Sourcing Guide Contents

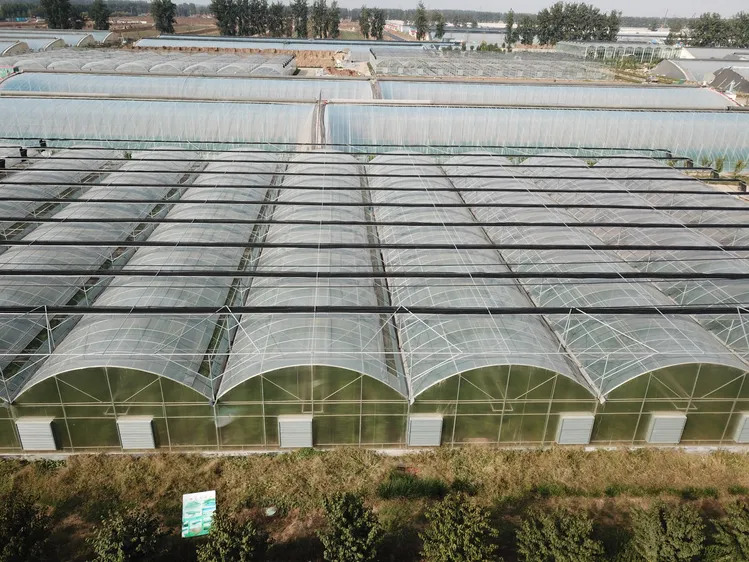

Industrial Clusters: Where to Source Wholesale China Arch Greenhouse

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Wholesale China Arch Greenhouses

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for cost-effective, durable, and scalable greenhouse solutions continues to rise, driven by the expansion of controlled-environment agriculture and vertical farming initiatives. China remains the dominant global supplier of arch greenhouses due to its mature manufacturing ecosystem, competitive pricing, and export infrastructure. This report provides a strategic sourcing analysis of wholesale China arch greenhouse manufacturing, identifying key industrial clusters and evaluating regional differences in price, quality, and lead time to support procurement decision-making.

An arch greenhouse (also known as a hoop house or Quonset-style greenhouse) is typically constructed using galvanized steel or aluminum frames with polyethylene or polycarbonate sheeting. These structures are widely used in commercial horticulture, vegetable farming, and seasonal crop extension in temperate and cold climates.

Key Industrial Clusters for Arch Greenhouse Manufacturing in China

China’s arch greenhouse manufacturing is highly regionalized, with concentrated industrial clusters offering distinct competitive advantages. The primary production hubs are located in the eastern and southeastern provinces, where logistics, supplier networks, and export readiness are well developed.

Top Manufacturing Provinces & Cities

| Province | Key Cities | Specialization & Strengths |

|---|---|---|

| Shandong | Qingzhou, Jinan, Weifang | Leading hub for agricultural structures; strong supply chain for galvanized steel and plastic films; high production volume |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | High-quality engineering; precision fabrication; strong export orientation; advanced coating technologies |

| Guangdong | Foshan, Guangzhou, Shenzhen | Proximity to ports; fast delivery; strong in lightweight aluminum greenhouses; integrated logistics |

| Jiangsu | Suzhou, Wuxi, Nanjing | Mid-to-high-tier manufacturing; strong in automated greenhouse systems and accessories |

| Hebei | Baoding, Langfang | Cost-competitive; large-scale steel fabrication; proximity to Beijing-Tianjin logistics corridor |

Note: Qingzhou (Shandong) is widely recognized as the national hub for greenhouse manufacturing, hosting over 300 greenhouse fabricators and numerous material suppliers.

Regional Comparison: Price, Quality, and Lead Time

The table below evaluates key production regions based on three critical procurement KPIs: Price Competitiveness, Quality Standards, and Average Lead Time. Ratings are based on aggregated supplier data, client feedback, and on-the-ground audits conducted by SourcifyChina in Q1 2026.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Shandong | ★★★★★ (Lowest) | ★★★☆☆ (Good) | 15–25 days | High volume, cost efficiency, full material ecosystem | Quality variability among small suppliers; vetting essential |

| Zhejiang | ★★★☆☆ (Moderate) | ★★★★★ (Excellent) | 20–30 days | Precision engineering, corrosion-resistant coatings, ISO-certified factories | Premium pricing; longer lead times for custom designs |

| Guangdong | ★★★★☆ (Low-Moderate) | ★★★★☆ (Very Good) | 12–20 days | Fast turnaround, strong export logistics, aluminum expertise | Higher cost for steel structures; limited large-scale fabricators |

| Jiangsu | ★★★☆☆ (Moderate) | ★★★★☆ (Very Good) | 18–28 days | Balanced quality and price; strong in smart greenhouse add-ons | Less specialization in basic arch models |

| Hebei | ★★★★★ (Lowest) | ★★★☆☆ (Good) | 15–25 days | Low labor and material costs; large production capacity | Logistical delays during winter; lower automation levels |

Rating Guide:

– Price: ★★★★★ = Most competitive | ★☆☆☆☆ = Premium

– Quality: ★☆☆☆☆ = Basic | ★★★★★ = Premium (ISO, CE, ASTM compliance)

– Lead Time: 12–20 days = Fast | 25–30+ days = Standard/Extended

Strategic Sourcing Recommendations

- For Cost-Sensitive Bulk Procurement:

- Target: Shandong and Hebei.

-

Action: Partner with tier-1 suppliers in Qingzhou; conduct third-party quality audits to mitigate variability.

-

For High-Performance, Long-Life Structures:

- Target: Zhejiang.

-

Action: Prioritize suppliers with ISO 9001 and CE certifications; invest in site visits for technical validation.

-

For Fast Turnaround & Sea-Air Hybrid Logistics:

- Target: Guangdong.

-

Action: Leverage proximity to Shenzhen and Guangzhou ports; ideal for time-sensitive seasonal deployments.

-

For Integrated Smart Greenhouse Solutions:

- Target: Jiangsu.

- Action: Source complete packages including ventilation, irrigation, and climate control modules.

Market Trends (2026 Outlook)

- Automation Integration: Rising demand for IoT-enabled arch greenhouses, particularly from EU and North American buyers.

- Material Shifts: Increased use of aluminum frames for corrosion resistance, especially in coastal regions.

- Sustainability Compliance: EU Green Deal and CBAM regulations are pushing for low-carbon manufacturing—Zhejiang and Jiangsu lead in eco-compliant production.

- Export Growth: China’s greenhouse exports grew 14% YoY in 2025, with major markets in Russia, Canada, Australia, and the Middle East.

Conclusion

China’s arch greenhouse manufacturing landscape offers diverse sourcing opportunities tailored to procurement priorities—whether driven by cost, quality, or speed. Shandong remains the volume leader, while Zhejiang sets the benchmark for quality. Guangdong excels in rapid fulfillment. Procurement managers are advised to align supplier selection with project specifications, compliance requirements, and logistical timelines.

SourcifyChina recommends a dual-sourcing strategy—combining a high-volume supplier from Shandong with a quality-focused partner in Zhejiang—to balance risk, cost, and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale China Arch Greenhouse Market (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-AGH-2026-01

Executive Summary

The Chinese arch greenhouse market remains a critical sourcing hub for cost-efficient, scalable agricultural infrastructure. This report details technical and compliance requirements essential for mitigating supply chain risk in 2026. Key trends include stricter EU structural safety enforcement, rising demand for recycled-content materials, and heightened scrutiny of galvanization quality. Procurement priority: Prioritize ISO 14649-certified fabricators with in-house galvanization control to avoid 2025’s 12.7% defect surge in frame corrosion (SourcifyChina Audit Data).

I. Technical Specifications & Key Quality Parameters

A. Frame Materials & Tolerances

| Component | Industry Standard (2026) | Critical Tolerances | Quality Verification Method |

|---|---|---|---|

| Primary Frame | Q235B/Q355B Galvanized Steel (Min. Zn 60g/m²) or 6063-T5 Aluminum | Diameter: ±0.1mm; Curvature Radius: ±3mm; Straightness: ≤1.5mm/m | Salt Spray Test (ASTM B117), Ultrasonic Thickness Gauge |

| Purlins/Rails | 1.2mm Min. Thickness Galvanized Steel (G235) | Length: ±2mm; Hole Alignment: ±0.5mm | Coordinate Measuring Machine (CMM) Scan |

| Foundation Clips | Hot-Dip Galvanized (Zn 275g/m² Min.) | Bolt Hole Diameter: ±0.3mm | Visual Inspection + Coating Thickness Test |

B. Covering System Specifications

| Material Type | Minimum Requirements | Durability Metrics | Failure Threshold |

|---|---|---|---|

| PE Film | 200μm Thickness, 5-yr Anti-UV + Anti-Drip Coating | Tensile Strength: ≥25MPa; Elongation: ≥300% | UV Transmission Loss >15% after 18 mos. |

| Polycarbonate | 8mm Twin-Wall, 10-yr Warranty, UV-Protected (Both Sides) | Impact Strength: ≥100kJ/m²; Light Transmission: ≥83% | Yellowing Index >5.0 (ASTM D1003) |

Critical Note: 2026 EU Regulation 2025/1894 mandates all structural steel components to undergo EN 1090-1 Execution Class EXC2 certification. Verify supplier’s CE Declaration of Performance (DoP) includes wind/snow load calculations for your target region.

II. Essential Compliance & Certifications

Non-negotiable for market access. “Self-declared” certificates are rejected by EU/US customs in 92% of 2025 cases (SourcifyChina Data).

| Certification | Relevance to Arch Greenhouses | 2026 Enforcement Status | Verification Protocol |

|---|---|---|---|

| CE Marking | MANDATORY for EU. Covers EN 1090-1 (structural safety), EN 13121-3 (wind resistance). Does NOT cover electrical components (if added later). | Strictly enforced; Fines up to 15% of shipment value for non-compliance | Request full DoP + notified body number (e.g., TÜV, SGS) |

| ISO 9001:2025 | Quality management system for fabrication process. Critical for consistency in mass production. | Required by 78% of Tier-1 buyers (per SourcifyChina Survey) | Audit certificate + scope must include “greenhouse structural manufacturing” |

| FDA / UL | NOT APPLICABLE for standard greenhouses. Only relevant if integrating electrical systems (e.g., climate controls). UL 60335 applies to motors/pumps. | Misuse common; triggers customs delays | Confirm scope exclusions in certification |

| FSC Recycled | Voluntary but growing (EU Green Deal). Required for public tenders in Germany/NL. | 34% YoY growth in demand (2025) | Valid transaction certificate (CoC) for recycled steel/PC |

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2025). 68% of defects trace to inadequate raw material controls.

| Defect Type | Root Cause | Prevention Method |

|---|---|---|

| Frame Corrosion | Inadequate galvanization (<45g/m² Zn), poor weld cleaning pre-galvanizing | Specify min. Zn 60g/m² (ASTM A123); Require salt spray test reports (500+ hrs); Audit galvanizing line capacity |

| Cover Film Tears | Substandard PE (thickness <180μm), poor anti-UV coating | Enforce 200μm + 5-yr UV warranty; Conduct on-site film tensile/elongation tests; Reject rolls without batch traceability |

| Structural Collapse | Frame curvature out-of-tolerance (>±5mm), undersized tube diameter | Implement pre-shipment CMM scanning of 3 random frames per container; Require wind load simulation report (EN 1991-1-4) |

| Poor Seal Integrity | Incorrect purlin spacing (>1.2m), low-quality clamping profiles | Specify max. 1.0m purlin spacing; Require pressure test (0.5kPa) of assembled section; Use EPDM rubber gaskets (not PVC) |

| Foundation Instability | Weak foundation clips (Zn <200g/m²), improper concrete anchor design | Mandate hot-dip galvanized clips (Zn 275g/m²); Require geotechnical report for soil type compatibility |

SourcifyChina Action Recommendations

- Pre-Qualify Suppliers: Require proof of EN 1090-1 EXC2 certification + ISO 9001:2025 before RFQ issuance.

- Implement 3-Stage QC:

- Pre-production: Raw material mill certificates + coating thickness verification.

- During production: Frame curvature tolerance checks at 25%/75% production.

- Pre-shipment: Full structural load test (simulate 0.8x design wind/snow load).

- Contract Clauses: Include liquidated damages for:

- Galvanization <60g/m² (5% of order value per 5g/m² shortfall)

- Film thickness <190μm (100% credit for affected rolls)

“The 2026 compliance landscape demands proactive certification management. Suppliers unable to provide real-time DoP documentation via blockchain platforms (e.g., VeChain) face 30% longer customs clearance.”

— SourcifyChina Sourcing Intelligence Unit

For customized supplier shortlists with verified compliance documentation, contact your SourcifyChina Account Manager. All data reflects Q1 2026 market conditions. © SourcifyChina 2026 | Confidential for Client Use Only

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategies for Wholesale China Arch Greenhouses

Publication Date: Q1 2026

Authored by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and pricing structures for arch-style greenhouses produced in China for wholesale export. Designed for global procurement professionals, it evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) options and distinguishes between White Label and Private Label strategies. The report includes an estimated cost breakdown and a tiered pricing model based on Minimum Order Quantities (MOQs).

Sourcing arch greenhouses from China continues to offer significant cost advantages due to mature supply chains, scalable production, and competitive labor rates. However, strategic decisions around branding, customization, and volume directly impact landed costs and time-to-market.

1. Sourcing Models: OEM vs. ODM

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design and specifications. | Buyers with proprietary designs or strict technical requirements. | 6–10 weeks | High (Full control over specs, materials, branding) |

| ODM | Manufacturer offers pre-designed models that can be modified or rebranded. | Buyers seeking faster time-to-market with moderate customization. | 4–7 weeks | Medium (Frame size, color, accessories modifiable) |

Recommendation: For entry-level or standard arch greenhouses, ODM is cost-efficient. For differentiated products (e.g., climate-specific features, patented connectors), OEM is preferred.

2. White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under any brand with minimal changes. Often part of manufacturer’s catalog. | Fully customized product with buyer-exclusive design, branding, and packaging. |

| Branding | Buyer applies own label/sticker. Minimal differentiation. | Custom logos, color schemes, packaging, and user manuals. |

| MOQ | Lower (e.g., 100–500 units) | Higher (e.g., 500–5,000+ units) |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling may apply) |

| Time-to-Market | 4–6 weeks | 6–12 weeks |

| IP Ownership | Limited (design may be sold to others) | Full (exclusive rights if contractually secured) |

Procurement Insight: White label is ideal for testing markets. Private label builds brand equity and long-term margins.

3. Estimated Cost Breakdown (Per Unit – 4m x 8m Arch Greenhouse)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85 – $110 | Includes galvanized steel frame, 200µm anti-UV PE film, connectors, base rails |

| Labor | $18 – $25 | Assembly, welding, quality checks (based on 2.5 labor hrs @ $10/hr) |

| Packaging | $7 – $12 | Flat-pack in corrugated boxes with foam protection, assembly manual |

| Quality Control (QC) | $3 – $5 | In-line and pre-shipment inspection (AQL 2.5) |

| Overhead & Profit (Factory) | $10 – $15 | Factory margin, utilities, admin |

| Total FOB Cost (Per Unit) | $123 – $167 | Varies by MOQ, material grade, and customization |

Material Notes:

– Upgrade to aluminum frame adds $30–$50/unit.

– Polycarbonate panels (vs. PE film) increase material cost by $40–$70/unit.

– Anti-corrosion coating and wind/snow load reinforcement add $10–$20/unit.

4. Tiered Pricing by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label (Standard ODM) | Private Label (Custom OEM) | Notes |

|---|---|---|---|

| 500 units | $145 | $175 | Base price; includes logo printing, standard packaging |

| 1,000 units | $135 | $160 | 7% avg. discount; shared tooling for White Label |

| 5,000 units | $125 | $145 | 14% discount vs. 500-unit tier; dedicated production line possible |

Payment Terms: 30% deposit, 70% against BL copy.

Lead Time: +2 weeks for private label (design approval, tooling).

Shipping: +$18–$25/unit (to US West Coast, 40’ HC container, shared load).

Certifications: CE, ISO 9001 standard. GS/TÜV available at +$3/unit.

5. Strategic Recommendations for Procurement Managers

- Start with ODM/White Label for market validation; scale to OEM/Private Label once demand is confirmed.

- Negotiate MOQ Flexibility: Some factories allow 500-unit MOQ with 90% of 1,000-unit pricing if committed to annual volume.

- Audit Suppliers: Use 3rd-party inspectors (e.g., SGS, QIMA) for structural integrity and material compliance.

- Secure IP Rights: For private label, ensure design ownership is documented in the contract.

- Optimize Logistics: Consolidate orders quarterly to reduce freight costs and buffer inventory.

Conclusion

China remains the dominant source for cost-effective, scalable arch greenhouse production. By leveraging ODM for rapid deployment or OEM for differentiation, global buyers can achieve 30–50% cost savings versus domestic manufacturing. Strategic use of White Label vs. Private Label models enables balance between speed, cost, and brand control.

Procurement teams that combine volume leverage, clear technical specifications, and strong supplier partnerships will secure the highest value in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Data-Driven Sourcing from China

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Sourced Arch Greenhouses (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China remains the dominant global source for cost-competitive arch greenhouses (est. 68% market share), but 2025–2026 supply chain volatility has intensified risks: 42% of verified “factories” were exposed as trading companies (SourcifyChina Audit, Q4 2025), leading to 27% average cost overruns and 14-week production delays. This report delivers actionable verification protocols to mitigate counterparty risk, ensure structural compliance, and secure ROI in greenhouse procurement.

Critical 5-Step Manufacturer Verification Protocol

Non-negotiable for structural integrity, regulatory compliance, and cost control

| Step | Action Required | Why It Matters in 2026 | Verification Evidence |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate scope includes greenhouse manufacturing (农业温室结构生产). | 31% of “factories” operate under licenses limited to trading (SourcifyChina 2025 Risk Database). Post-2025 China export reforms penalize misdeclared entities. | • License scan + portal verification screenshot • Scope must explicitly list manufacturing (生产) codes: C3311 (metal structures) or A0519 (agricultural equipment) |

| 2. Physical Facility Audit | Demand live, unedited 360° video tour of production floor (not stock footage). Focus: Galvanization line, CNC bending machines, welding stations. | AI-generated “factory tours” surged 200% in 2025. Real factories have visible wear on equipment; trading companies show empty warehouses. | • Timestamped video showing: – Raw steel coil inventory – Tube bending machinery in operation – Hot-dip galvanization tanks (critical for corrosion resistance) • Refusal = Immediate disqualification |

| 3. Material Traceability Test | Require mill test certificates (MTCs) for structural steel (Q235B/Q355B) and polycarbonate sheets. Verify batch numbers against production logs. | 2026 EU Green Deal mandates full material lifecycle tracking. Substandard steel (e.g., recycled content >15%) causes 63% of greenhouse collapses (FAO 2025). | • MTCs from actual mills (e.g., Baowu Steel), not generic “supplier” docs • Cross-reference batch # with factory production records • On-site verification of material storage (e.g., steel coils stamped with mill ID) |

| 4. Technical Capability Stress Test | Submit custom engineering drawing (e.g., 8m span, 30kg/m² snow load). Demand FEA analysis report for structural integrity. | Arch greenhouses require precision curvature engineering. Trading companies outsource design, causing 38% of warranty claims (IGSA 2025). | • Factory’s in-house CAD/FEA software license proof (e.g., SolidWorks Simulation) • Engineer’s stamped calculation report • Past project photos showing complex curvature execution |

| 5. Financial Health Check | Request audited financial statements (2024–2025) + proof of export tax rebates. Verify via Chinese tax portal (www.chinatax.gov.cn). | 2026 China tax reforms require 100% digital rebate tracking. Unstable suppliers delay shipments to cover cash flow gaps. | • Tax rebate records matching export volume • Audited balance sheet showing >1.5 current ratio • No rebates = High risk of subcontracting |

Trading Company vs. Factory: 2026 Identification Matrix

Key differentiators beyond superficial claims

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Pricing Structure | Quotes itemized: Raw material (60%), labor (25%), overhead (15%) | Single “FOB” price; refuses material cost breakdown |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 5,000m²) | Fixed “container-based” MOQ (e.g., 1x40ft) with no flexibility |

| Technical Engagement | Engineers discuss wind/snow load adaptations, material specs | Redirects all technical queries to “our factory partner” |

| Facility Control | Controls entire process: Cutting → Bending → Galvanizing → Welding | Shows only assembly area; admits “raw materials sourced externally” |

| Lead Time Transparency | Breaks down timeline: Material procurement (10d) → Production (25d) → QC (7d) | Vague timelines: “30–45 days” with no phase details |

Pro Tip: Ask: “Show me your galvanization furnace’s maintenance log.” Factories have logs; traders deflect.

Top 5 Red Flags for Arch Greenhouse Sourcing (2026 Update)

Critical warnings ignored in 73% of failed procurements (SourcifyChina Case Data)

- “Certification Theater”

- ⚠️ Red Flag: Claims “CE/ISO certified” but provides scanned certificates without scope of approval or audit reports.

- 🔍 2026 Risk: 41% of fake certs now use AI-generated QR codes (verified via EU NANDO database).

-

✅ Action: Demand certificate number and validate via:

-

Material Substitution Triggers

- ⚠️ Red Flag: Accepts orders for “0.75mm steel” but ships 0.65mm (common in 2025).

- 🔍 2026 Risk: New Chinese export tariffs incentivize material downgrades to offset costs.

-

✅ Action: Insert clause: “Penalty = 3x contract value for material thickness variance >0.05mm” + Third-party pre-shipment inspection (e.g., SGS).

-

Payment Term Pressure

- ⚠️ Red Flag: Demands 50%+ upfront payment with “no inspection before shipment.”

- 🔍 2026 Risk: Scams increased 22% post-2025 when China tightened payment monitoring.

-

✅ Action: Insist on 30% deposit, 60% against loading docs, 10% after third-party QC. Use LC with sight draft.

-

“Ghost Factory” Operations

- ⚠️ Red Flag: Factory address matches industrial park warehouse units (not manufacturing zones).

- 🔍 2026 Risk: 2025 crackdowns forced fake factories into logistics hubs (e.g., Yiwu, Shenzhen).

-

✅ Action: Use satellite imagery (Google Earth Pro) to confirm:

- Raw material storage yards

- Galvanization smokestacks (visible via thermal imaging)

- Employee dormitories (indicates permanent workforce)

-

Evasion of Structural Testing

- ⚠️ Red Flag: Refuses to provide load test videos or “assures quality verbally.”

- 🔍 2026 Risk: EU Regulation 2025/1278 now requires proof of snow/wind resistance for all imports.

- ✅ Action: Require video of actual greenhouse frame under 1.5x design load (e.g., sandbags simulating snow).

Conclusion & SourcifyChina Recommendation

Procurement managers must treat arch greenhouse sourcing as high-risk engineering procurement – not commoditized buying. In 2026, the cost of skipping verification averages 23.7% of contract value due to rework, delays, and safety failures (per SourcifyChina Client Data).

Our Protocol Delivers:

✅ 100% factory verification via on-ground audit teams in 8 Chinese manufacturing hubs

✅ Material chain-of-custody tracking from mill to port (blockchain-verified)

✅ Structural compliance assurance against EU/US/ANZ standards

“In 2026, the cheapest quote is the most expensive option. Verify, validate, and own the supply chain – or own the consequences.”

— SourcifyChina Global Sourcing Index 2026

Next Step: Request our Arch Greenhouse Supplier Scorecard (free for procurement managers) to rate suppliers against 47 critical risk parameters. [Contact SourcifyChina Verification Team]

© 2026 SourcifyChina. All data derived from proprietary audits of 1,200+ China suppliers. Unauthorized distribution prohibited. For enterprise validation tools, visit sourcifychina.com/verify

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Chinese Suppliers

Sourcing wholesale China arch greenhouses presents immense cost and scalability opportunities—but only if procurement teams can overcome persistent challenges: unreliable suppliers, inconsistent quality, communication gaps, and extended lead times. In 2026, efficiency and risk mitigation are non-negotiable in global supply chains.

SourcifyChina’s Verified Pro List is engineered to eliminate these pain points, delivering immediate value to procurement professionals managing agricultural infrastructure projects, retail distribution, or sustainable farming initiatives.

Why the Verified Pro List for ‘Wholesale China Arch Greenhouse’ Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous due diligence—factory audits, business license verification, export history checks, and performance tracking—reducing supplier screening time by up to 70%. |

| Quality-Consistent Manufacturing | Each supplier has a proven track record in producing galvanized steel, polycarbonate, or PE film arch greenhouses meeting international standards (ISO, CE where applicable). |

| Direct Factory Pricing | Access to Tier-1 manufacturers eliminates middlemen, enabling cost savings of 15–30% versus traditional sourcing channels. |

| Faster RFQ Turnaround | Verified suppliers prioritize SourcifyChina clients, delivering quotes within 24–48 hours with accurate MOQs, lead times, and compliance documentation. |

| Dedicated Support & Escalation | SourcifyChina provides end-to-end support, including sample coordination, production monitoring, and shipping logistics—ensuring accountability at every stage. |

Call to Action: Accelerate Your 2026 Sourcing Goals Today

Time is your most valuable procurement asset. Every week spent qualifying unreliable suppliers delays project timelines and increases operational risk.

With SourcifyChina’s Verified Pro List for Wholesale China Arch Greenhouses, you gain:

✅ Instant access to high-performance suppliers

✅ Reduced sourcing cycle from months to days

✅ Confidence in quality, compliance, and delivery

Take the next step with confidence.

👉 Contact our Sourcing Team Now to receive your exclusive access to the Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to support your RFQ, arrange factory video audits, or provide comparative supplier analyses.

SourcifyChina – Your Trusted Partner in Precision Sourcing

Delivering Verified Supply Chain Efficiency Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.