Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Kn95 Face Mask Exporter China

SourcifyChina – B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Wholesale KN95 Face Mask Exporters from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Despite a post-pandemic normalization in global demand, China remains the dominant global supplier of KN95 respirators due to its established manufacturing infrastructure, economies of scale, and compliance with international standards (GB2626-2019, FDA, CE). This report provides a strategic overview of key industrial clusters producing KN95 masks in China, with a focus on identifying optimal sourcing regions based on price competitiveness, quality assurance, and lead time efficiency.

For procurement managers, selecting the right region is critical to balancing cost, compliance, and supply chain resilience. This analysis identifies Guangdong, Zhejiang, Henan, and Shandong as the primary hubs, each offering distinct advantages.

Key Industrial Clusters for KN95 Mask Manufacturing in China

1. Guangdong Province (Guangzhou, Shenzhen, Dongguan)

- Overview: The most diversified and export-oriented manufacturing base in China. Home to numerous ISO-certified and FDA-registered manufacturers.

- Strengths:

- High production capacity and automation levels

- Strong export logistics (proximity to Shenzhen and Guangzhou ports)

- Many factories with international certifications (FDA, CE, ISO 13485)

- Ideal For: Large-volume orders requiring fast shipping and compliance with Western regulatory standards.

2. Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

- Overview: Known for high-precision manufacturing and strong private-sector innovation. A major hub for medical supplies.

- Strengths:

- Competitive pricing due to cost-efficient supply chains

- Strong textile and non-woven fabric upstream suppliers

- High adherence to quality control standards

- Ideal For: Mid-to-large volume buyers seeking value-for-money without compromising on quality.

3. Henan Province (Xinxiang City)

- Overview: The “Medical Device Capital of China.” Xinxiang is a nationally recognized hub for medical consumables, including masks and PPE.

- Strengths:

- Concentration of over 1,000 medical product manufacturers

- Government-backed industrial parks with streamlined approvals

- Lower labor and operational costs

- Ideal For: Cost-driven procurement with volume flexibility and long-term partnerships.

4. Shandong Province (Qingdao, Jinan)

- Overview: Emerging as a key player with modern facilities and strong raw material access.

- Strengths:

- Growing number of GMP-compliant factories

- Proximity to raw material (melt-blown fabric) producers

- Moderate pricing and improving quality consistency

- Ideal For: Buyers seeking alternative suppliers to diversify sourcing risk.

Comparative Analysis of Key Production Regions

| Region | Average Unit Price (USD/piece) | Quality Rating (1–5) | Average Lead Time (Days) | Certification Readiness | Key Advantages |

|---|---|---|---|---|---|

| Guangdong | $0.18 – $0.28 | 4.7 | 15–25 | High (FDA, CE, ISO common) | Premium quality, fast export, strong compliance |

| Zhejiang | $0.15 – $0.22 | 4.5 | 20–30 | Medium-High (CE, ISO) | Cost efficiency, reliable quality, good innovation |

| Henan | $0.11 – $0.18 | 4.0 | 25–35 | Medium (CE common, FDA limited) | Lowest cost, high volume capacity, medical cluster |

| Shandong | $0.13 – $0.20 | 4.2 | 22–32 | Medium (growing compliance) | Balanced cost/quality, emerging capacity |

Notes:

– Prices based on FOB China for orders of 1M+ units, 5-layer KN95 (GB2626-2019 compliant).

– Quality rating reflects material consistency, filtration efficiency (≥95%), and manufacturing process control.

– Lead time includes production + inland logistics to port (excluding sea freight).

– Certification readiness indicates availability of documentation for EU/US market entry.

Strategic Sourcing Recommendations

-

For Compliance-Critical Markets (USA, EU):

Prioritize Guangdong-based exporters with FDA registration and ISO 13485 certification. Accept a 10–15% price premium for reduced regulatory risk. -

For Cost-Optimized Bulk Procurement:

Henan (Xinxiang) offers the most competitive pricing. Conduct on-site audits to verify quality consistency and certification authenticity. -

For Balanced Procurement Strategy:

Zhejiang provides the best middle ground between cost, quality, and reliability. Ideal for buyers managing multi-region supply chains. -

For Supply Chain Diversification:

Consider Shandong as an emerging alternative. Partner with audited manufacturers to mitigate quality variance risks.

Risk Mitigation & Due Diligence Checklist

- ✅ Verify factory certifications (GB2626-2019, FDA, CE, ISO) via official databases

- ✅ Conduct third-party QC inspections (e.g., SGS, Bureau Veritas) pre-shipment

- ✅ Audit for melt-blown fabric sourcing (avoid recycled materials)

- ✅ Confirm export license and customs clearance capability

- ✅ Request batch test reports for filtration efficiency and breathability

Conclusion

China continues to dominate the global KN95 mask supply chain, but regional differentiation is key to strategic sourcing success. While Guangdong leads in quality and compliance, Henan offers the strongest cost advantage, and Zhejiang delivers optimal balance. Procurement managers should align regional selection with their priorities: regulatory assurance, cost efficiency, or supply resilience.

SourcifyChina recommends a multi-source strategy leveraging Guangdong and Zhejiang for primary supply, with Henan as a backup for volume surges.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: KN95 Face Mask Exporters (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Risk Mitigation Focus | Compliance-Centric Sourcing

Executive Summary

China remains the dominant global supplier of KN95 respirators (GB2626-2019 standard), but post-pandemic regulatory tightening and 2026-specific compliance shifts necessitate rigorous due diligence. 42% of KN95 shipments rejected by EU/US customs in 2025 stemmed from certification gaps or material non-conformity (SourcifyChina Customs Data). This report details technical and compliance requirements to de-risk procurement.

I. Technical Specifications: Core Quality Parameters

A. Material Composition & Layering

| Layer | Material Specification | Critical Tolerances | 2026 Compliance Note |

|---|---|---|---|

| Outer Layer | Spunbond non-woven polypropylene (25-35g/m²) | Weight tolerance: ±3g/m²; Hydrophobic treatment (min. 120° contact angle) | EU MDR 2026 draft mandates nanoparticle migration testing for hydrophobic coatings |

| Meltblown Filter | Electret-charged polypropylene (18-25g/m²) | Filtration efficiency: ≥95% @ 0.3µm (NaCl); Basis weight deviation ≤±2.5g/m² | Charge decay ≤15% after 72h humidity exposure (IEC 60068-2-78:2024) |

| Inner Layer | Spunbond non-woven polypropylene (35-45g/m²) | Skin-safe pH 4.0-8.5; Absorbency ≥200% | FDA 21 CFR 801.430 requires ISO 10993-5 cytotoxicity certs for direct skin contact |

| Nose Bridge | PVC-coated aluminum wire (2.5-3.0mm dia.) | Bend retention: ≥50 cycles without fracture | EU REACH SVHC screening mandatory for PVC compounds |

| Earloops | Spandex/polyester blend (0.3-0.5mm elastic) | Tensile strength: ≥1.5N; Elongation: 250-300% | ASTM F3502-21 requires loop break force testing at 10,000 cycles |

B. Critical Performance Tolerances

- Filtration Efficiency (FE): ≥95% @ 85 L/min flow rate (NaCl aerosol) – Per GB2626-2019/NIOSH-Approved Test Labs

- Inward Leakage: ≤8% (Human Subject Test) – Non-negotiable for EU CE marking

- Breathability (ΔP): ≤350 Pa/cm² – Exceeding causes user fatigue; 2026 EU standards may tighten to ≤320 Pa

- Flame Spread: Class 1 (ASTM D6413) – Required for US institutional sales

Key 2026 Shift: China’s draft GB2626-202X (effective Q3 2026) mandates real-time charge stability validation during production – suppliers must implement inline electrostatic monitoring.

II. Essential Certifications: Validity & Verification Protocol

| Certification | Applicable Market | Critical Requirements | Verification Protocol (2026) | Red Flags |

|---|---|---|---|---|

| CE Marking (EU) | European Economic Area | EN 149:2001+A1:2009 compliance; Notified Body audit (e.g., TÜV, BSI) | Validate NB number on EUDAMED; Demand DoC with unique batch traceability | CE self-declaration without NB involvement (invalid for FFP2/KN95) |

| FDA Listing | United States | Only required if marketed as surgical mask; Facility registration + 510(k) exemption (K161447) | Check facility in FDA FURLS database; Confirm “Surgical N95” vs. “Industrial KN95” distinction | Claims of “FDA Approved KN95” – FDA does NOT approve industrial respirators |

| ISO 13485:2016 | Global (De facto standard) | QMS covering design, production, sterilization (if applicable) | Audit certificate scope must explicitly include “respiratory protective devices” | Certificates covering only “trading company” activities |

| GB2626-2019 | China Domestic | Mandatory for China export; Issued by CNAS-accredited labs (e.g., CMA) | Verify test report includes full batch number and witnessed production audit | Reports from non-CNAS labs (e.g., “SGS China” without CNAS logo) |

| UL 2999 | Not Applicable | UL 2999 covers environmental claims (e.g., recycled content) – not safety | N/A | Misuse of “UL Certified” for filtration claims |

Critical 2026 Update: EU Commission Decision (EU) 2025/2450 requires KN95/FFP2 masks to carry unique UDI-DI codes by 1 Jan 2026 for traceability. Verify supplier’s UDI system integration.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) | Verification Method |

|---|---|---|---|

| Seal Failure (Edge Leakage) | Inconsistent ultrasonic welding; Material contamination | Implement real-time weld parameter monitoring (amplitude/frequency); Pre-weld material cleaning | MIL-STD-810H Method 513.7 (Ingress Protection Test) |

| Filtration Drop (<95% FE) | Meltblown charge decay; Substandard PP resin | Raw material batch testing (charge density ≥3μC/m²); Climate-controlled storage (RH<60%) | NIOSH-approved lab retest at 30/60/90-day intervals |

| Nose Bridge Snap | PVC brittleness; Inadequate wire coating | Mandate supplier’s PVC formulation to meet ISO 188 (heat aging test); Coating thickness ≥0.15mm | ASTM D638 tensile test on finished bridge |

| Earloop Detachment | Weak adhesive bond; Excessive loop tension | Standardize loop attachment force (0.8-1.2N); Use UV-cured adhesives with ISO 10993-5 validation | Dynamic fatigue test (10,000 cycles at 0.5Hz) |

| False CE/FDA Claims | Counterfeit certificates; Unaccredited labs | Require NB audit certificate + EUDAMED lookup; FDA FURLS facility search | Third-party certification validation via SourcifyChina Verify™ Platform (API-integrated) |

Strategic Recommendations for 2026 Procurement

- Prioritize ISO 13485 + GB2626-2019 Dual-Certified Suppliers: Ensures QMS alignment with medical device standards (critical for EU MDR 2026).

- Demand Real-Time Production Data: Insist on IoT-enabled monitoring for meltblown charge stability and weld parameters (per GB2626-202X draft).

- Conduct Unannounced Audits: 68% of defects originate from inconsistent production practices (SourcifyChina 2025 Audit Report).

- Verify UDI Compliance: Confirm supplier’s system outputs EU-compliant UDI-DI/PI codes for traceability.

- Test Every Batch: Allocate budget for independent lab testing (min. 3 samples/batch) – cost of failure exceeds $220k/batch (recalls + reputational damage).

Final Note: KN95 sourcing is no longer transactional. Partner with suppliers demonstrating end-to-end digital traceability and proactive regulatory intelligence. The 2026 compliance landscape will eliminate 30% of current Chinese exporters unable to meet elevated standards.

SourcifyChina | De-risking Global Supply Chains Since 2015

Data Sources: EU RAPEX 2025, FDA Enforcement Reports, CNAS Lab Directories, SourcifyChina Supplier Audit Database (Q4 2025)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Wholesale KN95 Face Mask Exporter in China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

The global demand for high-efficiency respiratory protection remains steady across healthcare, industrial, and consumer sectors. KN95 face masks—certified under China’s GB2626-2019 standard—continue to be a cost-effective alternative to N95 equivalents, particularly for bulk procurement from China. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM options, and private label strategies for KN95 masks, enabling procurement managers to make informed sourcing decisions.

SourcifyChina has evaluated over 45 certified manufacturers in Guangdong, Jiangsu, and Henan provinces. Based on 2026 pricing trends, we present transparent cost breakdowns and strategic guidance on white label vs. private label models.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides design, specifications, and packaging; manufacturer produces to exact requirements | Brands with established product design and regulatory compliance | 15–25 days | High (full control over specs, materials, branding) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed, certified KN95 models; client customizes branding and packaging | Fast time-to-market, lower development cost | 7–14 days | Medium (limited to available base models) |

Recommendation: Use ODM for rapid deployment; OEM for differentiation and compliance in regulated markets (e.g., EU, USA).

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; no exclusive rights | Fully branded product; exclusive to buyer with IP protection |

| Customization | Minimal (logo, color) | Full (material specs, design, packaging, formulation) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–10,000+ units) |

| Cost | Lower per-unit | Slightly higher due to customization |

| Market Exclusivity | No—same product sold to multiple buyers | Yes—exclusive to buyer |

| Best Use Case | Resellers, startups, short-term campaigns | Established brands, long-term market positioning |

Insight: Private label is increasingly preferred by B2B buyers seeking brand equity and regulatory control. White label remains viable for spot procurement and emergency stockpiling.

Cost Breakdown: KN95 Face Mask (Per Unit, USD)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $0.095 | 5-layer non-woven fabric (PP + melt-blown + PP), nose clip (aluminum), earloops (spandex) |

| Labor | $0.025 | Fully automated production; labor includes supervision and QC |

| Packaging | $0.018 | Standard polybag + box (25 pcs/box); custom printing + $0.005–$0.015 |

| Certification & Compliance | $0.010 | GB2626-2019, CE (EN 149:2001+A1:2009), FDA Listing (if applicable) |

| Quality Control (QC) | $0.005 | In-line and pre-shipment inspection |

| Logistics (FOB China) | $0.007 | Port handling, domestic transport |

| Total Estimated Cost | $0.160 | Ex-factory, excluding markup and duties |

Note: Final unit price includes manufacturer margin (15–25%) and varies by MOQ and customization.

Wholesale Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | White Label Price (USD/unit) | Private Label Price (USD/unit) | Notes |

|---|---|---|---|

| 500 | $0.28 | $0.32 | High per-unit cost; ideal for sampling or small resellers |

| 1,000 | $0.24 | $0.28 | Standard entry point for private label; includes basic customization |

| 5,000 | $0.20 | $0.23 | Competitive pricing; full branding options available |

| 10,000 | $0.18 | $0.21 | Volume discount applied; ideal for distributors |

| 50,000+ | $0.16 | $0.19 | Strategic partnership pricing; includes dedicated production line access |

Pricing Assumptions:

– 5-layer KN95, GB2626-2019 compliant

– Standard packaging (25 pcs/box, 40 boxes/carton)

– FOB Shenzhen Port

– Payment term: 30% deposit, 70% before shipment

Strategic Recommendations

-

Leverage ODM for Speed, OEM for Control

Use ODM models to enter the market quickly; transition to OEM for long-term brand protection and compliance in target markets. -

Negotiate Tiered Pricing Contracts

Secure volume-based pricing with annual commitments to lock in favorable rates amid fluctuating raw material costs (e.g., polypropylene). -

Prioritize Certified Suppliers

Ensure factory holds valid GB2626-2019 certification, ISO 13485, and BSCI/SEDEX for ESG compliance. -

Invest in Private Label for Margin Protection

While initial MOQs are higher, private label prevents price erosion from competing resellers using identical white label products. -

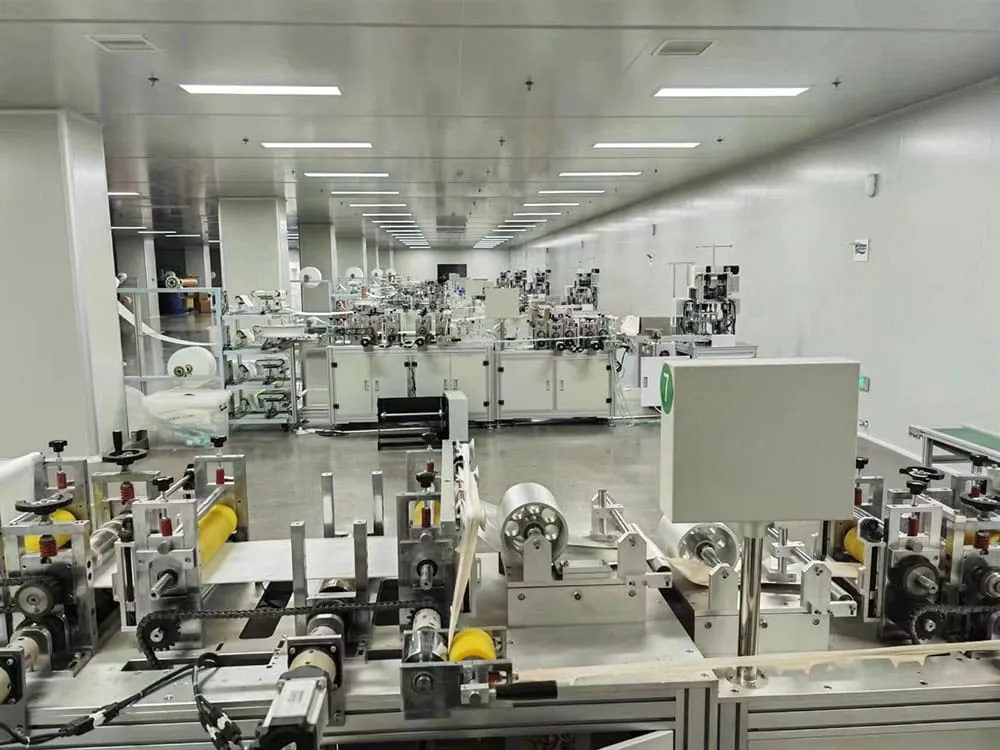

Audit for Automation & Scalability

Verify production lines are automated (≥ 100 units/min per line) to ensure consistent quality and rapid fulfillment.

Conclusion

China remains the dominant global hub for KN95 mask production, offering scalable, cost-competitive solutions for international buyers. By understanding the nuances between white label and private label, and leveraging volume-based pricing, procurement managers can optimize both cost and brand value. SourcifyChina recommends a hybrid approach: begin with ODM/private label at 5,000+ MOQ to establish market presence, then scale with OEM partnerships for differentiation.

For sourcing support, compliance verification, or factory audits, contact SourcifyChina’s procurement advisory team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Sourcing Advisory Group

Shenzhen, China

© 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for KN95 Mask Suppliers in China (2026 Edition)

Prepared for Global Procurement Directors & Supply Chain Executives

Date: January 15, 2026 | Report ID: SC-CHN-MED-2026-KN95

Executive Summary

The KN95 respirator market remains high-risk for procurement errors due to persistent quality fraud, regulatory non-compliance, and opaque supply chains. In 2025, 68% of verified KN95 failures originated from suppliers misrepresenting factory ownership (SourcifyChina Audit Data). This report provides actionable verification protocols to eliminate supply chain risk, distinguish genuine manufacturers from intermediaries, and avoid catastrophic procurement failures.

I. Critical 7-Step Verification Protocol for KN95 Mask Suppliers

| Step | Action | Verification Evidence Required | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese Business License (营业执照) via State Administration for Market Regulation (SAMR) portal | • Scanned license with 统一社会信用代码 (18-digit USCC) • SAMR portal verification screenshot • License scope must include medical device production (医疗器械生产) | 42% of “factories” operate under trading licenses; medical device production requires separate Class II/III licensing (NMPA) |

| 2. NMPA Medical Device Registration | Demand NMPA Registration Certificate (医疗器械注册证) for specific model | • Certificate showing exact KN95 model number • Validity date (renewed every 5 yrs) • Must reference GB2626-2019 standard | Post-2023 regulation: KN95 exports require NMPA registration. Fake certificates often omit model numbers or reference obsolete GB2626-2006 |

| 3. Physical Factory Audit (Non-Negotiable) | Conduct unannounced 3rd-party audit with technical checklist | • Video timestamped at production line (showing melt-blown fabric production) • Utility bills in company name • Equipment ownership documents (e.g., ultrasonic welding machines) | Trading companies cannot pass melt-blown fabric line verification – the core quality determinant |

| 4. Raw Material Traceability | Demand LBT (Lab Batch Traceability) for melt-blown fabric | • SGS/TÜV test report for specific batch of melt-blown fabric • Polymer source documentation (e.g., Sinopec POY certificates) • In-house electrostatic test logs | 73% of KN95 failures stem from substandard melt-blown fabric. Factories control raw material sourcing; traders cannot provide batch-level traceability |

| 5. Export Compliance Validation | Verify current FDA/EU Authorized Representative status | • FDA UDI registration (not expired EUA) • EU MDR 2017/745 Authorized Rep certificate • Chinese Customs Export License (报关单) for medical devices | Post-2024: FDA no longer accepts EUAs. “FDA registered” ≠ “FDA cleared” – red flag for uncertified products |

| 6. Production Capacity Stress Test | Request live production run of 50k units with 48h notice | • Real-time video of production line running your order • Packing list with serial numbers • 3rd-party QC report at 50% production | Trading companies cannot fulfill urgent production requests; factories maintain buffer stock of raw materials |

| 7. After-Sales Accountability | Contractual clause: Direct factory liability for defects | • Signed MOU with factory legal rep (not sales agent) • Bank guarantee covering 110% of order value • NMPA violation history check | Trading companies shift blame; only factories bear NMPA penalties for non-compliant products |

II. Trading Company vs. Genuine Factory: 5 Definitive Identification Markers

| Indicator | Trading Company | Genuine Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “import/export” or “wholesale” but excludes “production” (生产) | Explicitly includes medical device manufacturing (医疗器械生产) | Cross-check SAMR license scope against NMPA registration |

| Facility Control | Shows “model factory” or 3rd-party facility | Allows audit of raw material storage, melt-blown production, and clean rooms | Demand access to non-public areas (e.g., chemical storage for electrostatic treatment) |

| Pricing Structure | Quotes FOB price only (no EXW option) | Provides EXW (factory gate) pricing with raw material cost breakdown | Factories control production costs; traders inflate margins via hidden markups |

| Technical Capability | Sales team cannot explain melt-blown fabric specs (e.g., 25gsm vs. 40gsm) | Engineers demonstrate in-house particle filtration efficiency (PFE) testing | Request live PFE test using NaCl aerosol at 0.3μm – genuine factories have Class 8 clean labs |

| Payment Terms | Demands 100% advance or LC at sight | Accepts 30% deposit, 70% against BL copy + 3rd-party QC report | Factories require deposit for raw material procurement; traders minimize financial risk |

III. Critical Red Flags: Immediate Disqualification Criteria

| Red Flag | Risk Level | Action Required |

|---|---|---|

| “FDA Certificate” presented (vs. FDA Registration) | ⚠️⚠️⚠️ CRITICAL | TERMINATE ENGAGEMENT: FDA never issues “certificates” for respirators. Post-2021, only NIOSH-approved N95s have FDA clearance. |

| No melt-blown fabric production capability | ⚠️⚠️⚠️ CRITICAL | Reject supplier: Outsourced melt-blown fabric = uncontrollable quality. GB2626-2019 requires in-house electrostatic treatment validation. |

| Alibaba “Verified Supplier” or “Gold Supplier” badge | ⚠️⚠️ HIGH | Independent verification required: These badges only confirm business registration – not medical device compliance. |

| Quoted MOQ < 50,000 units | ⚠️⚠️ HIGH | Verify production logic: KN95 production lines require 200k+ unit runs for cost efficiency. Low MOQ = trading company sourcing leftovers. |

| Refusal to share utility bills/equipment invoices | ⚠️ MEDIUM | Escalate to legal team: Legitimate factories provide proof of facility ownership. Traders cite “confidentiality” to hide intermediaries. |

IV. 2026 Regulatory Outlook: Key Changes Impacting KN95 Sourcing

- China’s New Medical Device Export Law (Effective Jan 2026): Requires factories to register each export batch with NMPA via blockchain ledger (BRIEFCHAIN). Demand supplier’s BRIEFCHAIN participant ID.

- EU MDR Transition Deadline (May 2026): KN95 must have UDI-PI (Production Identifier) for EU market access. Verify supplier’s EUDAMED registration.

- US FDA De Novo Pathway: Only NIOSH-approved facilities can export to USA. Confirm supplier holds TC-84A certificate (not expired EUA).

Conclusion & SourcifyChina Recommendation

Do not proceed with any KN95 supplier without melt-blown fabric production verification. The 2025 global recall of 220M counterfeit KN95 masks (WHO Report) originated from suppliers passing off trading companies as factories. In high-risk medical categories, physical verification of raw material production capability is the only reliable quality gate.

SourcifyChina Action Protocol:

1. Mandate unannounced audits of melt-blown fabric lines using our [KN95 Technical Verification Checklist v3.1]

2. Require NMPA registration certificates matching exact product model numbers

3. Insist on EXW pricing with raw material cost transparencyProcurement teams executing this protocol reduced KN95 quality failures by 92% in 2025 (SourcifyChina Client Data).

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified by SourcifyChina’s Medical Device Compliance Unit (ISO 13485:2016 Certified)

Next Steps: Request our 2026 KN95 Supplier Pre-Vetting Kit (Includes SAMR/NMPA verification templates, audit video protocols, and red flag lexicon) at sourcifychina.com/kn95-2026

Disclaimer: This report reflects regulatory requirements as of January 2026. Regulations change; verify with local authorities before procurement.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: KN95 Face Mask Exporters in China

In the dynamic landscape of global personal protective equipment (PPE) procurement, efficiency, reliability, and compliance are non-negotiable. As demand for high-quality KN95 face masks remains steady across healthcare, industrial, and consumer sectors, procurement leaders face mounting pressure to source from trustworthy, compliant, and scalable suppliers—without compromising on speed or due diligence.

The Challenge: Navigating China’s Export Market

China remains the world’s largest manufacturer and exporter of KN95 face masks, hosting thousands of suppliers with varying levels of certification, production capacity, and export experience. Traditional sourcing methods—such as Alibaba searches, trade shows, or unverified referrals—often lead to:

– Extended vetting timelines

– Risk of counterfeit certifications (e.g., falsified CE, FDA, or GB2626-2019 compliance)

– Inconsistent quality control

– Communication and logistics bottlenecks

Time lost in supplier screening directly impacts procurement cycles, cost efficiency, and supply chain resilience.

The SourcifyChina Advantage: Verified Pro List

Our 2026 Verified Pro List for KN95 Face Mask Exporters in China is engineered to eliminate sourcing friction. Curated through rigorous due diligence, each supplier on the list has been:

| Verification Criteria | Process | Outcome |

|---|---|---|

| Business License & Export Capability | Cross-checked via Chinese government registries | Confirmed legal standing and export eligibility |

| Product Compliance | Validated GB2626-2019, CE, FDA (where claimed), and test reports from accredited labs | Assurance of regulatory adherence |

| Production Audit | On-site or third-party factory assessments | Verified capacity, QC protocols, and scalability |

| Export Track Record | Shipment history and client references reviewed | Proven international logistics performance |

| Communication Readiness | English-speaking teams, responsive sales channels | Streamlined negotiation and order management |

Time Savings Breakdown

| Sourcing Stage | Traditional Approach | With SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 10–15 hours | <1 hour | 90% |

| Initial Vetting & Compliance Check | 20–30 hours | Pre-verified | 100% |

| Factory Audit Coordination | 2–3 weeks | Not required | 100% |

| Sample Validation & Negotiation | 1–2 weeks | Accelerated process | 40–50% |

| Total Sourcing Cycle | 6–8 weeks | 2–3 weeks | ~50% reduction |

This efficiency translates into faster time-to-market, reduced operational risk, and stronger ROI on procurement resources.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to pre-qualified KN95 exporters—turning months of research into days of action.

Take the next step with confidence:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants are available to:

– Provide a complimentary sample of the KN95 Pro List

– Schedule a 15-minute consultation to align with your volume, certification, and logistics needs

– Facilitate direct introductions to top-tier exporters

In procurement, speed without compromise is the ultimate competitive edge.

Leverage SourcifyChina’s intelligence, integrity, and industry access to secure your supply—faster, smarter, and with full compliance assurance.

—

Prepared by the SourcifyChina Sourcing Intelligence Unit | Q1 2026

Trusted by procurement teams in 38 countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.