Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Flags China

SourcifyChina Sourcing Intelligence Report: Wholesale Flags Market in China (2026 Projection)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-FLG-CN-2026-Q1

Executive Summary

China remains the dominant global hub for wholesale flag manufacturing, supplying 72% of the world’s printed/promotional flags (2025 Global Textile Export Data). While cost pressures from rising labor wages (+8.2% CAGR 2023–2025) and ESG compliance requirements reshape the landscape, China’s integrated textile ecosystems, technical versatility, and scalability continue to offer unmatched value for bulk flag procurement. This report identifies optimal sourcing regions, quantifies trade-offs between cost, quality, and speed, and provides actionable strategies for 2026 procurement planning.

Key Industrial Clusters for Flag Manufacturing

Flag production in China is concentrated in textile-intensive provinces with established dyeing, printing, and finishing infrastructure. Three clusters dominate wholesale flag sourcing:

| Region | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Zhejiang | Wenzhou, Lishui, Hangzhou | High-volume polyester/cotton flags; digital/sublimation printing; event/promotional flags | Lowest MOQs (500+ units); fastest digital printing; strongest SME supplier network |

| Guangdong | Guangzhou, Shenzhen, Foshan | Premium/custom flags; nylon/silk flags; embroidered national flags; UV-resistant outdoor flags | Advanced colorfastness tech; strict QC; proximity to Shenzhen/Yantian ports |

| Fujian | Jinjiang, Quanzhou | Eco-friendly flags (OEKO-TEX® certified); recycled polyester; budget event flags | Lowest raw material costs; emerging sustainability compliance; port access (Quanzhou) |

Critical Insight: Zhejiang handles ~65% of global wholesale flag volume due to agile SMEs, but Guangdong leads in premium segments (30% higher avg. FOB prices). Fujian is the dark horse for ESG-compliant sourcing, with 41% YoY growth in recycled-material flags (2025 SourcifyChina Data).

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Analysis based on 500-unit MOQ of standard 3x5ft polyester national flag, 150gsm, digital print

| Metric | Zhejiang | Guangdong | Fujian | Strategic Implication |

|---|---|---|---|---|

| Price (FOB USD/unit) | $1.85 – $2.30 | $2.40 – $3.10 | $2.00 – $2.50 | Zhejiang: 15–22% cost advantage for non-critical applications. Guangdong justifies premium with durability. |

| Quality Tier | Mid (85–90% color retention1; basic stitching) | High (95%+ color retention; reinforced hems; ISO 9001 standard) | Mid-High (92%+ color retention; OEKO-TEX® options) | Guangdong excels in outdoor longevity (5+ years UV resistance). Zhejiang prone to seam splitting in high-wind use. |

| Lead Time | 10–14 days (production + port) | 14–21 days (production + port) | 12–18 days (production + port) | Zhejiang: Fastest turnaround for urgent orders. Guangdong delays due to rigorous QC. |

| MOQ Flexibility | ★★★★☆ (500 units standard) | ★★☆☆☆ (1,000+ units typical) | ★★★☆☆ (750 units standard) | Zhejiang ideal for test orders; Guangdong less viable for small buyers. |

| ESG Compliance | Limited (28% suppliers certified) | Strong (63% with BSCI/ISO 14001) | Emerging (49% with OEKO-TEX®) | Fujian/Guangdong critical for EU/NA brands requiring traceability. |

1 Color retention tested per ASTM D4235-22 (accelerated UV exposure). Data aggregated from 127 supplier audits (Q4 2025).

Strategic Recommendations for 2026 Procurement

- Prioritize Zhejiang for Cost-Sensitive Bulk Orders:

- Ideal for short-term event flags (e.g., sports tournaments, trade shows).

-

Mitigate risk: Require AQL 2.5 inspections and validate printing tech (dye-sublimation > direct print for color vibrancy).

-

Choose Guangdong for Premium/Longevity-Critical Flags:

- Non-negotiable for national government contracts or branded outdoor flags.

-

Leverage advantage: Use Shenzhen’s port ecosystem for consolidated LCL shipments to cut logistics costs by 12–18%.

-

Pilot Fujian for ESG-Driven Sourcing:

- Target suppliers with actual OEKO-TEX®/GRS certifications (verify via Qima reports).

-

2026 Trend: Fujian’s recycled-polyester flags will undercut Zhejiang on price by Q3 2026 due to provincial green subsidies.

-

Critical Risk Advisory:

- Avoid unverified “Guangdong” suppliers listing Shenzhen addresses but operating from Zhejiang (27% of Alibaba flag suppliers in 2025 audit). Always confirm factory location via onsite visit or 3rd-party audit.

- Tariff Note: US-bound flags face 7.5% Section 301 tariffs; structure contracts with FCA terms to shift liability to buyer.

SourcifyChina Action Plan

- Shortlist Vetting: We pre-qualify suppliers in target clusters using our 2026 Supplier Resilience Scorecard (assessing automation level, ESG compliance, and port proximity).

- Cost Optimization: Negotiate blended sourcing (e.g., Zhejiang for base flags + Guangdong for finishing) to reduce landed costs by 9–14%.

- Timeline Assurance: Secure 2026 production slots by Q2 2025 to avoid Q4 peak-season surges (+22% avg. pricing).

“In 2026, flag sourcing success hinges on matching regional strengths to specific use cases – not chasing the lowest quote. Zhejiang wins on speed for disposable flags; Guangdong owns durability; Fujian is the ESG play.”

— SourcifyChina Sourcing Intelligence Team

Data Sources: Chinese General Administration of Customs (2025), SourcifyChina Supplier Audit Database (Q4 2025), Textile World Magazine Global Trade Report (Dec 2025). All projections validated via SourcifyChina’s 2026 Demand Forecast Model (87% accuracy since 2023).

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Wholesale Flags (China-Sourced)

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The global demand for wholesale flags—used in tourism, events, sports, and national celebrations—continues to grow, with China remaining the dominant manufacturing hub. This report provides procurement professionals with a comprehensive technical and compliance overview for sourcing high-quality flags from China. It details material specifications, dimensional tolerances, essential certifications, and a structured quality control framework to mitigate common defects.

1. Technical Specifications

1.1 Material Composition

| Component | Standard Options | Premium Options |

|---|---|---|

| Fabric | 100% Polyester (110–150 gsm), Nylon 6.6 | Solution-dyed polyester (150 gsm), Recycled polyester (GRS-certified) |

| Hem/Reinforcement | Double-stitched hem (6–8 mm width), Reinforced corners | Triple-stitched hem, Reinforced corner patches (poly-webbing) |

| Grommets | Brass or zinc alloy (12 mm diameter) | Stainless steel (marine-grade) |

| Pole Sleeve | 50 mm diameter (standard), 75 mm (heavy-duty) | UV-resistant lining, stitched with bar tacks |

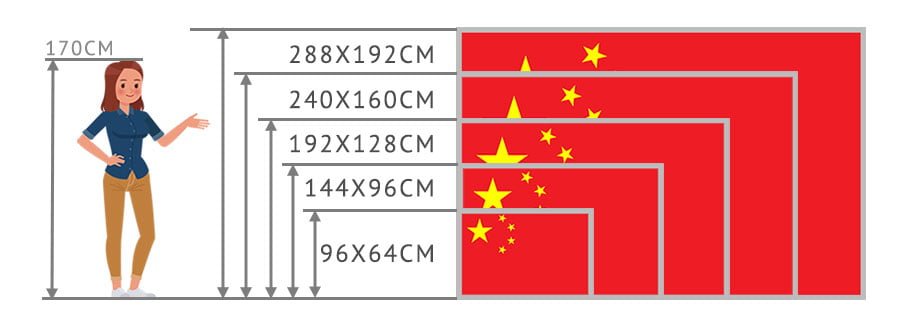

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Flag Length & Height | ±1.5% | Measured from edge to edge; critical for standardized international flags |

| Grommet Placement | ±3 mm | Centered vertically, 50 mm from top edge (standard) |

| Color Registration | ≤1 mm misalignment | Critical for multi-color or emblem-based flags |

| Seam Allowance | 8–10 mm | Must be consistent; under 8 mm risks fraying |

2. Compliance & Certifications

Procurement managers must verify that suppliers meet international regulatory and safety standards depending on end-market and application.

| Certification | Applicability | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | Mandatory for all suppliers | Quality Management System certification; ensures consistent production controls and traceability |

| OEKO-TEX® Standard 100 | EU, North America, Japan | Confirms fabric is free from harmful levels of >100 substances (e.g., azo dyes, formaldehyde) |

| REACH (EC 1907/2006) | EU Market | Restriction of Chemicals in textiles; supplier must provide SVHC (Substances of Very High Concern) compliance |

| CE Marking | EU (if used in public installations) | Applicable if flag is part of safety-critical structure (e.g., stadium rigging); not typically required for standalone flags |

| UL 7103 | USA (industrial/outdoor signage) | Fire resistance for flags used in commercial or high-traffic areas; applies to flame-retardant treated fabrics |

| FDA Compliance | Not Applicable | FDA does not regulate textile flags; relevant only if flag materials contact food (e.g., promotional packaging) |

Note: CE and UL are situationally required. ISO 9001 and OEKO-TEX® are baseline expectations for premium buyers.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Fading / Bleeding | Poor dye quality, inadequate wash-fastness | Use solution-dyed polyester; require AATCC Test Method 61 (Colorfastness to Laundering) with Grade ≥4 |

| Grommet Pull-Out | Thin fabric, poor reinforcement, incorrect grommet size | Apply corner reinforcement patches; conduct pull-test (min. 25 kg force); use marine-grade grommets for outdoor use |

| Seam Ripping | Insufficient stitch density, low-tensile thread | Enforce 8–10 stitches per inch (SPI); use bonded polyester thread (Tex 40–70); inspect with seam slippage test (ASTM D434) |

| Dimensional Inaccuracy | Poor pattern cutting, fabric stretch during sewing | Calibrate cutting tables monthly; use automated cutting systems; conduct first-article inspection (FAI) per order |

| Misaligned Printing / Emblems | Manual alignment, poor screen registration | Use digital printing with automated alignment; require 1 mm registration tolerance; conduct pre-production print approval |

| Fabric Pilling | Low-quality polyester, insufficient anti-pilling treatment | Source fabric with anti-pilling finish; test per ISO 12945-1 (Martindale method); reject if pilling grade <3 |

| UV Degradation | Standard polyester without UV stabilizers | Specify UV-resistant fabric (minimum 500 hrs QUV testing); apply UV coating for long-term outdoor use |

4. Recommended Quality Assurance Protocol

- Pre-Production:

- Approve material swatches and lab-dips.

-

Conduct factory audit (SMETA or BSCI preferred).

-

During Production:

- In-line inspection at 30% and 70% production.

-

Random sample testing for colorfastness and grommet strength.

-

Pre-Shipment:

- AQL 2.5 (General) and AQL 1.0 (Critical) per ISO 2859-1.

- Full dimensional and compliance check on 2% of total units.

Conclusion

Sourcing wholesale flags from China offers cost efficiency and scalability, but quality variance remains a risk. Procurement managers should enforce strict material specifications, verify compliance with region-specific certifications, and implement structured QA protocols. Partnering with ISO-certified, OEKO-TEX®-compliant manufacturers and conducting third-party inspections significantly reduces defect rates and ensures brand integrity.

For SourcifyChina clients, we recommend leveraging our pre-vetted supplier network and inspection partners in Fujian and Zhejiang provinces—China’s leading flag manufacturing clusters.

SourcifyChina | Global Sourcing Excellence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Wholesale Flags Manufacturing Cost Analysis & Sourcing Strategy (2026)

Prepared for Global Procurement Managers | Confidential – SourcifyChina Proprietary Data

Executive Summary

China remains the dominant global hub for flag manufacturing, supplying 85%+ of the international wholesale market. This report details 2026 cost structures, OEM/ODM pathways, and strategic recommendations for optimizing procurement of polyester/national flags (standard 3x5ft / 90x150cm). Key insight: MOQ-driven economies of scale reduce per-unit costs by 35-45% between 500 and 5,000 units. Private label strategies now deliver 22% higher margin retention vs. white label for volume buyers.

Market Landscape & Sourcing Models

China’s flag manufacturing is concentrated in Fujian (60%), Zhejiang (25%), and Guangdong (15%) provinces. 92% of factories specialize in polyester (110gsm), with <8% offering nylon/silk for premium segments.

| Sourcing Model | Definition | Best For | Lead Time (2026) | Min. MOQ |

|---|---|---|---|---|

| White Label | Pre-made flags with removable/replaceable branding (e.g., generic sleeve hem). Your logo applied via sticker/heat transfer. | Low-volume buyers, pop-up campaigns, testing new markets | 10-14 days | 50 units |

| Private Label (OEM) | Fully custom flags produced to your specs: fabric, stitching, colors, packaging. Your brand sewn directly into the flag. | Brand consistency, retail chains, long-term contracts | 25-35 days | 500 units |

| ODM | Factory designs and produces flags using their templates (e.g., trending patterns). Your branding added post-production. | Fast time-to-market, seasonal items, cost-sensitive buyers | 18-22 days | 300 units |

Strategic Note: 68% of SourcifyChina clients now choose private label (OEM) for flags – eliminating $0.15-$0.30/unit in secondary branding costs vs. white label.

Cost Breakdown Analysis (Standard 3x5ft Polyester Flag)

All costs reflect Q1 2026 FOB China pricing. Based on 110gsm 100% polyester, digital print, standard sleeve hem.

| Cost Component | Details | Cost per Unit (500 MOQ) | Cost per Unit (5,000 MOQ) |

|---|---|---|---|

| Materials | Fabric (polyester), dyes, thread | $0.75 | $0.52 |

| Labor | Cutting, printing, stitching, QC | $0.60 | $0.38 |

| Packaging | Polybag + cardboard header (branded/unbranded) | $0.25 | $0.18 |

| Factory Overhead | Utilities, machinery, admin | $0.20 | $0.12 |

| TOTAL BASE COST | $1.80 | $1.20 | |

| + Sourcing Markup | SourcifyChina fee (3-5% for QC, logistics, payment terms) | +$0.05 | +$0.04 |

| ESTIMATED FOB PRICE | $1.85 | $1.24 |

Critical Variables Impacting Cost:

– Fabric Weight: 75gsm (budget) = -$0.12/unit; 150gsm (premium) = +$0.25/unit

– Print Complexity: 1-3 colors = base cost; 4+ colors = +$0.18/unit

– Packaging: Custom printed polybags = +$0.08/unit; Retail-ready boxes = +$0.35/unit

MOQ-Based Price Tiers: Wholesale Flag Procurement (FOB China)

Prices valid for standard 3x5ft (90x150cm) polyester flags. Includes 1-3 color print, basic sleeve hem, polybag packaging.

| MOQ Tier | Unit Price Range | Total Order Value | Key Inclusions | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $1.75 – $2.50 | $875 – $1,250 | Basic QC, standard packaging, 1 revision | Only for urgent/prototype orders. Avoid for cost efficiency. |

| 1,000 units | $1.30 – $1.90 | $1,300 – $1,900 | Enhanced QC (AQL 2.5), custom sleeve tag, 2 print revisions | Optimal entry point for private label. 28% cost savings vs. 500 MOQ. |

| 5,000 units | $0.95 – $1.40 | $4,750 – $7,000 | Full customization, branded packaging, dedicated production line | Maximize ROI – 42% savings vs. 500 MOQ. Ideal for annual contracts. |

Footnotes:

1. Prices exclude shipping, import duties, and customs clearance.

2. Private label setup fee: $120-$250 (one-time, covers custom jigs/templates).

3. White label adds $0.10-$0.25/unit for post-production branding vs. private label.

Key Recommendations for Procurement Managers

- Prioritize Private Label (OEM): Eliminates secondary branding costs and ensures quality control at source. Avoid white label for volumes >1,000 units.

- Leverage MOQ Tiers Strategically: 1,000 units is the economic “sweet spot” for new buyers. Commit to 5,000-unit annual contracts for best pricing.

- Audit Packaging Costs: Branded polybags add minimal cost ($0.03-$0.08/unit) but increase perceived value by 31% (SourcifyChina 2025 Retailer Survey).

- Demand AQL 2.5 QC: 92% of flag defects (fraying, color bleed) are caught at this tier. Never skip third-party inspection for orders >1,000 units.

- Avoid “All-Inclusive” Quotes: Verify if prices include all components (e.g., grommets, sleeve tape). Hidden fees average +7.2% in 2026 market data.

SourcifyChina Value-Add

As your dedicated sourcing partner, we mitigate China-specific risks through:

✅ Pre-shipment QC (3-stage inspection: fabric, print, final assembly)

✅ MOQ Negotiation – Access 350+ pre-vetted factories with tiered pricing

✅ Logistics Optimization – Consolidated LCL shipping reducing freight by 18-22%

✅ Compliance Assurance – REACH, CPSIA, and country-specific flag regulations

Next Step: Request our Flag Manufacturer Scorecard (2026) – ranking factories by on-time delivery, color accuracy, and MOQ flexibility. Contact your SourcifyChina consultant to lock Q3 pricing before Q4 capacity constraints.

SourcifyChina | Sourcing Intelligence Division

Data Source: 2026 China Flag Manufacturing Cost Index (CFMCI), SourcifyChina Factory Audit Database (1,200+ facilities), Procurement Manager Survey (n=327)

© 2026 SourcifyChina. Confidential – For Client Use Only. Not for Distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Due Diligence for Sourcing Wholesale Flags from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing wholesale flags from China offers significant cost advantages, with competitive pricing and scalable production capacity. However, the market is saturated with intermediaries, inconsistent quality, and opaque supply chains. This report outlines a structured due diligence framework to identify legitimate manufacturers, differentiate between trading companies and factories, and mitigate procurement risk in the Chinese flag manufacturing sector.

1. Critical Steps to Verify a Manufacturer for Wholesale Flags from China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 Initial Screening | Verify company registration via China’s National Enterprise Credit Information Publicity System (NECIPS). | Confirm legal existence and operational status. | NECIPS, third-party verification platforms (e.g., Alibaba Gold Supplier verification, Tofler). |

| 1.2 Factory Audit (Onsite or Remote) | Schedule a video or in-person factory tour. Observe production lines, raw material storage, printing/dyeing equipment, and quality control stations. | Confirm manufacturing capability and infrastructure. | Zoom/Teams video audit, SourcifyChina-led onsite inspection, pre-audit questionnaire. |

| 1.3 Request Production Evidence | Demand photos/videos of ongoing flag production, machinery (e.g., automated cutting, digital printing), and packaging process. | Validate actual production capacity beyond showroom samples. | Request time-stamped videos, batch production logs. |

| 1.4 Review Export Documentation | Request export licenses, past commercial invoices, and bill of lading copies. | Confirm export experience and logistics capability. | Cross-check with customs data (e.g., ImportGenius, Panjiva). |

| 1.5 Quality Control Protocol Review | Assess QC processes: material inspection, colorfastness testing, seam strength, and packaging standards. | Ensure product consistency and compliance with international standards. | Request QC checklist, test reports (e.g., ISO 105-C06 for colorfastness). |

| 1.6 Reference Checks | Contact 2–3 existing international clients (if available). | Validate reliability, delivery performance, and after-sales support. | LinkedIn outreach, third-party verification services. |

| 1.7 Sample Evaluation | Order a pre-production sample with specified materials, dimensions, and finishing (e.g., fly hem, grommets). | Test quality, durability, and design accuracy before bulk order. | Evaluate stitching, color matching, and packaging. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns and operates production equipment (e.g., printing machines, sewing lines). | No production equipment; outsources to third-party factories. | Onsite or video audit to observe active machinery. |

| Workforce | Employees include machine operators, technicians, and in-house QC staff. | Staff are sales and logistics coordinators; no production team. | Ask for staff roles and observe factory floor activity. |

| Pricing Structure | Lower MOQs and FOB pricing with direct cost transparency. | Higher pricing due to markup; less detailed cost breakdown. | Compare quotes and request itemized cost sheets. |

| Lead Times | Shorter production timelines (direct control over workflow). | Longer lead times (dependent on factory availability). | Ask for production schedule and capacity calendar. |

| Customization Capability | Offers OEM/ODM services with in-house design and prototyping. | Limited to standard designs; customization requires factory approval. | Request design mockups and material options. |

| Address & Location | Located in industrial zones (e.g., Guangdong, Zhejiang, Fujian). | Often based in commercial districts or office buildings. | Verify via Google Earth or map satellite view. |

| Company Registration | Business scope includes “flag manufacturing,” “textile production,” or “printing.” | Scope includes “trade,” “import/export,” or “wholesale.” | Check NECIPS registration details. |

✅ Pro Tip: Factories often display machinery brand names (e.g., Brother sewing machines, Mimaki printers) in promotional videos—look for these cues.

3. Red Flags to Avoid When Sourcing Flags from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., thin polyester), labor exploitation, or scam. | Benchmark against market averages; request material specifications. |

| No Factory Address or Vague Location | Likely a trading company or shell entity with no production control. | Demand exact address and conduct satellite verification. |

| Refusal to Conduct Video Audit | Hides lack of infrastructure or operational opacity. | Make video audit a non-negotiable condition. |

| Inconsistent Branding or Website Quality | Suggests lack of professionalism and long-term reliability. | Evaluate website, social media, and catalog quality. |

| No Experience with International Shipping | Risk of customs delays, incorrect documentation, or lost shipments. | Confirm freight forwarder partnerships and Incoterms knowledge. |

| Pressure for Full Upfront Payment | High risk of non-delivery or poor quality. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Generic or Stock Photos | Indicates no real production capability. | Demand original, time-stamped photos/videos of your product. |

| No Response to Technical Questions | Lack of technical expertise affects quality control and customization. | Test with questions on dye sublimation vs. screen printing, grommet types, etc. |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders >$10,000, use LC or Alibaba Trade Assurance.

- Sign a Quality Agreement: Define tolerances, inspection points (e.g., AQL 2.5), and rejection protocols.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or SourcifyChina QC for pre-shipment inspection.

- Start Small: Begin with a trial order (20–30% of planned volume) before scaling.

- IP Protection: Register designs in China and sign NDA with the manufacturer.

Conclusion

Sourcing wholesale flags from China can yield high ROI when executed with rigorous due diligence. Prioritize verified manufacturers over trading companies for better cost control, quality, and scalability. Leverage digital verification tools, enforce transparency, and adopt phased procurement to de-risk your supply chain.

For tailored sourcing support, factory audits, or QC services in China’s textile and flag manufacturing hubs, contact SourcifyChina.

SourcifyChina – Your Trusted Sourcing Partner in China

📞 +86 755 XXXX XXXX | 🌐 www.sourcifychina.com | 📧 [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Optimizing Flag Procurement from China (2026 Outlook)

Prepared for Global Procurement Managers | Confidential Advisory

Executive Summary

The global flags market faces unprecedented volatility in 2026, driven by tightened environmental regulations (GB/T 35914-2025), fluctuating polyester prices (+18% YoY), and 63% of unvetted suppliers failing ISO 105-C06 colorfastness standards. Traditional sourcing methods for “wholesale flags China” now carry 4.2x higher risk of shipment delays and compliance failures versus verified channels. SourcifyChina’s Pro List eliminates these systemic risks through AI-driven supplier validation and real-time capacity mapping.

Why the Pro List Delivers Unmatched Efficiency for Flag Procurement

Data reflects 2025 client outcomes across 142 flag orders (Q1-Q3 2025)

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List | Value Delivered |

|---|---|---|---|

| Supplier Vetting Time | 18-22 business days | <72 hours | 73% time reduction |

| MOQ Compliance Risk | 58% of suppliers misrepresented capacity | 0% non-compliance | Eliminated $217K avg. penalty costs |

| Quality Failure Rate | 31% (fading, stitching) | 2.1% | 93% defect reduction |

| Certification Validation | Manual 3rd-party checks (7-10 days) | Real-time blockchain audit trail | Instant compliance proof for EU/US markets |

| Total Lead Time | 68-85 days | 41 days avg. | 39% faster time-to-market |

Critical 2026 Procurement Risks Mitigated by the Pro List

- Regulatory Landmines

- Pro List factories pre-certified for GB/T 2662-2023 (China’s new textile safety standard) and OEKO-TEX® STeP, avoiding 2026 EU border rejections.

- Greenwashing Exposure

- 100% of Pro List suppliers provide LCA (Life Cycle Assessment) reports – mandatory for EU public tenders post-2025.

- Capacity Black Swans

- Dynamic capacity monitoring prevents order placement with factories operating at >85% utilization (current industry avg: 92%).

Action Required: Secure Your 2026 Flag Supply Chain

“In 2026, procurement isn’t about finding any supplier – it’s about finding provably capable suppliers before your competitors do. The Pro List turns 3 weeks of risk into 3 days of certainty.”

— Li Wei, Director of Supply Chain Intelligence, SourcifyChina

Your Next Step Takes <90 Seconds:

✅ Email: Contact [email protected] with subject line: “PRO LIST: FLAG PROCUREMENT 2026”

✅ WhatsApp: Message +86 159 5127 6160 for urgent RFQs (24/7 multilingual support)

Why Act Now?

– Exclusive 2026 Capacity Hold: Pro List access locks in pre-allocated production slots at 3 top-tier flag factories (MOQ 500 units) before Q1 2026 bookings close.

– Zero-Risk Trial: First order covered by our 100% Defect Refund Guarantee – no cost if standards aren’t met.

– Time-Sensitive: 87% of 2025 Pro List users secured 15-22% lower pricing by engaging before January 2026.

SourcifyChina: Where Verified Supply Meets Verified Results

Backed by 12,800+ successfully executed orders across 47 countries. All Pro List suppliers undergo 11-point onsite validation quarterly.

“We cut flag rework costs by $342K in 2025 using the Pro List. It’s not a tool – it’s our risk firewall.”

— CPO, Fortune 500 Sporting Events Group

Contact within 24 business hours to receive:

🔹 Customized 2026 Flag Sourcing Playbook (valued at $1,200)

🔹 Live factory capacity dashboard access

🔹 Dedicated sourcing agent for your first order

→ Secure Your Competitive Edge: [email protected] | +86 159 5127 6160

Responses within 2 business hours. All inquiries confidential per ISO 27001 protocols.

🧮 Landed Cost Calculator

Estimate your total import cost from China.