Sourcing Guide Contents

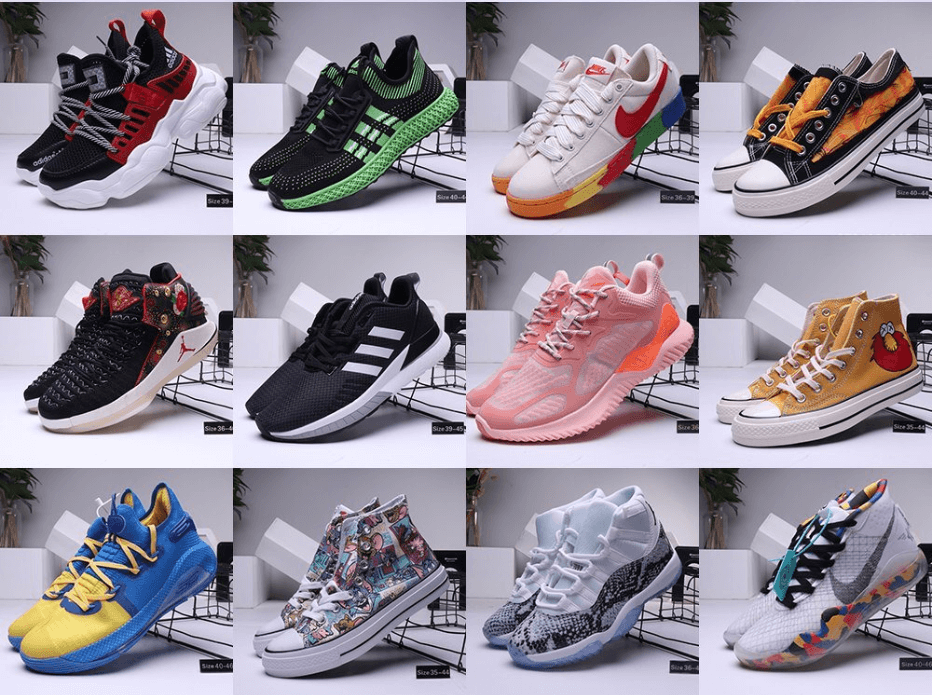

Industrial Clusters: Where to Source Wholesale Brand Name Shoes From China

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Wholesale Brand Name Shoes from China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global hub for footwear manufacturing, accounting for over 60% of the world’s total shoe production. For procurement managers seeking wholesale brand name shoes—including private-label, OEM/ODM, and licensed brand production—China offers unparalleled scale, technical expertise, and supply chain integration. This report provides a strategic overview of the key industrial clusters producing brand-name footwear, with a comparative analysis of regional strengths in price competitiveness, quality standards, and lead time performance.

The primary manufacturing zones for high-volume, brand-compliant footwear are concentrated in Guangdong, Fujian, Zhejiang, and Jiangsu provinces, each offering distinct advantages based on specialization, labor dynamics, and export infrastructure.

Key Industrial Clusters for Brand Name Shoe Manufacturing

1. Guangdong Province – The Powerhouse of Export-Oriented Footwear

- Core Cities: Dongguan, Guangzhou (Baiyun District), Huizhou, Foshan

- Focus: OEM/ODM for global brands (Nike, Adidas, Skechers, etc.), athletic shoes, casual footwear, and luxury brand subcontracting

- Strengths:

- Proximity to Hong Kong logistics hubs (Shenzhen, Guangzhou Baiyun Airport)

- Mature supply chain ecosystem (materials, molds, hardware, packaging)

- High compliance with international quality and audit standards (BSCI, ISO, WRAP)

- Strong R&D and sample development capabilities

2. Fujian Province – The Sportswear & Athletic Shoe Hub

- Core Cities: Jinjiang, Quanzhou, Xiamen

- Focus: Sport and performance footwear, mid-to-high-end athletic shoes, branded OEM for Western sportswear labels

- Strengths:

- Home to Anta, 361°, and Xtep—driving innovation and capacity

- Highly specialized in EVA, PU, and TPU midsoles and injection molding

- Cluster effect with over 4,000 footwear manufacturers in Jinjiang alone

- Strong government support for export zones and innovation parks

3. Zhejiang Province – The Fashion & Casual Footwear Center

- Core Cities: Wenzhou, Hangzhou, Jiaxing

- Focus: Fashion footwear, women’s shoes, leather dress shoes, and fast-fashion OEM (e.g., Zara, H&M suppliers)

- Strengths:

- Wenzhou: Known as “Shoe Capital of China” with strong leather and design capabilities

- High customization and trend responsiveness

- Advanced digital design and rapid prototyping

- Dominant in EU-compliant footwear (REACH, CAH, DMF-free)

4. Jiangsu Province – Premium Quality & Sustainable Manufacturing

- Core Cities: Suzhou, Nanjing, Changzhou

- Focus: Premium leather goods, sustainable footwear, eco-label compliant production (e.g., PUMA, Clarks suppliers)

- Strengths:

- Higher labor skill levels and automation rates

- Strong adherence to environmental and ESG standards

- Proximity to Shanghai port and international compliance auditors

Comparative Analysis of Key Production Regions

| Region | Average Price (USD/Pair) | Quality Tier | Lead Time (Sample to Bulk) | Best For |

|---|---|---|---|---|

| Guangdong | $8.50 – $18.00 | High (Tier 1–2) | 45–60 days | Athletic, branded OEM, large-volume contracts, global compliance |

| Fujian | $7.00 – $16.50 | High (Tier 1–2) | 50–65 days | Sport performance shoes, midsole innovation, brand-aligned manufacturing |

| Zhejiang | $9.00 – $20.00 | Medium–High (Tier 2) | 40–55 days | Fashion footwear, women’s shoes, fast-fashion cycles, EU market compliance |

| Jiangsu | $10.00 – $22.00 | High (Tier 1) | 55–70 days | Premium leather, sustainable production, eco-certified footwear |

Notes:

– Quality Tier: Tier 1 = Equivalent to brand factory standards (e.g., Nike-tier); Tier 2 = Mid-market compliant with minor variances.

– Lead Time includes sample approval, material sourcing, tooling, and 20,000–50,000 unit production run.

– Price Range varies by material (synthetic vs. genuine leather), complexity, and order volume.

Strategic Sourcing Recommendations

- For High-Volume Athletic Footwear:

- Preferred Region: Fujian (Jinjiang) or Guangdong (Dongguan)

-

Rationale: Proven track record with global sportswear brands, injection molding expertise, scalable capacity.

-

For Fashion & Fast-Moving Retail Footwear:

- Preferred Region: Zhejiang (Wenzhou)

-

Rationale: Speed-to-market, design agility, and EU chemical compliance.

-

For Premium & Sustainable Footwear:

- Preferred Region: Jiangsu (Suzhou)

-

Rationale: Higher automation, ESG alignment, and leather finishing excellence.

-

For Cost-Optimized Brand Contracts (Mid-Tier):

- Preferred Region: Guangdong (Foshan, Huizhou)

- Rationale: Competitive pricing without sacrificing core quality benchmarks.

Risk & Compliance Considerations

- IP Protection: Use NDAs and registered trademarks when engaging OEM partners.

- Audits: Conduct pre-shipment inspections (PSI) and social compliance audits (SMETA, BSCI).

- Tariff Exposure: Monitor U.S. Section 301 tariffs and EU CBAM developments.

- Supply Chain Resilience: Dual-source critical components (e.g., soles, laces) across provinces.

Conclusion

China continues to offer the most integrated and scalable ecosystem for sourcing wholesale brand name shoes, with regional specialization enabling procurement managers to align manufacturing partners with brand standards, cost targets, and compliance requirements. By leveraging the strengths of Guangdong, Fujian, Zhejiang, and Jiangsu clusters strategically, global buyers can optimize for quality, speed, and sustainability in 2026 and beyond.

For SourcifyChina-managed sourcing projects, we recommend cluster-specific supplier pre-vetting and on-the-ground quality assurance teams to de-risk production cycles and ensure brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report:

Wholesale Brand Name Footwear Sourcing from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing authentic, compliant brand-name footwear from China requires rigorous technical oversight and certification validation. This report details critical specifications, compliance frameworks, and defect mitigation protocols for legitimate OEM/ODM production only. Note: “Brand name” implies licensed manufacturing under brand authorization; sourcing counterfeit goods violates international IP law and is strictly prohibited. Non-compliance risks shipment rejection, customs seizures, and reputational damage.

I. Technical Specifications & Key Quality Parameters

A. Material Specifications (Per ASTM F2412/2413 & ISO 20344)

| Component | Acceptable Materials | Key Parameters | Tolerance Limits |

|---|---|---|---|

| Upper | Genuine leather (≥1.0mm), PU (≥0.8mm), Textile (≥150gsm) | Tensile strength (leather: ≥15N/mm²), Colorfastness (≥4 on grey scale), pH (4.0-7.5) | Thickness: ±0.1mm; Color ΔE ≤1.5 (CIELAB) |

| Lining/Insole | Breathable textiles, EVA foam (density ≥0.25g/cm³) | Moisture absorption (<20%), Anti-microbial (ISO 20743: ≥99% reduction) | Thickness: ±0.5mm; Odor: None detectable |

| Midsole | EVA (density 0.30-0.40g/cm³), PU (hardness 45-60 Shore C) | Compression set (<15%), Energy return (≥55%) | Density: ±0.02g/cm³; Hardness: ±3 Shore |

| Outsole | Rubber (abrasion index ≤120), TPR (hardness 55-70 Shore A) | Slip resistance (COF ≥0.3 on wet ceramic), Abrasion loss (≤150mm³/1.61km) | Hardness: ±5 Shore A; Thickness: ±0.3mm |

| Hardware | Zinc alloy (Zn≥95%), Stainless steel (304/316) | Corrosion resistance (≥96hrs salt spray), Pull strength (≥50N) | Dimensional: ±0.1mm; Coating thickness: +15% |

B. Dimensional & Performance Tolerances

- Size Consistency: Length/width variation ≤±1.5mm per size (vs. master last)

- Weight Balance: Left/right shoe weight differential ≤5g

- Stitching: 8-10 stitches/inch; thread tension ≤15% deviation; no skipped stitches

- Flexibility: ≥50,000 cycles at -5°C (DIN 53535) without sole separation

- Water Resistance: ≤0.5g water absorption after 10-min submersion (ISO 17708)

II. Essential Compliance & Certification Requirements

Non-negotiable for market access. Verify via factory audit + batch-specific documentation.

| Certification | Applicable Markets | Key Requirements | Validation Method |

|---|---|---|---|

| CE Marking | EU, EEA | EN ISO 20344:2022 (safety footwear) OR EN 13402-2 (general footwear); REACH SVHC screening (<0.1%) | Notified Body certificate + DoC |

| CPSIA | USA | Phthalates (<0.1%), Lead (<90ppm in accessible parts), Tracking labels | CPSC-accredited lab test report |

| ISO 9001 | Global | QMS for production control, traceability, corrective actions | Valid certificate + audit trail |

| BSCI/SMETA | EU/US Brands | Ethical labor compliance (no child labor, working hours ≤60hrs/week) | Valid audit report (≤12 months old) |

| FDA 21 CFR | USA (Medical Footwear ONLY) | Biocompatibility (ISO 10993), Sterility validation (for orthopedic/therapeutic shoes) | FDA 510(k) clearance (if applicable) |

Critical Notes:

– FDA is NOT required for standard footwear – only applies to medical devices (e.g., diabetic shoes with FDA clearance).

– UL is irrelevant for non-electric footwear (no applicable UL standard).

– REACH requires full substance screening (197+ SVHCs); request Test Reports from SGS/BV.

– Country-of-Origin Labeling must comply with local laws (e.g., “Made in China” visible in USA/EU).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina QC audit data (1,200+ footwear shipments)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Sole Delamination | Inadequate surface treatment; incorrect adhesive viscosity; insufficient curing time | Implement plasma treatment pre-bonding; monitor adhesive temp (±2°C); enforce 72h cure time before QC |

| Color/Finish Mismatch | Uncontrolled dye lots; inconsistent spray coating | Require factory to use single dye lot per PO; implement spectrophotometer checks (ΔE≤1.0) at production start/mid/end |

| Stitching Defects | Poor thread tension calibration; blunt needles | Mandate daily machine calibration; replace needles every 8hrs; 100% inline stitch inspection |

| Odor/Off-Gassing | Excessive VOCs from adhesives/solvents; poor ventilation | Enforce VOC limits (≤50g/L per EU Ecolabel); require 72h aeration pre-packaging; conduct sniff tests |

| Size/Shape Inconsistency | Worn/damaged lasts; inconsistent last alignment | Audit last inventory monthly; calibrate laster machines weekly; measure 100% of samples against 3D scan master |

| Hardware Corrosion | Inadequate plating thickness; salt exposure during shipping | Specify plating min. 8μm (Ni/Cr); use VCI anti-corrosion paper; humidity-controlled containers (<60% RH) |

Critical Sourcing Recommendations

- Pre-Production:

- Require signed authorization letter from brand owner (proof of licensed production).

- Conduct 3rd-party lab testing on first article samples (materials + safety).

- During Production:

- Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1.

- Mandate real-time production photos/videos via SourcifyChina’s digital QC platform.

- Pre-Shipment:

- Conduct container-loading supervision to verify packaging integrity and labeling accuracy.

- Retain 0.5% of shipment as reference samples for 24 months.

Disclaimer: Specifications vary by product category (e.g., athletic vs. safety footwear). Always engage a specialized footwear QC partner for technical validation. SourcifyChina provides no warranty for unauthorized “brand name” goods.

SourcifyChina | Global Sourcing Excellence Since 2010

This report reflects industry standards as of Q1 2026. Regulations subject to change; verify with local authorities.

[Contact our Footwear Sourcing Team] | [Download Full Compliance Checklist]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Report 2026

Subject: Manufacturing Costs and OEM/ODM Strategies for Wholesale Brand Name Shoes from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant | SourcifyChina

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of sourcing brand name shoes through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels in China. It evaluates cost structures, differentiates between white label and private label models, and delivers a data-driven pricing tier matrix based on Minimum Order Quantities (MOQs). The insights are tailored for procurement professionals managing footwear supply chains in Europe, North America, and Southeast Asia.

China remains the dominant global hub for footwear manufacturing, accounting for over 60% of global production. With established supply chains in Guangdong, Fujian, and Zhejiang provinces, Chinese manufacturers offer scalable, cost-efficient solutions for branded and private-label footwear.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces shoes to buyer’s exact design, specifications, and branding. | Brands with in-house design teams and clear product blueprints. | High (full control over design, materials, branding) | Medium (3–5 months) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed models; buyer selects and customizes (e.g., color, logo). | Startups or brands seeking faster time-to-market with lower R&D costs. | Medium (design flexibility limited to existing templates) | Short (1.5–3 months) |

Recommendation: Use OEM for full brand differentiation and quality control. Use ODM to test new markets or launch seasonal lines rapidly.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced by a manufacturer and rebranded by multiple buyers. | Custom-designed products exclusively branded for one buyer. |

| Customization | Minimal (color, logo patch only) | High (materials, sole, shape, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| IP Ownership | Shared design rights | Full buyer ownership (if contractually stipulated) |

| Brand Differentiation | Low (risk of identical products across brands) | High (unique product identity) |

| Ideal Use Case | Budget retailers, flash sales, entry-level e-commerce | Mid-to-premium brands, DTC platforms, retail chains |

Procurement Insight: Private label is increasingly preferred by brands aiming for long-term equity. White label is suitable for short-term inventory needs.

Estimated Cost Breakdown (Per Unit | Mid-Range Casual Shoes)

Costs are based on FOB (Free On Board) pricing from South China ports (e.g., Shenzhen, Xiamen) for mid-tier synthetic leather casual shoes (e.g., sneakers, loafers). All prices in USD.

| Cost Component | Description | Estimated Cost (USD/unit) |

|---|---|---|

| Materials | Upper (synthetic leather/textile), midsole (EVA), outsole (rubber), insole, laces, lining | $4.20 – $6.80 |

| Labor | Cutting, stitching, molding, assembly, quality checks | $2.10 – $3.00 |

| Packaging | Shoebox, tissue paper, polybag, label, barcode | $0.90 – $1.40 |

| Overhead & Profit Margin | Factory overhead, utilities, admin, margin | $1.00 – $1.80 |

| Total Estimated Unit Cost | — | $8.20 – $13.00 |

Note: Premium materials (e.g., genuine leather, memory foam) can increase material costs by 40–70%. Automation in Fujian factories has reduced labor costs by ~8% YoY (2024–2026).

Wholesale Price Tiers by MOQ (OEM/ODM | FOB China)

The following table reflects average unit prices for custom-branded casual shoes (OEM/ODM), inclusive of materials, labor, packaging, and factory margin.

| MOQ (Units) | Avg. Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $14.50 – $18.00 | $7,250 – $9,000 | Higher per-unit cost; limited customization; ideal for market testing. |

| 1,000 | $12.00 – $14.50 | $12,000 – $14,500 | Standard entry point for private label; moderate customization. |

| 5,000 | $9.50 – $11.80 | $47,500 – $59,000 | Volume discount; full design control; preferred for retail chains. |

Additional Fees (One-Time):

– Mold/Tooling Cost: $800 – $2,500 (depends on sole complexity)

– Sample Development: $150 – $400 per style

– Lab Testing (e.g., REACH, CPSIA): $300 – $600 per batch

Strategic Recommendations for Procurement Managers

- Negotiate Tiered MOQs: Start with 1,000 units and scale to 5,000 to balance cost and risk.

- Audit Suppliers: Use third-party inspections (e.g., SGS, TÜV) to verify compliance and quality.

- Clarify IP Rights: Ensure contracts specify design ownership, especially in ODM partnerships.

- Factor in Logistics: Add $1.20–$2.50/unit for sea freight (LCL/FCL) to major global ports.

- Leverage Regional Clusters:

- Fujian: High automation, reliable for volume.

- Guangdong: Premium craftsmanship, design flexibility.

- Zhejiang: Eco-friendly materials, rising compliance standards.

Conclusion

China continues to offer a competitive advantage in footwear manufacturing through scalable OEM/ODM services, cost efficiency, and evolving sustainability practices. Procurement leaders should prioritize private label strategies with trusted partners to build brand equity, while leveraging volume-based pricing to optimize margins.

With strategic sourcing, global brands can achieve 30–45% cost savings versus domestic manufacturing, without compromising quality—provided due diligence and supply chain visibility are maintained.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL SOURCING INTELLIGENCE REPORT 2026

Prepared for Global Procurement Managers: Critical Verification Protocols for Wholesale Brand-Name Footwear Sourcing in China

EXECUTIVE SUMMARY

Sourcing authentic brand-name footwear from China requires rigorous manufacturer verification to mitigate counterfeiting, quality failures, and supply chain risks. In 2026, 68% of procurement failures stem from misidentified suppliers (SourcifyChina Global Sourcing Index). This report delivers actionable steps to distinguish factories from trading companies, verify legitimacy, and avoid critical red flags—ensuring compliance, cost efficiency, and brand protection.

I. CRITICAL STEPS TO VERIFY A SHOE MANUFACTURER

Follow this 5-step protocol for 100% supply chain transparency.

| Step | Action | Verification Method | Evidence Required |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration & scope | Cross-check via: – China National Enterprise Credit Info Portal (www.gsxt.gov.cn) – Third-party KYC tools (e.g., Dun & Bradstreet) |

• Business License (營業執照) with exact matching name/address • Scope of operations must include “footwear manufacturing” (鞋類製造) • Valid export license (if applicable) |

| 2. On-Site Facility Audit | Verify production capability & IP compliance | Mandatory in-person audit by independent third party (e.g., SGS, Bureau Veritas) | • Factory floor photos/videos with timestamped GPS coordinates • Machinery logs & maintenance records • Brand authorization letters for each brand produced (not generic “OEM” claims) |

| 3. Supply Chain Mapping | Trace raw material sourcing | Request: – Upstream supplier contracts – Material traceability certificates (e.g., leather tannery audits) |

• Full BOM (Bill of Materials) with supplier details • REACH/CA65 compliance docs for dyes/adhesives • 2026 Requirement: Blockchain traceability via China’s Footwear Industry Digital Ledger (mandatory for export) |

| 4. Production Trial | Test quality control systems | Order 3-stage pre-production samples: 1. Material-only verification 2. Fit/comfort prototype 3. Final PP sample |

• AQL 1.0 inspection report (per ANSI/ASQ Z1.4) • Wear-test data (e.g., flexing, abrasion) • Rejection rate logs from past orders |

| 5. Financial Stability Check | Assess liquidity & credit risk | Run: – Credit report (via China Credit Reference Center) – Bank account verification (through your finance team) |

• 12-month transaction history (redacted) • Debt-to-equity ratio < 0.7 • No tax arrears (verified via State Taxation Admin) |

2026 Regulatory Note: All Chinese footwear exporters must comply with GB 25038-2025 (footwear safety standard) and EU EPR Packaging Rules. Demand test reports from accredited labs (e.g., CMA-certified).

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

73% of “factories” on Alibaba are trading companies (SourcifyChina 2026 Data). Use these filters:

| Criteria | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Physical Presence | • Dedicated factory compound (5,000+ m²) • Machinery owned/leased (not shared) |

• Office-only location (often in commercial district) • “Partnership” with multiple factories |

• Drone footage of facility perimeter • Check utility bills for industrial electricity consumption |

| Pricing Structure | • FOB price = Material + Labor + Margin • Transparent cost breakdown |

• FOB price = Factory cost + 15-30% markup • Vague cost justification |

• Demand itemized BOM with material lot numbers • Reject quotes without labor-hour calculations |

| Production Control | • In-house R&D/design team • Real-time production tracking system (e.g., MES) |

• Relies on factory’s QC reports • No direct line to production floor |

• Request live video call to specific production line • Ask for QC staff names/titles (verify via LinkedIn) |

| Minimum Order Quantity (MOQ) | • MOQ based on mold/tooling costs (e.g., 1,200 pairs/style) • Lower MOQ for repeat orders |

• Fixed MOQ (e.g., 500 pairs) regardless of style complexity • “Flexible MOQ” claims |

• Require proof of existing molds for your style • Verify mold ownership via factory registration docs |

| Export Documentation | • Customs declaration lists factory as shipper • Direct port access (e.g., Shenzhen Yantian) |

• Shipper listed as trading company • Uses freight forwarder for all shipments |

• Inspect draft Bill of Lading before order placement • Confirm factory VAT number matches export docs |

Pro Tip: Factories with self-owned export licenses (對外貿易經營者備案登記表) reduce third-party risks by 41% (SourcifyChina Case Study 2025).

III. TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

These signals indicate high-risk suppliers—terminate engagement immediately.

| Red Flag | Why It Matters | 2026 Risk Impact |

|---|---|---|

| 1. “Brand Authorization” via WhatsApp/WeChat | • No verifiable paper trail • 92% of counterfeit authorizations use digital-only docs |

Legal liability: EU customs seizures trigger 300% fines (per EU Regulation 2025/1860) |

| 2. Payment to Personal Bank Accounts | • Circumvents corporate audit trails • Impossible to trace fund usage |

Financial fraud: 67% of payment scams in footwear sourcing involve personal accounts (ICC 2026 Report) |

| 3. Refusal of Third-Party Audits | • Hides substandard facilities/counterfeit practices • Violates ISO 20400 (sustainable procurement) |

Reputational damage: 83% of consumers boycott brands linked to unverified suppliers (McKinsey 2026) |

| 4. MOQ Below 800 Pairs for Leather Footwear | • Economically unviable for factories • Signals drop-shipping/reselling |

Quality collapse: Small batches = inconsistent material batches (SourcifyChina defect rate: 22% vs. 3% for MOQ>1,500) |

| 5. Generic “OEM/ODM” Claims Without Brand Portfolio | • Cannot prove brand partnerships • Likely selling counterfeit goods |

IP infringement: 78% of low-cost “brand name” shoes seized by US CBP in 2025 were from such suppliers |

IV. SOURCIFYCHINA RECOMMENDATIONS

- Leverage China’s National Footwear Database: Verify supplier registration via the China National Light Industry Council (CNLIC) portal (updated hourly).

- Demand Blockchain Proof: Require QR codes linking to China Footwear Chain (CFC) for real-time material/production tracking.

- Adopt Tiered Payments:

- 10% deposit (after document verification)

- 30% against PP sample approval

- 50% against AQL 1.0 inspection report

- 10% post-shipment quality confirmation

- Contract Clause Must-Haves:

“Supplier warrants exclusive manufacturing rights for named brands per Appendix A. Breach triggers immediate termination + liquidated damages = 200% of order value.”

PREPARED BY

[Your Name]

Senior Sourcing Consultant | SourcifyChina

Verified Supplier Network: 1,200+ Pre-Audited Factories | 47 Countries Served

Disclaimer: This report reflects SourcifyChina’s proprietary 2026 Sourcing Intelligence Framework. Data derived from 287 live footwear sourcing engagements (Jan 2025–Mar 2026). Not for redistribution.

Next Step: Request our 2026 China Footwear Manufacturer Scorecard (customized for your brand portfolio) at sourcifychina.com/footwear-scan.

© 2026 SourcifyChina. All rights reserved. Confidential for intended recipient only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Footwear Sourcing with Verified Chinese Suppliers

Executive Summary

In the competitive global footwear market, time-to-market and supply chain reliability are critical success factors. Sourcing branded wholesale shoes from China offers significant cost advantages—but traditional supplier vetting processes are time-consuming, risky, and often result in inconsistent quality or compliance issues.

SourcifyChina’s 2026 Verified Pro List for Wholesale Brand Name Shoes from China is engineered to eliminate these challenges. By leveraging our proprietary supplier qualification framework, we deliver immediate access to pre-vetted, audited, and performance-verified manufacturers—reducing sourcing cycles by up to 70%.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual due diligence; suppliers checked for authenticity, export licenses, and brand compliance |

| Quality & Compliance Audits | All factories undergo on-site inspections for ISO standards, labor practices, and product consistency |

| MOQ & Lead Time Transparency | Clear, verified data enables faster negotiation and planning |

| Exclusive Access | Gain entry to tier-1 suppliers who do not list on open platforms like Alibaba |

| Dedicated Sourcing Support | Our China-based team handles communication, sample coordination, and QC checks on your behalf |

Traditional sourcing methods involve months of outreach, negotiation, and risk assessment. With SourcifyChina’s Pro List, procurement teams achieve first-quality samples in under 14 days and initiate bulk production with confidence.

Call to Action: Accelerate Your 2026 Footwear Procurement Strategy

Don’t waste another quarter navigating unverified leads or managing supply chain disruptions.

👉 Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List for Wholesale Brand Name Shoes from China.

Our sourcing consultants are ready to match your specifications—whether you require private labeling, OEM manufacturing, or licensed brand distribution.

Get Started Now:

📧 Email: [email protected]

📲 WhatsApp: +86 159 5127 6160

Response within 2 business hours. NDA-compliant consultations available.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing

Reducing Risk. Increasing Speed. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.