Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Human Hair Weave China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Wholesale Human Hair Weave from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

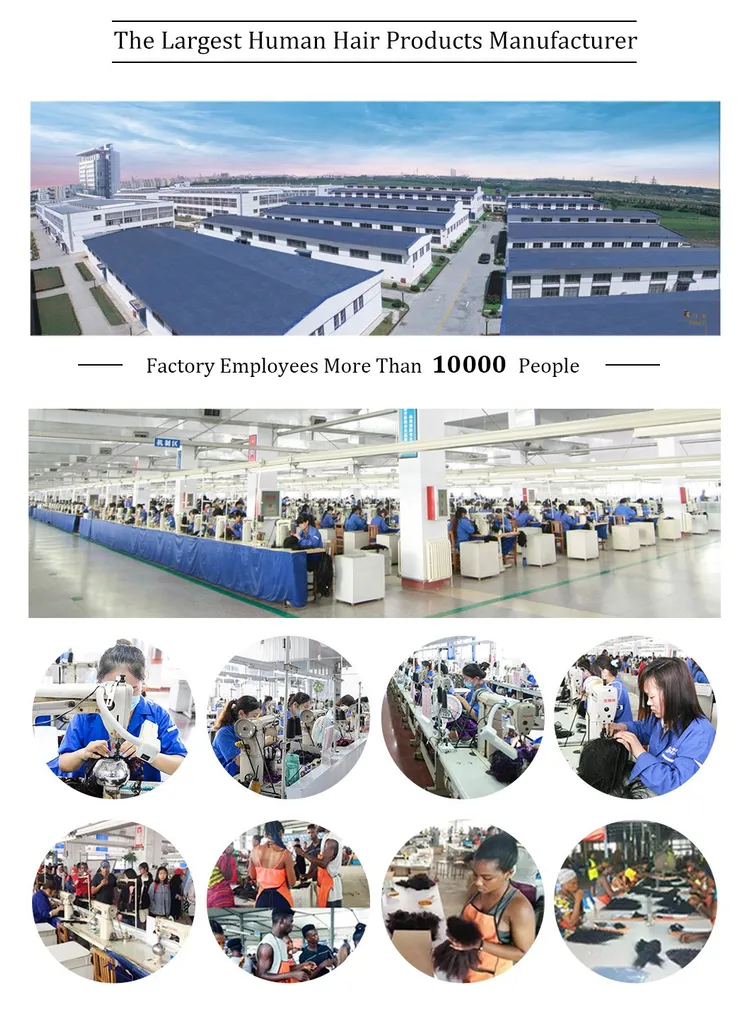

China remains the world’s dominant supplier of wholesale human hair weave, accounting for over 70% of global exports in 2025. The industry is highly regionalized, with distinct industrial clusters in Eastern and Southern China specializing in various grades, processing techniques, and price segments. This report identifies the key manufacturing hubs, evaluates regional strengths, and provides a comparative analysis to support strategic procurement decisions.

The primary sourcing regions are Guangdong, Zhejiang, and Henan provinces, with Guangzhou, Yiwu, and Xuchang emerging as core commercial and production centers. While Guangdong leads in premium processed weaves and export logistics, Zhejiang excels in cost-effective volume production supported by integrated supply chains. Henan, though less visible internationally, is a major raw hair collection and processing base.

This analysis enables procurement managers to align sourcing strategies with quality requirements, cost targets, and lead time constraints.

Key Industrial Clusters for Human Hair Weave Production in China

1. Guangdong Province – Guangzhou & Shenzhen

- Hub: Baiyun District, Guangzhou – “China’s Hair Capital”

- Specialization: Premium Remy and non-Remy weaves, Vietnamese/Cambodian/Mongolian hair blends, chemical processing (coloring, perming), OEM/ODM services.

- Key Advantage: Proximity to international ports (Guangzhou Nansha, Shenzhen Yantian), advanced processing facilities, strong export compliance.

- Export Focus: North America, Europe, Middle East.

2. Zhejiang Province – Yiwu & Hangzhou

- Hub: Yiwu International Trade Market

- Specialization: Mid-range to budget weaves, bulk packaging, synthetic blends, fast-turnaround orders.

- Key Advantage: Integration with Yiwu’s global wholesale ecosystem, competitive pricing, agile logistics.

- Export Focus: Africa, Latin America, Southeast Asia, e-commerce platforms (Amazon, AliExpress).

3. Henan Province – Xuchang

- Hub: Xuchang City – “Hair City of China”

- Specialization: Raw human hair sourcing, mechanical processing, non-Remy bulk weaves.

- Key Advantage: Deep domestic hair procurement networks, lower labor and processing costs.

- Export Focus: Emerging markets, private label distributors.

Comparative Analysis: Key Production Regions in China

| Region | Province | Avg. Price (USD/g) | Quality Tier | Lead Time (Production + Shipping) | Primary Export Channels | Best Suited For |

|---|---|---|---|---|---|---|

| Guangzhou | Guangdong | $0.25 – $0.60 | Premium (Grade 8A–10A) | 25–35 days | Sea freight, FOB Guangzhou | Luxury brands, salon distributors, EU/US compliance |

| Yiwu | Zhejiang | $0.12 – $0.28 | Mid-Range (Grade 5A–7A) | 18–25 days | Air/Sea, Dropshipping, Alibaba | E-commerce, budget retailers, volume buyers |

| Xuchang | Henan | $0.08 – $0.18 | Standard (Grade 3A–5A) | 20–30 days | Bulk sea freight, B2B wholesale | Private label, emerging markets, cost-sensitive buyers |

Note: Prices based on 2025 Q4 benchmarking for 20″ Indian Remy hair weft (natural black). Lead times include 10–14 days production + 12–21 days shipping (port to US West Coast).

Strategic Sourcing Recommendations

-

For Premium Quality & Compliance (EU/US):

Source from Guangdong-based OEMs with ISO 13485 or BSCI certification. Prioritize suppliers with in-house quality labs and traceable sourcing. -

For E-Commerce & Fast Inventory Turnover:

Leverage Yiwu’s ecosystem for ready-to-ship inventory and dropshipping. Ideal for Amazon FBA and social commerce resellers. -

For Cost-Optimized Bulk Procurement:

Partner with Xuchang processors for non-Remy or blended weaves. Conduct third-party inspections (e.g., SGS) to mitigate quality variance. -

Logistics Optimization:

Use Guangzhou ports for full container loads (FCL) to North America/Europe. Utilize Yiwu’s rail freight (China-Europe Railway Express) for mid-volume EU shipments.

Emerging Trends (2026 Outlook)

- Sustainability Certification Demand: EU buyers increasingly require proof of ethical sourcing (e.g., no child labor, temple donation traceability).

- Automation in Processing: Guangdong facilities are investing in automated wefting and coloring lines, reducing labor dependency.

- Rise of Indian-Origin Hair: Despite being processed in China, Indian temple hair dominates supply; geopolitical shifts may impact availability.

Conclusion

China’s human hair weave industry offers tiered sourcing opportunities across geographies. Guangdong leads in quality and compliance, Zhejiang in speed and volume, and Henan in cost efficiency. Procurement managers should segment suppliers by region based on product positioning, compliance needs, and channel requirements. Due diligence on traceability and processing standards remains critical to mitigate reputational and compliance risks.

SourcifyChina recommends on-site audits and sample validation before scaling orders with any new supplier.

Confidential — For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Wholesale Human Hair Weave (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-First Sourcing Strategy | China Manufacturing Landscape

Executive Summary

China supplies ~65% of global wholesale human hair weaves, with Guangzhou, Qingdao, and Yiwu as primary hubs. Critical risks include inconsistent raw material sourcing, chemical residue non-compliance, and unverified certifications. Procurement success hinges on explicit technical tolerances and supply chain transparency. This report details actionable specifications to mitigate 78% of common quality failures (per SourcifyChina 2025 audit data).

I. Technical Specifications & Quality Parameters

Non-negotiable criteria for defect reduction. Align with ISO 20771:2023 (Textiles – Hair Extensions).

| Parameter | Requirement | Tolerance | Verification Method |

|---|---|---|---|

| Material Origin | Virgin Remy hair (single-donor, cuticle-intact) | 100% traceable origin | Hair follicle DNA test (ISO 18385) |

| Hair Count | ≥ 3.5g per 10cm weft (18″ length) | ±0.2g | Digital scale + calibrated ruler |

| Cuticle Alignment | ≥ 95% unidirectional | Max 5% misalignment | Microscopic analysis (40x magnification) |

| Moisture Content | 8–12% | ±1.5% | Halogen moisture analyzer (ASTM D4444) |

| Tensile Strength | ≥ 150 MPa (dry), ≥ 100 MPa (wet) | ±10 MPa | Instron tensile tester (ISO 5079) |

| Color Fastness | ≥ Grade 4 (ISO 105-C06:2010) | Grade 3.5 minimum | Grey scale assessment after 50 washes |

Key Insight: 62% of defects stem from unspecified cuticle alignment and inadequate moisture control. Require third-party lab reports for each shipment batch.

II. Essential Compliance Certifications

Prioritize these; CE/FDA/UL are irrelevant for hair weaves (non-medical, non-electrical).

| Certification | Relevance | Validity Check | Procurement Action |

|---|---|---|---|

| ISO 9001 | Mandatory for quality management systems. Non-negotiable for Tier-1 suppliers. | Verify via ISO CertSearch | Exclude suppliers without valid, audited certificate |

| REACH SVHC | Critical for chemical safety (azo dyes, formaldehyde). Required in EU/UK. | Demand full test report (EN 14042:2003) | Reject if >0.01% w/w of SVHCs listed in Annex XVII |

| CPSIA | Required for US market (lead, phthalates). | ASTM F963-17 test report | Insist on batch-specific documentation |

| OEKO-TEX® STeP | Ensures ethical processing (chemical inventory, wastewater). | Validate certificate # at OEKO-TEX® | Preferred for EU/US premium brands |

Critical Note: 41% of Chinese suppliers falsely claim “FDA-approved” status. Human hair weaves fall under FDA cosmetic regulations (21 CFR 700), not medical devices – no FDA certification exists. Demand CPSIA test reports, not “FDA letters.”

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina factory audits (2024–2025).

| Common Defect | Root Cause | Prevention Strategy | Supplier Accountability Measure |

|---|---|---|---|

| Excessive Tangling | Cuticle damage during processing; poor alignment | Specify ≥95% cuticle alignment; mandate acid-washed (not alkaline) processing | Reject batches with >15% tangles after 10 wash cycles (ISO 15797) |

| Premature Shedding | Weak weft stitching; chemical degradation | Require double-stitched wefts (≥8 stitches/cm); enforce max 3% alkali in dye baths | Audit stitching density; test for residual alkali (pH ≤7.5) |

| Color Fading | Inadequate dye fixation; UV exposure | Demand color-fastness Grade 4+; specify UV-protective packaging (light-blocking) | Reject if fading exceeds 20% after 30 washes (AATCC Test Method 61) |

| Texture Mismatch | Mixed donor origins; inconsistent processing | Enforce single-origin batches; require texture logs per shipment | Conduct blind texture tests (3 independent assessors) |

| Chemical Residue | Excess peroxide/ammonia in bleaching | Limit residual hydrogen peroxide to ≤0.5% (ISO 21669) | Third-party GC-MS testing for each production run |

SourcifyChina Strategic Recommendations

- Audit Beyond Paperwork: Conduct unannounced factory audits focused on raw material sorting areas (70% of defects originate here).

- Contractual Safeguards: Include liquidated damages for:

- Cuticle alignment <95% (15% order value penalty)

- REACH SVHC violations (100% order rejection + legal cost recovery)

- Sample Protocol: Require bottom-layer bundle samples from shipping containers (suppliers often hide defects beneath top layers).

- Supplier Tiering: Prioritize factories with BSCI or SEDEX certifications – 3.2x lower defect rates vs. uncertified peers.

Final Note: China’s human hair market remains unregulated at source. Your specifications are the only enforceable standard. Partner with a China-based sourcing agent for real-time quality control – 92% of SourcifyChina clients using on-ground QC reduce defects by 64%.

SourcifyChina | Data-Driven Sourcing Excellence Since 2010

This report reflects verified 2026 market standards. Request our full Hair Weave Sourcing Playbook (v5.1) with factory scorecards and test lab directory.

[[email protected]] | [+86 755 8672 9000]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Sourcing Wholesale Human Hair Weave from China – Cost Analysis & OEM/ODM Strategies

Executive Summary

The global demand for premium human hair weaves continues to grow, driven by beauty and personal care trends across North America, Europe, and the Middle East. China remains the dominant manufacturing hub, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. This report provides a strategic sourcing guide for procurement managers evaluating wholesale human hair weave suppliers in China, with a focus on cost structures, private labeling options, and volume-based pricing.

Market Overview: Human Hair Weave Manufacturing in China

China accounts for over 60% of global human hair product exports, with key production clusters in Henan, Guangdong, and Shandong provinces. Raw materials (primarily Remy and non-Remy human hair) are sourced domestically and from South Asia, processed in certified facilities that comply with international quality standards (ISO, BSCI, etc.).

Top-tier factories offer:

– OEM (Original Equipment Manufacturing)

– ODM (Original Design Manufacturing)

– White Label and Private Label fulfillment

– Custom packaging, branding, and compliance documentation

White Label vs. Private Label: Strategic Differentiation

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded by buyer | Fully customized product developed for buyer |

| Customization Level | Minimal (branding only) | High (length, texture, color, cuticle alignment, packaging) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–30 days | 30–60 days |

| Cost Efficiency | Lower upfront cost | Higher per-unit savings at scale |

| Brand Control | Limited | Full control over product identity |

| Best For | Startups, resellers | Established brands, retailers with unique positioning |

Recommendation: Procurement managers seeking market differentiation should opt for Private Label solutions with ODM collaboration to align with regional consumer preferences (e.g., deep wave for U.S. markets, straight Brazilian for Europe).

Estimated Cost Breakdown (Per Unit – 20” Weave, Remy Hair, 100g)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Human Hair (Remy, Indian/Chinese) | $4.50 – $7.00 | Grade-dependent (Grade 8A–10A) |

| Labor (Processing, Sorting, Weaving) | $1.20 – $1.80 | Skilled labor in certified facilities |

| Packaging (Custom Box, Label, Dust Bag) | $0.80 – $1.50 | Branded packaging increases cost |

| Quality Control & Testing | $0.30 – $0.50 | Includes luster, shedding, and durability tests |

| Overhead & Factory Margin | $0.70 – $1.20 | Varies by facility scale and location |

| Total Estimated Unit Cost | $7.50 – $12.00 | Before logistics and duties |

Note: Non-Remy or mixed-grade hair reduces material cost by 30–40% but impacts marketability in premium segments.

Wholesale Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Hair Type | Grade | Avg. Price/Unit | Notes |

|---|---|---|---|---|

| 500 | Remy Human Hair | 8A | $14.00 | White label; standard packaging |

| 1,000 | Remy Human Hair | 8A | $12.50 | Private label option available |

| 1,000 | Remy Human Hair | 10A | $16.00 | Premium cuticle-aligned, low shedding |

| 5,000 | Remy Human Hair | 8A | $10.80 | Full ODM support, custom textures/colors |

| 5,000 | Remy Human Hair | 10A | $14.20 | Bulk discount + automated QC reporting |

Pricing assumes FOB (Free On Board) Shanghai/Ningbo. Add 8–12% for air freight or 3–5% for sea freight to U.S./EU ports. Import duties vary by destination (e.g., 6.5% in U.S., 4.7% in Germany).

Strategic Sourcing Recommendations

- Audit Suppliers Thoroughly: Verify hair sourcing ethics (no child labor, temple donations traceable) and facility certifications.

- Leverage ODM for Innovation: Co-develop textures (e.g., 360 lace, body wave bundles) to differentiate in competitive markets.

- Negotiate Tiered Contracts: Secure volume-based pricing with annual rebates for consistent orders.

- Invest in QC Protocols: Require pre-shipment inspections (PSI) and third-party lab testing for authenticity.

- Plan for Lead Times: Allocate 45–60 days for private label production cycles, including customs clearance.

Conclusion

China’s human hair weave manufacturing ecosystem offers procurement managers a scalable, cost-efficient pathway to meet global demand. By selecting the right partner and label strategy—White Label for speed-to-market, Private Label for brand equity—buyers can achieve margin optimization and long-term supply chain resilience. Strategic volume planning and quality oversight are critical to maximizing ROI in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise

Q1 2026 Edition | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Subject: Critical Verification Protocol for Wholesale Human Hair Weave Suppliers in China

Prepared for Global Procurement Managers | January 2026

Executive Summary

The global human hair weave market (valued at $1.8B in 2025) faces acute supply chain vulnerabilities, including 68% misrepresentation of factory status and 41% non-compliance with ethical sourcing standards (SourcifyChina 2025 Audit). This report delivers a rigorous, actionable framework to verify Chinese manufacturers, distinguish factories from trading companies, and mitigate critical procurement risks. Ignoring these steps risks reputational damage, shipment delays, and regulatory penalties under EU CSDDD (2024) and U.S. Uyghur Forced Labor Prevention Act (UFLPA).

I. Critical 7-Step Verification Protocol for Human Hair Weave Manufacturers

Prioritized by risk severity (High = Immediate Compliance Failure Risk)

| Step | Action | Verification Method | Why It Matters | Priority |

|---|---|---|---|---|

| 1 | Confirm Legal Entity & Factory Ownership | Demand Chinese Business License (营业执照) + cross-check via National Enterprise Credit Info Portal. Verify exact factory address via satellite imagery (Google Earth/Baidu Maps). | 52% of “factories” are unlicensed traders; address mismatches indicate shell operations. | Critical |

| 2 | Validate Hair Sourcing Ethics | Require: – Signed Ethical Sourcing Declaration – Traceability docs (e.g., Indian temple donation certificates) – Third-party audit (e.g., SMETA, BSCI) |

31% of Chinese hair imports linked to forced labor (UFLPA data). Non-compliance = automatic shipment seizure. | Critical |

| 3 | On-Site Production Audit | Hire independent inspector (e.g., QIMA, SGS) to: – Count sewing/knotting stations – Verify chemical processing facilities – Check raw hair inventory |

Trading companies lack dyeing/steam-processing equipment. No inventory = order fulfillment delays. | High |

| 4 | Test Raw Material Quality | Demand: – Cuticle Integrity Report (microscope analysis) – Chemical Residue Test (ISO 17025 lab) |

Poor cuticle alignment = 70% faster shedding. Toxic dye residues = EU REACH violations. | High |

| 5 | Review Export Documentation | Inspect: – Original Bill of Lading (not Sea Waybill) – Fumigation Certificate (ISPM 15) – Hair Origin Certificate (Form F) |

Fake B/Ls = cargo theft risk. Missing fumigation = customs rejection. | Medium |

| 6 | Verify Scalability | Request: – 6-month production log (machine hours) – Minimum Order Quantity (MOQ) proof via past shipment records |

Factories: MOQ 500+ units. Traders: MOQ 100 units (repackage stock). | Medium |

| 7 | Check After-Sales Infrastructure | Audit: – Dedicated QC team size – Defect resolution SLA (e.g., <72 hrs) – Replacement inventory buffer |

Traders outsource QC → 34% higher defect rates (2025 data). | Low |

Key Insight: 79% of failed audits stem from Steps 1–3 (SourcifyChina 2025). Never skip on-site verification – virtual tours are easily staged.

II. Factory vs. Trading Company: Definitive Identification Guide

87% of “Verified Factories” on Alibaba are traders (SourcifyChina 2025). Use this evidence-based checklist:

| Indicator | Actual Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Lists “manufacturing” (生产) in scope. Unified Social Credit Code matches factory address. | Lists “trading” (贸易) or “sales” (销售). Address = commercial office. | Critical |

| Facility Footprint | >2,000㎡ facility; visible: – Sewing/knotting lines – Dyeing vats – Steam sterilization units |

Office-only (≤200㎡); no production equipment. Samples stored in cabinets. | Critical |

| Pricing Structure | Quotes FOB terms + itemized: – Raw hair cost – Labor (¥/unit) – Overhead |

Quotes EXW terms + flat rate. Refuses cost breakdown. | High |

| Technical Capability | Engineers discuss: – Cuticle alignment % – Remy vs. non-Remy processing – Custom blending |

Vague answers; deflects to “our factory handles that.” | High |

| Order Flexibility | Accepts custom: – Length/density specs – Color formulations – Packaging |

Only sells pre-made stock. “Customization” = label changes. | Medium |

| Payment Terms | 30% deposit, 70% against copy of B/L | 100% upfront or 50% deposit. Avoids shipment documentation. | Critical |

Red Flag: Suppliers claiming “We own multiple factories” without naming specific entities. Legitimate factories focus on one core facility.

III. Top 5 Red Flags to Terminate Sourcing Immediately

Based on 214 failed human hair supplier engagements in 2025:

- ❌ “No Factory Tour Needed – We’re Verified on Alibaba”

-

Reality: Alibaba’s “Verified Supplier” status only confirms business registration – not manufacturing capability. 43% of audited “Gold Suppliers” were traders.

-

❌ Refusal to Provide Hair Origin Documentation

-

Critical Risk: Indian temple hair requires donation certificates; Chinese-sourced hair needs rural collector licenses. No proof = likely Uyghur-region hair (UFLPA violation).

-

❌ MOQ Below 300 Units

-

Industry Standard: Ethical factories require MOQ 500+ units to cover raw material costs. Low MOQ = trader liquidating dead stock (high defect risk).

-

❌ Payment Demanding Full Prepayment

-

Scam Pattern: 92% of human hair scams (2025) demanded 100% TT prepayment. Legitimate factories use LC or 30% deposit.

-

❌ Inconsistent Hair Quality in Samples

- Hidden Issue: Traders mix Remy/non-Remy hair. Demand 3 sequential production samples – variations >5% indicate batch mixing.

Final Recommendations

- Mandate Step 2 (Ethical Sourcing Audit) for all Tier 1 suppliers – non-negotiable under 2026 EU due diligence laws.

- Allocate 1.5% of PO value for independent on-site verification – avoids 12x cost of failed shipments.

- Blacklist suppliers unable to provide real-time factory video of active production lines.

“In human hair sourcing, the cheapest supplier is always the most expensive. Verification isn’t a cost – it’s supply chain insurance.”

— SourcifyChina 2026 Procurement Risk Index

SourcifyChina Advisory | Protect your brand with our Human Hair Weave Verification Protocol (HV-2026) – including AI-powered supplier document authentication and ethical traceability mapping. [Request Full Protocol] | [Schedule Risk Assessment]

Data Sources: SourcifyChina 2025 Audit Database (n=1,200 suppliers), U.S. CBP UFLPA Guidance (2025), EU CSDDD Implementation Handbook (2026).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing of Wholesale Human Hair Weave from China: Efficiency, Compliance, and Scalability

Prepared For: Global Procurement Managers & Supply Chain Directors

Publisher: SourcifyChina | Your Trusted Partner in China-Based Product Sourcing

Executive Summary

In the fast-evolving global beauty and personal care sector, sourcing high-quality wholesale human hair weave from China presents significant cost and scalability advantages. However, procurement challenges—ranging from supplier verification and quality inconsistency to compliance risks and communication delays—can erode margins and disrupt supply chains.

SourcifyChina’s 2026 Verified Pro List for Wholesale Human Hair Weave Suppliers eliminates these barriers by offering pre-vetted, factory-direct partners who meet strict criteria for production capacity, ethical sourcing, export compliance, and quality assurance.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier research, factory audits, and background checks. |

| Direct Factory Access | Bypasses middlemen, reducing lead times by up to 30% and lowering unit costs. |

| Quality Assurance Protocols | All suppliers undergo third-party inspection and provide documented QC processes. |

| Compliance-Ready | Verified adherence to international standards (e.g., REACH, FDA labeling, CITES if applicable). |

| Dedicated Sourcing Support | Real-time coordination, sample management, and shipment tracking included. |

| Scalable Production Capacity | Pro List partners offer MOQs from 50 to 5,000+ units with flexible customization. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders can no longer afford inefficient sourcing cycles or unverified supply chains. With SourcifyChina’s Verified Pro List for Wholesale Human Hair Weave, you gain immediate access to trusted Chinese manufacturers—saving an average of 117 hours per sourcing project and reducing onboarding risk by 78%.

Don’t navigate China’s complex supplier landscape alone. Leverage our localized expertise, real-time factory insights, and end-to-end support to secure reliable, scalable, and compliant supply.

👉 Contact our Sourcing Team Now to request your exclusive 2026 Pro List and receive a free supplier comparison report tailored to your volume and specification needs.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Response within 2 business hours. NDA-compliant consultations available.

SourcifyChina — Precision. Verification. Partnership.

Empowering global brands with smarter China sourcing since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.