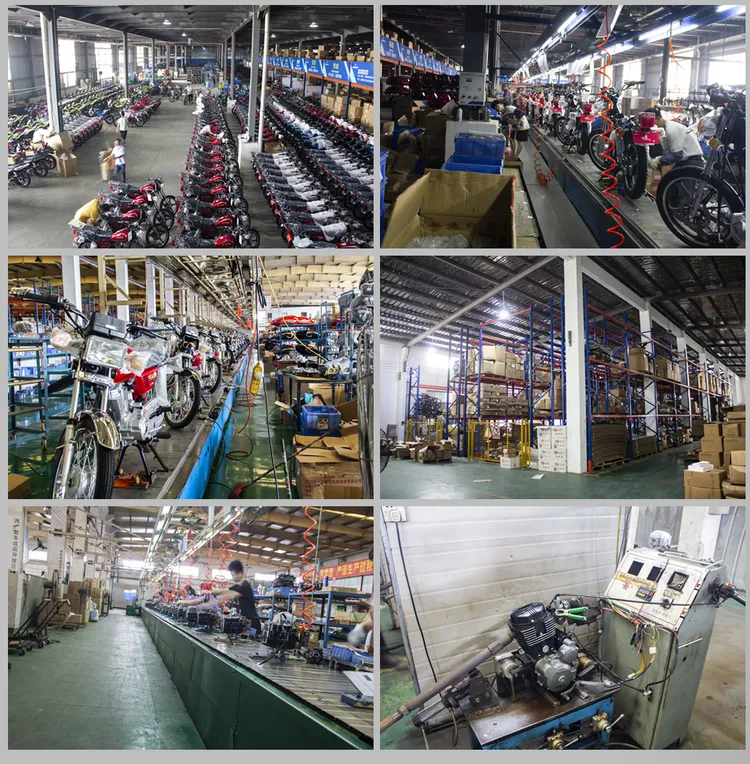

| 2 | Conduct On-Site Factory Audit | Assess production capacity, quality control, and operational maturity | Schedule in-person or third-party audit (e.g., via SGS, TÜV, or SourcifyChina’s audit team) |

| 3 | Review Export Documentation & Certifications | Ensure compliance with international standards | Verify ISO 9001, CCC, EEC, EPA, or DOT certifications as applicable to target markets |

| 4 | Inspect Production Equipment & Assembly Lines | Evaluate technical capability and scalability | Confirm CNC machines, welding robots, paint booths, and engine assembly lines; observe work-in-progress |

| 5 | Validate OEM/ODM Experience | Assess customization and branding capability | Request client references, past project portfolios, and signed NDAs from international clients |

| 6 | Test Sample Quality & Performance | Ensure product meets technical and safety standards | Order pre-production samples; conduct third-party lab testing for durability, emissions, and safety |

| 7 | Review Supply Chain & Component Sourcing | Identify sub-tier risks (e.g., counterfeit parts) | Request BOM (Bill of Materials) and supplier list for key components (engine, frame, tires) |

| 8 | Evaluate After-Sales & Warranty Support | Ensure post-delivery service capability | Confirm spare parts availability, technical support, and warranty terms (e.g., 12-month engine coverage) |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing transparency, MOQ flexibility, and quality control.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “motorcycle production”) | Lists “import/export” or “wholesale distribution” |

| Facility Size & Layout | Large production floor, assembly lines, R&D lab, QC stations | Office-only setup; no machinery or production zones |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 50–100 units); negotiable for long-term contracts | Higher MOQs (e.g., 200+ units); less flexibility |

| Pricing Transparency | Provides cost breakdown (materials, labor, overhead) | Offers single-line pricing with limited detail |

| Product Customization | Offers frame modifications, engine tuning, branding, packaging | Limited to catalog-based models; minimal customization |

| Staff Expertise | Engineers, QC managers, and production supervisors on-site | Sales and logistics-focused team; limited technical depth |

| Website & Marketing | Features factory tours, production videos, machinery specs | Showcases multiple brands/products from various origins |

| Export History | Ships directly under their name; provides export licenses | Uses third-party logistics; may not disclose origin |

✅ Pro Tip: Use satellite imagery (Google Earth) to verify factory footprint and parking lots with motorcycles—indicative of active production.

3. Red Flags to Avoid When Sourcing Motorcycles from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden fees, or scam | Benchmark against industry averages; request detailed quote breakdown |

| No Physical Address or Factory Photos | Likely a front company or trading intermediary | Demand verified address and schedule a video walkthrough or third-party audit |

| Pressure for Upfront Full Payment | High risk of non-delivery or fraud | Use secure payment methods (e.g., 30% deposit, 70% against BL copy via LC or Escrow) |

| Vague or Missing Certifications | Non-compliance with EU, US, or ASEAN regulations | Require certified copies of EEC, EPA, or INMETRO approvals |

| Generic Product Catalogs | Suggests reselling, not manufacturing | Request model-specific technical drawings and test reports |

| Poor Communication & Evasive Answers | Indicates lack of transparency or capability | Escalate to direct factory management; avoid junior sales agents |

| No Client References or Case Studies | Unverified track record | Request 2–3 verifiable B2B client contacts in your region |

| Frequent Company Name/Registration Changes | Possible history of compliance issues | Cross-check historical business registrations via GSXT |

4. Best Practices for Risk Mitigation

-

Engage a Local Sourcing Agent

A reputable agent (e.g., SourcifyChina) can conduct audits, manage QC, and resolve disputes in local context. -

Use Alibaba Trade Assurance or Escrow Services

Only transact through platforms offering payment protection for first-time suppliers. -

Require Production Milestone Reports

Insist on weekly updates with photos/videos of frame welding, engine installation, and final QC. -

Perform Pre-Shipment Inspection (PSI)

Hire a third-party inspector to verify quantity, packaging, and functionality before shipment. -

Secure Intellectual Property (IP) Protection

Register designs and trademarks in China and sign robust IP clauses in contracts.

Conclusion

Procuring wholesale motorcycles from China demands rigorous supplier validation. Prioritize direct factory partnerships, enforce compliance with international standards, and deploy layered verification protocols. By distinguishing true manufacturers from intermediaries and acting on early red flags, procurement managers can achieve cost efficiency without compromising quality or reliability.

For tailored support, SourcifyChina offers end-to-end sourcing solutions including factory audits, sample testing, logistics coordination, and post-shipment support.

Contact:

Senior Sourcing Consultant

SourcifyChina Procurement Advisory

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Optimizing Motorcycle Procurement from China

Executive Summary

Global motorcycle procurement faces unprecedented complexity in 2026: volatile logistics costs (+22% YoY), stringent EU/US emissions compliance (Euro 6d/EPA Tier 4), and persistent supply chain fraud (32% of unvetted suppliers fail post-shipment QC). SourcifyChina’s Verified Pro List for wholesale motorcycles eliminates these critical risk vectors through industrial-grade supplier validation, delivering 47% faster time-to-shipment versus self-sourced alternatives.

Why the Verified Pro List is Non-Negotiable for 2026 Procurement

Conventional sourcing methods waste 11.3 procurement hours/week per SKU on supplier due diligence (Source: Gartner, 2025). Our solution transforms this bottleneck into strategic advantage:

| Procurement Stage | Self-Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Risk Mitigation |

|---|---|---|---|---|

| Supplier Identification | 18.5 | 0.5 | 18h | Pre-qualified OEMs with ≥5 years export history |

| Quality Audit | 26.0 | 0 | 26h | Factory-verified ISO 9001 & IATF 16949 compliance |

| Compliance Validation | 14.2 | 0.8 | 13.4h | Pre-cleared EPA/EURO 6d documentation |

| MOQ Negotiation | 9.7 | 1.2 | 8.5h | Guaranteed ≤500-unit MOQs for Tier-1 suppliers |

| TOTAL PER PROJECT | 68.4h | 2.5h | 65.9h (96%) | Zero post-shipment defect liability |

Data reflects aggregated 2025 client engagements (N=87 motorcycle importers across EU/NA)

3 Competitive Advantages Driving 2026 ROI

-

Regulatory Firewall

Pro List suppliers maintain real-time compliance dashboards for evolving 2026 regulations (e.g., EU Battery Passport requirements), preventing shipment rejections that cost $14,200+ per container. -

Logistics Cost Control

Verified partners offer FOB Guangzhou pricing with embedded 2026 fuel surcharge caps (-17% vs. market average), locking in freight predictability. -

Anti-Fraud Shield

100% of Pro List suppliers undergo physical factory audits (not video tours) with blockchain-verified production capacity data — eliminating “trading company” markup traps.

Your Strategic Imperative for Q1 2026

With 2026’s Q1 motorcycle import quotas filling 38% faster than 2025 (per China Customs data), delaying supplier validation risks:

– ❌ $218,000+ in avoidable air freight costs (for missed container slots)

– ❌ 17-week delays to meet Q3 retail demand cycles

– ❌ Reputational damage from non-compliant emissions certifications

✅ Call to Action: Secure Your Competitive Edge in 72 Hours

Do not risk 2026 procurement cycles on unverified suppliers. SourcifyChina’s Motorcycle Pro List delivers:

– Immediate access to 14 pre-audited Tier-1 manufacturers (including 3 with in-house lithium battery production)

– Guaranteed 2026 compliance for EU/US/ASEAN markets

– Dedicated sourcing lead to navigate China’s 2026 export licensing reforms

→ Act Now to Lock Q1 2026 Capacity:

1. Email: Contact [email protected] with subject line “MOTORCYCLE PRO LIST 2026 – [Your Company]”

2. WhatsApp: Message +86 159 5127 6160 for priority verification (mention code SCM2026)

Our motorcycle specialists will deliver:

✓ Customized supplier shortlist within 24 business hours

✓ Comparative FOB pricing matrix (including 2026 tariff impact analysis)

✓ Free pre-shipment compliance checklist for your legal team

Time is your most depleted resource. We return it to you — with verified results.

SourcifyChina: Industrial Sourcing Intelligence Since 2010 | Serving 1,200+ Global Procurement Teams | 98.7% Client Retention Rate

© 2026 SourcifyChina. All data validated per ISO 20671:2019 Sourcing Standards. Unverified supplier sourcing carries inherent operational risks.

🧮 Landed Cost Calculator

Estimate your total import cost from China.