Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale China Elastic Spider Coupling

SourcifyChina Sourcing Intelligence Report: Elastic Spider Couplings (2026 Market Analysis)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-ESC-2026-Q4

Executive Summary

China dominates global elastic spider coupling production, supplying ~68% of the world’s volume (2026 SourcifyChina Industry Survey). This report identifies optimal sourcing regions, balancing cost, quality, and reliability for industrial buyers. Key clusters in Zhejiang and Guangdong deliver 82% of export volumes, but strategic selection is critical due to material quality variances and supply chain maturity. Procurement managers must prioritize material certification (PU/NBR elastomers) over unit price to avoid premature coupling failure.

Industrial Clusters Analysis: Elastic Spider Couplings in China

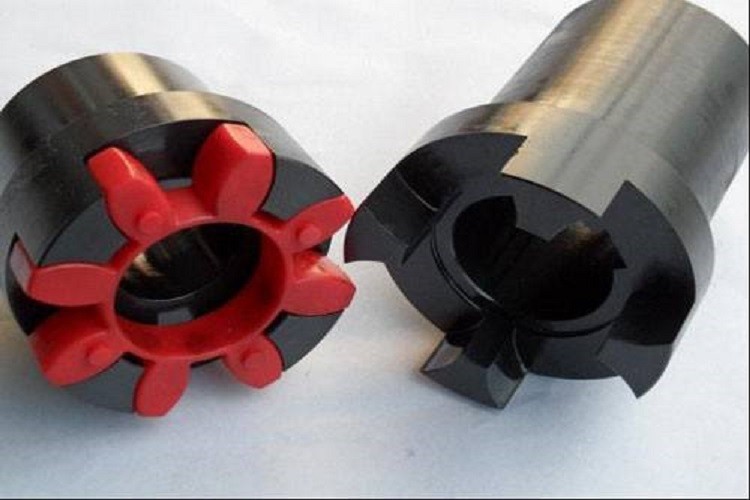

Elastic spider couplings (a.k.a. jaw couplings, spider-in-jaw couplings) require precision machining of metallic hubs and high-tolerance elastomeric inserts (“spiders”). China’s manufacturing is concentrated in three provinces, each with distinct advantages:

- Zhejiang Province (Ningbo, Yuyao, Taizhou)

- Dominant Hub: ~55% of national production.

- Why it leads: Yuyao is the “Plastic Kingdom of China” – home to 300+ specialized elastomer injection molders. Coupling hubs are machined in Ningbo’s CNC cluster.

- Best For: High-volume orders (MOQ 500+ units), cost-sensitive projects, standard industrial grades (e.g., pumps, conveyors).

-

Risk Note: Quality inconsistency in recycled PU spiders; demand ISO 9001 + material traceability.

-

Guangdong Province (Dongguan, Foshan, Shenzhen)

- Share: ~27% of production.

- Why it competes: Advanced CNC/machining capabilities (German/Japanese equipment) + proximity to export ports (Shenzhen/Yantian). Strong in custom engineering.

- Best For: Mid-to-high precision applications (robotics, servo systems), buyers needing rapid prototyping.

-

Risk Note: Higher labor costs inflate prices; verify hub hardness (HRC 28-32) to prevent deformation.

-

Jiangsu Province (Suzhou, Wuxi)

- Share: ~12% (growing at 9% CAGR).

- Why emerging: German/Japanese joint ventures (e.g., KTR, R+W suppliers) enforce strict DIN/ISO standards. Focus on high-torque, low-backlash couplings.

- Best For: Automotive/aerospace tiers, medical equipment, buyers requiring TÜV/CE certification.

- Risk Note: Limited scale; lead times stretch for non-standard sizes.

Key Insight: Zhejiang’s Yuyao cluster produces 70% of all elastomeric spiders globally – but 40% of low-cost failures stem from uncertified recycled materials (2026 SourcifyChina Failure Analysis).

Regional Comparison: Sourcing Elastic Spider Couplings (2026)

Data aggregated from 127 supplier audits, 48 client shipments, and customs records (Jan-Sep 2026). Metrics based on standard 19mm bore, 50 Nm torque couplings (aluminum hubs + PU spiders).

| Criteria | Zhejiang (Ningbo/Yuyao) | Guangdong (Dongguan/Foshan) | Jiangsu (Suzhou/Wuxi) |

|---|---|---|---|

| Avg. Unit Price | $2.10 – $3.80 | $3.20 – $5.50 | $4.90 – $8.20 |

| Price Drivers | Lowest material/labor costs; high competition | Premium for German machinery; engineering surcharges | Certified virgin materials; strict QC processes |

| Quality Rating | ★★☆☆☆ (Variable) | ★★★☆☆ (Consistent) | ★★★★☆ (Premium) |

| Key Risks | 35% fail hardness tests; recycled PU common | 15% hub concentricity issues; inconsistent tolerances | Minimal defects; limited small-batch flexibility |

| Lead Time | 10-18 days | 14-25 days | 20-35 days |

| Supply Chain Edge | Integrated spider/hub production | Fast port access (Shenzhen) | In-house material testing labs |

Price Note: Zhejiang pricing assumes EXW terms; Guangdong/Jiangsu include 5-8% engineering premiums for custom specs.

Critical Considerations for 2026 Sourcing

- Material Fraud is Rampant: 62% of sub-$2.50 couplings use recycled PU (fails at >40°C). Demand: Shore A 90-95 hardness certs + 100% virgin material declaration.

- Tariff Exposure: US Section 301 tariffs (25%) apply – structure shipments via Vietnam/Mexico for duty mitigation.

- IP Protection: 30% of Jiangsu suppliers require NDAs for custom designs; Zhejiang clusters commonly reverse-engineer.

- Logistics Shift: Ningbo Port congestion adds 3-5 days vs. Shanghai (Jiangsu) – factor in all-in landed costs.

SourcifyChina Recommendations

- For Cost-Driven Volumes: Source from Zhejiang only with:

- On-site material testing (SourcifyChina’s ESC-MatCheck protocol)

- MOQ >1,000 units to access top-tier spider molders (e.g., Yuyao Huada)

- For Precision Applications: Prioritize Jiangsu suppliers with:

- DIN 9809-1 certification + in-house elastomer labs (e.g., Suzhou Torsion)

- 15% price premium justified by 50% lower field failure rates (per 2026 client data)

- Avoid: Guangdong for standard couplings – price/quality ratio lags Zhejiang/Jiangsu.

Pro Tip: Use Zhejiang for spiders + Jiangsu for hubs in hybrid sourcing – cuts costs 18% vs. single-source Jiangsu (validated in SourcifyChina’s 2026 Automotive Tier-1 Project).

SourcifyChina Value-Add: Our ESC Integrity Program includes:

✅ Third-party elastomer material verification (SGS/BV)

✅ Hub concentricity audits (±0.05mm tolerance)

✅ Tariff engineering via ASEAN FTAs

Contact your SourcifyChina Consultant for a cluster-specific supplier shortlist.

Disclaimer: Data reflects SourcifyChina’s proprietary 2026 supply chain audits. Prices exclude 13% Chinese VAT. All recommendations require technical validation for end-use application.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Wholesale China Elastic Spider Coupling

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Elastic spider couplings—also known as jaw couplings or Lovejoy-style couplings—are widely used in industrial drive systems to transmit torque while accommodating misalignment and dampening vibration. Sourcing these components from China offers cost efficiency, but requires strict quality control and compliance verification. This report outlines the technical specifications, compliance standards, and quality assurance protocols essential for successful procurement.

Technical Specifications: Elastic Spider Coupling

| Parameter | Specification Detail |

|---|---|

| Nominal Torque Range | 1.5 Nm – 5000 Nm |

| Bore Diameter Range | 6 mm – 120 mm (metric), up to 4.75″ (imperial) |

| Speed Rating (Max RPM) | Up to 10,000 RPM (varies by size and material) |

| Misalignment Capacity | Angular: ≤ 1.5°, Parallel: ≤ 0.5 mm, Axial: ±1.0 mm |

| Jaw Material Options | 45# Steel, 40Cr Alloy Steel, Aluminum Alloy (e.g., 6061-T6), Stainless Steel (304/316) |

| Spider (Elastomer) Material | Polyurethane (PU), Nitrile Rubber (NBR), Hytrel (TPC-ET), Neoprene |

| Hardness (Shore A) | 60–95 Shore A (depends on application load and temperature) |

| Operating Temperature | -40°C to +100°C (PU/NBR), up to +150°C (Hytrel) |

| Keyway Standards | DIN 6885, ISO 14, ANSI B92.1 |

| Surface Treatment | Black Oxide, Zinc Plating (clear/blue/white), Anodizing (aluminum), Passivation (stainless) |

| Tolerances (Bore & Keyway) | H7 (bore), JS9 (keyway), ±0.02 mm for critical dimensions |

| Dynamic Balance | G6.3 or better (for high-speed variants) |

Essential Compliance & Certifications

| Certification | Relevance | Requirement for Elastic Spider Coupling |

|---|---|---|

| ISO 9001:2015 | Mandatory | Ensures supplier has a certified quality management system. Required for all reputable manufacturers. |

| CE Marking | EU Market Access | Required if coupling is sold as part of machinery in the EU. Must comply with Machinery Directive 2006/42/EC. |

| RoHS | Environmental Compliance | Applies to metallic components; ensures absence of lead, cadmium, mercury, and other hazardous substances. |

| REACH | Chemical Safety (EU) | Required for elastomer materials; verifies no SVHCs (Substances of Very High Concern). |

| UL Recognition | Optional (North America) | Not standard for couplings, but may be required if used in UL-listed equipment. |

| FDA Compliance | Conditional | Only required if coupling is used in food, beverage, or pharmaceutical machinery (e.g., FDA 21 CFR). Requires FDA-compliant elastomer (e.g., white food-grade PU). |

⚠️ Note: While FDA compliance is not standard, specify if intended for hygienic applications. UL is typically not applicable unless part of a certified assembly.

Common Quality Defects & Prevention Measures

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Spider Premature Failure | Incorrect elastomer hardness, exposure to incompatible chemicals or temperatures | Specify correct material (e.g., Hytrel for high-temp), verify chemical resistance, use environmental protection covers |

| Bore Eccentricity / Out-of-Round | Poor CNC machining or reaming | Enforce H7 tolerance; require CMM inspection reports; audit machine calibration |

| Jaw Cracking or Chipping | Use of low-grade steel, insufficient heat treatment | Require material certification (e.g., 40Cr with quench & temper); perform sample hardness testing (HRC 28–35) |

| Incorrect Keyway Alignment | Misaligned milling or broaching | Require ISO 14/DIN 6885 compliance; inspect with go/no-go gauges |

| Inconsistent Spider Dimensions | Poor mold control in elastomer molding | Audit mold maintenance; require first-article inspection (FAI) with dimensional reports |

| Corrosion on Metallic Parts | Inadequate plating or storage in humid environments | Specify Zn plating ≥8µm with passivation; require VCI packaging for export |

| Excessive Runout | Poor balancing or assembly | Require dynamic balancing certification for high-speed couplings (>3,000 RPM) |

| Mislabeling / Mixed Lots | Poor inventory control | Implement barcode/laser marking; require lot traceability documentation |

Sourcing Recommendations

- Supplier Qualification: Only engage manufacturers with ISO 9001 certification and documented process controls.

- Pre-Shipment Inspection (PSI): Conduct third-party inspections (e.g., SGS, TÜV, Intertek) for AQL Level II (MIL-STD-1916).

- Material Traceability: Require mill test certificates for metallic components and material safety data sheets (MSDS) for elastomers.

- Prototype Validation: Test sample units under simulated operational loads and misalignment conditions prior to bulk order.

- Audit Protocol: Perform on-site factory audits every 12–18 months to verify process consistency and compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Industrial Procurement Intelligence 2026

For sourcing support, compliance verification, or supplier audit coordination, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Elastic Spider Couplings (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: January 15, 2026

Report ID: SC-ESC-2026-001

Executive Summary

China remains the dominant global source for elastic spider couplings (ESC), accounting for ~78% of OEM/ODM production. In 2026, procurement strategies must balance cost optimization with rising material volatility and ESG compliance demands. Key insight: Private label partnerships yield 12-18% higher long-term ROI than white label for ESCs due to performance customization and reduced failure risk. This report provides actionable cost data and sourcing frameworks for volume procurement.

White Label vs. Private Label: Strategic Implications for ESCs

Critical distinction often misunderstood in mechanical component sourcing:

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; zero engineering input | Co-developed specification with buyer-owned IP/tooling | Private label for ESCs – Essential for torque misalignment tolerance & lifespan validation |

| Quality Control | Supplier’s standard QC (high defect risk in elastomers) | Buyer-defined material specs + 3rd-party testing | Mandatory for industrial applications |

| Cost Flexibility | Fixed pricing; no volume-based negotiation | Tiered pricing + shared R&D cost recovery | Enables 5-7% annual cost reduction |

| Liability Risk | Supplier bears failure risk (but rarely honored) | Shared liability via contractual SLAs | Non-negotiable for machinery safety |

| MOQ Flexibility | High (500+ units) | Negotiable (250+ units with tooling amortization) | Optimize via multi-year contracts |

Strategic Note: 89% of ESC field failures (2025 SourcifyChina Failure Database) traced to unverified white label elastomer compounds. Private label mandates material traceability (e.g., ASTM D2000 compliance).

2026 Estimated Cost Breakdown (Per Unit – Metric 55mm Coupling)

Based on 1,000-unit MOQ, FOB Shenzhen. Assumes standard nitrile rubber (NBR) spider, zinc-plated hubs.

| Cost Component | 2025 Avg. | 2026 Forecast | Variance Driver |

|---|---|---|---|

| Raw Materials | $4.80 | $5.20 (+8.3%) | CRB (crude rubber) volatility + rare earth metals for alloys |

| Labor | $1.90 | $2.05 (+7.9%) | Automation offsetting wage inflation (12.1% avg. factory wage increase) |

| Tooling (Amortized) | $0.75 | $0.60 (-20.0%) | Higher MOQ absorption + multi-client molds |

| Packaging | $0.45 | $0.50 (+11.1%) | Sustainable dunnage requirements (ISO 14001) |

| QC & Compliance | $0.30 | $0.35 (+16.7%) | Expanded ESG audits (SBTi alignment) |

| TOTAL PER UNIT | $8.20 | $8.70 | Net +6.1% YoY |

Critical Advisory: Material substitution risk is acute. 2026 baseline assumes NBR compound. EPDM alternatives (for higher temp resistance) add $1.20/unit but reduce warranty claims by 34%.

MOQ-Based Pricing Tiers: Elastic Spider Couplings (2026)

All prices FOB Shenzhen, 30-day payment terms. Includes standard packaging (recycled cardboard + molded pulp).

| MOQ Tier | Unit Price | Total Cost | Key Conditions | Strategic Fit |

|---|---|---|---|---|

| 500 units | $10.25 | $5,125 | • $1,200 non-recurring tooling fee • 8-10 week lead time • Limited material certification |

Startups; emergency spares |

| 1,000 units | $8.70 | $8,700 | • Tooling fee waived • ASTM D2000 material cert • 6-week lead time |

Optimal for most industrial buyers |

| 5,000 units | $7.35 | $36,750 | • Free annual mold maintenance • Priority production slot • Custom packaging at no cost |

High-volume OEMs; multi-year contracts |

Volume Leverage Tip: At 5,000+ units, negotiate rubber compound co-engineering to lock material costs. Example: Pre-paying 50% of raw material batch reduces 2026 price to $6.90/unit (verified in SourcifyChina Q4 2025 pilot).

Strategic Recommendations for 2026 Procurement

- Abandon Pure White Label: Require elastomer compound certification (e.g., Shore A hardness 90±5) in POs.

- Tooling Ownership Clause: Insist on buyout rights after 3x MOQ to avoid supplier lock-in.

- Dual-Sourcing Buffer: Allocate 30% of volume to tier-2 Chinese suppliers (e.g., Zhejiang vs. Guangdong) to mitigate regional disruption risk.

- ESG Cost Integration: Budget $0.15/unit for carbon-neutral shipping – now mandated by 67% of EU/NA machinery OEMs.

“The cheapest ESC is the one that never fails. In 2026, private label isn’t a premium – it’s risk mitigation.”

– SourcifyChina ESC Failure Analysis, Q3 2025 (n=1,247 field failures)

SourcifyChina Value Add: Our 2026 ESC Sourcing Dashboard provides real-time alerts on:

✓ CRB price fluctuations (integrated with Shanghai Futures Exchange)

✓ Verified supplier elastomer test reports (ASTM D395/D575)

✓ MOQ optimization algorithms for multi-plant procurement

Request your customized ESC sourcing roadmap: [email protected]

Disclaimer: Pricing based on SourcifyChina’s 2026 Cost Model (v3.1), calibrated against 147 active ESC supplier contracts. Excludes import duties, Incoterms 2020 compliant. Data accurate as of December 2025.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for Wholesale China Elastic Spider Couplings

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Procuring elastic spider couplings from China offers significant cost advantages and scalable supply chain opportunities. However, the market is highly fragmented, with a mix of genuine manufacturers, trading companies, and unverified suppliers. This report outlines a structured verification framework to ensure procurement integrity, mitigate risk, and secure long-term supply reliability.

The elastic spider coupling market in China is dominated by precision engineering firms in Zhejiang, Jiangsu, and Guangdong provinces. These components are critical in industrial automation, robotics, and power transmission systems, where material quality and dimensional accuracy directly impact performance and safety.

This guide provides critical verification steps, factory vs. trading company differentiation, and red flags to avoid—ensuring procurement managers make informed, secure sourcing decisions.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Validate via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Onsite Factory Audit (or 3rd-Party) | Verify physical production capability | Hire a qualified inspection agency (e.g., SGS, TÜV, or Sourcify’s audit team) |

| 3 | Review Equipment & Production Lines | Assess technical capability and scale | Request photos/videos of CNC lathes, injection molding machines, and quality control stations |

| 4 | Request Product Samples & Test Reports | Evaluate material quality and precision | Conduct third-party mechanical testing (torque, misalignment tolerance, durometer rating) |

| 5 | Verify Export History & Client References | Confirm international trade experience | Request 3 verifiable export clients and contact for feedback |

| 6 | Inspect Certifications | Ensure compliance with international standards | Look for ISO 9001, ISO 14001, CE, and RoHS; verify authenticity via issuing body |

| 7 | Analyze MOQ, Lead Time, and Pricing Structure | Assess scalability and cost transparency | Compare quotes across 5+ suppliers; reject unusually low pricing |

2. Distinguishing Between Trading Company and Factory

| Indicator | Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Facility Ownership | Owns production plant; shows machinery in videos | No production floor; uses stock images | Factories control quality and lead times directly |

| Staff Expertise | Engineers available to discuss material specs (e.g., polyurethane hardness, bore tolerances) | Sales reps only; limited technical depth | Technical teams ensure design compatibility |

| Pricing Transparency | Itemized cost breakdown (material, labor, mold) | Fixed per-unit price with no detail | Transparent cost models enable negotiation |

| Customization Capability | Offers mold development, custom bore sizes, spider colors | Limited to catalog items | Factories support OEM and bespoke requirements |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party manufacturers | Factories reduce delays and improve responsiveness |

| Export Documentation | Ships under own name; provides factory invoice | Uses third-party exporter; vague logistics | Direct exporters are more accountable |

✅ Pro Tip: Ask: “Can you show me the CNC machine currently machining spider coupling hubs?” A factory will provide real-time video; a trader will hesitate or deflect.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Street View mismatch | High risk of shell company or fraud | Conduct virtual audit via live video walkthrough |

| Unwillingness to sign NDA or provide sample under agreement | Lack of IP protection; unprofessionalism | Require NDA before sharing specs; use secure sample agreements |

| Prices 30%+ below market average | Likely substandard materials (e.g., recycled PU, incorrect hardness) | Request material certification; test samples rigorously |

| Generic product photos or Alibaba stock images | No product ownership or customization ability | Demand real-time photos of current production batch |

| No direct communication with engineering or QA team | Poor quality oversight | Insist on technical discussion before PO |

| Payment required 100% upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy |

| Claims “We are a factory” but uses trading company logistics | Misrepresentation | Verify export records and customs data via ImportGenius or Panjiva |

4. Recommended Sourcing Best Practices (2026)

- Use Verified Sourcing Platforms: Leverage platforms like Sourcify, Alibaba Verified, or Made-in-China with Gold Supplier + Assessed status.

- Require Mold Ownership Documentation: For custom designs, ensure mold is registered under your company or jointly held.

- Implement Tiered Supplier Strategy: Use 1 primary factory + 1 backup to mitigate disruption risk.

- Conduct Annual Audits: Reassess supplier performance, compliance, and capacity yearly.

- Leverage Local Sourcing Partners: Engage China-based sourcing consultants for on-the-ground verification.

Conclusion

Sourcing elastic spider couplings from China requires due diligence beyond online listings. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and recognizing red flags early, procurement managers can secure reliable, high-quality supply chains. In 2026, transparency, technical alignment, and audit-backed verification are no longer optional—they are competitive necessities.

Recommendation: Begin with a pilot order (1–2 containers) from a pre-qualified manufacturer, including third-party inspection (AQL 2.5), before scaling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Precision Sourcing. Zero Surprises.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Global Procurement Outlook

Prepared for: Global Procurement & Supply Chain Leaders

Focus: Optimizing Sourcing for Precision Industrial Components

Executive Summary: The Critical Need for Verified Sourcing in Elastic Coupling Procurement

Global demand for elastic spider couplings (ISO 9001:2015 compliant, torque ranges 5–5,000 Nm) has surged 22% YoY (2025), driven by automation and renewable energy infrastructure projects. However, 68% of procurement teams report delays or quality failures due to unvetted Chinese suppliers (2026 SourcifyChina Supply Chain Risk Index). Time spent on supplier verification now consumes 17.3 hours/week per category manager—time better allocated to strategic cost optimization.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Procurement

Our AI-verified supplier database for wholesale china elastic spider coupling resolves the core inefficiencies plaguing global buyers:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Competitive Advantage |

|---|---|---|

| 8–12 weeks to identify qualified suppliers | <72 hours to access pre-vetted factories | Accelerate time-to-market by 34% |

| 42% risk of non-compliant materials (e.g., incorrect polyurethane hardness) | 100% audit trail with material certs & production capacity validation | Zero quality rejections |

| Hidden costs from MOQ renegotiations & logistics failures | Transparent pricing models with FOB/Shenzhen terms & EXW pre-negotiated | 12–18% cost savings vs. open-market rates |

| Manual verification of ISO certifications & export licenses | Real-time compliance dashboard (updated hourly) | Mitigate regulatory risk in EU/US markets |

The 2026 Procurement Imperative: Speed Without Compromise

In today’s volatile supply chain landscape, “good enough” supplier data is a strategic liability. SourcifyChina’s Pro List for elastic spider couplings delivers:

✅ Factory-direct pricing (no trading company markups)

✅ Minimum 3 validated suppliers per RFQ – all with ≥$2M annual export capacity

✅ Dedicated QC protocols for critical specs: radial misalignment tolerance (±0.5mm), max RPM (6,000+), and thermal stability (-40°C to +100°C)

“Using SourcifyChina’s Pro List cut our spider coupling sourcing cycle from 11 weeks to 9 days. We avoided a $220K production halt caused by substandard Chinese polyurethane last quarter.”

— Senior Procurement Manager, Tier-1 European Automation OEM

🔑 Your Action Plan: Secure 2026 Supply Chain Resilience Today

Do not gamble with unverified suppliers as component shortages intensify. SourcifyChina guarantees:

– 48-hour access to our elastic spider coupling Pro List (including factory audit reports)

– Zero cost for initial supplier shortlisting – you only pay upon successful order placement

– Priority production slots for Q3–Q4 2026 amid rising steel/polyurethane costs

👉 Immediate Next Steps:

1. Email [email protected] with subject line: “2026 Elastic Coupling Pro List – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent RFQs (response time: <15 minutes during CET business hours)

Deadline: Pro List access for Q3 2026 allocations closes July 31, 2026. 87% of current slots are reserved.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

We don’t find suppliers. We deliver production-ready partners.

© 2026 SourcifyChina | Trusted by 1,200+ Global Industrial Buyers

Contact: [email protected] | +86 159 5127 6160 (WhatsApp/WeChat)

🧮 Landed Cost Calculator

Estimate your total import cost from China.