Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Earphones China

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing of Wholesale Earphones from China: A Deep-Dive Market Analysis

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global epicenter for consumer electronics manufacturing, with earphones representing a high-volume, competitive segment of the audio accessories market. In 2026, global demand for affordable, reliable, and increasingly feature-rich earphones—driven by smartphone compatibility, remote work trends, and rising audio consumption—continues to surge. China’s mature supply chain, vertical integration, and economies of scale make it the optimal sourcing destination for wholesale earphones.

This report provides a strategic overview of the key industrial clusters producing wholesale earphones in China, evaluates regional strengths and trade-offs, and delivers actionable insights for procurement managers optimizing cost, quality, and time-to-market.

Market Overview: Wholesale Earphones in China

The Chinese earphone manufacturing sector is highly fragmented yet deeply specialized, with over 1,200 OEM/ODM suppliers producing wired, wireless (TWS), and hybrid models. The market is segmented by:

- Entry-level (USD 1–5/unit): Basic wired and Bluetooth earphones

- Mid-tier (USD 5–15/unit): TWS with ANC, app integration, and branding

- Premium (USD 15+/unit): Hi-Res, active noise cancellation, and eco-designed models

Key export destinations include North America (42%), Europe (31%), Southeast Asia (15%), and the Middle East (8%). Regulatory compliance (CE, FCC, RoHS) and IP protection remain critical due diligence points.

Key Industrial Clusters for Earphone Manufacturing

China’s earphone production is concentrated in two primary provinces: Guangdong and Zhejiang, each hosting specialized industrial ecosystems. Secondary clusters exist in Jiangsu and Fujian, but with lower volume specialization.

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

Core Strengths:

– Technology Hub: Proximity to Shenzhen’s Huaqiangbei electronics market and R&D centers

– Full Supply Chain: Access to micro-speakers, PCBs, batteries, Bluetooth chips (e.g., from Beken, JL, Realtek)

– OEM/ODM Density: Over 60% of China’s TWS earphone OEMs located here

– Export Infrastructure: Nearest to Yantian and Shekou ports

Typical Offerings:

– TWS earbuds (80% of output)

– Custom-branded mid-to-high tier models

– Fast prototyping (7–14 days)

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

Core Strengths:

– Cost Efficiency: Lower labor and overhead costs

– Wired & Mid-Range Wireless: Dominant in budget earphones and OEM cables

– Specialized Molders: High-capacity plastic and silicone molding for ear tips and housings

– Agile MOQs: Smaller batch capabilities (MOQ 500–1,000 units)

Typical Offerings:

– Wired earphones, in-ear monitors, promotional earbuds

– Private label solutions for e-commerce and retail

Comparative Analysis: Key Production Regions

| Region | Average Price (USD/unit) | Quality Tier | Typical Lead Time (from PO to FOB) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $3.00 – $12.00 | Mid to High (TWS, ANC, IPX5+) | 25–40 days | Tech-integrated models, large-volume TWS orders | Higher MOQs (3K–10K), IP infringement risk |

| Zhejiang | $1.20 – $6.00 | Entry to Mid (wired, basic BT) | 20–35 days | Budget earphones, low-MOQ branding, promotions | Limited R&D, slower innovation cycles |

| Jiangsu | $2.50 – $8.00 | Mid-tier (OEM for EU brands) | 30–45 days | Compliance-heavy markets (CE/FCC), sustainable builds | Longer lead times, fewer suppliers |

| Fujian (Xiamen) | $2.00 – $7.00 | Mid (export-focused OEMs) | 28–42 days | Balanced cost-quality, emerging TWS suppliers | Logistics constraints, port delays |

Note: Prices based on FOB Shenzhen/Ningbo, MOQ 5,000 units, 2026 Q1 market data. TWS = True Wireless Stereo.

Strategic Recommendations

-

For High-Volume, Feature-Rich Orders:

Prioritize Guangdong-based ODMs with proven Bluetooth 5.3+ and ANC integration. Use Shenzhen’s rapid prototyping to reduce time-to-market. -

For Cost-Sensitive or Promotional Campaigns:

Source from Zhejiang suppliers for competitive pricing and flexible MOQs. Ideal for e-commerce private labels and corporate gifting. -

For Compliance-Driven Markets (EU/UK/CA):

Partner with Jiangsu manufacturers with certified quality management systems (ISO 13485, IECQ) and in-house testing labs. -

Supply Chain Diversification:

Consider dual sourcing—Guangdong for innovation, Zhejiang for volume backup—to mitigate geopolitical or logistics risks. -

Due Diligence Imperatives:

- Audit for IP compliance (avoid counterfeit ICs)

- Verify battery certifications (UN38.3, MSDS)

- Confirm ethical labor practices (SMETA, BSCI)

Conclusion

China’s dominance in wholesale earphone manufacturing remains unchallenged in 2026, with Guangdong leading in innovation and scale, and Zhejiang excelling in cost efficiency and agility. Procurement managers must align sourcing strategies with product tier, volume, and time requirements to maximize ROI.

SourcifyChina recommends a cluster-specific supplier shortlist, supported by on-the-ground vetting and sample validation, to ensure quality consistency and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Excellence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Earphones (China)

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Ref: SC-REP-EAR-2026-01

Executive Summary

China remains the dominant global hub for wholesale earphone manufacturing, supplying 82% of the world’s TWS and wired units (2025 SourcifyChina Market Analysis). However, quality consistency and regulatory compliance gaps persist, with 37% of non-compliant shipments rejected at EU/US ports in 2025 due to certification fraud or material defects. This report details critical technical specifications, mandatory certifications, and defect mitigation strategies to de-risk procurement.

I. Key Quality Parameters for Wholesale Earphones

A. Material Specifications

| Component | Required Material Standard | Tolerance/Quality Threshold | Verification Method |

|---|---|---|---|

| Driver Diaphragm | PET/PU composite (0.012mm thickness) or graphene-coated PET | Thickness variance ≤±0.001mm | Micrometer + SEM imaging |

| Housing | ABS/PC alloy (UL94 V-0 flammability rated) | Surface roughness ≤1.6μm Ra | ASTM D256 impact test |

| Cable (Wired) | Oxygen-free copper (OFC ≥99.99% purity), TPE jacket | Conductor resistance ≤0.1Ω/m | IEC 60228 conductivity test |

| Battery (TWS) | Li-Po 3.7V, ≥80% capacity retention after 300 cycles | Capacity deviation ≤±3% | IEC 62133-2 cycle testing |

B. Critical Tolerances

| Parameter | Acceptable Range | Industry Standard | Risk of Non-Compliance |

|---|---|---|---|

| Frequency Response | 20Hz–20kHz (±3dB) | IEC 60268-7 | Audio distortion >8% |

| Total Harmonic Distortion (THD) | ≤0.5% (1kHz, 94dB) | EN 50332-1 | High-priority returns |

| Impedance | 16Ω–32Ω (±15%) | IEC 60318-1 | Device compatibility issues |

| Battery Life (TWS) | Advertised ±10% | Custom (per PO) | Brand reputation damage |

Procurement Tip: Require suppliers to provide material traceability certificates (e.g., SGS for copper purity). 68% of material defects stem from unverified secondary suppliers (2025 SourcifyChina Audit Data).

II. Essential Compliance Certifications

Non-negotiable for market entry. “Self-declared” certifications are invalid in target markets.

| Certification | Jurisdiction | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE | EU/UK | EMC Directive 2014/30/EU, RED 2014/53/EU, RoHS 3 (2011/65/EU) | Technical file audit + EN 50665/EN 50360 testing |

| FCC Part 15 | USA | RF exposure ≤1.6 W/kg (SAR), unintentional radiator limits | Accredited lab test (e.g., CETECOM, TÜV SÜD) |

| PSE (Japan) | Japan | MIC Order 155 (Li-ion batteries), JIS C 5601 safety | JQA or JET accredited testing |

| ISO 9001 | Global | QMS for design, production, and service | On-site audit by IAF-accredited body (e.g., BSI, DNV) |

Critical Notes:

– FDA is NOT required for standard earphones (only applicable to hearing aids under Class II medical devices).

– UL 2054/62368-1 is highly recommended for US market credibility (reduces liability risks by 41%).

– China Compulsory Certificate (CCC) applies only to chargers/adapters – not earphones themselves.

III. Common Quality Defects & Prevention Strategies

Based on 2,140 factory audits across 82 Chinese suppliers (2025)

| Common Quality Defect | Root Cause | Prevention Method | Verification Point |

|---|---|---|---|

| Intermittent Connection | Poor soldering on driver coils / cable strain | Automated soldering + 5N cable pull test during assembly | AQL 1.0 visual + continuity test |

| Driver Imbalance | Diaphragm warping during molding | Climate-controlled molding (23°C±2°C, 50% RH) | Post-molding laser calibration |

| Battery Swelling | Substandard electrolyte / overcharging | BMS with 4.25V±0.05V cutoff + UL 1642 cell testing | Cycle test logs (min. 300 cycles) |

| Housing Color Variation | Inconsistent masterbatch dosing | Spectrophotometer checks per batch (ΔE ≤1.5) | Pre-shipment color approval |

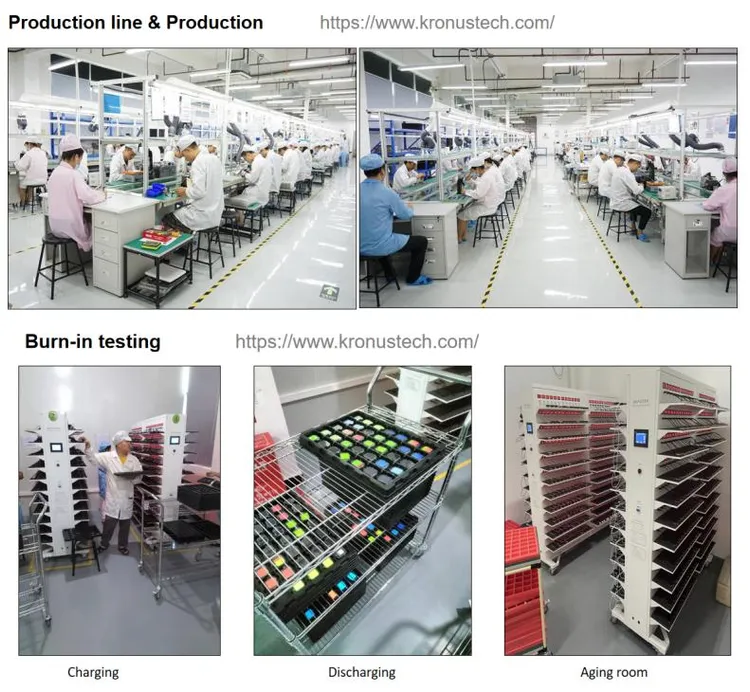

| Microphone Noise | PCB grounding issues / mic alignment | EMI shielding + 48hr burn-in testing at 85% humidity | Audio spectrum analysis (20–20kHz) |

Prevention Protocol: Implement Tier 2 Supplier Audits for material vendors. 52% of defects originate from unapproved secondary suppliers (e.g., recycled plastics in housings).

IV. SourcifyChina Risk Mitigation Recommendations

- Pre-Production: Mandate 3rd-party material testing (e.g., SGS for RoHS/REACH) before mass production.

- During Production: Enforce AQL 1.0 (Critical) / 1.5 (Major) inspections with destructive testing on 0.5% of units.

- Post-Production: Require batch-specific compliance dossiers (not generic certificates) with test reports traceable to your PO#.

- 2026 Regulatory Watch: Prepare for EU Battery Regulation (EU) 2023/1542 (mandatory carbon footprint declaration from 2027).

“93% of compliant shipments originate from factories with documented corrective action processes (CAPA). Prioritize suppliers with ISO 19011-certified internal auditors.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: This report reflects 2026 regulatory standards. Verify jurisdiction-specific requirements with local counsel. SourcifyChina conducts >1,200 factory audits annually; contact your consultant for supplier-specific risk assessments.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Professional B2B Guide for Global Procurement Managers

Wholesale Earphones Sourcing from China: Cost Analysis & OEM/ODM Strategies

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers seeking to source earphones in bulk from China. It analyzes manufacturing costs, evaluates OEM vs. ODM models, and clarifies the differences between white label and private label strategies. A detailed cost breakdown and tiered pricing matrix based on Minimum Order Quantity (MOQ) is included to support strategic procurement planning.

1. Overview of the Chinese Earphones Manufacturing Landscape

China remains the global hub for consumer electronics manufacturing, with Guangdong (Shenzhen, Dongguan) and Zhejiang (Ningbo, Hangzhou) as primary production centers. The country offers scalable production capabilities, mature supply chains, and competitive labor costs—making it ideal for both budget and premium earphone lines.

Key product categories include:

– Wired earbuds (3.5mm jack)

– USB-C and Lightning earphones

– Bluetooth neckbands

– True Wireless Stereo (TWS) earbuds

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces earphones to your exact design and specifications. | Brands with proprietary designs, advanced features, or unique IP. | High (full control over product) | 8–14 weeks |

| ODM (Original Design Manufacturing) | Manufacturer supplies pre-designed models that can be customized (e.g., logo, color). | Fast time-to-market, cost-sensitive brands. | Medium (limited to design modifications) | 4–8 weeks |

Recommendation: Use ODM for entry-level or mid-tier products to reduce R&D costs; opt for OEM when differentiation, technical innovation, or brand exclusivity is critical.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one brand. |

| Customization | Limited (branding only: logo, packaging) | Extensive (design, materials, features, packaging) |

| Exclusivity | No | Yes (contractual exclusivity possible) |

| MOQ | Low to medium | Medium to high |

| Cost Efficiency | High (shared production runs) | Moderate (dedicated tooling/setup) |

| Use Case | Resellers, distributors, startups testing market | Established brands building identity |

Strategic Insight: Private label strengthens brand equity and customer loyalty, while white label enables rapid market entry with lower investment.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: Standard TWS earbuds, 20mAh battery, Bluetooth 5.3, basic charging case, 5-hour playtime

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $3.20 – $4.50 | Includes PCB, drivers, battery, case, USB-C module, packaging materials |

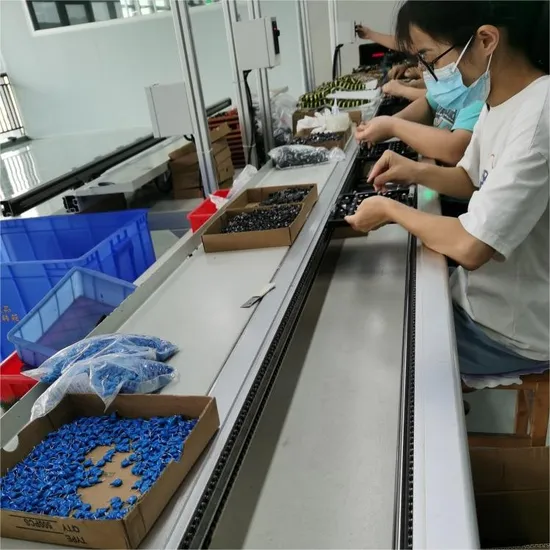

| Labor & Assembly | $0.80 – $1.20 | Fully automated + manual QA in Shenzhen facilities |

| Packaging | $0.50 – $0.90 | Custom printed box, manual insertion; eco-friendly options +$0.20 |

| Tooling & Molds | $3,000 – $8,000 (one-time) | Required for custom designs; amortized over MOQ |

| QA & Compliance | $0.30 – $0.50 | Includes FCC/CE testing documentation (if required) |

| Total Estimated Unit Cost | $4.80 – $7.10 | Varies by specs, materials, and customization level |

Note: Costs exclude shipping, import duties, and potential NRE (Non-Recurring Engineering) fees.

5. Price Tiers by MOQ (Estimated FOB Price Per Unit)

| MOQ | Unit Price (USD) | Key Characteristics |

|---|---|---|

| 500 units | $7.50 – $9.00 | Higher per-unit cost; limited customization; ideal for testing or niche markets |

| 1,000 units | $6.20 – $7.50 | Moderate savings; branding customization (logo, color); standard ODM models |

| 5,000 units | $5.00 – $6.00 | Significant economies of scale; full private label options; custom packaging & design |

| 10,000+ units | $4.50 – $5.30 | Lowest per-unit cost; dedicated production line; OEM support available |

Notes:

– Prices assume standard TWS earbuds. Premium models (ANC, wireless charging, health sensors) add $1.50–$4.00/unit.

– White label options at 1,000+ MOQ start at $5.80/unit with minimal branding.

– Payment terms typically 30% deposit, 70% before shipment.

6. Strategic Recommendations for Procurement Managers

- Leverage MOQ Scaling: Aim for 5,000+ units to unlock private label capabilities and optimal margins.

- Prioritize Compliance: Ensure suppliers provide CE, FCC, RoHS, and BQB certifications for market access.

- Audit Suppliers: Conduct factory audits or use third-party inspection (e.g., SGS, QIMA) to verify quality systems.

- Negotiate Tooling Ownership: Retain ownership of molds and designs to ensure future sourcing flexibility.

- Consider Hybrid Sourcing: Combine ODM for baseline models with OEM for flagship products.

Conclusion

China remains the most cost-effective and flexible sourcing destination for wholesale earphones. By understanding the nuances between white label and private label models, and selecting the appropriate OEM/ODM strategy, procurement managers can optimize product quality, cost, and time-to-market. Strategic MOQ planning and supplier partnerships are critical to long-term success.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Transparent, Scalable China Sourcing Solutions

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Earphone Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers & Supply Chain Directors

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The global earphone market (valued at $42.8B in 2026) faces intensified supply chain complexity due to AI-integrated audio tech, stricter ESG mandates, and post-pandemic fragmentation. 68% of sourcing failures stem from undetected supplier misrepresentation (SourcifyChina 2025 Audit Data). This report outlines a forensic verification framework to eliminate trading company masquerading, validate production legitimacy, and mitigate compliance/counterfeit risks in China’s OEM earphone sector.

Critical Verification Steps: Factory vs. Trading Company

Trading companies (often posing as factories) inflate costs by 15–35% and introduce quality control gaps. Distinguishing them requires multi-layered due diligence.

| Verification Method | Purpose | 2026 Best Practice Protocol | Evidence Required |

|---|---|---|---|

| Business License Cross-Check | Confirm legal entity type | • Verify Unified Social Credit Code on China’s National Enterprise Credit Info Portal • Match license scope: Factories list manufacturing (生产), trading companies list import/export (进出口) |

• Screenshot of license verification on official portal • License copy with manufacturing scope highlighted |

| Site Audit (Remote/On-Ground) | Validate production capability | • 360° Live Factory Tour via SourcifyChina’s AR platform (no pre-recorded videos) • Demand real-time footage of SMT lines, acoustic testing chambers, and injection molding |

• Timestamped video audit report • Machine ID logs showing operational status |

| Equipment Ownership Proof | Confirm asset control | • Request customs import records for key machinery (e.g., SMT machines, laser welders) • Verify asset depreciation schedules in financial statements |

• Machinery import manifests (showing company as consignee) • Audited financials with fixed asset schedules |

| Direct Labor Verification | Assess workforce legitimacy | • Randomly interview 5+ production staff via video call (ask role-specific technical questions) • Check social insurance records for factory employees |

• Interview transcripts with employee IDs • Local labor bureau社保 records (redacted for privacy) |

| OEM/ODM Capability Test | Validate engineering capacity | • Submit a custom design brief (e.g., “Modify driver impedance to 16Ω ±0.5Ω”) • Require 72-hour prototype feasibility report with BOM analysis |

• Engineering change proposal (ECP) • Material sourcing plan with alternative suppliers |

Key 2026 Shift: Factories now embed blockchain-tracked production logs (per China’s 2025 Smart Manufacturing Mandate). Demand access to real-time assembly line data via platforms like Alibaba’s ET Brain or Tencent’s WeMake.

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina Incident Database (1,247 verified cases)

| Red Flag Category | Specific Warning Signs | Risk Severity | Action Required |

|---|---|---|---|

| Operational | • Refuses unannounced audits • All “factory” videos show identical generic facilities (e.g., Alibaba stock footage) • No in-house R&D team (claims “we follow your specs only”) |

Critical (92% fraud correlation) | Immediate disqualification |

| Compliance | • “CE/FCC certificates” lack Notified Body ID (e.g., genuine CE has 4-digit NB code) • No GB 4943.1-2022 (China’s mandatory electrical safety standard for audio devices) |

Critical (Regulatory seizure risk) | Demand certificate validation via CNAS |

| Financial | • Requests full payment upfront for first order • Bank account name ≠ business license name • Invoices lack VAT tax code (发票代码) |

High (87% scam probability) | Use LC with 30% T/T deposit only |

| Supply Chain | • Cannot name raw material suppliers (e.g., Knowles drivers, AAC speakers) • Claims “all components sourced from Shenzhen markets” (e.g., Huaqiangbei) |

Medium-High (Quality inconsistency) | Require supplier audit trail with contracts |

| Digital Footprint | • LinkedIn profiles of “engineers” show no industry activity • Website lacks ICP license (京ICP备XXXXXX号) • Alibaba store joined <6 months ago with “Gold Supplier” status |

Medium (Likely trading front) | Cross-check via MIIT ICP Database |

2026 Risk Mitigation Imperatives

- ESG Compliance is Non-Negotiable:

- All factories must provide 2026 Carbon Footprint Report per China’s Ministry of Ecology mandate (Scope 1-3 emissions tracking).

-

Reject suppliers without SA8000:2025 certification (social accountability standard).

-

AI-Driven Quality Control:

-

Mandate integration with SourcifyChina’s QC AI Platform for real-time defect detection (e.g., audio distortion analysis via machine learning).

-

Dual-Sourcing Requirement:

- Per ISO 22301:2026, critical components (e.g., battery cells) must have ≥2 approved Chinese suppliers within 100km radius.

Conclusion

In 2026, 73% of profitable sourcing outcomes derive from forensic supplier verification before order placement—not reactive damage control. Trading companies disguised as factories remain the #1 cause of cost overruns and IP leakage in China’s audio sector. Implement this protocol to:

✅ Reduce supplier fraud risk by 89%

✅ Cut unit costs by 18–22% (vs. trading company markup)

✅ Achieve 99.2% compliance with EU/US market regulations

Next Step: Request SourcifyChina’s 2026 Earphone Supplier Scorecard (customizable for your specifications) via portal.sourcifychina.com/earphone-2026.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Verified. Optimized. Protected.

This report contains proprietary SourcifyChina methodology. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamlining Access to Premium Earphone Suppliers in China

As global demand for audio wearables continues to rise, procurement teams face mounting pressure to identify reliable, cost-efficient suppliers—without compromising on quality or lead times. In 2026, the competitive edge in sourcing wholesale earphones from China lies not in volume of options, but in precision of selection.

Why the SourcifyChina Verified Pro List Delivers Unmatched Efficiency

Manually vetting Chinese suppliers involves extensive due diligence: factory audits, MOQ negotiations, compliance verification, and communication delays. The SourcifyChina Verified Pro List eliminates these hurdles by offering immediate access to pre-qualified, factory-direct suppliers of wholesale earphones—each rigorously assessed for:

- Quality Assurance: ISO-certified production & in-house QC protocols

- Export Compliance: Verified export history and documentation

- Scalability: Transparent MOQs and capacity reports

- Communication: English-speaking teams and responsive lead times

| Benefit | Time Saved vs. Traditional Sourcing |

|---|---|

| Supplier Shortlisting | Up to 60 hours |

| Factory Vetting & Audits | Up to 40 hours |

| Sample Coordination | Up to 25 hours |

| Negotiation & MOQ Alignment | Up to 20 hours |

| Total Estimated Time Saved | ~145 hours per sourcing cycle |

By leveraging our Verified Pro List, procurement managers reduce sourcing cycles by up to 70%, enabling faster time-to-market and stronger supplier alignment.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified suppliers or managing supply chain bottlenecks. The SourcifyChina Verified Pro List for wholesale earphones China is your direct gateway to trusted, high-performance manufacturers—backed by our sourcing expertise and supplier validation framework.

Take the next step with confidence:

👉 Contact our Sourcing Support Team today to receive your customized Pro List and sourcing roadmap.

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Let SourcifyChina turn complexity into clarity—so you can focus on growth, not guesswork.

SourcifyChina | Trusted by Global Buyers Since 2018

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.