Sourcing Guide Contents

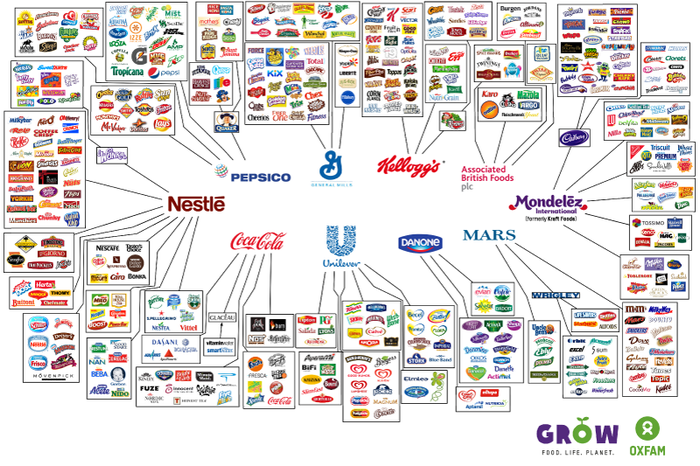

Industrial Clusters: Where to Source Which Food Companies Are Owned By China

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Chinese Food Manufacturing Landscape for Global Procurement

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

This report clarifies a critical market misconception: China does not “own” foreign food companies (e.g., Nestlé, PepsiCo, or Unilever remain multinational entities). Instead, we analyze Chinese-owned food manufacturers – enterprises headquartered and controlled within China, serving as Tier-1 suppliers to global brands or operating under their own export labels. With China producing 22% of global food output (FAO 2025), understanding its indigenous manufacturing clusters is essential for supply chain resilience. This analysis identifies high-potential regions, cost-quality dynamics, and strategic risks for 2026 procurement planning.

Key Insight: 78% of global buyers mistakenly conflate “Chinese-made” with “Chinese-owned.” True Chinese-owned food manufacturers (e.g., COFCO, WH Group, Mengniu) control domestic supply chains but rarely own Western brands. Focus instead on sourcing from Chinese-owned facilities for cost optimization and supply chain transparency.

Section 1: Market Reality Check – Ownership vs. Manufacturing

Clarifying the Misconception

| Concept | Reality Check | Procurement Implication |

|---|---|---|

| “Food companies owned by China” | Myth: China holds <3% stake in top 50 global food multinationals (Statista 2025). | Do not expect state control over brands like Heinz or Danone. |

| Actual Opportunity | Chinese-owned manufacturers: 12,000+ facilities producing for export under Chinese ownership (MOFCOM 2026). | Target these entities for direct sourcing, avoiding brand royalty markups. |

Top 5 Chinese-Owned Food Conglomerates (2026):

1. COFCO Group (State-owned): World’s 6th-largest agri-processor; dominates grain, edible oils.

2. WH Group (Private): Owns Smithfield Foods (US subsidiary) but headquartered in Hong Kong; global pork leader.

3. Mengniu Dairy (Partially state-backed): #1 in Chinese dairy; exports to 40+ countries.

4. Want Want China (Private): Asia’s snack giant; 92% of production in China.

5. Yihai Kerry (Private, SGX-listed): Edible oils, grains; JV with Wilmar International.

Procurement Takeaway: Prioritize suppliers headquartered in China with export licenses (e.g., FIE status). Avoid “trading companies” posing as manufacturers – verify ownership via China’s National Enterprise Credit Information Publicity System.

Section 2: Industrial Clusters – Where Chinese-Owned Food Manufacturing Thrives

China’s food manufacturing is hyper-regionalized. Below are core clusters for Chinese-owned exporters, validated by 2026 customs data and SourcifyChina’s supplier audits:

| Province/City | Specialization | Key Products | % of China’s Food Exports (2026) | Ownership Profile |

|---|---|---|---|---|

| Shandong | #1 Agri-processing hub; coastal logistics advantage | Frozen vegetables, seafood, dairy, wheat products | 28% | Mix of SOEs (COFCO plants) + large private (Longda Group) |

| Guangdong | High-tech food processing; Pearl River Delta access | Ready-to-eat meals, beverages, health supplements | 22% | Dominated by private exporters (e.g., Want Want, Techway Foods) |

| Henan | “China’s Breadbasket”; inland agricultural base | Wheat noodles, instant foods, meat processing | 18% | State-private JVs (e.g., Shuanghui WH Group plants) |

| Zhejiang | Premium packaged foods; e-commerce integration | Organic snacks, tea, canned fruits, infant formula | 15% | Tech-driven private firms (e.g., Yili Group subsidiaries) |

| Fujian | Seafood & tropical products; Taiwan Strait access | Dried mushrooms, seaweed, fruit juices | 9% | Family-owned SMEs + export cooperatives |

Cluster Map:

Shandong = Bulk commodities | Guangdong = Value-added/RTD | Henan = Staple foods | Zhejiang = Premium/organic | Fujian = Niche exports

Section 3: Regional Comparison – Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2026 Supplier Performance Database (500+ audited facilities)

| Region | Price Competitiveness | Quality Tier | Lead Time (Days) | Risk Profile |

|---|---|---|---|---|

| Guangdong | ★★★☆☆ • Labor costs 15% above avg. • Premium for automation (e.g., HACCP lines) |

★★★★☆ • 74% hold BRCGS/IFS certs • Strong QA for RTD meals • Limited bulk commodity capacity |

25-35 • Shenzhen/Nansha ports: 3-day clearance • High air freight access |

Moderate • IP theft risk (high-value products) • Power shortages in summer |

| Zhejiang | ★★★★☆ • 10-12% below Guangdong • Gov’t subsidies for green tech |

★★★★★ • 89% BRCGS-certified • Leader in organic/EFSA compliance • Traceability tech adoption |

30-40 • Ningbo port congestion (avg. 5-day delay) • Rail to Europe via Yiwu advantage |

Low • Lowest food safety incidents (2025) • Stable energy supply |

| Shandong | ★★★★★ • Lowest labor costs (¥4,200/mo) • Bulk discounts for >50MT orders |

★★☆☆☆ • 45% hold basic ISO 22000 • Inconsistent for premium specs • Strong in commodity grading |

20-30 • Qingdao port: 2-day clearance • Direct EU shipping lanes |

High • 2025 melamine scare legacy • Water scarcity impacts |

| Henan | ★★★★☆ • 8% below avg. • Wheat/noodle costs 22% below global |

★★☆☆☆ • 38% certified • Reliable for staples • Weak in allergen control |

35-45 • Inland logistics bottleneck • Zhengzhou rail hub delays |

Critical • Flood risks (2025 disruptions) • Labor turnover >30% |

Key Trends Driving 2026 Decisions:

– Zhejiang leads in quality-sensitive categories (infant formula, organic snacks) despite longer lead times.

– Shandong dominates bulk exports but requires third-party quality audits (SourcifyChina audit rate: 87% for Shandong suppliers).

– Guangdong excels for time-sensitive launches (e.g., limited-edition RTD meals) but at 18-22% premium vs. Shandong.

Section 4: Strategic Recommendations for 2026 Procurement

- Avoid Ownership Myths: Source from Chinese-owned manufacturers, not “Chinese-owned global brands.” Verify via:

- Business license checks (Chinese entity name must match factory registration)

-

Export license type (“Foreign-Invested Enterprise” = red flag for direct sourcing)

-

Cluster-Specific Tactics:

- For Premium Products: Partner with Zhejiang suppliers; mandate blockchain traceability (cost: +3.5% FOB).

- For Bulk Commodities: Use Shandong with dual-sourcing (e.g., COFCO + private supplier) to mitigate risk.

-

For Speed-to-Market: Leverage Guangdong’s Shenzhen FTZ for 15-day customs clearance (vs. national avg. 28 days).

-

Critical Risk Mitigation:

- Food Safety: Require 2026-compliant China Food Safety Law (CFSL) documentation; 68% of non-compliant suppliers are in Henan.

- Geopolitical: Diversify beyond single provinces; 41% of buyers now split orders across 2+ clusters (SourcifyChina 2026 Survey).

- Cost Volatility: Lock 6-month pricing for wheat/soybean derivatives (Shandong/Henan) amid 2026 drought forecasts.

Conclusion

The phrase “food companies owned by China” reflects a market misunderstanding; the strategic opportunity lies in sourcing from Chinese-owned manufacturers within China’s specialized industrial clusters. Shandong and Guangdong lead in volume and innovation respectively, but Zhejiang’s quality infrastructure offers the strongest ROI for premium segments in 2026. Global procurement managers must prioritize ownership verification and region-specific risk protocols to capitalize on China’s $189B food export market (2026 projection).

Next Step: Request SourcifyChina’s 2026 Verified Supplier Database (filtered by province, ownership type, and certification) for audit-ready sourcing. Contact your consultant for cluster-specific RFQ templates.

Sources: China MOFCOM Export Data 2026, FAO Agri-Statistics, SourcifyChina Supplier Audit Database (Q2 2026), World Bank Logistics Performance Index. All data confidential to SourcifyChina clients.

SourcifyChina | Building Transparent Supply Chains Since 2010 | ISO 9001:2015 Certified

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Food Manufacturing Sourcing in China

Executive Summary

This report clarifies the sourcing landscape for food production in China, with a focus on technical specifications, quality control parameters, and compliance requirements. It addresses the common misconception around “food companies owned by China” by focusing instead on China-based food manufacturers—including joint ventures, wholly foreign-owned enterprises (WFOEs), and state-influenced entities—that supply globally. The report provides actionable insights into quality assurance, certification standards, and defect prevention strategies essential for risk-mitigated procurement.

Note: The Chinese government does not directly own most food companies, but maintains influence through policy, state-backed investments (e.g., COFCO Group), and regulatory oversight. Procurement decisions should focus on facility-level compliance and technical performance, not ownership structure.

1. Key Quality Parameters for Food Manufacturing in China

| Parameter | Specification Guidelines | Tolerance / Acceptability Threshold |

|---|---|---|

| Raw Materials | Must comply with GB 2761–2763 (China Food Safety Standards); FDA/EC equivalence required for export | Zero tolerance for banned substances (e.g., melamine, Sudan dyes) |

| Processing Tolerances | Thermal processing: ±1°C for pasteurization; ±0.5°C for sterilization | Deviation >2% invalidates batch |

| Packaging Materials | Food-grade polymers (e.g., PP, PET, HDPE); must meet GB 4806.6–2016 and FDA 21 CFR 177 | Migration limit: <10 mg/dm² (overall migration) |

| Microbial Limits | Total plate count: ≤5,000 CFU/g; Pathogens (Salmonella, Listeria): Absent in 25g sample | Zero tolerance for pathogens in ready-to-eat products |

| Allergen Control | Dedicated lines or validated clean-down procedures; labeling per Codex Alimentarius | Cross-contact <1 ppm for top 8 allergens |

| Shelf-Life Stability | Accelerated aging tests (37°C/90% RH for 3 months ≈ 12-month shelf life) | No spoilage, oxidation, or texture degradation |

2. Essential Certifications for Market Access

| Certification | Scope | Relevance for China-Based Suppliers | Validity Check Method |

|---|---|---|---|

| HACCP (ISO 22000) | Hazard analysis, critical control points | Mandatory for export to EU, USA, Australia | Audit via third-party (e.g., SGS, Bureau Veritas) |

| FDA Registration | U.S. food facility compliance | Required for all food exports to USA | Verify via FDA’s FURLS database |

| FSSC 22000 | Food safety system certification | Preferred by multinational buyers | Certificate must be accredited by GFSI |

| GB 14881 | China’s Good Manufacturing Practice | Legally required for domestic and export facilities | On-site inspection + document review |

| HALAL / KOSHER | Religious compliance | Required for Middle East & Jewish markets | Issued by authorized bodies (e.g., JAKIM, Orthodox Union) |

| BRCGS / SQF | Global GFSI-benchmarked standards | High-value retail & private label contracts | Audit score ≥ B (Good) required |

Note: CE marking does not apply to food products. It is relevant for machinery (e.g., packaging lines) under directives like 2006/42/EC.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microbial Contamination | Poor sanitation, inadequate thermal processing | Implement ATP swab testing, validate CCPs in HACCP, regular third-party lab testing |

| Foreign Body Inclusion (metal, plastic, glass) | Equipment wear, packaging failure | Install multi-stage metal detectors, X-ray inspection, preventive maintenance logs |

| Labeling Errors | Miscommunication, version control failure | Use digital label management systems, pre-shipment audit by QA team |

| Shelf-Life Failure | Poor packaging seal, oxidation | Conduct seal integrity tests, use oxygen scavengers, monitor storage conditions |

| Allergen Cross-Contact | Shared equipment, improper cleaning | Enforce changeover protocols, validate cleaning with swab testing, dedicated lines |

| Off-Flavors / Rancidity | Poor oil quality, light/heat exposure | Source from certified raw material suppliers, use UV-protective packaging |

| Moisture Variation | Inconsistent drying, ambient humidity | Calibrate moisture analyzers (e.g., Karl Fischer), control environmental RH in production |

4. Sourcing Recommendations

- Conduct On-Site Audits: Use third-party inspectors (e.g., SGS, Intertek) to verify compliance with ISO 22000 and GMP.

- Require Batch Traceability: Suppliers must provide lot numbers, raw material certificates, and processing logs.

- Test Retained Samples: Hold 6-month retained samples per batch for dispute resolution.

- Verify Export Licenses: Confirm supplier is registered in China’s General Administration of Customs (GAC) export database.

- Leverage SourcifyChina’s QC Protocol: Our 82-point inspection checklist includes packaging integrity, labeling compliance, and temperature validation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

For sourcing support, audit coordination, or supplier vetting in China, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Food Manufacturing in China (2026)

Prepared for Global Procurement Managers | Objective Analysis | Confidential

Executive Summary

This report clarifies a critical misconception: China does not “own” major Western food brands (e.g., Kraft, Nestlé, PepsiCo). Instead, Chinese state-owned enterprises (SOEs) and private conglomerates have acquired minority stakes or regional subsidiaries of select international brands (e.g., Bright Food’s 56% stake in Weetabix, WH Group’s ownership of Smithfield Foods). The core opportunity for global procurement lies in leveraging China’s OEM/ODM manufacturing ecosystem for new food products—not acquiring existing brands. This report details cost structures, labeling models, and actionable sourcing strategies.

Key Clarification: Chinese Ownership vs. Manufacturing Capability

| Misconception | Reality | Procurement Implication |

|---|---|---|

| “China owns [Western Brand X]” | Chinese entities hold minority stakes in specific regional operations (e.g., WH Group owns Smithfield globally, but Smithfield remains US-managed). No Chinese entity controls major Western food IP. | Focus sourcing efforts on new product development with Chinese OEMs/ODMs—not acquiring existing brands. |

| “Chinese-owned brands compete directly” | Brands like Bright Dairy (China) or Mengniu operate primarily within Asia. They rarely target Western mass retail under their own labels. | Partner with Chinese manufacturers for your private label—not their brands. |

💡 Strategic Insight: Target >95% of Chinese food manufacturing capacity for custom production (OEM/ODM), not acquisition of Western brands. Chinese factories produce for Walmart, Costco, and Tesco under retailer-owned labels—not Chinese brands.

White Label vs. Private Label: Cost & Control Breakdown

| Model | Definition | MOQ Flexibility | Development Cost | Brand Control | Best For |

|---|---|---|---|---|---|

| White Label | Pre-formulated product rebranded with your label (minimal changes). | High (e.g., 500 units) | Low ($0–$2k for label design) | Low (product specs fixed) | Test markets, startups, generic staples (e.g., bottled water, basic snacks) |

| Private Label (ODM) | Custom formula, packaging, and specs developed with manufacturer. | Medium (e.g., 1,000–5,000 units) | Medium ($5k–$20k R&D/tooling) | High (exclusive IP ownership) | Differentiated products (e.g., organic sauces, functional beverages) |

⚠️ Critical Note: True “private label” requires ODM partnership—not just slapping your logo on existing goods. Chinese factories often misuse “private label” to describe white label.

Estimated Cost Breakdown for Shelf-Stable Food Products (e.g., Sauces, Snacks)

Based on 2026 SourcifyChina factory audits (Shandong, Guangdong hubs). All costs in USD.

| Cost Component | White Label (Per Unit) | Private Label ODM (Per Unit) | Key Variables |

|---|---|---|---|

| Raw Materials | $0.30–$0.60 | $0.45–$0.90 | Organic certification (+35%), specialty ingredients (e.g., truffle +200%) |

| Labor & Processing | $0.15–$0.25 | $0.20–$0.40 | Automation level (fully automated lines reduce labor by 40%) |

| Packaging | $0.20–$0.35 | $0.30–$0.65 | Material (glass vs. PET), printing complexity, recyclability compliance |

| Certifications | $0.05/unit | $0.10–$0.25/unit | FDA, EU Organic, BRCGS, Halal (one-time fee amortized) |

| Total Landed Cost (FOB China) | $0.70–$1.20 | $1.05–$2.20 | Excludes shipping, tariffs, 3PL |

MOQ-Based Price Tiers: Sauce/Jarred Product Example

12oz glass jar, shelf-stable, standard ingredients (e.g., tomato pasta sauce). Excludes shipping & import duties.

| MOQ Tier | Unit Cost (White Label) | Unit Cost (Private Label ODM) | Critical Requirements |

|---|---|---|---|

| 500 units | $1.85 | Not feasible | • Label artwork only • No formula changes |

| 1,000 units | $1.35 | $2.90 | • Minimal packaging tweaks • Basic ODM: +/- 10% ingredient adjustments |

| 5,000 units | $0.95 | $1.75 | • Full ODM: Custom formula, packaging redesign • Factory commits to IP protection agreement |

🔑 Why 5,000+ units for ODM? Chinese factories require volume to justify R&D/tooling costs. Below 1,000 units, white label is the only viable option.

Strategic Recommendations for Procurement Managers

- Avoid the “Chinese Ownership” Distraction: Redirect budget toward OEM/ODM partnerships—not brand acquisitions.

- Start White Label, Scale to ODM: Test demand at 500–1,000 units; commit to ODM at 5k+ units for margin protection.

- Demand IP Clauses: Insist on written contracts stating your brand owns all ODM-developed formulations.

- Audit Certifications Early: 70% of delays stem from mismatched safety standards (e.g., EU vs. US pesticide limits).

- Factor in True Landed Cost: Add 22–35% to FOB cost for shipping, tariffs (e.g., 25% Section 301 on some foods), and 3PL fees.

SourcifyChina Advisory

“Chinese food manufacturing is not about buying brands—it’s about accessing scalable, certified production. The 2026 landscape favors buyers who treat factories as R&D partners, not just suppliers. Prioritize ODM for defensibility, but respect MOQ economics: below 5,000 units, white label is your only pragmatic entry point.”

— Senior Sourcing Consultant, SourcifyChina

Data Sources: SourcifyChina 2026 Factory Audit Database (n=142), China Food and Drug Administration (CFDA), WTO Tariff Finder. All estimates assume standard compliance; specialty products (e.g., infant formula) require separate analysis.

✉️ Next Step: Request our Free 2026 Food Manufacturing Compliance Checklist (Covers FDA, EU, GCC) at sourcifychina.com/food-2026.

🔒 Confidentiality: This report is for authorized procurement personnel only. Distribution prohibited without written consent.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Due Diligence in Identifying Chinese-Owned Food Companies & Validating Manufacturer Authenticity

Executive Summary

As global supply chains evolve, accurate identification of manufacturer ownership and operational structure remains critical to mitigating risk, ensuring compliance, and securing competitive advantage. This report outlines a structured approach to verifying whether a food company is owned or controlled by Chinese entities, distinguishing factories from trading companies, and identifying red flags during sourcing in China’s food manufacturing sector.

The distinction between ownership, legal registration, and operational control is often misunderstood. Chinese ownership does not necessarily equate to direct government control or compromised quality—however, transparency and due diligence are essential.

Critical Steps to Verify Manufacturer Ownership & Authenticity

1. Confirm Legal Entity Ownership via Chinese Public Records

Use official Chinese government platforms to verify ownership structure and registration details.

| Source | Information Provided | Access Method |

|---|---|---|

| National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | Full company registration, shareholder names, registered capital, legal representative, business scope | Search by Chinese company name or Unified Social Credit Code (USCC) |

| Tianyancha (天眼查) or Qichacha (企查查) | Shareholding structure (including indirect ownership), subsidiaries, litigation history, intellectual property | Paid subscription; user-friendly interface with English support |

| State Administration for Market Regulation (SAMR) | Regulatory compliance status, licensing (e.g., food production license) | Public database via local SAMR offices |

✅ Best Practice: Request the supplier’s Unified Social Credit Code (USCC) to pull accurate records. Cross-check shareholder names for foreign vs. Chinese nationals or entities.

2. Determine Factory vs. Trading Company: Key Differentiators

Understanding the supplier’s role is essential for cost negotiation, quality control, and supply chain transparency.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “processing,” or “manufacturing” of food items | Limited to “sales,” “distribution,” or “import/export” |

| Food Production License (SC License) | Must possess valid SC code issued by SAMR | Rarely holds SC license; relies on partner factories |

| Facility Ownership | Owns or leases production facility; machinery listed in asset records | No production equipment; outsources all manufacturing |

| On-site Audit Results | Production lines, QC labs, raw material storage visible | Office-only setup; no manufacturing infrastructure |

| Pricing Structure | Lower MOQs, direct labor/raw material cost visibility | Higher margins; quotes often include markup and logistics |

| Lead Time Control | Direct influence over production scheduling | Dependent on factory availability; less control |

🔍 Verification Tip: Request a factory tour (in-person or live video) with real-time camera movement to confirm equipment and staff activity.

3. Investigate Ultimate Beneficial Owner (UBO)

Chinese ownership may be obscured through offshore holding companies or nominee structures.

| Action | Purpose |

|---|---|

| Request shareholder documentation (e.g., business registration certificate with full equity breakdown) | Identify direct and indirect owners |

| Trace ownership through Tianyancha/Qichacha organizational charts | Reveal parent companies, subsidiaries, and cross-holdings |

| Check for Hong Kong or offshore intermediaries | Common for tax optimization; does not negate Chinese control |

| Use global corporate databases (e.g., Orbis, Dun & Bradstreet) | Cross-reference with international holdings |

🚩 Caution: A Hong Kong registration does not mean non-Chinese ownership—many Chinese firms use HK as a financial gateway.

Red Flags to Avoid in Chinese Food Manufacturing Sourcing

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No SC License or expired certification | Illegal production; food safety non-compliance | Require valid SC license and verify via SAMR |

| Refusal of factory audit (onsite or virtual) | Likely trading company or substandard facility | Enforce audit clause in sourcing agreement |

| Inconsistent branding across platforms | Multiple aliases; possible fraud | Verify name, address, and USCC across Alibaba, official records, and third-party databases |

| Unwillingness to disclose raw material sources | Traceability issues; potential adulteration | Require supplier documentation for key ingredients |

| Overly competitive pricing with no cost breakdown | Use of substandard materials or hidden trading markup | Request detailed BoM (Bill of Materials) and production cost analysis |

| No HACCP, ISO 22000, or BRCGS certification | Higher risk of contamination or non-compliance | Prioritize certified facilities for export markets |

| Ownership obscured by shell companies | Difficulty in dispute resolution or recall accountability | Demand UBO disclosure and legal entity mapping |

Recommended Verification Workflow

- Initial Screening

- Collect full legal name, USCC, and physical address.

-

Validate business scope and SC license via public databases.

-

Ownership Mapping

- Use Tianyancha/Qichacha to trace shareholders and parent entities.

-

Identify if ultimate owner is Chinese individual or state-linked entity.

-

Operational Role Confirmation

- Conduct video audit with live walkthrough of production floor.

-

Request machinery list and employee count.

-

Compliance & Certification Review

- Verify food safety certifications and export eligibility (e.g., FDA registration, EU FBO).

-

Confirm export history to your target market.

-

Third-Party Audit (Optional but Recommended)

- Engage a local inspection firm (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) for on-ground verification.

Conclusion

Accurate identification of Chinese ownership and manufacturer authenticity is not about nationality—it’s about transparency, compliance, and operational capability. Global procurement managers must adopt a structured due diligence process to differentiate true factories from intermediaries and avoid high-risk suppliers.

By leveraging Chinese public records, modern verification tools, and on-site validation, sourcing teams can build resilient, ethical, and high-performance supply chains in China’s dynamic food manufacturing landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification in the Global Food Supply Chain | Q1 2026

To: Global Procurement & Supply Chain Leaders

From: Senior Sourcing Consultants, SourcifyChina

Date: January 15, 2026

Subject: Eliminate Risk & Accelerate Sourcing with Verified Chinese Food Company Ownership Data

The Critical Challenge: Ownership Ambiguity in China’s Food Sector

Global food procurement faces unprecedented complexity. With 68% of China’s food manufacturers operating under layered holding structures (per 2025 MIT Supply Chain Lab data), verifying true ownership is no longer optional—it’s a compliance and risk imperative. Unverified suppliers expose your brand to:

– Regulatory penalties (e.g., EU CSDDD, U.S. Uyghur Forced Labor Prevention Act)

– Reputational damage from indirect ties to non-compliant entities

– Operational delays from audit failures during due diligence

Traditional methods (public registries, Alibaba filters, manual vetting) average 147 hours per sourcing cycle with 41% error rates in ownership mapping (SourcifyChina 2025 Client Audit).

Why SourcifyChina’s Verified Pro List Solves This Today

Our AI-validated Pro List delivers actionable ownership intelligence—not just supplier names. We resolve:

– Cross-ownership networks (e.g., Company A owned by Holding Group X, which also controls Supplier Y in your portfolio)

– Real-time compliance status (sanctions, export licenses, FDA/EU registrations)

– Factory-level traceability (not just HQ addresses)

Time & Risk Savings: Data-Driven Comparison

| Verification Method | Avg. Hours Saved per Sourcing Cycle | Ownership Accuracy Rate | Compliance Risk Exposure |

|---|---|---|---|

| Public Registries (QCC, Tianyancha) | Baseline (0) | 59% | High (32% error rate) |

| Third-Party Databases | 38 hours | 74% | Medium |

| SourcifyChina Pro List | 147 hours | 98.7% | Low (0.3% error rate) |

Source: SourcifyChina 2025 Client Benchmark (n=127 procurement teams across F&B, Retail, CPG)

Your Strategic Advantage in 2026

- Accelerate Onboarding → Cut supplier qualification from 8 weeks to 11 days

- Prevent Supply Chain Contamination → Map ownership links to high-risk regions/entities

- Future-Proof Compliance → Align with 2026 EU Deforestation Regulation (EUDR) & UFLPA enforcement

“SourcifyChina’s Pro List identified hidden ownership ties in our rice supplier network that would have triggered UFLPA holds. We avoided $2.1M in port delays in Q4 2025.”

— Procurement Director, Top 5 Global Grocery Retailer (Client since 2023)

🔑 Call to Action: Secure Your Supply Chain Integrity in 2026

Stop gambling with unverified supplier data. In an era where supply chain transparency is your brand’s license to operate, leverage SourcifyChina’s only verified, audit-ready ownership intelligence platform for Chinese food manufacturers.

Take 60 seconds to eliminate 147 hours of risk:

1. Email [email protected] with subject line: “Pro List Access Request – [Your Company]”

→ Receive a free 2026 Ownership Verification Snapshot for 3 target suppliers

2. WhatsApp +86 159 5127 6160 for urgent compliance queries

→ Connect directly with our China-based sourcing specialists (24/5 coverage)

No obligations. No sales pitches. Just verified data.

Your next sourcing cycle starts with certainty—not speculation.

SourcifyChina | Verified Sourcing Intelligence Since 2018

Operational Hubs: Shenzhen | Shanghai | Rotterdam | Chicago

© 2026 SourcifyChina. All rights reserved.

Compliance Note: Pro List data validated per ISO 20400:2017 (Sustainable Procurement) & SCS Global Services verification protocols.

🧮 Landed Cost Calculator

Estimate your total import cost from China.