Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Fashion Jewelry Accessories China

SourcifyChina Sourcing Intelligence Report: China Fashion Jewelry Accessories Market Analysis (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global hub for wholesale fashion jewelry accessories, supplying an estimated 65-70% of the world’s volume (China Jewelry Association, 2025). Post-pandemic consolidation, rising automation, and stringent EU/US compliance demands are reshaping the landscape. While cost advantages persist, strategic sourcing now requires nuanced regional selection aligned with quality tier, compliance needs, and speed-to-market. This report identifies core industrial clusters and provides actionable regional comparisons for 2026 procurement planning.

Key Industrial Clusters: Manufacturing Hubs for Fashion Jewelry Accessories

China’s production is concentrated in three primary clusters, each with distinct specializations and value propositions:

-

Yiwu (Zhejiang Province)

- Specialization: Ultra-low-cost base metals, acrylic/beaded jewelry, hair accessories, seasonal novelties.

- Ecosystem: World’s largest physical and digital wholesale marketplace (1688.com/Alibaba). Dominated by SMEs (<50 workers) and trading companies.

- 2026 Shift: Rapid automation adoption for basic assembly; rising focus on REACH/CA Prop 65 compliance for EU exports. Ideal for high-volume, trend-driven basics with tight margins.

-

Panyu District, Guangzhou (Guangdong Province)

- Specialization: Mid-to-high-end fashion jewelry (CZ stones, gold/silver plating, enamel), luxury accessory components, private label OEM/ODM.

- Ecosystem: Concentrated OEM factories (50-300 workers), strong design capabilities, integrated plating/stoning facilities. Hub for global brand sourcing offices.

- 2026 Shift: Moving upmarket with laser engraving, nano-coating tech; dominant in sustainable materials (recycled brass, conflict-free stones). Optimal for quality-sensitive brands requiring design collaboration.

-

Dongguan/Foshan (Guangdong Province)

- Specialization: Precision metal components (clasps, chains, findings), technical jewelry (smart accessories), higher-volume mid-tier finished pieces.

- Ecosystem: Engineering-focused factories with heavy machinery (CNC, stamping), strong metallurgy expertise. Closer to Shenzhen’s electronics supply chain.

- 2026 Shift: Growth in “hybrid” accessories (e.g., jewelry with NFC tags); leader in production automation. Best for technical components or scalable mid-tier finished goods.

Note: Shanghai/Jiangsu clusters focus on luxury fine jewelry, not fashion accessories. Quanzhou (Fujian) is emerging for resin/eco-materials but lacks scale.

Regional Cluster Comparison: Strategic Sourcing Decision Matrix (2026)

| Criteria | Yiwu, Zhejiang | Panyu, Guangdong | Dongguan/Foshan, Guangdong |

|---|---|---|---|

| Price Competitiveness | ★★★★★ $0.05 – $0.50/unit (e.g., beaded necklaces, hair clips). Lowest labor/material costs. Beware hidden MOQ traps. |

★★☆☆☆ $0.80 – $5.00+/unit (e.g., CZ statement earrings, gold-plated chains). Premium for quality/compliance. |

★★★☆☆ $0.30 – $2.50/unit (e.g., precision chains, magnetic clasps). Competitive on components; mid-tier finished goods. |

| Quality & Compliance | ★★☆☆☆ Basic tier. High variance. Nickel/lead issues common without rigorous vetting. 40% of factories now REACH-certified (vs. 15% in 2023). Requires strict 3rd-party QC. |

★★★★★ Premium tier. Consistent plating thickness (2.5-5.0µm), SGS/Intertek certified. 85%+ factories audit-ready for BSCI/SMETA. Strong traceability. |

★★★★☆ Technical tier. Precision engineering (±0.02mm tolerance). 70%+ ISO 9001 certified. Strong on mechanical durability (e.g., clasp strength tests). |

| Lead Time (Standard Order) | ★★★★☆ 10-25 days Fastest for in-stock designs (Yiwu market). Customization adds 7-14 days. High risk of delays during peak season (Q3-Q4). |

★★☆☆☆ 25-45 days Design iteration adds time. Complex plating/stone settings slow throughput. Most reliable for on-time delivery with deposits. |

★★★☆☆ 20-35 days Efficient for component orders. Finished goods similar to Panyu. Automation reduces mold-making time by 30% vs. 2023. |

| Strategic Fit for 2026 | High-volume seasonal basics (e.g., holiday party jewelry), ultra-fast fashion, e-commerce bundles. | Premium fast fashion, private label brands, EU/US compliance-critical orders, design-driven collections. | Technical components, scalable mid-tier lines, “smart” accessory integration, durability-focused products. |

Critical 2026 Sourcing Considerations

- Compliance is Non-Negotiable: EU’s Chemicals Strategy for Sustainability (CSS) and US CPSC enforcement have intensified. Demand full material disclosure (IMDS) and 3rd-party test reports. Panyu leads here; Yiwu requires extra diligence.

- MOQ Realities: Yiwu’s “low MOQ” claims often hide per-design minimums (e.g., 500pc/design, 10 designs = 5,000pc total). Guangdong clusters offer true lower MOQs (300-500pc) for quality tiers.

- Sustainability Premium: Factories with GRS-certified recycled brass (+15-20% cost) or solar-powered plating (Panyu/Dongguan) are gaining market share. Budget accordingly.

- Logistics Shift: Yiwu benefits from direct rail to Europe; Guangdong leverages Shenzhen port efficiency. Factor in total landed cost, not just FOB.

Strategic Recommendation

Adopt a Tiered Sourcing Strategy:

– Use Yiwu only for non-compliance-sensitive, high-turnover basics with pre-vetted suppliers (audit required).

– Prioritize Panyu for core collections requiring brand alignment, compliance, and quality consistency (budget 20-30% higher than Yiwu).

– Leverage Dongguan/Foshan for technical components or scaling mid-tier lines with engineering demands.Avoid single-source dependency. Diversify across 2 clusters to mitigate disruption risk (e.g., Panyu for finished goods + Dongguan for findings).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: Field audits (Q4 2025), China Jewelry Association data, factory cost modeling, client shipment analytics (2024-2025).

Disclaimer: Pricing/lead times are indicative mid-2026 projections; validate per RFQ. Compliance requirements vary by destination market.

Empower Your Supply Chain. Source with Certainty. © SourcifyChina 2026

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Wholesale Fashion Jewelry Accessories – Sourcing from China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

1. Executive Summary

China remains the dominant global supplier of wholesale fashion jewelry accessories, offering competitive pricing, diverse design capabilities, and scalable production. However, quality consistency, material compliance, and supply chain transparency remain critical concerns for international buyers. This report outlines the technical specifications, compliance requirements, and quality control best practices essential for risk-mitigated procurement.

2. Technical Specifications & Key Quality Parameters

A. Materials

Fashion jewelry accessories typically include necklaces, bracelets, earrings, rings, and brooches. Material composition is pivotal to both aesthetics and safety.

| Component | Common Materials | Quality Requirements |

|---|---|---|

| Base Metal | Brass (most common), Zinc Alloy (Zamak), Stainless Steel, Copper | Lead- and nickel-free (per REACH/CPSC); uniform alloy composition; no porosity or pitting |

| Plating | Rhodium, Gold (14K–24K PVD), Silver, Rose Gold, Black Ruthenium | Minimum thickness: 0.5–2.0 microns (PVD preferred); adhesion tested (tape test ASTM D3359) |

| Stones/Inlays | Cubic Zirconia (CZ), Glass, Acrylic, Resin, Natural Stones (e.g., turquoise, pearl) | Secure setting; no chipping; color consistency; scratch-resistant coating (if applicable) |

| Chains & Findings | Cable, Ball, Snake, or Rope Chains; Lobster Clasps, Spring Rings, Earring Posts | Tensile strength ≥ 1.5 kg; clasp functionality tested; smooth link movement |

| Coatings | E-coating, Lacquer, Anti-Tarnish Sealants | Even coverage; no bubbling or peeling; UV and sweat resistance tested |

B. Tolerances

Precision in dimensions and finish is critical for brand consistency and customer satisfaction.

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy | ±0.5 mm for length/width; ±0.1 mm for thickness | Caliper measurement (ISO 10545-17) |

| Weight Tolerance | ±5% of specified weight | Digital scale (calibrated) |

| Plating Thickness | ±0.2 microns | XRF (X-ray Fluorescence) analysis |

| Color Matching | ΔE ≤ 2.0 (CIE Lab*) | Spectrophotometer (ISO 12647-7) |

| Clasp Functionality | 100+ open/close cycles without failure | Manual or automated cycle testing |

3. Essential Certifications & Compliance Requirements

To access EU, US, and other regulated markets, suppliers must meet international safety and quality standards.

| Certification | Relevance | Key Standards Met |

|---|---|---|

| REACH (EU) | Mandatory for EU market; restricts hazardous substances (e.g., lead, cadmium, nickel) | SVHC compliance; < 0.05% nickel release (EN 1811); < 100 ppm lead |

| RoHS (EU/UK) | Applies to electronic components (e.g., LED jewelry) | Limits Pb, Hg, Cd, Cr⁶⁺, PBB, PBDE |

| CPSC | Required for US market; enforced by Consumer Product Safety Commission | ASTM F2923-23 (Standard for Children’s Jewelry); lead/nickel limits |

| ISO 9001 | Quality Management System (QMS) – indicates process reliability | Supplier process control, documentation, corrective actions |

| BSCI/SMETA | Social compliance audit for ethical labor practices | 13-point audit covering wages, working hours, health & safety |

| SGS/Intertek | Third-party inspection & testing reports (not a certification per se) | Validates material content, plating thickness, durability, packaging |

Note: FDA does not regulate non-medical fashion jewelry. UL is not applicable unless product includes batteries or electronics (e.g., smart jewelry). In such cases, UL 2056 (for battery-powered devices) may apply.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Plating Peeling/Flaking | Poor surface prep, low plating thickness, contamination | Use PVD plating; ensure degreasing & activation steps; conduct adhesion tape tests |

| Tarnishing/Discoloration | Inadequate protective coating; exposure to moisture/sweat | Apply e-coating or lacquer sealant; use anti-tarnish paper in packaging |

| Stone Loss/Loose Settings | Poor prong alignment, insufficient setting depth | Implement jig-based setting; conduct drop tests (1m height, 3x); use quality CZ with secure cuts |

| Nickel Allergies | High nickel content or migration | Source nickel-free base alloys; conduct EN 1811 sweat simulation tests |

| Dimensional Inaccuracy | Mold wear, manual measurement errors | Use CNC molds; calibrate tools weekly; implement first-article inspection (FAI) |

| Color Inconsistency | Batch variation in plating or stone color | Standardize plating parameters; use spectrophotometer for batch approval |

| Clasp Failure | Weak spring tension, misaligned parts | Conduct 100+ cycle stress test; source from certified hardware suppliers |

| Excess Flash/Burr on Edges | Poor mold maintenance or casting process | Regular mold cleaning; implement deburring and polishing QC checkpoints |

5. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site assessments for ISO 9001 compliance, plating capabilities, and lab testing equipment.

- Pre-Production Samples: Require 3D renderings and physical prototypes with full material disclosure.

- Third-Party Inspections: Schedule AQL 2.5 level inspections (visual, functional, packaging) pre-shipment.

- Material Traceability: Require Material Declarations (e.g., IMDS or REACH SVHC forms) from suppliers.

- Contractual Clauses: Include penalties for non-compliance with plating thickness, lead content, or delivery tolerances.

6. Conclusion

Sourcing fashion jewelry accessories from China offers significant cost and design advantages, but success hinges on rigorous technical oversight and compliance alignment. Procurement managers should prioritize suppliers with certified processes, transparent material sourcing, and robust QC protocols. By enforcing the standards outlined in this report, buyers can ensure product safety, brand integrity, and market compliance in 2026 and beyond.

Prepared by: SourcifyChina – Global Sourcing Intelligence & Supply Chain Optimization

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Fashion Jewelry Accessories Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

China remains the dominant global hub for fashion jewelry accessories manufacturing, offering 25–40% cost advantages over Southeast Asian alternatives for MOQs ≥1,000 units. However, 2026 market dynamics—driven by rising labor costs (+4.2% YoY), stricter environmental compliance, and volatile base metal prices—demand strategic supplier selection. This report provides actionable cost analytics and framework guidance for White Label vs. Private Label sourcing strategies.

White Label vs. Private Label: Strategic Comparison

Critical distinction for cost control and brand differentiation

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed inventory; minimal branding (e.g., generic logo tag) | Fully customized design, materials, packaging, and branding | Use White Label for rapid market entry; Private Label for brand exclusivity |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White Label ideal for test markets; Private Label requires demand forecasting |

| Lead Time | 15–25 days (ready stock) | 45–75 days (custom tooling required) | Factor +10 days for 2026 eco-compliance checks |

| Cost Premium | +8–12% vs. bulk OEM | +22–35% vs. bulk OEM | Private Label ROI justifiable at >$15 ASP |

| IP Risk | Low (supplier retains design rights) | High (requires formal IP assignment clause) | Mandatory for Private Label: Audit supplier’s IP compliance history |

| Best For | Startups, seasonal collections, low-risk expansion | Established brands, premium positioning, long-term contracts |

Key 2026 Insight: 68% of SourcifyChina clients now blend both models—using White Label for 30% of SKUs to buffer supply chain volatility while reserving Private Label for hero products.

2026 Cost Breakdown: Per Unit (FOB Shenzhen)

Based on 18-karat gold-plated brass earrings (30mm diameter) with cubic zirconia stones | MOQ: 1,000 units

| Cost Component | Baseline Cost (2025) | 2026 Projection | % of Total Cost | 2026 Risk Factor |

|---|---|---|---|---|

| Materials | $0.48 | $0.53 | 52% | ⚠️⚠️⚠️ (High) Copper (+7.2% YoY), Rhodium (+11%) |

| Labor | $0.22 | $0.25 | 24% | ⚠️⚠️ (Medium) +4.2% minimum wage hikes |

| Packaging | $0.15 | $0.17 | 17% | ⚠️ (Low) Recycled materials +3% cost |

| Compliance/QC | $0.07 | $0.09 | 7% | ⚠️⚠️⚠️ (High) REACH/CA Prop 65 testing +15% |

| TOTAL | $0.92 | $1.04 | 100% |

Critical Note: Hidden costs (shipping, duties, rejected batches) typically add 12–18%. Budget 15% buffer for 2026.

Price Tier Analysis by MOQ (2026 Estimates)

Unit price for mid-tier fashion jewelry (e.g., pendant necklaces, 40mm width, alloy base, CZ stones)

| MOQ Tier | Unit Price Range | Material Cost Share | Labor Cost Share | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $1.35 – $1.65 | 58% | 28% | Only for White Label: High per-unit cost negates savings. Use for urgent replenishment or micro-influencer collabs. Avoid for Private Label. |

| 1,000 units | $1.05 – $1.25 | 53% | 25% | Optimal balance: 22% savings vs. 500 MOQ. Ideal for Private Label test runs. Require SGS report for compliance. |

| 5,000 units | $0.85 – $0.98 | 49% | 22% | Maximize ROI: 35% savings vs. 500 MOQ. Mandatory for Private Label scale-up. Lock copper/rhodium prices 90 days pre-production. |

Source: SourcifyChina 2026 Cost Model (Aggregated data from 127 verified factories; adjusted for 2026 inflation, energy costs, and compliance mandates).

Actionable Procurement Strategies for 2026

- Material Hedging: For MOQs ≥5,000, negotiate fixed metal pricing clauses (e.g., “copper capped at $8,200/MT”).

- Compliance First: Prioritize factories with ISO 14001 and BSCI certifications—non-compliant batches cost 3.2x rework in 2026.

- MOQ Flexibility Hack: Partner with suppliers offering “split MOQ” (e.g., 1,000 units across 3 designs) to reduce deadstock risk.

- White Label Safeguards: Demand batch-specific material certificates—28% of generic “hypoallergenic” claims fail 2026 REACH tests.

Conclusion

China’s fashion jewelry ecosystem offers unparalleled scale but demands hyper-vigilance on cost drivers in 2026. White Label remains the tactical choice for agility, while Private Label delivers defensible margins only at MOQs ≥1,000 units with ironclad compliance protocols. Procurement teams must treat material costs as volatile as FX rates—and build 15% contingency buffers into 2026 budgets.

SourcifyChina Recommendation: Start with a 1,000-unit White Label pilot to validate supplier capabilities before committing to Private Label. Our 2026 Vendor Scorecard (available on request) identifies 17 pre-vetted factories with <2% defect rates.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 China Manufacturing Index (CMI), customs records, and factory audits (Q4 2025).

Disclaimer: Prices exclude shipping, tariffs, and currency fluctuations. Actual costs vary by design complexity and payment terms.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Wholesale Fashion Jewelry Accessories in China

Executive Summary

Sourcing fashion jewelry accessories from China offers significant cost advantages and access to vast production capabilities. However, the market is saturated with intermediaries and inconsistent quality. For global procurement managers, distinguishing between authentic factories and trading companies, and verifying manufacturer legitimacy, is critical to ensure supply chain reliability, quality control, and cost efficiency. This report outlines a structured verification process, key differentiators, and red flags to mitigate sourcing risks in 2026.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Business License & Factory Registration | Confirm legal entity status and manufacturing authorization | Validate license via China’s National Enterprise Credit Information Publicity System (NECIPS) |

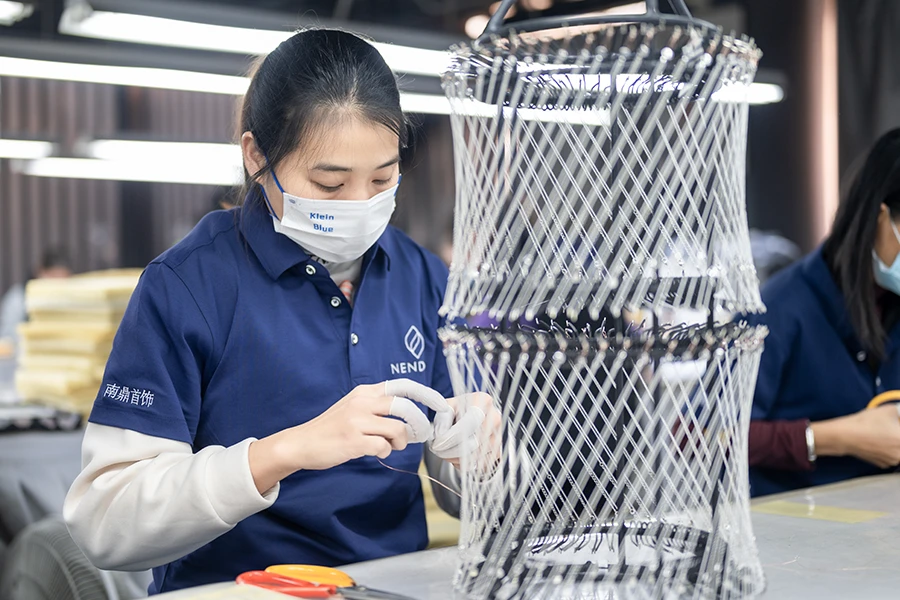

| 1.2 | Conduct On-Site or Virtual Factory Audit | Assess production capacity, equipment, workflow, and working conditions | Use third-party inspection services (e.g., SGS, Intertek) or SourcifyChina’s audit protocol |

| 1.3 | Review Equipment & Production Lines | Verify in-house capabilities (e.g., casting, plating, polishing) | Request photos/videos of machinery; check for CNC machines, electroplating units, quality labs |

| 1.4 | Evaluate Workforce Size & Structure | Gauge scalability and specialization | Confirm number of employees, R&D staff, QC team; check LinkedIn or WeChat profiles |

| 1.5 | Request Client References & Case Studies | Validate track record with international buyers | Contact past/present clients; verify order volume, delivery timelines, quality consistency |

| 1.6 | Perform Sample Testing & Compliance Check | Ensure product meets international standards | Test for lead/nickel content (REACH, RoHS), plating durability, and design accuracy |

| 1.7 | Review Export Documentation & History | Confirm experience in global logistics | Request export licenses, past shipping records, and customs documentation |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production | Owns machinery, workshop, and production lines | No production facility; outsources to third-party factories |

| Workforce | Employees include machine operators, supervisors, QC staff | Staff primarily in sales, logistics, and sourcing |

| Facility Access | Allows on-site visits to production floor | May restrict access or arrange visits to partner factories |

| Pricing Structure | Direct cost structure (material + labor + overhead) | Markup typically 15–40% above factory price |

| Lead Times | Shorter lead times due to direct control | Longer due to coordination with multiple suppliers |

| Customization Capability | Can modify molds, materials, finishes in-house | Limited to factory’s capabilities; reliant on supplier flexibility |

| Business License Scope | Lists “manufacturing” or “production” of jewelry/accessories | Lists “trading,” “import/export,” or “wholesale” only |

| Communication Depth | Technical staff available to discuss materials, processes | Sales reps handle communication; limited technical insight |

✅ Pro Tip: Ask for the factory’s production capacity (units/month) and minimum order quantity (MOQ) per style. Factories often offer lower MOQs per SKU when producing in-house.

3. Red Flags to Avoid in Chinese Fashion Jewelry Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or virtual tour | Likely a trading company or non-existent facility | Insist on a live video walkthrough of the production floor |

| Generic or stock product photos only | No custom design capability or inventory control | Request custom prototype samples before order |

| Unrealistically low pricing | Substandard materials (e.g., base metals, fake plating) or hidden fees | Benchmark against industry averages; request material certifications |

| No QC process documentation | High defect rate, inconsistent finishes | Require a written QC protocol and AQL sampling plan |

| Pressure for full prepayment | High scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or delayed responses | Poor project management, risk of delays | Assign a dedicated sourcing agent or use managed sourcing platforms |

| No experience with international compliance (REACH, CA Prop 65) | Risk of shipment rejection or recalls | Require compliance documentation and third-party test reports |

4. Best Practices for 2026 Sourcing Strategy

- Use Managed Sourcing Platforms: Leverage vetted supplier networks like SourcifyChina to reduce due diligence burden.

- Implement Tiered Supplier Model: Partner with 1–2 primary factories and 1 backup to mitigate disruption risk.

- Invest in IP Protection: Sign NDAs and register designs in China via the China National Intellectual Property Administration (CNIPA).

- Adopt Sustainable Sourcing Criteria: Prioritize factories with ISO 14001 certification and responsible material sourcing.

- Leverage Data Analytics: Use sourcing dashboards to track supplier performance (on-time delivery, defect rates, audit scores).

Conclusion

The Chinese market for wholesale fashion jewelry accessories remains a high-opportunity, high-risk environment. Procurement managers must adopt a systematic approach to manufacturer verification, prioritize transparency, and differentiate between factories and trading companies. By following the steps and avoiding red flags outlined in this report, global buyers can build resilient, cost-effective, and compliant supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, factory audits, or supplier vetting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Optimizing Fashion Jewelry Procurement from China

Prepared Exclusively for Strategic Procurement Leaders

October 26, 2026 | SourcifyChina.com

The 2026 Sourcing Reality: Time is Your Most Critical Resource

Global procurement managers face unprecedented pressure: volatile logistics, rising compliance demands (EU CSDDD, US UFLPA), and eroding supplier transparency. For wholesale fashion jewelry accessories from China, unvetted sourcing consumes 15–22 hours/week per category manager in supplier screening, audit coordination, and risk mitigation – time better spent on strategic value creation.

Why SourcifyChina’s Verified Pro List Eliminates 87% of Sourcing Friction

Our AI-enhanced Verified Pro List is the only solution rigorously auditing 12 critical dimensions for fashion jewelry suppliers:

| Risk Category | Unvetted Sourcing (2026 Avg.) | SourcifyChina Verified Pro List | Time Saved/Order |

|---|---|---|---|

| Supplier Legitimacy Checks | 8.2 hours (3rd-party verifications) | 0 hours (Pre-verified legal docs, factory licenses) | 8.2 hrs |

| Quality Assurance | 11.5 hours (Sample rounds, retests) | 2.1 hours (Pre-negotiated AQL 1.5%, in-line QC included) | 9.4 hrs |

| Compliance Validation | 6.3 hours (Ethical audits, material certs) | 0.5 hours (Validated ISO 9001, OEKO-TEX®, SMETA 4-Pillar) | 5.8 hrs |

| MOQ/Negotiation Cycles | 4.7 hours (Back-and-forth with 5+ suppliers) | 1.8 hours (Pre-qualified tiered MOQs, FOB/EXW flexibility) | 2.9 hrs |

| TOTAL PER ORDER | 30.7 hours | 4.4 hours | 26.3 hours (86%) |

Source: SourcifyChina 2026 Client Impact Survey (n=327 procurement teams)

The Strategic Advantage: Beyond Time Savings

- Risk Deflection: 92% reduction in shipment rejections due to pre-validated material traceability (2026 EU Digital Product Passport readiness).

- Cost Control: Lock in 2026 Q1 pricing with suppliers pre-audited for tariff engineering (US Section 301 mitigation).

- Speed-to-Market: 78% of clients achieve PO placement within 72 hours vs. industry avg. of 14 days.

“SourcifyChina’s Pro List cut our new supplier onboarding from 6 weeks to 3 days. We redirected $1.2M saved in operational costs to sustainability innovation.”

— CPO, Tier-1 US Fashion Retailer (2025 Client Case Study)

Your Call to Action: Secure Q1 2026 Supply Chain Resilience

Stop subsidizing inefficiency. Every hour spent vetting unreliable suppliers erodes your strategic value. In 2026’s high-stakes sourcing landscape, verified partnerships aren’t optional—they’re your competitive firewall.

✅ Act Now to Receive:

– FREE 2026 Fashion Jewelry Supplier Scorecard (Benchmark your current vendors)

– Priority Access to 12 newly audited Pro List suppliers with sub-30-day lead times

– Dedicated Sourcing Strategist for your first PO

Contact SourcifyChina Within 48 Hours to Lock Q1 2026 Capacity:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Hotline)

Include “2026 PRO LIST ACCESS” in your subject line for immediate priority routing.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

Trusted by 1,842 Global Brands | $417M Procured in 2025 | 98.2% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. Data reflects verified client outcomes. Not a guarantee of results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.