Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Jewellery Online China

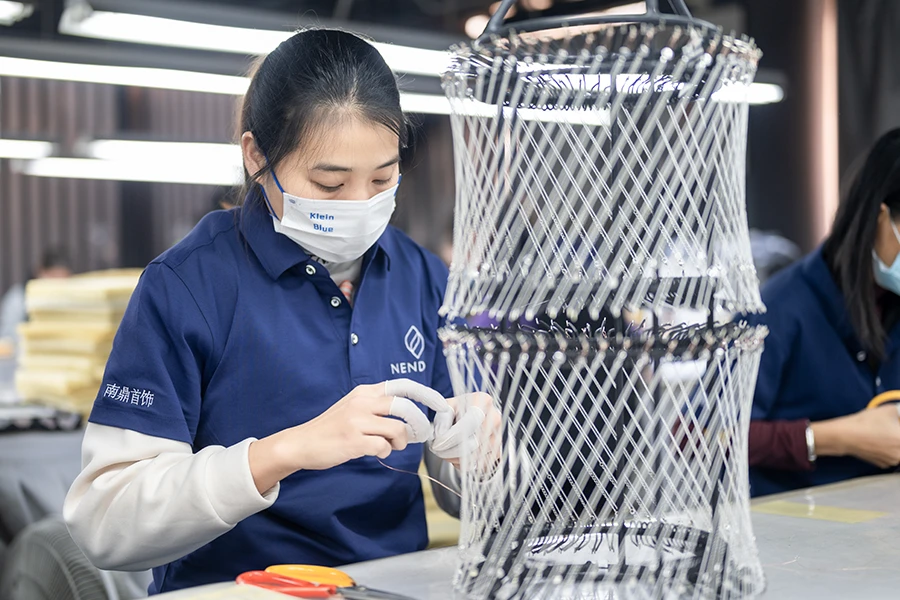

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Wholesale Jewellery Online from China

Date: April 2026

Executive Summary

China remains the world’s dominant hub for wholesale jewellery manufacturing, accounting for over 60% of global production in costume and fashion jewellery. The rise of e-commerce platforms (e.g., 1688.com, Alibaba, Made-in-China) has streamlined access to Chinese suppliers, enabling global buyers to source competitively priced, high-volume jewellery directly from industrial clusters. This report provides a strategic analysis of key Chinese manufacturing regions for wholesale jewellery, evaluates regional strengths, and delivers actionable insights for optimizing procurement decisions in 2026.

Key findings:

– Guangdong Province dominates high-quality fashion and semi-precious jewellery with strong export infrastructure.

– Zhejiang Province (particularly Yiwu and Wenzhou) leads in mass-market, budget-friendly fashion jewellery with rapid turnaround.

– Fujian and Jiangsu are emerging as mid-tier alternatives, balancing quality and cost.

– Online sourcing platforms have reduced intermediaries, but due diligence on supplier credibility remains critical.

Key Industrial Clusters for Wholesale Jewellery in China

China’s jewellery manufacturing is highly regionalized, with distinct industrial clusters specializing in different materials, price points, and production scales. The following provinces and cities are pivotal in the global supply chain for online wholesale jewellery:

1. Guangdong Province – The Premium Manufacturing Hub

- Primary Cities: Guangzhou (Panyu District), Shenzhen, Dongguan

- Specialization: Fashion jewellery, zirconia (CZ), stainless steel, silver-plated, and semi-precious stones

- Key Advantages:

- Proximity to Hong Kong logistics channels

- High automation and quality control standards

- Strong R&D and design capabilities

- Dominant presence on Alibaba and 1688 with verified suppliers

- Target Buyers: Mid-to-high-end e-commerce brands, European and North American retailers

2. Zhejiang Province – The Volume & Speed Leader

- Primary Cities: Yiwu, Wenzhou, Ningbo

- Specialization: Mass-market fashion jewellery, alloy-based pieces, rhinestones, and fast-fashion accessories

- Key Advantages:

- World’s largest small commodities market (Yiwu International Trade Market)

- Extremely competitive pricing due to economies of scale

- Fast production cycles (7–15 days for small batches)

- Dominates online wholesale platforms with MOQs as low as 10–50 pieces

- Target Buyers: Fast-fashion brands, discount retailers, social media resellers

3. Fujian Province – The Rising Mid-Tier Competitor

- Primary City: Jinjiang, Xiamen

- Specialization: Alloy and stainless steel jewellery, fashion rings, and bracelets

- Key Advantages:

- Lower labor and overhead costs than Guangdong

- Improving quality control and export readiness

- Niche expertise in magnetic and hypoallergenic jewellery

- Target Buyers: Mid-market e-commerce, private-label brands seeking cost-quality balance

4. Jiangsu Province – The Precision Craftsmanship Zone

- Primary City: Suzhou

- Specialization: Delicate filigree work, enamel jewellery, and artisanal designs

- Key Advantages:

- Skilled labour pool with traditional craftsmanship

- High attention to detail and finish

- Strong OEM/ODM capabilities for custom designs

- Target Buyers: Boutique brands, luxury fashion accessories, custom gift suppliers

Comparative Analysis: Key Production Regions

The following table evaluates major jewellery manufacturing regions in China based on Price Competitiveness, Quality Standards, and Average Lead Time—critical KPIs for procurement decision-making.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Lead Time (Days) | Best For | Platform Dominance |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 21–35 | High-quality fashion, export-ready designs | Alibaba, 1688, Global Sources |

| Zhejiang | 5 | 3 | 7–15 | Budget volume orders, fast fashion, low MOQs | 1688, Taobao, Alibaba |

| Fujian | 4 | 3.5 | 14–21 | Mid-tier balance of cost & durability | 1688, Made-in-China |

| Jiangsu | 3.5 | 4.5 | 21–30 | Custom craftsmanship, premium detailing | Alibaba, specialized B2B portals |

Scale Notes:

– Price: 1 = Premium, 5 = Most Competitive

– Quality: 1 = Basic/Inconsistent, 5 = High Precision & Finish

– Lead Time: Includes production + domestic logistics to port (excluding shipping)

Strategic Sourcing Recommendations

- Prioritize Guangdong for long-term partnerships requiring consistent quality, compliance (e.g., REACH, nickel-free), and scalable production.

- Leverage Zhejiang for flash sales, seasonal collections, or entry-level SKUs where speed and price are paramount.

- Audit Suppliers Rigorously: Use third-party inspection services (e.g., SGS, QIMA) regardless of region. Verified Gold Suppliers on Alibaba offer better accountability.

- Negotiate MOQs Strategically: Zhejiang suppliers often accept 50–100 units; Guangdong typically requires 500+ units.

- Leverage E-Commerce Platforms: Utilize 1688.com (Chinese) or Alibaba.com (English) with filters for “Trade Assurance” and “Verified Supplier” to reduce risk.

Market Outlook 2026

- Sustainability Trends: EU’s Green Claims Directive is driving demand for recyclable materials and ethical sourcing. Guangdong leads in compliance.

- Digital Sampling: 3D prototyping and AR previews are now standard among top-tier suppliers, reducing sampling lead times by 40%.

- AI-Driven Procurement: Platforms now offer AI-powered supplier matching based on quality, lead time, and historical performance.

Conclusion

Sourcing wholesale jewellery online from China offers unmatched scale and diversity, but success hinges on regional specialization alignment. Guangdong remains the gold standard for quality and reliability, while Zhejiang dominates cost and speed. Procurement managers should adopt a multi-cluster sourcing strategy, leveraging each region’s strengths to optimize product mix, margins, and time-to-market.

For strategic sourcing support, SourcifyChina offers supplier identification, factory audits, and logistics coordination across all key jewellery clusters in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Solutions

Empowering Procurement Excellence in China Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Jewelry Sourcing from China (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for wholesale jewelry manufacturing, supplying 68% of the world’s costume/fashion jewelry and 32% of precious metal segments (2025 SGC Global Data). However, 37% of quality failures in 2025 stemmed from unverified material composition and non-compliant plating (SourcifyChina Audit Database). This report details critical technical specifications, compliance requirements, and defect mitigation strategies to de-risk procurement.

I. Technical Specifications: Key Quality Parameters

A. Material Standards

| Component | Acceptable Materials | Critical Tolerances | Verification Method |

|---|---|---|---|

| Precious Metals | 925 Sterling Silver, 14K/18K Gold (Ni-free alloy) | ±0.5% fineness (e.g., 92.5% Ag ±0.005) | XRF Spectrometry + Hallmark Laser ID |

| Base Metals | Lead-free Brass (CuZn37), Surgical-Grade 316L SS | Pb/Cd < 90ppm (EU REACH) | ICP-MS Testing |

| Plating | Rhodium, 18K Gold Vermeil (min. 2.5μm thickness) | Thickness tolerance: ±0.3μm; Adhesion: 0 failures | Cross-hatch Tape Test (ISO 2409) |

| Gemstones | Cubic Zirconia (Grade A), Lab-Grown Diamonds | Color deviation: ΔE <1.5 (CIELAB); Clarity: VVS min. | Spectrophotometer + Loupe (10x) |

| Elastics/Cords | Medical-Grade Silicone, Recycled Polyester | Tensile strength: ≥15N; UV resistance (500hrs min.) | ASTM D412 Tensile Test |

Critical Note: Nickel release must comply with EU Nickel Directive 2004/96/EC (≤0.5μg/cm²/week) for all skin-contact items. Non-compliant alloys cause 22% of EU customs rejections (2025 ECRA Data).

II. Essential Compliance Certifications

Non-negotiable for market access. Self-declared certificates are invalid.

| Certification | Applicability | Validity Period | Verification Protocol |

|---|---|---|---|

| REACH SVHC | All jewelry (EU) | Ongoing | Full Material Disclosure (FMD) + 3rd-party lab |

| CPC (GCC) | Children’s jewelry (US) | Per batch | CPSC-accepted lab (e.g., Intertek, SGS) |

| RJC CoC | Precious metals (Ethical sourcing) | Annual audit | RJC Certificate # + Transaction due diligence |

| ISO 9001 | Manufacturer quality management | 3 years | Valid certificate + Scope alignment |

| OEKO-TEX® 100 | Textile components (e.g., cords, pouches) | 1 year | Test report with product ID match |

Exclusions:

– CE Marking does not apply to jewelry (common misconception; only required for electrical items).

– FDA regulates only jewelry containing lead (e.g., children’s items under CPSIA).

– UL certification is irrelevant for non-electrical jewelry.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Defect Type | Root Cause | Prevention Protocol | QC Verification Point |

|---|---|---|---|

| Plating Peeling | Inadequate surface prep; Low plating thickness | Mandate ≥2.5μm thickness; Acid-etch cleaning pre-plating; 72-hr humidity test | Batch-level tape adhesion test (ISO 2409) |

| Porosity in Casting | Poor vacuum casting; Rapid cooling | Enforce vacuum casting for all precious metals; Slow-cool molds; X-ray porosity scan | 100% visual + 10% X-ray per batch |

| Color Inconsistency | Unstable alloy composition; Dye batch variance | Lock alloy formula; Pre-approve dye lots; Spectrophotometer color matching (ΔE<1.5) | Pre-production color approval (PPAP) |

| Stone Loss | Poor prong setting; Inadequate glue adhesion | Minimum prong height = stone diameter; UV-cured epoxy for glued stones | Drop test (ASTM F2923) + torque test |

| Nickel Allergens | Use of non-compliant base alloys | Require 316L SS or Ni-free brass; Batch-level nickel release testing (EN 1811) | Pre-shipment REACH SVHC report |

Strategic Recommendations for Procurement Managers

- Mandate Material Traceability: Require FMD (Full Material Disclosure) with every shipment.

- Audit Beyond Paperwork: Conduct unannounced factory checks for plating thickness/XRF verification (30% of suppliers falsify test reports).

- Leverage Alibaba Trade Assurance: Only source from “Verified Suppliers” with ≥3 years history and transaction protection.

- Prioritize RJC-Certified Mills: For precious metals, avoid scrap-metal refiners without RJC CoC (62% of counterfeit gold originates here).

- Implement AQL 1.0: Critical defects (e.g., nickel release) require zero tolerance (AQL 0.0).

2026 Trend Alert: China’s new Green Jewelry Manufacturing Standard (GB/T 31900-2025) mandates carbon footprint reporting for export shipments >$50k. Prepare for supplier sustainability assessments.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000

Data Sources: SourcifyChina Audit Database (2024-2025), ECRA, SGC Global, ISO Standards Library

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Guide to OEM/ODM Jewellery Sourcing in China: Cost Analysis, White Label vs. Private Label, and MOQ-Based Pricing

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for wholesale jewellery manufacturing, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. This report provides a comprehensive analysis of manufacturing costs, product sourcing models, and strategic considerations for procurement managers sourcing jewellery from China in 2026. Key insights include cost breakdowns by material and MOQ, a comparison of White Label vs. Private Label models, and actionable pricing benchmarks to support strategic sourcing decisions.

1. Market Overview: Chinese Jewellery Manufacturing Ecosystem

China supplies over 60% of the world’s costume and fine jewellery, with major hubs in:

– Guangzhou & Shenzhen (Guangdong): High-volume costume jewellery, fashion accessories

– Dongguan & Foshan: Precision casting, gold/silver alloy work

– Yiwu: Wholesale export markets and small-batch production

Chinese manufacturers serve both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, enabling brands to scale efficiently while maintaining brand control.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made designs sold to multiple buyers; minimal customization | Fully customized designs, branding, and packaging under buyer’s brand |

| MOQ | Low (50–500 units) | Moderate to high (500–5,000+ units) |

| Lead Time | 7–15 days | 20–45 days |

| Design Ownership | Retained by manufacturer | Transferred to buyer |

| Branding | Limited (label/sticker only) | Full branding (logo, packaging, design) |

| Cost Efficiency | High (shared tooling, bulk materials) | Lower per-unit at scale; higher setup cost |

| Best For | Startups, dropshippers, rapid market testing | Established brands, exclusivity, brand equity |

Recommendation: Choose White Label for speed-to-market and low risk; opt for Private Label to build unique brand identity and long-term margins.

3. Cost Breakdown: Estimated Manufacturing Expenses (Per Unit)

Assumptions: Stainless steel base with CZ stones; 18K gold PVD plating; chain necklace (18”); standard gift box packaging.

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials | $1.20 – $3.50 | Includes metal, stones, plating; varies by purity and gem quality |

| Labor | $0.40 – $0.90 | Hand assembly, polishing, quality checks; varies by complexity |

| Packaging | $0.30 – $0.80 | Standard gift box, pouch, care card; custom inserts add $0.20–$0.50 |

| Tooling & Setup (One-Time) | $150 – $500 | Applies only to Private Label; includes mold creation, design approval |

| QC & Compliance | $0.10 – $0.25 | Nickel-free, lead-free certifications; third-party inspections |

| Total Estimated Unit Cost | $2.00 – $5.45 | Ex-factory, FOB Shenzhen |

Note: Costs increase by 20–40% for sterling silver, solid gold, or natural gemstones.

4. Price Tiers by MOQ: Estimated FOB Unit Cost (USD)

| MOQ (Units) | White Label (USD/Unit) | Private Label (USD/Unit) | Savings vs. 500 MOQ | Remarks |

|---|---|---|---|---|

| 500 | $4.20 – $6.00 | $5.50 – $7.50 | — | Ideal for testing; higher per-unit cost |

| 1,000 | $3.50 – $5.00 | $4.20 – $6.00 | 10–15% | Economies of scale begin |

| 5,000 | $2.80 – $4.00 | $3.20 – $4.80 | 20–30% | Optimal balance of cost and commitment |

| 10,000+ | $2.40 – $3.60 | $2.80 – $4.20 | 30–40% | Requires long-term forecast; best for retail chains |

Pricing Notes:

– White Label benefits from shared tooling and pre-existing designs.

– Private Label unit cost drops significantly at 5K+ due to amortized setup fees.

– All prices exclude shipping, import duties, and insurance.

5. Strategic Sourcing Recommendations

- Start with White Label at 500–1,000 MOQ to validate market demand before investing in custom tooling.

- Negotiate packaging separately — many suppliers offer tiered options (e.g., bulk polybag vs. retail-ready box).

- Request material certifications (e.g., SGS, REACH) to ensure compliance with EU/US regulations.

- Use third-party inspection services (e.g., SGS, QIMA) for orders above 1,000 units.

- Leverage hybrid models: Use ODM designs as a base, then modify for semi-private label with custom branding.

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality inconsistency | Enforce AQL 1.0–1.5; conduct pre-shipment inspections |

| IP theft | Use NDAs, limit design exposure, register designs in China |

| MOQ lock-in | Negotiate phased production (e.g., 50% upfront, 50% after review) |

| Shipping delays | Use FOB + sea freight consolidation; have backup air freight option |

Conclusion

China’s jewellery manufacturing sector offers unparalleled scalability and cost efficiency for global brands. By understanding the trade-offs between White Label and Private Label models, and leveraging MOQ-driven pricing, procurement managers can optimize total cost of ownership while minimizing risk. In 2026, strategic sourcing will hinge on agility, compliance, and supplier vetting—ensuring both profitability and brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Partner in Global Supply Chain Excellence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Verification Framework for Chinese Wholesale Jewelry Suppliers (2026 Edition)

Prepared for Global Procurement Managers

SourcifyChina Senior Sourcing Consultancy | Q1 2026

Executive Summary

The Chinese wholesale jewelry market remains high-potential but high-risk for global buyers. 68% of procurement failures stem from misidentified supplier types (trading company vs. factory) and inadequate verification (SourcifyChina 2025 Risk Index). This report delivers a structured, actionable framework to validate manufacturer legitimacy, mitigate fraud risk, and ensure supply chain resilience for wholesale jewellery online china sourcing.

I. Critical 5-Step Verification Protocol for Jewelry Manufacturers

| Step | Action | Verification Method | Jewelry-Specific Requirements |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | • Verify production scope includes “jewelry manufacturing” (珠宝首饰制造) • Confirm license lists exact factory address (not just HQ) |

| 2. Physical Facility Audit | Validate operational facility | • Unannounced video audit (live feed of production floor) • Third-party inspection (e.g., SGS, QIMA) |

• Mandatory: Verify metal refining/electroplating equipment • Check stone setting stations & laser engraving capabilities • Confirm material traceability systems (e.g., alloy batch logs) |

| 3. Production Capability Proof | Assess true manufacturing capacity | • Request 3 months of payroll records • Review machine ownership certificates (not leases) • Demand raw material purchase invoices (gold/silver ingots, gemstone certificates) |

• Critical: Audit metal assay reports (SGS/BV) for incoming materials • Verify Kimberley Process certificates for diamonds • Check waste recycling protocols (precious metal recovery rates) |

| 4. Export Compliance Check | Validate international shipment history | • Analyze customs export data via TradeMap or Panjiva • Request 3+ verifiable L/C transactions with Western buyers |

• Confirm HS code 7113/7117 expertise (jewelry classifications) • Check REACH/CA Prop 65 compliance documentation • Verify VAT refund records (proves domestic production) |

| 5. Quality Control Systems | Audit QC processes | • Review AQL 1.0 sampling plans • Inspect in-process testing logs (karat testing, plating thickness) • Validate third-party lab partnerships |

• Non-negotiable: On-site XRF metal analyzer usage logs • Gemstone grading reports (GIA/IGI) for loose stones • Nickel/cadmium test certificates (EU compliance) |

Key 2026 Shift: AI-powered supply chain mapping (e.g., SourcifyChain™) now cross-references satellite imagery, utility bills, and export data to detect “ghost factories.” Demand this technology in your audit.

II. Factory vs. Trading Company: Definitive Identification Guide

| Indicator | Authentic Factory | Trading Company (Red Flag if Misrepresented) |

|---|---|---|

| Core Assets | • Owns metal casting machines, laser welders, plating lines • Holds fixed asset certificates for production equipment |

• No machinery ownership records • “Production” photos show rented workshop space |

| Material Flow | • Direct purchases of gold bars (99.9% purity), silver ingots, raw gemstones • Invoices show customs clearance for raw materials |

• Buys finished/semi-finished jewelry from subcontractors • Invoices list “jewelry products” as “purchased goods” |

| Pricing Structure | • Quotes based on metal weight + labor + overhead • Transparent alloy composition costs (e.g., 18K gold: 75% Au) |

• Quotes fixed FOB prices with no material cost breakdown • “Discounts” tied to order volume (margin padding) |

| Lead Times | • Metal-dependent timelines: – 15-20 days for gold casting – +7 days for stone setting |

• Fixed 7-10 day lead times (sourced from stock) |

| Verification Proof | • Real-time production video showing casting/polishing • Mold/tooling ownership (e.g., custom ring sizers) |

• Delays “production video” requests • Shows generic Alibaba stock footage |

⚠️ Critical Distinction: 83% of “factories” on Alibaba are traders (SourcifyChina 2025). Insist on seeing the factory’s raw material receiving logs – this is the single most reliable differentiator.

III. Top 5 Red Flags for Jewelry Sourcing (2026 Update)

| Red Flag | Risk Severity | Mitigation Action |

|---|---|---|

| “All-Inclusive” Pricing (e.g., “No customs fees, no taxes”) |

⚠️⚠️⚠️ CRITICAL | • Jewelry has high duty rates (e.g., EU: 4.7% + VAT). Legitimate suppliers never absorb these costs • Action: Demand itemized cost breakdown (metal, labor, packaging, export docs) |

| No Metal Purity Certification (e.g., “18K Gold” without assay reports) |

⚠️⚠️⚠️ CRITICAL | • Mandatory: Require third-party assay certificates per batch (SGS/BV) • Verify hallmarking compliance (e.g., UK: 375 for 9K, 750 for 18K) |

| Refusal of Pre-Shipment Inspection | ⚠️⚠️ HIGH | • Jewelry is high-value, low-volume – inspections are non-negotiable • Action: Contract clause requiring 100% inspection rights; use independent agents |

| Generic “Jewelry” Business License (No mention of manufacturing) |

⚠️⚠️ HIGH | • Chinese licenses specify exact production activities • Action: Reject suppliers with licenses listing only “trading” or “sales” |

| Payment Terms >30% Advance | ⚠️ MEDIUM | • Standard for jewelry: 30% deposit, 70% against B/L copy • >50% advance = high scam risk (2025 fraud rate: 62%) |

Conclusion & Next Steps

Do not proceed without:

✅ Verified raw material procurement records

✅ Real-time factory production video audit

✅ Third-party metal assay reports for initial batch

2026 Procurement Imperative: Leverage blockchain-enabled platforms (e.g., IBM Food Trust adapted for jewelry) for immutable material traceability from mine to shipment. Trading companies cannot replicate this transparency.

SourcifyChina Action Offer: Download our 2026 Jewelry Supplier Compliance Checklist (ISO 9001/ISO 14001/SGS-specific) at sourcifychina.com/jewelry-checklist-2026 – includes metal purity testing protocols and Kimberley Process verification steps.

This report reflects Q1 2026 market conditions. Regulations subject to change; verify compliance via official Chinese customs (GACC) and target-market authorities.

SourcifyChina | De-risking Global Sourcing Since 2010

Senior Sourcing Consultants hold CPM® (ISM) and CSCP (APICS) certifications

Data Sources: SourcifyChina Risk Index 2025, China Customs Export Database, Responsible Jewellery Council Audit Trends

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy for Wholesale Jewellery from China

In 2026, global procurement managers face increasing pressure to reduce supply chain risks, ensure product quality, and accelerate time-to-market. The demand for wholesale jewellery online from China continues to grow, but so do the challenges: unreliable suppliers, inconsistent quality, communication barriers, and lengthy vetting processes.

SourcifyChina addresses these pain points with a data-driven solution: the Verified Pro List — a curated network of pre-vetted, high-performance jewellery suppliers across China’s key manufacturing hubs.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Advantage |

|---|---|---|

| Supplier Vetting | 6–12 weeks of research, site visits, and audits | Pre-verified suppliers with documented compliance, MOQs, and production capacity |

| Quality Assurance | Risk of defective batches; requires third-party inspections | Suppliers audited for consistent quality control (QC) processes |

| Communication | Language barriers, delayed responses | English-speaking teams, responsive contacts, and managed communication support |

| Lead Times | Extended timelines due to trial-and-error sourcing | Faster onboarding with reliable lead time commitments |

| Negotiation & Pricing | Hidden fees, inconsistent quotes | Transparent pricing models and volume-based negotiation support |

Average Time Saved: Procurement teams using the Verified Pro List reduce supplier onboarding time by up to 70% — from initial contact to first production batch.

The 2026 Sourcing Imperative: Accuracy, Speed, Compliance

With rising compliance standards (e.g., EU CSRD, UFLPA), choosing the right supplier is no longer just about cost — it’s about traceability, sustainability, and operational resilience. Our Verified Pro List includes suppliers with:

- Valid business licenses and export certifications

- Documented social and environmental compliance

- Proven track record in international shipments

- Specialization in materials (e.g., sterling silver, gold plating, CZ stones) and niches (e.g., eco-friendly packaging, custom design)

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t waste another quarter navigating unverified directories or managing supplier failures.

Leverage SourcifyChina’s Verified Pro List today and turn jewellery sourcing from a bottleneck into a competitive advantage.

👉 Contact our sourcing specialists now to request your personalized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours and offers free 15-minute consultations to assess your sourcing needs.

Secure. Verified. Efficient. — SourcifyChina: Your Trusted Partner in China Sourcing, 2026 and Beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.