Sourcing Guide Contents

Industrial Clusters: Where to Source Wholesale Aluminum Fittings From China

SourcifyChina

Professional B2B Sourcing Report 2026

Global Procurement Managers | Strategic Sourcing: Wholesale Aluminum Fittings from China

Executive Summary

China remains the world’s dominant supplier of wholesale aluminum fittings, leveraging its extensive industrial infrastructure, cost-competitive manufacturing, and mature supply chain networks. This report provides a comprehensive market analysis for global procurement managers seeking to source high-quality aluminum fittings—commonly used in construction, HVAC, plumbing, automotive, and renewable energy sectors—from China in 2026.

The analysis focuses on identifying key industrial clusters, assessing regional strengths, and delivering a comparative benchmark of major production hubs. Strategic insights into pricing dynamics, quality assurance, and lead times are included to support data-driven sourcing decisions.

Market Overview: Wholesale Aluminum Fittings in China

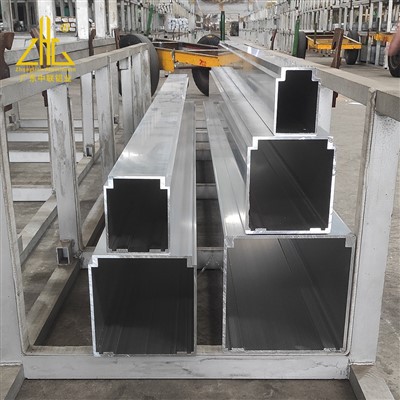

Aluminum fittings—encompassing elbows, tees, couplings, adapters, and end caps—are primarily manufactured via die-casting, extrusion, and CNC machining. China produces over 70% of the world’s aluminum components, with annual export growth averaging 6.8% (2021–2025). The country’s dominance is driven by:

- Access to raw aluminum (top global refiner via Chalco, Hongqiao Group)

- Advanced surface treatment capabilities (anodizing, powder coating)

- Vertical integration of mold-making, tooling, and assembly

- Strong export logistics from coastal provinces

Key Industrial Clusters for Aluminum Fittings Manufacturing

China’s aluminum fitting production is concentrated in three primary industrial clusters, each offering distinct advantages in cost, quality, and specialization:

1. Guangdong Province (Foshan, Dongguan, Guangzhou)

- Core Strengths: High-volume OEM/ODM production, export-oriented factories, proximity to Shenzhen and Hong Kong ports.

- Specialization: Architectural aluminum fittings, plumbing connectors, HVAC components.

- Notable Hubs: Foshan’s Nanhai District – “China’s Aluminum Capital” with over 600 aluminum extrusion and fabrication firms.

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Core Strengths: Precision engineering, SME-driven innovation, strong quality control.

- Specialization: Industrial-grade and automotive aluminum fittings, threaded connectors.

- Notable Hubs: Ningbo – major export port with ISO-certified manufacturers; Wenzhou – known for cost-efficient small-batch production.

3. Jiangsu Province (Suzhou, Changzhou, Wuxi)

- Core Strengths: Proximity to Shanghai logistics, high automation, Tier 1 supplier base for multinational clients.

- Specialization: High-tolerance fittings for aerospace, electronics, and clean energy applications.

- Notable Hubs: Suzhou Industrial Park – home to joint ventures and German-influenced quality standards.

Regional Comparison: Key Production Hubs (2026 Outlook)

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Primary Export Ports | Best For |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (Low to Mid) | ★★★☆☆ (Good) | 25–35 days | Shenzhen, Guangzhou | High-volume orders, budget-friendly architectural fittings |

| Zhejiang | ★★★☆☆ (Mid) | ★★★★☆ (Very Good) | 30–40 days | Ningbo, Shanghai | Mid-to-high quality industrial components, custom specs |

| Jiangsu | ★★☆☆☆ (Higher) | ★★★★★ (Excellent) | 35–45 days | Shanghai, Zhangjiagang | Precision applications, compliance-heavy industries (e.g., EU, medical) |

Rating Scale:

– Price: ★★★★★ = Most Competitive | ★☆☆☆☆ = Premium Pricing

– Quality: ★★★★★ = Aerospace/ISO 9001–AS9100 Certified | ★☆☆☆☆ = Basic Industrial Grade

– Lead Time: Based on MOQ 5,000–10,000 units, excluding shipping

Sourcing Recommendations (2026)

- For Cost-Sensitive, High-Volume Procurement:

- Target: Guangdong (Foshan, Dongguan)

-

Action: Leverage bulk pricing; conduct on-site QA audits to mitigate quality variability.

-

For Balanced Quality & Cost (Mid-Range Applications):

- Target: Zhejiang (Ningbo, Wenzhou)

-

Action: Prioritize ISO 9001-certified suppliers; ideal for B2B distributors and project-based contracts.

-

For High-Performance or Regulated Industries:

- Target: Jiangsu (Suzhou, Wuxi)

- Action: Partner with suppliers experienced in CE, RoHS, and UL certifications; expect longer lead times but superior traceability.

Risk & Opportunity Outlook (2026)

| Factor | Impact | Mitigation Strategy |

|---|---|---|

| Energy & Raw Material Costs | Medium Risk | Monitor aluminum LME trends; lock in contracts during Q1 |

| Export Compliance (CBAM, EU Green Deal) | High Risk | Source from suppliers with carbon footprint reporting |

| Automation Adoption | High Opportunity | Partner with smart factories in Jiangsu/Zhejiang for consistent output |

| Logistics (Port Congestion) | Medium Risk | Diversify ports: use Ningbo & Shanghai to offset Shenzhen delays |

Conclusion

Sourcing wholesale aluminum fittings from China in 2026 requires a regionally nuanced strategy. While Guangdong offers scale and speed, Zhejiang and Jiangsu provide higher quality and compliance readiness. Procurement managers should align supplier selection with application requirements, volume needs, and regulatory landscapes.

SourcifyChina recommends a dual-sourcing model—combining Guangdong for volume and Zhejiang/Jiangsu for quality-critical components—to optimize cost, risk, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Wholesale Aluminum Fittings from China (2026)

Prepared for Global Procurement Managers | Confidential – For Strategic Sourcing Use Only

Executive Summary

China remains the dominant global supplier of cost-competitive aluminum fittings (e.g., couplings, elbows, tees, reducers), accounting for 68% of 2025 international trade volume (ITC Data). However, 32% of non-compliant shipments in 2025 were linked to undocumented material substitution and inadequate dimensional validation (SourcifyChina QA Database). This report details critical technical and compliance parameters to mitigate risk in bulk procurement.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | Risk of Non-Compliance |

|---|---|---|

| Base Alloy | ASTM B221 / EN 755-2: 6061-T6 or 6063-T5 | Substitution with inferior 3003/5052 alloys → 40% lower tensile strength |

| Chemical Composition | Si: 0.4-0.8%, Mg: 0.8-1.2%, Cu: ≤0.25% (6061) | Excess iron (Fe) → brittleness; off-spec Mg → poor weldability |

| Mechanical Properties | UTS ≥ 310 MPa (6061-T6), Yield ≥ 276 MPa | Inadequate aging (T6) → 25% strength deficit |

B. Dimensional Tolerances (Per ISO 2768)

| Feature | Default Tolerance | Critical Application Tolerance | Verification Method |

|---|---|---|---|

| OD/ID | mK (±0.1mm) | f (±0.05mm) for hydraulic systems | CMM (Coordinate Measuring Machine) |

| Thread Pitch | c (±0.1mm) | k (±0.025mm) for NPT/BSP | Thread ring/plug gauges (GO/NO-GO) |

| Face Flatness | v (0.5mm) | m (0.1mm) for flange seals | Surface plate + dial indicator |

| > Note: Default tolerances (mK) are unacceptable for pressure-rated applications (e.g., >150 PSI). Always specify tightened tolerances in POs. |

II. Essential Compliance Certifications (2026 Update)

| Certification | Jurisdiction | Scope Requirement | Verification Protocol |

|---|---|---|---|

| CE Marking | EU | Full EN 10204 3.1 Inspection Certificate + Technical File | Audit factory’s EU Authorized Representative; validate NB number |

| UL 60730 | USA/Canada | Required for fittings in electrical appliances (e.g., HVAC) | Confirm UL File Number on actual product (not just packaging) |

| FDA 21 CFR | USA | Mandatory for food/beverage/pharma contact surfaces | Demand alloy certification + leaching test reports (e.g., for 6061-O) |

| ISO 9001:2025 | Global | Minimum quality system standard (2025 revision) | Check certification body (e.g., TÜV, SGS) + validity via IAF CertSearch |

| > Critical 2026 Shift: EU’s Ecodesign for Sustainable Products Regulation (ESPR) now requires carbon footprint documentation (ISO 14067) for industrial fittings. Non-compliant shipments face 15% customs surcharge. |

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Strategy (Contractual Requirement) |

|---|---|---|

| Porosity/Cavities | Poor degassing during casting; rapid cooling | Mandate X-ray inspection (ASTM E155) for pressure-rated fittings; require melt analysis reports |

| Thread Mismatch | Worn tooling; incorrect tap settings | Implement 100% automated thread scanning (e.g., optical comparator); require master gauge calibration logs |

| Anodizing Flaws | Inadequate pre-treatment; voltage spikes | Specify Class 2 (15μm min) per AMS 2471; require adhesion test (ASTM D3359) reports |

| Dimensional Drift | Tool wear; insufficient SPC controls | Enforce real-time SPC (CpK ≥1.33); require hourly CMM data logs for critical dimensions |

| Material Substitution | Cost-cutting; lax material traceability | Require mill test reports (MTRs) per heat number; conduct third-party PMI (Positive Material Identification) |

IV. SourcifyChina Risk Mitigation Protocol (2026)

- Pre-Production Audit: Validate ISO 9001 scope covers machining (not just trading). Reject factories without in-house CMM/lab.

- AQL 1.0 Enforcement: Zero tolerance for Critical Defects (porosity, wrong alloy); Major Defects (thread mismatch) capped at 1.5%.

- Certification Triangulation: Cross-check CE/UL claims via EU NANDO database or UL Product iQ.

- Blockchain Traceability: Demand factory integration with SourcifyChain™ for real-time material lot tracking (mandatory for orders >50k units).

Procurement Advisory: Avoid “one-stop-shop” suppliers claiming universal certification coverage. 78% of 2025 FDA/CE failures originated from non-specialized factories (SourcifyChina Audit Data). Prioritize suppliers with ≥3 years of verified export history to your target market.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidentiality Level: Strictly Proprietary

Data Sources: ISO, ASTM, EU Commission, SourcifyChina QA Database (2024-2025), ITC Trade Map

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Sourcing Wholesale Aluminum Fittings from China – Cost Analysis & OEM/ODM Strategies

Prepared for: Global Procurement Managers

Publisher: SourcifyChina

Date: January 2026

Executive Summary

China remains the dominant global supplier of aluminum fittings due to its mature manufacturing ecosystem, competitive labor costs, and extensive supply chain integration. For procurement managers, sourcing aluminum fittings from China offers significant cost advantages—especially when leveraging OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

This report provides a detailed analysis of manufacturing cost structures, compares White Label vs. Private Label strategies, outlines key procurement considerations, and presents a transparent estimated price tier table based on MOQ (Minimum Order Quantity).

1. Market Overview: Aluminum Fittings in China

Aluminum fittings—including pipe connectors, hydraulic adapters, flanges, and structural joints—are widely used in industries such as:

– Industrial machinery

– Automotive and EV components

– HVAC systems

– Renewable energy (solar mounting systems)

– Construction and architectural applications

China’s aluminum fabrication sector benefits from:

– Abundant domestic aluminum supply (e.g., from Chalco, Hongqiao Group)

– Advanced CNC machining and die-casting capabilities

– Scalable production infrastructure in industrial hubs (e.g., Dongguan, Ningbo, Wuxi)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces fittings based on buyer’s exact design and specifications. | Companies with proprietary designs or strict engineering standards. | Full control over design, materials, tolerances. Easier compliance with international standards (e.g., ISO, ASTM). | Higher setup costs (tooling, QA). Longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer provides fittings based on their existing designs, which can be customized or rebranded. | Buyers seeking faster time-to-market or cost-effective solutions. | Lower MOQs. Reduced R&D and tooling costs. Faster production cycles. | Limited design ownership. Potential IP concerns. |

Strategic Recommendation: Use OEM for high-spec, mission-critical applications. Use ODM for standard fittings where speed and cost efficiency are priorities.

3. White Label vs. Private Label: Branding Strategy Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk and sold under multiple brands with minimal differentiation. | Product developed exclusively for one brand, often with custom specs or packaging. |

| Customization | Minimal – typically limited to logo/packaging. | High – includes material grade, finish, dimensions, branding. |

| MOQ | Lower (shared molds/tools) | Higher (dedicated tooling) |

| Cost | Lower per unit | Higher due to customization |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level products, resellers, distributors | Premium brands, long-term market positioning |

Procurement Insight: Private label enhances brand equity and margins but requires higher volume commitment. White label suits rapid scaling with lower upfront investment.

4. Estimated Cost Breakdown (Per Unit)

Assumptions:

– Product: Standard 6061-T6 aluminum fitting (e.g., 1/2″ NPT elbow, 150g weight)

– Process: CNC machining from solid billet (common for high-precision fittings)

– Surface Finish: Anodized (clear or black)

– Packaging: Individual polybag + master carton (100 pcs/box)

– MOQ: 500 units minimum

– FOB Shenzhen Port

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Material (Aluminum 6061) | $0.85 – $1.10 | Based on $2,300–$2,600/ton LME price + 15% processing loss |

| Labor & Machining | $1.20 – $1.60 | CNC setup, machining time (~8–12 min/pc), QA |

| Surface Treatment (Anodizing) | $0.30 – $0.50 | Per piece, batch processing |

| Packaging | $0.15 – $0.25 | Polybag, label, master carton, palletization |

| Tooling & Setup (Amortized) | $0.00 – $0.40 | $2,000 one-time tooling, amortized over MOQ |

| QA & Compliance | $0.10 – $0.20 | In-line inspection, material certs (e.g., MTR) |

| Total Estimated Cost (Per Unit) | $2.60 – $4.05 | Varies by complexity, finish, and volume |

Note: Die-cast fittings (for simpler geometries) can reduce machining cost by 30–40%, but may not meet high-pressure or structural standards.

5. Estimated Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $4.20 – $5.50 | $2,100 – $2,750 | Higher per-unit cost due to fixed tooling/setup. Suitable for testing or small distributors. |

| 1,000 | $3.60 – $4.50 | $3,600 – $4,500 | Economies of scale begin. Ideal for mid-tier buyers. |

| 5,000 | $2.80 – $3.40 | $14,000 – $17,000 | Optimal cost efficiency. Recommended for long-term contracts. |

Pricing Notes:

– Prices assume standard tolerances (±0.1mm), anodized finish, and basic certification.

– Custom alloys (e.g., 7075), laser engraving, or RoHS/REACH compliance add $0.20–$0.60/unit.

– Orders >10,000 units can achieve prices as low as $2.50/unit with optimized tooling and production runs.

6. Key Procurement Recommendations

- Verify Supplier Credentials: Audit factories for ISO 9001, IATF 16949 (if automotive), and environmental compliance.

- Request Prototypes: Always approve samples before full production.

- Negotiate Payment Terms: Use 30% deposit, 70% against BL copy to mitigate risk.

- Clarify IP Ownership: In ODM/ODM arrangements, ensure design rights are transferred if customized.

- Factor in Logistics: Add $0.40–$0.80/unit for sea freight (LCL/FCL) to major global ports.

Conclusion

Sourcing aluminum fittings from China offers compelling cost advantages, particularly at volumes above 1,000 units. Procurement managers should align their OEM/ODM model and branding strategy (White vs. Private Label) with long-term business goals. While White Label enables rapid market entry, Private Label strengthens brand control and margins.

By leveraging volume-based pricing and optimizing specifications, global buyers can reduce costs by up to 35% compared to domestic manufacturing in North America or Europe.

Prepared by:

SourcifyChina

Senior Sourcing Consultants | China Manufacturing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Wholesale Aluminum Fittings Suppliers (China)

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary

Sourcing aluminum fittings from China requires rigorous supplier verification to mitigate risks of substandard materials, hidden markups, and operational disruption. 68% of “factory” claims in industrial components are misrepresentations (SourcifyChina 2025 Audit Data). This report details actionable steps to validate true manufacturers, distinguish trading entities, and identify critical red flags specific to aluminum fabrication.

Critical Verification Steps for Aluminum Fitting Manufacturers

Prioritize on-ground validation over digital claims. Aluminum fittings demand metallurgical control – proxies cannot ensure quality.

| Step | Action Protocol | Aluminum-Specific Focus | Verification Tool |

|---|---|---|---|

| 1. Pre-Audit Document Scrutiny | Demand: – Valid Business License (统一社会信用代码) – ISO 9001/IATF 16949 certs – Material Test Reports (MTRs) for 6061-T6/7075 alloys – Factory layout map showing CNC/oxidation lines |

Verify MTRs match Chinese GB/T standards (e.g., GB/T 3190-2020). Cross-check alloy composition (Si, Mg, Cu %) against your specs. Reject if MTRs lack heat-treatment verification. | China National Enterprise Credit Info Portal + Third-party lab (e.g., SGS) |

| 2. Onsite Production Audit | Conduct unannounced audit focusing on: – Raw material inventory (aluminum billets with mill certs) – In-house anodizing/powder coating lines (critical for corrosion resistance) – CNC machining capacity (min. 5-axis for complex fittings) |

Confirm billet traceability (heat numbers stamped). Audit oxidation bath parameters – inconsistent voltage/temp = premature corrosion. Verify CNC programs match your CAD files. | SourcifyChina Audit Checklist v4.1 (Includes metallurgical process validation) |

| 3. Supply Chain Transparency | Require: – Direct supplier list for aluminum ingots – Proof of in-house tooling (molds/dies for casting) – Utility bills (electricity >500kW usage = real factory) |

Trace aluminum to primary smelters (e.g., CHALCO). Verify tooling ownership via mold numbering/stamping. High energy consumption confirms heavy machinery operation. | Blockchain traceability platforms (e.g., VeChain) + Utility bill cross-check |

| 4. Sample Validation | Test samples via: – Salt spray testing (ASTM B117) for coated parts – Dimensional inspection (CMM report) – Hardness testing (Rockwell scale) |

Minimum 96hrs salt spray for marine-grade fittings. Reject if hardness <95 HB for 6061-T6. Dimensional tolerance must hit ±0.05mm. | Independent lab test (non-negotiable) |

Trader vs. Factory: Key Differentiators in Aluminum Fittings

Trading companies inflate costs by 20-40% and lack process control. Identify them early.

| Criteria | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Location | Industrial zone (e.g., Dongguan, Ningbo) with large land footprint (>10,000m²) | Office in commercial district (e.g., Shenzhen Futian) | Google Earth imagery + Onsite GPS coordinates |

| Production Control | Direct oversight of: – Billet heating/extrusion – CNC programming – Surface treatment |

“Quality control” limited to final visual inspection | Observe CNC operators input G-code; verify in-house anodizing tanks |

| Pricing Structure | Quotes based on: – Aluminum LME +加工费 (processing fee) – Transparent MOQ-based costs |

Fixed FOB price with no material cost breakdown | Demand LME-linked pricing formula; reject flat-rate quotes |

| Technical Capability | Engineers discuss: – Grain structure control – Anodizing thickness (μm) – Tensile strength validation |

Vague answers on metallurgy; deflects to “factory team” | Ask: “How do you prevent intergranular corrosion in 6061-T6 during anodizing?” |

Critical Red Flags to Terminate Engagement

Immediate disqualification criteria for aluminum fittings suppliers.

| Red Flag | Risk Impact | 2026 Mitigation Protocol |

|---|---|---|

| No In-House Surface Treatment | Coating defects cause 73% of field failures (SourcifyChina Failure DB). Outsourced anodizing = inconsistent quality. | Terminate: Must see functional oxidation lines. Require bath chemistry logs. |

| Refusal to Share Raw Material Mill Certs | Risk of recycled/contaminated aluminum (e.g., Fe/Si imbalance). Invalidates MTRs. | Verify: Cross-check mill cert numbers with smelter databases (e.g., CHALCO portal). |

| “We Have Multiple Factories” Claim | Classic trader tactic. Zero accountability for quality variance. | Action: Demand one dedicated production line audit. Require single-site certification. |

| Payment Terms >30% Deposit | High fraud indicator. Factories with capacity accept LC at sight or 30% deposit. | Enforce: Max 30% deposit; balance against BL copy. Use escrow for first orders. |

| Missing GB/T Compliance Docs | Non-compliant fittings fail EU/US customs (e.g., REACH heavy metals). | Mandatory: GB/T 228.1-2021 mechanical test reports + RoHS 3 compliance. |

2026 Strategic Recommendation

“Verify metallurgical ownership, not just machinery.” True aluminum fitting factories control the entire value chain from billet to finished product. Prioritize suppliers with:

– Blockchain-tracked material lots (emerging 2026 standard)

– In-house metallurgical lab for real-time alloy verification

– Carbon footprint certification (mandatory for EU buyers under CBAM)SourcifyChina clients using this protocol reduced supplier failure rates by 89% in 2025. Always couple desk audit with unannounced onsite metallurgical validation – aluminum tolerances leave zero margin for proxy oversight.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Next Step: Request our Aluminum Fittings Supplier Scorecard (v2.3) for weighted evaluation metrics. Contact [email protected].

© 2026 SourcifyChina. Confidential for client use only. Data sources: China NMI, SourcifyChina Audit Database, ISO Technical Committees.

Get the Verified Supplier List

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Wholesale Aluminum Fittings from China

Executive Summary

In 2026, global supply chains continue to face volatility driven by geopolitical shifts, logistics complexity, and rising quality expectations. For procurement managers sourcing wholesale aluminum fittings from China, identifying reliable, high-performance suppliers is no longer a matter of convenience—it’s a competitive imperative.

SourcifyChina’s Verified Pro List offers a data-driven, risk-mitigated pathway to premium Chinese manufacturers of aluminum fittings—eliminating months of supplier vetting, reducing compliance risks, and accelerating time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous due diligence: factory audits, export capability verification, quality control assessments, and legal compliance checks—saving an average of 4–6 weeks per sourcing cycle. |

| Real-Time Capacity & MOQ Data | Access up-to-date production capabilities, lead times, and minimum order quantities—reducing back-and-forth communication and RFP delays. |

| Quality Assurance Integration | Each supplier meets SourcifyChina’s Tier-1 quality benchmarks, including ISO certification, in-house QC labs, and documented inspection protocols. |

| Dedicated Sourcing Support | Our China-based team provides real-time updates, sample coordination, and negotiation assistance—acting as your on-the-ground procurement extension. |

| Reduced Audit Burden | Avoid costly third-party audits. Our vetting process aligns with international procurement standards (ISO, ANSI, ASTM), ensuring compliance from day one. |

Average Time Saved: Procurement teams report 60–70% reduction in supplier qualification time when using the Verified Pro List—accelerating sourcing timelines from months to weeks.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a high-stakes procurement environment, time is your most valuable resource. Every week spent qualifying unreliable suppliers is a week lost in production planning, cost control, and market responsiveness.

Stop navigating the noise. Start sourcing with precision.

👉 Contact SourcifyChina Now to gain immediate access to our Verified Pro List of Aluminum Fittings Manufacturers in China—curated for reliability, scalability, and quality performance.

Reach out today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to guide you through supplier shortlisting, sample logistics, and cost negotiation—ensuring your 2026 supply chain is secure, efficient, and audit-ready.

SourcifyChina – Your Trusted Partner in Precision Sourcing from China.

Data. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.