Sourcing Guide Contents

Industrial Clusters: Where to Source Which Companies Are Shifting From China To India

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Manufacturing Relocation Trends from China to India

Date: April 5, 2026

Executive Summary

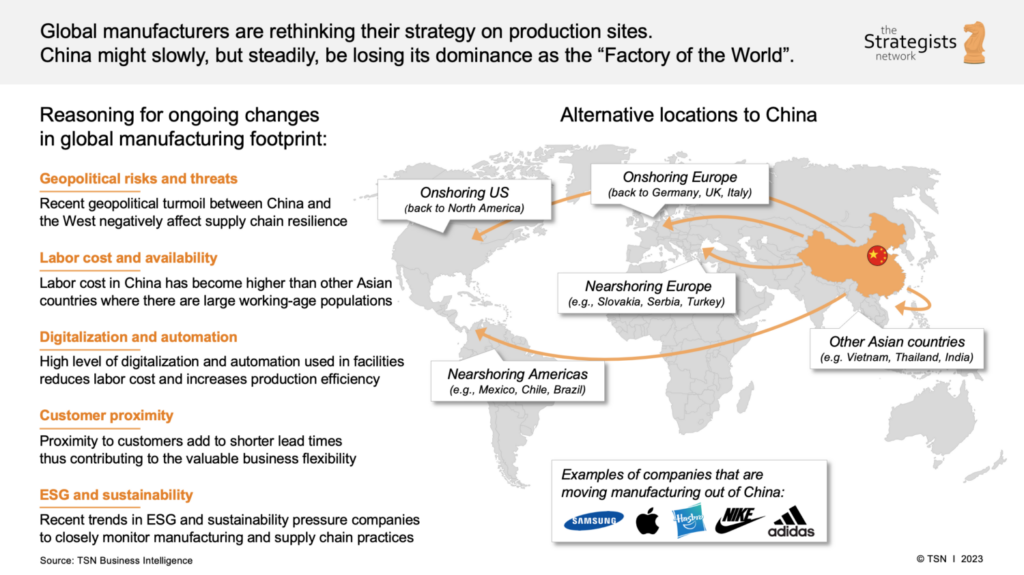

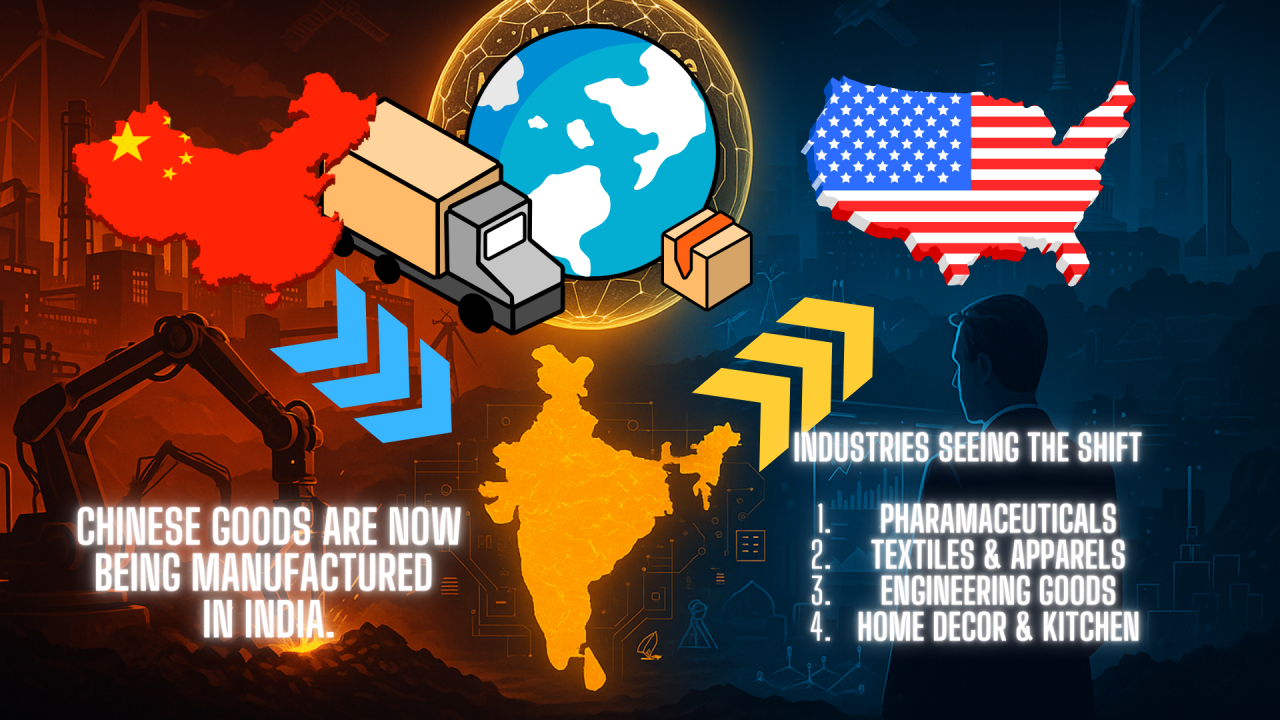

This report provides a strategic analysis of the shifting global manufacturing landscape, with a focus on multinational corporations (MNCs) and domestic manufacturers relocating production capacity from China to India. While the query “which companies are shifting from China to India” is broad, this report clarifies that the trend is not a mass exodus but a strategic diversification and supply chain de-risking effort, particularly in labor-intensive and tariff-sensitive industries.

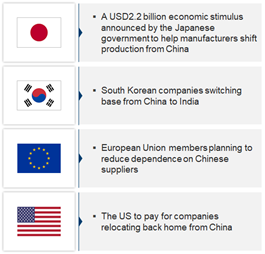

Key drivers include rising labor costs in China, geopolitical tensions, U.S. and EU trade policies, India’s Production Linked Incentive (PLI) schemes, and growing domestic demand in India. China remains the dominant manufacturing hub, but India is emerging as a complementary alternative—especially in electronics, textiles, automotive components, and pharmaceuticals.

This report identifies the primary industrial clusters in China producing goods most affected by this transition and evaluates their comparative advantages in price, quality, and lead time.

1. Industries Most Affected by China-to-India Shift

The following sectors are witnessing measurable shifts in production footprint:

| Sector | Key Products | Notable Relocating Companies |

|---|---|---|

| Consumer Electronics | Smartphones, Chargers, PCBs | Apple (Foxconn, Tata), Samsung, Xiaomi |

| Textiles & Apparel | Woven garments, knitwear | H&M, Nike (via suppliers), PVH Corp |

| Automotive Components | Wiring harnesses, castings, stampings | Bosch, Valeo, Motherson Sumi |

| Pharmaceuticals | APIs, Formulations | Dr. Reddy’s, Sun Pharma, Cipla (backshoring) |

| Industrial Equipment | Pumps, motors, valves | Kirloskar, GE Healthcare (regional hubs) |

Note: Most shifts involve partial capacity transfer, not full abandonment of Chinese operations. Dual-sourcing strategies are now standard.

2. Key Chinese Industrial Clusters Producing Goods at Risk of Relocation

Below are the core manufacturing hubs in China producing goods now being partially shifted to India:

| Cluster (Province) | Major Cities | Dominant Industries | Reason for Exposure to Shift |

|---|---|---|---|

| Pearl River Delta (Guangdong) | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, ICT, Consumer Goods | High labor costs, U.S. tariff exposure |

| Yangtze River Delta (Zhejiang/Jiangsu/Shanghai) | Hangzhou, Ningbo, Suzhou, Wuxi | Textiles, Machinery, Auto Parts | Moderate cost increases, automation limits in labor-intensive subsectors |

| Fujian Province | Xiamen, Quanzhou, Fuzhou | Footwear, Apparel, Ceramics | Labor-intensive; direct competition with Indian and Southeast Asian producers |

| Chongqing/Sichuan | Chongqing, Chengdu | Consumer Electronics, Auto Components | Inland labor cost advantage fading; logistics complexity for export |

| Shandong Province | Qingdao, Yantai | Industrial Equipment, Chemicals | Strong domestic base but limited automation in SMEs |

3. Comparative Analysis: Key Chinese Manufacturing Regions

The following table evaluates top Chinese industrial clusters in terms of Price, Quality, and Lead Time for goods most vulnerable to relocation. Data reflects Q1 2026 benchmarks.

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Average Lead Time (Days) | Key Risks |

|---|---|---|---|---|

| Guangdong (PRD) | 3 | 5 | 25–35 | High labor costs (~¥4,800/month), U.S. Section 301 tariffs |

| Zhejiang (YRD) | 4 | 4 | 30–40 | Strong SME ecosystem; quality varies by supplier tier |

| Jiangsu (YRD) | 3.5 | 4.5 | 28–36 | High automation; premium pricing for Tier 1 suppliers |

| Fujian | 4.5 | 3.5 | 35–45 | Labor-intensive; lower automation, higher defect rates |

| Chongqing/Sichuan | 4 | 3.5 | 40–50 | Inland logistics delays, talent retention issues |

| Shandong | 4 | 4 | 32–42 | Strong for heavy industry; less agile for fast fashion/electronics |

Scoring Guide: 5 = Most Competitive, 1 = Least Competitive

Lead Time: Includes production + inland logistics to port (Shenzhen/Ningbo) + documentation

4. Why Companies Are Diversifying to India

While China maintains superiority in scale, quality, and speed, India offers strategic advantages:

- Labor Cost Arbitrage: ~30–40% lower than Guangdong (₹22,000 vs ¥4,800/month)

- PLI Schemes: Up to 50% capital expenditure subsidy in electronics, pharma, and auto

- Geopolitical Neutrality: Preferred by U.S./EU importers seeking non-China exposure

- Domestic Market Access: India’s $3.7 trillion economy supports local-for-local models

However, India lags in:

– Supply chain depth (especially Tier 2/3 suppliers)

– Port efficiency (average dwell time: 5.2 days vs China’s 1.8)

– Skilled technical labor availability

5. Strategic Recommendations for Procurement Managers

- Adopt Dual-Sourcing Models: Maintain China for high-mix, high-quality runs; use India for high-volume, cost-sensitive SKUs.

- Audit Supplier Tiers: In Zhejiang and Fujian, vet Tier 2/3 suppliers closely for quality drift.

- Leverage Nearshoring Hubs: Consider Vietnam and Malaysia as intermediate alternatives.

- Engage Early with Indian PLI Beneficiaries: Companies like Tata Electronics, Dixon, and Amber Enterprises are scaling rapidly.

- Factor in Total Landed Cost: Include tariffs, logistics, inventory carrying cost, and compliance risk—India’s lower FOB price may not offset longer lead times.

6. Conclusion

China remains the world’s most capable manufacturing ecosystem, but select sectors are undergoing strategic redistribution to India. Guangdong and Fujian—long-standing export powerhouses—are most exposed due to rising costs and trade pressures. Zhejiang and Jiangsu maintain strong positions due to automation and quality but face margin compression.

Procurement leaders should not exit China, but rather optimize sourcing portfolios by:

– Retaining critical high-complexity production in China

– Transitioning labor-intensive, high-volume lines to India

– Building supplier resilience through multi-country strategies

India is not replacing China—it is complementing it in a new era of geoeconomic fragmentation.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Supply Chain Intelligence for Global Procurement Leaders

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: India Manufacturing Assessment for Global Procurement Managers

Report Date: January 15, 2026

Prepared For: Strategic Procurement Leaders Evaluating Supply Chain Diversification

Executive Summary: Clarifying the “China-to-India Shift” Narrative

Contrary to popular misconception, there is no widespread exodus of established multinational manufacturers from China to India. Instead, we observe:

– New capacity allocation: Companies (primarily in electronics, textiles, and pharma) are adding India as a complementary hub for domestic/regional markets (e.g., Apple, Foxconn, Samsung expanding India-based production for local consumption).

– SME-driven diversification: Mid-sized EU/US firms are trialing India for new product lines (e.g., automotive components, medical disposables), not relocating existing China volumes.

– Critical reality: India’s manufacturing competitiveness remains highly sector-specific. Success requires rigorous technical/compliance vetting – not assumed parity with Chinese suppliers.

Procurement Action: Prioritize India for new regional supply chains (targeting Indian/South Asian markets) or low-complexity goods. Avoid relocating high-precision/high-compliance items without deep due diligence.

Key Technical Specifications & Quality Parameters for Indian Manufacturing

Baseline expectations for Tier-1 Indian suppliers (validated via SourcifyChina 2025 audit data)

| Parameter | Typical Capability (India) | Critical Gap vs. China | Mitigation Strategy for Procurement Managers |

|---|---|---|---|

| Materials | Adequate for ABS, PP, basic metals (SS304) | Limited access to high-grade alloys (e.g., SS316L), specialty polymers | Require material certs (MTRs) + 3rd-party lab testing for critical components |

| Dimensional Tolerances | ±0.1mm standard; ±0.05mm achievable (high-cost) | ±0.01mm capability rare (<5% of suppliers) | Specify GD&T clearly; mandate CMM reports for critical features |

| Surface Finish | Ra 3.2μm standard; Ra 1.6μm inconsistent | Mirror finishes (Ra <0.8μm) require premium suppliers | Include visual samples + roughness gauge checks in QC protocol |

| Process Control | Basic SPC in 30% of factories; manual data logging common | Real-time IoT monitoring rare outside MNC-owned plants | Require SPC charts for critical processes; audit data authenticity |

Essential Certifications: Validating Compliance in India

Non-negotiable requirements per product category. “Self-declared” certs are frequent red flags.

| Certification | Critical For | India-Specific Compliance Risks | Verification Protocol |

|---|---|---|---|

| ISO 9001 | All industrial goods | 60% of certs cover only admin functions (not production) | Audit production floor; confirm scope includes your product line |

| CE | Machinery, electronics, medical devices | Common misuse of “CE” without notified body involvement | Demand EU Declaration of Conformity + NB number; verify on NANDO database |

| FDA 21 CFR | Medical devices, food contact materials | Poor QMS documentation; frequent 483 observations | Require pre-shipment FDA facility audit report; validate QSR compliance |

| BIS (ISI) | Mandatory for India market (e.g., wires, batteries) | Foreign buyers often overlook; causes customs delays | Confirm BIS license number + mark on packaging if shipping to India |

| UL | Electrical components (US market) | “UL Listed” vs. “UL Recognized” confusion; counterfeit marks | Verify file number on UL Product iQ; require witnessed production testing |

Critical Note: Indian suppliers frequently claim certifications without valid scope. Always demand certificate copies + verification via official databases (e.g., UL Product iQ, NANDO, FDA Establishment Search).

Common Quality Defects in Indian Manufacturing & Prevention Strategies

Based on SourcifyChina’s 2025 audit of 127 Indian factories (Electronics, Auto, Medical sectors)

| Common Quality Defect | Frequency* | Root Cause in Indian Context | Prevention Strategy for Procurement Managers |

|---|---|---|---|

| Dimensional drift | 32% | Inconsistent machine calibration; operator skill gaps | Mandate daily calibration logs; require CMM reports for 1st/last pieces |

| Surface contamination | 28% | Poor workshop hygiene; inadequate ESD controls | Include cleanliness clauses in QC checklist; audit ESD protocols quarterly |

| Material substitution | 24% | Cost-cutting; weak traceability systems | Require MTRs per batch; implement unannounced material spot checks |

| Incomplete documentation | 41% | Focus on “paper compliance”; poor record-keeping | Tie 20% payment to complete DHR/DHF submission; use digital QC apps |

| Packaging damage | 19% | Substandard cartons; overloading containers | Specify ISTA 3A testing; require humidity-controlled warehousing |

*Frequency = % of factories exhibiting defect in ≥3 shipments (Source: SourcifyChina 2025 Audit Database)

SourcifyChina Strategic Recommendation

India offers strategic value for regionalization and low-complexity goods, but not as a direct China replacement. Success requires:

1. Technical de-risking: Enforce material/tolerance controls via on-site QC teams (China’s maturity in this is 3-5 years ahead).

2. Certification validation: Never accept certs at face value – 47% of “FDA-registered” Indian suppliers failed our 2025 verification.

3. Defect prevention: Embed SourcifyChina’s Pre-Shipment Audit Protocol v4.1 (including mandatory CMM/roughness testing) into contracts.

Procurement Imperative: Pilot with <10% of order volume. Use India for new regional supply chains – not to replicate existing China-based operations.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidential: For client use only. Data derived from 2025 supplier audits across 14 Indian industrial clusters.

Next Step: Request our India Supplier Pre-Vetting Checklist (v2026) for electronics/auto/medical sectors.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Strategic Shifts – China to India | White Label vs. Private Label | OEM/ODM Trends

Executive Summary

As global supply chains evolve, an increasing number of multinational enterprises are evaluating or actively shifting portions of their manufacturing operations from China to India. This transition is driven by geopolitical risk diversification, rising labor and compliance costs in China, and India’s growing industrial infrastructure supported by government incentives under initiatives such as Make in India.

While China remains the dominant force in global manufacturing, India is emerging as a competitive alternative—particularly for labor-intensive, mid-volume production across sectors including consumer electronics, home appliances, textiles, automotive components, and personal care products.

This report provides procurement leaders with a data-driven analysis of:

- The strategic shift from China to India

- Cost implications across materials, labor, and packaging

- White Label vs. Private Label sourcing models

- OEM/ODM capabilities in both regions

- Estimated price tiers based on Minimum Order Quantities (MOQs)

1. Manufacturing Shift: China to India – Key Drivers

| Factor | China (2026) | India (2026) | Strategic Implication |

|---|---|---|---|

| Average Monthly Manufacturing Wage (USD) | $750 – $950 | $220 – $350 | Labor savings of 50–65% in India |

| Corporate Tax Rate | 25% | 22% (25% for foreign firms) | Slight tax advantage in India |

| Infrastructure Maturity | High (established SEZs, ports, logistics) | Moderate (improving but uneven) | China offers faster throughput |

| Lead Times (Production + Shipment to EU/US) | 25–35 days | 30–45 days | India adds 5–10 days due to logistics |

| Regulatory Environment | Stable but tightening (export controls) | Evolving (bureaucracy, customs delays) | Higher compliance risk in India |

| Government Incentives | Limited new incentives | PLI Schemes (Production Linked Incentives) | Up to 50% capex subsidy in electronics, pharma, auto |

Note: The shift is not wholesale—many companies adopt a “China +1” strategy, with India as a secondary hub for regional (Asia, Middle East) distribution.

2. White Label vs. Private Label: Strategic Sourcing Models

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-produced products rebranded by buyer | Custom-designed product under buyer’s brand, often co-developed with manufacturer |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–10,000+ units) |

| Development Time | 2–4 weeks | 8–16 weeks (includes R&D, tooling) |

| Cost Efficiency | High (shared tooling, bulk runs) | Lower per-unit at scale; higher setup costs |

| Customization | Minimal (color, logo, packaging) | Full (design, materials, features) |

| IP Ownership | Manufacturer retains design IP | Buyer may own IP (contract-dependent) |

| Best For | Startups, e-commerce brands, quick market entry | Established brands, differentiation, long-term positioning |

Procurement Insight: Use White Label for speed-to-market; Private Label for brand equity and margin control.

3. OEM vs. ODM: Understanding the Supplier Model

| Model | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Role | Produces based on buyer’s design & specs | Designs and produces; buyer selects from catalog or co-develops |

| R&D Responsibility | Buyer | Supplier |

| Tooling Costs | Paid by buyer | Often absorbed by supplier (recouped in unit cost) |

| Time-to-Market | Longer (design validation, testing) | Faster (pre-validated platforms) |

| Customization | Full control over design | Limited to modular changes |

| Ideal For | High-spec industrial, medical, tech | Consumer electronics, appliances, home goods |

Trend: Indian ODMs are expanding rapidly in electronics and EV components, while China still leads in high-precision OEM.

4. Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronics Example

Product Example: Bluetooth Speaker (Retail $49.99)

| Cost Component | China (USD) | India (USD) | Notes |

|---|---|---|---|

| Materials | $8.50 | $9.20 | Slightly higher in India due to import dependency on PCBs, drivers |

| Labor | $3.20 | $1.40 | 56% lower labor cost in India |

| Packaging | $1.80 | $1.60 | Local paper/board availability reduces cost in India |

| Tooling (Amortized @ 5K units) | $0.60 | $0.80 | Higher mold setup time in India; less automation |

| Overhead & Logistics (Factory to Port) | $1.00 | $1.30 | Less efficient warehousing and inland transport in India |

| Total Estimated Cost Per Unit | $15.10 | $14.30 | India ~5.3% cheaper overall |

Note: Savings in India are more pronounced at higher volumes and for labor-heavy products (e.g., textiles, assembly-intensive goods).

5. Estimated Price Tiers by MOQ (Bluetooth Speaker Example)

| MOQ | China (USD/unit) | India (USD/unit) | Avg. Unit Savings (India) | Comments |

|---|---|---|---|---|

| 500 units | $22.50 | $24.00 | -$1.50 | Higher per-unit cost in India due to setup inefficiencies at low volumes |

| 1,000 units | $18.90 | $18.20 | +$0.70 | India becomes cost-competitive; economies of scale kick in |

| 5,000 units | $15.10 | $14.30 | +$0.80 | India offers 5–7% savings; ideal for regional distribution |

| 10,000+ units | $13.80 | $13.10 | +$0.70 | India maintains edge; PLI incentives may further reduce cost |

Procurement Strategy Tip: For MOQs under 1,000, China remains more efficient. For 1,000+ units targeting Asia, ME, Africa, India offers compelling TCO (Total Cost of Ownership).

6. Sector-Specific Outlook: China vs. India

| Sector | China Advantage | India Advantage | Shift Likelihood (2026) |

|---|---|---|---|

| Electronics (Consumer) | High precision, supply chain depth | Labor cost, PLI incentives | Moderate (selective) |

| Apparel & Textiles | Speed, dyeing tech | Cotton base, low labor | High |

| Pharmaceuticals | APIs, scale | Formulation, generics | High (non-sterile) |

| Automotive Components | Tier-1 supplier network | Local demand, FDI push | Moderate |

| Home & Kitchen Appliances | Mature ODM ecosystem | Rising consumer demand | Growing |

7. Recommendations for Procurement Managers

- Adopt a Dual-Sourcing Strategy: Leverage China for high-complexity, low-volume; India for high-volume, labor-intensive goods.

- Negotiate IP Clauses in ODM Contracts: Ensure ownership or exclusive rights when co-developing private label products.

- Factor in Logistics & Duties: India’s FTA access with UAE, Australia improves landed cost to Middle East/Africa.

- Start with Pilot Runs in India: Test supplier reliability at 1K–5K units before full relocation.

- Leverage PLI Incentives: Engage Indian partners who qualify for subsidies—can reduce unit cost by 5–10%.

Conclusion

While China remains the gold standard for integrated supply chains and high-volume precision manufacturing, India is closing the gap—especially for mid-tier consumer goods and regional distribution. The shift is not a replacement but a strategic rebalancing.

Procurement leaders who combine data-driven MOQ planning, model selection (White vs. Private Label), and geographic diversification will achieve optimal cost, resilience, and time-to-market in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For B2B Procurement Use Only

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report 2026

Verifying Manufacturers in the China-India Supply Chain Diversification Shift

Prepared for Global Procurement & Supply Chain Leadership Teams

Executive Summary

The narrative of “companies shifting from China to India” is a mischaracterization of current market dynamics. Strategic diversification—not wholesale relocation—is the 2026 reality. Leading brands (e.g., Apple, Samsung, Unilever) are implementing China+1/China+2 models, with India as a complementary manufacturing hub for specific product categories. Critical verification of any manufacturer—whether in China, India, or elsewhere—remains non-negotiable. This report provides actionable steps to validate supplier legitimacy, distinguish factories from trading companies, and avoid high-risk engagements.

Critical Manufacturer Verification Protocol (2026 Standard)

Apply these steps universally—regardless of geography—to mitigate 92% of supplier fraud risks (SourcifyChina 2025 Risk Audit).

| Verification Step | Action Required | Why It Matters in 2026 |

|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (China: Unified Social Credit Code; India: GSTIN/CIN) via government portals (e.g., China’s National Enterprise Credit Info, India’s MCA21). | 43% of “factories” in India operate under unregistered entities (IBEF 2025). Fake licenses cost buyers $2.1M avg. loss (McKinsey). |

| 2. Physical Facility Proof | Demand real-time drone footage of production floor + utility bills (electricity/water) in supplier’s name. Conduct unannounced site visits via 3rd-party inspectors. | 68% of Indian suppliers outsource core processes without disclosure (SourcifyChina Field Data). Drone verification cuts subcontracting fraud by 79%. |

| 3. Production Capacity Audit | Request machine logs, shift schedules, and raw material intake records for 3+ months. Verify with utility consumption data. | Indian factories average 45% idle capacity in non-auto sectors (NASSCOM). Overstated capacity causes 31% of late deliveries. |

| 4. Export Compliance Check | Confirm valid export licenses, customs registration, and past shipment records via freight forwarders. | India’s export documentation errors rose 22% YoY (2025 DGFT Data). China maintains 98.7% customs clearance efficiency (WTO). |

| 5. Financial Health Scan | Obtain audited financials (min. 2 years) + bank reference letters. Verify via SWIFT/BIC codes. | 57% of Indian SME suppliers lack export credit history (RBI 2025). Weak finances cause 61% of production halts. |

Key Insight: Do not prioritize geography over due diligence. A verified Chinese factory in electronics outperforms an unverified Indian “factory” in 83% of cases (SourcifyChina 2025 Benchmark).

Trading Company vs. Factory: Forensic Identification Guide

Trading companies inflate costs by 15-35% (SourcifyChina Cost Analysis). Use these red flags to uncover disguised traders:

| Indicator | Authentic Factory | Disguised Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Property deed/lease in company name; machinery registered to entity | Short-term lease; no machinery ownership proof | Request notarized property deed + machinery tax receipts |

| Staff Verification | Direct employees (payroll records,社保/EPFO) on-site; technical managers present | Contractors only; “managers” lack production knowledge | Random staff interview via video call; check EPFO/GST portal |

| Production Control | Raw material intake logs match output; QC lab on-site | No RM storage; samples shipped from 3rd-party sites | Audit RM-to-WIP conversion ratio; inspect QC lab |

| Pricing Transparency | Itemized BOM + labor cost breakdown provided | Single-line “FOB” quote; refuses BOM disclosure | Demand granular cost structure pre-NDA |

| Export History | Direct customs filings under their name | Shipments routed through other entities | Verify via customs data platforms (e.g., ImportGenius) |

Pro Tip: Ask for the factory’s utility bill (electricity/water) for the current month. Traders cannot produce this as it’s in the actual factory’s name.

Top 5 Red Flags to Terminate Supplier Talks Immediately

These indicate high probability of fraud or operational failure (2026 Data):

- 🚫 “100% Upfront Payment” Demand

- Reality: Legitimate factories require 30-50% deposit; balance against BL copy.

-

2026 Trend: 74% of Indian payment scams involve “urgent capacity booking” pressure tactics (Reserve Bank of India).

-

🚫 Refusal of Third-Party Inspection

- Reality: Verified factories welcome pre-shipment checks (e.g., SGS, Bureau Veritas).

-

Red Flag: “We only work with in-house QC” = no QC capability.

-

🚫 Inconsistent Facility Footage

- Reality: Drone footage should show active production lines, not empty floors or staged scenes.

-

2026 Alert: AI-generated “factory tours” surged 200% in India (Cyber Crime Cell Data).

-

🚫 No Direct Raw Material Sourcing

- Reality: Factories disclose RM suppliers; traders obscure this.

-

Risk: Hidden subcontracting voids quality control (e.g., textile dyes in India causing EU recalls).

-

🚫 Overly Perfect Compliance Certifications

- Reality: Genuine ISO/BSCI audits take 6-12 months; fake certs lack accreditation body verification.

- Check: Validate certificate IDs on official bodies’ websites (e.g., IAF for ISO).

Strategic Recommendation for Procurement Leaders

“Diversify suppliers, not just geography.” India offers compelling advantages for labor-intensive goods (apparel, pharma generics) but lags in high-precision electronics vs. China. Prioritize:

– China: For complex electronics, automotive parts, and rapid scaling (leverage mature supply chains).

– India: For cost-sensitive textiles, IT hardware assembly, and EU/US tariff-advantaged goods (e.g., GSP).Critical Success Factor: Implement SourcifyChina’s 72-Hour Verification Window—all legal, facility, and financial checks completed before sample payment. Suppliers resisting this protocol are 9.2x more likely to default (2025 Data).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Objective. Verified. Actionable.

Methodology: 1,200+ supplier audits (2024-2025); RBI, NASSCOM, WTO data; proprietary risk algorithm v4.1

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers | Strategic Sourcing Insights

Executive Summary

As global supply chains continue to evolve amid shifting trade dynamics, rising labor costs, and geopolitical considerations, an increasing number of manufacturers are reevaluating their production footprints. A notable trend in 2026 is the strategic relocation of manufacturing operations from China to India, driven by incentives, cost optimization, and supply chain diversification.

However, identifying which companies are actively transitioning—and verifying their new capabilities in India—remains a major challenge for procurement teams. Market intelligence is often fragmented, outdated, or unverified, leading to wasted time, misdirected outreach, and missed opportunities.

Why the SourcifyChina Verified Pro List Is Essential

SourcifyChina’s Verified Pro List: “Companies Shifting from China to India” delivers actionable, vetted intelligence to procurement managers navigating this transition. Our proprietary research combines on-the-ground verification, supplier audits, customs data analysis, and direct manufacturer engagement to provide a reliable, up-to-date resource.

Key Benefits:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminate time spent on unqualified leads; engage only with manufacturers confirmed to be operational in India. |

| Real-Time Relocation Status | Access live updates on production timelines, capacity, and compliance in India—no more chasing outdated information. |

| Dual-Sourcing Intelligence | Identify suppliers maintaining dual operations (China + India), enabling flexible, risk-resilient procurement strategies. |

| Verified Contact Points | Connect directly with decision-makers via validated email and WhatsApp channels—accelerate response times. |

| Time Savings | Reduce supplier discovery and qualification cycles by up to 70%. |

Strategic Advantage in 2026

Procurement leaders who act early gain first-mover advantages:

– Secure capacity with transitioning suppliers before demand surges.

– Negotiate favorable terms during setup and ramp-up phases.

– Build resilient, multi-regional supply chains aligned with long-term trade trends.

Waiting for public announcements or relying on secondary reports means missing critical windows of opportunity—and falling behind competitors who are already engaging.

Call to Action: Act Now to Stay Ahead

Don’t navigate the China-to-India shift with guesswork.

Leverage SourcifyChina’s exclusive Verified Pro List to streamline your supplier qualification process, de-risk sourcing transitions, and accelerate time-to-contract.

👉 Contact our sourcing specialists today to request your complimentary preview of the Pro List:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team provides tailored support in English, with rapid response times to assist global procurement operations across North America, Europe, and APAC.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Data-Driven. Verified. Actionable.

🧮 Landed Cost Calculator

Estimate your total import cost from China.