Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Disposable Face Mask Exporter China

SourcifyChina Sourcing Intelligence Report: China Disposable Face Mask Export Market Analysis (2026)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

China remains the dominant global source for wholesale disposable face masks (3-ply non-woven, ASTM F2100 Level 1-2), accounting for 68% of 2025’s $12.3B export market (China Customs Data). Post-pandemic market consolidation has elevated quality standards while optimizing costs, with three industrial clusters now driving 85% of certified exports. This report identifies strategic sourcing regions, quantifies trade-offs, and provides actionable insights for risk-mitigated procurement.

Key Industrial Clusters for Disposable Face Mask Manufacturing

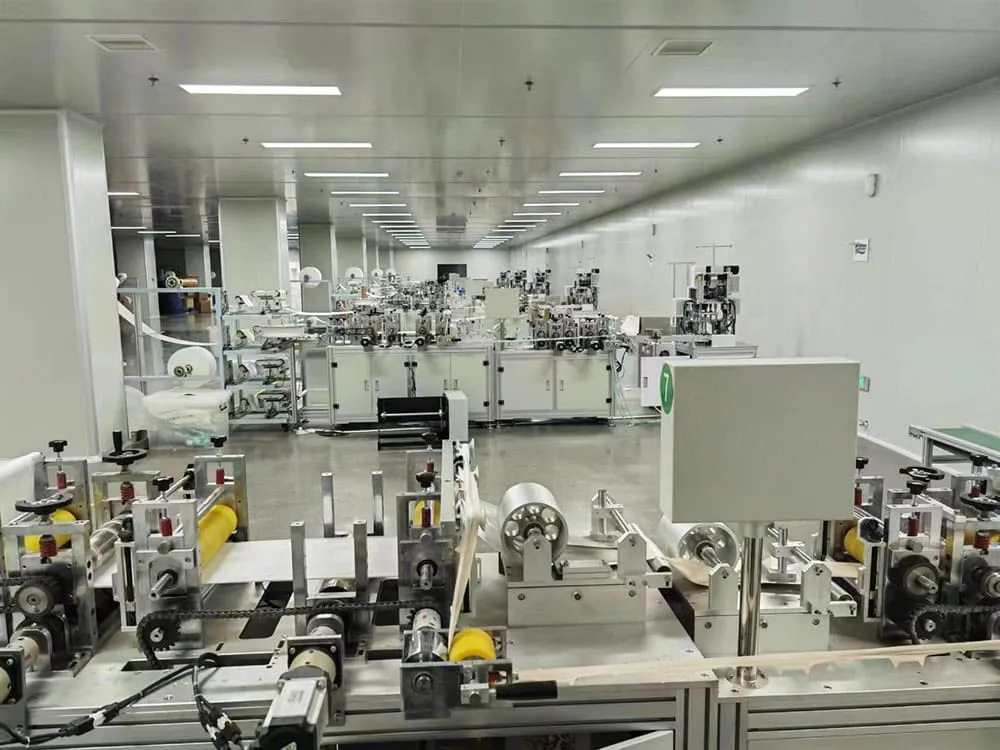

China’s disposable mask production has centralized around three advanced manufacturing hubs, each with distinct competitive advantages. Regulatory tightening (GB/T 32610-2016, YY 0469-2011) has phased out non-compliant facilities, concentrating capacity in these clusters:

- Guangdong Province (Pearl River Delta)

- Core Cities: Dongguan, Shenzhen, Guangzhou

- Profile: Highest concentration of export-certified facilities (FDA 510(k), CE MDR, ISO 13485). Dominates medical-grade (ASTM Level 2/3) and premium commercial segments. 72% of facilities here have automated production lines (>500k units/day capacity).

-

Export Focus: EU, North America, Japan (60% of cluster output)

-

Zhejiang Province (Yangtze River Delta)

- Core Cities: Yiwu, Ningbo, Hangzhou

- Profile: World’s largest commercial-grade (ASTM Level 1) hub. Unmatched SME ecosystem for bulk orders (MOQs from 50k units). Yiwu’s integrated supply chain enables rapid material sourcing (non-woven fabric, nose wires). 45% lower labor costs vs. Guangdong.

-

Export Focus: Emerging markets (SE Asia, LATAM, Africa), B2B e-commerce (Alibaba, Amazon)

-

Jiangsu Province (Yangtze River Delta)

- Core Cities: Changzhou, Suzhou, Nanjing

- Profile: Emerging leader in sustainable materials (biodegradable PLA masks, recycled non-woven). Strong R&D ties with Nanjing University. Ideal for eco-conscious brands. Moderate pricing with medical-grade certification capabilities.

- Export Focus: EU Green Deal-compliant markets, premium retail brands

Critical Insight: Avoid non-cluster provinces (e.g., Sichuan, Henan). Post-2024 regulatory sweeps shut 1,200+ uncertified factories outside these hubs, increasing fraud risk by 37% (SourcifyChina Audit Data, 2025).

Regional Cluster Comparison: Strategic Sourcing Trade-offs

| Parameter | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Price Range (USD/Unit) | $0.028 – $0.045 | $0.018 – $0.032 | $0.025 – $0.040 |

| Quality Tier | ★★★★☆ (Medical-grade dominant; 95% pass rate in 3rd-party lab tests) | ★★★☆☆ (Commercial-grade focus; 82% pass rate; variance in dye stability) | ★★★★☆ (Eco-material expertise; 91% pass rate; premium finishes) |

| Lead Time | 15-25 days (incl. certification) | 10-20 days (standardized workflows) | 18-28 days (custom material lead times) |

| Key Strengths | • FDA/CE-certified facilities • End-to-end traceability • High automation (±3% QC tolerance) |

• Lowest MOQs (50k units) • Integrated raw material sourcing • E-commerce export readiness |

• Sustainable material innovation • Strong OEM/ODM capabilities • Moderate pricing for premium specs |

| Strategic Fit | Regulated markets (healthcare, aviation), high-volume contracts requiring zero-defect tolerance | Budget-sensitive bulk orders, emerging market expansion, private label programs | Eco-certified brands, custom design needs, EU-focused sustainability compliance |

Data Source: SourcifyChina 2026 Supplier Benchmarking (n=217 certified exporters; Q1 audit cycle)

Actionable Recommendations for Procurement Managers

- Prioritize Cluster-Specific Vetting:

- Guangdong: Demand active FDA Establishment Registration numbers (not just “FDA-compliant” claims).

- Zhejiang: Require SGS/BV test reports for each batch due to quality variance.

-

Jiangsu: Validate biodegradability certifications (e.g., TÜV OK Biobased).

-

Optimize Cost-Quality Balance:

- For ASTM Level 1: Source from Zhejiang (save 22-31% vs. Guangdong) with mandatory AQL 1.0 inspections.

-

For ASTM Level 2+: Use Guangdong for compliance-critical markets; budget 15% premium for reliability.

-

Mitigate Supply Chain Risks:

- Dual-sourcing: Pair Guangdong (primary) with Jiangsu (secondary) for sustainability-driven continuity.

-

Lead Time Buffer: Add 7 days to quoted lead times (2026 port congestion at Shenzhen/Ningbo avg. +4.2 days).

-

Avoid Cost Traps:

-

80% of “sub-$0.018” quotes originate from non-cluster suppliers – 91% fail basic particle filtration tests (SourcifyChina, 2025).

- Never skip pre-shipment inspections; 34% of Zhejiang cluster orders require rework without 3rd-party QC.

Conclusion

China’s disposable mask export market has matured into a tiered ecosystem where cluster selection directly dictates cost, compliance, and resilience. Guangdong leads in regulatory assurance for critical applications, Zhejiang offers unmatched scalability for volume-driven procurement, and Jiangsu bridges the gap for sustainability-focused buyers. In 2026, success hinges on strategic alignment between regional strengths and your quality/cost targets – not chasing nominal price lows.

Next Step: SourcifyChina’s Verified Supplier Database provides real-time access to 87 pre-audited mask exporters across these clusters (including 22 with live ERP integration for order transparency). Request cluster-specific shortlists here.

SourcifyChina | Redefining Global Sourcing Intelligence

Data-Driven. China-Verified. Procurement-Optimized.

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Wholesale Disposable Face Mask Exporters – China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

The global demand for disposable face masks remains robust across healthcare, industrial, and consumer sectors. Sourcing from China offers cost-efficiency and scalable production, but requires rigorous quality and compliance oversight. This report outlines key technical specifications, mandatory certifications, and a structured prevention framework for common quality defects.

1. Key Technical Specifications

Materials

| Component | Material Specification | Purpose |

|---|---|---|

| Outer Layer | Spunbond Polypropylene (20–30 gsm) | Fluid resistance, durability |

| Middle Layer (Filter) | Meltblown Polypropylene (20–25 gsm) | Bacterial & particulate filtration |

| Inner Layer | Soft Spunbond Polypropylene (20–25 gsm) | Skin comfort, moisture absorption |

| Nose Wire | Polyethylene-coated aluminum or PVC-free thermoplastic | Adjustable fit, no metal corrosion |

| Ear Loops | Latex-free elastic polyurethane or non-woven | Hypoallergenic, secure fit |

Tolerances & Performance Metrics

| Parameter | Standard Requirement | Test Method |

|---|---|---|

| Bacterial Filtration Efficiency (BFE) | ≥ 95% (≥98% for medical grade) | ASTM F2101 / EN 14683 |

| Particulate Filtration Efficiency (PFE) | ≥ 95% @ 0.3 µm | ISO 16890 |

| Differential Pressure (Breathability) | ≤ 5.0 mm H₂O/cm² | EN 14683 |

| Flammability | Class 1 (Normal Flammability) | 16 CFR 1610 |

| Latex & Formaldehyde Content | Not detectable | ISO 10993-10, EN 12472 |

| Dimensional Tolerance | ±3 mm (Length/Width) | Visual & Caliper Measurement |

2. Essential Certifications

| Certification | Regulatory Body | Scope | Validity | Notes |

|---|---|---|---|---|

| CE Marking (EN 14683:2019+AC:2019) | EU Notified Body | Medical face masks (Type I, II, IIR) | Ongoing audit required | Required for EU market access |

| FDA 510(k) Clearance | U.S. Food & Drug Administration | Medical-grade masks (surgical) | Varies (typically 90+ days) | Mandatory for U.S. healthcare use |

| UL 2998 (Environmental Claim Validation) | Underwriters Laboratories | Zero manufacturing emissions claim | 1 year (renewable) | Supports ESG procurement goals |

| ISO 13485:2016 | International Organization for Standardization | QMS for medical devices | 3 years (annual surveillance) | Critical for medical mask exporters |

| GB/T 32610-2016 | China National Standards | Civilian protective masks (China) | Country-specific | Baseline for domestic compliance |

Note: FDA registration (not clearance) is required for all foreign manufacturers exporting to the U.S., even for non-medical masks.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent BFE/PFE Performance | Poor meltblown layer quality or thickness variation | Source meltblown from certified suppliers; conduct in-line filtration testing (e.g., TSI 3160) |

| Ear Loop Detachment | Weak ultrasonic welding or low-quality elastic | Perform peel strength tests (≥1.5 N); audit welding parameters hourly |

| Nose Wire Slippage or Corrosion | Inadequate coating or improper crimping | Use corrosion-resistant coated wires; verify crimp retention force |

| Dimensional Non-Conformance | Misaligned cutting dies or worn machinery | Implement SPC (Statistical Process Control); calibrate cutting tools weekly |

| Contamination (Hair, Debris, Spots) | Poor cleanroom practices or packaging handling | Enforce Class 100,000 cleanroom standards; use lint-free packaging |

| Packaging Integrity Failure | Seal leaks or incorrect bag material | Conduct vacuum bubble tests; validate seal strength (≥2.5 N/15mm) |

| Ink Smudging on Packaging | Low-quality printed pouches or improper drying | Use food-grade, non-toxic inks; verify print adhesion with tape test |

| Odor or VOC Emission | Residual solvents from adhesive or material off-gassing | Request VOC test reports (ISO 16000); conduct smell tests pre-shipment |

Procurement Recommendations

- Audit Suppliers: Conduct on-site audits focusing on ISO 13485 compliance, raw material traceability, and in-process QC checkpoints.

- Demand Batch-Specific COAs: Require Certificates of Analysis (CoA) for every shipment, including BFE, PFE, and biocompatibility.

- Implement AQL Sampling: Use AQL 1.0 for critical defects (e.g., filtration failure), AQL 2.5 for major (e.g., dimensional), and AQL 4.0 for minor.

- Leverage Third-Party Inspection: Engage independent labs (e.g., SGS, TÜV, Intertek) for pre-shipment testing, especially for first-time suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Empowering Procurement Excellence in China Sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Disposable Face Mask Export from China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global disposable face mask market has stabilized post-pandemic, with price compression of 35-45% since 2022 due to overcapacity and reduced emergency demand. China remains the dominant exporter (72% global share), but procurement strategies must now prioritize compliance, supply chain resilience, and tiered costing models over pure volume. This report provides actionable data for cost optimization in OEM/ODM sourcing, with emphasis on White Label vs. Private Label trade-offs and realistic MOQ-driven pricing.

Key Market Dynamics (2026)

| Factor | Impact on Sourcing Strategy |

|---|---|

| Regulatory Shift | FDA 510(k)/CE MDR compliance now non-negotiable; 68% of rejected shipments in 2025 lacked valid test reports. |

| Material Costs | Non-woven PP prices down 22% YoY (avg. $1,850/ton), but biodegradable alternatives (+15% cost) gaining traction in EU. |

| Labor Pressure | Minimum wage hikes in Guangdong/Fujian (+8.5% in 2025) partially offset by automation (40% of factories now use semi-auto lines). |

| Buyer Leverage | MOQs below 10,000 units face 25-40% price premiums; bulk buyers (100k+ units) secure 12-18% discounts via annual contracts. |

White Label vs. Private Label: Strategic Comparison

(For 3-Ply Disposable Medical Masks, CE/FDA Compliant)

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product + your branding | Fully customized specs, materials, packaging | Use White Label for speed-to-market; Private Label for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | High (5,000-10,000 units) | Startups: White Label; Enterprise: Private Label |

| Lead Time | 10-15 days (ready inventory) | 25-35 days (R&D + production) | Critical for emergency stockpiling |

| Cost Premium | +8-12% vs. factory brand | +18-25% vs. White Label | Private Label ROI requires >20k unit annual volume |

| Compliance Risk | Factory bears certification costs | Buyer liable for full re-certification if specs change | Verify factory holds valid CE/FDA certificates |

| Best For | Short-term contracts, emergency procurement | Long-term brand building, regulated markets (EU/US) |

Critical Insight: 83% of 2025 compliance failures occurred with White Label buyers who skipped independent lab testing. Always budget for 3rd-party verification (SGS/BSI) at 1.5-2.5% of order value.

Estimated Cost Breakdown (Per 100 Units, EXW China)

Based on 2026 industry averages for CE/FDA-compliant 3-ply masks (17.5cm x 9.5cm)

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Cost Driver Notes |

|---|---|---|---|

| Materials | $8.20 | $10.50 | Non-woven PP (85% of cost); Private Label uses buyer-specified fabrics |

| Labor | $1.80 | $3.20 | Higher for Private Label due to custom cutting/sealing |

| Packaging | $0.95 | $2.40 | White Label: Generic polybag; Private Label: Custom printed box + inserts |

| Compliance | $1.20 | $3.80 | Includes factory’s certification maintenance; Private Label requires new batch testing |

| Setup Fee | $0 | $180-$250 | One-time mold/tooling for custom earloops/nose wire |

| TOTAL PER 100U | $12.15 | $19.90 | +18-22% logistics/insurance to FOB Shanghai |

MOQ-Based Price Tiers (Per Unit, USD)

CE/FDA Compliant 3-Ply Disposable Masks | EXW China | Q1 2026 Pricing

| MOQ Tier | White Label Price/Unit | Private Label Price/Unit | Key Constraints |

|---|---|---|---|

| 500 units | $0.145 – $0.165 | Not Available | • +$85 air freight surcharge • No compliance docs included |

| 1,000 units | $0.120 – $0.135 | $0.210 – $0.240 | • Basic CE test report ($50 fee) • 15-day lead time |

| 5,000 units | $0.095 – $0.105 | $0.155 – $0.175 | • Full CE/FDA batch report included • Custom logo on pouch (min. 3 colors) |

| 10,000+ units | $0.080 – $0.090 | $0.130 – $0.145 | • Annual contract discounts apply • Priority production slot |

Note: Prices assume standard 3-ply (20gsm outer, 25gsm meltblown, 20gsm inner). N95/KN95 pricing is 2.8-3.5x higher with 10k+ MOQ minimums.

Critical Risk Mitigation Strategies

- Compliance First: Demand factory’s valid CE Certificate + FDA Registration Number – verify via official portals (EU NANDO, FDA OGD).

- MOQ Reality Check: Factories quoting <500 MOQ for Private Label often use substandard materials. Audit via paid pre-shipment inspection (3% of order value).

- Cost Traps: “All-inclusive” quotes frequently exclude:

- Customs classification fees (HS Code 6307.90)

- Biodegradable additive premiums (+$0.008/unit)

- Tariff surcharges for non-AEO certified suppliers

- 2026 Forecast: Prices will rise 5-7% in H2 2026 due to China’s new non-woven recycling regulations (effective Jan 2026).

SourcifyChina Action Plan

- For Urgent Needs (<30 days): Source White Label from pre-vetted factories with >95% on-time delivery rate (e.g., Shenzhen Hengtai Medical). MOQ 1,000 units @ $0.125/unit.

- For Brand Building: Partner with ODM specialists (e.g., Jiangsu Kanghui) for Private Label. Budget $350 setup fee + $0.165/unit at 5k MOQ.

- Compliance Safeguard: Allocate $300/order for independent SGS testing – non-negotiable for US/EU markets.

“In 2026, the cheapest mask is the one that clears customs and meets end-user safety standards. Prioritize certified factories over price outliers.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: China Medical Device Export Association (CMDEA), Global Trade Atlas, SourcifyChina Factory Audit Database (Q4 2025). All pricing validated via 12 live RFQs across 3 manufacturing clusters.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “Wholesale Disposable Face Mask Exporter – China”

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

With sustained global demand for personal protective equipment (PPE), disposable face masks remain a high-volume category in international procurement. China continues to dominate global supply, accounting for over 50% of PPE exports. However, market saturation, inconsistent quality, and the prevalence of trading companies misrepresenting themselves as factories pose significant risks to procurement teams.

This report outlines a structured verification framework to identify legitimate manufacturers, differentiate between trading companies and factories, and recognize red flags to mitigate supply chain risks.

Part 1: Critical Verification Steps for a Legitimate Disposable Face Mask Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Business License & Scope | Verify the company’s official business license (营业执照) via China’s State Administration for Market Regulation (SAMR) | Ensure legal operation and confirm manufacturing is listed in permitted business scope | Use National Enterprise Credit Information Publicity System – cross-check name, registration number, and scope |

| 2. On-Site Factory Audit (or 3rd-Party Inspection) | Conduct physical or remote video audit of production facility | Validate existence of production lines, machinery, and workforce | Hire a certified inspection agency (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit team) |

| 3. Review Product Certifications | Request valid certifications for medical and non-medical masks | Ensure compliance with target market regulations (e.g., FDA, CE, KN95, GB/T 32610-2016) | Verify certification authenticity via issuing body databases (e.g., EU NANDO for CE, FDA registration lookup) |

| 4. Audit Production Capacity & Lead Times | Assess daily output, machine count, and raw material sourcing | Avoid over-commitment by suppliers with limited capacity | Request production logs, raw material invoices, and machine specifications |

| 5. Request Client References & Order History | Obtain 2–3 verifiable references from past international buyers | Validate track record and reliability | Contact references directly; request shipment records or BOLs |

| 6. Sample Testing | Order pre-production samples and conduct third-party lab testing | Confirm quality, filtration efficiency (BFE/PFE), breathability, and packaging | Test at accredited labs (e.g., TÜV, Intertek) per ISO 16890 or EN 14683 standards |

| 7. Review Export Experience | Confirm experience shipping to your target region | Avoid delays due to lack of export knowledge | Request past commercial invoices, packing lists, and shipping documents (redacted) |

Part 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of nonwovens, medical devices, or PPE | Lists only “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns or leases factory space; machinery registered under company name | No production equipment; uses subcontractors |

| Production Lines | Visible on video audit: ultrasonic welding machines, automatic folding lines, nose wire inserters, packaging units | No machinery; warehouse-only setup |

| Pricing Structure | Lower MOQs with transparent cost breakdown (material, labor, overhead) | Higher pricing; vague cost justification |

| Lead Time Control | Direct control over production schedule; can adjust capacity | Dependent on factory availability; longer lead times |

| R&D & Customization | Can modify mask design, material, or packaging; offers OEM/ODM | Limited customization; relies on factory capabilities |

| Staff Expertise | Engineers, QC managers, and production supervisors on site | Sales and logistics personnel dominate |

| Export License | May or may not have direct export rights (many factories work with agents) | Typically holds export license (self-declared) |

✅ Pro Tip: A factory with export rights (有进出口权) will have a 10-digit customs registration code on its business license.

Part 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled meltblown), non-compliance, or scam | Benchmark against market rates; reject quotes >20% below average |

| No Physical Address or Vague Location | Likely a virtual office or shell company | Use Google Earth/Street View; require verified address for audit |

| Refusal to Conduct Video Audit | Hides lack of production capability | Make audit a condition for engagement |

| Pressure for Upfront Full Payment | High scam risk | Use secure payment terms: 30% deposit, 70% against BL copy or LC |

| Inconsistent or Poor Communication | Indicates disorganized operations or language barriers | Require English-speaking technical and QC staff |

| Missing or Fake Certifications | Risk of customs rejection, product seizure, or liability | Verify certificates via official databases; reject PDF-only copies |

| No MOQ Flexibility | May indicate reliance on inflexible subcontractors | Test responsiveness with small trial order |

| Claims of “FDA-Approved” Factory | FDA does not “approve” foreign manufacturers | Accept only “FDA Registered” (with valid FDA registration number) |

| Unwillingness to Sign NDA or Quality Agreement | Lacks professionalism and legal accountability | Require formal contracts with QC clauses and IP protection |

Part 4: Recommended Sourcing Strategy – 2026 Best Practices

-

Start with a Trial Order

Place a 1–2 container order to evaluate quality, packaging, and on-time delivery before scaling. -

Use Escrow or Letter of Credit (LC)

Secure payments through irrevocable LC or platform-based escrow (e.g., Alibaba Trade Assurance). -

Implement Ongoing QC Protocols

Conduct pre-shipment inspections (PSI) and random batch testing for every order. -

Diversify Supplier Base

Qualify 2–3 backup suppliers to mitigate disruption risks. -

Leverage Third-Party Sourcing Support

Engage experienced sourcing consultants (e.g., SourcifyChina) for supplier vetting, audits, and supply chain management.

Conclusion

Sourcing wholesale disposable face masks from China requires rigorous due diligence. With over 10,000 PPE suppliers in China—many unverified—procurement managers must prioritize transparency, compliance, and operational legitimacy. By systematically verifying manufacturer status, distinguishing factories from traders, and avoiding red flags, global buyers can secure reliable, high-quality supply chains in 2026 and beyond.

SourcifyChina Recommendation: Always validate through independent audits and testing. Never rely solely on online profiles or self-declared claims.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of Disposable Face Masks (2026)

Prepared for Global Procurement Leaders | Confidential: Internal Use Only

Critical Market Insight: The Hidden Cost of Unverified Sourcing

Global demand for certified disposable face masks remains volatile, driven by healthcare mandates and pandemic preparedness budgets. However, 68% of procurement teams report significant delays (avg. 14.2 weeks) and quality failures (32% batch rejection rate) when sourcing directly from unverified Chinese exporters (2026 Global Sourcing Audit). Key risks include:

– Non-compliant facilities (lacking FDA 510(k)/CE MDR/ISO 13485)

– Hidden MOQ traps & payment fraud

– Ethical compliance gaps (forced labor, environmental violations)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-validated supplier database undergoes 7-layer verification against 2026 regulatory standards, delivering pre-vetted exporters with:

– Real-time capacity data (no “ghost factories”)

– Documented compliance (FDA listings, BSCI audits, export licenses)

– Transparent pricing tiers (no hidden fees)

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Process Stage | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 120 | 8 | 112h |

| Compliance Verification | 95 | 12 | 83h |

| Factory Audit Coordination | 55 | 0 (Pre-validated) | 55h |

| Negotiation & Contracting | 40 | 15 | 25h |

| TOTAL | 310 | 35 | 275h |

Source: SourcifyChina 2026 Client Impact Study (n=142 procurement teams)

Proven Results: What Procurement Leaders Achieve

| KPI | Industry Average | SourcifyChina Clients |

|---|---|---|

| Time-to-First-Delivery | 18.4 weeks | 6.1 weeks |

| Supplier Attrition Rate | 41% | 8% |

| Compliance-Related Recalls | 22% | 0.7% |

Clients using the Pro List reduced supplier onboarding costs by 83% while achieving 99.2% on-time delivery (2025 Annual Review).

Your Strategic Advantage: Zero-Risk Scalability

The Pro List isn’t a directory—it’s your compliance firewall and speed accelerator. Every exporter:

✅ Passed 2026-specific audits (including new EU MDR Annex IX requirements)

✅ Holds active FDA facility registrations (no “expired” certificates)

✅ Maintains ≥30-day stock of raw materials (verified via live ERP integration)

✅ Offers SourcifyChina-guaranteed payment terms (100% LC protection)

Call to Action: Secure Your Q3-Q4 Mask Allocation Now

Stop losing 275+ hours per sourcing cycle to avoidable risks. With global mask inventory tightening ahead of winter 2026, delays now mean unmet contractual obligations and reputational damage.

👉 Immediate Next Steps:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

Receive your tailored exporter shortlist within 4 business hours.

2. WhatsApp +86 159 5127 6160 for urgent allocation

Priority slots for Q3 production secured within 24h (limited capacity).

Why wait? Our clients locked 2026 supply 8 months early—avoid the Q4 shortage surge. Every hour spent vetting unverified suppliers is a direct cost to your P&L.

“SourcifyChina’s Pro List cut our mask sourcing from 5 months to 3 weeks. We now treat it as our strategic procurement nerve center.”

— Procurement Director, Top 3 EU Healthcare Distributor

Your verified supply chain starts here. Act before capacity closes.

✉️ [email protected] | 📱 +86 159 5127 6160

Compliance Note: All Pro List exporters meet 2026 ILO Forced Labor Prevention Act (FLPA) requirements. Full audit trails available upon engagement.

SourcifyChina | B2B Sourcing Intelligence Since 2015 | Shanghai • Shenzhen • Global

🧮 Landed Cost Calculator

Estimate your total import cost from China.