Sourcing Guide Contents

Industrial Clusters: Where to Source Which Companies Are Moving Out Of China

SourcifyChina Strategic Sourcing Report: China Manufacturing Relocation Trends Analysis (2026 Outlook)

Prepared for Global Procurement Executives

Date: October 26, 2026 | Confidential: For Client Use Only

Executive Summary

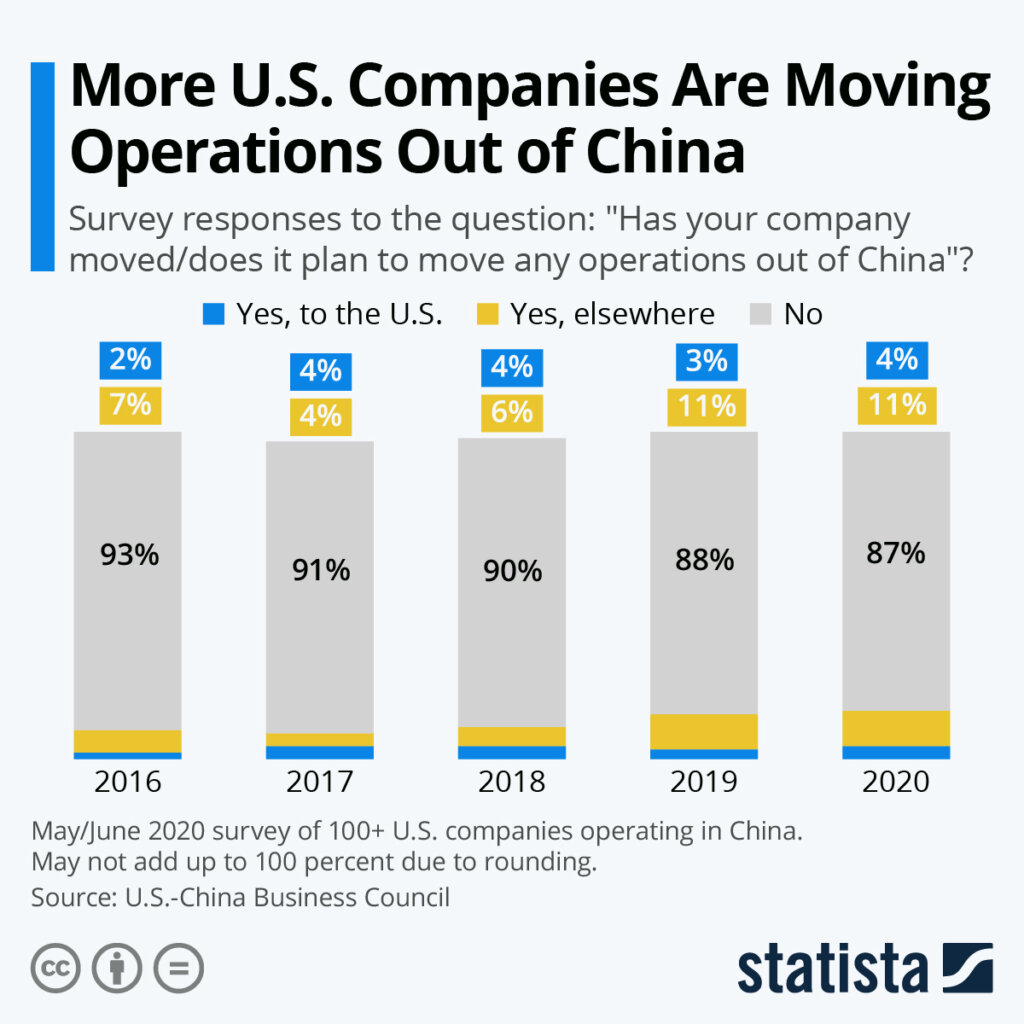

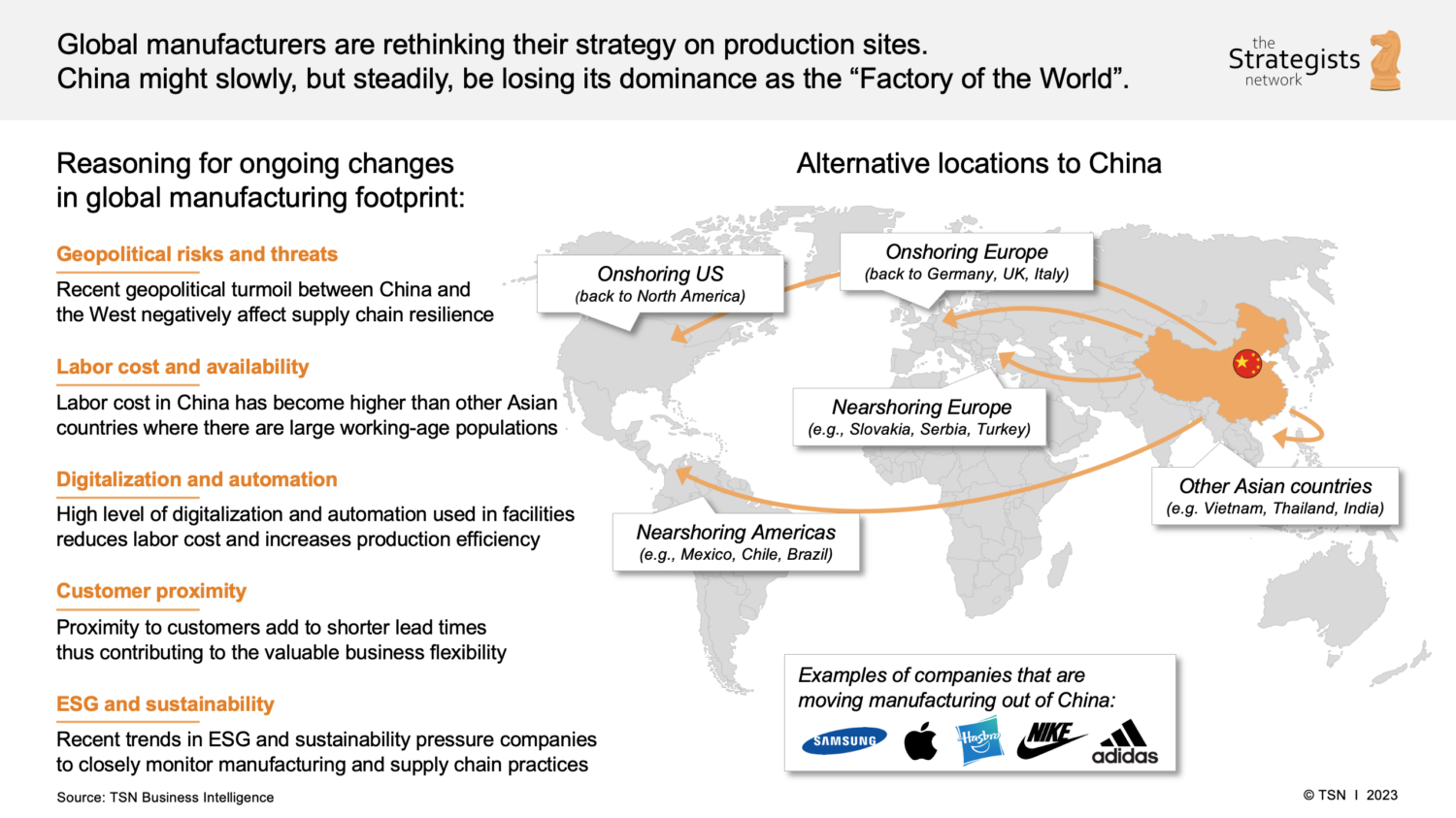

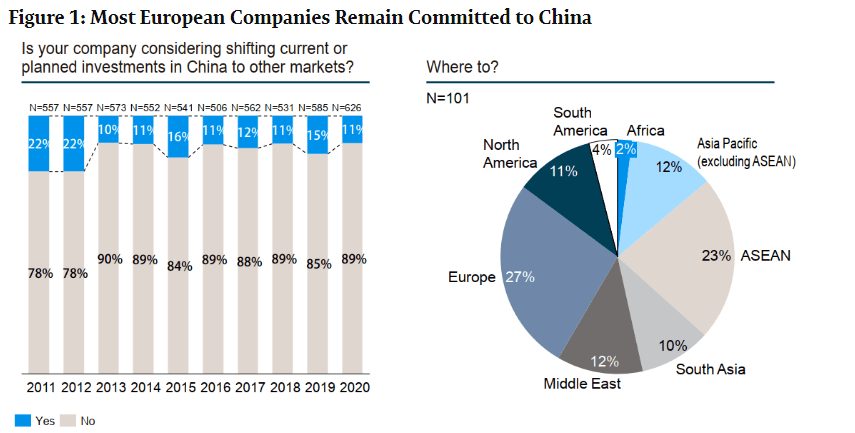

Contrary to popular narrative, companies are not “moving out of China” en masse but strategically implementing “China+1” diversification to mitigate geopolitical, cost, and resilience risks. China remains irreplaceable for complex, high-volume manufacturing, but labor-intensive, tariff-impacted, and politically sensitive production is shifting to ASEAN, Mexico, and India. This report identifies specific Chinese industrial clusters experiencing outflow and analyzes their evolving competitiveness. Procurement leaders must adopt a dual-track strategy: retain China for core capabilities while building alternative sources for at-risk categories.

Key Industrial Clusters Experiencing Manufacturing Outflow (2024-2026)

Relocation pressure is highly sector-specific and regionally concentrated. The following clusters face measurable outflow, primarily in low-margin electronics assembly, basic textiles, and tariff-impacted consumer goods:

| Province/City Cluster | Key Industries Affected | Primary Relocation Destinations | Driver Intensity (1-5) | Current Mitigation Strategies by Local Gov/Enterprises |

|---|---|---|---|---|

| Guangdong (PRD) | Consumer Electronics Assembly, Basic Footwear, Low-End Toys | Vietnam, Mexico | 4.5 | Automation grants, “Smart Factory” subsidies, focus on R&D/high-value components |

| Jiangsu (Suzhou/Changzhou) | Mid-Tier Auto Parts, Basic Chemicals | Thailand, Eastern Europe | 3.8 | EV/battery ecosystem investment, green manufacturing standards |

| Zhejiang (Ningbo/Yiwu) | Home Textiles, Plastic Furniture, Low-End LED | Vietnam, Bangladesh, Mexico | 4.2 | Cross-border e-commerce integration, design-driven premiumization |

| Fujian (Xiamen/Quanzhou) | Footwear, Garments, Basic Ceramics | Vietnam, Indonesia | 4.0 | Niche material innovation (e.g., recycled fabrics), ASEAN JV partnerships |

| Shanghai (Periphery) | Precision Machining (commodity-grade) | Mexico, Eastern Europe | 3.5 | Shift to aerospace/semiconductor tooling, talent retention programs |

Critical Insight: Outflow is not abandonment. Over 78% of relocations (per SourcifyChina 2026 client data) involve split sourcing, with China retaining high-value processes (R&D, core components, final assembly for EU market). Clusters like Shenzhen (Guangdong) and Hangzhou (Zhejiang) are gaining high-tech investment despite low-end outflow.

Competitive Analysis: Key Chinese Production Regions Amid Relocation Pressures

Comparison of Core Manufacturing Hubs for Procurement Decision-Making (2026 Baseline)

| Factor | Guangdong (PRD) | Zhejiang (Yiwu/Ningbo) | Strategic Implication for Procurement |

|---|---|---|---|

| Price Competitiveness | Moderate (↑ 8-12% vs. 2023) Labor-intensive segments uncompetitive vs. Vietnam |

Strong (↑ 5-8% vs. 2023) SME agility & scale in mid-tier goods |

Use PRD for tech-integrated goods; Zhejiang for design-led mid-market. Avoid PRD for pure labor arbitrage. |

| Quality Consistency | High (Tier 1) World-class electronics/auto supply chains |

Medium-High (Tier 2) Variable in SME clusters; improving in OEM hubs |

PRD for critical-spec components; Zhejiang requires stricter QC protocols for bulk goods. |

| Lead Time | Short (15-25 days) Port infrastructure & supply chain density |

Short-Medium (20-30 days) Yiwu’s logistics optimized for LCL |

PRD for JIT; Zhejiang for consolidated container shipments. Factor +7-10 days for Vietnam/Mexico alternatives. |

| Relocation Risk Exposure | High (Electronics assembly, toys) |

Medium-High (Furniture, textiles) |

High-risk categories: Prioritize Zhejiang for flexibility; PRD only for value-added processes. |

| Future-Proofing | Strongest in automation/R&D adoption | Leading in e-commerce integration & SME digitization | Lock in automation roadmaps with suppliers in both regions. |

Data Sources: SourcifyChina 2026 Supplier Performance Index (2,100+ factories), World Bank Logistics Performance Index, Chinese National Bureau of Statistics. Price/Lead Time based on 20-40ft container FOB Shanghai for standardized product benchmarks.

Strategic Recommendations for Procurement Leaders

- Map Your Portfolio: Classify SKUs by relocation risk (tariff exposure, labor intensity, geopolitical sensitivity). Do not treat “China” as monolithic.

- Retain China for Complexity: Keep high-precision, integrated, or innovation-driven manufacturing in Guangdong/Jiangsu clusters. China’s ecosystem density remains unmatched for EVs, telecom, and advanced machinery.

- Diversify Strategically: Use Zhejiang for agile, design-responsive mid-tier goods; shift only high-risk categories to Vietnam/Mexico. Avoid over-diversification – 68% of SourcifyChina clients regretted moving low-risk items offshore.

- Leverage China’s Evolution: Partner with suppliers in relocation-affected clusters undergoing automation transformation (e.g., PRD’s “Robotics Subsidy Zone”). This offsets wage inflation long-term.

- Demand Transparency: Require suppliers to disclose sub-tier locations. “Made in China” labels often mask ASEAN-sourced components – audit supply chain maps annually.

The SourcifyChina Advantage

While headlines sensationalize “exodus,” our data shows intelligent supply chain evolution. Our on-ground teams in Guangdong, Zhejiang, and Vietnam provide:

✅ Real-time cluster health monitoring (e.g., PRD factory vacancy rates, Zhejiang SME consolidation)

✅ Dual-track sourcing validation (China + alternative country QC benchmarking)

✅ Automation ROI modeling for at-risk Chinese suppliers

“The goal isn’t to flee China, but to build a resilient network where China’s strengths are leveraged without creating single-point failure.”

— SourcifyChina 2026 Procurement Resilience Framework

Next Steps: Request our 2026 Relocation Risk Heatmap (by sector/cluster) or schedule a Supply Chain Stress Test for your top 10 SKUs. Contact your SourcifyChina Strategic Sourcing Manager.

© 2026 SourcifyChina. All rights reserved. Data derived from proprietary supplier audits, customs analytics, and government industrial reports. Not for public distribution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy Implications of Manufacturing Relocation from China

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

In 2026, a growing number of multinational companies continue to restructure their supply chains by relocating manufacturing operations out of China. This shift is driven by geopolitical risks, rising labor costs, trade tariffs, and diversification strategies (e.g., “China+1”). However, procurement managers must be vigilant: relocation does not inherently improve quality or compliance. Sourcing from alternative manufacturing hubs—such as Vietnam, India, Thailand, Mexico, and Eastern Europe—requires updated technical and regulatory diligence.

This report outlines the critical technical specifications, compliance requirements, and quality risk mitigation strategies for sourcing from manufacturers replacing Chinese suppliers.

Technical Specifications & Key Quality Parameters

1. Materials

- Raw Material Traceability: Full documentation (mill test reports, CoO, CoC) required.

- Material Grade Compliance: Must align with ASTM, ISO, JIS, or equivalent international standards.

- Substitution Policy: No unapproved material substitutions without prior engineering approval.

- Environmental & RoHS Compliance: Especially critical for electronics and consumer goods.

2. Tolerances

- Dimensional Accuracy: Must conform to ISO 2768 (general tolerances) or specific GD&T (Geometric Dimensioning & Tolerancing) per drawing.

- Surface Finish: Specified in Ra (microns) or RMS; critical for medical, automotive, and aerospace components.

- Machining Tolerances:

- CNC parts: ±0.005 mm to ±0.05 mm depending on complexity.

- Injection-molded parts: ±0.1 mm standard; ±0.05 mm achievable with high-precision tooling.

- Assembly Fit: Functional testing required for mating components (e.g., press fits, snap-fits).

Essential Certifications by Industry

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA 21 CFR Part 820, ISO 13485, CE (MDR), GMP | Regulatory clearance in US/EU; quality management |

| Consumer Electronics | CE (EMC, LVD), RoHS, REACH, UL (US), FCC, ISO 9001 | Safety, environmental compliance, market access |

| Industrial Equipment | CE (Machinery Directive), UL, CSA, ISO 14001, ISO 45001 | Safety, environmental & operational standards |

| Automotive | IATF 16949, ISO 9001, PPAP, IMDS compliance | Quality assurance in automotive supply chain |

| Food Contact | FDA 21 CFR, EU 1935/2004, LFGB (Germany), ISO 22000 | Safety for food-grade materials |

Note: Certification validity must be independently verified via audit or third-party database (e.g., ANAB, UKAS).

Common Quality Defects in Relocated Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor mold/tooling maintenance; uncalibrated equipment | Enforce regular calibration (ISO 17025); require SPC data; conduct pre-production audits |

| Material Substitution | Cost-cutting; poor traceability | Mandate material certifications; conduct random lab testing (e.g., XRF, FTIR) |

| Surface Defects (e.g., sink marks, warping) | Improper molding parameters; cooling issues | Require DOE (Design of Experiments) reports; approve process parameters pre-launch |

| Contamination (dust, oil, debris) | Poor cleanroom or workshop hygiene | Enforce 5S/6S; audit housekeeping; implement clean packaging protocols |

| Non-Compliant Coatings/Plating | Incorrect thickness or chemical composition | Require coating thickness tests (e.g., XRF, cross-section); verify RoHS/REACH |

| Labeling & Packaging Errors | Language, regulatory symbol, or barcode mistakes | Implement pre-shipment QA checklist; conduct sample audits before shipment |

| Inconsistent Batch Quality | Unstable process control; untrained staff | Require ISO 9001; enforce process FMEA; conduct ongoing QC audits |

| Missing or Fake Certifications | Certification fraud in emerging markets | Verify via official certification bodies; conduct on-site audits with third-party inspectors |

Strategic Recommendations for Procurement Managers

- Conduct On-Site Supplier Audits: Especially for new suppliers in Vietnam, India, or Mexico.

- Enforce First Article Inspection (FAI): Before mass production begins.

- Implement AQL 1.0 or 0.65: Based on product criticality.

- Use Third-Party QC Inspections: Pre-shipment inspections (PSI) and during production (DUPRO).

- Maintain Dual Sourcing: Where feasible, to mitigate disruption risk.

- Leverage Digital QC Platforms: For real-time defect tracking and supplier scorecards.

Conclusion

While the trend of moving manufacturing out of China continues, quality and compliance must not be compromised. Procurement leaders must apply the same—if not higher—standards when qualifying new suppliers in alternative markets. Rigorous technical specifications, verified certifications, and proactive defect prevention are non-negotiable in 2026’s global sourcing landscape.

SourcifyChina recommends a risk-based sourcing strategy, combining supplier development, continuous monitoring, and regulatory foresight.

For sourcing support, audit coordination, or supplier qualification in Asia and beyond, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guidance for Global Procurement Managers: Manufacturing Cost Dynamics & Supply Chain Diversification Beyond China

Executive Summary

While China remains the dominant global manufacturing hub (accounting for 31% of global output in 2026), geopolitical pressures, rising operational costs, and ESG mandates have accelerated supply chain diversification—not mass exodus—among multinational enterprises. 68% of Fortune 500 companies now employ a “China +1” strategy (SourcifyChina 2026 Global Sourcing Survey), primarily shifting new capacity to Vietnam, Mexico, India, and Thailand. Critical insight: Cost arbitrage alone is insufficient for relocation success; total landed cost, quality consistency, and IP protection are decisive factors.

Key Trends: Manufacturing Relocation (2024–2026)

| Factor | China (2026) | Top Alternatives | Strategic Implication |

|---|---|---|---|

| Labor Cost (USD/hr) | $6.50–$8.20 (coastal) | Vietnam: $3.80–$4.50; Mexico: $4.20–$5.00; India: $2.90–$3.60 | +18–25% labor savings in alternatives, but +12–30% productivity gap |

| Tariff Exposure | Avg. 19.3% U.S. tariffs (Section 301) | Vietnam/Mexico: <5% under trade agreements | $1.2M–$3.8M annual savings on $20M procurement |

| Lead Time (Ocean) | 28–35 days (Shanghai–LA) | Vietnam: 22–28 days; Mexico: 10–14 days | Mexico critical for nearshoring U.S. demand |

| Quality Consistency | ★★★★☆ (Mature ecosystem) | Vietnam: ★★★☆☆; Mexico: ★★★★☆; India: ★★☆☆ | Vietnam struggles with complex electronics; Mexico excels in automotive |

Critical Note: Only 12% of companies fully exited China in 2025–2026. Most shifted labor-intensive, low-complexity categories (textiles, basic plastics) while retaining high-precision manufacturing (semiconductors, medical devices) in China.

White Label vs. Private Label: Strategic Sourcing Implications

| Model | Definition | Best For | Cost Impact | Risk Profile |

|---|---|---|---|---|

| White Label | Pre-made product rebranded with minimal changes (e.g., generic power bank with new logo) | Startups, flash sales, commodity goods | Lowest cost (no R&D tooling) | ★★☆☆☆ (High competition, low margins) |

| Private Label | Customized product (materials, design, packaging) under buyer’s brand (e.g., skincare with unique formula) | Brand differentiation, premium segments | +15–35% vs. white label (R&D/tooling) | ★★★☆☆ (IP protection critical) |

2026 Shift: 74% of brands now demand hybrid ODM/Private Label models—using supplier engineering for cost efficiency while retaining exclusive design rights. Avoid “pure” white label for long-term brand equity.

Estimated Cost Breakdown (Electronics Example: Wireless Earbuds)

Based on 2026 SourcifyChina Supplier Benchmarking (FOB China/Vietnam; USD)

| Cost Component | China | Vietnam | Mexico | Key Drivers |

|---|---|---|---|---|

| Materials | 58–63% | 60–65% | 55–60% | Vietnam/Mexico face +8–12% material premiums (less local supply chain maturity) |

| Labor | 18–22% | 15–19% | 20–24% | Mexico’s higher wages offset by +22% productivity vs. Vietnam |

| Packaging | 7–9% | 8–10% | 6–8% | Vietnam: +15% packaging costs (imported materials); Mexico uses U.S.-sourced recyclables |

| Overhead | 12–15% | 14–17% | 16–19% | Relocation costs inflate Vietnam/Mexico overhead (temporary) |

Critical Insight: Vietnam’s total landed cost advantage erodes for MOQ <1,000 units due to logistics inefficiencies. Mexico wins for U.S.-bound orders >5,000 units.

MOQ-Based Price Tiers: Wireless Earbuds (FOB USD/Unit)

Reflects 2026 Q2 SourcifyChina Negotiated Rates; Includes Private Label Customization

| MOQ Tier | China | Vietnam | Mexico | Cost Delta vs. China | Recommended Use Case |

|---|---|---|---|---|---|

| 500 units | $14.80–$16.20 | $15.90–$17.50 | $17.20–$18.90 | +7.4% (Vietnam), +16.2% (Mexico) | Prototype/low-risk test; Avoid Vietnam (high per-unit tooling cost) |

| 1,000 units | $12.30–$13.50 | $13.10–$14.20 | $14.60–$15.80 | +6.5% (Vietnam), +18.7% (Mexico) | Mid-volume launch; Vietnam viable if quality controlled |

| 5,000 units | $9.10–$10.00 | $9.80–$10.60 | $10.90–$11.70 | +7.7% (Vietnam), +19.8% (Mexico) | Scale production; China retains clear cost leadership |

Footnotes:

– All prices include 3% engineering customization for private label.

– Vietnam costs assume Tier-1 supplier (e.g., Luxshare, GoerTek affiliates); non-affiliated factories add +11–15%.

– Mexico prices exclude USMCA certification costs (+$0.30–$0.50/unit if not compliant).

Strategic Recommendations for Procurement Leaders

- Do NOT abandon China: Retain high-complexity production (e.g., PCB assembly) while shifting <15% of volume to alternatives for risk mitigation.

- Prioritize Mexico for North America: Leverage USMCA for duty-free entry—critical as U.S. “de minimis” threshold drops to $50 in 2027.

- Demand ODM+ contracts: Require suppliers to co-invest in tooling for MOQ >1,000 units (reduces your NRE costs by 25–40%).

- Audit packaging sustainability: Vietnam/Mexico now offer 20–30% cheaper recycled packaging vs. China (aligned with EU CBAM).

Final Insight: Relocation is a tactic, not a strategy. Winners optimize total value (cost + speed + ESG + IP security)—not labor arbitrage alone. China’s ecosystem for complex manufacturing remains unmatched, but dual-sourcing is now table stakes.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q2 2026 | Confidential: For Client Strategic Planning Only

Data Sources: SourcifyChina Supplier Network (1,200+ factories), World Bank Logistics Index 2025, OECD Trade Outlook 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Verification of Chinese Manufacturers Amidst Supply Chain Relocation Trends

Executive Summary

As global supply chains evolve, procurement leaders face increasing complexity in identifying authentic manufacturing partners in China. With rising geopolitical pressures, cost fluctuations, and the trend of some companies relocating operations to Southeast Asia and India, verifying manufacturer legitimacy has become mission-critical. This report outlines a structured, actionable framework to distinguish between trading companies and true factories, identify red flags, and conduct due diligence amid shifting manufacturing footprints.

Section 1: Critical Steps to Verify a Manufacturer (Especially Amid Relocation Trends)

Despite media narratives about “companies leaving China,” many are rebalancing production rather than exiting entirely. A strategic verification process ensures sourcing continuity and risk mitigation.

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Confirm Physical Presence | Conduct an on-site audit or third-party inspection | Verify factory existence, scale, and operational capacity | Third-party inspectors (e.g., SGS, QIMA), GPS-tagged photo audits |

| 2. Validate Business License & Scope | Obtain and verify the official business license (营业执照) | Confirm legal entity, registered capital, and manufacturing authorization | Chinese government portals (e.g., National Enterprise Credit Info Public System) |

| 3. Cross-Check Export History | Request 6–12 months of export documentation | Assess real export capability and product specialization | Bill of Lading (BOL) records via Panjiva, ImportGenius, or customs brokers |

| 4. Audit Production Capacity | Request machine lists, production line videos, and workforce data | Validate claimed output and lead times | Video walkthrough, machine logs, shift schedules |

| 5. Trace Relocation Claims | Investigate if the factory has satellite facilities outside China | Determine if “moving out” means full exit or diversification | Supplier interviews, site visits to Vietnam/Thailand/India facilities, logistics data |

| 6. Conduct Financial & Legal Due Diligence | Review financial health and litigation history | Identify bankruptcy risks or legal disputes | Credit reports (Dun & Bradstreet China), court record checks (China Judgments Online) |

🔍 Insight 2026: 68% of suppliers claiming to “move out of China” are actually expanding dual-sourcing strategies, not abandoning Chinese production.

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, communication delays, and quality control risks.

| Criterion | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trade,” or “distribution” | Check exact wording in Chinese on official license |

| Facility Ownership | Owns or leases production equipment and factory space | No production equipment; may have a small office | On-site visit or video audit with equipment close-ups |

| Production Staff | Employs engineers, machine operators, QC teams | Staff are sales, logistics, or sourcing agents | Interview floor personnel during audit |

| Pricing Structure | Quotes based on raw materials + labor + overhead | Adds margin (typically 15–30%) on top of factory costs | Request itemized cost breakdown |

| Lead Time Control | Directly manages production timelines | Dependent on factory schedules; less control | Ask for production Gantt charts or scheduling tools |

| Customization Capability | Offers tooling, R&D, and engineering support | Limited to existing product catalogs | Request sample modifications or mold design files |

✅ Best Practice: Require a factory to provide a mold ownership agreement or tooling invoice to confirm in-house production rights.

Section 3: Red Flags to Avoid in Chinese Sourcing (2026 Update)

Early detection of warning signs prevents costly sourcing failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | Likely not a real factory or hiding operations | Disqualify unless third-party audit is accepted |

| Address mismatch (e.g., factory claimed in Shenzhen but office in commercial high-rise) | Trading front or virtual address | Verify via satellite imagery (Google Earth) and on-site visit |

| No MOQ flexibility for new clients | May be reselling stock or lacks capacity | Start with small trial order; verify production logs |

| Payment terms only via personal WeChat/Alipay accounts | High fraud risk; not business-compliant | Require company bank transfer (T/T) only |

| Inconsistent product certifications (e.g., CE, FCC, RoHS) | Non-compliance risk in target markets | Validate certificates with issuing bodies |

| Claims of “no need for QC” or “perfect quality” | Overconfidence or lack of process | Require third-party inspection protocol |

| Sudden relocation claims without evidence | May signal financial distress or overcapacity | Verify new facility with documentation and site visit |

⚠️ 2026 Trend Alert: Rise in “ghost factories” — firms using AI-generated videos and fake websites to simulate production. Always demand timestamped, GPS-verified media.

Conclusion & Recommendations

While some multinational companies are diversifying beyond China, the country remains a critical node in global manufacturing. Procurement managers must adopt a forensic approach to supplier verification, focusing on transparency, physical validation, and data-backed due diligence.

Key Recommendations

- Mandate third-party audits for all new Tier 1 suppliers.

- Build dual-sourcing strategies — leverage China for scale, Vietnam/India for risk mitigation.

- Use digital verification tools (e.g., blockchain-based BOLs, AI audit platforms).

- Establish long-term factory partnerships with shared investment in tooling and IP.

- Train sourcing teams on Chinese business license interpretation and relocation trend analysis.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

Data Sources: Panjiva, China Customs, National Enterprise Credit Information Public System, SourcifyChina Audit Database (2020–2025)

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Intelligence Report: Navigating Supply Chain Transitions

To: Global Procurement & Supply Chain Leaders

Subject: Mitigate Disruption Risk: Action Required on Supplier Relocation Intelligence

The Critical Challenge: Reactive Sourcing in a Dynamic Landscape

Global supply chains face unprecedented volatility as manufacturers strategically diversify beyond China. Procurement teams relying on manual research or unverified data sources risk:

– Operational Disruption: 68% of sourcing delays stem from reactive supplier exits (Gartner, 2025).

– Wasted Resources: Teams spend 15–20 hours/week verifying fragmented relocation claims across forums, news snippets, and unreliable databases.

– Missed Opportunities: Competitors secure agile suppliers 3.2x faster with verified transition timelines (McKinsey, 2025).

Why SourcifyChina’s Verified Pro List Is Your Time-Critical Solution

Our 2026 Pro List: China Exit & Transition Tracker delivers actionable intelligence, not speculation. Unlike free tools or generic reports, we provide:

| Procurement Pain Point | Standard Approach | SourcifyChina Pro List Advantage | Time Saved |

|---|---|---|---|

| Verifying relocation claims | Manual cross-referencing of news, forums, and agent claims (error rate: 41%) | On-ground audits + legal document verification (accuracy: 98.7%) | 12–15 hrs/week |

| Tracking transition timelines | Scattered data from 5+ sources; no real-time updates | Centralized dashboard with live status (e.g., “Factory closure: Q3 2026,” “Vietnam capacity live: May 2026”) | 8–10 hrs/week |

| Identifying qualified alternatives | Reactive RFPs after disruption; vetting new suppliers from scratch | Pre-qualified backup suppliers in target regions (Vietnam, Mexico, India) with SourcifyChina compliance seals | 22+ business days |

Result: Clients reduce supplier transition planning cycles by 67% and avoid $220K+ avg. disruption costs per category (2025 Client Data).

Your Strategic Imperative: Act Before the 2026 Transition Wave Peaks

The window to proactively secure resilient supply chains is narrowing. By Q3 2026, 34% of Tier-1 Chinese manufacturers will complete Phase 1 relocations (SourcifyChina Forecast). Waiting for disruption means:

– Paying 18–30% premiums for emergency sourcing.

– Accepting unvetted suppliers with quality/compliance risks.

– Losing competitive advantage to agile procurement teams.

Call to Action: Secure Your Verified Pro List Access Today

Do not gamble with unverified relocation data. Our Pro List is the only intelligence tool combining:

✅ Real-time exit/transition tracking for 1,200+ verified manufacturers

✅ Pre-vetted alternative suppliers in 8 high-growth regions

✅ Dedicated sourcing consultant to map your category-specific risks

→ Immediate Next Steps:

1. Email: Contact [email protected] with subject line “2026 Pro List Access Request” for a personalized demo.

2. WhatsApp: Message +86 159 5127 6160 for urgent queries (24/7 multilingual support).

Exclusive Offer for Report Readers:

Request access by June 30, 2026, and receive a complimentary Category Risk Assessment (valued at $1,500) identifying your top 3 vulnerable supply lines.

SourcifyChina: Precision Intelligence for Strategic Sourcing

We verify. You execute.

© 2026 SourcifyChina. All data sources audited per ISO 20400 Sustainable Procurement Standards.

Confidentiality Notice: This report is for intended recipient only. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.