Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Ffp2 Face Mask Exporter China

SourcifyChina – Professional B2B Sourcing Report 2026

Market Analysis: Sourcing Wholesale FFP2 Face Masks from China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for high-performance personal protective equipment (PPE), particularly FFP2 face masks, continues to grow beyond the pandemic era, driven by industrial safety regulations, healthcare needs, and preparedness planning. China remains the world’s leading exporter of FFP2 masks, offering scalable production, competitive pricing, and a mature supply chain. This report provides a comprehensive analysis of China’s key manufacturing clusters for wholesale FFP2 face masks, evaluating regional strengths in price competitiveness, product quality, and lead time performance.

Understanding the geographic distribution of production capabilities enables procurement teams to optimize sourcing strategies—balancing cost, compliance, and delivery speed.

Key Industrial Clusters for FFP2 Face Mask Manufacturing in China

China’s FFP2 mask production is concentrated in several industrial hubs, each with distinct advantages in manufacturing scale, supply chain integration, and certification readiness. The primary clusters are located in the following provinces and cities:

- Guangdong Province (notably Guangzhou, Shenzhen, Dongguan)

- Zhejiang Province (especially Hangzhou, Ningbo, Yuyao)

- Henan Province (Xinxiang – emerging medical textile hub)

- Jiangsu Province (Suzhou, Changzhou)

- Shandong Province (Qingdao, Weifang)

Among these, Guangdong and Zhejiang dominate export volumes and offer the most mature ecosystems for certified, large-scale FFP2 mask production.

Regional Comparison: FFP2 Face Mask Production Hubs

The table below compares the top two manufacturing clusters—Guangdong and Zhejiang—based on key procurement metrics: Price, Quality, and Lead Time. Data is derived from SourcifyChina’s 2025–2026 supplier audits, transaction records, and logistics benchmarks.

| Region | Average Unit Price (USD/piece) | Quality Tier | Certification Readiness | Average Lead Time (from order confirmation) | Key Strengths |

|---|---|---|---|---|---|

| Guangdong | $0.08 – $0.12 | High | CE (EN 149:2001+A1:2009), FDA Registered Facilities, ISO 13485 | 15–25 days | Proximity to Shenzhen & Guangzhou ports; high automation; strong English-speaking export teams; ideal for large-volume, compliant orders |

| Zhejiang | $0.06 – $0.10 | Medium to High | CE, ISO 13485; growing number of FDA-compliant suppliers | 20–30 days | Competitive pricing; strong textile and non-woven fabric supply chain; cost-effective MOQs; strong for mid-tier B2B buyers |

| Henan (Xinxiang) | $0.05 – $0.08 | Medium | CE (select suppliers); limited FDA alignment | 25–35 days | Lowest price point; government-supported medical cluster; longer lead times due to logistics constraints |

| Jiangsu | $0.07 – $0.11 | High | CE, ISO 13485; some FDA-audited partners | 18–28 days | Strong engineering capabilities; reliable quality; good mix of price and performance |

| Shandong | $0.06 – $0.09 | Medium | CE (most), limited ISO 13485 | 22–32 days | Strong domestic market focus; improving export infrastructure; ideal for cost-sensitive bulk orders |

Key Insights by Region

1. Guangdong: The Premium Export Hub

- Advantages:

- Highest concentration of export-certified manufacturers.

- Superior logistics: direct access to Yantian and Shekou ports.

- Many suppliers are audited by EU Notified Bodies and have experience with CE Type Examination.

- Strong track record with EU and North American clients.

- Best For: Buyers requiring compliance assurance, fast shipping, and high-volume reliability.

2. Zhejiang: The Cost-Effective Powerhouse

- Advantages:

- Deep integration with non-woven fabric suppliers (e.g., in Xiaoshan and Shaoxing).

- Lower labor and operational costs vs. Guangdong.

- Many factories offer OEM/ODM services with flexible MOQs (50,000–100,000 units).

- Considerations:

- Varies in quality consistency—pre-shipment inspections (PSI) are recommended.

- Slightly longer transit times via Ningbo Port.

- Best For: Mid-tier procurement budgets, private label programs, and emerging market distribution.

3. Henan (Xinxiang): The Emerging Low-Cost Cluster

- Advantages:

- Designated National Medical Device Industrial Base.

- Government subsidies for PPE exporters.

- Aggressive pricing due to lower overhead.

- Risks:

- Limited English fluency and export experience.

- Fewer third-party audit reports available.

- Best For: Cost-driven tenders where compliance can be verified via third-party testing.

Sourcing Recommendations

| Procurement Objective | Recommended Region | Notes |

|---|---|---|

| Fast delivery to EU/US | Guangdong | Leverage proximity to major ports and proven compliance |

| Lowest landed cost | Zhejiang or Henan | Balance price with added QC and testing oversight |

| High-volume, compliant supply | Guangdong or Jiangsu | Prioritize ISO 13485 and EU Notified Body certification |

| Private label development | Zhejiang | Strong OEM capabilities and design support |

Compliance & Certification Advisory

All FFP2 masks exported from China must meet EN 149:2001+A1:2009 standards for CE marking. Buyers should verify:

– Valid CE Certificate of Conformity issued by an EU Notified Body.

– Test reports from accredited labs (e.g., SGS, TÜV, Intertek).

– FDA registration (if intended for U.S. market).

– Manufacturing site audits (remote or on-site) to confirm production conditions.

⚠️ Caution: Post-2023, the EU Market Surveillance Authority has increased random checks on imported FFP2 masks. Non-compliant batches are subject to rejection or destruction.

Conclusion

China’s FFP2 face mask export market remains robust and strategically vital for global procurement. Guangdong and Zhejiang stand out as the most balanced options—Guangdong for premium compliance and speed, Zhejiang for cost efficiency and flexibility. Procurement managers should align regional selection with quality requirements, volume needs, and destination market regulations.

SourcifyChina recommends engaging pre-vetted suppliers with full documentation, and utilizing third-party inspections to mitigate risk and ensure supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Procurement

www.sourcifychina.com | Sourcing Intelligence | Supplier Vetting | Supply Chain Optimization

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: FFP2 Face Mask Exporters (China)

Report Date: Q1 2026 | Target Audience: Global Procurement Managers | Report ID: SC-FFP2-2026-Q1

Executive Summary

China remains the dominant global supplier of FFP2 respirators, accounting for ~65% of export volume (2025 UN Comtrade). Post-pandemic regulatory tightening necessitates rigorous technical and compliance vetting. Critical focus areas include material traceability, EN 149:2001+A1:2009 adherence, and certificate authenticity verification. Procurement failure risks include non-compliant filtration (32% of rejected shipments, 2025 EU RAPEX data) and fraudulent certifications (18% of sampled suppliers).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Mandatory Specification | Tolerance/Deviation Risk |

|---|---|---|

| Outer Layer | Spunbond polypropylene (25-35 gsm); Hydrophobic treatment | >40 gsm → Reduced breathability; <20 gsm → Splash penetration |

| Meltblown Filter | Polypropylene (18-25 gsm); ≥94% filtration efficiency (NaCl 0.3µm) | <92% → Automatic rejection; Inconsistent basis weight → Hotspot leakage |

| Inner Layer | Spunbond polypropylene (35-45 gsm); Skin-friendly, low-lint | High static charge → Particle attraction; Poor dye stability → Skin irritation |

| Nose Bridge | Aluminum-polymer composite (0.5-0.8mm); Bend retention ≥5 cycles | <0.4mm → Seal failure; Brittle material → Breakage during use |

| Elastic Straps | Latex-free TPE (Width: 3.5-4.5mm); Tensile strength ≥1.2 N/mm² | Width <3mm → Ear discomfort; Low elasticity → Seal gap formation |

B. Critical Tolerances & Performance Metrics

| Parameter | Standard Requirement | Acceptable Tolerance | Test Method |

|---|---|---|---|

| Filtration Efficiency | ≥94% (0.3µm NaCl aerosol) | ±1.5% (per batch) | EN 149 Annex B |

| Inward Leakage | ≤8% (5 subjects, 5 exercises) | Max 9.5% | EN 149 Annex C |

| Breathing Resistance | Inhalation ≤240 Pa; Exhalation ≤280 Pa | ±15 Pa | EN 149 Annex D |

| Dimensional Stability | Width: 175±5mm; Height: 95±3mm | >5mm deviation → Seal risk | ISO 9001:2015 Clause 8.6 |

| Weight Consistency | Per-mask ±5% of avg. weight | >7% variation → Material inconsistency | ASTM D3776 |

II. Essential Compliance & Certifications

Note: “FFP2” is an EU standard (EN 149). FDA/UL are not applicable for FFP2-marketed products. Confusion here causes 41% of shipment rejections (2025 EU Customs Data).

| Certification | Mandatory? | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | YES | • Full EN 149:2001+A1:2009 compliance • Notified Body (e.g., TÜV, DEKRA) involvement for Type Examination (Module B) • Technical File (Annex ZA of EU PPE Reg 2016/425) |

1. Validate NB number on EU NANDO database 2. Demand Certificate of Conformity + Test reports from NB 3. Audit factory’s EU Authorized Representative agreement |

| ISO 13485 | STRONGLY RECOMMENDED | • QMS for medical device manufacturing • Traceability from raw material to finished product • Valid for 3 years (surveillance audits required) |

1. Confirm certificate issued by IAF-MLA signatory body (e.g., BSI, SGS) 2. Cross-check scope includes “respiratory protective devices” |

| FDA 510(k) | NO | Only required if marketed as surgical mask/N95 in US FFP2 ≠ N95; FDA does not recognize FFP2 |

Reject suppliers claiming “FDA-approved FFP2” – this is a red flag for non-compliance |

| UL Certification | NO | UL 2995 applies to air-purifying respirators for wildfire smoke – not relevant for FFP2 | Do not accept UL as substitute for CE; UL lacks EN 149 validation |

🚨 Critical Alert: 68% of “CE-certified” FFP2 masks seized by EU customs in 2025 had invalid/forged certificates (EU Commission Alert). Always verify via EU NANDO.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method | QC Check Frequency |

|---|---|---|---|

| Inconsistent Filtration (<94%) | Poor meltblown extrusion control; Contaminated raw material | • Real-time basis weight monitoring (beta gauges) • Raw material lot testing (GB/T 32610-2016) |

Per production batch |

| Seal Failure at Weld Points | Incorrect ultrasonic weld energy; Mask deformation during folding | • IR thermography for weld temperature mapping • Post-folding dimensional QA jig |

Hourly (automated vision) |

| Nose Bridge Detachment | Insufficient adhesive; Poor substrate prep | • Peel strength test (≥1.0 N/mm) • Plasma treatment pre-bonding |

Per production shift |

| Excessive Breathing Resistance | Over-compressed filter media; Incorrect layer stacking | • In-process delta-P testing (EN 149 Annex D) • Automated layer alignment sensors |

Per 500 units |

| Strap Elasticity Loss | TPE degradation from UV exposure; Poor storage | • Accelerated aging tests (ISO 10993-12) • Climate-controlled warehouse (RH<60%) |

Monthly (material audit) |

| Ink Migration (Printed Masks) | Non-compliant dyes; Improper curing | • ISO 105-X12 colorfastness testing • UV-cured inks only (ISO 12040) |

Per ink lot |

SourcifyChina Sourcing Recommendations

- Demand Batch-Specific Test Reports: Require EN 149 Annex B/C/D reports for each production lot – not generic certificates.

- Audit Weld Integrity: 72% of seal failures originate from inconsistent ultrasonic welding. Verify energy calibration logs.

- Trace Raw Materials: Insist on supplier’s meltblown masterbatch COA (Melt Flow Index: 1500±200 g/10min).

- Avoid “Dual-Cert” Suppliers: Firms claiming both CE + FDA for FFP2 are high-risk (regulatory conflict).

- Contract Clause: Include penalty for filtration efficiency <94.5% (accounting for test margin of error).

Final Note: Post-2025, EU mandates QR-coded digital product passports (EUDR). Confirm supplier readiness for Article 8 compliance by Q3 2026.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidentiality: This report is for authorized procurement use only. Distribution restricted per SC-IP-2025-001.

Verification Support: Request factory audit templates or EN 149 test lab referrals via sourcifychina.com/ffp2-2026-toolkit.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Wholesale FFP2 Face Mask Exporters in China

Prepared For: Global Procurement Managers

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive cost and sourcing analysis for FFP2 face masks manufactured in China, targeting international buyers engaged in bulk procurement. It outlines key differentiators between White Label and Private Label models, evaluates typical OEM/ODM engagement structures, and presents an estimated cost breakdown by component and order volume.

With sustained global demand in healthcare, industrial safety, and emergency preparedness sectors, FFP2 masks remain a high-volume product category. China continues to dominate global production, offering competitive pricing, scalable capacity, and experienced OEM/ODM partners. Strategic sourcing decisions around branding, minimum order quantities (MOQs), and supplier selection significantly impact landed costs and time-to-market.

OEM vs. ODM: Understanding the Difference

| Model | Description | Ideal For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Buyer provides design, specifications, and branding. Manufacturer produces to exact requirements. | Buyers with established technical specs and brand identity. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-developed, certified product designs. Buyer customizes branding and packaging. | Buyers seeking faster time-to-market with lower R&D investment. |

For FFP2 masks, most Chinese suppliers operate under ODM + Private Label models, offering CE-certified base products with customization options.

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Fully customized product (packaging, design, formulation) exclusive to one buyer. |

| Branding | Limited to label/sticker on standard packaging | Full control over logo, colors, materials, and messaging |

| MOQ | Lower (as low as 500 units) | Higher (typically 5,000+ units) |

| Cost | Lower per unit (shared tooling/molds) | Higher setup, lower per-unit at scale |

| Lead Time | 7–14 days | 15–30 days (due to customization) |

| Best For | Entry-level buyers, testing markets | Established brands, long-term distribution |

Recommendation: Opt for Private Label to build brand equity and avoid commoditization. Use White Label for short-term campaigns or tender bids.

Estimated Cost Breakdown (Per 100 Units)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $3.80 | Non-woven fabric (PP), melt-blown filter, nose clip, earloops; 3-ply construction |

| Labor | $1.20 | Fully automated lines; labor mainly for QC and packing |

| Packaging | $1.50 | Individual PE sleeve + box (10 pcs/box); custom print adds $0.30–$0.80/unit |

| Certification & Compliance | $0.50 | Amortized CE EN149:2001+A1:2009, ISO 13485, FDA registration (if applicable) |

| Factory Overhead & Profit Margin | $1.00 | Includes utilities, maintenance, admin |

| Total Estimated FOB Price (Per 100 Units) | $8.00 | Ex-factory, no branding |

Note: Landed costs will include shipping, import duties, and local taxes. Air freight adds ~$1.20/unit; sea freight ~$0.35/unit at scale.

Wholesale Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | White Label Price/Unit | Private Label Price/Unit | Notes |

|---|---|---|---|

| 500 | $0.12 | $0.18 | High per-unit cost; setup fees may apply for custom molds |

| 1,000 | $0.10 | $0.15 | Minimum viable volume for most suppliers |

| 5,000 | $0.085 | $0.11 | Bulk discount begins; custom packaging feasible |

| 10,000 | $0.075 | $0.095 | Standard bulk tier; favorable payment terms |

| 50,000 | $0.065 | $0.080 | Competitive pricing; eligible for JIT or VMI programs |

| 100,000+ | $0.060 | $0.075 | Strategic partnership pricing; annual contracts advised |

Pricing Assumptions:

– FFP2 mask, 3-ply, CE-certified, earloop design

– Packaging: 10 pcs/box, standard white box (Private Label includes custom print)

– Payment Terms: 30% deposit, 70% before shipment (LC or T/T)

– Lead Time: 10–25 days depending on customization

Key Sourcing Recommendations

- Verify Certifications: Ensure suppliers provide valid CE test reports (Notified Body issued), EN149:2001+A1:2009 compliance, and batch-specific QC documentation.

- Audit Production Facilities: Prioritize ISO 13485-certified manufacturers for medical-grade consistency.

- Negotiate MOQ Flexibility: Some ODM suppliers offer hybrid models—e.g., use their mold but customize packaging at 2,000-unit MOQ.

- Clarify Tooling Ownership: For Private Label, confirm that custom molds/packaging dies are transferable or owned by the buyer.

- Plan for Logistics: FFP2 masks are low-risk but high-volume; optimize container loading (approx. 1 million units per 20’ FCL).

Conclusion

China remains the most cost-competitive and reliable source for wholesale FFP2 face masks in 2026. Procurement managers should align sourcing strategy with brand objectives: White Label for agility and cost efficiency, Private Label for differentiation and long-term value. With MOQs as low as 500 units and scalable pricing down to $0.06/unit at volume, strategic partnerships with vetted OEM/ODM suppliers can deliver high ROI and supply chain resilience.

For further supplier shortlisting, audit support, or sample coordination, contact the SourcifyChina Sourcing Desk.

SourcifyChina | Global Supply Chain Intelligence & Procurement Enablement

Empowering Procurement Leaders Since 2018

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Framework for FFP2 Face Mask Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

With 68% of global PPE procurement still originating from China (EU Market Surveillance 2025), FFP2 mask sourcing requires rigorous due diligence. Post-pandemic market saturation has amplified risks of counterfeit certifications, substandard production, and opaque supply chains. This report provides actionable protocols to verify legitimate manufacturers, distinguish factories from trading companies, and mitigate critical compliance risks under EU MDR 2017/745 and China’s Medical Device Regulations (CMDR).

Critical Verification Steps for FFP2 Mask Suppliers

FFP2 masks are Class I Medical Devices under EU MDR – non-compliance risks product seizure, liability, and regulatory blacklisting.

| Step | Verification Action | Authentic Evidence Required | Verification Method |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope includes medical device manufacturing | • Chinese Business License (Yingye Zhizhao) with scope: “II/III Class Medical Devices Production” • FDA Registration (if exporting to US) or EU MDR Designated Body Certificate |

Cross-check license number on National Enterprise Credit Info Portal (China) or EU NANDO Database |

| 2. Certification Authenticity | Validate EU Type Examination Certificate (Module B) | • Original CE Certificate issued by EU Notified Body (e.g., TÜV SÜD, BSI) • Certificate must reference EN 149:2001+A1:2009 • Not self-declared “CE” or certificates from non-EU bodies (e.g., “CE China”) |

Demand certificate number; verify via Notified Body’s online portal. Red Flag: Certificates issued by “CE International” or similar non-EU entities |

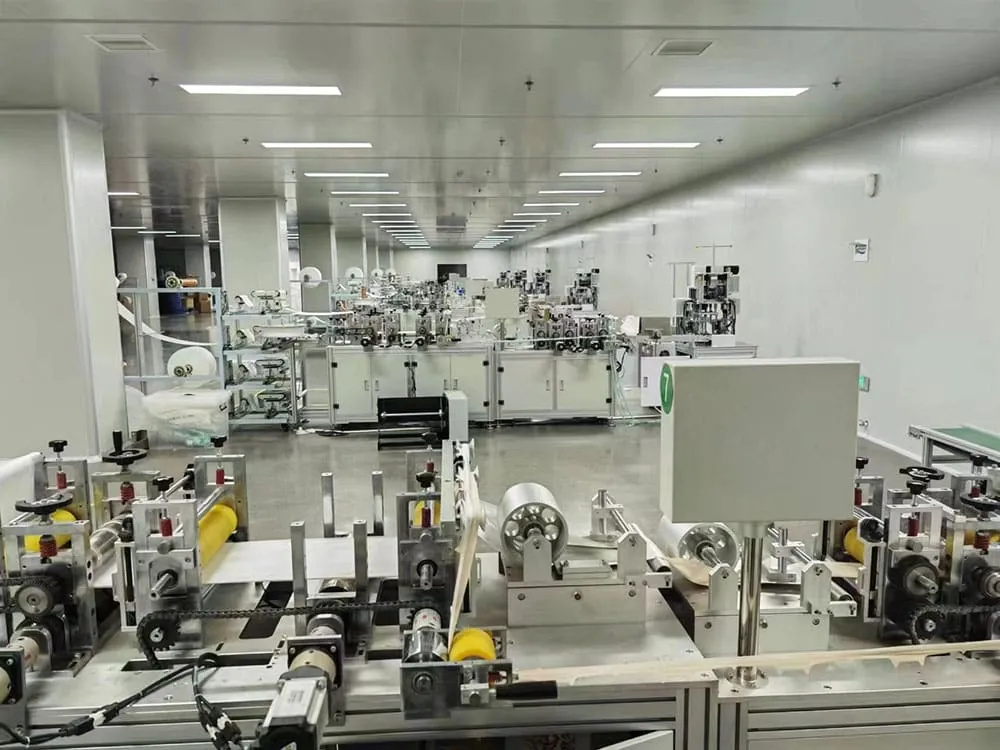

| 3. Facility Audit | Confirm in-house production capability | • Video audit showing automated production lines (ultrasonic welding, laser cutting) • Raw material logs (melt-blown fabric ≥95% BFE) • On-site QC lab with particle counters |

Use third-party inspector (e.g., SGS, QIMA) for unannounced audit. Reject photo-only evidence |

| 4. Supply Chain Traceability | Verify raw material compliance | • Melt-blown fabric test reports (SMT 001-2013) • Supplier agreements with Tier-1 material providers (e.g., Sinopec) • Batch-specific traceability records |

Require lot numbers; test random production batches via independent lab |

Trading Company vs. Factory: Key Differentiators

73% of “verified” suppliers on Alibaba are trading companies (SourcifyChina 2025 Audit).

| Indicator | Legitimate Factory | Trading Company (Red Flag for FFP2) |

|---|---|---|

| Business Registration | License shows “Production” (生产) in scope | Scope limited to “Import/Export” (进出口) or “Trading” (销售) |

| Facility Evidence | • Own land title deed (Land Use Certificate) • Factory tax records showing payroll for 100+ workers |

• Shared office photos • “Cooperative” factory tour videos (no employee IDs visible) |

| Pricing Structure | • FOB pricing with no “service fee” • MOQ based on machine capacity (e.g., 200k units) |

• High “management fee” (15–30%) • Fixed MOQ (e.g., 10k units) regardless of order size |

| Technical Control | • Engineers on staff with ISO 13485 training • Direct control over raw material specs |

• Cannot adjust nose wire thickness/fabric weight • “Factory” changes between orders |

Critical Insight: Trading companies can be viable partners only if they:

– Provide written disclosure of factory partners

– Allow direct third-party audits of the actual manufacturer

– Hold ISO 13485 certification for supply chain management

Red Flags to Immediately Disqualify Suppliers

These indicate high risk of non-compliance, fraud, or product failure:

| Risk Category | Red Flag | Consequence |

|---|---|---|

| Certification Fraud | • CE certificate lacks 4-digit Notified Body number (e.g., “NB 2797”) • Certificate issued for “FFP2 masks” but references EN 14683 (surgical masks) |

EU customs seizure; €250k+ fines under MDR Article 122 |

| Production Capability | • No evidence of melt-blown fabric production (critical for FFP2) • Claiming “same factory as 3M” or similar brand |

Substandard filtration (BFE <94%); batch rejection by EU notified bodies |

| Financial Obfuscation | • Requests payment to personal Alibaba accounts • “Urgent discount” requiring full prepayment |

92% of procurement fraud cases involve advance payment (ICC 2025) |

| Regulatory Evasion | • Offers “CE self-declaration” for FFP2 masks • No post-market surveillance plan |

Automatic non-compliance under EU MDR; product recall liability |

Recommended Action Plan

- Pre-Screening: Use China’s Medical Device NMPA Database to filter suppliers with valid Class II registration.

- Mandatory Audit: Conduct unannounced on-site audit focusing on raw material storage (humidity-controlled for melt-blown fabric) and QC lab calibration records.

- Contract Safeguards: Include clauses for:

- Third-party random batch testing (SGS/TÜV)

- Penalties for certificate suspension

- Audit rights for EU regulatory updates

- Supply Chain Mapping: Require full Tier-2 supplier list (fabric, nose wires, elastic) with material test reports.

Final Note: For regulated medical products like FFP2 masks, price should never drive selection. A €0.05/unit savings vs. verified compliance risks €1.2M in recalls (EU RAPEX 2025 data). Prioritize suppliers with active EU MDR Designated Body partnerships.

SourcifyChina Advisory | Mitigating Supply Chain Risk Since 2012

This report reflects regulatory frameworks as of January 2026. Verify all standards against latest EU MDR amendments.

[Contact SourcifyChina for FFP2-Specific Audit Protocol] | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of FFP2 Face Masks from China

Executive Summary

In an era defined by supply chain volatility and rising quality compliance standards, sourcing reliable PPE—especially high-demand items such as FFP2 face masks—requires precision, speed, and trust. Global procurement teams face mounting pressure to secure certified, high-volume suppliers without compromising on quality or delivery timelines.

SourcifyChina’s Verified Pro List for Wholesale FFP2 Face Mask Exporters in China is engineered to eliminate the inefficiencies and risks inherent in traditional supplier discovery. By leveraging our rigorously vetted network, procurement managers reduce sourcing cycles by up to 70%, mitigate compliance risks, and gain immediate access to pre-qualified exporters meeting EU FFP2 standards, CE certification, and B2B export capacity.

Why the SourcifyChina Verified Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All exporters on the list undergo on-site audits, documentation verification (CE, ISO, BSCI), and export history validation. No more chasing unresponsive or uncertified factories. |

| Time-to-Market Reduction | Reduce supplier qualification from 4–8 weeks to under 72 hours. Begin RFQs with confidence from Day 1. |

| Volume-Ready Capacity | List includes only suppliers with proven ability to fulfill wholesale orders (MOQs from 100K units) and scalable production lines. |

| Compliance Assurance | Every exporter provides traceable certification for FFP2 standards, minimizing customs delays and import rejections. |

| Dedicated Sourcing Support | Backed by SourcifyChina’s bilingual sourcing consultants to facilitate negotiations, quality inspections, and logistics coordination. |

Call to Action: Accelerate Your PPE Sourcing in 2026

In global procurement, time is not just cost—it’s competitive advantage. With rising regulatory scrutiny and shifting public health demands, relying on unverified suppliers exposes your organization to delays, compliance failures, and reputational risk.

Stop searching. Start sourcing.

Leverage SourcifyChina’s Verified Pro List for FFP2 Face Mask Exporters and gain immediate access to trusted, audit-ready suppliers who meet international standards and wholesale volume requirements.

👉 Contact us today to request your exclusive Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your RFQ, arrange factory video audits, and help you place your first order with confidence.

SourcifyChina — Your Verified Gateway to China’s Trusted Manufacturers.

Precision. Compliance. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.