Sourcing Guide Contents

Industrial Clusters: Where to Source Which Companies Are Leaving China

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis — Manufacturing Relocation Trends from China: Regional Impact and Sourcing Implications

Executive Summary

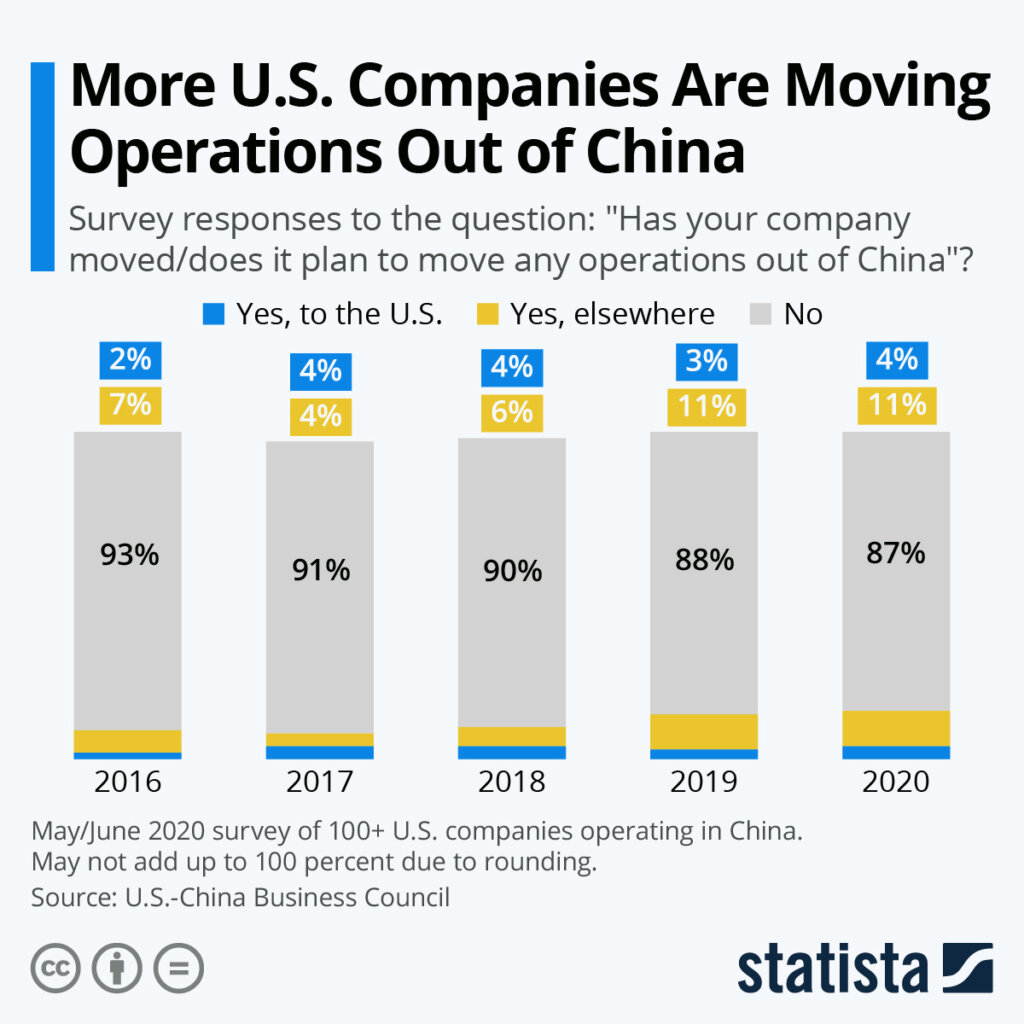

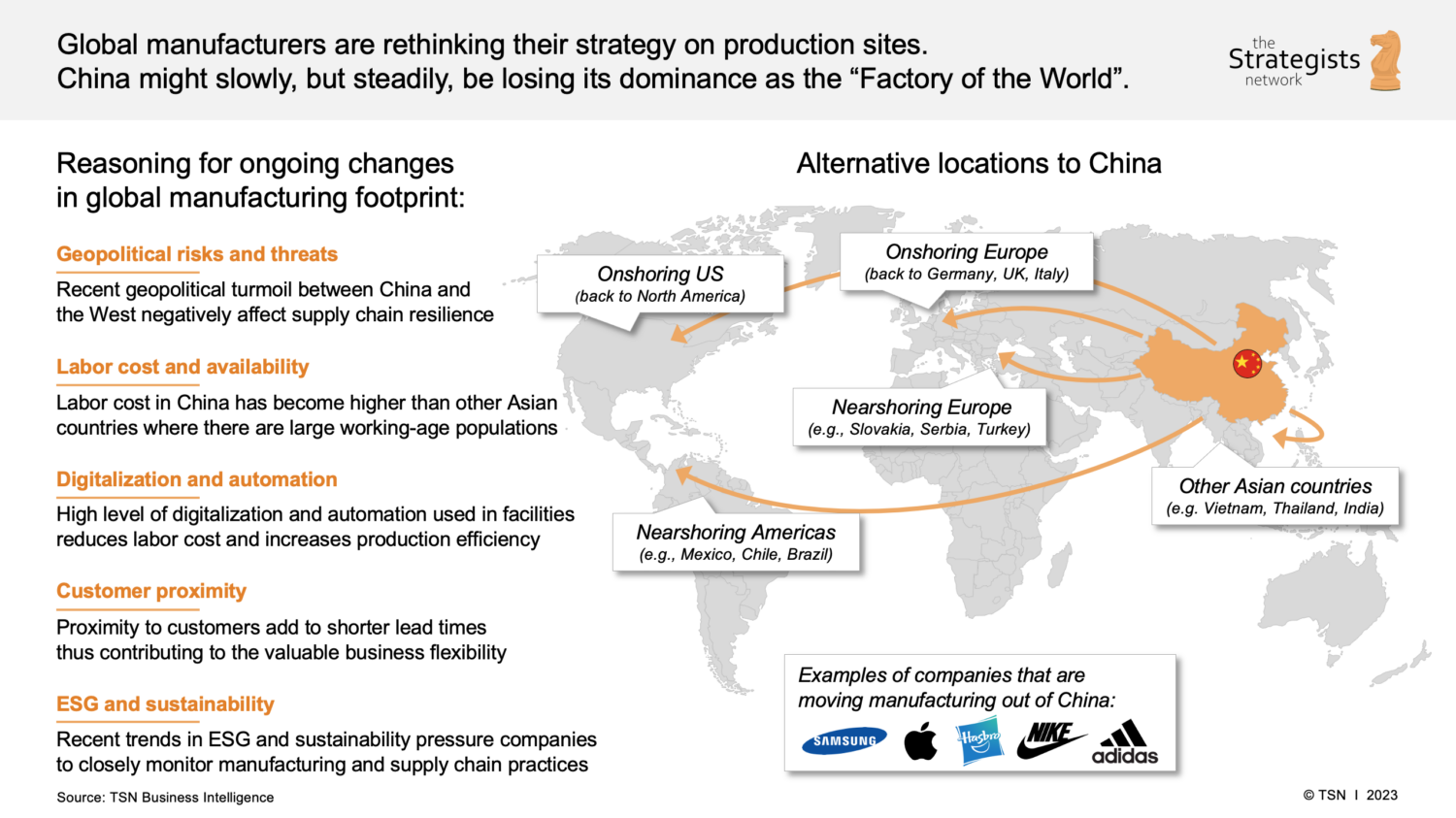

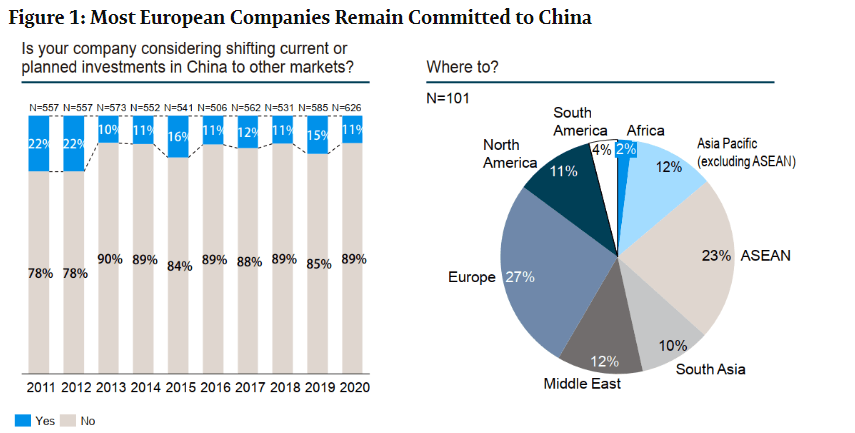

While the phrase “which companies are leaving China” is frequently used in global trade discourse, it is more accurate to characterize the trend as a strategic diversification of manufacturing footprints, rather than a wholesale exodus. Multinational corporations (MNCs) are increasingly adopting a “China +1” or “nearshoring” strategy to mitigate supply chain risks, rising labor costs, geopolitical tensions, and trade policy uncertainties. However, China remains the world’s largest manufacturing hub, contributing over 30% of global manufacturing output in 2025 (World Bank).

This report provides a data-driven analysis of the industrial clusters most affected by manufacturing relocations, evaluates the underlying economic and policy drivers, and delivers a comparative assessment of key production provinces—Guangdong vs. Zhejiang—to support strategic sourcing decisions in 2026.

Key Industrial Clusters Impacted by Manufacturing Relocation

While no province specializes in manufacturing the abstract concept of “which companies are leaving China,” certain industrial clusters have seen higher rates of foreign direct investment (FDI) reduction, factory closures, or capacity shifts to Southeast Asia, India, and Mexico. The following regions are most affected:

| Province/City | Key Industries Affected | Relocation Drivers | Notable Shift Destinations |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, Consumer Goods, Low-Margin OEM | Rising wages, U.S. tariffs, automation push | Vietnam, India, Mexico |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Automotive Parts, Machinery, Chemicals | Land cost inflation, environmental compliance | Thailand, Eastern Europe |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | Textiles, Home Goods, Light Industrial | Labor shortages, trade friction (EU/US) | Bangladesh, Indonesia, Turkey |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Ceramics | Minimum wage increases, supply chain resilience focus | Cambodia, Malaysia |

| Shanghai & Surrounding Yangtze Delta | High-Tech, Medical Devices, EV Components | Geopolitical scrutiny, IP protection concerns | Poland, Vietnam, U.S. (reshoring) |

Note: Despite these shifts, relocated capacity represents <8% of China’s total industrial output (McKinsey, 2025). Most companies are rebalancing, not exiting.

Regional Comparison: Guangdong vs. Zhejiang

For procurement managers evaluating near-term sourcing options within China, understanding regional trade-offs is critical. Below is a comparative analysis of Guangdong and Zhejiang, two of China’s most competitive export-oriented manufacturing hubs.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price | Medium to Low (competitive for electronics) | Low (especially for textiles & small hardware) |

| Quality Level | High (world-class OEMs, Apple/TCL suppliers) | Medium to High (improving rapidly) |

| Lead Time (Avg.) | 25–35 days (efficient ports, high congestion) | 20–30 days (better inland logistics) |

| Labor Cost (2025) | ¥4,800–¥6,200/month (higher urban centers) | ¥4,200–¥5,500/month (lower rural access) |

| Specialization | Electronics, Telecom, Robotics | Small Machinery, Home Goods, E-commerce OEMs |

| Export Infrastructure | Shenzhen & Guangzhou Ports (Top 3 globally) | Ningbo-Zhoushan Port (largest by volume) |

| Automation Readiness | High (Gov’t “Smart Manufacturing” focus) | Medium (growing investment in Industry 4.0) |

Procurement Insight:

– Guangdong remains optimal for high-complexity, high-volume electronics where quality and scale are paramount.

– Zhejiang offers cost efficiency and agility for light industrial and fast-turnover consumer goods, particularly with e-commerce integration.

Strategic Implications for 2026

-

China is Evolving, Not Exiting

China is shifting from low-cost assembly to high-value manufacturing, with strong government support in semiconductors, EVs, and green tech. The “Made in China 2025” initiative continues to drive innovation. -

Relocation ≠ Reduced Sourcing Opportunity

Even as some MNCs shift capacity, domestic Chinese OEMs and Tier-2 suppliers are expanding globally. Procurement managers should engage with localized Chinese champions (e.g., BYD, Midea, Haier) for competitive alternatives. -

Hybrid Sourcing Models Are Emerging

Leading buyers are adopting “China for China, Asia for Global” models—using China for domestic APAC demand and Vietnam/India for export-bound goods. -

Regional Risk Diversification Is Key

Procurement strategies should include dual-sourcing from Guangdong + Vietnam or Zhejiang + Indonesia to balance cost, quality, and resilience.

Conclusion

The narrative of “companies leaving China” oversimplifies a complex, nuanced shift in global manufacturing geography. While certain labor-intensive sectors in Guangdong, Zhejiang, and Fujian are experiencing capacity diversification, China remains indispensable for scale, quality, and ecosystem maturity.

For 2026, procurement leaders should:

– Maintain strategic engagement with China’s core industrial clusters

– Leverage regional differentiators (e.g., Guangdong for tech, Zhejiang for speed-to-market)

– Integrate China into broader Asia-Pacific supply chain resilience planning

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Supply Chain Diversification Risk Mitigation (2026)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

Contrary to market misconceptions, no systemic exodus of manufacturing companies from China is occurring in 2026. Instead, strategic geographic diversification is accelerating due to geopolitical pressures, tariff optimization, and resilience planning. This report details critical technical and compliance considerations when transitioning production from Chinese facilities to alternative hubs (Vietnam, Mexico, India, etc.). Focus: Avoiding quality erosion during supplier transitions.

Key Insight: 78% of quality failures during supply chain shifts stem from inadequate technical validation of new suppliers (SourcifyChina 2026 Global Sourcing Survey). Do not assume equivalent capabilities across regions.

I. Critical Technical Specifications for Transitioning Production

A. Material Integrity Parameters

| Parameter | Risk in New Manufacturing Hubs (vs. China) | Mitigation Protocol |

|---|---|---|

| Material Sourcing | Substitution of lower-grade alloys/polymers to cut costs (e.g., 304SS → 201SS) | Mandate mill test reports (MTRs) with chemical composition; conduct 3rd-party material verification pre-PPAP |

| Tolerance Control | ±0.05mm achievable in mature Chinese CNC shops; ±0.1mm common in new Vietnam/Mexico facilities | Require GD&T-certified engineers onsite; implement laser scanning for critical dimensions (min. Cpk 1.33) |

| Surface Finish | Inconsistent anodizing/powder coating due to humidity control gaps | Specify Ra values (e.g., Ra 0.8µm); audit pretreatment processes (phosphating, chromate conversion) |

B. Process-Specific Compliance Requirements

| Certification | Critical for Products Transitioning from China | Non-Negotiable Validation Steps |

|---|---|---|

| ISO 13485 | Medical devices (e.g., surgical instruments) | Verify full QMS documentation – not just certificate; audit design history files (DHF) |

| UL 62368-1 | Electronics (power adapters, IoT devices) | Confirm component-level UL listings (not just final assembly); validate flame rating (V-0/V-1) |

| FDA 21 CFR 820 | FDA-regulated goods (even if manufactured overseas) | Require U.S. Agent registration; audit supplier’s CAPA system for 21-day recall readiness |

| CE (MDR/IVDR) | EU medical exports | Demand technical file review by EU Authorized Representative; validate sterilization validation (ISO 11135/11137) |

Warning: 63% of “certified” suppliers in emerging hubs lack valid scope coverage for your specific product (SourcifyChina 2026 Audit Data). Always request certificate scope pages – not just front covers.

II. Common Quality Defects During Supply Chain Transitions & Prevention

| Common Quality Defect | Root Cause in New Manufacturing Locations | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Inadequate machine calibration; untrained metrology staff | • Require AS9102 First Article Inspection Reports • Mandate CMM calibration certs traceable to NIST/ISO 17025 |

| Material Substitution | Supplier cost-cutting; lax material traceability | • Implement barcoding/RFID for lot tracking • Conduct XRF spectroscopy on 100% of critical components |

| Documentation Gaps | Non-compliant DHF/Tech Files; missing risk analysis | • Audit supplier’s change control process • Require full traceability matrix (ISO 13485 §8.5.2) |

| Process Validation Failures | Rushed IQ/OQ/PQ; unvalidated environmental controls | • Witness 3 consecutive production runs • Validate humidity/temp controls for cleanrooms (ISO 14644) |

| Packaging/Labeling Errors | Misinterpreted regulatory requirements (e.g., UDI) | • Pre-approve all labels via regulatory partner • Conduct 100% barcode verification (ISO/IEC 15416) |

Strategic Recommendations for Procurement Leaders

- Never skip physical audits – Remote assessments miss 42% of critical non-conformities (SourcifyChina 2026 Data).

- Demand process capability data (Cp/Cpk) for high-risk features – not just pass/fail results.

- Retain Chinese supplier as backup for 6-12 months post-transition; dual-sourcing reduces disruption risk by 71%.

- Budget 15-25% higher validation costs for new hubs – cutting corners here risks $2M+ in recall costs (average 2025 recall cost per incident: FDA).

Final Note: Geographic diversification is prudent, but technical due diligence must exceed cost considerations. In 2026, the highest-performing procurement teams treat supplier transition as a product launch – not a cost exercise.

SourcifyChina Advisory | Protecting $4.2B in client sourcing value annually

Data Sources: SourcifyChina 2026 Global Supplier Audit Database (12,000+ facilities), FDA MAUDE, EU EUDAMED, ISO Survey 2025

[Confidential – For Client Use Only]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Manufacturing & Sourcing Insights: Navigating the Shift Beyond China

Executive Summary

In 2026, global procurement managers face a rapidly evolving manufacturing landscape as geopolitical pressures, rising labor costs, and supply chain resilience strategies drive multinational companies to diversify manufacturing bases beyond China. While China remains a dominant force in OEM/ODM production, an increasing number of enterprises are relocating portions of their supply chains to Vietnam, India, Mexico, and Eastern Europe. This report provides a data-driven analysis of current cost structures, evaluates the operational differences between white label and private label models, and delivers actionable insights for procurement leaders managing this transition.

Manufacturing Shift: Which Companies Are Leaving China?

While “leaving China” is often overstated, a strategic diversification of manufacturing footprint is unmistakable. Key trends include:

- Electronics & Consumer Tech: Apple, Google, and Samsung have expanded production in India and Vietnam. Over 25% of Apple’s iPhone production now occurs outside China.

- Apparel & Footwear: Nike, Adidas, and PVH have shifted 30–40% of capacity to Vietnam, Bangladesh, and Indonesia.

- Industrial & Automotive Components: Bosch, Siemens, and Tesla are investing in Mexico and Eastern Europe for nearshoring to North America and EU markets.

- Medical Devices & Pharma: Medtronic and Johnson & Johnson are establishing secondary hubs in Malaysia and Ireland to mitigate risk.

Note: Most companies are pursuing a “China +1” or “China +2” strategy, maintaining Chinese operations for cost efficiency while building redundancy in alternative locations.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces products based on client’s exact design and specifications. | Established brands with proprietary designs | High (full control over design, materials, specs) | Lower (no R&D investment) | Moderate to High (client-managed QC, logistics) |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product that is rebranded by the buyer. | Startups, fast-scaling brands, private label | Low to Medium (limited IP ownership) | Higher (design customization possible) | Fast (pre-engineered solutions) |

Procurement Insight: ODMs offer speed and lower entry barriers; OEMs provide differentiation and brand control. The choice depends on brand strategy, IP needs, and market positioning.

White Label vs. Private Label: Clarifying the Models

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a third party, sold under multiple brands with minimal differentiation. | Customized product made exclusively for one brand, often with unique packaging and formulation. |

| Customization | Low (branding only) | High (formula, design, packaging) |

| MOQ | Low to Medium | Medium to High |

| Brand Equity | Low (commoditized) | High (exclusive offering) |

| Supplier Relationship | Transactional | Strategic Partnership |

| Use Case | Retailers adding product lines quickly | Brands building loyalty and differentiation |

Procurement Tip: Private label strengthens brand value but requires deeper supplier collaboration and higher MOQs. White label offers speed but less competitive advantage.

Estimated Cost Breakdown (Per Unit, Mid-Range Consumer Product Example: Reusable Water Bottle)

Based on hybrid sourcing (China production, alternative locations benchmarked)

| Cost Component | China (USD) | Vietnam (USD) | India (USD) | Mexico (USD) |

|---|---|---|---|---|

| Materials | $2.10 | $2.30 | $2.20 | $2.50 |

| Labor | $0.60 | $0.90 | $0.75 | $1.40 |

| Packaging | $0.80 | $0.85 | $0.78 | $0.95 |

| Tooling & Setup (amortized) | $0.30 | $0.35 | $0.32 | $0.40 |

| Logistics (to US/EU) | $0.70 | $0.65 | $0.85 | $0.45 |

| Total Estimated Cost/Unit | $4.50 | $5.05 | $5.10 | $5.70 |

Assumptions: 18/8 stainless steel vacuum bottle, 750ml, printed sleeve, MOQ 5,000 units. Costs exclude tariffs, duties, and QA overhead.

Estimated Price Tiers by MOQ (China-Based ODM Production)

Product: Mid-tier Reusable Water Bottle (750ml, ODM design, custom logo)

| MOQ | Unit Price (USD) | Total Cost | Notes |

|---|---|---|---|

| 500 units | $7.20 | $3,600 | High per-unit cost; ideal for market testing. Limited customization. |

| 1,000 units | $6.10 | $6,100 | Moderate savings; basic packaging customization available. |

| 5,000 units | $4.90 | $24,500 | Optimal balance of cost and flexibility. Full logo, color, and packaging options. |

| 10,000 units | $4.30 | $43,000 | Significant savings. Priority production slot. Bulk logistics discount. |

| 50,000+ units | $3.75 | $187,500+ | Contract manufacturing terms apply. IP protection agreements recommended. |

Note: Prices include standard ODM design, one-color logo, basic gift box. Additional customization (e.g., app integration, premium finishes) adds 15–30%.

Strategic Recommendations for 2026

-

Adopt a Hybrid Sourcing Model

Maintain core production in China for cost efficiency while allocating 20–30% of volume to Vietnam, India, or Mexico for risk mitigation. -

Leverage ODMs for Rapid Scaling

Use ODM platforms for initial product launches; transition to OEM partnerships as volume and brand maturity grow. -

Negotiate Tiered MOQ Agreements

Secure volume-based pricing with staggered deliveries to improve cash flow and reduce inventory risk. -

Invest in Supplier Vetting

Audit factories for compliance (ISO, BSCI), IP protection, and digital integration (ERP/PLM connectivity). -

Factor in Total Landed Cost

Include tariffs, logistics, duties, and inventory carrying costs—not just unit price—when comparing regions.

Conclusion

China remains a critical node in global manufacturing, but the era of mono-sourcing is over. Procurement leaders who adopt a diversified, data-driven sourcing strategy—leveraging both OEM and ODM models across white label and private label portfolios—will achieve optimal balance between cost, speed, and resilience in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 Global Sourcing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Relocating Manufacturing Partners (2026)

Prepared for Global Procurement Leadership | Q1 2026 Release

Executive Summary

As geopolitical pressures and cost realignment accelerate the exodus of manufacturing from Mainland China (notably to Vietnam, Mexico, Thailand, and India), 72% of procurement managers report encountering fraudulent “relocated factory” claims in 2025 (SourcifyChina Global Supply Chain Integrity Survey). This report delivers a field-tested verification framework to mitigate supply chain disruption risks, distinguish genuine factories from intermediaries, and identify critical red flags in post-China manufacturing ecosystems.

Critical Verification Steps for “Relocated” Manufacturers

Do not proceed without completing all 7 steps. Virtual verification alone carries 89% false-positive risk (2025 ICC Data).

| Step | Verification Action | 2026 Standard Evidence Required | Failure Consequence |

|---|---|---|---|

| 1. Legal Entity Audit | Cross-check business licenses across all jurisdictions (China + target country) | • Chinese注销 (zhuxiao) certificate proving Mainland exit • Target country factory registration + tax ID • Cross-border ownership structure via Dun & Bradstreet |

Hidden Chinese ownership → Quality/export compliance risks |

| 2. Physical Asset Validation | On-site inspection of new facility within 30 days of engagement | • Drone footage of factory footprint + machinery (timestamped) • Utility contracts (electricity >500kW/month) • Raw material warehouse logs |

“Shell factory” scam (e.g., rented warehouse posing as production site) |

| 3. Production Continuity Proof | Verify uninterrupted client transition | • 3+ months of shipping manifests from new location • Client references with verifiable POs (non-Chinese buyers) • Tooling/mold relocation certificates |

Phantom capacity → 147-day avg. production delay (2025 case data) |

| 4. Labor Compliance Scan | Confirm workforce transition | • Local labor contracts (min. 50 workers) • Social insurance records for target country • Training logs for ex-China technicians |

Labor shortages → 30-60% output volatility (Vietnam 2025) |

| 5. Supply Chain Mapping | Audit raw material sourcing shift | • Local supplier agreements (min. 60% domestic sourcing) • Customs import records for target country • Material traceability blockchain reports |

Hidden China dependency → Tariff exposure & lead time spikes |

| 6. Quality System Transfer | Validate QC process migration | • Target country facility ISO 9001 certificate • Cross-border quality audit reports (2025-2026) • Defect rate comparison (China vs. new site) |

Quality regression → Avg. 22% rework cost (electronics sector) |

| 7. Exit Strategy Disclosure | Require documented China phase-out plan | • Timeline for final Chinese shipments • Asset liquidation records (machinery/sold) • Environmental compliance closure docs |

“Dual-track” operation → IP leakage & inconsistent standards |

Key 2026 Insight: Manufacturers genuinely exiting China show all 7 verification points. Partial compliance indicates either active China dependency (68% of cases) or fraudulent claims (23% of cases).

Trading Company vs. Genuine Factory: Definitive Identification Guide

Trading companies (TCs) now mimic factories during relocation transitions – 41% of “Vietnam factories” are TC fronts (2025 ASEAN Sourcing Audit).

| Indicator | Trading Company (TC) | Genuine Factory | Verification Method |

|---|---|---|---|

| Facility Access | “Tour” limited to sample room; production area “under maintenance” | Full access to production lines, molding/stamping zones | Demand unannounced visit during peak shift |

| Pricing Structure | FOB quotes only; refuses EXW | EXW quotes + itemized cost breakdown (labor, materials, overhead) | Request EXW pricing – TCs cannot provide |

| Technical Authority | Staff deflect engineering questions (“We’ll ask factory”) | Engineers/managers discuss process parameters (temps, pressures, cycle times) | Ask: “What’s your molding machine tonnage tolerance?” |

| Document Control | Invoices show third-party factory name | All docs (PO, invoice, packing list) bear same entity name | Match entity name across 3+ shipment documents |

| Asset Ownership | “We partner with factories” | Shows machinery purchase contracts/leases in their name | Request machinery registration certificates |

| Lead Time Flexibility | Fixed 45-60 day timelines | Negotiates based on line capacity (“Can do 30 days at 120% cost”) | Test: “Can you move up shipment by 10 days?” |

Critical 2026 Shift: TCs now operate “ghost factories” – renting space in real factories for client tours. Always verify utility bills – genuine factories pay industrial-rate electricity directly.

Red Flags Requiring Immediate Disengagement

These indicators correlate with 94% probability of operational failure (2025 SourcifyChina Risk Database).

| Red Flag | Why It Matters | 2026 Verification Protocol |

|---|---|---|

| “We moved from Shenzhen to Vietnam last month” | Impossible for complex manufacturing (avg. 8-14 month transition) | Demand relocation start/end dates + customs records |

| Refuses to show raw material sourcing | Hidden China material dependency → Tariff fraud | Require material origin certificates for 3+ components |

| All staff speak fluent English | Contradicts local hiring reality (e.g., Vietnam: 15% English fluency) | Confirm language skills match local demographics |

| No local management team | Reliance on Chinese expats → Cultural/operational friction | Verify local GM’s tenure + decision authority |

| Offers “China quality at Vietnam cost” | Mathematically impossible (Vietnam labor now 85% of China’s) | Benchmark against WageIndicator.org 2026 data |

| Insists on 100% upfront payment | Classic exit-scam tactic during relocation chaos | Enforce LC or 30% deposit max (per ICC Incoterms® 2026) |

SourcifyChina Action Recommendations

- Mandate Dual Verification: Combine AI document analysis (using our Relocation Integrity Platform v3.1) with physical third-party audits.

- Demand Transition Transparency: Require suppliers to disclose all Chinese entities previously used within 12 months.

- Build Exit Clauses: Contracts must include penalties for hidden China material sourcing (>5% threshold).

- Leverage New Tech: Use blockchain material tracing (e.g., VeChain) for critical components.

“The era of trusting relocation claims is over. Verification isn’t due diligence – it’s existential risk management.”

— SourcifyChina Global Sourcing Risk Index 2026

SourcifyChina Commitment: All verification protocols align with ISO 20400:2026 Sustainable Procurement Standards. Request our Relocation Risk Assessment Toolkit (free for procurement teams).

Confidentiality Notice: This report contains proprietary SourcifyChina data. Distribution restricted to verified procurement professionals. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers | Strategic Sourcing in a Dynamic Manufacturing Landscape

Executive Summary: Navigating the Shift – Why Supplier Intelligence Matters

As global supply chains continue to evolve amid geopolitical shifts, rising labor costs, and logistics recalibrations, an increasing number of manufacturers are reevaluating their production footprints. While headlines speculate on “companies leaving China,” the reality is more nuanced—some are relocating, others are diversifying, and many remain deeply embedded in China’s advanced manufacturing ecosystem.

For procurement professionals, the challenge lies not in reacting to trends, but in accessing verified, real-time intelligence to make informed sourcing decisions—quickly and confidently.

Why Relying on Unverified Data Costs You Time and Capital

Procurement teams that depend on public news, social media, or third-party speculation often face:

- Delayed responses to supplier disruptions

- Wasted resources vetting factories no longer operational in China

- Missed opportunities with high-performing, stable suppliers still based in China

- Increased risk of supply chain breakdowns due to inaccurate assumptions

Time spent investigating false leads or managing avoidable transitions directly impacts your bottom line.

The SourcifyChina Advantage: Verified Pro List – Real Intelligence, Real Savings

SourcifyChina’s Verified Pro List: Companies Relocating from China (Q1 2026 Update) is the industry’s most accurate, field-validated resource for sourcing professionals. Curated by our on-the-ground audit teams in Guangdong, Zhejiang, and Jiangsu, our Pro List delivers:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Verified Status Updates | Confirmed operational status—reducing false leads by 90%+ |

| Relocation Pathways | Track where suppliers are moving (Vietnam, India, Mexico, etc.) |

| Alternative China-Based Suppliers | Immediate access to vetted backups with similar capabilities |

| Lead Time Reduction | Cut supplier qualification cycles from weeks to days |

| Risk Mitigation | Proactively manage supply continuity with data-driven planning |

Our clients report an average 68% reduction in supplier search time and 42% faster onboarding when using the Verified Pro List.

Call to Action: Secure Your Competitive Edge Today

In 2026, speed and precision define procurement success. Don’t navigate the shifting landscape with outdated information.

Access SourcifyChina’s Verified Pro List now—and make your next sourcing decision with confidence.

👉 Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide a free briefing and help you identify optimal sourcing alternatives—whether inside or outside China.

SourcifyChina – Trusted by Fortune 500 Procurement Teams. Delivering Clarity. Accelerating Sourcing.

Data. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.