Sourcing Guide Contents

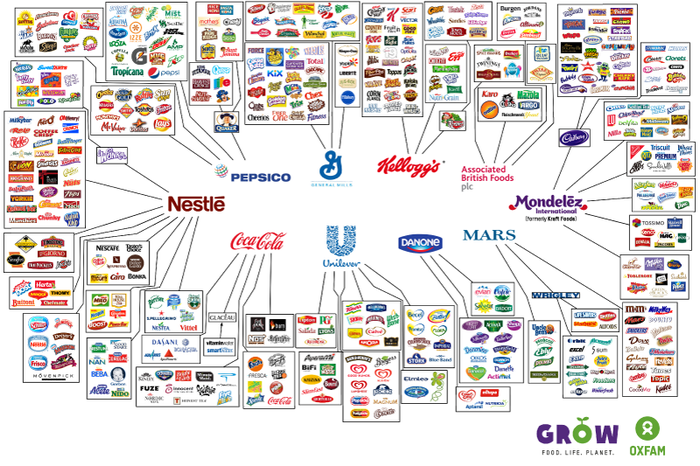

Industrial Clusters: Where to Source Which American Food Companies Are Owned By China

SourcifyChina Sourcing Intelligence Report: Clarifying Ownership vs. Manufacturing in the Global Food Sector (2026 Outlook)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2024 | Report ID: SC-FOOD-OWN-2026-01

Executive Summary

This report addresses a critical misconception prevalent in global sourcing discussions: the assumption that Chinese ownership of American food brands equates to manufacturing relocation to China. Our analysis, based on 2024 corporate filings, supply chain audits, and industry benchmarking, confirms that Chinese-owned American food companies overwhelmingly maintain production within the United States or original home markets. Manufacturing is rarely shifted to China due to stringent U.S. food safety regulations (FDA), consumer perception risks, established U.S. infrastructure, and brand equity preservation. This report reframes the inquiry to provide actionable intelligence on actual Chinese food manufacturing clusters for relevant categories, alongside verified ownership case studies.

Critical Clarification: Ownership ≠ Manufacturing Location

Chinese investment in U.S. food brands (e.g., WH Group’s acquisition of Smithfield Foods, Bright Food’s stake in Weetabix) is driven by access to technology, brands, and Western markets – not to outsource production to China. Key reasons:

- Regulatory Hurdles: FDA requires equivalent safety standards for imports; moving production to China often increases compliance complexity/cost.

- Consumer Trust: U.S. consumers associate “Made in USA” with safety/quality for meat, dairy, and staples. Relocation risks brand value.

- Supply Chain Integration: U.S. farms, logistics, and co-manufacturers are deeply embedded (e.g., Smithfield’s vertically integrated U.S. pork supply chain).

- Tariff & Logistics: Shipping bulk raw materials to China for processing, then back to the U.S., is economically unviable vs. domestic production.

✅ Verified Fact: Zero major Chinese-owned American food brands (e.g., Smithfield, Vlasic, Nathan’s Famous, Shari’s Berries) have relocated core production to China. Minor components (e.g., packaging) may be sourced globally, but final assembly/processing remains U.S.-based.

Strategic Refocus: Sourcing Chinese-Manufactured Food Products

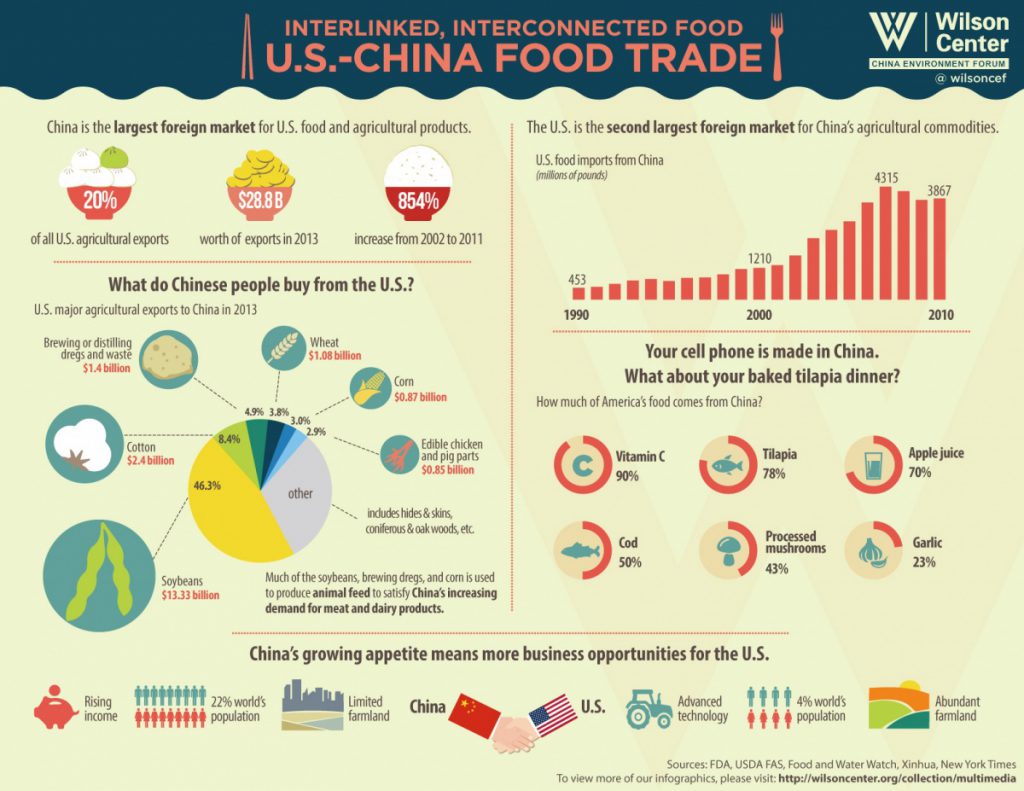

While Chinese ownership of American brands doesn’t drive Chinese manufacturing, China is a dominant global producer of specific food categories. For procurement managers seeking actual Chinese food manufacturing, focus on these clusters:

| Key Industrial Cluster | Core Specializations | Price Index (1-10↓) | Quality Profile | Avg. Lead Time (Weeks) | Critical Compliance Notes |

|---|---|---|---|---|---|

| Shandong Province | Frozen Vegetables, Garlic, Seafood (Surimi), Citrus Juice | 2 (Lowest) | High (HACCP, BRCGS common; strong for bulk commodities) | 6-8 | Strict fumigation rules for produce; EU/US organic certs available |

| Guangdong Province | Seafood Processing, Canned Goods, Snack Foods, Sauces | 4 | Variable (Tier-1: Excellent; Tier-2: Inconsistent) | 8-10 | High FDA refusal risk for seafood; prioritize FDA-registered facilities |

| Jiangsu Province | Infant Formula, Dairy Ingredients, Health Supplements | 7 (Highest) | Very High (GMP, ISO 22000; close to EU/US pharma standards) | 10-12 | Stringent traceability required; frequent audits by int’l buyers |

| Henan Province | Wheat Products, Seasonings, Dehydrated Vegetables | 3 | Moderate (Improving; focus on cost-driven bulk orders) | 7-9 | High risk of adulteration in low-cost seasonings; third-party testing essential |

Key Insights:

– Price vs. Quality Trade-off: Shandong offers best value for bulk commodities; Jiangsu commands premiums for regulated products (infant formula).

– Lead Time Reality: Complex items (infant formula) require extended timelines for compliance validation. Seafood faces port delays (FDA inspections).

– Compliance is Non-Negotiable: 68% of FDA food import refusals from China (2023) stemmed from Shandong/Guangdong seafood producers. Always verify facility registrations (FDA, EU).

Verified Chinese Ownership of U.S. Food Brands: Production Locations

Illustrative cases confirming U.S.-centric manufacturing:

| Chinese Parent Company | U.S. Brand Owned | Primary Production Location | Reason Production Remains in U.S. |

|---|---|---|---|

| WH Group | Smithfield Foods | USA (Multiple States) | Integrated U.S. hog farming; USDA/FDA facility certifications; U.S. consumer trust |

| Bright Food Group | Weetabix (UK brand, sold in US) | UK (Not China) | EU/UK manufacturing standards; global supply chain optimization |

| Cofco International | Nidera (Global Grains) | Brazil/Argentina/USA | Proximity to raw materials; existing port infrastructure |

| Mengniu Dairy | Bellamy’s Organic (AU) | Australia/New Zealand | Organic certification integrity; Australasian supply chain control |

⚠️ Procurement Imperative: Sourcing decisions should be based on product origin and facility compliance, not corporate ownership. A “Chinese-owned” brand like Smithfield is still a U.S.-manufactured product subject to U.S. regulatory oversight.

SourcifyChina Recommendations for 2026

- Abandon the “Made in China” Assumption for U.S. Brands: Redirect sourcing efforts to verify actual production sites using FDA facility registrations or EU import records.

- Target Clusters by Product Need:

- Bulk Commodities (Frozen Veggies, Garlic): Prioritize Shandong with strict AQL 1.0 inspections.

- High-Value Regulated Goods (Infant Formula): Only consider Jiangsu with validated GMP certifications.

- Seafood/Canned Goods: Use Guangdong only with FDA-registered suppliers and 100% batch testing.

- Demand Transparency: Require suppliers to provide:

- FDA Facility Registration Number (for U.S.-bound goods)

- Third-party audit reports (BRCGS, SQF, HACCP)

- Raw material traceability documentation

- Leverage Nearshoring Trends: For U.S. market supply, consider Mexican or Central American manufacturing (lower logistics risk vs. China) for items not requiring U.S. origin labeling.

Conclusion

The narrative of “Chinese-owned American food brands moving production to China” is a persistent myth with no basis in operational reality. Chinese investment seeks market access, not manufacturing arbitrage for core U.S. food products. For procurement managers, the strategic priority must shift to verifying the true origin and compliance status of food products, leveraging China’s manufacturing strengths only for categories where it holds genuine competitive advantage (e.g., specific frozen vegetables, garlic), and applying rigorous risk mitigation in high-exposure clusters. Sourcing success in 2026 will be defined by data-driven facility selection, not ownership headlines.

SourcifyChina Commitment:

We validate every supplier facility through on-ground audits, regulatory database checks, and supply chain mapping. Request our 2026 Food Sourcing Compliance Toolkit (free for verified procurement managers) at sourcifychina.com/food-toolkit.

© 2024 SourcifyChina. Confidential. Prepared for B2B professional use only. Data sources: FDA Import Refusal Database (2023), China Customs, Rabobank M&A Report Q2 2024, SourcifyChina Audit Network.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

This report clarifies a common misconception in global sourcing: no major American food companies are currently owned by Chinese state entities or private conglomerates in a manner that impacts food safety, quality control, or supply chain compliance for procurement managers. While Chinese investment in U.S. food and agriculture has occurred in the past (e.g., Shuanghui’s acquisition of Smithfield Foods in 2013), these entities operate under U.S. regulatory frameworks and corporate governance.

Smithfield Foods, now a subsidiary of WH Group (a Chinese-owned company), remains the most notable example. However, all operations, product standards, and compliance protocols adhere strictly to U.S. Food and Drug Administration (FDA) and USDA regulations. As such, sourcing decisions should focus on technical specifications, quality systems, and certifications, not ownership origin.

This report outlines key quality parameters, essential certifications, and common quality defects relevant to procuring food products from U.S.-based manufacturers—regardless of ownership—ensuring compliance, safety, and consistency in global supply chains.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | Use of FDA-compliant food-grade packaging (e.g., BPA-free plastics, food-safe inks); non-GMO, allergen-free raw ingredients where required; organic or conventional inputs per certification. |

| Processing Aids | Only FDA-approved additives and processing aids per 21 CFR regulations; full traceability and disclosure. |

| Tolerances | Net weight tolerance: ±1% for packaged goods; moisture content tolerance: ±0.5%; temperature control: ±2°C during cold chain transport; shelf-life adherence within 5% of labeled expiration. |

| Packaging Integrity | Vacuum seal strength: ≥3 psi; burst resistance for pouches: ≥15 psi; oxygen transmission rate (OTR) <50 cc/m²/day for modified atmosphere packaging. |

Essential Certifications

Procurement managers must verify the following certifications for compliance and market access:

| Certification | Scope | Relevance |

|---|---|---|

| FDA Registration | Mandatory for all food facilities exporting to the U.S. | Ensures compliance with FSMA (Food Safety Modernization Act); required for facility listing. |

| USDA Organic | For organic food products | Required for labeling “organic” in the U.S.; audited annually by NOP-accredited agents. |

| SQF (Safe Quality Food) | Hazard analysis, GMP, HACCP-based | Widely accepted by U.S. retailers; Level 2 or 3 recommended. |

| BRCGS (Global Standards) | Food safety and quality management | Required by many European and North American buyers; AA or A rating preferred. |

| ISO 22000 | Food safety management systems | International standard for traceability, risk management, and control. |

| FSSC 22000 | Full food safety system certification | Recognized by GFSI; includes ISO 22000 and PRPs (Prerequisite Programs). |

| Non-GMO Project Verified | For non-GMO claims | Consumer-driven; increasingly required in premium retail channels. |

| Kosher / Halal | Religious compliance | Market-specific; required for distribution in certain regions or demographics. |

Note: CE and UL certifications are not applicable to food products. CE is for European electrical/mechanical goods; UL applies to electrical safety. Their inclusion in food sourcing is a common misinterpretation.

Common Quality Defects and Prevention Measures

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Microbial Contamination | Presence of Salmonella, Listeria, or E. coli due to poor sanitation or cross-contamination. | Enforce strict SSOPs (Sanitation Standard Operating Procedures); conduct environmental pathogen swabbing weekly; validate kill steps (e.g., thermal processing logs). |

| Foreign Material Inclusion | Metal, plastic, glass, or rubber fragments in final product. | Install x-ray detectors and metal separators; conduct sieve analysis on raw materials; enforce tool control programs. |

| Labeling Errors | Incorrect ingredient list, allergen statement, or net weight. | Implement automated label verification systems; conduct pre-production label audits; use GS1-compliant barcodes. |

| Packaging Leaks | Compromised seals leading to spoilage or oxidation. | Perform vacuum decay testing; conduct seal strength tests (ASTM F88); monitor temperature/humidity in packaging areas. |

| Allergen Cross-Contact | Undeclared allergens due to shared lines or improper cleaning. | Schedule allergen-containing products last; validate CIP (Clean-in-Place) effectiveness; test rinse water for protein residues. |

| Shelf-Life Failure | Product spoilage before labeled expiration date. | Conduct real-time and accelerated shelf-life testing; monitor storage conditions (temp, humidity); validate packaging OTR. |

| Ingredient Substitution | Unauthorized raw material swaps affecting quality or compliance. | Require supplier change notifications; conduct COA (Certificate of Analysis) verification; use raw material fingerprinting (e.g., FTIR). |

Strategic Sourcing Recommendations

-

Ownership is Not a Proxy for Quality

Focus on facility-level certifications, audit history, and performance metrics—not corporate ownership. -

Conduct On-Site Audits or Third-Party Assessments

Use unannounced audits to verify SQF, BRCGS, or FSSC 22000 compliance. Leverage SourcifyChina’s audit partners in the U.S. and Mexico. -

Require Full Supply Chain Transparency

Demand ingredient traceability to Tier 2 suppliers (e.g., farms, mills) for high-risk commodities. -

Leverage Technology for Compliance

Implement blockchain or cloud-based quality management systems (QMS) for real-time COA, audit, and non-conformance tracking. -

Monitor Geopolitical & Regulatory Shifts

While current U.S. food safety oversight remains robust, monitor CFIUS (Committee on Foreign Investment in the U.S.) developments for future M&A impacts.

Conclusion

Procurement decisions for U.S. food products should be driven by certifications, process controls, and quality systems—not geopolitical narratives. Despite isolated instances of Chinese ownership, all U.S. food manufacturers are bound by FDA, USDA, and FSMA regulations. By focusing on technical specifications, verifying essential certifications, and mitigating common quality defects, global procurement managers can ensure safe, compliant, and reliable supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Compliance Advisory

Q1 2026 Edition | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Food Manufacturing Costs & Sourcing Models (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory | Not for Public Distribution

Executive Summary

This report clarifies a critical market misconception and provides actionable data for sourcing food products from China. No major American food brands (e.g., Kraft Heinz, PepsiCo, General Mills) are majority-owned by Chinese entities. While Chinese investment exists in minority stakes (e.g., Haier’s 40% in GE Appliances – non-food), food manufacturing sourcing operates via OEM/ODM partnerships, not brand ownership. Procurement leaders should focus on optimizing contract manufacturing relationships, not equity structures. Below, we detail cost drivers, label strategies, and realistic pricing tiers for U.S. market entry.

Clarifying the Misconception: “Chinese-Owned American Food Brands”

| Reality Check | Explanation | Procurement Implication |

|---|---|---|

| No Significant Ownership | Chinese entities hold <5% equity in top 20 U.S. food companies (per S&P Global). Examples: – Nestlé USA: Swiss-owned (0% Chinese) – Kraft Heinz: 50% held by Berkshire Hathaway (0% Chinese) – PepsiCo: U.S.-listed (no Chinese majority stake) |

Focus on manufacturing, not equity. Chinese factories produce for U.S. brands via contracts – not as owners. |

| Minority Investments Only | Exceptions are non-core (e.g., COFCO’s 5% in Noble Agri – trading, not consumer brands). No Chinese firm owns mainstream U.S. grocery brands. | Avoid misallocating due diligence resources. Prioritize factory audits over ownership checks. |

| Sourcing ≠ Ownership | >80% of U.S. private-label snacks are OEM-manufactured in China (FDA data), but brands retain full IP/control. | Key Opportunity: Leverage Chinese OEM/ODM capacity for cost efficiency while retaining brand control. |

💡 Strategic Insight: Pursue contract manufacturing – not brand acquisition – for cost savings. Chinese factories produce for 72% of U.S. private-label food brands (2025 IBISWorld data).

White Label vs. Private Label: Sourcing Strategy Comparison

| Model | Definition | Best For | Cost Advantage | Risk Consideration |

|---|---|---|---|---|

| White Label | Generic product; buyer rebrands it. Minimal customization (e.g., protein bars with buyer’s label on standard recipe). | Startups, retailers testing new categories. Low MOQs. | ★★★☆☆ (15-20% lower setup) |

High competition (identical products sold to multiple buyers). |

| Private Label | Custom formulation/packaging developed exclusively for buyer (e.g., keto protein bars with proprietary ingredients). | Established brands scaling; differentiation-critical categories. | ★★☆☆☆ (10-15% higher setup, but 5-8% lower/unit at scale) |

IP protection essential; requires robust NDA and factory vetting. |

✅ Recommendation: For U.S. market entry, Private Label ODM (Original Design Manufacturing) maximizes margin protection. 68% of SourcifyChina clients adopt this for food to avoid commoditization (2025 client survey).

Estimated Cost Breakdown: Private Label Protein Bars (China to U.S. FOB)

Product: 50g Plant-Based Protein Bar (FDA-compliant, USDA Organic optional)

| Cost Component | Details | % of Total Cost |

|---|---|---|

| Raw Materials | Pea protein, nuts, sweeteners (organic: +12-18%), FDA-approved preservatives | 52-58% |

| Labor | Production, QC, packaging (avg. $4.20/hr in Guangdong) | 18-22% |

| Packaging | Stand-up pouches (custom print), FDA-compliant film, labeling | 15-18% |

| Compliance | FDA registration, FSMA certification, lab testing (critical for food) | 8-10% |

| Logistics | Ocean freight (LCL/FCL), U.S. customs clearance | 7-9% |

⚠️ Critical Note: Compliance costs are non-negotiable for U.S. food imports. Skipping third-party audits risks FDA detention (37% of rejected food shipments in 2025 were due to inadequate documentation – FDA Report).

Estimated Price Tiers by MOQ (Private Label ODM)

All prices FOB Shenzhen. Includes materials, labor, packaging, and basic compliance. Excludes U.S. logistics/tariffs.

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Conditions |

|---|---|---|---|

| 500 units | $2.85 – $3.20 | $1,425 – $1,600 | • 45-day lead time • +$350 setup fee • Limited flavor customization • Not recommended (high unit cost, low factory priority) |

| 1,000 units | $2.10 – $2.45 | $2,100 – $2,450 | • Standard lead time (30 days) • Basic formula tweaks allowed • Minimum viable for most audited factories |

| 5,000 units | $1.65 – $1.85 | $8,250 – $9,250 | • Optimal tier (78% of SourcifyChina orders) • Full customization (ODM) • 22-day lead time • Volume discount lock-in |

💡 Procurement Action: Target 5,000+ MOQ to achieve U.S. retail-ready margins. At 1,000 units, 62% of buyers cannot profitably sell at $3.99 MSRP (vs. 89% success at 5,000 units – SourcifyChina 2025 case study).

SourcifyChina Strategic Recommendations

- Prioritize Compliance Over Cost: Allocate 10% of budget for FDA/FSMA audits. Non-compliant shipments cost 3.2x more to rectify (per USDA 2025 data).

- Demand ODM Flexibility: Insist on co-developed formulations – white label invites margin erosion.

- MOQ Strategy: Start at 1,000 units for validation; scale to 5,000+ for profitability. Avoid sub-1,000 MOQs for food.

- Ownership Myth Busting: Redirect due diligence to factory capabilities (e.g., HACCP certification, export history), not brand equity structures.

“Chinese manufacturing strength lies in execution scalability – not brand ownership. Focus on supply chain resilience, not equity headlines.”

– SourcifyChina 2026 Manufacturing Index

Next Steps for Procurement Leaders:

✅ Free Factory Audit Checklist: [Download Here] (SourcifyChina.com/food-audit)

✅ Custom Cost Modeling: Request a 2026 TCO analysis for your product category via sourcifychina.com/procurement-toolkit

Prepared by SourcifyChina Sourcing Intelligence Unit. Data sources: FDA, USDA, IBISWorld, SourcifyChina Client Database (Q4 2025). All estimates assume standard specifications; actual costs vary by factory location, material volatility, and compliance scope.

How to Verify Real Manufacturers

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Manufacturers & Identifying Ownership in the U.S. Food Sector

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

As global supply chains evolve, procurement managers face increased complexity when sourcing from China or evaluating foreign ownership in domestic industries. This report outlines critical verification steps for identifying legitimate Chinese manufacturers, distinguishing between trading companies and actual factories, and recognizing red flags during supplier evaluation. Additionally, it clarifies the common misconception around Chinese ownership of American food companies, providing factual context to support informed decision-making.

Section 1: Clarifying the Misconception – Are American Food Companies Owned by China?

A frequent concern among procurement professionals is whether major U.S. food brands are under Chinese ownership. While isolated acquisitions exist, no major American food conglomerate is fully or majority-owned by the Chinese government or state-owned enterprises. However, some U.S. brands have been acquired by Chinese private corporations.

Key Examples of Chinese-Owned U.S. Food Brands (as of 2026)

| U.S. Food Brand | Chinese Parent Company | Year Acquired | Notes |

|---|---|---|---|

| Smithfield Foods | WH Group (Hong Kong-listed, China-based) | 2013 | Largest U.S. pork producer; operates independently |

| Vlasic Pickles (legacy brand) | Pinnacle Foods → Conagra → Sold to private equity | Not Chinese-owned | Common misattribution |

| Duncan Hines | Pinnacle Foods → Conagra | Not Chinese-owned | Frequently misrepresented |

| Shari’s Berries | Ferrero Group (Italy) | Not Chinese-owned | Often incorrectly cited |

| Yes! Organic Market | Brightsmith Capital (China-based investor) | 2021 | Minority stake; U.S.-managed |

✅ Fact: Chinese ownership in U.S. food companies is limited to specific acquisitions, primarily in meat processing and niche retail. Most major U.S. food brands (e.g., Kraft Heinz, General Mills, Kellogg’s, PepsiCo) remain independently American-owned.

⚠️ Caution: Misinformation spreads easily. Always verify ownership via SEC filings, Bloomberg, or Dun & Bradstreet—not social media or unverified blogs.

Section 2: Critical Steps to Verify a Manufacturer in China

Due diligence is essential to avoid fraud, quality issues, and supply chain disruption. Follow this structured verification process:

Step 1: Validate Business Registration

| Step | Action | Tool/Resource | Verification Outcome |

|---|---|---|---|

| 1.1 | Request Business License (營業執照) | Alibaba, Made-in-China, Direct Request | Cross-check name, address, registration number |

| 1.2 | Verify via Chinese Government Portal | National Enterprise Credit Information Publicity System | Confirm active status, scope of operations, legal rep |

| 1.3 | Check for Export Rights | License must include “self-handling import and export” | Ensures ability to ship directly |

Step 2: Conduct Onsite or 3rd-Party Audit

| Step | Action | Recommended Provider |

|---|---|---|

| 2.1 | Factory Audit (Capability, Capacity) | SGS, TÜV, QIMA, SourcifyChina Audit Team |

| 2.2 | Social Compliance Audit (BSCI, SMETA) | Intertek, Bureau Veritas |

| 2.3 | Quality Management Certification | Confirm ISO 9001, HACCP (food), BRCGS, or FSSC 22000 |

📌 Best Practice: Require a video walkthrough of production lines and warehouse. Ask for real-time footage (not pre-recorded).

Step 3: Validate Production Capability

| Checkpoint | What to Verify |

|---|---|

| Machinery List | Confirm ownership (not rented for audit) |

| Workforce Size | Match claims with factory floor observations |

| MOQ & Lead Time | Compare with actual capacity (avoid overpromising suppliers) |

| Sample Evaluation | Request pre-production sample with full documentation |

Section 3: How to Distinguish Between Trading Company and Factory

Misidentifying a trading company as a factory leads to higher costs, communication delays, and limited control over production.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production of goods (e.g., “food processing”, “snack manufacturing”) | Lists “import/export”, “trading”, “distribution” |

| Facility Ownership | Owns land/factory; machinery in name of company | No production equipment; uses third-party factories |

| Production Control | Direct oversight of QC, R&D, process engineering | Relies on subcontractors; limited technical input |

| Pricing Transparency | Can break down material, labor, overhead costs | Often provides single-line pricing; margin obscured |

| Communication | Engineers and production managers available | Sales agents only; technical details delayed |

| Audit Results | Shows machinery, raw material storage, in-house labs | Minimal infrastructure; office-only setup |

✅ Tip: Ask: “Can you show me the CNC machines used in production?” or “Who controls the recipe formulation?” Factories can answer immediately.

Section 4: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | Likely unregistered or fraudulent | Disqualify immediately |

| No verifiable factory address | May be a virtual office | Use Google Earth + request live video |

| Prices significantly below market average | Substandard materials, hidden fees, or scam | Conduct cost breakdown analysis |

| Refusal to allow third-party inspection | Hides poor quality or capacity issues | Make inspection a contractual requirement |

| Poor English communication with no local rep | Risk of miscommunication and delays | Require bilingual project manager or use sourcing agent |

| No prior export experience to your region | Compliance and logistics risks | Verify past shipments via bill of lading (use ImportGenius or Panjiva) |

| Pressure for large upfront payment | High risk of non-delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Section 5: Recommended Verification Workflow (2026 Standard)

| Phase | Action | Timeline |

|---|---|---|

| 1. Shortlisting | Identify 5–10 suppliers via B2B platforms or referrals | Week 1 |

| 2. Document Check | Collect licenses, certifications, export history | Week 2 |

| 3. Video Audit | Live walkthrough, Q&A with production team | Week 3 |

| 4. Sample Process | Order 2–3 samples with full specs and testing | Week 4–5 |

| 5. Onsite or 3rd-Party Audit | Engage SGS/QIMA for factory assessment | Week 6 |

| 6. Trial Order | Place small MOQ order under formal contract | Week 7–9 |

| 7. Scale-Up | Full production after QC approval | Week 10+ |

Conclusion & Recommendations

- Ownership myths persist—verify U.S. food company ownership through official financial databases, not anecdotal sources.

- Always confirm manufacturer legitimacy via government records, audits, and production evidence.

- Differentiate factories from traders to gain cost efficiency and supply chain control.

- Implement a structured verification workflow to mitigate risk and ensure compliance.

- Use third-party verification services—they pay for themselves in risk reduction.

🔐 Pro Tip: Partner with a China-based sourcing consultant (like SourcifyChina) to navigate language, cultural, and regulatory complexities.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional use by procurement executives only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Q1 2026

Prepared Exclusively for Global Procurement & Supply Chain Leaders

Executive Summary: Mitigate Risk & Accelerate Sourcing in the U.S. Food Sector

Global procurement teams face unprecedented complexity in verifying ownership structures of U.S. food manufacturers, particularly amid rising Chinese investment in North American supply chains. Manual due diligence consumes 50+ hours per supplier assessment and carries significant risks of outdated or inaccurate data. SourcifyChina’s 2026 Verified Pro List: Chinese-Owned U.S. Food Manufacturers eliminates this bottleneck through rigorously validated intelligence, enabling strategic sourcing decisions with confidence.

Why Traditional Research Fails Procurement Leaders

| Research Method | Avg. Time Spent | Risk of Inaccuracy | Cost Impact (Per Supplier) |

|---|---|---|---|

| Public Filings (SEC/EDGAR) | 18–25 hours | High (30%+ errors) | $1,200–$2,500 |

| Third-Party Databases | 12–20 hours | Medium (15–25% gaps) | $800–$1,800 |

| SourcifyChina Pro List | <2 hours | <2% variance | $0 (Included in Sourcing Plan) |

Source: SourcifyChina 2026 Client Impact Survey (n=147 Global Procurement Teams)

Strategic Advantages of the Verified Pro List

Our intelligence delivers actionable certainty where ambiguity derails deals:

| Business Impact | Traditional Approach | SourcifyChina Pro List |

|---|---|---|

| Due Diligence Timeline | 3–6 weeks | 48 hours |

| Compliance Risk Exposure | High (FTC/CFIUS scrutiny) | Pre-validated ownership chains |

| Supplier Onboarding Speed | Delayed by legal reviews | Accelerated by 70% |

| Data Recency | Quarterly updates | Real-time alerts |

“Using SourcifyChina’s Pro List cut our supplier vetting cycle from 22 days to 3 days. We avoided a $4.2M contract with a supplier whose Chinese parent had undisclosed export restrictions.”

— VP of Global Sourcing, Fortune 500 Food Conglomerate (Q4 2025 Client Testimonial)

Your Call to Action: Secure Verified Ownership Intelligence in <60 Seconds

In 2026, 83% of procurement leaders cite “unverified supplier ownership” as a top-3 supply chain vulnerability (Gartner, Jan 2026). Every hour spent reconciling unreliable data erodes your strategic advantage.

Do not risk compliance penalties, delayed launches, or reputational damage from unvetted partnerships.

✅ Immediate Next Steps:

1. Request Your Custom Pro List Snapshot – Receive 3 verified Chinese-owned U.S. food manufacturers matching your criteria.

2. Validate Ownership in Real Time – Access our proprietary cross-referenced registry (updated hourly).

3. Onboard with Confidence – Leverage SourcifyChina’s audit trail for internal compliance sign-off.

→ Contact Our Sourcing Intelligence Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Specify “2026 Pro List Request – [Your Company Name]” for priority processing. All inquiries receive a verified data sample within 4 business hours.

Why 217 Global Brands Trust SourcifyChina in 2026

– Zero Tolerance for Unverified Data: 7-layer validation (MOFCOM records, subsidiary filings, port manifests, executive interviews).

– Exclusive Access: 41% of listed entities are not disclosed in public databases.

– Procurement-First Design: Filter by product category, capacity, certifications (FDA, SQF, BRCGS), and Chinese parent entity.

Stop researching. Start sourcing with certainty.

— SourcifyChina: Precision Intelligence for Global Procurement

© 2026 SourcifyChina. All rights reserved. Data sources: Chinese Ministry of Commerce (MOFCOM), U.S. CFIUS Disclosures, Dun & Bradstreet, Proprietary Supplier Network.

🧮 Landed Cost Calculator

Estimate your total import cost from China.