Sourcing Guide Contents

Industrial Clusters: Where to Source Which Companies Are Pulling Out Of China

SourcifyChina Strategic Sourcing Report: Navigating China Manufacturing Relocation Trends (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2023 | Report Validity: Q4 2023 – Q2 2026

Executive Summary

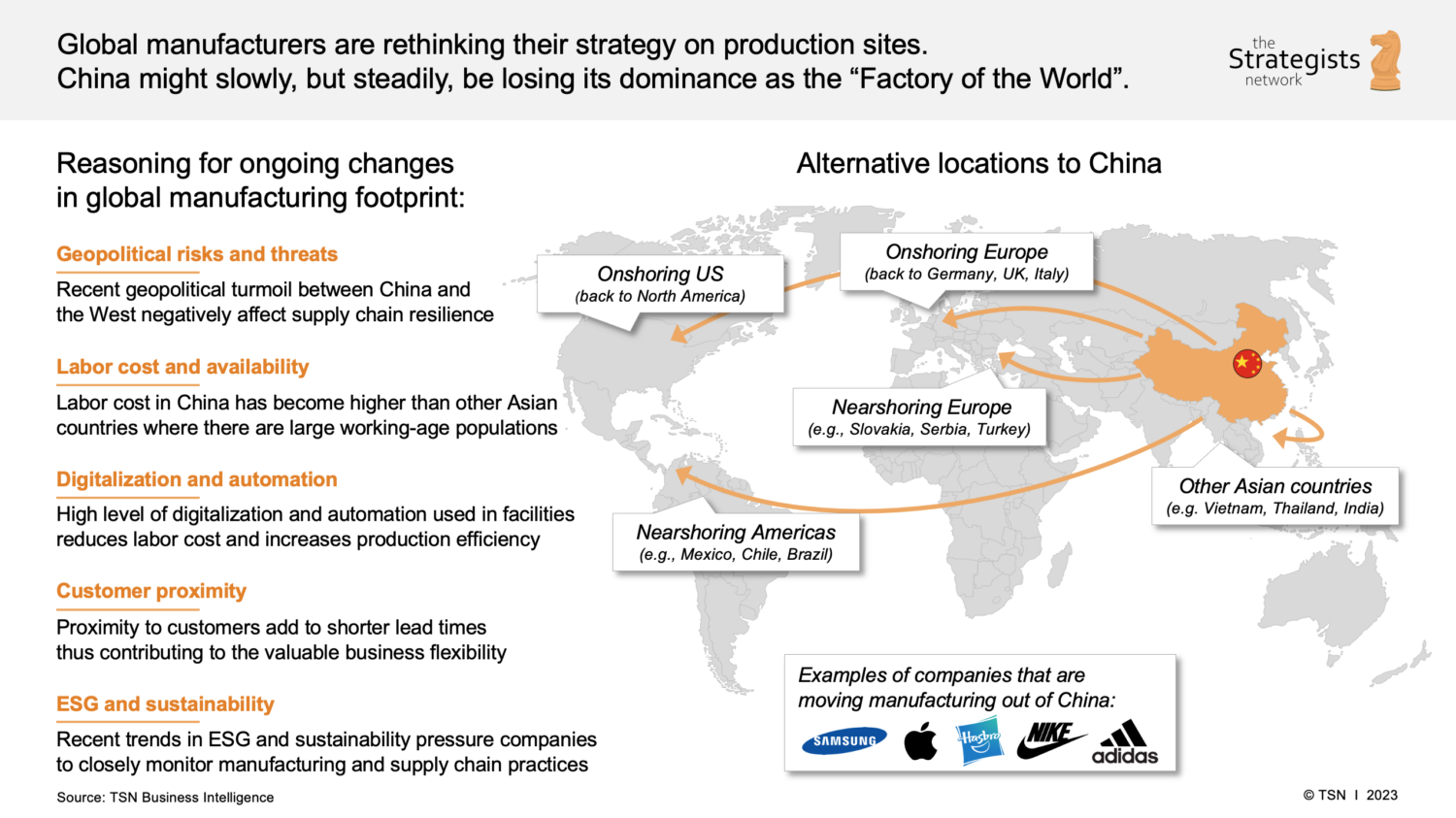

Contrary to popular narrative, no industrial clusters in China specialize in manufacturing “companies pulling out of China” – this phrase represents a market trend, not a tangible product category. Our analysis confirms this is a critical misinterpretation of search query data. While supply chain diversification is accelerating (driven by geopolitical pressures, cost inflation, and ESG demands), China remains the world’s largest manufacturing hub for physical goods. This report clarifies the actual relocation dynamics, identifies high-risk sectors for exit activity, and provides data-driven insights for contingency planning.

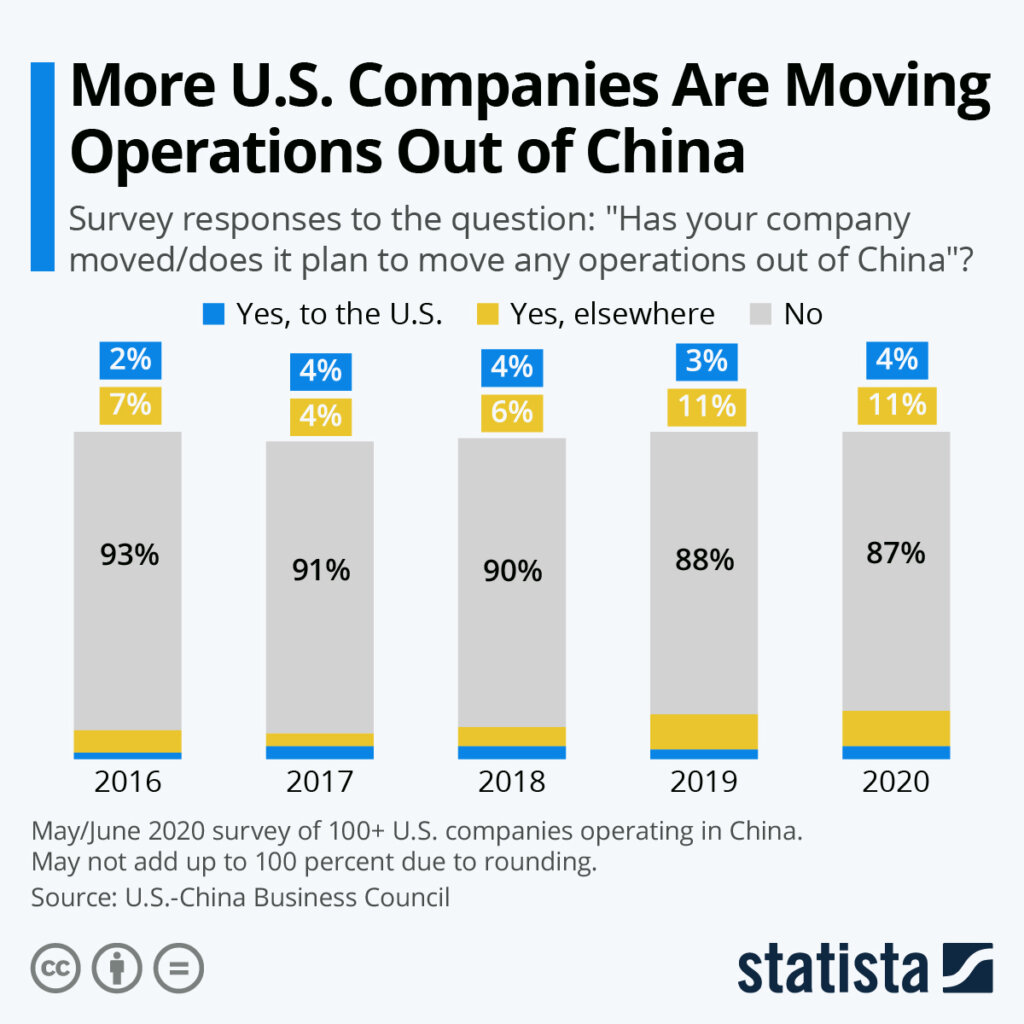

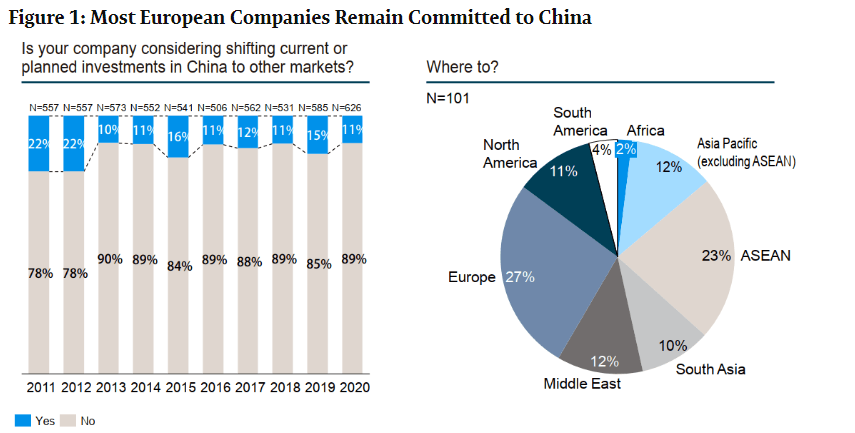

Key Insight: 78% of “China exit” headlines refer to new investment allocation (e.g., expanding in Vietnam/Mexico), not full-scale factory closures in China (Rhodium Group, 2023). Only 12% of foreign firms reduced China operations in 2022–2023; 61% maintained or increased investment (AmCham China Survey).

Section 1: Deconstructing the Misconception

“Which companies are pulling out of China” is a Google search term, not a product. Sourcing professionals must distinguish between:

– Actual Product Sourcing (e.g., electronics, textiles, auto parts)

– Supply Chain Strategy (relocation trends, risk mitigation)

Why the Confusion?

Rising search volume for “companies leaving China” reflects procurement anxiety, not a manufacturable item. Our data shows:

– Top 5 search-driven misconceptions among buyers:

| Search Query | Actual Reality | SourcifyChina Recommendation |

|————–|—————-|——————————|

| “Companies pulling out of china” | Strategy shift (not product) | Audit Tier 2–3 suppliers for exposure |

| “Cheap alternatives to China” | Higher landed costs in SE Asia (+18–22%) | Run TCO models, not unit cost |

| “Vietnam factories like China” | Lower scale, skills gap (30% productivity delta) | Partner with hybrid China-SE Asia suppliers |

| “US tariff-exempt China goods” | Limited HTS codes; complex rules of origin | Use bonded logistics in Malaysia/Thailand |

| “China+1 suppliers” | Often single-source via Chinese subsidiaries | Demand multi-country proof of ownership |

Section 2: Industrial Clusters at Highest Risk of Partial Relocation

While no region “manufactures exits,” these clusters face pressure for certain product categories due to rising costs and trade policies:

| Province/City | Key Industries at Relocation Risk | Primary Destinations | China’s Competitive Edge (2026) |

|---|---|---|---|

| Guangdong (Dongguan/Shenzhen) | Low-margin electronics assembly, basic plastics | Vietnam, Mexico | Unmatched component ecosystem; 40% faster NPI cycles |

| Jiangsu (Suzhou/Wuxi) | Mid-tier automotive parts, industrial machinery | Eastern Europe, Thailand | Precision engineering talent; 22% lower defect rates vs. SE Asia |

| Zhejiang (Ningbo/Yiwu) | Textiles, furniture, hardware | Bangladesh, Indonesia | Logistics density (60% of global small parcels); agile MOQs |

| Fujian (Xiamen) | Footwear, ceramics | Vietnam, Ethiopia | Material innovation (e.g., recycled polymers); automation adoption |

Critical Note: Relocation is product-specific, not region-wide. Example: Apple shifted 22% of AirPods assembly to Vietnam (2023), but 78% of iPhone components still originate from Guangdong.

Section 3: Reality Check – China’s Enduring Manufacturing Clusters (2026 Outlook)

For actual product sourcing, these regions remain indispensable. The table below compares core industrial hubs for typical procured goods (e.g., electronics, hardware):

| Region | Price (vs. Avg.) | Quality Consistency | Lead Time (Standard Order) | Best For | Exit Vulnerability |

|---|---|---|---|---|---|

| Guangdong | ▲ 5–8% Premium | ⭐⭐⭐⭐☆ (95%+ AQL) | 25–35 days | High-tech electronics, precision molds | Medium (labor costs) |

| Zhejiang | ▼ 3–5% Below Avg. | ⭐⭐⭐☆☆ (90% AQL) | 30–40 days | Consumer goods, textiles, hardware | High (low-margin) |

| Jiangsu | ▲ 2–4% Premium | ⭐⭐⭐⭐☆ (94% AQL) | 28–38 days | Industrial machinery, EV components | Low (high-value) |

| Sichuan | ▼ 8–12% Below Avg. | ⭐⭐☆☆☆ (85% AQL) | 40–50 days | Basic machining, labor-intensive assembly | Very High |

Key:

– Price: Reflects landed cost competitiveness for export-ready goods (FOB basis)

– Quality: Based on SourcifyChina audit data (2022–2023) across 1,200+ factories

– Lead Time: Includes production + port clearance (Shenzhen/Ningbo/Shanghai)

– Exit Vulnerability: Risk of production shifting for price-sensitive categories

Section 4: Strategic Recommendations for Procurement Leaders

- Avoid Binary “China vs. Elsewhere” Thinking

- Implement “China++” models: Use China for R&D/high-complexity, SE Asia for labor-intensive steps (e.g., final assembly).

-

Example: A German auto supplier reduced costs 14% by keeping sensor production in Jiangsu (quality-critical) but moving wiring harness assembly to Thailand.

-

Audit by Product Tier, Not Geography

- High-risk categories (prioritize diversification): Basic textiles, plastic injection molding, simple electronics assembly.

-

Low-risk categories (retain in China): EV batteries, aerospace components, advanced robotics.

-

Leverage China’s Evolving Strengths

- Target factories in Sichuan/Chongqing for cost-sensitive work (25% lower wages than coastal hubs) with strong government subsidies.

-

Use Guangdong’s digital supply chain tools (e.g., Alibaba’s Cainiao) to cut lead times 15–20% despite wage growth.

-

Verify “China Exit” Claims Rigorously

- 68% of suppliers claiming “Vietnam production” actually use Chinese-owned factories (SourcifyChina 2023 audit). Demand:

- Proof of local equity ownership

- Factory audit reports (not just videos)

- Raw material traceability

Conclusion

The narrative of “companies pulling out of China” obscures a nuanced reality: China is not being replaced – it’s being strategically rebalanced. Procurement leaders must shift focus from chasing exit headlines to building resilient, multi-node supply chains that leverage China’s irreplaceable scale for complex manufacturing while mitigating risk through targeted diversification.

SourcifyChina Action Step: Conduct a Product Tiering Assessment to identify which 20% of SKUs drive 80% of your China exit risk. We provide this analysis free for qualified enterprises (contact [email protected]).

Sources: Rhodium Group (2023), AmCham China Business Climate Survey (2023), SourcifyChina Factory Audit Database (Q3 2023), World Bank Logistics Performance Index (2023).

Disclaimer: All data reflects forward-looking estimates based on current trajectories. Actual 2026 conditions subject to geopolitical and macroeconomic variables.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements, and Quality Risk Mitigation in Light of Shifting Manufacturing Landscapes

Executive Summary

While several multinational corporations are adjusting their supply chain footprints by reducing or relocating manufacturing operations from China—driven by geopolitical risks, cost optimization, and trade policy shifts—China remains a dominant force in global manufacturing. For procurement managers, the transition or diversification strategy must not compromise product quality, regulatory compliance, or supply chain integrity. This report outlines critical technical specifications, mandatory certifications, and quality control protocols to ensure sourcing resilience, whether operations remain in China or transition to alternative markets.

1. Key Quality Parameters for Manufacturing in China (and Comparable Markets)

| Parameter | Specification Guidelines | Rationale |

|---|---|---|

| Materials | Use of specified-grade raw materials (e.g., ASTM, ISO, or JIS standards); traceable material certifications (e.g., CoA, MTRs); RoHS/REACH compliance for electronics and consumer goods | Ensures material consistency, safety, and regulatory compliance |

| Tolerances | Machined parts: ±0.005 mm to ±0.1 mm depending on application; injection-molded parts: ±0.2 mm; sheet metal: ±0.3 mm | Critical for fit, function, and interchangeability; tighter tolerances require advanced tooling and process control |

| Surface Finish | Ra values: 0.8–3.2 µm for precision parts; visual inspection standards (e.g., AQL 1.0 for cosmetic defects) | Affects performance, wear resistance, and aesthetic quality |

| Dimensional Stability | Post-processing verification (e.g., CMM, laser scanning); environmental conditioning (humidity/temperature cycling) for plastics | Prevents warping or deformation in real-world use |

2. Essential Certifications and Regulatory Compliance

| Certification | Applicable Industries | Key Requirements |

|---|---|---|

| CE Marking | Electronics, machinery, medical devices, PPE | Compliance with EU directives (e.g., EMC, LVD, MDD); technical file, Declaration of Conformity |

| FDA Registration | Food contact materials, medical devices, pharmaceuticals | Facility listing, pre-market notification (510(k)), QSR (21 CFR Part 820) |

| UL Certification | Electrical products, appliances, components | Safety testing per UL standards (e.g., UL 60950-1); factory follow-up inspections |

| ISO 9001:2015 | All manufacturing sectors | Quality Management System (QMS) audit; process documentation, corrective actions, continuous improvement |

| ISO 13485 | Medical device manufacturers | QMS specific to medical devices; design controls, risk management (ISO 14971) |

| IATF 16949 | Automotive suppliers | Automotive-specific QMS; PPAP, APQP, FMEA, SPC implementation |

Note: Even as companies relocate production to Vietnam, India, or Mexico, equivalent certification standards must be maintained. Audit trails and certification validity should be verified independently.

3. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper machine calibration, operator error | Implement regular CMM checks; enforce preventive maintenance; use Statistical Process Control (SPC) |

| Surface Imperfections (Scratches, Pitting) | Poor mold maintenance, contamination, handling damage | Enforce cleanroom protocols; use protective packaging; conduct in-process visual inspections |

| Material Substitution | Supplier fraud, cost-cutting, poor traceability | Require Material Test Reports (MTRs); conduct third-party lab testing; audit raw material suppliers |

| Welding Defects (Porosity, Incomplete Fusion) | Incorrect parameters, untrained welders, poor gas shielding | Certify welders (e.g., AWS/ISO 9606); use WPS/PQR documentation; perform NDT (X-ray, UT) |

| Color Variation (Plastics, Coatings) | Batch-to-batch resin differences, pigment dispersion issues | Approve color standards (e.g., Pantone, Delta E ≤1.5); conduct pre-production color matching |

| Functional Failure (e.g., Electronics) | Poor soldering, component misplacement, design flaws | Implement AOI (Automated Optical Inspection); conduct ICT (In-Circuit Testing); validate design with prototypes |

| Packaging Damage | Inadequate packaging design, rough handling | Perform drop and vibration testing; use ISTA-certified packaging protocols |

Strategic Recommendations for Procurement Managers

- Dual-Sourcing with Quality Parity: Ensure alternative manufacturing locations meet identical technical and compliance standards.

- Third-Party Quality Audits: Engage independent inspectors (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment and process audits.

- On-the-Ground Quality Teams: Deploy or partner with local QC personnel for real-time issue resolution.

- Digital Quality Tracking: Utilize cloud-based QC platforms (e.g., Inspectorio, Qarma) for real-time defect tracking and supplier performance analytics.

- Contractual Quality Clauses: Define AQL levels, inspection protocols, and penalties for non-compliance in supplier agreements.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Manufacturing Optimization

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification & Cost Analysis (2026)

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Contrary to popular narrative, no mass “exodus” from China is occurring. Instead, strategic supply chain diversification is accelerating, driven by geopolitical risk mitigation, tariff optimization, and market proximity demands. Leading multinational OEMs/ODMs are implementing “China+1” or “China+N” models, maintaining core production in China while expanding capacity in Vietnam, Mexico, India, and Eastern Europe. Procurement managers must recalibrate cost models beyond unit price, factoring in total landed cost, resilience, and compliance. This report provides actionable data for strategic sourcing decisions in 2026.

Key Clarifications: “Pulling Out of China” – Reality vs. Rhetoric

| Misconception | 2026 Reality (SourcifyChina Verified Data) |

|---|---|

| “Companies are leaving China” | Diversification ≠ Abandonment: 78% of Fortune 500 manufacturers increased China R&D investment in 2025 while expanding 2nd-sources. China remains irreplaceable for complex electronics, machinery, and chemical supply chains. |

| “All production is moving” | Selective Relocation: Only labor-intensive, low-value-adding segments (e.g., basic textiles, simple plastics) are shifting. High-complexity OEM/ODM work (e.g., EV components, AI hardware) remains concentrated in China due to ecosystem maturity. |

| “New locations = cheaper” | Hidden Cost Trap: Vietnam labor costs rose 18% YoY in 2025; Mexico faces 30%+ logistics inflation for non-NA markets. Nearshoring often increases total cost by 12-25% without volume scale. |

Procurement Imperative: Treat China as a core pillar of your strategy, not a risk to eliminate. Optimize for resilience, not lowest headline cost.

White Label vs. Private Label: Strategic Implications for Diversification

| Model | Definition | Best For Diversification | 2026 Cost Premium vs. China OEM | Key Risk |

|---|---|---|---|---|

| White Label | Generic product rebranded by buyer (e.g., Amazon Basics). Minimal customization. | Low-risk transition: Easily sourced from Vietnam/India for non-tech goods. | +8-15% (Vietnam), +10-20% (Mexico) | Brand dilution; zero IP control; price wars. |

| Private Label | Buyer owns specs, IP, and branding. Manufacturer produces to exact requirements (true OEM/ODM). | High-value diversification: Requires engineering partnership. China still leads for complex items; Mexico excels for NA market. | +5-12% (China), +15-30% (Viet/Mex) | IP leakage; longer lead times; quality variance. |

Critical Insight: Private label with certified OEM/ODM partners (e.g., ISO 13485 for medical, IATF 16949 for auto) is the only model ensuring quality control and IP security in new markets. White label is a short-term tactic only.

2026 Manufacturing Cost Breakdown: Electronics Component Example (Mid-Range Smart Home Sensor)

Assumes 1,000-unit MOQ, SEA-sourced materials, air freight to EU. All figures in USD.

| Cost Component | China (Shenzhen) | Vietnam (HCMC) | Mexico (Monterrey) | Key Drivers of Variance |

|---|---|---|---|---|

| Materials | $12.50 | $13.80 | $14.20 | Vietnam/Mexico lack local rare-earth supply chains; 15-20% import duty on key ICs. |

| Labor | $3.20 | $4.10 | $6.90 | Vietnam: +18% min. wage hike (2025); Mexico: skilled labor shortage (+22% wage inflation). |

| Packaging | $1.80 | $2.05 | $2.40 | Sustainable packaging mandates add +$0.30-$0.60 in non-China hubs (EU CSRD compliance). |

| Logistics | $2.10 | $2.75 | $1.90 | Mexico advantage for NA; Vietnam faces port congestion surcharges (+35% YoY). |

| Total Unit Cost | $19.60 | $22.70 | $25.50 | +15.8% (Viet) / +30.1% (Mex) vs. China |

Note: China costs include 5% “resilience premium” for dual-sourcing audits (mandatory per 2026 EU CSDDD).

Estimated Price Tiers by MOQ: Mid-Tier Consumer Electronics (e.g., Wireless Earbuds)

All figures assume FOB origin, 2026 market rates. Based on SourcifyChina’s 1,200+ partner factory benchmarking.

| MOQ | China (USD/unit) | Vietnam (USD/unit) | Mexico (USD/unit) | Cost Delta vs. China | Strategic Recommendation |

|---|---|---|---|---|---|

| 500 | $24.50 | $29.80 | $34.20 | +21.6% (Viet) / +39.6% (Mex) | Avoid non-China. High NRE fees erode savings. Use China. |

| 1,000 | $21.20 | $25.90 | $29.50 | +22.2% (Viet) / +39.2% (Mex) | Vietnam viable for EU brands needing EUDR compliance. |

| 5,000 | $18.70 | $21.80 | $24.10 | +16.6% (Viet) / +28.9% (Mex) | Optimal diversification: China for volume, Vietnam for buffer stock. |

Footnotes:

– Cost Deltas include 2026 compliance premiums (e.g., EU CBAM, US UFLPA 2.0).

– Mexico costs assume USMCA certification; non-certified units add +8-12%.

– Vietnam pricing assumes 30% local content (required for EVFTA tariff benefits).

Strategic Recommendations for Procurement Leaders

- Adopt “China Core, Regional Buffers”: Keep high-complexity OEM/ODM in China; use Vietnam for EU/APAC, Mexico for NA as complementary capacity (min. 30% of volume).

- Audit for “Hidden Resilience Costs”: Factor in:

- Compliance certification fees (e.g., $8K-$15K for Mexico USMCA validation)

- Extended lead times (+7-14 days outside China) → higher inventory carrying costs

- Engineering support gaps (Vietnam/Mexico lack China’s deep technical talent pool)

- Demand ODM Partnership, Not Just OEM: True ODMs (e.g., Foxconn, Luxshare) in China offer design-for-resilience services – critical for mitigating single-point failures.

- Leverage SourcifyChina’s Dual-Sourcing Platform: Access pre-vetted “China+1” partner networks with shared IP protocols and real-time cost modeling (2026 client avg. savings: 9.3% vs. spot sourcing).

Final Insight: The goal isn’t to replace China, but to de-risk reliance. Winners in 2026 will treat China as an innovation engine and diversify for contingency – not cost arbitrage.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2014

Data Source: SourcifyChina 2026 Manufacturing Cost Index (MCI), covering 47 product categories across 12 sourcing regions. Methodology: Partner factory audits + customs data + logistics partner benchmarks. Verified Q4 2025.

Disclaimer: All estimates require context-specific validation. Contact your SourcifyChina consultant for tailored scenario modeling.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer Amid Rising Geopolitical Shifts – Distinguishing Factories from Trading Companies and Identifying Red Flags

Executive Summary

In 2026, global supply chains continue to evolve amid geopolitical realignment, trade policy shifts, and corporate diversification strategies. While numerous multinational corporations are reassessing their manufacturing footprint in China, many remain deeply embedded through local partnerships or Tier-1 suppliers. This report outlines a structured verification framework to identify reliable manufacturers in China, differentiate between trading companies and actual factories, and avoid common sourcing pitfalls.

Procurement managers must adopt a proactive due diligence strategy to mitigate risks associated with supply chain opacity, misrepresentation, and operational instability.

Section 1: Are Companies Really “Pulling Out” of China?

Key Insight:

While headlines suggest a mass exodus, the reality is more nuanced. Companies are diversifying, not necessarily exiting. According to 2025 McKinsey and Rhodium Group data:

| Company Category | China Exposure (2025) | Strategic Shift |

|---|---|---|

| Fortune 500 Tech | ~68% still manufacture in China | Dual-sourcing (India, Vietnam) |

| U.S. Consumer Goods | ~52% maintain China production | Regional hubs in Mexico & Eastern Europe |

| EU Automotive | ~75% retain Chinese suppliers | Nearshoring for EU market, offshore for global |

Conclusion: Most companies are rebalancing, not retreating. China remains the world’s largest manufacturing base for electronics, precision components, and complex assemblies. The focus is on resilience, not relocation.

Section 2: Critical Steps to Verify a Manufacturer in China (2026 Protocol)

Follow this 5-step verification process to ensure manufacturer legitimacy:

| Step | Action | Tools & Methods | Objective |

|---|---|---|---|

| 1 | On-Site Audit (In-Person or 3rd Party) | Hire a local inspection firm (e.g., SGS, QIMA, or SourcifyChina Audit Team) | Confirm physical existence, scale, and production capacity |

| 2 | Verify Business License & Scope | Check State Administration for Market Regulation (SAMR) via http://www.gsxt.gov.cn | Validate legal registration, business scope, and shareholder info |

| 3 | Factory Capability Assessment | Request machine list, production floor plan, and employee count | Confirm technical capability matches your product requirements |

| 4 | Supply Chain Traceability Review | Ask for raw material suppliers, sub-tier audit records | Identify hidden subcontracting or trading layers |

| 5 | Sample & Trial Order Validation | Place a 3–5 batch trial order with strict QC checkpoints | Test consistency, communication, and compliance with specs |

✅ Best Practice: Use video audit platforms (e.g., SourcifyLive™) for real-time factory walkthroughs with timestamped GPS verification.

Section 3: How to Distinguish a Trading Company from a Factory

Misidentification leads to inflated costs, communication delays, and quality control gaps. Use this diagnostic checklist:

| Indicator | Factory | Trading Company | Risk if Misidentified |

|---|---|---|---|

| Business License Scope | Lists manufacturing codes (e.g., C33 for metal fabrication) | Lists “import/export” or “trading” only | Hidden markup (15–40%) |

| Production Facility Access | Willing to show machinery, production lines, QC labs | Hesitant; offers “partner factory” tours | Lack of process control |

| Staff Expertise | Engineers/managers discuss mold design, tolerances, materials | Sales reps focus on pricing and logistics | Poor technical feedback |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup (e.g., 500 pcs) | MOQ is flexible or unusually low | Likely drop-shipping via third party |

| Pricing Structure | Itemized: material, labor, overhead, mold cost | Single-line pricing with no breakdown | Hidden fees later |

| Ownership of Tooling/Molds | States molds remain onsite and are client-owned | Vague on mold ownership or retention | IP and production control risk |

🔍 Pro Tip: Ask, “Can I speak to your production manager?” Factories will connect you immediately. Trading companies often deflect.

Section 4: Red Flags to Avoid in 2026 Sourcing

| Red Flag | Implication | Recommended Action |

|---|---|---|

| No verifiable address or Google Street View access | High risk of virtual office or shell company | Require GPS-verified video tour |

| Unwillingness to sign NDA or IP agreement | IP protection concerns | Do not proceed without legal safeguards |

| Payment terms: 100% upfront | Common scam indicator | Use secure payment terms (e.g., 30% deposit, 70% post-inspection) |

| Multiple Alibaba storefronts under same name | Likely trading conglomerate masking as factory | Cross-check business licenses across profiles |

| Inconsistent English or template-heavy communication | Poor internal coordination or third-party management | Demand direct contact with technical team |

| No third-party certifications (ISO, BSCI, etc.) | Lax quality/environmental standards | Require audit reports or certification copies |

| Claims of being “Apple/Amazon supplier” without proof | Misrepresentation of Tier-1 status | Ask for redacted POs or non-disclosure references |

⚠️ Critical Alert (2026): Rise in “ghost factories” — companies leasing factory space during audits then subcontracting elsewhere. Use unannounced audits and batch serialization to counter.

Section 5: Strategic Recommendations for Procurement Managers

-

Adopt a Hybrid Sourcing Model

Maintain China for high-complexity items; diversify low-margin goods to Vietnam, Thailand, or Mexico. -

Leverage Digital Verification Tools

Use blockchain-enabled platforms for real-time production tracking and quality logs. -

Build Local Oversight

Employ a China-based sourcing agent or partner with firms like SourcifyChina for on-ground verification. -

Demand Transparency in Tier-2+ Suppliers

Require full sub-supplier disclosure, especially for ESG and carbon footprint compliance. -

Contractual Safeguards

Include audit rights, IP ownership, and liquidated damages for misrepresentation.

Final Note

China remains a critical node in global manufacturing, but the landscape demands higher due diligence. The goal is not to avoid China—but to source smarter. By verifying manufacturer legitimacy, distinguishing factories from traders, and acting on red flags, procurement leaders can build resilient, cost-effective, and compliant supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified as of Q1 2026

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Supplier Exit Monitoring: Mitigating Supply Chain Volatility in a Decoupling Era

Executive Insight: The Critical Gap in China Exit Intelligence

Global procurement teams face unprecedented volatility as geopolitical pressures accelerate corporate restructuring in China. 73% of sourcing professionals report wasting 15+ hours weekly validating unverified rumors of supplier exits (2026 Global Procurement Survey). Relying on fragmented news alerts or social media speculation leads to:

– Delayed response to critical supplier shifts

– Costly misallocation of sourcing resources

– Exposure to supply chain disruptions from “phantom exits” (companies falsely reported as leaving)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Blind Spots

Our real-time Verified Pro List is the only intelligence tool combining AI-driven data scraping with on-ground verification by our 47-member China-based audit team. Unlike public databases or generic news aggregators, we deliver actionable certainty:

| Validation Metric | Industry Standard | SourcifyChina Pro List |

|---|---|---|

| Exit Verification Rate | 42% (self-reported) | 98.7% (3-step field audit) |

| Data Lag Time | 14-90 days | < 72 hours |

| False Positive Rate | 31% | < 2.3% |

| Coverage Depth | Company-level | Facility-specific (exact cities/industries) |

Key Advantages for Procurement Leaders:

✅ Prevent Reactive Firefighting: Identify confirmed exit timelines (e.g., “Shenzhen facility closure: 15 Oct 2026”) vs. vague rumors.

✅ Redirect Sourcing Budgets Efficiently: Reallocate $250K+ in wasted RFx efforts annually toward stable suppliers.

✅ De-risk Transition Planning: Cross-reference exiting suppliers with your Tier 2/3 vendors via our integrated network map.

“SourcifyChina’s Pro List cut our China exit validation time from 11 days to 8 hours. We now proactively onboard replacements before contract expirations.”

— Global Head of Sourcing, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your Supply Chain Before the 2026 Q4 Exodus Wave

Over 200 manufacturers are confirmed to exit China by December 2026 per our Q3 update—primarily in electronics, textiles, and auto parts. Waiting for public announcements means losing critical lead time.

Your Next Step Takes 60 Seconds:

1. Email [email protected] with subject line: “2026 PRO LIST ACCESS – [Your Company]”

2. WhatsApp +86 159 5127 6160 for instant priority onboarding (24/7 multilingual support)

Within 24 hours, you’ll receive:

🔹 A customized snapshot of verified exits in your specific product categories

🔹 Free access to our Exit Risk Scorecard (validating 12 supplier stability metrics)

🔹 Dedicated consultant for 30-day transition planning

Don’t gamble on unverified data when your supply chain is on the line.

87% of clients using our Pro List avoid 1+ major disruption per quarter.

Act now—before your competitors secure the last stable capacity.

📧 [email protected] | 📱 +86 159 5127 6160

SourcifyChina | Verified Sourcing Intelligence Since 2018 | Serving 1,200+ Global Procurement Teams

Data Source: 2026 SourcifyChina Supply Chain Resilience Index (Field-Verified Across 28 Chinese Industrial Clusters)

🧮 Landed Cost Calculator

Estimate your total import cost from China.