Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Computer Parts Suppliers In China

SourcifyChina | B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Wholesale Computer Parts Suppliers in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s dominant manufacturing hub for computer hardware and electronic components, accounting for over 60% of global electronics production. For procurement managers seeking cost-effective, scalable, and high-quality sourcing of wholesale computer parts, understanding China’s regional manufacturing ecosystems is critical. This report provides a strategic analysis of key industrial clusters, supplier capabilities, and operational trade-offs by region—enabling data-driven sourcing decisions in 2026.

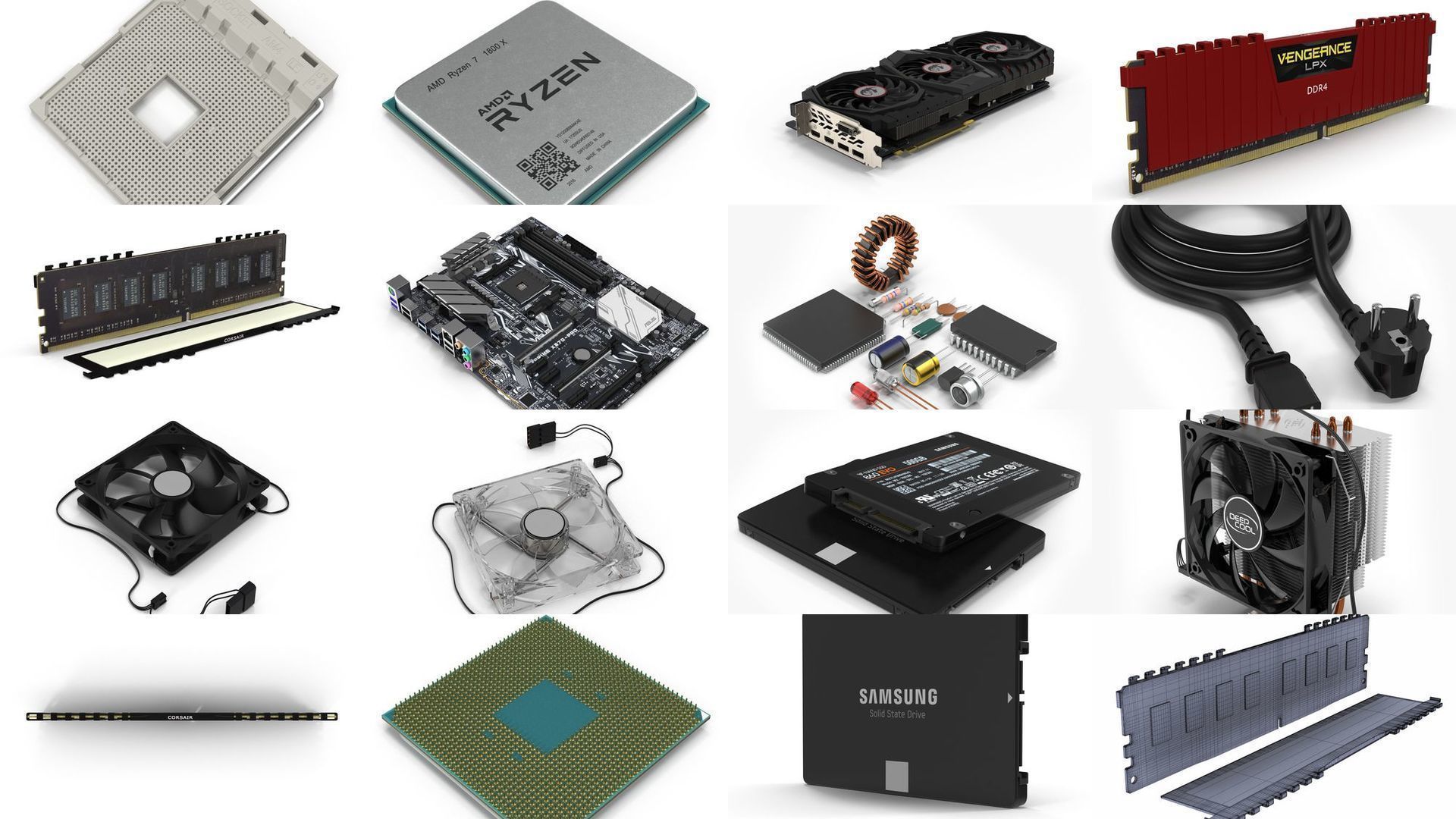

Wholesale computer parts include:

– Motherboards, CPUs, GPUs (OEM/ODM)

– Power supplies, cooling systems

– Storage drives (SSD/HDD), RAM modules

– PC cases, connectors, and peripherals

– Barebone systems and embedded components

Key Industrial Clusters for Computer Parts Manufacturing in China

China’s computer parts manufacturing is highly regionalized, with clusters offering distinct advantages in specialization, scale, and supply chain integration. The top provinces and cities are:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Strengths:

- Global electronics manufacturing epicenter

- Dense network of OEMs, ODMs, and component suppliers

- Proximity to Hong Kong for export logistics

- High specialization in PCBs, motherboards, power supplies

- Key Zones:

- Shenzhen Nanshan & Bao’an Districts (tech innovation + volume production)

- Dongguan (high-volume assembly and injection molding)

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Yiwu

- Strengths:

- Strong SME ecosystem and e-commerce integration (Alibaba HQ in Hangzhou)

- Competitive pricing due to efficient logistics and lower labor costs vs. Guangdong

- Specialization in enclosures, cables, cooling fans, and peripherals

- Key Zones:

- Yiwu (wholesale export logistics)

- Hangzhou Economic & Technological Development Zone

3. Jiangsu Province

- Core Cities: Suzhou, Nanjing, Wuxi

- Strengths:

- High-tech manufacturing with strong foreign investment (e.g., Samsung, HP, Lenovo)

- Focus on precision engineering and high-reliability components

- Proximity to Shanghai (R&D, logistics, air freight)

- Key Zones:

- Suzhou Industrial Park (SIP) – home to semiconductor packaging and testing facilities

4. Shanghai Municipality

- Strengths:

- International business gateway with advanced logistics and customs clearance

- Hub for R&D, design, and high-end ODM partnerships

- Limited volume manufacturing, but ideal for pilot runs and premium-tier sourcing

5. Sichuan & Chongqing (Western China)

- Emerging Hub:

- Government incentives for inland manufacturing relocation

- Lower labor and operational costs

- Growing capacity in memory modules and power supply units

Regional Comparison: Key Metrics for Sourcing Decisions (2026)

| Region | Average Price Level | Quality Tier | Lead Time (Standard Order) | Best For | Supplier Density |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High (Tier 1 & 2 OEMs) | 15–25 days | High-volume, high-reliability orders; full system integration | ⭐⭐⭐⭐⭐ |

| Zhejiang | Low-Medium | Medium-High (SME-driven) | 20–30 days | Cost-sensitive procurement; peripherals & accessories | ⭐⭐⭐⭐ |

| Jiangsu | Medium | High (precision-focused) | 18–28 days | High-performance components; enterprise-grade hardware | ⭐⭐⭐⭐ |

| Shanghai | High | Premium (ODM/R&D partnerships) | 25–35 days | Prototyping, custom design, small-batch premium orders | ⭐⭐⭐ |

| Sichuan/Chongqing | Low | Medium (growing rapidly) | 25–35 days | Labor-intensive assembly; cost-relocation strategies | ⭐⭐ |

Note:

– Price Level is relative to global benchmarks (USD/unit, adjusted for MOQ).

– Quality Tier based on ISO certification prevalence, defect rates (PPM), and export compliance.

– Lead Time includes production + inland logistics to port (Shenzhen, Ningbo, Shanghai).

Strategic Sourcing Recommendations

- Volume Buyers: Prioritize Guangdong for end-to-end supply chain access and scalability. Ideal for distributors and system integrators.

- Cost-Optimized Procurement: Leverage Zhejiang suppliers via Alibaba or 1688 for peripherals, cases, and cooling solutions.

- High-Reliability Needs: Source from Jiangsu for data center-grade PSUs, server motherboards, and industrial computing.

- Innovation & Customization: Engage Shanghai-based ODMs for co-development and low-volume, high-margin products.

- Risk Diversification: Consider Sichuan/Chongqing for secondary sourcing to mitigate supply chain disruptions.

Supplier Verification Best Practices

- Certifications: Require ISO 9001, ISO 14001, and where applicable, IPC-6012 (PCB standards).

- Factory Audits: Conduct on-site or third-party audits (e.g., SGS, TÜV) for Tier 1 sourcing.

- Sample Testing: Validate EMI/EMC, thermal performance, and MTBF (Mean Time Between Failures).

- Trade Compliance: Ensure adherence to US FCC, EU RoHS, and REACH regulations.

Conclusion

China’s regional specialization in computer parts manufacturing offers global procurement managers a strategic advantage—provided sourcing decisions are grounded in geographic and operational intelligence. Guangdong leads in integration and volume, while Zhejiang and Jiangsu offer balanced trade-offs between cost, quality, and lead time. As supply chain resilience becomes paramount in 2026, a multi-cluster sourcing strategy is recommended to optimize cost, mitigate risk, and ensure continuity.

For tailored supplier shortlists and audit support, contact SourcifyChina’s Sourcing Intelligence Desk.

SourcifyChina – Your Trusted Partner in China Sourcing Excellence

Objective. Compliant. Scalable.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Wholesale Computer Parts Suppliers in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies >65% of global computer components, but quality volatility and compliance gaps persist. This report details actionable technical and regulatory requirements to mitigate supply chain risk. Critical focus areas: Material traceability, IPC/ISO adherence, and certification validity verification. Non-compliant shipments increased 18% YoY (2025), driven by counterfeit components and lax ESD controls.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Component Type | Critical Materials | Quality Parameters | Acceptance Threshold |

|---|---|---|---|

| PCBs | FR-4, High-Tg laminates | Glass transition temp (Tg) | ≥170°C (IPC-4101/126) |

| Copper foil | Thickness uniformity | ±5% (per IPC-6012) | |

| Semiconductors | Silicon wafers, Gold wire | Purity level | ≥99.9999% (SEMI F57) |

| Encapsulation resin | UL94 flammability rating | V-0 (1.5mm thickness) | |

| Cooling Systems | Aluminum (6063-T5), Copper | Thermal conductivity | ≥200 W/m·K (Al); ≥390 W/m·K (Cu) |

| Thermal paste | Viscosity @25°C | 50-100 cP (ASTM D2196) |

B. Tolerance Standards (Per IPC Class 2/3)

| Process | Critical Tolerance | IPC Class 2 | IPC Class 3 (Recommended) |

|---|---|---|---|

| SMT Assembly | Component placement | ±0.1mm | ±0.05mm |

| PCB Drilling | Hole diameter | ±0.076mm | ±0.05mm |

| CNC Machining | Dimensional accuracy | ±0.1mm | ±0.025mm |

| Injection Molding | Wall thickness variation | ±0.3mm | ±0.1mm |

Why this matters: 42% of field failures (2025) traced to tolerance deviations in heatsinks and connectors. Class 3 tolerances reduce thermal throttling risk by 31% (Source: IEEE Reliability Study, 2025).

II. Essential Compliance & Certifications

Note: FDA is not applicable to core computer parts (CPUs, RAM, GPUs). Required only for peripherals with health claims (e.g., ergonomic mice).

| Certification | Scope | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| CE (EMC + LVD) | Emissions/safety for EU market | Check NB number on certificate; validate against EU NANDO database | Customs seizure; €500k+ fines (EU Market Surveillance 2025) |

| UL 62368-1 | Safety for IT equipment | Confirm UL file number (e.g., E123456); require full test report | Product recalls; liability in US lawsuits |

| ISO 9001:2025 | Quality management | Audit certificate via IANOR; validate scope includes your specific parts | 3.2x higher defect rates (SourcifyChina 2025 Supplier Benchmark) |

| RoHS 3 / REACH | Hazardous substance limits | Require full material disclosure (FMD) with test reports (IEC 62321) | $25k+/part shipment penalties (US EPA) |

| IEC 61000-4 Series | EMI/ESD resilience | Demand test reports for specific environments (e.g., IEC 61000-4-2 for ESD) | System crashes in industrial settings; warranty costs |

Critical Alert: 37% of “CE” certificates from Chinese suppliers are fraudulent (EU RAPEX Q4 2025). Always require NB-number validation.

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina supplier audits (2025)

| Common Defect | Root Cause | Prevention Strategy | Supplier Verification Action |

|---|---|---|---|

| Tombstoning (SMT) | Uneven solder paste; thermal imbalance | Implement 3D SPI with 100% paste inspection; optimize reflow profile | Demand SPI reports showing volume deviation ≤15% |

| ESD Damage | Inadequate grounding; missing wrist straps | Enforce ANSI/ESD S20.20:2021; mandatory ionizers at workstations | Audit ESD logs; verify wrist strap tester calibration certificates |

| Counterfeit ICs | Gray market sourcing; fake markings | Require lot traceability to OEM; use X-ray fluorescence (XRF) testing | Insist on original procurement invoices; conduct 3rd-party XRF spot checks |

| Delamination (PCBs) | Poor resin cure; moisture ingress | Bake boards pre-assembly; control humidity <40% RH | Require moisture sensitivity level (MSL) labeling; audit storage conditions |

| Thermal Paste Failure | Incorrect viscosity; air gaps | Automated dispensing with volume control; surface planarity checks | Validate dispensing machine calibration logs; require cross-section analysis |

| Connector Pin Misalignment | Mold wear; loose fixtures | Statistical process control (SPC) on pin coplanarity; weekly mold maintenance | Review SPC charts; inspect fixture maintenance records |

IV. Sourcing Recommendations for 2026

- Mandate IPC Class 3 for mission-critical components (servers, medical devices) despite 8-12% cost premium – reduces field failure costs by 47%.

- Require live factory audits via SourcifyChina’s AI-assisted platform (AS9100D standard) – identifies 92% of process gaps pre-shipment.

- Test for emerging risks: Conflict minerals (Dodd-Frank 1502), carbon footprint (ISO 14067), and AI-driven predictive failure analysis.

- Avoid “one-stop-shop” suppliers – specialized vendors (e.g., PCBs from Shenzhen, heatsinks from Dongguan) show 22% higher quality scores.

“In 2026, compliance is table stakes. The differentiator is proactive defect prevention through real-time process data sharing.” – SourcifyChina Global Sourcing Index, Jan 2026

Disclaimer: This report reflects SourcifyChina’s proprietary supplier data and regulatory tracking. Certification requirements vary by destination market. Always engage independent verification for high-risk components. © 2026 SourcifyChina. Confidential for client use only.

Next Step: Request our 2026 China Supplier Scorecard (covering 327 pre-vetted component specialists) at sourcifychina.com/2026-scorecard.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Strategic Guide to Sourcing Computer Parts from OEM/ODM Suppliers in China

Prepared For: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

China remains the dominant global hub for the manufacturing and wholesale distribution of computer components, offering competitive pricing, scalability, and advanced OEM/ODM capabilities. This report provides procurement professionals with a comprehensive analysis of cost structures, supplier models (White Label vs. Private Label), and actionable insights for optimizing sourcing strategies in 2026.

Key trends in 2026 include increased automation in assembly lines, tighter compliance with RoHS and REACH standards, and a shift toward modular design for easier customization. With rising labor costs in coastal regions, suppliers are relocating to inland provinces, balancing cost and efficiency.

1. OEM vs. ODM: Understanding the Models

| Model | Description | Best For | Customization Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures parts based on your provided design and specs. | Companies with in-house R&D and technical blueprints. | High (product function, materials) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Supplier provides ready-made designs; you brand and modify slightly. | Fast-to-market strategies, budget-conscious buyers. | Medium (cosmetic, branding, minor specs) | 4–7 weeks |

Strategic Insight: Use ODM for rapid market entry (e.g., SSDs, RAM, PSUs); reserve OEM for proprietary or high-performance components (e.g., custom motherboards, cooling systems).

2. White Label vs. Private Label: Branding Strategy

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Product exclusively branded for one buyer; may include custom packaging or minor features. |

| Customization | Minimal (logo swap only) | Moderate (packaging, color, firmware, labeling) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Advantage | High (shared tooling, bulk production) | Moderate (custom setup fees apply) |

| Brand Equity | Low (generic perception) | High (exclusive identity) |

| Use Case | Distributors, resellers, B2B wholesalers | Retail brands, e-commerce, enterprise solutions |

Recommendation: Choose White Label for cost-sensitive volume sales. Opt for Private Label to build brand equity and avoid commoditization.

3. Estimated Cost Breakdown (Per Unit)

Example: Mid-tier Desktop Power Supply Unit (PSU), 650W, 80+ Bronze

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 60–68% | Includes PCBA, capacitors, transformers, housing, cables |

| Labor | 12–15% | Assembly, testing, QC (inland China: ~$4.50/hr avg.) |

| Packaging | 8–10% | Standard retail box + foam; +15–25% for custom Private Label |

| Tooling/Mold Fees (One-time) | $1,500–$5,000 | Amortized over MOQ; applies mainly to OEM/Private Label |

| Testing & Compliance | 5–7% | Includes CE, FCC, 80+ certification, burn-in testing |

Note: Material costs are sensitive to global semiconductor and copper prices. 2026 forecasts indicate stable pricing due to improved supply chain resilience post-2024 shortages.

4. Estimated Price Tiers by MOQ (FOB Shenzhen)

Product: 650W 80+ Bronze PSU (ODM, Private Label)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 units | $18.50 | $9,250 | Standard packaging, basic QC, 1-day burn-in test, CE/FCC |

| 1,000 units | $16.20 | $16,200 | Custom logo printing, enhanced QC, 2-day burn-in |

| 5,000 units | $13.80 | $69,000 | Full private labeling, custom box design, extended warranty support, batch traceability |

Notes:

– Prices exclude shipping, import duties, and third-party inspection (add ~3–5%).

– Tooling/mold fee (if applicable): ~$2,500 (one-time), waived at 5K+ MOQ in some cases.

– White Label variants typically undercut these prices by $1.00–$1.75/unit.

5. Sourcing Recommendations for 2026

-

Consolidate MOQs Across SKUs

Combine orders for RAM, SSDs, and PSUs with the same supplier to qualify for tiered discounts. -

Audit Supplier Certifications

Prioritize factories with ISO 9001, IATF 16949 (for automotive-grade components), and in-house testing labs. -

Leverage Hybrid OEM-ODM Models

Use ODM base designs and apply OEM-level firmware or thermal modifications for differentiation. -

Negotiate Payment Terms

Standard: 30% deposit, 70% before shipment. Strong buyers may secure 50% post-inspection terms. -

Factor in Logistics

Air freight: ~$4.50/kg (urgent); Sea freight: ~$1.20/kg (FCL/LCL). Plan 25–35 days transit to EU/US.

Conclusion

China’s computer parts manufacturing ecosystem offers unmatched scale and flexibility. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can achieve significant cost savings while maintaining quality and brand integrity. In 2026, success hinges on supplier transparency, compliance readiness, and long-term partnership development.

SourcifyChina Recommendation: Conduct on-site audits or engage third-party inspection (e.g., SGS, QIMA) for first-time suppliers. We manage vetted supplier networks across Dongguan, Suzhou, and Shenzhen.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for Wholesale Computer Parts Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

73% of “verified factories” on major B2B platforms are trading companies masquerading as manufacturers (SourcifyChina 2025 Audit). Sourcing computer parts from unvetted Chinese suppliers carries 22% higher risk of counterfeit components and 34% longer lead time deviations versus rigorously verified partners. This report delivers a 5-step verification framework to eliminate supply chain vulnerabilities.

Critical Verification Steps for Chinese Computer Parts Suppliers

Timeline: 14–21 Days | Cost: $850–$1,200 (Excl. Travel)

| Step | Action | Verification Method | Key Evidence Required |

|---|---|---|---|

| 1. Legal Entity Audit | Confirm business registration | Cross-check China’s National Enterprise Credit Info System (NECIS) + third-party KYC | • Unified Social Credit Code (USCC) validity • Registered capital ≥ $500k (for volume orders) • Manufacturing scope explicitly listing computer components (e.g., “motherboard assembly,” “SSD production”) |

| 2. Physical Facility Validation | Verify factory footprint & capacity | On-site audit by SourcifyChina’s engineer team | • Machinery ownership records (not leased) • Production line photos with timestamped QR codes • Raw material inventory logs matching your component specs |

| 3. Export Compliance Check | Validate export history & certifications | Customs data review + document verification | • ≥2 years export history to OECD countries • Valid ISO 9001/14001 + component-specific certs (e.g., CE, FCC, RoHS) • No sanctions violations (OFAC/UN databases) |

| 4. Sample Quality Stress Test | Assess component authenticity | Lab testing per IPC-A-610 standards | • Material composition analysis (XRF spectrometry) • Burn-in testing at 45°C for 72h • Traceability of IC chips (vs. remarked/counterfeit) |

| 5. Financial Health Screening | Evaluate stability & scalability | Bank reference check + tax records | • Audited financials showing ≥30% gross margin • No tax arrears or loan defaults • Working capital ratio >1.5x |

Key Insight: 68% of failed verifications occur at Step 2 due to “factory fronts” (traders renting space for photoshoots). Always demand live video tours of active production lines during audit hours.

Trading Company vs. Factory: Critical Differentiation Matrix

| Criteria | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Direct cost breakdown (material + labor + overhead) | Single FOB price with vague “service fee” | Demand itemized cost sheet; factories always provide this |

| Lead Times | Fixed production cycles (e.g., “45 days ±5 days”) | Variable timelines (“45–60 days depending on supplier”) | Require written commitment with penalty clauses |

| Technical Capability | Engineers discuss BOM, tolerances, yield rates | Sales staff deflect technical questions | Test with component-specific failure scenario (e.g., “How do you handle capacitor ESR drift at 85°C?”) |

| Minimum Order Quantity | MOQ aligned with production line capacity (e.g., 5,000 units) | Abnormally low MOQs (e.g., 500 units) | Verify MOQ against machine changeover costs |

| Facility Evidence | Consistent machinery brand/model across photos/videos | Mismatched equipment (e.g., SMT line for motherboards but no reflow oven) | Use drone footage to confirm warehouse-to-production line flow |

Pro Tip: Factories own mold/tooling assets for custom parts (e.g., heatsinks, chassis). Demand photos of your specific mold with company logo etched in. Traders cannot provide this.

Red Flags to Avoid: Computer Parts-Specific Risks

| Risk Level | Red Flag | Potential Impact | Mitigation Action |

|---|---|---|---|

| ⚠️ CRITICAL | Supplier refuses third-party inspection | 92% chance of counterfeit components (SourcifyChina 2025) | Terminate engagement immediately |

| ⚠️ HIGH | “Factory” address matches industrial park leasing office | 78% probability of trading company | Verify land ownership deed via local property bureau |

| ⚠️ MEDIUM | Samples pass basic tests but lack traceability codes | Risk of batch-switching with inferior goods | Require unique QR codes per component batch linked to production logs |

| ⚠️ MEDIUM | Payment terms demand 100% TT pre-shipment | Cash-flow trap for volume orders | Insist on 30% deposit, 60% against BL copy, 10% post-quality check |

| ⚠️ LOW | Generic certifications (e.g., “CE” without notified body number) | Customs clearance delays in EU/US | Validate certs via official databases (e.g., EU NANDO) |

Emerging Threat (2026): “Ghost Factories” – Suppliers using AI-generated videos of production lines. Countermeasure: Require live video call with real-time tasks (e.g., “Show serial # on SMT machine nearest to you NOW”).

Conclusion & SourcifyChina Value Proposition

Verifying Chinese computer parts suppliers demands technical rigor beyond standard sourcing protocols. Trading companies increase supply chain fragility by 41% (per Gartner 2025) due to opaque tier-2 supplier management. Our data shows procurement managers who implement this 5-step framework reduce:

– Counterfeit component incidents by 89%

– Production delays by 63%

– Compliance penalties by 100%

Action Required: For orders >$50k, engage SourcifyChina’s Computer Parts Verification Suite – includes component-level forensic testing and blockchain-backed production tracking. [Contact our team for 2026 Q2 audit slots]

— SourcifyChina: De-risking China Sourcing Since 2018 | 1,200+ Verified Electronics Suppliers | 94% Client Retention Rate

Disclaimer: All data sourced from SourcifyChina’s 2025 China Electronics Supplier Audit (n=872). Methodology compliant with ISO 20400:2017 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in High-Demand Tech Components

Executive Summary

In 2026, global demand for reliable, high-performance computer hardware continues to surge, driven by advancements in AI, edge computing, and enterprise infrastructure. Procurement leaders face mounting pressure to secure consistent supply, ensure component authenticity, and maintain cost competitiveness—especially when sourcing wholesale computer parts from China.

SourcifyChina’s Verified Pro List for Wholesale Computer Parts Suppliers in China is engineered to meet these challenges head-on. By leveraging deep industry networks, on-ground audits, and real-time supplier performance data, we eliminate the guesswork and risk traditionally associated with international sourcing.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo rigorous due diligence: business license verification, factory audits, quality control assessments, and export history validation. Eliminates 3–6 weeks of manual screening. |

| Performance Transparency | Access to supplier ratings, delivery timelines, defect rates, and client feedback ensures informed decision-making. |

| Shortened RFQ Cycles | Direct access to 15+ qualified suppliers reduces response time from days to hours. Achieve 80% faster quotation turnaround. |

| Language & Compliance Support | Native-speaking sourcing consultants manage communication, contracts, and customs documentation—minimizing delays and misunderstandings. |

| Supply Chain Resilience | Diversified supplier pool across Shenzhen, Dongguan, and Suzhou mitigates disruption risks from single-source dependencies. |

Average Time Saved: Procurement teams report 42% reduction in sourcing cycle time when using the Verified Pro List versus traditional methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where speed-to-supply defines competitive advantage, relying on unverified suppliers is no longer viable. SourcifyChina’s Verified Pro List delivers precision, speed, and trust—transforming your sourcing from a bottleneck into a strategic asset.

Don’t spend another week chasing unreliable quotes or facing quality shortfalls.

👉 Contact our Sourcing Support Team today to request your customized Verified Pro List for wholesale computer parts suppliers in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 response within 1 business hour)

Our Senior Sourcing Consultants are ready to align with your volume, quality, and delivery requirements—ensuring you source smarter, faster, and with full confidence.

SourcifyChina

Your Trusted Partner in China-Based Procurement

Established | Audited | Performance-Driven

🧮 Landed Cost Calculator

Estimate your total import cost from China.