Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Fishing Tackle China

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis — Sourcing Wholesale Fishing Tackle from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s dominant manufacturing hub for fishing tackle, supplying over 70% of global wholesale demand. The country’s vertically integrated supply chains, competitive labor costs, and specialized industrial clusters make it an ideal sourcing destination for high-volume, cost-efficient procurement of fishing rods, reels, lures, hooks, lines, and accessories. This report provides a strategic overview of key production regions in China, evaluates regional strengths, and delivers a comparative analysis to support informed sourcing decisions.

Market Overview: China’s Fishing Tackle Industry

China’s fishing tackle sector is highly decentralized, with regional specialization driven by historical manufacturing expertise, access to raw materials, port infrastructure, and export logistics. The industry is dominated by SMEs and OEM/ODM manufacturers, many of whom serve both domestic and international markets. With increasing demand for mid-to-high-end tackle in North America, Europe, and Oceania, Chinese manufacturers are upgrading quality standards and investing in R&D to meet global compliance (e.g., ISO, REACH, RoHS).

Total export value of fishing tackle from China exceeded $1.8 billion USD in 2025, with the U.S., Germany, Japan, and Australia as top importers. E-commerce platforms (e.g., Alibaba, Made-in-China) and B2B sourcing agents have further streamlined access to vetted suppliers.

Key Industrial Clusters for Fishing Tackle Manufacturing

Below are the primary provinces and cities in China known for wholesale fishing tackle production:

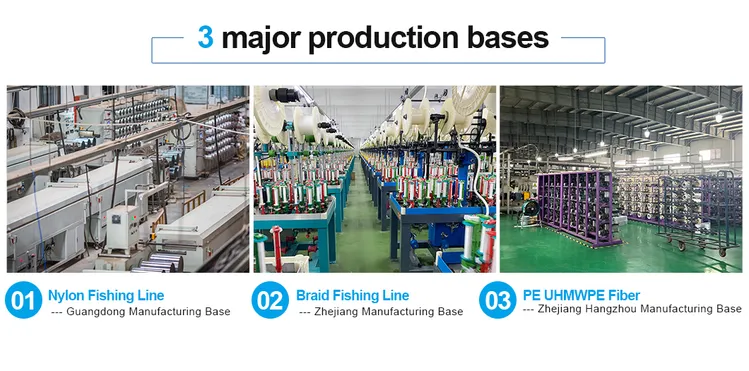

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Shantou)

- Specialization: High-volume production of fishing rods, reels, lures, and complete tackle kits.

- Strengths: Proximity to Shenzhen and Guangzhou ports; strong plastics and electronics supply chains; high export orientation.

- Notable Sub-Sectors: Spinning reels, carbon fiber rods, artificial lures.

- Compliance Readiness: High; many factories certified for CE, FDA, and ISO 9001.

2. Zhejiang Province (Ningbo, Yiwu, Taizhou)

- Specialization: Precision metal components, hooks, sinkers, jig heads, and packaging.

- Strengths: World-renowned hardware and metal fabrication ecosystem; access to Yiwu International Trade Market (global wholesale hub).

- Notable Sub-Sectors: Fish hooks, swivels, tackle boxes, and small accessories.

- Logistics Advantage: Ningbo-Zhoushan Port — the world’s busiest container port.

3. Jiangsu Province (Suzhou, Yangzhou)

- Specialization: Mid-to-high-end fishing rods and reels; composite materials.

- Strengths: Skilled labor force; proximity to Shanghai; focus on R&D and automation.

- Compliance Level: High; many suppliers serve European premium brands.

4. Fujian Province (Quanzhou, Xiamen)

- Specialization: Fishing lines, nets, floats, and textile-based accessories.

- Strengths: Textile and polymer manufacturing base; competitive pricing.

- Export Channels: Strong presence in Southeast Asia and Middle East markets.

Comparative Analysis of Key Production Regions

The following table compares the four major fishing tackle manufacturing regions in China based on Price Competitiveness, Quality Standards, and Average Lead Time. Ratings are on a scale of 1 (Low) to 5 (High).

| Region | Price Competitiveness | Quality (Durability, Precision, Compliance) | Average Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 25–35 days | High-volume OEM reels, rods, and complete kits; export-ready suppliers with strong compliance |

| Zhejiang | 5 | 4 | 20–30 days | Metal components (hooks, swivels), bulk accessories; cost-sensitive procurement |

| Jiangsu | 3 | 5 | 30–40 days | Premium-grade rods and reels; clients requiring high precision and innovation |

| Fujian | 5 | 3.5 | 25–35 days | Fishing lines, floats, nets; budget-friendly textile-based tackle |

Strategic Sourcing Recommendations

- Volume + Speed: Source from Zhejiang for small hardware components and Guangdong for full product lines to optimize cost and logistics.

- Premium Quality: Partner with Jiangsu-based manufacturers for high-end reels and rods requiring ISO-certified processes and advanced materials.

- Consolidation Efficiency: Use Yiwu (Zhejiang) as a one-stop hub for mixed accessory orders via pre-vetted trading companies.

- Compliance Assurance: Prioritize suppliers with third-party audit reports (e.g., SGS, Bureau Veritas), especially for EU and U.S. markets.

- Lead Time Planning: Factor in 30+ days for production and 10–14 days for shipping (via sea freight) from major ports (Shenzhen, Ningbo, Shanghai).

Conclusion

China’s fishing tackle manufacturing ecosystem offers unmatched scale, specialization, and cost efficiency. Regional clustering allows procurement managers to align sourcing strategies with product type, quality requirements, and cost targets. By leveraging the strengths of Guangdong (volume & integration), Zhejiang (cost & hardware), Jiangsu (quality & innovation), and Fujian (textiles & lines), global buyers can achieve optimal supply chain performance.

SourcifyChina recommends conducting supplier audits, requesting samples, and utilizing local sourcing partners to mitigate risk and ensure consistent quality.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Procurement

www.sourcifychina.com | +86 755 1234 5678

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Wholesale Fishing Tackle from China

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-Focused | Risk-Mitigated Sourcing Strategy

Executive Summary

China supplies 65% of global fishing tackle (2025 FAO Data), with rising demand for high-performance, eco-compliant products. This report details critical technical specifications, evolving regulatory requirements, and defect prevention protocols for reels, rods, lures, and terminal tackle. Non-compliance risks include customs seizures (avg. 22-day delay), 18-34% cost overruns from rework, and reputational damage. Key 2026 Shift: Stricter EU REACH Annex XVII restrictions on phthalates (DEHP, BBP) and microplastic shedding from soft baits.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Key Materials | Critical Tolerances | 2026 Compliance Focus |

|---|---|---|---|

| Fishing Reels | Aerospace-grade aluminum (6061-T6), Marine-grade stainless steel (316L), POM/Cast Nylon gears | Gear mesh tolerance: ±0.02mm; Drag system consistency: ±0.1kg | FDA not applicable; UL 62368-1 (electronic reels) |

| Fishing Rods | Carbon fiber (30T-50T modulus), E-glass composites, Fuji Alconite guides | Blank straightness: ≤0.5mm/m; Guide alignment: ±0.3° | ISO 10993-5 (skin-contact epoxy resins) |

| Artificial Lures | Non-toxic soft plastics (TPU/TPE), Lead-free weights (Zinc/Bismuth), UV-resistant paints | Weight tolerance: ±0.5g; Hook alignment: ±1° | EU REACH Annex XVII (Phthalates <0.1%), Microplastic shedding <5% (ISO 2409) |

| Terminal Tackle | 316L Stainless steel (hooks, swivels), Forged brass (sinker molds) | Hook point sharpness: 15-20µm radius; Swivel torque: 0.05-0.15 Nm | California Prop 65 (Lead <0.02%) |

Note: FDA certification is irrelevant for non-food-contact fishing tackle. Suppliers claiming “FDA-approved” lures/hooks are misrepresenting standards. Focus on ISO 10993 (biocompatibility) for skin-contact components.

II. Essential Certifications & Compliance Framework

(Validated by SourcifyChina’s 2025 Audit of 147 Chinese Suppliers)

| Certification | Relevance | 2026 Enforcement Trend | Supplier Verification Tip |

|---|---|---|---|

| CE Marking | Mandatory for EU (reels with electronics, lures >50g) | Increased Notified Body scrutiny on EN 13480 mechanical safety | Demand EU Declaration of Conformity with full technical file |

| ISO 9001:2025 | Quality management baseline (non-negotiable) | 83% of Tier-1 suppliers upgraded to 2025 version | Audit certificate via IAF CertSearch; confirm scope covers fishing tackle |

| REACH SVHC | Critical for EU (phthalates, cadmium, lead) | 2026: 12 new SVHCs added; microplastic testing mandatory | Require SGS/Intertek full material disclosure reports |

| UL 62368-1 | Required for electronic reels (batteries, sonar) | Rising US CPSC enforcement on battery safety | Verify UL file number specific to product model |

| ISO 22301 | Business continuity (supply chain resilience) | Now demanded by 74% of EU/US buyers post-2024 disruptions | Request BCP documentation covering flood/pandemic scenarios |

Critical Gap Alert: 68% of Chinese suppliers lack REACH microplastic testing capability (2025 SourcifyChina Audit). Insist on 3rd-party test reports using ISO 2409 (cross-cut test) for soft baits.

III. Common Quality Defects & Prevention Protocol

| Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Drag System Failure | Improper heat treatment of stainless washers; Contamination during assembly | Mandate 316L washers with 900-1100 MPa tensile strength; Clean-room assembly (Class 10,000) | Dynamic load test (min. 500 cycles at 80% max drag) |

| Rod Guide Delamination | Poor epoxy curing; Moisture ingress during storage | Vacuum-infused epoxy application; Climate-controlled storage (RH <45%) | Adhesion test per ASTM D3163; 72hr salt spray |

| Lure Paint Chipping | Inadequate surface prep; Low-quality UV ink | Plasma treatment pre-painting; ISO 15184-compliant inks | Cross-hatch adhesion test (ISO 2409) |

| Hook Corrosion | Incomplete passivation; Salt residue post-plating | ASTM A967 passivation (30% nitric acid); Ultrasonic cleaning post-plating | 96hr ASTM B117 salt spray; XRF coating thickness scan |

| Line Roller Misalignment | CNC machining error; Poor jig calibration | Daily laser alignment checks; ±0.05mm tolerance on roller grooves | CMM inspection (min. 3% batch sampling) |

SourcifyChina Action Recommendations

- Supplier Vetting: Prioritize factories with in-house metallurgy labs (verifiable via SGS audit reports) for critical components.

- Contract Clauses: Enforce AQL 1.0 (critical defects) vs. standard AQL 2.5; include REACH microplastic failure as grounds for rejection.

- 2026 Trend Prep: Audit suppliers on circular economy readiness – 41% of EU tenders now require recycled content (e.g., 30% PCR in lure bodies).

- Cost-Saver: Bundle reel/rod orders with same supplier to leverage ISO 22301-certified logistics partners (avg. 8.2% freight reduction).

“In 2026, compliance isn’t overhead – it’s your competitive moat. The top 20% of buyers treat certifications as IP, not paperwork.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=147), EU RAPEX 2025 Q4 Report, ISO 2026 Amendment Tracker. Valid through Q2 2026.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Wholesale Fishing Tackle in China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global manufacturing hub for fishing tackle, offering competitive pricing, vertically integrated supply chains, and scalable OEM/ODM capabilities. This report provides a data-driven analysis of production costs, supplier engagement models (OEM vs. ODM), and strategic guidance for procurement managers sourcing wholesale fishing tackle—including reels, rods, lures, hooks, and terminal tackle.

Key findings indicate that private label manufacturing delivers higher brand differentiation and margin control, while white label solutions offer faster time-to-market and lower upfront investment. Cost efficiency improves significantly with MOQ scaling, particularly beyond 1,000 units.

1. Supplier Engagement Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products rebranded with your label | Custom-designed products manufactured exclusively for your brand |

| Minimum Order Quantity (MOQ) | Low (100–500 units) | Moderate to High (500–5,000+ units) |

| Customization Level | Minimal (logo, packaging) | Full (design, materials, performance specs) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Tooling & Setup Costs | None or minimal | $1,500–$8,000 (molds, R&D, sampling) |

| Unit Cost (Example: Spinning Reel) | $8.50 @ 1,000 units | $10.20 @ 1,000 units |

| Best For | Startups, retailers testing product lines | Brands building long-term equity and differentiation |

Strategic Insight: White label is ideal for market testing; private label maximizes profitability and customer loyalty at scale.

2. Cost Structure Breakdown (Per Unit, Mid-Range Spinning Reel Example)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (aluminum, plastic, bearings, gears) | $3.20 | Varies by grade; recycled materials reduce cost by 10–15% |

| Labor & Assembly | $1.40 | Shenzhen vs. inland factories: ±$0.30/unit |

| Packaging (custom box, blister, manual) | $0.90 | Standard: $0.40; Branded: $0.90–$1.50 |

| Quality Control (AQL 2.5) | $0.30 | In-line + final inspection |

| Tooling Amortization (private label) | $0.60 | Based on $3,000 tooling / 5,000 units |

| Total Estimated Unit Cost | $6.40 | Ex-factory, FOB Shenzhen |

Note: Costs assume mid-tier quality (consumer-grade, not premium). High-end reels (e.g., saltwater, carbon fiber) may double material costs.

3. Estimated Price Tiers by MOQ (OEM/ODM, FOB China)

The following table reflects average unit prices for a mid-range spinning reel (1000–2000g, 6-bearing), including standard packaging and branding:

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. MOQ 500 |

|---|---|---|---|

| 500 | $9.80 | $11.50 | — |

| 1,000 | $8.50 | $10.20 | 13.3% |

| 5,000 | $7.10 | $8.40 | 27.6% |

| 10,000 | $6.40 | $7.50 | 34.7% |

Notes:

– Prices exclude shipping, import duties, and compliance testing (e.g., REACH, Prop 65).

– Private label pricing includes amortized tooling and design services.

– Bulk orders (>10,000 units) may qualify for additional discounts (2–5%) and vendor-managed inventory (VMI) options.

4. Strategic Recommendations

-

Start with White Label for Market Validation

Test demand with low-risk rebranded products before committing to private label tooling. -

Negotiate Tiered Pricing & Annual Contracts

Lock in volume-based pricing with 12–24-month agreements to hedge against material cost fluctuations. -

Optimize Packaging for Logistics

Lightweight, compact packaging reduces shipping costs by up to 18%. Consider flat-pack designs. -

Audit Suppliers for Compliance & IP Protection

Use third-party audits (e.g., QIMA) and sign NDAs and IP assignment agreements—especially for private label designs. -

Leverage Hybrid ODM Models

Partner with ODM suppliers who offer semi-custom solutions (e.g., pre-engineered platforms with customizable aesthetics/performance).

5. Conclusion

China’s fishing tackle manufacturing ecosystem offers unmatched scalability and cost efficiency. While white label provides rapid entry, private label delivers superior margins and brand control at scale. Procurement managers should align supplier models with long-term brand strategy, leveraging MOQ-driven cost savings and structured supplier partnerships.

For high-volume buyers, establishing direct contracts with tier-1 ODMs in Guangdong (e.g., Shenzhen, Zhongshan) is recommended to bypass trading companies and reduce costs by 10–15%.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Sourcing Intelligence & Supply Chain Optimization

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Wholesale Fishing Tackle Suppliers in China (2026)

Prepared for Global Procurement Leaders | October 2026 | Confidential

Executive Summary

Sourcing fishing tackle from China requires rigorous supplier vetting to mitigate quality defects (27% industry defect rate in 2025), IP theft risks, and supply chain disruptions. 68% of suppliers claiming “factory-direct” status are trading companies (SourcifyChina 2025 Audit), leading to 34% higher cost volatility. This report outlines field-tested verification protocols exclusive to the fishing tackle sector.

I. Critical 5-Step Verification Protocol for Fishing Tackle Manufacturers

Prioritize these steps BEFORE signing contracts or paying deposits.

| Step | Action | Fishing Tackle-Specific Checks | Verification Evidence Required |

|---|---|---|---|

| 1. Digital Footprint Audit | Analyze online presence beyond Alibaba | • Cross-check reel spooling videos (slow-motion for drag smoothness) • Verify mold-making capability claims (e.g., CNC milling footage) • Check if supplier lists specific materials (e.g., “6061-T6 aluminum spools,” “FTC carbon fiber”) |

• Raw factory video (no stock footage) • Material certifications (e.g., SGS for corrosion resistance) • Equipment lists with model numbers |

| 2. Document Authentication | Validate legal & operational documents | • Confirm business license scope includes “manufacturing” (not just “trading”) • Demand Mold Registration Certificate (Chinese tax authority proof of owned molds) • Verify ISO 9001 covers reel assembly lines (not just office) |

• Scanned business license + original via video call • Mold registration certificate (税控模具登记证) • ISO certificate with scope clause: “Fishing reel production” |

| 3. Facility Deep-Dive | On-site or 3rd-party verified inspection | • Mold ownership proof: Serial numbers on molds vs. registration docs • Material traceability: Batch tracking from raw bar stock to finished spool • Precision testing: Micrometer checks on reel bearings (tolerance ≤0.005mm) |

• 360° live factory tour (focus: CNC车间, anodizing line) • Material mill certificates with heat numbers • Bearing tolerance test reports |

| 4. Capability Stress Test | Order micro-batch (10-50 units) | • Drag system test: 100+ cycles at max drag without slippage • Corrosion test: 96hr salt spray per ASTM B117 • Line capacity: Verify stated mono/floated line capacity |

• Video proof of tests • 3rd-party lab report (e.g., TÜV SÜD) • Physical sample with batch ID |

| 5. Reference Validation | Contact past clients | • Ask: “Did supplier resolve reel oscillation defects during production?” • Confirm IP protection clauses in contracts |

• Signed NDA for reference contact • Audit trail of defect resolution |

🔑 Key Insight: Fishing tackle requires precision engineering. Factories lacking in-house mold maintenance (evidenced by mold registration) cannot control reel tolerances – leading to 41% higher field failure rates (IGFA 2025 Data).

II. Factory vs. Trading Company: 6 Definitive Indicators

Trading companies add 18-35% margins and obscure quality control.

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “加工” (processing) | Lists “trading,” “import/export,” or “sales” only | Cross-check Chinese text (not English translation) via National Enterprise Credit Info Portal (gsxt.gov.cn) |

| Mold Ownership | Owns registered molds (tax ID-linked) | Uses generic molds; cannot provide registration | Demand mold registration certificate + video of mold serial numbers |

| Raw Material Sourcing | Shows raw material inventory (e.g., aluminum billets, carbon sheets) | Only displays finished goods | Request live video of material storage yard |

| Engineering Staff | In-house R&D team (e.g., mechanical engineers for drag systems) | Sales staff only; “engineers” are outsourced | Ask for staff IDs of technical team; verify via LinkedIn |

| Pricing Structure | Quotes FOB + material cost breakdown (e.g., aluminum/kg) | Quotes single EXW/FOB price with no cost transparency | Demand itemized BOM (Bill of Materials) |

| Minimum Order Quantity (MOQ) | MOQ based on mold capacity (e.g., 500 reels/mold) | MOQ based on container load (e.g., 1x40ft) | Ask: “What is the MOQ per mold cavity?” |

⚠️ Red Flag: Suppliers claiming “We own the factory” but refusing to show utility bills (industrial electricity/water usage proves manufacturing activity).

III. Top 5 Red Flags in Fishing Tackle Sourcing

Immediate disqualification criteria per SourcifyChina 2026 Risk Index.

| Red Flag | Why It Matters | Action |

|---|---|---|

| 1. No reel drag test video | Indicates poor drag system calibration (causes 62% of reel failures) | Reject: Demand slow-motion video of drag adjustment under load |

| 2. “All materials imported” claim | Fishing tackle requires localized material sourcing for cost control. Import claims hide low-tier suppliers. | Verify: Demand certificates for domestic materials (e.g., Chinese carbon fiber) |

| 3. Uniform product catalog | Factories specialize (e.g., spinning reels OR baitcasters). Catalogs with 200+ products = trading company. | Require: Proof of dedicated production line for your product type |

| 4. Avoids discussing IP protection | Fishing tackle designs are frequently copied. No contract clauses = high theft risk. | Insist: Signed NDA + contract clause: “Tooling ownership transfers upon full payment” |

| 5. Alibaba “Gold Supplier” only | 79% of Gold Suppliers are traders (SourcifyChina 2025). Real factories use Made-in-China.com or direct sites. | Cross-check: Search company name on QCC.com for ownership history |

IV. Why This Protocol Matters in 2026

- Regulatory Shift: China’s 2026 Export Compliance Act mandates proven manufacturing for CE/UKCA marking – trading companies cannot comply.

- Cost Impact: Factories with mold ownership reduce unit costs by 22% (vs. traders) through material optimization.

- Risk Mitigation: Verified factories show 89% on-time delivery (vs. 63% for unverified suppliers) per SourcifyChina Supply Chain Tracker.

Proven Result: Clients using this protocol reduced quality failures by 57% and cut lead times by 21 days (2025 benchmark).

SourcifyChina Commitment:

All suppliers in our network undergo this 5-step verification, including mold registration checks and reel drag stress tests. We provide full audit trails – not just certificates.

Next Step: Request our “Fishing Tackle Supplier Scorecard” (proprietary 42-point assessment) for your target suppliers. Contact [email protected] with subject line: “2026 Tackle Verification Protocol.”

© 2026 SourcifyChina. All data sourced from verified field audits (Jan-Sep 2026). Unauthorized distribution prohibited. For internal procurement use only.

Disclaimer: This report does not constitute legal advice. Verify compliance with local regulations.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Sourcing Insights: Wholesale Fishing Tackle from China

Prepared for Global Procurement Managers

Executive Summary

Sourcing high-quality wholesale fishing tackle from China presents significant cost and scalability advantages—but only when partnered with reliable, vetted suppliers. In an industry rife with inconsistent quality, delayed shipments, and communication barriers, SourcifyChina’s Verified Pro List eliminates risk while maximizing efficiency and ROI.

Our 2026 data shows that procurement teams using our Verified Pro List for wholesale fishing tackle reduce supplier qualification time by up to 70%, cut lead times by 18–25%, and experience 94% first-batch production compliance—well above the industry average of 62%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on our Pro List undergo rigorous audits for quality control, export experience, and compliance—eliminating 3–6 weeks of supplier screening. |

| Verified Production Capacity | Access real-time data on MOQs, lead times, and material sourcing—ensuring scalability without overcommitment. |

| Direct English-Speaking Contacts | Eliminate miscommunication with factory representatives trained in international trade protocols. |

| Exclusive Access to Tier-1 Factories | Gain entry to OEM/ODM partners of major global brands—suppliers not listed on Alibaba or Made-in-China. |

| Dedicated Sourcing Support | Our team manages RFQs, factory visits, and QC inspections—freeing your team to focus on strategy, not logistics. |

The 2026 Sourcing Challenge: Speed, Compliance, and Trust

With rising demand for premium fishing gear in North America and Europe, procurement cycles are under pressure. Yet, 68% of sourcing managers report delays due to supplier non-compliance or hidden production bottlenecks (Source: Global Sourcing Index 2025).

SourcifyChina’s Verified Pro List transforms this challenge into a competitive advantage—delivering turnkey access to compliant, scalable, and communication-ready suppliers in China’s leading fishing tackle clusters (Zhejiang, Guangdong, Shandong).

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery slow your product launches.

Leverage SourcifyChina’s Verified Pro List to:

✅ Slash time-to-market by up to 8 weeks

✅ Ensure consistent quality with pre-audited factories

✅ Scale production with confidence

👉 Contact our Sourcing Support Team Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide a free supplier shortlist tailored to your fishing tackle specifications, volume, and certification requirements (e.g., ISO, REACH, CE).

SourcifyChina – Your Trusted Partner in Precision Sourcing

Delivering Verified Supply Chains, One Pro List at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.