The global white cardamom market is experiencing steady growth, driven by rising demand in the food and beverage, spice, and essential oil industries. According to Grand View Research, the global cardamom market was valued at USD 528.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. White cardamom, a bleached variant of green cardamom prized for its milder flavor and aesthetic appeal in premium culinary applications, constitutes a significant segment of this growth. Increasing consumer preference for natural spices and flavor enhancers, particularly in North America and Europe, is amplifying demand for high-quality white cardamom. As supply chains evolve and sourcing transparency becomes critical, identifying reliable manufacturers has become essential for importers, food processors, and spice brands. Based on production scale, export volume, certifications, and industry reputation, here are the top 7 white cardamom manufacturers shaping the global market.

Top 7 White Cardamom Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

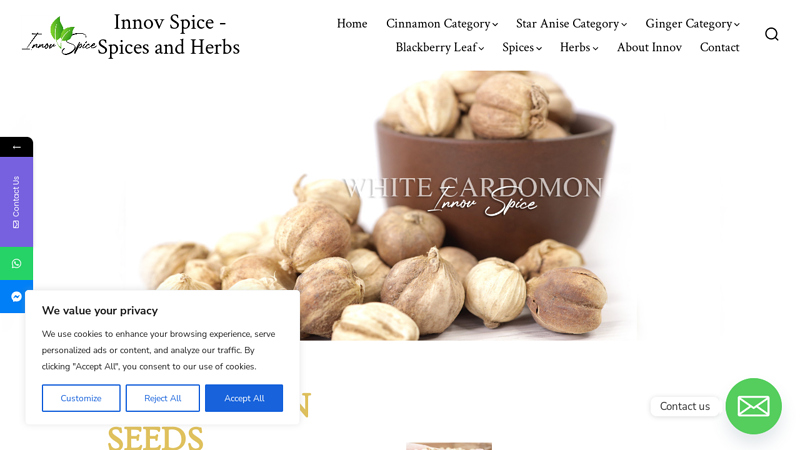

#1 Whole White Cardamon seeds

Domain Est. 2021

Website: novspice.com

Key Highlights: We supply White cardamon seeds to the whole world from our factory in China. Cardamon is both hard to grow and hard to pick and supply….

#2 Spices Board

Domain Est. 1997

Website: indianspices.com

Key Highlights: Spices Board (Ministry of Commerce and Industry, Government of India) is the flagship organization for the development and worldwide promotion of Indian spices….

#3 Supplier White Cardamom Indonesia High Quality #1

Domain Est. 2019

Website: ramnu.com

Key Highlights: Health benefits of cardamom are to overcome heartburn, intestinal spasms, Irritable bowel syndrome (IBS), liver complaints and gallbladder, loss of appetite, ……

#4 What is Cardamom, the Queen of Spices?

Domain Est. 2021

Website: sakiproducts.com

Key Highlights: Black Cardamom: Larger and darker with a smoky flavor, often used in savory dishes. White Cardamom: A bleached version of green cardamom, milder in flavor….

#5 White Cardamom

Domain Est. 2022

Website: marssejahtera.com

Key Highlights: White Cardamom is one of spices product that produced in Indonesia. it is in the same family with true cardamom (green cardamom)….

#6 Best Cardamom Manufacturers in india

Domain Est. 2021

Website: malpanispices.com

Key Highlights: MalPani & Co., one of the best cardamom manufacturers in India. We specialize in sourcing and supplying high-quality cardamom to meet the diverse needs of ……

#7 Best Cardamom Indonesia Supplier and Exporter

Domain Est. 2021

Website: agriospice.com

Key Highlights: Cardamom Indonesia spices supplier exporter. Most of the farmers cultivate local cardamom in Indonesia is White Cardamom or Java cardamom (Amomum compactum….

Expert Sourcing Insights for White Cardamom

2026 Market Trends for White Cardamom

Rising Global Demand Driven by Culinary and Health Applications

By 2026, the market for white cardamom is projected to experience steady growth, fueled by increasing consumer interest in exotic spices and natural wellness products. White cardamom, known for its delicate, sweet aroma and pale color achieved through bleaching or sun-drying, is gaining favor in high-end culinary applications, particularly in confectionery, baked goods, and premium beverages in North America and Europe. Its use in clean-label food formulations—where natural flavors are preferred over artificial additives—will further boost demand. Additionally, growing awareness of cardamom’s digestive and antioxidant properties is expanding its presence in functional foods and herbal supplements, contributing to market expansion.

Supply Chain Constraints and Climate Vulnerability

Despite rising demand, the white cardamom market faces supply-side challenges. The spice is primarily cultivated in India, Guatemala, and Tanzania, with India’s Malabar Coast being a key region for high-quality white cardamom. Climate change impacts—including erratic rainfall, prolonged droughts, and increased pest incidence—are expected to constrain yields through 2026. These environmental pressures may lead to price volatility and tighter supply, particularly as white cardamom requires specific agro-climatic conditions and labor-intensive harvesting. Investments in sustainable farming practices and climate-resilient cultivation techniques will be critical for maintaining output.

Premiumization and Niche Market Expansion

The premium spice segment is growing, and white cardamom is benefitting from this trend. Its milder, more refined flavor compared to green cardamom makes it desirable in gourmet and specialty food markets. By 2026, retailers and food manufacturers are anticipated to increasingly highlight origin traceability, organic certification, and fair-trade sourcing—factors that enhance consumer trust and justify higher price points. E-commerce platforms and direct-to-consumer models will likely play a larger role in distributing premium white cardamom, especially in urban markets where demand for artisanal ingredients is rising.

Competitive Pressure from Substitutes and Sustainability Concerns

White cardamom faces competition from green cardamom and synthetic flavorings, particularly in cost-sensitive markets. However, its unique sensory profile helps maintain differentiation. Sustainability is becoming a key market differentiator; environmentally conscious buyers are pushing for reduced chemical use in the bleaching process traditionally used to whiten the pods. Alternative processing methods, such as natural sun-bleaching or steam treatment, are expected to gain traction to meet eco-certification standards and appeal to green consumers.

Conclusion: Cautious Growth Amid Opportunities and Risks

The 2026 outlook for white cardamom is one of cautious optimism. While demand is on an upward trajectory due to culinary innovation and health trends, supply limitations and environmental challenges pose significant risks. Stakeholders who invest in sustainable cultivation, transparent supply chains, and value-added product development are likely to capture greater market share. Overall, white cardamom will remain a niche but high-value spice, with growth concentrated in premium and health-focused segments.

Common Pitfalls Sourcing White Cardamom (Quality, IP)

Sourcing white cardamom—often referring to bleached green cardamom or a specific regional variety—requires vigilance to avoid quality degradation and intellectual property (IP) issues, especially given its premium status in global spice markets. Below are key pitfalls to watch for:

Poor Quality Due to Improper Processing

One of the most frequent issues is the degradation of quality during the bleaching process used to turn green cardamom pods white. Harsh chemical treatments (e.g., chlorine or sulfur dioxide) can strip essential oils, alter flavor profiles, and leave harmful residues. Buyers may receive visually appealing but flavorless or unsafe product.

Adulteration and Substitution

White cardamom is often adulterated with inferior-grade pods, synthetic dyes, or even entirely different spices. Some suppliers mix in broken seeds, husks, or other fillers to increase weight. Without rigorous testing and traceability, buyers risk receiving substandard goods that fail quality standards.

Lack of Traceability and Origin Verification

White cardamom is sometimes marketed as originating from premium regions (e.g., Nepal, Bhutan, or specific Indian states), but without proper documentation or certification, false claims are common. This lack of traceability undermines quality assurance and exposes buyers to reputational and regulatory risk.

Misrepresentation of Organic or Fair Trade Status

Suppliers may falsely claim organic certification or fair trade practices to command higher prices. Without verifiable documentation from accredited bodies, such claims can constitute greenwashing and expose buyers to compliance violations.

Intellectual Property and Geographical Indication (GI) Infringement

Certain cardamom varieties are protected under Geographical Indication (GI) tags—such as “Malabar Cardamom” or “Salem Cardamom” in India. Sourcing white cardamom labeled with these GIs without proper authorization constitutes IP infringement and can lead to legal action or import rejections.

Inadequate Supply Chain Transparency

Opaque supply chains make it difficult to monitor labor practices, environmental impact, or post-harvest handling. This lack of transparency can lead to ethical sourcing concerns and non-compliance with international trade regulations.

Seasonal Variability and Stockpiling Risks

White cardamom supply is often subject to seasonal fluctuations. Buyers who source in bulk without proper storage facilities risk mold, insect infestation, or loss of aroma due to improper warehousing.

Avoiding these pitfalls requires due diligence, third-party testing, clear contracts, and partnerships with reputable, audited suppliers who provide full traceability and compliance documentation.

Logistics & Compliance Guide for White Cardamom

White cardamom, a premium spice derived from bleached green cardamom pods, requires careful handling and adherence to international trade regulations to ensure quality, safety, and legal compliance. This guide outlines key logistics and compliance considerations for importing, exporting, and transporting white cardamom.

Sourcing and Quality Standards

White cardamom must be sourced from reputable producers adhering to strict quality control measures. Key quality indicators include uniform light color, strong aroma, and absence of mold or foreign matter. Suppliers should comply with Good Agricultural Practices (GAP) and Good Manufacturing Practices (GMP). Certification such as Organic (e.g., USDA, EU Organic), Fair Trade, or Rainforest Alliance can enhance marketability and ensure ethical sourcing.

Packaging and Storage Requirements

Proper packaging is essential to preserve aroma and prevent contamination. White cardamom should be packed in food-grade, moisture-resistant materials such as vacuum-sealed bags or multi-layered poly-lined jute sacks. Storage areas must be cool, dry, and well-ventilated, with temperatures ideally between 15–20°C and relative humidity below 60%. Protection from direct sunlight and strong odors is critical to maintain quality during transit and warehousing.

Transportation and Cold Chain Considerations

While white cardamom does not require refrigeration, it must be transported under controlled ambient conditions. Use of clean, odor-free containers or trucks is mandatory to avoid cross-contamination. Air freight may be preferred for high-value shipments to reduce transit time and preserve freshness, while sea freight is cost-effective for bulk orders. Ensure proper ventilation and use of moisture-absorbing desiccants in shipping containers to minimize mold risk.

Import and Export Documentation

Accurate documentation is critical for customs clearance. Required documents typically include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin

– Phytosanitary Certificate (issued by the national plant protection organization)

– Fumigation Certificate (if required by the destination country)

– Certificate of Analysis (for quality and contaminant testing)

Regulatory Compliance and Food Safety

Exporters and importers must comply with food safety regulations in both origin and destination countries. Key regulatory frameworks include:

– FDA regulations (USA): Compliance with FSMA (Food Safety Modernization Act), including preventive controls and traceability.

– EU Regulations: Adherence to EC No 178/2002 and maximum residue levels (MRLs) for pesticides under Regulation (EC) No 396/2005.

– Import alerts or restrictions may apply if contamination (e.g., aflatoxins, salmonella) is detected. Pre-shipment laboratory testing is recommended.

Labeling and Traceability

All packages must be clearly labeled with product name (“White Cardamom”), net weight, batch/lot number, country of origin, harvest date, and shelf life. Labels should also include allergen statements and handling instructions. Full traceability from farm to importer is required under most food safety systems, supported by digital or physical batch tracking systems.

Pest and Contamination Control

White cardamom is susceptible to insect infestation and microbial contamination. Fumigation or heat treatment may be required depending on import regulations. However, chemical residues must remain within permitted limits. Non-chemical methods such as controlled atmosphere storage or hermetic sealing are increasingly preferred.

Sustainability and Ethical Trade Compliance

Growing consumer demand for sustainable products necessitates compliance with environmental and labor standards. Ensure adherence to ILO labor standards, prohibition of child labor, and sustainable harvesting practices. Participating in third-party audits or certification programs enhances credibility and market access.

Risk Mitigation and Insurance

Given its high value and sensitivity, white cardamom shipments should be insured against loss, damage, theft, and spoilage. Risk assessments should consider route security, transit duration, and political stability in transit countries. Contingency plans for customs delays or rejections are recommended.

By following this logistics and compliance guide, stakeholders can ensure the safe, legal, and high-quality movement of white cardamom across global markets.

In conclusion, sourcing white cardamom requires careful consideration of origin, quality, sustainability, and ethical practices. As a premium spice derived from bleached green cardamom, white cardamom is prized for its milder flavor and aesthetic appeal in culinary and medicinal applications. Reliable sourcing involves partnering with reputable suppliers from regions known for high-quality cardamom production, such as Nepal, India, and Bhutan—particularly in the Eastern Himalayan regions. Buyers should prioritize transparent supply chains, fair trade practices, and sustainable farming methods to ensure both product integrity and social responsibility. Additionally, proper storage and handling are essential to maintain freshness and aroma. Ultimately, successful sourcing of white cardamom hinges on balancing quality, traceability, and ethical considerations to meet market demands and support long-term viability for producers and consumers alike.