The global plasterboard market is experiencing steady expansion, driven by rising construction activities and demand for energy-efficient, lightweight building materials. According to Mordor Intelligence, the global gypsum boards market was valued at USD 28.3 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2029. This growth is fueled by increasing urbanization, renovations in developed regions, and infrastructure development in emerging economies. With sustainability and fire resistance becoming key priorities in modern construction, white plasterboard—known for its smooth finish, compatibility with eco-friendly paints, and superior performance in interior applications—has become a preferred choice among architects and contractors. As demand escalates, a select group of manufacturers are leading innovation, scale, and quality in the production of white plasterboard. The following list highlights the top nine manufacturers shaping the industry through technological advancements, global reach, and strong market presence.

Top 9 White Plasterboard Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 USG

Domain Est. 1996

Website: usg.com

Key Highlights: USG Corporation remains a leading manufacturer of ceiling, wall, backerboard, underlyament, gypsum, roofing, sheathing, and industrial products….

#2 Knauf

Domain Est. 1997

Website: knauf.com

Key Highlights: Leading manufacturers of construction materials utilising sustainable gypsum drywall for interior design, building insulation and design ceilings….

#3 British Gypsum

Domain Est. 2003

Website: british-gypsum.com

Key Highlights: With over 100 years’ experience in plaster, plasterboard and ceiling solutions, we create innovative product which deliver meaningful customer benefits….

#4 GYPSUM BRANDS

Domain Est. 1995

Website: saint-gobain.com

Key Highlights: OUR OFFER. We design, manufacture and supply plaster, dry lining and ceilings innovative products and systems that improve wellbeing in living spaces….

#5 CertainTeed

Domain Est. 1995

Website: certainteed.com

Key Highlights: CertainTeed is North America’s leading brand of exterior and interior products, including roofing, siding, trim, insulation, gypsum, and ceilings….

#6 National Gypsum® Company

Domain Est. 1998

Website: nationalgypsum.com

Key Highlights: National Gypsum® is a leading supplier of gypsum board and drywall products. Click here to discover more….

#7 American Gypsum Company

Domain Est. 1998

Website: americangypsum.com

Key Highlights: American Gypsum has been manufacturing, selling, and distributing gypsum wallboard products throughout the United States for over 50 years….

#8 Gypsum Plain Board

Domain Est. 2011

Website: gyproc.in

Key Highlights: Rating 4.5 (2) Gypboard Plain is a cost effective Plasterboard for standard performance and used as best substrate where SEAMLESS FINISH is required….

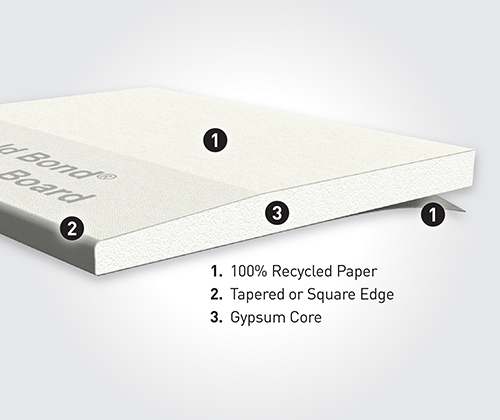

#9 Gold Bond® Gypsum Board

Domain Est. 2020

Website: goldbondbuilding.com

Key Highlights: Gold Bond Gypsum Board consists of a fire-resistant gypsum core encased in heavy, natural-finish, 100% recycled paper on the face and back sides….

Expert Sourcing Insights for White Plasterboard

H2: 2026 Market Trends for White Plasterboard

The global white plasterboard market is projected to experience steady growth through 2026, driven by rising construction activity, demand for energy-efficient buildings, and evolving architectural preferences. White plasterboard, also known as gypsum board or drywall, remains a fundamental material in both residential and commercial construction due to its versatility, fire resistance, and ease of installation.

One of the primary drivers shaping the 2026 market landscape is the global push toward sustainable construction. Regulatory frameworks in regions such as the European Union, North America, and parts of Asia-Pacific are increasingly mandating energy-efficient building materials. White plasterboard, especially products with enhanced thermal and acoustic insulation properties, aligns well with these standards. Manufacturers are responding by introducing eco-friendly variants with recycled gypsum content and low-emission manufacturing processes, further boosting market appeal.

Another significant trend is the growth of modular and prefabricated construction. As developers seek faster, more cost-effective building solutions, off-site construction methods are gaining momentum. White plasterboard is ideally suited for prefabrication due to its lightweight nature and compatibility with digital design tools. This shift is expected to increase demand, particularly in urban development and affordable housing projects.

Regionally, Asia-Pacific is anticipated to lead market growth through 2026, fueled by rapid urbanization in countries like China, India, and Vietnam. Government infrastructure initiatives and increasing foreign direct investment in real estate are contributing to strong demand for construction materials, including white plasterboard. In contrast, mature markets in North America and Europe will see moderate growth, supported by renovation and retrofitting activities in aging building stocks.

Technological advancements are also influencing product development. Smart plasterboard variants—integrated with sensors or moisture-resistant coatings—are emerging, particularly in high-end commercial applications. Additionally, digital supply chain platforms are improving distribution efficiency, enabling just-in-time delivery and reducing waste.

However, the market faces challenges, including fluctuating raw material prices—especially for natural gypsum and synthetic gypsum derived from flue gas desulfurization—and supply chain disruptions. Geopolitical tensions and energy costs may impact production margins, prompting companies to explore regional sourcing and vertical integration strategies.

In conclusion, the 2026 white plasterboard market is poised for resilient growth, underpinned by sustainability trends, technological innovation, and global construction expansion. Stakeholders who invest in green manufacturing, digital integration, and market-specific product differentiation are likely to capture significant share in this evolving landscape.

Common Pitfalls When Sourcing White Plasterboard (Quality, IP)

Sourcing white plasterboard requires careful consideration of both quality standards and intellectual property (IP) aspects. Overlooking these factors can lead to project delays, safety risks, and legal complications. Below are some common pitfalls to avoid:

Poor Quality Control and Substandard Materials

One of the most frequent issues when sourcing white plasterboard is receiving products that do not meet required performance standards. Low-quality boards may have inconsistent thickness, weak core strength, or poor moisture resistance, which can compromise structural integrity and fire safety. Always verify compliance with relevant standards such as EN 520 (Europe) or ASTM C1396 (USA), and request test certificates from suppliers.

Lack of Certification and Compliance Documentation

Reputable plasterboard should come with proper certification, including CE marking, fire ratings (e.g., A2-s1,d0), and environmental declarations (e.g., EPD). Buyers often overlook the importance of documentation, leading to installations that fail building inspections or do not meet insurance requirements. Ensure suppliers provide full technical dossiers and product traceability.

Counterfeit or Misrepresented Products

In global supply chains, counterfeit or rebranded plasterboard is a growing concern. Some suppliers may pass off lower-grade or uncertified boards as premium products. This poses safety risks and may void warranties. To mitigate this, work only with authorized distributors and verify batch numbers against manufacturer databases.

Ignoring Intellectual Property (IP) Rights

White plasterboard technologies, especially fire-resistant, moisture-resistant, or eco-friendly variants, are often protected by patents and trademarks. Sourcing generic copies of branded products (e.g., alternatives mimicking British Gypsum or Knauf systems) can lead to IP infringement. Using such products in commercial projects may expose contractors and developers to legal action. Always confirm that the product design and manufacturing process do not violate existing patents.

Inadequate Technical Support and System Compatibility

Plasterboard performance depends on the entire system—including framing, tapes, jointing compounds, and fixings. Sourcing boards without ensuring compatibility with certified installation systems can lead to failures. Some suppliers may not provide full technical support or system warranties, especially with unbranded products. Choose suppliers who offer complete system solutions with backed performance guarantees.

Conclusion

To avoid these pitfalls, conduct thorough due diligence on suppliers, demand full compliance and IP documentation, and prioritize certified, reputable brands. Investing time upfront ensures long-term safety, compliance, and project success.

Logistics & Compliance Guide for White Plasterboard

White plasterboard, also known as gypsum board or drywall, is a widely used construction material. Proper logistics and compliance are essential to ensure product integrity, worker safety, environmental protection, and adherence to regulatory standards. This guide outlines best practices for handling, transporting, storing, and complying with relevant regulations when managing white plasterboard.

Handling and Storage

Proper handling and storage are critical to prevent damage and maintain the quality of white plasterboard.

- Manual Handling: Use appropriate personal protective equipment (PPE) such as gloves and safety glasses. Boards should be lifted using correct ergonomic techniques—bend knees, keep back straight, and use team lifting for large or heavy sheets.

- Mechanical Handling: Use trolleys, forklifts, or suction lifters designed for sheet materials to reduce risk of injury and damage.

- Storage Conditions: Store boards flat on a level, dry surface, preferably elevated on wooden bearers to prevent moisture absorption from the ground. Keep under cover and protected from rain, snow, and direct sunlight.

- Stacking Limits: Do not stack higher than 1.8 meters (6 feet) to prevent collapse and ensure stability. Avoid placing heavy objects on stored boards.

Transportation Requirements

Safe and compliant transportation ensures that plasterboard arrives undamaged and ready for use.

- Vehicle Suitability: Use vehicles with flat, secure loading areas. Tail lifts may be required for safe offloading.

- Securing Loads: Boards must be tightly strapped and secured to prevent shifting during transit. Use edge protectors to avoid chipping or cracking.

- Weather Protection: Cover loads with waterproof, UV-resistant tarpaulins to prevent moisture damage and degradation from sun exposure.

- Labeling: Clearly label loads as “Fragile” and “This Side Up” where applicable to promote careful handling.

Regulatory Compliance

White plasterboard is subject to various national and international regulations concerning health, safety, and environmental impact.

- Construction Product Regulations (CPR) – EU: Plasterboard placed on the EU market must comply with Regulation (EU) No 305/2011. Products must bear the CE marking and be accompanied by a Declaration of Performance (DoP) detailing fire resistance, mechanical properties, and other relevant characteristics.

- UKCA Marking (UK): In Great Britain, post-Brexit, UKCA marking may be required. Suppliers must ensure conformity with UK regulations and provide a UK Declaration of Performance.

- Health & Safety at Work Regulations: Comply with local occupational health and safety laws. Provide Material Safety Data Sheets (MSDS) or Safety Data Sheets (SDS) outlining hazards, handling instructions, and emergency measures.

- Dust Control: Cutting plasterboard generates gypsum dust, which can irritate the respiratory system. Use dust extraction tools, wear appropriate respiratory protection (e.g., FFP2 masks), and follow local exposure limits (e.g., OSHA PEL or COSHH in the UK).

Environmental and Sustainability Considerations

Environmental compliance is increasingly important in construction material management.

- Waste Management: Follow local waste regulations. Plasterboard waste must not be mixed with general landfill waste due to sulfates that can produce hazardous hydrogen sulfide gas in landfill conditions.

- Recycling: Use licensed waste carriers and recycling facilities that accept plasterboard. Many regions require separate collection and recycling of gypsum waste.

- Sustainable Sourcing: Choose products from manufacturers with environmental management systems (e.g., ISO 14001) and those using recycled content in production.

Fire Safety and Building Codes

Plasterboard plays a key role in fire protection and must meet relevant fire performance standards.

- Fire Ratings: Ensure plasterboard complies with fire resistance classifications (e.g., REI ratings) as required by local building codes. Fire-rated boards must be installed according to certified systems.

- Documentation: Retain product test reports and certifications to demonstrate compliance during inspections or audits.

Training and Documentation

Ensure all personnel involved in handling, installation, and disposal are properly trained.

- Staff Training: Provide training on safe handling, cutting, and disposal procedures, including use of PPE and dust control.

- Record Keeping: Maintain logs of deliveries, storage conditions, waste disposal receipts, and compliance documentation (e.g., DoP, SDS, recycling certificates).

By following this guide, businesses can ensure the safe, compliant, and environmentally responsible management of white plasterboard throughout its lifecycle—from delivery to installation and disposal.

In conclusion, sourcing white plasterboard requires careful consideration of quality, supplier reliability, cost-effectiveness, and specific project requirements. It is essential to evaluate suppliers based on their product standards, delivery capabilities, and sustainability practices to ensure consistent performance and compliance with building regulations. Additionally, comparing pricing, lead times, and availability—whether sourcing locally or internationally—can help optimize procurement and project timelines. By establishing strong relationships with reputable suppliers and clearly specifying technical requirements such as fire resistance, moisture tolerance, and dimensional accuracy, stakeholders can secure high-quality white plasterboard that meets both performance needs and budgetary goals. A strategic sourcing approach ultimately supports efficient construction processes and long-term project success.