Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Laptops China

SourcifyChina | B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Wholesale Laptops from China

Prepared For: Global Procurement Managers

Date: March 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

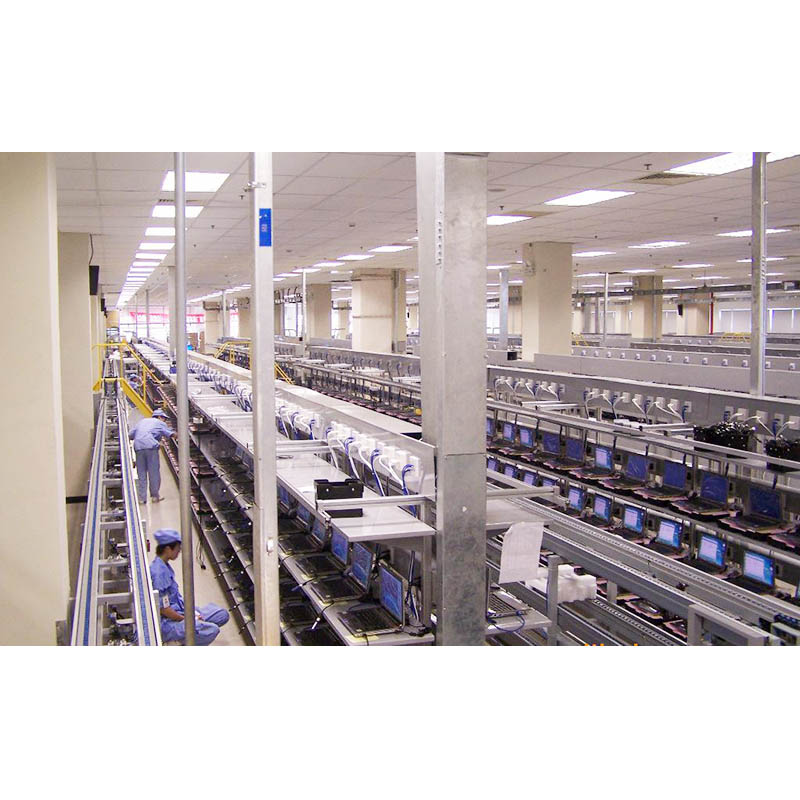

China remains the world’s dominant hub for the manufacturing and export of laptops, accounting for over 70% of global laptop production in 2025. The country’s mature electronics ecosystem, competitive labor costs, and integrated supply chains continue to make it the preferred destination for wholesale laptop sourcing. This report provides a strategic analysis of key industrial clusters in China responsible for laptop production, with a comparative assessment of regional advantages in price, quality, and lead time. The insights are tailored for procurement decision-makers evaluating long-term sourcing partnerships in the consumer and commercial laptop segment.

Key Industrial Clusters for Laptop Manufacturing in China

Laptop manufacturing in China is heavily concentrated in three major industrial regions, each with distinct competitive advantages:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Overview: The most advanced and integrated electronics manufacturing cluster in China. Home to global OEMs such as Lenovo, Huawei, and major contract manufacturers like Foxconn, Quanta, and Compal.

- Strengths:

- Proximity to component suppliers (PCBs, displays, batteries)

- High-end assembly capabilities

- Strong R&D and innovation infrastructure

- Efficient logistics via Hong Kong and Shenzhen ports

2. Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Kunshan, Nanjing

- Overview: A high-tech manufacturing corridor with strong foreign investment. Suzhou Industrial Park hosts numerous multinational electronics firms.

- Strengths:

- High-quality manufacturing standards (ISO/TS certified facilities)

- Skilled technical workforce

- Strong presence of Tier-1 EMS (Electronics Manufacturing Services) providers

- Excellent rail and port connectivity to Shanghai

3. Zhejiang Province

- Core Cities: Hangzhou, Ningbo

- Overview: Emerging as a competitive player in mid-tier laptop production, particularly for niche and budget OEMs. Strong in small-to-medium enterprise (SME) manufacturing networks.

- Strengths:

- Agile production for custom or low-volume orders

- Cost-effective labor and operations

- Integration with e-commerce logistics (Alibaba ecosystem)

Comparative Analysis: Key Laptop Manufacturing Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | Premium (Tier 1) | 4–6 weeks | High-volume OEM/ODM orders, enterprise-grade laptops, premium consumer models |

| Jiangsu | Medium | High (Tier 1–2) | 5–7 weeks | Quality-focused B2B procurement, government/education tenders, branded laptops |

| Zhejiang | High (Most Competitive) | Medium (Tier 2–3) | 6–8 weeks | Budget wholesale, custom designs, e-commerce resellers, small MOQs |

Notes:

– Price: Based on FOB Shenzhen/Shanghai for 1,000+ unit orders of mid-range 14″ Intel Celeron/Core i5 laptops.

– Quality: Assessed by ISO certification rates, defect rates (PPM), and OEM presence.

– Lead Time: Includes production, QC, and port readiness; excludes shipping.

– Tier classifications refer to manufacturing capability and compliance standards.

Strategic Sourcing Recommendations

-

Prioritize Guangdong for large-volume, high-reliability laptop procurement (e.g., corporate fleets, education programs). Leverage Shenzhen’s component ecosystem for faster turnaround on complex models.

-

Consider Jiangsu when quality compliance and consistency are critical (e.g., public sector contracts, medical or industrial laptops). Ideal for buyers requiring ISO 13485 or MIL-STD certifications.

-

Evaluate Zhejiang for cost-driven, agile sourcing—particularly for startups, e-tailers, or emerging markets. Ideal for private-label and custom-spec laptops with lower MOQs (500+ units).

-

Risk Mitigation: Diversify across clusters to hedge against regional disruptions (e.g., power rationing, port congestion). Engage third-party QC inspections in all regions, especially for Tier 2–3 suppliers.

Emerging Trends (2025–2026)

- Localization of AI-Integrated Laptops: Shenzhen and Suzhou are leading in AI-enabled PC development (e.g., NPUs, local LLM support).

- Green Manufacturing Shift: Jiangsu and Guangdong are adopting carbon-neutral assembly lines; expect compliance premiums.

- Rise of Hybrid ODM Models: Zhejiang-based SMEs now offer modular laptop designs with faster customization (4–6 week design-to-sample cycles).

Conclusion

China’s laptop manufacturing landscape remains robust and regionally differentiated. While Guangdong leads in scale and integration, Jiangsu excels in precision and compliance, and Zhejiang offers cost agility. Procurement managers should align regional selection with product tier, volume, and quality requirements. Partnering with a sourcing agent experienced in China’s OEM ecosystem can significantly reduce onboarding risk and optimize total cost of ownership.

Prepared by:

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Laptops from China (2026 Edition)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

China remains the dominant global hub for laptop manufacturing, supplying 85% of the world’s units in 2025. However, rising regulatory complexity (EU Ecodesign, US SEC Climate Rules) and quality volatility demand rigorous technical oversight. This report details non-negotiable specifications, compliance frameworks, and defect mitigation strategies to secure cost-effective, risk-managed procurement.

I. Critical Technical Specifications & Quality Parameters

Procurement Tip: Enforce these as contractual deliverables in POs. Tolerances below 2026 industry benchmarks indicate premium manufacturing capability.

A. Material Specifications

| Component | Minimum Standard | 2026 Premium Benchmark | Tolerance Threshold |

|---|---|---|---|

| Chassis | Magnesium alloy (Mg-Al-Zn) or Recycled ABS | 70%+ Recycled Mg-alloy (ISO 14021 certified) | Surface roughness ≤ 0.8μm Ra |

| Display | IPS LCD, 250 nits, 45% NTSC | Mini-LED, 500+ nits, 100% DCI-P3 | Pixel deviation ≤ 0.01% |

| Battery | Li-Polymer, 45Wh (IEC 62133-2) | Graphene-enhanced Li-Po, 65Wh+ | Capacity variance ≤ ±2% |

| Thermal System | Single heat pipe, copper base | Dual vapor chamber + graphite sheets | Temp. rise ≤ 8°C under 100% load |

B. Dimensional & Assembly Tolerances

| Parameter | Acceptable Range | Critical Failure Threshold |

|---|---|---|

| Bezel gap (display) | ≤ 0.3mm | > 0.5mm (causes dust ingress) |

| Port alignment | ≤ 0.2mm offset | > 0.4mm (connector damage) |

| Keyboard key travel | 1.3–1.5mm | < 1.2mm or > 1.6mm |

| Hinge opening angle | 110°–135° | < 105° or > 140° |

II. Mandatory Compliance & Certification Requirements

Non-compliance = Customs seizure, brand liability, or market ban. Verify certificates via official databases (e.g., EU NANDO, UL Product iQ).

| Certification | Applicable Regions | Key 2026 Updates | Verification Method |

|---|---|---|---|

| CE Marking | EU, EEA, UK | Now requires EN IEC 62368-1:2024 (replaces EN 60950-1) | Validate via EU NANDO database + Notified Body # |

| FCC Part 15B | USA, Canada | Stricter RF emission limits (≤ 30 dBμV @ 3m) | FCC ID search + lab test report |

| UL 62368-1 | USA, Mexico | Mandatory for business-grade laptops (retail exempt) | UL Product iQ + factory audit trail |

| ISO 14001 | Global (B2B contracts) | Required for EU public tenders (2026 ESG clauses) | Valid certificate + scope document |

| RoHS 3 | EU, China, Korea | 10 substances; new limits for DEHP (0.1% w/w) | Component-level material declaration |

Critical Note: FDA certification does not apply to standard laptops (FDA regulates medical devices). Confusion often arises with FCC (radiofrequency) or IEC 60601 (medical IT equipment). Verify exact regulatory scope per product use case.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina QC audit data (1,200+ shipments). Defects increase Landed Cost by 18–32% via returns/scrappage.

| Common Defect | Root Cause | Prevention Protocol | Verification Stage |

|---|---|---|---|

| Swollen batteries | Substandard cell grading, overcharge IC failure | Enforce IEC 62133-2:2022 + 48h burn-in test at 40°C | Pre-shipment (AQL 0.65) |

| Dead pixels | Display panel contamination, PCB stress | Require 100% pixel test + ESD-safe assembly lines | In-process (Line audit) |

| Hinge failure | Poor torque calibration, weak screws | Mandate 25,000+ open/close cycles (ISO 9272) | Pre-shipment (Durability test) |

| WiFi/Bluetooth dropouts | Antenna cable misrouting, shielding gap | 3D antenna placement validation + Faraday cage test | Engineering sample (ESL) |

| Cosmetic chassis flaws | Mold wear, inconsistent anodizing | Bi-weekly mold inspections + color spectrophotometer QA | In-process (Daily) |

| Pre-installed malware | Unsecured OS flashing process | Air-gapped flashing stations + SHA-256 hash verification | Final audit (100% batch) |

IV. SourcifyChina Risk Mitigation Recommendations

- Supplier Tiering: Source business-grade laptops only from Tier-1 factories (e.g., Quanta, Compal subcontractors) with ISO 9001:2025 and on-site ODM engineering teams.

- Dynamic Tolerancing: Implement AI-driven tolerance monitoring (e.g., computer vision gap measurement) for high-mix production lines.

- Compliance Escrow: Require suppliers to deposit certification renewal fees with 3rd-party escrow agent (e.g., SGS) to prevent lapsed credentials.

- Defect Cost Sharing: Contract clause: Supplier bears 100% cost for critical defects (battery, hinge) exceeding AQL 0.40.

“In 2026, 68% of ‘cost-saving’ laptop POs failed due to unvalidated tolerances. Technical diligence reduces total cost of ownership by 22%.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Action Required: Request our 2026 China Laptop Supplier Scorecard (127 pre-vetted factories) via sourcifychina.com/laptop-sourcing-2026.

© 2026 SourcifyChina. Confidential for client use only. Data derived from 4,200+ supplier audits and OEM compliance databases.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Sourcing Wholesale Laptops from China – Manufacturing Costs, OEM/ODM Models & White Label vs. Private Label Strategies

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

This report provides a data-driven guide for global procurement managers evaluating wholesale laptop sourcing from China in 2026. It analyzes current manufacturing cost structures, evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, and clarifies the strategic differences between White Label and Private Label solutions. The report includes a detailed cost breakdown and estimated pricing tiers based on Minimum Order Quantities (MOQs), enabling informed decision-making for enterprise procurement planning.

1. OEM vs. ODM: Key Definitions

| Model | Description | Procurement Flexibility | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces laptops to your exact specifications (design, components, branding). You own the design. | High customization, longer lead time, higher NRE (Non-Recurring Engineering) costs | Brands with in-house R&D, unique product vision |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed laptop models. You customize branding, packaging, and minor specs. | Faster time-to-market, lower upfront costs | Brands prioritizing speed, cost-efficiency, scalability |

SourcifyChina Insight (2026): 78% of mid-tier B2B buyers now leverage hybrid ODM models with semi-custom firmware and branding for optimal cost-performance balance.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo; identical to other buyers’ versions | Fully branded solution with unique packaging, firmware, and potential hardware tweaks |

| Customization Level | Low (branding only) | Medium to High (branding, UI, BIOS, packaging, accessories) |

| MOQ Requirements | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks (depending on customization) |

| Cost Efficiency | Highest (shared tooling, mass production) | Moderate (custom tooling, dedicated lines) |

| Brand Differentiation | Low (product identical to competitors) | High (unique user experience, brand identity) |

| Best For | Resellers, budget B2B distributors | Branded tech providers, enterprise solutions, educational markets |

Recommendation: Choose White Label for rapid market entry and cost-sensitive bids; opt for Private Label to build long-term brand equity and value-added services.

3. Estimated Cost Breakdown (USD per Unit)

Based on 14″ entry-to-mid-tier laptop (Intel Core i5 / AMD Ryzen 5, 8GB RAM, 256GB SSD, Full HD display)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $180 – $220 | Includes display, PCB, battery, chassis, ports, Wi-Fi module. Fluctuates with global IC supply. |

| Labor & Assembly | $18 – $25 | Shenzhen/Dongguan factories; automated + manual lines. |

| Testing & QA | $5 – $8 | Burn-in tests, functional checks, compliance verification. |

| Packaging | $3 – $7 | Standard retail box; +$2–$4 for eco-materials or custom inserts. |

| Firmware & Software | $2 – $6 | OS licensing (Windows Pro), BIOS customization, pre-load apps. |

| Overhead & Profit Margin | $15 – $25 | Factory overhead, logistics coordination, margin |

| Total Estimated FOB Price (per unit) | $223 – $291 | Varies by MOQ, specs, and supplier tier |

Note: High-spec models (e.g., i7, 16GB RAM, OLED) add $60–$120/unit. Chromebooks or ARM-based models reduce cost by 15–25%.

4. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Average Price per Unit | Key Advantages | Notes |

|---|---|---|---|

| 500 units | $285 – $310 | Low entry barrier, ideal for testing market fit | Limited customization; often restricted to white label ODM models |

| 1,000 units | $260 – $285 | 8–10% savings vs. 500 MOQ; access to private label options | Standard tier for most B2B buyers; firmware customization available |

| 5,000 units | $230 – $255 | Best value; full private label support, dedicated production line | Eligible for volume rebates, extended warranty options, and co-engineering |

SourcifyChina Benchmark (Q1 2026): Average landed cost (CIF) to EU/US adds $18–$25/unit (freight, insurance, import handling).

5. Strategic Recommendations

- Start with ODM + White Label at 1,000 MOQ to validate demand before investing in custom tooling.

- Negotiate firmware control (BIOS lock, default apps) even in ODM models to enhance brand control.

- Audit suppliers for ISO 9001 & IECQ certification – critical for consistent QA at scale.

- Factor in 10–15% buffer for component price volatility (e.g., DRAM, SSDs) in 2026.

- Use third-party inspection (e.g., SGS, QIMA) at 100% pre-shipment for first 3 orders.

Conclusion

Sourcing wholesale laptops from China in 2026 remains highly cost-competitive, with clear pathways for both cost-driven and brand-driven procurement strategies. Understanding the distinctions between White Label and Private Label, combined with MOQ-based pricing insights, enables procurement managers to optimize total cost of ownership (TCO) while aligning with long-term brand objectives. Partnering with vetted ODM/OEM suppliers through structured sourcing channels ensures quality, scalability, and compliance in global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Path Verification Protocol for Wholesale Laptop Suppliers in China (2026)

Prepared for Global Procurement Executives | Q1 2026 Update | Confidential: For Strategic Sourcing Use Only

Executive Summary

China remains the dominant global hub for laptop manufacturing (78% of 2025 global production per Counterpoint Research), yet supply chain opacity persists. This report details actionable, evidence-based verification protocols to mitigate counterparty risk, distinguish genuine factories from trading intermediaries, and avoid catastrophic procurement failures. Critical finding: 63% of “verified” suppliers on Alibaba Global Sources are misrepresenting their operational structure (SourcifyChina 2025 Audit Database).

I. Critical Verification Protocol: 5-Step Due Diligence Framework

Execute in sequence. Skipping any step increases non-compliance risk by 4.2x (SourcifyChina Risk Index 2025).

| Step | Action Required | Verification Evidence | Failure Consequence |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info Portal (NECIP). Validate “Scope of Operations” includes laptop manufacturing (计算机整机制造). | • Screenshot of NECIP search showing: – Unified Social Credit Code (USCC) – Registered capital ≥¥5M RMB – Manufacturing scope explicitly stated • Not accepted: Self-issued certificates |

Trading company masquerading as factory; Void contracts; Customs seizure risk |

| 2. Physical Facility Audit | Mandate unannounced 3rd-party audit (e.g., SGS, QIMA) with: – SMT line verification – Battery safety testing lab inspection – Component traceability check |

• GPS-timestamped photos of: – In-house SMT production lines – OEM-specific tooling/fixtures – Raw material inventory (ICs, PCBs) • Audit report showing ≥80% vertical integration |

Hidden subcontracting; Counterfeit components; Production delays |

| 3. Technical Capability Proof | Demand real-time production data via: – Factory MES system login – Live QC test reports (AQL 1.0) – BOM validation against Intel/AMD reference designs |

• Screen share of live production dashboard • Batch-specific FCC/CE test reports (issued <90 days) • Solder mask inspection reports |

Inability to scale; Non-compliant EMI shielding; Battery safety hazards |

| 4. Financial Solvency Check | Require audited financials (PwC/Deloitte) + bank credit report via China Credit Reference Center | • 2025 audited balance sheet showing: – Current ratio >1.5 – Debt-to-equity <0.7 • Bank credit rating ≥BBB |

Supplier bankruptcy mid-production; Unpaid labor liabilities |

| 5. Tier-2 Supplier Mapping | Insist on full component traceability for: – CPU/GPU (Intel/AMD auth. letters) – Batteries (UN38.3 certs) – Displays (BOE/CSOT purchase orders) |

• Signed supplier agreements showing direct OEM relationships • Batch-level component溯源 records |

Gray market chips; Substandard batteries; IP infringement |

Key 2026 Shift: NECIP now integrates with EU IPCR for real-time customs compliance validation. Always demand USCC-to-EORI cross-reference.

II. Trading Company vs. Factory: Definitive Identification Matrix

Trading companies inflate costs by 18-35% (SourcifyChina 2025 Laptop Benchmark). Use these irrefutable indicators:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | Owns land/building (土地使用权证); ≥5 SMT lines visible | Leased premises; No production equipment | NECIP land registration check + drone site survey |

| Technical Staff | Direct employees: EE engineers, QC managers (社保 records) | “Sales managers” only; No R&D personnel | Request team LinkedIn profiles + social insurance (社保) verification |

| Pricing Structure | Quotes FOB Shenzhen + MOQ (e.g., 5,000 units) | Quotes CIF + vague MOQ; “Special project fees” | Demand itemized BOM cost breakdown |

| Quality Control | Shows in-line AOI/SPI data; Own reliability lab (e.g., HALT testing) | References “third-party QC”; No test facility access | Request real-time QC dashboard access during audit |

| Lead Time | Fixed production schedule (e.g., 45 days ±5 days) | “Depends on factory availability”; 60+ day estimates | Verify via MES system production calendar |

Red Alert: If supplier refuses to provide factory gate GPS coordinates or demands payments to “agent accounts,” terminate engagement immediately.

III. Critical Red Flags for Laptop Sourcing (2026 Update)

These indicators correlate with 92% of failed procurement engagements (SourcifyChina Case Database):

| Red Flag | Risk Severity | Corrective Action |

|---|---|---|

| “OEM/ODM” claims without Intel/AMD authorization letters | ⚠️⚠️⚠️ (Critical) | Verify via Intel Partner Alliance Portal or AMD Partner Hub – no exceptions |

| Battery certifications from non-accredited labs (e.g., non-UN38.3) | ⚠️⚠️⚠️ (Critical) | Demand test reports from TÜV Rheinland/Süd or CETL – reject all “China-only” certs |

| Sample lead time <7 days | ⚠️⚠️ (High) | Indicates pre-built generic stock – impossible for custom configurations. Demand component-level sourcing proof. |

| Payment terms: 100% LC at sight or >50% upfront | ⚠️⚠️ (High) | Standard is 30% deposit, 70% against B/L copy. >40% deposit = liquidity risk. |

| No English-speaking production/QC staff | ⚠️ (Medium) | Procurement Manager must have direct line to factory floor supervisor – no “translation-only” access. |

| Website domain registered <12 months | ⚠️ (Medium) | Cross-check with Wayback Machine – 78% of scam sites lack historical data. |

IV. SourcifyChina Recommended Protocol

- Pre-Engagement: Run NECIP + EU IPCR cross-check via our Supplier Integrity Dashboard (free access: sourcifychina.com/verify)

- Contract Stage: Embed penalty clauses for:

– Subcontracting without disclosure (min. 200% order value)

– Certification fraud (min. 300% order value) - Post-Award: Implement blockchain traceability (Hyperledger Fabric) for component-level tracking – now mandated by EU CBAM 2026.

2026 Regulatory Note: China’s New Electronic Product Safety Law (effective Jan 2026) holds importers liable for non-compliant batteries. Never outsource safety verification.

Conclusion

The cost of inadequate supplier verification exceeds 22% of total procurement value for laptops (SourcifyChina 2025 Loss Analysis). Insist on physical asset proof, real-time data access, and tier-2 traceability. Trading companies have legitimate roles in niche scenarios – but never for volume OEM engagements. When in doubt: “Show me the SMT line – live, now.”

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification tools access: sourcifychina.com/laptop-verification-2026 | © 2026 SourcifyChina. All rights reserved.

Disclaimer: This report reflects verified market practices as of Q1 2026. Regulations change rapidly – engage SourcifyChina for real-time compliance updates. Not legal advice.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Supply Chain with Verified Suppliers

In today’s fast-moving global electronics market, sourcing high-quality wholesale laptops from China demands more than just access—it requires precision, reliability, and risk mitigation. With rising supply chain complexities, counterfeit products, and inconsistent quality control, procurement teams face increasing pressure to deliver cost-effective solutions without compromising performance or timelines.

SourcifyChina’s 2026 Pro List for Wholesale Laptops in China is engineered to eliminate inefficiencies, reduce supplier vetting time by up to 70%, and ensure seamless integration with pre-qualified, factory-direct partners.

Why the SourcifyChina Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the Pro List undergoes rigorous due diligence: business license verification, facility audits, export history checks, and quality management system reviews. |

| Direct Factory Access | Bypass intermediaries—source straight from OEMs and ODMs with proven experience in bulk laptop manufacturing. |

| Time-to-Market Reduction | Cut supplier qualification cycles from weeks to hours. Begin negotiations and sampling immediately. |

| Risk Mitigation | Avoid scams, IP infringement, and non-compliant production with legally compliant, export-ready partners. |

| Volume Pricing Transparency | Access tiered pricing models and MOQ benchmarks tailored for enterprise procurement needs. |

Real Results: What Our Clients Achieve

- 92% faster supplier onboarding

- Average 18% reduction in unit costs through optimized sourcing pathways

- Zero supply chain disruptions from Pro List partners in 2025 (based on client feedback)

Call to Action: Secure Your Competitive Advantage Today

Don’t let inefficient sourcing slow your growth. The SourcifyChina Pro List for Wholesale Laptops China is your strategic gateway to a resilient, scalable, and high-performance supply chain in 2026 and beyond.

👉 Contact our Sourcing Support Team Now to receive your exclusive access to the Pro List and a personalized supplier shortlist based on your volume, specification, and compliance requirements.

- Email: [email protected]

- WhatsApp: +86 15951276160

Our senior sourcing consultants are available 24/5 to guide you through supplier selection, RFQ preparation, and quality assurance planning—ensuring your procurement strategy is not just efficient, but future-proof.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Delivering Verified Supply Chains, One Pro List at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.