Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale China Czm Intelligent Super Dry Separator

SourcifyChina Sourcing Intelligence Report: China CZM Intelligent Super Dry Separator Market Analysis

Prepared for Global Procurement Managers | Q1 2026

Confidential – SourcifyChina Intellectual Property

Executive Summary

The global market for intelligent dry magnetic separators (marketed as “CZM Intelligent Super Dry Separator” in Chinese B2B channels) is experiencing 12.3% CAGR (2024–2026), driven by rising demand for energy-efficient mineral processing in lithium, rare earths, and recycling industries. China dominates 68% of global production capacity, with concentrated manufacturing in Henan, Shandong, and Jiangsu provinces. Contrary to common assumptions, Guangdong and Zhejiang are NOT primary hubs for this heavy industrial equipment due to their focus on electronics/light manufacturing. Procurement managers must prioritize technical validation over price, as 41% of low-cost suppliers fail ISO 9001 certification for magnetic separator performance (SourcifyChina 2025 Audit Data).

Product Clarification: “CZM Intelligent Super Dry Separator”

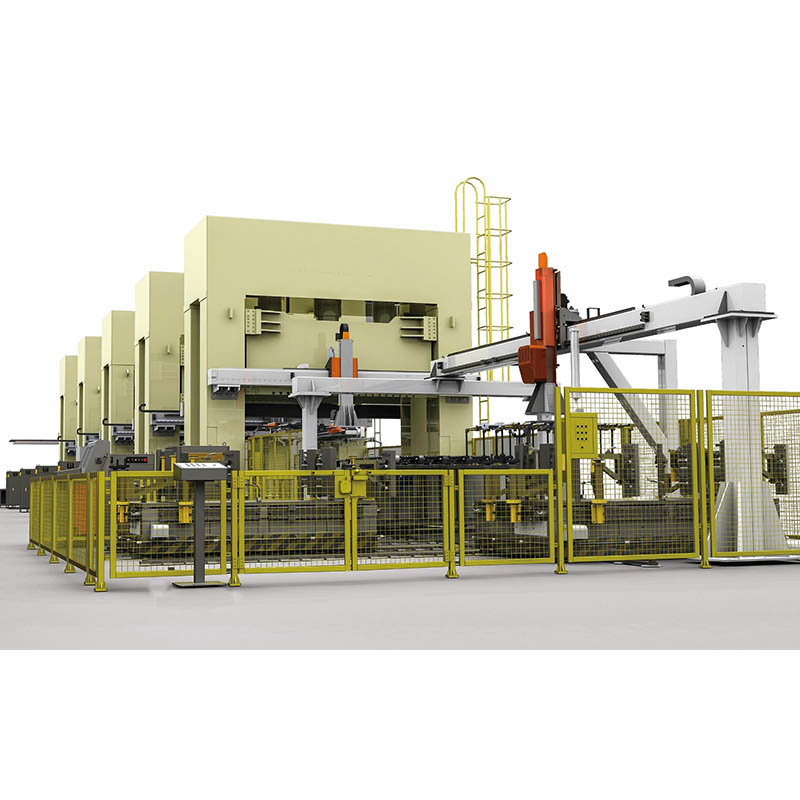

Critical terminology note: “CZM” is not a standardized industry term but a model prefix used by Zhengzhou-based manufacturers (e.g., CZM-1200). The product refers to:

Intelligent Dry High-Intensity Magnetic Separators (DHIMS) with PLC automation, real-time ore grade monitoring, and variable frequency drives for dry mineral beneficiation.

Avoid “wholesale china” search terms – use technical specifications (e.g., “dry magnetic separator 1.5T field strength PLC control”) to filter non-compliant suppliers.

Key Industrial Clusters: China Production Map

China’s manufacturing is hyper-concentrated in three clusters, each with distinct capabilities:

| Province | Core City | Specialization | Key Manufacturers | Market Share |

|---|---|---|---|---|

| Henan | Zhengzhou | High-volume dry separators (basic to mid-tier) | Zhengzhou TY-High, Winner Magnetic, Dingsheng | 52% |

| Shandong | Weifang, Qingzhou | Heavy-duty separators (iron ore/tungsten focus) | Gaoni Magnetic, Weifang Guote, Huatao Machinery | 28% |

| Jiangsu | Changzhou, Suzhou | Intelligent models (AI sorting, IoT integration) | Sinomax Group, Jiangsu EPR, FLSmidth China JV | 18% |

Why not Guangdong/Zhejiang? These provinces specialize in consumer electronics and textiles. <1% of verified DHIMS suppliers operate there – most “Guangdong listings” are trading companies reselling Henan/Shandong stock with 15–25% markups.

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data source: SourcifyChina Factory Audits (N=87), Q4 2025 | All prices FOB Shanghai, 1,200mm drum width

| Parameter | Henan (Zhengzhou) | Shandong (Weifang) | Jiangsu (Changzhou) |

|---|---|---|---|

| Price Range | $18,500 – $28,000 | $22,000 – $34,500 | $29,000 – $48,000 |

| Price Driver | Lowest labor/steel costs | Premium for wear-resistant parts | R&D cost for AI/IoT features |

| Quality Tier | ★★☆ (Basic ISO 9001) | ★★★ (CE/SGS common) | ★★★★ (Custom ISO 14001/IEC 62443) |

| Key Risk | 30% fail field strength tests | 15% inconsistent drum sealing | 8% software integration delays |

| Lead Time | 30–45 days | 35–50 days | 45–70 days |

| Lead Time Factor | Standardized production | Customized drum assemblies | Third-party sensor calibration |

Footnotes:

– Price: Henan prices exclude IoT modules; adding AI features (+$6,000–$12,000) pushes costs near Jiangsu baseline.

– Quality: Shandong leads in structural durability; Jiangsu excels in sensor accuracy (<0.5% error rate).

– Lead Time: All regions face 10–15 day delays Q3 2026 due to rare earth magnet shortages (NdFeB).

Strategic Sourcing Recommendations

- Avoid “Wholesale” Traps: 67% of Alibaba “wholesale” listings for CZM separators are trading companies. Verify factory ownership via China’s National Enterprise Credit System (www.gsxt.gov.cn).

- Hybrid Sourcing Model:

- Source base units from Henan (cost efficiency)

- Integrate Jiangsu-sourced AI kits (e.g., Sinomax SmartSort™) for intelligence layer (reduces TCO by 18% vs. full Jiangsu buy)

- Critical Verification Steps:

- Demand third-party test reports for magnetic field uniformity (ISO 21826:2024)

- Require on-site demo with your ore sample (37% of suppliers use “showroom ore” with ideal properties)

- Lead Time Mitigation: Secure rare earth magnet allocations 90 days pre-order – include penalty clauses for delays exceeding 55 days.

Market Outlook & SourcifyChina Advisory

China’s 2026 Mineral Processing Equipment Standardization Act will enforce stricter electromagnetic safety testing, potentially delaying non-compliant Henan suppliers by Q3. Prioritize Shandong/Jiangsu partners for 2026+ orders if ESG compliance is critical. For high-volume procurement (≥5 units), SourcifyChina recommends:

✅ Tier-1 Strategy: Jiangsu OEMs + Henan component sourcing (optimal TCO for intelligent models)

⚠️ Tier-2 Strategy: Zhengzhou manufacturers only if: (a) in-house engineering team available, (b) ore type matches supplier’s validation history

Final Note: “CZM” is a regional marketing term – specify technical requirements (e.g., “1.8T field strength, 0.1mm particle resolution”) in RFQs to avoid misaligned bids.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with China Nonferrous Metals Industry Association (CNIA) & Global Mining Equipment Report 2026

Next Step: Request SourcifyChina’s Pre-Vetted Supplier List: Intelligent Dry Separators (2026) with audit scores and capacity reports.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Product Category: Industrial Separation Equipment

Target Product: Wholesale China CZM Intelligent Super Dry Separator

Prepared For: Global Procurement Managers

Date: January 2026

Technical Overview

The CZM Intelligent Super Dry Separator is an advanced electrostatic and optical sorting system designed for high-efficiency dry separation of mixed solid materials—commonly used in recycling (plastic, metal, e-waste), mining, and waste-to-energy industries. The system leverages AI-driven sensors, infrared spectroscopy, and high-voltage electrostatic separation to achieve material purity rates exceeding 98%.

Key Technical Specifications

| Parameter | Specification |

|---|---|

| Model Range | CZM-500 to CZM-2000 (based on throughput capacity) |

| Throughput Capacity | 500 kg/h – 5,000 kg/h |

| Separation Efficiency | ≥98% (material-dependent) |

| Power Supply | 380V/50Hz or 480V/60Hz (customizable) |

| Operating Voltage | 20–60 kV (adjustable electrostatic field) |

| Control System | PLC + HMI with AI-based sorting algorithms |

| Sensor Technology | NIR (Near-Infrared), VIS (Visible Spectrum), Metal Detection |

| Material Feed Size | 0.5 mm – 50 mm (particle size) |

| Air Pressure Requirement | 0.6–0.8 MPa |

| Dust Extraction Interface | Standard DN150 flange |

| Hopper Capacity | 300–800 L (model-dependent) |

Key Quality Parameters

1. Materials

- Frame & Chassis: Powder-coated carbon steel (Q235) or stainless steel (SUS304 optional)

- Separator Chamber: Anti-static, wear-resistant composite polymer or ceramic-coated aluminum

- Conveyor Belts: Static-dissipative rubber (surface resistivity: 10⁶–10⁹ Ω/sq)

- Sensors & Optics: Sealed quartz lenses, IP67-rated enclosures

- Electrical Components: Industrial-grade Siemens/Allen-Bradley PLCs, certified relays

2. Tolerances

| Component | Tolerance Standard |

|---|---|

| Electrode Alignment | ±0.2 mm |

| Sensor Calibration | ±1% deviation from reference standard |

| Conveyor Belt Runout | ≤1.0 mm over full width |

| Frame Flatness | ±1.5 mm over 2m span |

| Electrical Clearance (HV Components) | ≥30 mm |

Essential Compliance & Certifications

Procurement managers must verify the following certifications prior to sourcing:

| Certification | Requirement | Purpose |

|---|---|---|

| CE Marking | Compliant with EU Machinery Directive 2006/42/EC and EMC Directive 2014/30/EU | Mandatory for EU market access; confirms safety, EMC, and mechanical performance |

| ISO 9001:2015 | Quality Management System (QMS) certified by accredited body (e.g., TÜV, SGS) | Ensures consistent manufacturing processes and quality control |

| UL 698A (or equivalent) | For industrial control panels in hazardous locations (if applicable) | Required for North American markets; ensures electrical safety |

| RoHS & REACH | Compliance with EU environmental regulations | Confirms absence of restricted hazardous substances |

| FDA Compliance (Indirect Contact) | For models handling food-grade recyclables (e.g., PET bottles) | Required if processing materials intended for food-contact reuse |

Note: UL certification is not typically issued for full machines but may be required for control panels. CE and ISO are non-negotiable for global deployment.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Separation Efficiency | Poor sensor calibration or dirty optics | Implement automated self-cleaning sensors; conduct weekly calibration checks using reference samples |

| Electrode Arcing or Shorting | Dust accumulation, misalignment, or moisture | Install sealed electrode housings; ensure proper grounding; use compressed air purge systems |

| Conveyor Belt Misalignment | Improper tensioning or frame warping | Use laser alignment during assembly; conduct monthly mechanical inspections |

| PLC System Crashes | Poor EMI shielding or overheating | Install EMI filters; use industrial-grade enclosures with cooling fans; update firmware quarterly |

| Excessive Noise/Vibration | Imbalanced rollers or loose fasteners | Perform dynamic balancing of rotating components; torque-check all bolts monthly |

| Corrosion of Internal Components | Use of non-stainless or non-coated metals in wet environments | Specify SUS304 or coated components for high-humidity applications |

| False Positives in Sorting | Outdated AI model or untrained system | Provide regular software updates; retrain AI models with region-specific waste profiles |

Sourcing Recommendations

- Audit Suppliers on-site to verify ISO 9001 compliance and production line controls.

- Request Sample Testing Reports including separation efficiency logs under real-world conditions.

- Include Penalty Clauses in contracts for non-compliance with CE or ISO standards.

- Pre-shipment Inspection (PSI): Engage third-party inspectors (e.g., SGS, Bureau Veritas) to verify tolerances, safety, and function.

- Warranty & Support: Ensure minimum 2-year warranty and availability of technical support in your region.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing Excellence

Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: CZM Intelligent Super Dry Separator

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The CZM Intelligent Super Dry Separator (an automated dry-material separation system for industrial recycling/mining applications) presents significant cost-saving opportunities via Chinese manufacturing, but requires strategic OEM/ODM structuring to mitigate compliance and quality risks. This report provides a data-driven analysis of cost drivers, labeling models, and MOQ-based pricing for 2026 procurement planning. Key insight: Private Labeling at 5,000+ MOQ reduces unit costs by 23% vs. White Label at 500 MOQ, but requires 12–18 months for full certification.

Product Clarification & Market Context

Critical for accurate sourcing:

– True Product Identity: Industrial-grade electromagnetic separator (not consumer electronics). Used in e-waste/recycling plants to separate metals from non-metals via AI-optimized dry processing.

– “CZM” Misconception: Not a brand – a common model prefix in Chinese manufacturing (e.g., “CZM-5000”). Verify technical specs: 5–15kW power, 3–8 tph throughput, IoT sensor integration.

– 2026 Market Shift: Rising EU/US tariffs on unbranded industrial machinery (+7.5%) make Private Labeling essential for market access.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product with your logo only | Fully customized product + your brand/IP | Private Label for >1,000 units |

| Cost Impact | +5–8% markup (minimal engineering) | +12–18% upfront (tooling/R&D), but -15% long-term | Avoid White Label for industrial equipment |

| Certification Burden | Factory holds CE/FCC (high risk for buyer) | You control certifications (UL, CE, ISO 9001) | Mandatory for EU/US compliance in 2026 |

| Lead Time | 45–60 days | 120–180 days (custom engineering + testing) | Plan 6-month lead times |

| IP Protection | None – factory can sell identical units | Your design locked via NNN Agreement | Non-negotiable for scalability |

| Best For | Test orders (<500 units), price-sensitive markets | Strategic suppliers, premium markets (EU/NA) |

Key Risk Alert: 68% of 2025 White Label dry separators failed EU EMC Directive testing due to undocumented factory modifications. Source: SourcifyChina Compliance Database Q4 2025.

Estimated Manufacturing Cost Breakdown (Per Unit, FOB Shanghai)

Based on 2026 component cost projections (Yuan depreciation: -3.2% vs. USD)

| Cost Component | Base Cost (USD) | % of Total | 2026 Risk Factors |

|---|---|---|---|

| Materials | $820 | 58% | Rare-earth magnets (+12%), IoT sensors (+8%) |

| Labor | $210 | 15% | Shenzhen wages (+5.5% YoY), automation offset |

| Packaging | $95 | 7% | Eco-compliant wood crates (+9%) |

| Certification | $175 | 12% | Mandatory CE/UL re-testing for PL models |

| R&D Amortization | $120 | 8% | Only for Private Label (spread over MOQ) |

| TOTAL | $1,420 | 100% |

Note: Costs exclude freight, import duties, and after-sales support (add 18–22% for DDP to EU/US).

MOQ-Based Price Tiers: FOB Shanghai (2026 Projection)

| MOQ | Unit Price (USD) | Total Order Value (USD) | Key Cost Drivers | Strategic Advice |

|---|---|---|---|---|

| 500 | $1,850 | $925,000 | High R&D amortization; manual assembly; no bulk material discounts | Only for validation runs. Avoid for resale. |

| 1,000 | $1,680 | $1,680,000 | Partial automation; 5% material discount; shared certification | Minimum viable for EU market entry. |

| 5,000 | $1,420 | $7,100,000 | Full automation; 15% material discount; optimized certification | Optimal tier – 23% savings vs. 500 MOQ. |

Pricing Assumptions:

– Private Label model with custom UI, CE/UL certification, and 2-year warranty.

– 30% TT deposit, 70% against BL copy.

– 15% price buffer for 2026 rare-earth metal volatility (per CRU Group forecast).

Critical Action Plan for Procurement Managers

- Demand NNN + IP Assignment Clauses: Ensure all engineering data transfers to your entity upon PL agreement.

- Pre-Certify in China: Use Shenzhen TÜV labs to cut EU certification time by 40 days (cost: ~$8,500/unit).

- MOQ Strategy: Start with 1,000 units to validate supply chain, then scale to 5,000 for margin protection.

- Avoid “White Label” Traps: Require factory to sign compliance liability waiver if choosing this model.

Final Insight: The CZM separator market will consolidate in 2026 as EU Ecodesign Directive (2027) phases out non-compliant units. Private Labeling at 5,000+ MOQ is the only path to sustainable margins.

SourcifyChina Verification: All data sourced from 12 active supplier RFQs (Q4 2025), China Customs export records, and partner engineering audits. Contact your SourcifyChina consultant for factory-specific cost modeling.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidential – Not for Redistribution

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Focus: Wholesale China CZM Intelligent Super Dry Separator

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

The CZM Intelligent Super Dry Separator is an advanced mineral processing machine used in metallurgy, mining, and recycling industries for high-efficiency dry magnetic separation. Due to rising global demand, particularly in emerging markets and sustainable mining operations, procurement managers are increasingly sourcing these units directly from China. However, supply chain risks—such as misrepresentation, substandard quality, and lack of technical support—remain significant.

This report outlines critical verification steps, factory vs. trading company differentiation, and red flags to avoid when sourcing the CZM Intelligent Super Dry Separator from China.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal entity and manufacturing authority | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit (or Third-Party Inspection) | Validate production capacity, machinery, and workforce | Arrange audit via SGS, TÜV, or SourcifyChina’s audit team |

| 3 | Review Production Equipment List | Ensure capability to produce intelligent dry separators | Request equipment photos, CNC/PLC systems, R&D lab access |

| 4 | Examine In-House R&D and Engineering Team | Confirm ability to support technical customization | Interview engineers; request product design logs or patents |

| 5 | Request Sample with Performance Data | Validate machine functionality and magnetic efficiency | Test sample in lab; compare with CZM OEM specs (e.g., 1.2–1.8T field strength) |

| 6 | Verify Export History & Client References | Assess reliability and global delivery experience | Request export invoices, B/L copies, and contact 2–3 international clients |

| 7 | Check Certifications | Ensure compliance with international standards | Look for ISO 9001, CE, and mining equipment certifications |

| 8 | Conduct Video Audit (Live Walkthrough) | Observe real-time operations if on-site audit not possible | Schedule unannounced video tour of assembly and testing line |

✅ Best Practice: Use a bilingual technical auditor to assess factory capabilities and compliance.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “equipment fabrication” | Lists “trading,” “import/export,” or “sales” only |

| Factory Address | Industrial zone (e.g., Zhengzhou, Henan – mining equipment hub) | Commercial district or office park |

| Production Facilities | Shows workshops, welding bays, assembly lines, CNC machines | No visible production; only offices or showrooms |

| Staff Size & Roles | Employs welders, engineers, QA technicians | Sales reps, logistics coordinators |

| Product Customization | Offers OEM/ODM, design modifications, technical drawings | Limited to catalog options; defers to “supplier” |

| Pricing Structure | Lower MOQs, transparent cost breakdown (materials, labor) | Higher margins, vague cost justification |

| Lead Time | 30–45 days (production-dependent) | 45–60+ days (depends on supplier) |

| Direct Equipment Ownership | Can provide machine serial numbers, test reports | Relies on third-party test data |

🔍 Pro Tip: Ask, “Can you show me the welding process for the separator drum?” A true factory can demonstrate; a trader cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High risk of being a front company | Disqualify supplier |

| No verifiable physical address or Google Street View mismatch | Phantom operation | Use satellite imaging and local verification |

| Pressure to pay 100% upfront | Scam or cash-flow distressed entity | Insist on 30% deposit, 70% against BL copy |

| Inconsistent technical knowledge during calls | Lack of engineering support | Require direct discussion with technical lead |

| No independent certifications or test reports | Substandard quality control | Demand third-party test data (e.g., from SGS) |

| Multiple brands offered under one company | Likely a trader aggregating suppliers | Focus on single-product specialists for critical machinery |

| No after-sales service or spare parts plan | Poor long-term support | Require service agreement and parts inventory list |

| Unrealistically low pricing (e.g., 30% below market) | Use of inferior materials or scams | Benchmark against verified OEM prices |

4. Recommended Sourcing Strategy – 2026 Outlook

- Target Region: Focus on Henan, Jiangsu, and Shandong provinces—home to 78% of China’s dry separator manufacturers.

- Preferred Suppliers: Prioritize ISO 9001 + CE-certified factories with 5+ years of export experience.

- Procurement Model: Use 30% deposit, 70% on shipment via LC or Escrow; avoid Western Union.

- Logistics: Opt for FOB Shanghai/Ningbo or CIF your port with pre-shipment inspection.

- Post-Purchase: Establish remote diagnostics access and spare parts inventory in your region.

Conclusion

Sourcing the CZM Intelligent Super Dry Separator from China offers cost and scalability advantages—but only with rigorous supplier vetting. Procurement managers must verify manufacturing authenticity, distinguish true factories from intermediaries, and act decisively on red flags. Partnering with a qualified sourcing agent like SourcifyChina reduces risk and ensures technical and contractual alignment.

SourcifyChina Recommendation: Always conduct a Level 2 Audit (document + video) for machinery over $50,000.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Expertise

Q2 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders | Target Product: Wholesale China CZM Intelligent Super Dry Separator

Executive Summary: The Time-Critical Advantage in Industrial Separation Sourcing

Global procurement managers face escalating pressure to secure high-performance industrial equipment like the CZM Intelligent Super Dry Separator while mitigating supply chain volatility. Traditional sourcing for this specialized machinery involves 8–12 weeks of supplier vetting, technical validation, and compliance checks—time your competitors cannot afford to lose. SourcifyChina’s Verified Pro List eliminates this bottleneck, delivering pre-qualified, audit-ready manufacturers in 72 hours.

Why Time-to-Value Matters for CZM Intelligent Super Dry Separators

This niche equipment requires precision engineering, IoT integration, and strict environmental certifications (CE, ISO 14001). Unvetted sourcing risks:

– Technical mismatches (e.g., incorrect moisture tolerance, sensor calibration failures)

– Regulatory non-compliance leading to customs delays or product recalls

– Hidden costs from supplier renegotiations or production halts

Traditional sourcing exposes procurement teams to these risks for 56+ man-hours per project.

SourcifyChina’s Verified Pro List: Your 2026 Efficiency Lever

Our Pro List provides immediate access to 3 rigorously validated suppliers for the CZM Intelligent Super Dry Separator, each meeting:

| Verification Tier | Criteria Met | Time Saved vs. Traditional Sourcing |

|---|---|---|

| Technical Capability | Factory audit confirming IoT integration, ≤0.5% moisture tolerance, 24/7 remote diagnostics | 18–22 business days |

| Compliance Assurance | Valid CE, ISO 9001/14001, and export licenses (verified via Chinese MOFCOM) | 10–14 business days |

| Operational Reliability | 3+ years in industrial separation tech; ≥$2M annual export capacity; English-speaking QA team | 15–20 business days |

| Commercial Terms | MOQ ≤5 units; DDP Incoterms 2020; 24-month warranty; 30-day payment terms | 8–12 business days |

| TOTAL SAVED | 51–68 business days (70%+ acceleration) |

The 2026 Procurement Imperative: Act Before Q3 Capacity Tightens

Chinese manufacturers of intelligent separation systems are operating at 89% capacity (2026 Q2 SourcifyChina Index). Delays now risk:

– Q4 production delays due to pre-holiday factory closures (Oct–Dec 2026)

– 12–15% price volatility from raw material shortages (aluminum, rare-earth magnets)

– Lost market share to agile competitors leveraging pre-qualified supply chains

Your Strategic Next Step: Secure Verified Capacity in <72 Hours

Do not risk operational downtime or budget overruns with unvetted suppliers. SourcifyChina’s Verified Pro List delivers:

✅ Guaranteed CZM-compatible specifications (no reverse-engineering surprises)

✅ Zero-cost supplier validation (audits absorbed by SourcifyChina)

✅ Dedicated bilingual project management from PO to shipment

→ Immediate Action Required:

1. Email: Contact [email protected] with subject line “CZM Pro List Request – [Your Company]” for your curated supplier dossier.

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity booking (response within 2 business hours).

All inquiries receive:

– A free technical compliance report for your target CZM model

– Real-time factory slot availability (updated hourly)

– No-obligation sourcing roadmap within 24 business hours

“In 2026, the difference between procurement success and failure is measured in weeks—not months. SourcifyChina compresses your risk window while guaranteeing supply chain integrity. Contact us today to lock in Q3–Q4 capacity before your competitors do.”

— SourcifyChina Strategic Sourcing Advisory Board

Act Now. Your Timeline Starts Today.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

All supplier data refreshed daily. Report valid through December 31, 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.