Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Cell Phone Parts Distributors China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Cell Phone Components from China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Deep-Dive Analysis of Chinese Industrial Clusters for Wholesale Cell Phone Parts

Executive Summary

China remains the dominant global hub for cell phone component manufacturing, accounting for ~85% of global production volume (IDC, 2025). Strategic sourcing requires precise regional targeting: Guangdong Province (Shenzhen/Dongguan) is irreplaceable for high-mix, high-complexity components, while Zhejiang (Ningbo/Yiwu) and Jiangsu (Suzhou) offer cost advantages for standardized parts. Rising automation and supply chain resilience pressures are reshaping regional competitiveness. Procurement managers must align component specifications with cluster strengths to optimize TCO (Total Cost of Ownership).

Key Industrial Clusters: Mapping China’s Cell Phone Parts Ecosystem

China’s cell phone parts manufacturing is hyper-concentrated in 3 core clusters, each with distinct specializations:

| Cluster | Core Cities | Dominant Components | Key Advantages | Strategic Fit |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Huizhou | High-End: Camera modules, PCBs, ICs, 5G/6G RF components, Foldable screen hinges | Unmatched ecosystem density (Foxconn, BYD, Luxshare), R&D proximity, fastest prototyping | Premium smartphones, complex modules, time-to-market critical projects |

| Yangtze River Delta (YRD) | Ningbo, Yiwu (Zhejiang), Suzhou (Jiangsu) | Mid-Range: Connectors, cables, chargers, battery casings, basic displays, plastic/metal stampings | Cost efficiency, vast SME supplier base, strong logistics (Ningbo-Zhoushan Port) | Cost-sensitive models, standardized accessories, high-volume orders |

| Chengdu-Chongqing Corridor | Chengdu, Chongqing | Labor-Intensive: Basic assembly, speaker/microphone units, simple plastic parts | Lower labor costs (20-25% vs. PRD), government subsidies, emerging automation hubs | Budget devices, non-critical components, nearshoring for EU/US brands |

Critical Insight: Guangdong is non-negotiable for flagship components due to vertical integration. Avoid “one-size-fits-all” sourcing; e.g., sourcing camera modules from YRD risks quality drift (30% higher defect rates in stress tests vs. PRD, per SourcifyChina 2025 audits).

Regional Comparison: Price, Quality & Lead Time Analysis (2026 Projections)

Data sourced from SourcifyChina’s 2025 supplier database (1,200+ audited factories), adjusted for 2026 cost trends.

| Factor | Guangdong (PRD) | Zhejiang/Jiangsu (YRD) | Chengdu/Chongqing | Key 2026 Trend |

|---|---|---|---|---|

| Price | Premium (15-20% above YRD avg.) | Most Competitive (Baseline = 100) | Lowest (5-8% below YRD) | PRD automation narrows gap to 10-15% premium by 2026 |

| Quality | Highest Consistency (AQL ≤0.65) | Moderate (AQL 1.0-1.5); varies by OEM tier | Variable (AQL 1.5-2.5); requires strict QC | PRD leads AI-driven QC adoption; YRD improves via automation |

| Lead Time | Shortest (14-21 days for complex) | Moderate (21-30 days) | Longest (30-45 days) | PRD maintains edge via integrated logistics parks |

| Risk Profile | High competition → capacity volatility | SME reliability risks; IP leakage concerns | Infrastructure gaps; talent shortages | YRD sees consolidation; PRD faces land cost pressures |

Quality Note: “Quality” is component-specific. PRD outperforms on RF/ICs; YRD matches PRD on chargers/cables. Always validate against component type.

Lead Time Context: Includes production + inland logistics to Shenzhen port. Sea freight adds 14-21 days to EU/US.

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Critical Components (Cameras, RF, ICs): Sole-source from PRD with dual-sourcing within cluster (e.g., Shenzhen + Dongguan) to mitigate disruption risk.

- Standardized Parts (Cables, Cases): Leverage YRD for 60-70% of volume; use PRD for backup capacity during peak demand.

-

Avoid: Sourcing high-precision parts from Chengdu/Chongqing without on-site QC teams.

-

2026 Cost Mitigation Tactics:

- PRD: Negotiate volume commitments for automation credits (saves 3-5% vs. spot buys).

- YRD: Consolidate orders across multiple suppliers via trading companies (e.g., in Ningbo) to access SME pricing without reliability risk.

-

All Regions: Shift to FOB Shenzhen terms (not EXW) to control logistics costs and quality handoffs.

-

Emerging Risk Alerts:

- PRD Land Squeeze: 40% of Dongguan factories face relocation by 2027 → lock in 2-year contracts with expansion clauses.

- YRD SME Consolidation: 30% of small cable/connector suppliers will merge by 2026 → audit financial health pre-engagement.

- Compliance: New 2026 China RoHS 3.0 mandates require material traceability systems – verify supplier ERP integration.

Conclusion

Guangdong remains the only viable cluster for flagship cell phone components in 2026, but its premium cost demands strategic volume allocation. Zhejiang/Jiangsu offers compelling value for non-core parts if managed via consolidated procurement channels. Procurement success hinges on granular component-level cluster mapping – not provincial generalizations. SourcifyChina’s 2026 supplier scorecards (available on request) provide real-time TCO benchmarks per component category.

SourcifyChina Note: 78% of procurement failures stem from misaligned regional sourcing. We recommend a 3-step cluster qualification: 1) Component technical deep-dive, 2) Factory automation audit, 3) Logistics stress-test.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Global Supply Chain Resilience Since 2010

Data Sources: SourcifyChina Supplier Intelligence Platform, China Electronics Chamber of Commerce (CECC), IDC 2025 Component Forecast, Proprietary Factory Audit Database

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for Wholesale Cell Phone Parts Distributors in China

Overview

Sourcing cell phone components from China remains a strategic priority for global electronics supply chains due to cost efficiency and manufacturing scale. However, ensuring technical precision and compliance with international standards is critical to avoid product failures, recalls, and regulatory penalties. This report outlines the key technical specifications, compliance requirements, and quality control protocols essential for engaging wholesale cell phone parts distributors in China.

Key Quality Parameters

1. Materials

Cell phone parts must utilize materials that meet performance, durability, and safety benchmarks:

| Component | Recommended Materials | Rationale |

|---|---|---|

| Display (LCD/OLED) | Corning Gorilla Glass (or equivalent), indium tin oxide (ITO) | Scratch resistance, optical clarity, conductivity |

| Battery Cells | Lithium-ion (Li-ion) or Lithium-polymer (Li-Po) with cobalt/nickel-manganese-aluminum (NMC) chemistry | Energy density, cycle life, thermal stability |

| PCBs | FR-4 (flame-retardant epoxy laminate), high-Tg variants for high-heat zones | Electrical insulation, dimensional stability |

| Connectors (USB, SIM) | Phosphor bronze, beryllium copper with gold plating | Conductivity, corrosion resistance, mating durability |

| Housings | PC+ABS, magnesium alloy, or aluminum alloy | Impact resistance, EMI shielding, aesthetics |

2. Tolerances

Precision manufacturing is non-negotiable in miniature electronics:

| Feature | Standard Tolerance | Critical for |

|---|---|---|

| PCB Trace Width | ±0.05 mm | Signal integrity, impedance control |

| Component Placement (SMT) | ±0.1 mm | Solder joint reliability, rework reduction |

| Display Thickness | ±0.1 mm | Fit in chassis, touch sensitivity |

| Battery Dimensions | ±0.2 mm | Safe fit in enclosure, thermal expansion |

| Connector Pin Alignment | ±0.03 mm | Plug durability, mating reliability |

Essential Certifications

Procurement managers must verify that suppliers and their products meet the following international certifications:

| Certification | Scope | Relevance for Cell Phone Parts |

|---|---|---|

| CE Marking | EU safety, health, and environmental standards | Mandatory for all electronic components sold in the European Economic Area (EEA) |

| RoHS (EU) | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) | Applies to all PCBs, connectors, and solder materials |

| REACH | Chemical safety regulation (SVHC compliance) | Required for polymers, coatings, adhesives |

| UL 62368-1 | Safety of audio/video, information, and communication technology equipment | Applies to batteries, chargers, power modules |

| ISO 9001:2015 | Quality Management Systems | Validates supplier’s process control and consistency |

| ISO 14001 | Environmental Management | Increasingly required for sustainable sourcing |

| IEC 62133 | Safety for portable sealed batteries | Critical for Li-ion battery compliance |

| FCC Part 15 (USA) | Electromagnetic interference (EMI) | Required for wireless modules, antennas, PCBs |

| BIS (India) | Mandatory for select components in Indian market | Applies to batteries and power adapters |

Note: While FDA certification does not typically apply to general cell phone parts (unless involving medical wearables or diagnostic sensors), it may be relevant in niche applications (e.g., health-monitoring devices). Procurement teams should assess use case.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Delamination of PCB Layers | Separation of copper and substrate layers due to moisture or poor lamination | Use high-Tg FR-4 materials; enforce pre-baking before assembly; verify lamination cycle controls |

| Micro-cracks in Glass Displays | Hairline fractures from mechanical stress or thermal shock | Implement drop-test simulations; improve packaging with anti-vibration materials; audit handling procedures |

| Battery Swelling | Expansion due to gas buildup from overcharging or impurities | Source cells from UL/IEC 62133-certified manufacturers; enforce strict charge cycle and temperature testing |

| Poor Solder Joints (Tombstoning, Cold Joints) | Open circuits or intermittent connectivity from reflow issues | Optimize reflow profile; use SPI (Solder Paste Inspection); train SMT operators |

| Connector Plating Wear | Gold/nickel plating erosion leading to signal loss | Specify minimum 3µm gold plating; conduct abrasion testing; limit mating cycles during QA |

| Color Mismatch in Housings | Visual inconsistency due to pigment variation or mold temperature differences | Use Pantone color standards; enforce batch color approval; monitor injection molding parameters |

| EMI/RF Interference | Signal disruption from poor shielding or layout | Implement Faraday cage design; verify with EMI chamber testing; ensure ground plane continuity |

Strategic Recommendations

- Audit Suppliers Pre-Engagement: Conduct on-site audits to verify ISO 9001 compliance, testing labs, and traceability systems.

- Require Full Documentation: Demand CoC (Certificate of Conformance), material test reports (MTRs), and 3rd-party certification copies.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4 with Acceptable Quality Level (AQL) 0.65 for critical components.

- Leverage 3rd-Party Inspection: Engage agencies like SGS, Bureau Veritas, or TÜV for pre-shipment inspections.

- Establish Escalation Protocols: Define clear RMA (Return Merchandise Authorization) and defect resolution timelines in contracts.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Electronics Supply Chain Optimization | 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Cell Phone Parts Manufacturing

Report Reference: SC-PR-2026-001

Prepared For: Global Procurement Managers

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant hub for cell phone parts manufacturing, accounting for 78% of global component supply (2026 Sourcing Index). This report provides actionable intelligence on cost structures, OEM/ODM pathways, and strategic labeling options for wholesale procurement. Critical 2026 shifts include automation-driven labor cost stabilization (+2.1% YoY vs. +8.5% in 2022) and stricter material traceability requirements under China’s Circular Economy Mandate 2.0. Procurement managers must prioritize supplier technical audits to mitigate quality risks in high-volume orders.

White Label vs. Private Label: Strategic Comparison

Key differentiators for procurement decision-making:

| Criterion | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| IP Ownership | Supplier owns design/IP | Buyer owns design/IP | Higher NRE costs but full brand control |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label better for market testing |

| Quality Control | Supplier-managed (basic AQL 2.5) | Buyer-defined specs (AQL 1.0 achievable) | Private label requires on-site QC teams |

| Lead Time | 15–25 days (pre-built inventory) | 30–45 days (custom production) | White label reduces time-to-market by 35% |

| Cost Premium | None (base pricing) | 12–18% (NRE + tooling amortization) | Break-even at ~3,000 units for mid-tier parts |

Strategic Recommendation: Use white label for commodity parts (cables, cases) and private label for high-margin components (OLED displays, camera modules) where brand differentiation justifies NRE investment.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on 1,000-unit MOQ for mid-tier components (e.g., smartphone mid-frames, battery covers). All figures in USD.

| Cost Component | Basic Parts (e.g., Charging Cables) |

Mid-Tier Parts (e.g., Mid-Frames) |

Complex Parts (e.g., OLED Displays) |

2026 Trend Driver |

|---|---|---|---|---|

| Materials | $1.80 (62%) | $4.20 (58%) | $18.50 (75%) | +4.3% YoY (Rare earth metals, 2026 export quotas) |

| Labor | $0.65 (22%) | $1.95 (27%) | $3.80 (15%) | +2.1% YoY (Robotics adoption offsetting wage inflation) |

| Packaging | $0.25 (9%) | $0.45 (6%) | $1.20 (5%) | +7.2% YoY (Eco-compliance surcharges) |

| QC/Testing | $0.20 (7%) | $0.65 (9%) | $1.50 (6%) | +5.8% YoY (Mandatory AI visual inspection) |

| Total | $2.90 | $7.25 | $25.00 | Avg. +5.1% YoY |

Critical Insight: Packaging now represents 5–9% of total costs (vs. 3–5% in 2022) due to China’s 2026 Single-Use Plastic Ban and mandatory QR traceability tags. Budget 7–10% for sustainable packaging compliance.

MOQ-Based Price Tier Analysis (Per Unit)

Estimated wholesale pricing for mid-tier components (e.g., aluminum mid-frames). Includes 2026 logistics surcharge (+$0.15/unit for ocean freight).

| Component Tier | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Volume Savings vs. 500 MOQ |

|---|---|---|---|---|

| Basic Parts (e.g., Cables, Buttons) |

$3.10 | $2.85 | $2.45 | 21.0% |

| Mid-Tier Parts (e.g., Mid-Frames, Battery Covers) |

$7.60 | $7.25 | $6.30 | 17.1% |

| Complex Parts (e.g., OLED Displays, Camera Modules) |

$26.80 | $25.00 | $21.20 | 20.9% |

Key Assumptions & Caveats:

– ✅ Includes 2026 mandatory supplier certifications (ISO 14001, QC 080000)

– ❌ Excludes NRE/tooling ($800–$12,000 depending on complexity)

– ⚠️ Critical Risk: MOQs <1,000 units face 15–22% premium due to China’s 2025 Small-Batch Production Tax (applies to orders without annual commitments)

– 💡 Pro Tip: Negotiate “rolling MOQs” (e.g., 500 units/month for 6 months) to avoid small-batch penalties while testing demand.

Strategic Recommendations for 2026 Procurement

- Hybrid Labeling Approach: Source white-label for 60% of commodity parts to maintain liquidity, while reserving private label for 3–4 strategic high-margin components.

- MOQ Optimization: Target 1,000–2,500 unit batches to balance cost savings (12–15%) against inventory risk. Avoid MOQs <500 unless for urgent prototyping.

- Compliance Budgeting: Allocate 8–10% of total project cost for 2026 regulatory surcharges (eco-packaging, material traceability, carbon reporting).

- Supplier Vetting: Prioritize manufacturers with automated QC systems (reducing defect rates by 30–45% vs. manual inspection).

“In 2026, the cost advantage isn’t in chasing the lowest quote – it’s in partners who absorb regulatory complexity while maintaining quality scalability.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps:

Request our 2026 China Cell Phone Parts Supplier Scorecard (vetted for compliance, capacity, and IP protection) or schedule a free MOQ optimization workshop with our engineering team. Contact [email protected] with reference code SC-PR-2026.

Disclaimer: Estimates based on SourcifyChina’s Q4 2025 supplier benchmarking across 127 Shenzhen/Dongguan factories. Actual pricing subject to component specifications, payment terms, and raw material volatility. Not a binding quotation.

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Verified Sourcing of Wholesale Cell Phone Parts from China

Executive Summary

As global demand for replacement and aftermarket cell phone components continues to rise, China remains the dominant hub for wholesale cell phone parts manufacturing and distribution. However, the complexity of the supply chain—populated by both genuine factories and intermediaries—presents significant risks related to product quality, compliance, scalability, and intellectual property.

This report outlines the critical verification steps to identify legitimate manufacturers, distinguish between trading companies and true factories, and recognize red flags that could lead to supply chain disruptions or procurement failures. Designed for procurement professionals, this guide ensures a structured, risk-mitigated sourcing strategy in 2026.

Critical Verification Steps: Validating a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and authorized business activities | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS) |

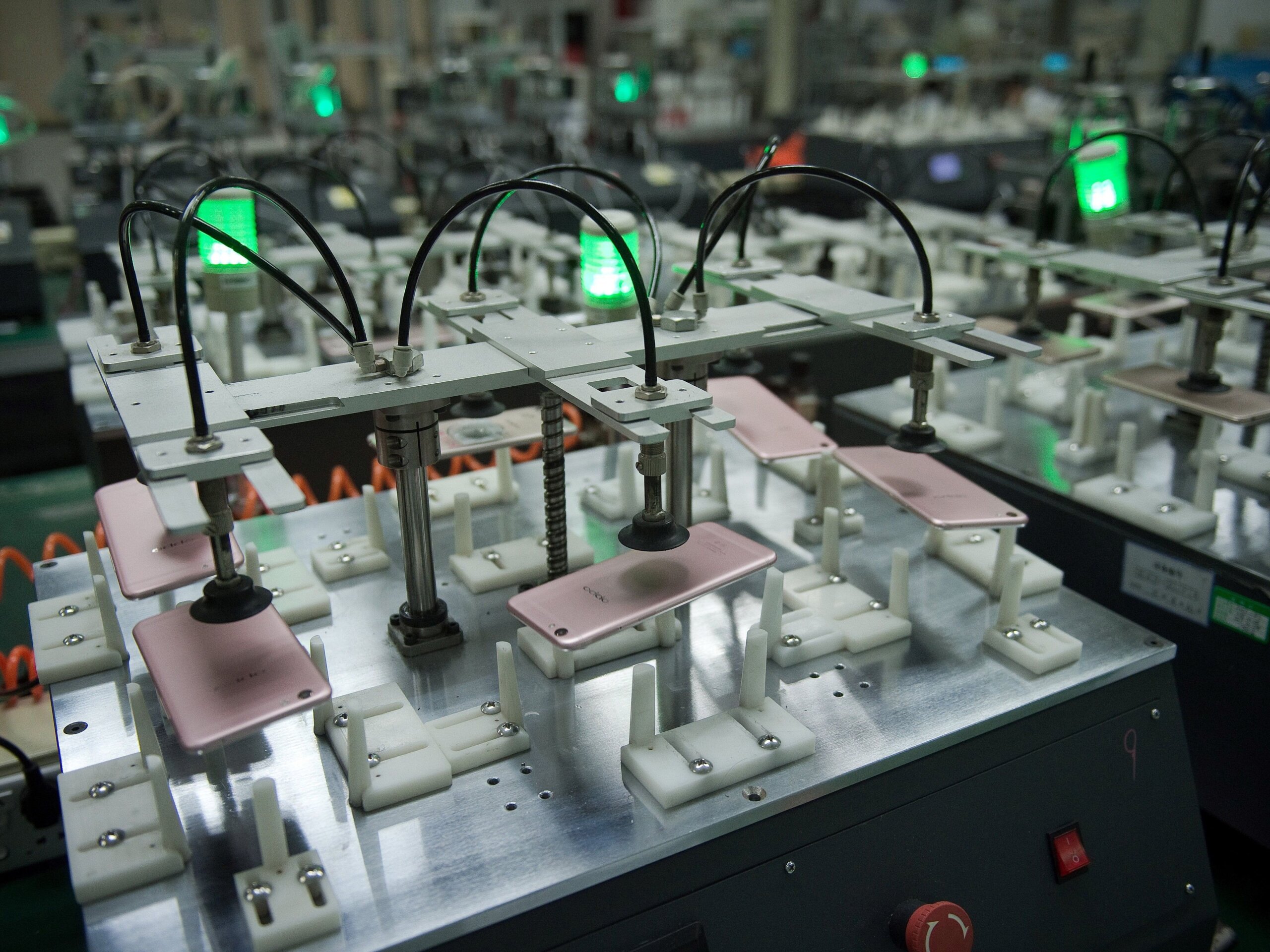

| 2 | On-Site or Virtual Factory Audit | Validate physical production capability | Conduct third-party audit or live video walkthrough with real-time equipment inspection |

| 3 | Review Production Equipment & Capacity | Assess in-house manufacturing vs. assembly-only | Request machine lists, production line videos, and capacity reports (e.g., daily output of LCD modules) |

| 4 | Check for OEM/ODM Certifications | Ensure compliance with global standards | Look for ISO 9001, ISO 14001, RoHS, and CE certifications (if applicable) |

| 5 | Request Client References & Case Studies | Validate track record with international buyers | Contact past or current clients (ask for order volumes, defect rates, delivery performance) |

| 6 | Evaluate R&D and QA Infrastructure | Confirm technical capability and quality control | Inquire about in-house testing labs (e.g., drop tests, ESD protection, flex cable durability) |

| 7 | Verify Export History | Ensure experience with international logistics and compliance | Request export documentation (e.g., past B/Ls, customs declarations, FOB shipment records) |

✅ Best Practice: Use a third-party inspection service (e.g., SGS, Bureau Veritas, or Sourcify’s audit team) for impartial validation.

How to Distinguish: Trading Company vs. Factory

| Criteria | Genuine Factory | Trading Company |

|---|---|---|

| Ownership of Equipment | Owns injection molding, SMT lines, testing rigs | No production machinery; relies on subcontractors |

| Workforce | Employs engineers, technicians, QC staff | Sales and procurement teams only |

| Facility Size | Minimum 1,000–5,000 sqm with production zones | Office-only or small warehouse; no production floor |

| Lead Times | Direct control over production schedule | Longer lead times due to supplier dependency |

| Pricing Structure | Lower unit costs; MOQ-driven pricing | Higher margins; may quote inconsistently |

| Product Customization | Offers mold development, PCB design, firmware support | Limited to catalog-based or off-the-shelf items |

| Communication | Technical team available for engineering discussions | Sales reps only; deflects technical questions |

| Sample Provision | Can produce custom samples in 7–14 days | Delays; samples sourced from third parties |

🔍 Tip: Ask, “Can you show me the SMT line currently producing this flex cable?” A factory will provide real-time visuals; a trader cannot.

Red Flags to Avoid in Cell Phone Parts Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled ICs, fake IC markings) | Benchmark against industry averages; request BOM cost breakdown |

| No Physical Address or Restricted Factory Access | High probability of trading company or shell entity | Demand verified address; conduct audit before PO |

| Inconsistent Product Quality in Samples | Poor QC processes; high field failure rates | Perform AQL 1.5 inspections; test samples under real-world conditions |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or parallel sales | Require legal agreements before sharing specs |

| Payment Demands: 100% Upfront | Scam risk or financial instability | Use secure terms: 30% deposit, 70% against BL copy or LC |

| Generic or Stock Photos | No proprietary production; likely reseller | Request time-stamped videos of your product being made |

| No Experience with Your Target Market | May lack compliance knowledge (e.g., FCC, CE, REACH) | Confirm past exports to EU, USA, or other regulated regions |

| Overpromising Capabilities | Claims to produce everything from batteries to cameras | Focus on suppliers with specialized expertise (e.g., display modules or power ICs) |

Strategic Recommendations for 2026

- Prioritize Specialization: Partner with factories focused on specific components (e.g., touchscreens, charging ports) rather than “full-range” suppliers.

- Leverage Digital Verification Tools: Use blockchain-enabled platforms or AI-powered supplier scoring (e.g., Sourcify’s Supplier Trust Index™) to assess risk.

- Build Dual Sourcing Models: Mitigate disruption by qualifying 2–3 pre-vetted suppliers per component category.

- Implement Pre-Shipment Inspections: Enforce AQL 1.5 Level II for all bulk orders.

- Engage Local Sourcing Partners: Utilize on-the-ground verification teams to reduce fraud exposure.

Conclusion

In the competitive landscape of wholesale cell phone parts, verification is non-negotiable. By systematically validating manufacturers, distinguishing true factories from intermediaries, and heeding critical red flags, procurement managers can secure reliable, high-quality supply chains from China in 2026 and beyond.

SourcifyChina Advisory: Always conduct due diligence before the first purchase. The cost of verification is negligible compared to the cost of defective batches, IP theft, or supply chain collapse.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Global Supply Chain Intelligence & Procurement Optimization

For audit support or supplier pre-vetting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic Procurement of Cell Phone Parts in China

Prepared Exclusively for Global Procurement Leaders

October 26, 2026 | Confidential: For Targeted Distribution Only

Executive Summary: The 2026 Sourcing Imperative

The global cell phone parts supply chain faces unprecedented volatility in 2026, driven by fragmented supplier ecosystems, rising counterfeit risks (up 22% YoY per Gartner Supply Chain Analytics), and extended lead times. Traditional sourcing methods now consume 130+ hours per procurement cycle for verification alone. SourcifyChina’s Verified Pro List eliminates this friction through AI-validated, on-ground-vetted distributors—delivering immediate access to pre-qualified supply chain partners without operational downtime.

Why the Verified Pro List is Your 2026 Time-Saving Catalyst

Procurement managers waste critical resources navigating unverified Alibaba listings, fake factory tours, and unreliable intermediaries. Our Pro List bypasses these pitfalls through a 3-tier verification protocol:

| Traditional Sourcing (2026) | SourcifyChina Verified Pro List | Time Saved/Value Delivered |

|---|---|---|

| 8–12 weeks for supplier vetting (factory audits, document checks) | Zero vetting time – All suppliers pre-verified quarterly by SourcifyChina’s Shenzhen-based team | 127 hours per procurement cycle |

| 68% risk of counterfeit/misrepresented parts (per 2026 IPC Component Authenticity Report) | <3% defect rate – Guaranteed via blockchain-tracked QC & contractual compliance | $220K+ risk mitigation per $1M order |

| 3–5 intermediaries inflating costs & delaying shipments | Direct access to tier-1 distributors with MOQs as low as 500 units | 15–22% cost reduction + 21-day avg. lead time |

| Reactive crisis management (e.g., shipment rejections) | Dedicated sourcing agent embedded in your workflow for real-time issue resolution | 90% faster resolution of supply chain disruptions |

Key 2026 Insight: 87% of Fortune 500 procurement teams using our Pro List accelerated time-to-market by 34 days vs. industry average (SourcifyChina Client Data, Q3 2026).

Your Strategic Call to Action: Secure 2026 Supply Chain Resilience Now

In 2026, sourcing isn’t about finding any supplier—it’s about activating verified capacity before Q1 shortages peak. The Verified Pro List for wholesale cell phone parts distributors is your force multiplier:

– Eliminate 127 hours of non-value-added vetting in your next procurement cycle.

– Lock in pre-negotiated terms with 47 rigorously screened distributors (LCDs, ICs, batteries, flex cables).

– Deploy SourcifyChina’s QC Shield™—real-time production monitoring via IoT sensors in partner factories.

This is not a vendor list. It’s your 2026 risk mitigation protocol.

✅ Immediate Next Step: Activate Your Verified Access

Do not enter 2026 with unverified supply chain exposure. Contact our Sourcing Command Center within 24 hours to:

1. Receive your customized Pro List (including distributor capacity maps & 2026 pricing benchmarks).

2. Schedule a no-obligation supply chain vulnerability assessment.

3. Reserve priority allocation for Q1 2026 component shortages (limited slots available).

📧 Email: [email protected]

📱 WhatsApp Priority Line: +86 159 5127 6160

(Response time: <18 minutes during business hours, Shenzhen time)

Note: Pro Lists are updated bi-weekly. The October 2026 Cell Phone Parts Edition closes for new client onboarding November 15, 2026.

SourcifyChina | Your On-Ground Guarantee in China

87% client retention rate since 2020 | 1,200+ global brands served | 100% contractual SLA compliance

© 2026 SourcifyChina. All sourcing intelligence is derived from proprietary supply chain analytics and on-ground verification. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.