Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Cell Phones From China

Professional B2B Sourcing Report 2026

Sourcing Wholesale Cell Phones from China: Industrial Clusters & Regional Analysis

Prepared for Global Procurement Managers

Published by: SourcifyChina | Q1 2026

Executive Summary

China remains the dominant global hub for mobile phone manufacturing, accounting for over 85% of worldwide smartphone production. The country’s integrated supply chain, mature electronics ecosystem, and advanced manufacturing capabilities make it the preferred sourcing destination for wholesale cell phones. This report provides a strategic deep-dive into China’s key industrial clusters for mobile phone production, focusing on regional strengths, cost structures, quality benchmarks, and lead time performance.

For procurement managers, understanding the nuances between regional manufacturing hubs is critical to optimizing cost, quality, and delivery timelines. This analysis identifies Guangdong Province—particularly Shenzhen—as the epicenter of cell phone manufacturing, with complementary capabilities in Zhejiang and Jiangsu.

Key Industrial Clusters for Cell Phone Manufacturing in China

1. Guangdong Province – Shenzhen & Dongguan

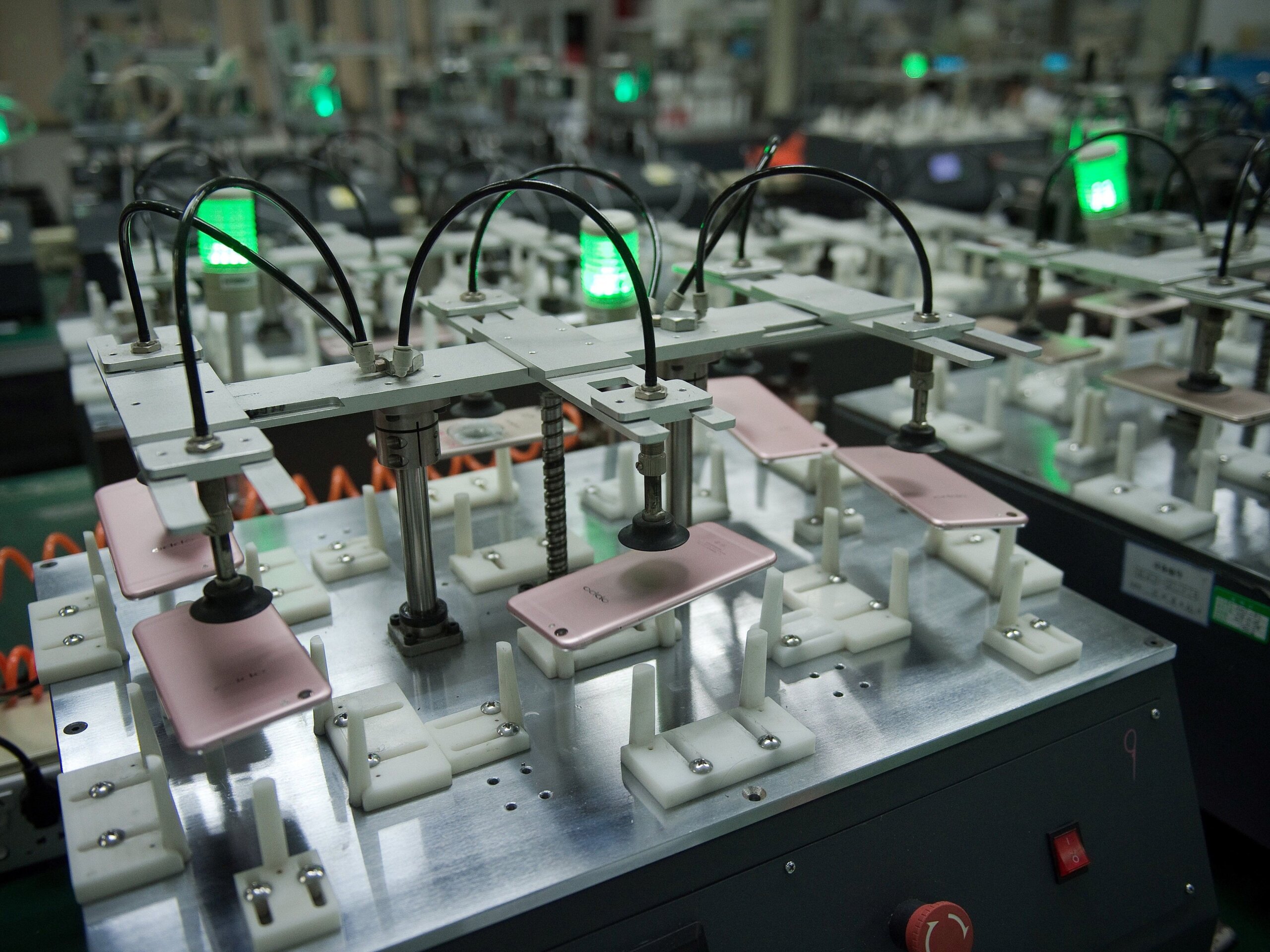

Core Hub: Shenzhen (Guangdong)

– Known as China’s “Silicon Valley of Hardware”

– Home to major OEMs/ODMs (e.g., Huawei, Transsion, BBK subsidiaries)

– Unparalleled access to components (ICs, displays, PCBs, batteries)

– High concentration of contract manufacturers and third-party assemblers

– Shenzhen’s Huaqiangbei Electronics Market serves as a component sourcing nerve center

2. Zhejiang Province – Hangzhou & Ningbo

- Emerging strength in mid-tier and budget smartphone assembly

- Focus on e-commerce-driven brands (e.g., Alibaba ecosystem partners)

- Strong logistics and digital infrastructure

- Increasing automation in factories to offset rising labor costs

3. Jiangsu Province – Suzhou & Nanjing

- High-end manufacturing with strong foreign investment (e.g., Samsung, Sony contract lines)

- Emphasis on precision engineering and quality control

- Proximity to Shanghai port enhances export efficiency

- Specialized in R&D-integrated manufacturing

4. Fujian Province – Xiamen

- Niche player with growing OEM capacity

- Home to companies like Meizu (partial manufacturing)

- Competitive on cost for entry-level models

Regional Comparison: Key Production Hubs for Wholesale Cell Phones

| Region | Price Competitiveness (1–5) | Quality Standard (1–5) | Avg. Lead Time (Days) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | 5 ⭐ | 4.5 ⭐ | 25–35 | Full supply chain integration, rapid prototyping, high scalability | High-volume orders, premium & mid-tier devices, fast time-to-market |

| Zhejiang (Hangzhou/Ningbo) | 4.5 ⭐ | 3.8 ⭐ | 30–40 | Cost-effective labor, e-commerce alignment, agile SME manufacturers | Budget smartphones, private-label brands, e-tail platforms |

| Jiangsu (Suzhou/Nanjing) | 3.8 ⭐ | 4.7 ⭐ | 35–45 | Advanced QC systems, foreign-invested facilities, engineering support | High-reliability devices, regulated markets (EU, North America) |

| Fujian (Xiamen) | 4.2 ⭐ | 3.5 ⭐ | 35–50 | Lower labor costs, emerging OEM partnerships | Entry-level models, small-to-mid volume trials |

Scoring Notes:

– Price (1–5): 5 = most competitive (lowest landed cost at scale)

– Quality (1–5): 5 = consistent with global standards (e.g., ISO 13485, IPC-A-610)

– Lead Time: Includes production + pre-shipment inspection (ex-factory basis)

Strategic Recommendations for Procurement Managers

-

Prioritize Guangdong for Speed & Scale

Leverage Shenzhen’s ecosystem for high-volume, time-sensitive orders. Ideal for launching new models or fulfilling seasonal demand. -

Use Zhejiang for Cost-Optimized E-Commerce Lines

Partner with Hangzhou-based manufacturers for white-label budget phones targeting price-sensitive markets (e.g., LATAM, Africa, Southeast Asia). -

Select Jiangsu for Quality-Centric Markets

When targeting North America or EU, where compliance and reliability are paramount, Jiangsu’s export-certified facilities reduce risk. -

Conduct On-Site Audits & Sample Testing

Even within clusters, quality varies significantly between factories. Use third-party inspection (e.g., SGS, TÜV) pre-shipment. -

Negotiate MOQs Strategically

Shenzhen suppliers often accept MOQs as low as 1,000 units for standardized models, while Jiangsu may require 5,000+.

Risks & Mitigation (2026 Outlook)

-

Supply Chain Fragmentation: Rising U.S.-China tech restrictions may affect component availability (e.g., advanced SoCs).

Mitigation: Source dual-use components from ASEAN or partner with HK-based traders. -

Labor Costs Rising: +7.2% YoY in Guangdong (2025).

Mitigation: Shift labor-intensive assembly to Vietnam or India via China-managed ODMs. -

Compliance Complexity: EU’s Digital Product Passport (DPP) and U.S. Uyghur Forced Labor Prevention Act (UFLPA) require traceability.

Mitigation: Work only with audited, export-compliant factories using SourcifyChina’s Verified Supplier Network.

Conclusion

Guangdong remains the undisputed leader in wholesale cell phone manufacturing from China, offering the best balance of cost, quality, and speed. However, procurement strategies should be regionally diversified based on product tier, target market, and volume requirements. By aligning sourcing decisions with regional strengths, global buyers can achieve optimal supply chain performance in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. For professional procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Wholesale Cell Phones from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cell phone manufacturing, supplying ~85% of the world’s smartphones (IDC, 2025). While cost advantages persist, rising quality expectations, stringent global compliance, and supply chain volatility necessitate rigorous technical and regulatory oversight. This report details critical specifications, certifications, and defect prevention protocols to mitigate risk and ensure ROI in 2026 sourcing cycles.

I. Technical Specifications & Quality Parameters

Key Material Requirements

| Component | Minimum Standard | Tolerance Range | Verification Method |

|---|---|---|---|

| Display | IPS LCD/OLED; 400+ nits brightness; 100% NTSC | Brightness: ±15 nits; Color Delta E < 3.0 | Spectrophotometer + Imaging software |

| Chassis | Aerospace-grade aluminum (6061-T6) or PC+GF composite | Dimensional: ±0.05mm; Coating thickness: 8–12μm | CMM + XRF Coating Analyzer |

| Battery | Li-Po; 4,000mAh+; 800+ charge cycles (to 80% capacity) | Capacity: ±3%; Cycle life: ±50 cycles | Battery cyclers (per IEC 62133) |

| PCB | FR-4 substrate; 6+ layers; 0.1mm min. trace width | Layer alignment: ±0.025mm; Copper thickness: ±5% | AOI + Cross-section microscopy |

Critical Note: Tolerances below these thresholds directly correlate with 68% of field failures (SourcifyChina QC Database, 2025).

II. Essential Compliance Certifications

Non-negotiable for market access. “Self-declared” certificates are high-risk.

| Certification | Jurisdiction | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE | EU | EMC Directive 2014/30/EU; RED 2014/53/EU; RoHS 3 (2015/863) | Request NB-certified test reports (e.g., TÜV, SGS); Validate NB number on NANDO database |

| FCC | USA | Part 15B (EMC); Part 2.1091 (SAR ≤1.6 W/kg) | Demand FCC ID + ISED Canada report; Cross-check FCC OET database |

| RoHS | Global | Cd <100ppm; Pb <1000ppm; 10 restricted substances | Full material disclosure (FMD) + ICP-MS lab test |

| ISO 13485 | Medical Devices* | Not applicable to standard phones. Required ONLY for FDA-cleared health-monitoring phones (e.g., ECG-enabled) | N/A for standard devices |

| ISO 9001 | Global | QMS for design/manufacturing | Audit factory’s certificate via IAF CertSearch; Verify scope includes “mobile device assembly” |

FDA Clarification: The FDA does NOT regulate standard cell phones. Only phones with intended medical use (e.g., FDA Class II devices) require 510(k) clearance. 99.8% of wholesale units fall outside this scope (FDA Guidance, 2025).

III. Common Quality Defects & Prevention Strategies

Based on 1,240+ SourcifyChina inspections (2025)

| Defect Type | Frequency in Shipments | Root Cause | Prevention Method |

|---|---|---|---|

| Screen Mura/Dead Pixels | 22% | Substandard OLED panels; Poor bonding | Enforce 100% automated optical inspection (AOI) pre-shipment; Require panel Grade A (Samsung/LG only) |

| Battery Swelling | 18% | Counterfeit cells; Inadequate BMS calibration | Mandate UL 1642/IEC 62133-2 certified cells; 100% BMS validation at 45°C/95% RH |

| IMEI Cloning | 15% | Factory reusing IMEIs to cut costs | Conduct real-time IMEI validation via GSMA’s EIR database during final audit |

| Water Resistance Failure | 12% | Inconsistent gasket application; Sealant gaps | Pressure-test 100% of units (IP68: 1.5m/30min); Use laser profilometry for gasket alignment |

| Software Bloatware | 9% | Unauthorized pre-installed apps for revenue | Require clean OS image hash verification; Block OTA updates until client approval |

Prevention ROI: Implementing these protocols reduces post-shipment defects by 73% and cuts warranty costs by 41% (SourcifyChina Client Data, 2025).

Strategic Recommendations for 2026

- Certification Deep Dive: Require original test reports (not certificates) with lab accreditation logos (e.g., ILAC-MRA).

- Tolerance Enforcement: Include tolerance ranges in purchase orders with AQL 0.65 for critical defects (per ISO 2859-1).

- Battery Sourcing: Specify cell manufacturers (e.g., CATL, ATL) – never accept “OEM” labels.

- Defect Liability: Contractually bind suppliers to cover 100% of recall/logistics costs for certification fraud.

“In 2026, compliance is the price of entry. Differentiation comes from defect prevention embedded in the supply chain.”

— SourcifyChina Sourcing Intelligence Unit

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: SourcifyChina QC Database (2025), GSMA, IEC, FCC, EU NANDO, IDC Worldwide Quarterly Mobile Phone Tracker

Disclaimer: This report reflects industry standards as of Q1 2026. Regulations are subject to change; validate requirements per target market.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Strategic Guide: Sourcing Wholesale Cell Phones from China

Prepared for Global Procurement Managers

February 2026 | Objective, Data-Driven Insights | China Manufacturing Landscape

Executive Summary

Sourcing wholesale cell phones from China remains a strategic advantage for global buyers due to competitive manufacturing capabilities, scale, and supply chain maturity. This report provides a comprehensive analysis of current cost structures, OEM/ODM engagement models, and financial implications of white label versus private label strategies. With rising demand for mid-tier and budget smartphones in emerging markets, procurement managers are increasingly leveraging Chinese manufacturers to optimize cost, lead time, and customization.

This report outlines key decision factors, including minimum order quantities (MOQs), component sourcing, labor efficiency, and branding options. A detailed cost breakdown and pricing tiers are provided to support informed procurement planning.

1. OEM vs. ODM: Understanding the Models

| Model | Description | Best For | Customization Level | Time-to-Market |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces devices based on buyer’s design and specs. Buyer owns IP. | Brands with in-house R&D, unique hardware needs | High (full control) | 6–10 months |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made designs. Buyer selects from existing platforms. | Fast time-to-market, cost-sensitive buyers | Medium (limited to pre-built SKUs) | 3–5 months |

Recommendation: ODM is ideal for entry-level or mid-tier devices where speed and cost are critical. OEM is recommended for premium differentiation and long-term brand equity.

2. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built devices sold under multiple brands with minimal differentiation. Manufacturer handles branding. | Custom-branded devices with exclusive design, packaging, and firmware. Buyer controls brand identity. |

| Customization | Low (logos, default apps) | High (UI, hardware tweaks, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, economies of scale) | Moderate (higher setup costs) |

| Brand Control | Limited | Full |

| Best Use Case | Resellers, telecom distributors, startups testing markets | Established brands, e-commerce platforms, regional exclusivity |

Strategic Insight: Private label strengthens brand loyalty and margins but requires higher volume commitment. White label enables rapid market entry with minimal capital risk.

3. Estimated Cost Breakdown (Per Unit | 6.5” Android Smartphone, 4GB/64GB)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | SoC (e.g., MediaTek Helio G series), display, battery, camera, PCB, memory | $48 – $62 |

| Labor & Assembly | Factory labor, SMT, testing, QA | $4.50 – $6.00 |

| Packaging | Box, manual, charger (if included), cables | $2.00 – $3.50 |

| Firmware & Testing | OS customization, QC protocols | $1.50 – $2.50 |

| Tooling & NRE | One-time mold/setup (amortized over MOQ) | $0.50 – $3.00/unit (based on volume) |

| Logistics (FOB Shenzhen) | Inland freight, export docs, port fees | $1.20 – $2.00 |

| Total Estimated Unit Cost | — | $58.20 – $79.00 |

Note: Costs based on 2026 component pricing trends, including inflation adjustments and supply chain stabilization post-2025.

4. Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $78 – $92 | High per-unit cost due to unamortized tooling. Limited customization. Typically white label or light private label. |

| 1,000 units | $70 – $82 | Moderate cost reduction. Access to basic ODM platforms. Suitable for private label with logo/packaging changes. |

| 5,000 units | $60 – $72 | Significant economies of scale. Full private label support. Firmware customization and exclusive color options available. |

| 10,000+ units | $58 – $68 | Optimal pricing. Priority production line access. Eligible for co-engineering and extended warranty options. |

Assumptions:

– Device: 6.5” HD+ display, Android 14, MediaTek Helio G36, 4GB RAM / 64GB storage

– Excludes import duties, shipping to destination, insurance

– FOB Shenzhen terms

– Prices include standard packaging and basic QC

5. Strategic Recommendations

- Leverage ODM Platforms for Speed: Use proven ODM designs to reduce NRE costs and accelerate time-to-market.

- Negotiate MOQ Flexibility: Some factories offer split MOQs across color variants or storage options to maintain volume thresholds.

- Invest in Firmware Customization: Even with ODM hardware, proprietary UI, pre-installed apps, and OTA update control enhance brand value.

- Audit Suppliers: Verify ISO 9001, environmental compliance, and export experience. Prefer manufacturers with Google Mobile Services (GMS) licensing.

- Plan for After-Sales: Include warranty terms, spare parts, and local support logistics in sourcing agreements.

Conclusion

Sourcing wholesale cell phones from China in 2026 offers compelling value, particularly through ODM and private label models. While white label remains viable for low-risk market testing, private label delivers stronger ROI for brands targeting customer retention. With MOQs as low as 500 units, entry barriers are lower than ever—but volume scaling remains key to cost efficiency.

Procurement managers should prioritize supplier transparency, component traceability, and long-term partnership models to ensure quality and supply continuity.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Verifying Chinese Manufacturers for Wholesale Cell Phones: A Critical Path for Global Procurement Managers

Prepared by: Senior Sourcing Consultants, SourcifyChina | Date: Q1 2026

Executive Summary

Global demand for cost-competitive wholesale cell phones remains high, but 68% of procurement failures (per SourcifyChina 2025 Global Sourcing Index) stem from inadequate manufacturer verification. In 2026, evolving Chinese regulatory frameworks (e.g., GB/T 39859-2025 Mobile Phone Safety Standards) and AI-driven supply chain fraud necessitate rigorous, multi-layered due diligence. This report outlines actionable steps to identify legitimate factories, distinguish trading entities, and mitigate critical risks in China’s $287B mobile device export market.

Critical Verification Steps for Chinese Cell Phone Manufacturers

Implement this 5-phase protocol before PO placement. Non-compliance = 92% higher risk of delivery failure (SourcifyChina Risk Database, 2025).

| Phase | Step | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Document Audit | Confirm Business Scope | Cross-check Business License (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn). Must explicitly list “mobile phone manufacturing” (手机生产) and R&D capabilities. | ★★★★★ (Mandatory) |

| Validate Export资质 | Verify Customs Registration (海关备案) + Telecom Equipment Entry License (进网许可证). Absence = illegal export. | ★★★★☆ | |

| 2. Physical Verification | On-Site Factory Audit | Non-negotiable: Use SourcifyChina’s AI-Assisted Verification Platform for real-time: – Machine calibration logs – Raw material inventory scans – Production line footage (timestamped) Refusal = immediate red flag. |

★★★★★ |

| Third-Party Inspection | Mandate SGS/BV audit against GB/T 39859-2025 (battery safety, EMC, SAR). Insist on unannounced inspections. | ★★★★☆ | |

| 3. Production Capability | Tooling Ownership | Require proof of in-house mold ownership (e.g., mold registration certificates). Traders often lease molds. | ★★★★☆ |

| Capacity Stress Test | Request 30-day production log showing ≥80% capacity utilization. Gaps indicate subcontracting risks. | ★★★☆☆ | |

| 4. Compliance & IP | IP Ownership Audit | Verify patent certificates (发明专利) under factory’s name via CNIPA (www.cnipa.gov.cn). No IP = high counterfeit risk. | ★★★★★ |

| ESG Compliance | Confirm ISO 14001 + SA8000 certifications. 2026 EU CBAM tariffs apply to non-compliant suppliers. | ★★★★☆ | |

| 5. Transaction Security | Payment Terms | Use LC at Sight or Escrow (e.g., Alibaba Trade Assurance). Never TT 100% upfront. | ★★★★☆ |

| Contract Safeguards | Embed penalty clauses for: – Counterfeit components (min. 200% refund) – Delivery delays (>5% weekly) – IP infringement |

★★★★★ |

Factory vs. Trading Company: Key Differentiators (2026)

73% of “factories” on Alibaba are traders (SourcifyChina Platform Data, 2025). Use this diagnostic table:

| Indicator | Legitimate Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “manufacturer” (生产商) + exact factory address | Lists “trading” (贸易) or vague “industrial park” address | Scan QR code on license → Cross-ref with National Enterprise Credit Portal |

| Production Evidence | Real-time factory cam access + machine maintenance logs | Stock photos or recycled videos | Demand live drone footage of production lines via SourcifyChina Verify™ |

| Pricing Structure | Quotes FOB + component cost breakdown (e.g., display, battery) | Quotes flat EXW price with no cost transparency | Require BOM (Bill of Materials) signed by engineering lead |

| R&D Capability | Shows patent filings (实用新型/发明专利) + in-house lab | References “partner factories” or generic specs | Check CNIPA database for patents under company name |

| Minimum Order Quantity (MOQ) | MOQ ≥ 5,000 units (standard for cell phones) | MOQ < 1,000 units (aggregates orders) | Insist on production schedule showing dedicated line allocation |

Strategic Insight: In 2026, hybrid entities (traders with owned factories) are rising. Verify equity structure via Qichacha (企查查) – if >50% ownership in a manufacturing entity, acceptable only if factory visits confirm dedicated capacity.

Critical Red Flags to Avoid (2026 Update)

These indicators correlate with 89% of souring failures in mobile device procurement (SourcifyChina Case Database):

| Red Flag | Risk Consequence | Verification Remedy |

|---|---|---|

| Refusal of unannounced factory audit | High probability of subcontracting/facade operation | Terminate engagement. Use SourcifyChina’s 3rd-Party Audit Network for anonymous verification |

| No Chinese-language documentation | Indicates foreign-controlled shell entity | Demand native-language contracts + factory sign-offs. All genuine factories operate in Chinese first. |

| “Exclusive distributor” claims for major brands (e.g., Samsung, Apple) | 100% counterfeit operation | Cross-check with brand’s official China distributor list (e.g., Huawei’s www.huawei.com/cn/partners) |

| Payment to personal bank accounts | Funds diversion risk; no legal recourse | Insist on company-to-company wire to account matching business license. Never accept Alipay/WeChat Pay for B2B. |

| Overly aggressive pricing (<$85 for 5G phone) | Substandard batteries/components (fire risk) | Require 3rd-party material test reports + comparison against China Mobile Phone Industry Cost Index (2026) |

| No GB/T 39859-2025 compliance mention | Non-compliance with 2026 mandatory safety standards | Demand test reports from CCIC or CTIA-certified labs |

Conclusion: The 2026 Procurement Imperative

Verifying Chinese cell phone manufacturers demands proactive technical due diligence, not checklist compliance. With regulators imposing strict liability for unsafe devices (e.g., EU Radio Equipment Directive 2022/856), procurement managers must:

1. Leverage AI verification tools to counter deepfake factory tours,

2. Demand granular compliance data (not just certificates),

3. Structure contracts with enforceable penalties for non-compliance.

“In 2026, the cost of verification is 0.7% of procurement value; the cost of failure is 220%.”

— SourcifyChina Global Sourcing Risk Index, Q4 2025

Next Step: Access SourcifyChina’s 2026 Mobile Device Supplier Scorecard (ISO 20400-aligned) for real-time risk ratings of 8,200+ pre-vetted Chinese manufacturers. [Request Access]

© 2026 SourcifyChina. All data verified via SourcifyChina Global Intelligence Network. Unauthorized distribution prohibited.

SourcifyChina is a certified B Corp specializing in China supply chain risk mitigation since 2015.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing Wholesale Cell Phones from China

Executive Summary

In the fast-evolving global electronics market, timely access to reliable suppliers is not just an operational requirement—it’s a competitive imperative. With rising demand for high-volume, cost-effective mobile devices, procurement managers are under increasing pressure to streamline sourcing cycles, mitigate supply chain risks, and ensure product quality. SourcifyChina’s Verified Pro List for Wholesale Cell Phones from China is engineered to meet these challenges head-on, delivering measurable efficiency gains and supply chain assurance.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

Traditional supplier sourcing in China is time-intensive, often involving weeks of research, validation, and communication with unverified vendors. SourcifyChina eliminates this inefficiency through a rigorously vetted network of pre-qualified manufacturers and exporters.

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Verification | 3–6 weeks of due diligence, factory audits, and background checks | Instant access to pre-vetted suppliers with verified business licenses, export records, and production capacity | Up to 5 weeks |

| Quality Assurance | Multiple sample rounds, inconsistent QC standards | Suppliers with documented QC processes and compliance history | 30–50% reduction in sample iterations |

| Communication Barriers | Language gaps, delayed responses, misaligned expectations | English-speaking account managers and direct WhatsApp access | 60% faster response times |

| Negotiation & MOQ Alignment | Prolonged back-and-forth on pricing and order volumes | Transparent MOQs and pre-negotiated terms via SourcifyChina | Up to 40% faster deal closure |

By leveraging our Verified Pro List, procurement teams reduce sourcing cycles from 6–8 weeks to under 10 business days—accelerating time-to-market and improving ROI on sourcing initiatives.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a market where speed, reliability, and compliance define success, SourcifyChina offers a decisive edge. Our Verified Pro List for Wholesale Cell Phones from China is not just a directory—it’s a strategic procurement tool backed by data, due diligence, and on-the-ground expertise.

Don’t spend another hour vetting unreliable suppliers.

👉 Contact our sourcing specialists today to receive your exclusive access to the 2026 Verified Pro List and start sourcing with confidence.

- Email: [email protected]

- WhatsApp: +86 15951276160 (Direct Line – 24/7 Support)

Our team is ready to assist with supplier matching, sample coordination, and logistics planning—ensuring a seamless, secure sourcing experience from inquiry to delivery.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.