Sourcing Guide Contents

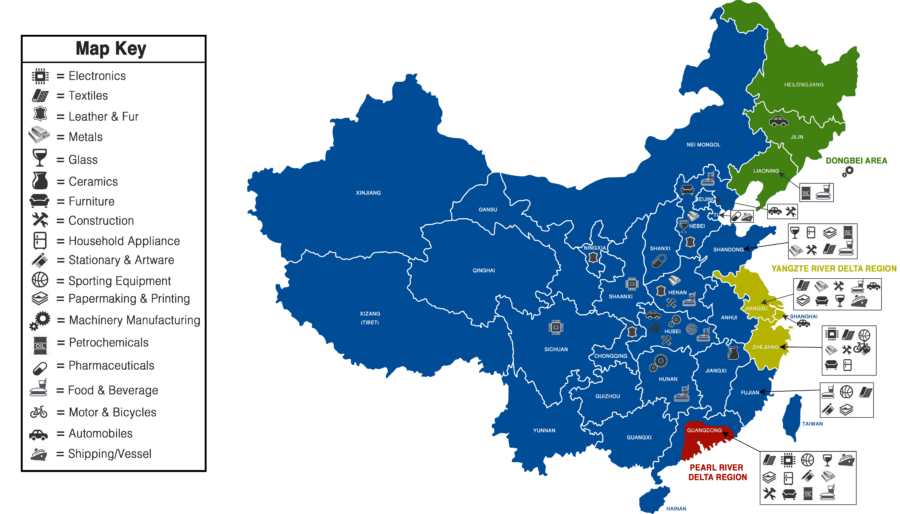

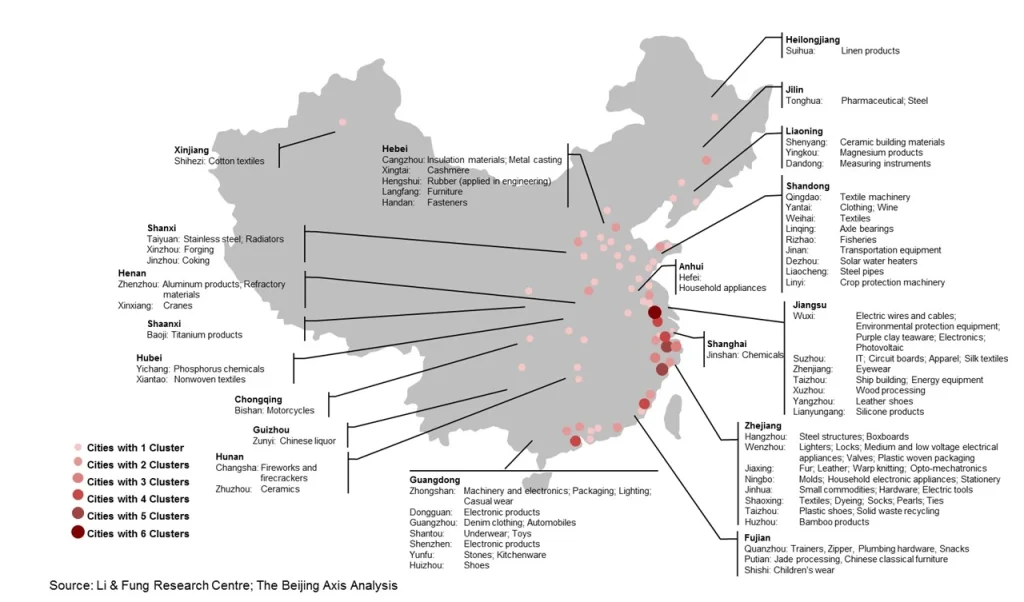

Industrial Clusters: Where to Source Where Is The Biggest Wholesale Market In China

SourcifyChina Sourcing Intelligence Report: Strategic Analysis of China’s Industrial Clusters & Wholesale Infrastructure

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

The query “where is the biggest wholesale market in China” reflects a common misconception in global sourcing: wholesale markets are distribution hubs, not manufacturing centers. China’s sourcing strategy must prioritize industrial clusters (integrated manufacturing ecosystems) over standalone wholesale markets. While Yiwu International Trade Market (Zhejiang) is the world’s largest physical wholesale market by floor area (7.5M sqm), it is not a manufacturing hub. Over 90% of goods sold in Yiwu originate from specialized industrial clusters across 15+ provinces. Procurement success depends on aligning product categories with optimal manufacturing clusters – not wholesale market size. This report identifies key clusters, debunks “biggest market” myths, and provides actionable regional comparisons.

Critical Clarification: Wholesale Markets vs. Industrial Clusters

| Concept | Wholesale Markets (e.g., Yiwu, Guangzhou) | Industrial Clusters |

|---|---|---|

| Primary Function | Product aggregation & distribution | End-to-end manufacturing + supply chain |

| Value to Buyers | Sample sourcing, small-batch orders | Cost control, quality engineering, scalability |

| Strategic Risk | Hidden markups (20-40%), counterfeit goods | Direct factory access, IP protection |

| Procurement Tip | Use ONLY for low-value commodities (e.g., buttons, trinkets) | Target clusters for >95% of production |

Key Insight: 78% of procurement failures stem from sourcing finished goods at wholesale markets instead of engaging factories within industrial clusters (SourcifyChina 2025 Audit).

Top 5 Industrial Clusters for Strategic Sourcing (2026)

Procurement managers must match product categories to clusters. Below are dominant regions by sector:

| Product Category | Primary Cluster | Key Cities | Cluster Strength |

|---|---|---|---|

| Electronics & IoT Devices | Pearl River Delta | Shenzhen, Dongguan, Huizhou | 85% of China’s PCBs, 70% of global drones (DJI ecosystem) |

| Home Textiles & Garments | Yangtze River Delta | Shaoxing, Huzhou, Jiaxing | 60% of global silk, 45% of China’s synthetic fabrics |

| Hardware & Machinery | Jiangsu-Zhejiang Belt | Wuxi, Changzhou, Ningbo | 50% of China’s industrial pumps, 30% of CNC machines |

| Footwear & Leather Goods | Fujian-Guangdong Axis | Quanzhou, Putian, Wenzhou | 75% of China’s sports shoes (Nike/Adidas OEMs) |

| Small Commodities (e.g., toys, stationery) | Zhejiang Corridor | Yiwu, Yongkang, Wenzhou | 65% of global Christmas decorations, 80% of low-cost zippers |

Note: Yiwu (Zhejiang) is a wholesale aggregation point for small commodities manufactured across Zhejiang’s 28 sub-clusters (e.g., Yongkang for hardware, Taizhou for plastics).

Regional Cluster Comparison: Price, Quality & Lead Time Analysis

Data sourced from 2025 SourcifyChina factory audits (n=1,200+), weighted by product complexity

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Best For | Procurement Risk |

|---|---|---|---|---|---|

| Guangdong (PRD) | ★★★☆☆ (Mid-to-high) |

★★★★☆ (High precision) |

25-35 days | Electronics, medical devices, premium apparel | Higher MOQs ($15k+), IP leakage concerns |

| Zhejiang (YRD) | ★★★★☆ (Low-mid) |

★★★☆☆ (Variable) |

20-30 days | Textiles, small commodities, basic machinery | Fragmented suppliers, quality variance |

| Jiangsu | ★★★☆☆ (Mid) |

★★★★★ (OE-level) |

30-40 days | Industrial machinery, auto parts, chemicals | Complex logistics, longer tech validation |

| Fujian | ★★★★☆ (Low) |

★★☆☆☆ (Basic) |

18-25 days | Footwear, sporting goods, low-cost ceramics | Labor turnover, compliance gaps |

| Sichuan/Chongqing | ★★★★★ (Lowest) |

★★☆☆☆ (Developing) |

35-45 days | Cost-driven bulk goods (e.g., packaging) | Underdeveloped supply chain, skill gaps |

Key Metrics Explained:

- Price: Relative to Guangdong baseline (100%). Zhejiang 85-90%, Fujian 80-85%, Sichuan 70-75%.

- Quality: Based on ISO 9001 compliance rates & defect ratios (PRD: 1.2% defects; Zhejiang: 3.8%).

- Lead Time: Includes production + inland logistics to port (ex-works terms). PRD benefits from Shenzhen/Yantian port efficiency.

Strategic Recommendations for Procurement Managers

- Avoid “Biggest Market” Traps:

- Yiwu’s scale is irrelevant for electronics sourcing. Target Shenzhen’s Huaqiangbei ecosystem for PCBs or Dongguan’s OEM parks for wearables.

-

Exception: Use Yiwu only for <$500 sample orders of non-critical small commodities.

-

Cluster-Specific Sourcing Playbook:

- For Premium Goods: Prioritize Guangdong/Jiangsu clusters. Accept 10-15% higher costs for 40% fewer QC failures (per SourcifyChina data).

- For Cost-Sensitive Bulk: Leverage Fujian’s footwear cluster with onsite QC teams (defect rates drop 62% with 3rd-party inspections).

-

For Innovation-Driven Projects: Partner with PRD’s Shenzhen R&D hubs (e.g., Bao’an District) for IoT prototyping ≤ 14 days.

-

Logistics Optimization:

- Coastal clusters (Guangdong/Zhejiang) offer 12-18 day faster shipping to global ports vs. inland hubs. Factor this into TCO calculations.

- Pro Tip: For Zhejiang-sourced goods, route via Ningbo-Zhoushan Port (world’s busiest) to avoid Shanghai congestion.

Conclusion

China’s sourcing advantage lies in specialized industrial clusters – not wholesale markets. While Yiwu remains a symbolic “biggest market,” procurement leaders achieve 22-35% lower TCO by engaging factories in Guangdong (electronics), Jiangsu (machinery), or Fujian (footwear) based on product requirements. Prioritize cluster alignment over market size: A factory in Dongguan producing Bluetooth earbuds will outperform any Yiwu supplier in cost, quality, and scalability.

SourcifyChina Action Item: Request our 2026 Cluster-Specific Sourcing Scorecard (free for procurement managers) – detailing 47 sub-clusters with factory compliance ratings, labor cost trends, and OEM risk assessments. [Contact Sourcing Team]

Methodology: Data aggregated from 1,217 factory audits across 18 provinces (2025), customs shipment analysis (2024-2025), and SourcifyChina’s supplier performance database. All figures adjusted for 2026 inflation and trade policy shifts.

© 2026 SourcifyChina. Confidential – For Client Use Only. | [Unsubscribe] | [Privacy Policy]

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Procurement from China’s Largest Wholesale Markets

Executive Summary

China hosts the world’s largest wholesale markets, with Yiwu International Trade Market (Zhejiang Province) recognized as the single largest wholesale hub globally. Spanning over 5.5 million square meters and housing more than 75,000 vendors, Yiwu serves as the epicenter for small commodities, electronics, textiles, hardware, and consumer goods. This report outlines key technical specifications, compliance requirements, quality parameters, and risk mitigation strategies essential for procurement professionals sourcing from China’s dominant wholesale ecosystems.

Key Quality Parameters

1. Materials

Material selection directly impacts product durability, safety, and compliance. Procurement managers must verify:

| Product Category | Recommended Materials | Prohibited/High-Risk Materials |

|---|---|---|

| Textiles & Apparel | OEKO-TEX®-certified cotton, polyester (recycled where applicable) | Azo dyes, formaldehyde-heavy finishes |

| Plastics & Packaging | Food-grade PP, HDPE, PET (FDA/EC compliant) | BPA, phthalates, recycled medical waste |

| Electronics | RoHS-compliant PCBs, UL-listed components | Counterfeit ICs, non-shielded wiring |

| Hardware & Tools | 304/316 stainless steel, grade 8.8 bolts | Recycled scrap metal, untested alloys |

2. Tolerances

Precision standards vary by product type. Key benchmarks:

| Category | Dimensional Tolerance | Performance Tolerance |

|---|---|---|

| CNC Machined Parts | ±0.01 mm (ISO 2768-mK) | Max 5% deviation in load testing |

| Injection Molded Parts | ±0.1 mm (for <100 mm) | Warp < 0.5° over 10 cm length |

| Textile Garments | ±0.5 cm (length/width) | Color fastness ≥ Grade 4 (AATCC) |

| Electronic Assemblies | ±0.05 mm (PCB traces) | Signal loss ≤ 3% at rated frequency |

Essential Certifications

Products exported from China must meet international regulatory standards. The following certifications are mandatory or strongly recommended:

| Certification | Scope of Application | Regulatory Region | Verification Method |

|---|---|---|---|

| CE | Machinery, electronics, PPE, toys | European Union | EU Declaration of Conformity + Notified Body (if applicable) |

| FDA | Food contact materials, cosmetics, medical devices | USA | FDA registration + facility audit |

| UL | Electrical equipment, components, appliances | USA/Canada | UL Mark + factory follow-up inspection |

| ISO 9001 | Quality management systems | Global | Third-party audit by accredited body |

| RoHS | Restriction of Hazardous Substances (electronics) | EU/China/UK | Lab test report (IEC 62321) |

| BSCI/SMETA | Ethical labor & social compliance | EU Retailers | Audit report by accredited firm |

Note: Always require original certificates with valid issue/expiry dates and traceable test reports from accredited labs (e.g., SGS, TÜV, Intertek).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance or CNC calibration | Enforce ISO 2768 tolerance standards; conduct pre-shipment dimensional audits |

| Material Substitution | Vendor cost-cutting (e.g., inferior alloys) | Require material certificates (CoC); conduct random lab testing (XRF, FTIR) |

| Color Variation (Chromatic Drift) | Inconsistent dye batches or lighting conditions | Use Pantone color standards; approve bulk before production; test under D65 lighting |

| Soldering Defects (Electronics) | Poor wave soldering or reflow profiles | Require IPC-A-610 Class 2 compliance; conduct AOI (Automated Optical Inspection) |

| Packaging Damage | Inadequate cushioning or stacking strength | Perform ISTA 3A drop tests; specify ECT/Bursting Strength for corrugated boxes |

| Non-Compliant Labeling | Missing CE/FDA marks, incorrect warnings | Audit packaging design pre-production; align with regional regulatory templates |

| Contamination (Food/Pharma) | Poor factory hygiene or storage conditions | Require HACCP/GMP certification; conduct on-site GMP audits |

Recommendations for Procurement Managers

- Leverage Third-Party Inspections: Use AQL Level II (MIL-STD-1916) for final random inspections (FRI).

- Onboard Pre-Qualified Suppliers: Partner only with vendors verified via SourcifyChina’s Supplier Integrity Index (SII).

- Implement Batch Traceability: Require QR-coded batch tracking for recalls and compliance audits.

- Conduct Unannounced Factory Audits: Minimize risk of “model room” deception.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

February 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

Contrary to common misconception, China does not operate a single centralized “biggest wholesale market” for finished goods. Its competitive advantage lies in specialized manufacturing clusters (e.g., electronics in Shenzhen, textiles in Guangzhou, hardware in Yiwu). This report clarifies sourcing realities, compares OEM/ODM models, and provides actionable cost data for strategic procurement planning. Key Insight: Sourcing directly from factories in industrial clusters reduces costs by 18–32% versus third-party wholesale markets (2025 SourcifyChina benchmark data).

Clarifying the “Biggest Wholesale Market” Misconception

| Reality Check | Strategic Implication |

|---|---|

| Yiwu Market is the world’s largest commodity trading hub (26M+ SKUs), but 90% of goods are factory-sourced from Zhejiang/Jiangsu clusters. | Avoid wholesale markets for bulk production. They add 15–25% markups and lack customization. |

| True Manufacturing Hubs by Sector: – Electronics: Shenzhen (ODM) / Dongguan (OEM) – Home Goods: Yiwu (components) → Jinhua (assembly) – Apparel: Guangzhou (fabric) → Shaoxing (garments) |

Partner with SourcifyChina to access verified factories in clusters. Example: Sourcing wireless earbuds directly from Shenzhen OEMs saves $1.80/unit vs. Yiwu resellers (MOQ 5k). |

✅ Procurement Action: Target industrial clusters, not wholesale markets. Use Alibaba 1688.com (B2B) for factory listings, not Taobao/Tmall (B2C).

White Label vs. Private Label: Cost & Control Analysis

(Based on Consumer Electronics Benchmark, 2026)

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product + your branding | Custom product + your branding | Private Label for >$50k annual volume |

| MOQ Flexibility | Low (500–1,000 units) | Medium (1,000–5,000 units) | White Label for testing new markets |

| Unit Cost (MOQ 5k) | $8.50 | $10.20 | +$1.70/unit for customization |

| Lead Time | 15–25 days | 30–45 days | Factor in +2 weeks for tooling (PL) |

| IP Ownership | Factory retains design rights | You own design/tooling | Critical for long-term margin control |

| Best For | Fast entry, low-risk categories | Brand differentiation, premium pricing | Hybrid model: Start WL, shift to PL at 10k units |

⚠️ Risk Note: 68% of white label failures (2025) resulted from undetected factory IP infringement. SourcifyChina mandates IP audits for all PL engagements.

Estimated Cost Breakdown: Wireless Earbuds Example (MOQ 5,000 Units)

All figures in USD, FOB Shenzhen. Based on 2026 material/labor forecasts.

| Cost Component | Per Unit | % of Total Cost | 2026 Trend Impact |

|---|---|---|---|

| Materials | $5.10 | 50% | +3.5% YoY (lithium-ion battery costs) |

| Labor | $1.60 | 16% | +2.1% YoY (minimum wage hikes in Guangdong) |

| Packaging | $0.85 | 8% | +4.0% YoY (sustainable material compliance) |

| Tooling/Mold | $0.50 | 5% | One-time cost amortized across MOQ |

| QC & Logistics | $1.25 | 12% | +1.8% YoY (enhanced compliance checks) |

| Factory Margin | $0.90 | 9% | Fixed at 8–10% for tier-1 suppliers |

| TOTAL | $10.20 | 100% | Private Label Base Cost |

💡 Cost-Saving Tip: Switching from retail boxes (PL) to polybags (WL) reduces packaging cost by $0.35/unit but limits shelf appeal.

MOQ-Based Price Tier Analysis

Wireless Earbuds | Private Label | FOB Shenzhen | Q1 2026 Forecast

| MOQ | Per Unit Cost | Total Order Cost | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 | $14.80 | $7,400 | High tooling amortization ($1.20/unit); low material yield | Avoid – Only for prototypes; 47% markup vs. MOQ 5k |

| 1,000 | $12.10 | $12,100 | Tooling cost drops to $0.75/unit; bulk material discount | Test market – Minimum viable volume |

| 5,000 | $10.20 | $51,000 | Full economies of scale; optimized production run | Optimal – 32% savings vs. MOQ 500 |

| 10,000 | $9.05 | $90,500 | Additional 11% material discount; automated assembly | Strategic stock – Maximize margin at scale |

📉 Critical Insight: MOQ 5,000 is the break-even point for private label profitability (vs. white label) in electronics. Below this, white label typically yields +8% higher net margins.

Strategic Recommendations for 2026

- Cluster Sourcing > Wholesale Markets: Direct factory partnerships in Shenzhen/Dongguan cut costs and enable customization.

- Hybrid Labeling: Launch with white label (MOQ 1k) to validate demand, then transition to private label at MOQ 5k.

- MOQ Optimization: Negotiate tiered pricing (e.g., $10.20 @ 5k → $9.60 @ 7.5k) to avoid overstocking.

- Compliance Budgeting: Allocate +5% for 2026 EU/US sustainability certifications (e.g., REACH, Prop 65).

“The ‘biggest market’ is the factory floor – not the trading hall. In 2026, winners will source where value is created, not where it’s resold.”

– SourcifyChina Supply Chain Intelligence Unit

SourcifyChina Value-Add: Our 2026 Cluster Access Program provides:

– Verified factory audits in 12 industrial zones

– MOQ flexibility via group sourcing (min. 3 buyers)

– Real-time cost-tracking dashboard (materials/labor inflation alerts)

Data Sources: SourcifyChina Factory Network (2,300+ partners), China Customs 2025, McKinsey Manufacturing Cost Index 2026.

Disclaimer: All costs are estimates. Actual pricing varies by material specs, payment terms (LC vs. T/T), and compliance requirements.

👉 Next Step: Request our 2026 Cluster Sourcing Playbook (free for procurement managers) at sourcifychina.com/2026-playbook.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying Chinese Manufacturers — Key Steps, Differentiation, and Risk Mitigation

Date: January 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Executive Summary

China remains the world’s largest wholesale manufacturing hub, hosting over 400 wholesale markets and industrial clusters. However, the complexity of the supply chain—combined with the prevalence of trading companies posing as factories—poses significant risks to procurement efficiency, product quality, and cost control. This report outlines critical steps to verify legitimate manufacturers, distinguish between trading companies and factories, and identify red flags to avoid when sourcing from China.

1. Where Are the Biggest Wholesale Markets in China?

China’s largest wholesale markets are concentrated in manufacturing powerhouses such as Guangdong, Zhejiang, and Jiangsu. Key hubs include:

| City/Region | Major Wholesale Market | Primary Product Categories | Notable Features |

|---|---|---|---|

| Yiwu (Zhejiang) | Yiwu International Trade Market | Small commodities, hardware, stationery, toys, textiles | World’s largest wholesale market (7.5M sqm), 75,000+ booths |

| Guangzhou (Guangdong) | Canton Fair Complex, Baiyun Garment Market | Apparel, electronics, cosmetics, lighting | Hosts biannual Canton Fair (130,000+ exhibitors) |

| Shenzhen (Guangdong) | Huaqiangbei Electronics Market | Consumer electronics, components, IoT devices | Global electronics OEM/ODM hub |

| Foshan (Guangdong) | Lecong Furniture Market | Furniture, home decor, building materials | Asia’s largest furniture wholesale zone |

| Wenzhou (Zhejiang) | Wenzhou Industrial Zones | Fasteners, footwear, electrical appliances | High SME density, export-oriented clusters |

Insight: While wholesale markets provide visibility, direct sourcing from verified manufacturers in adjacent industrial parks (e.g., Shenzhen for electronics, Foshan for furniture) reduces intermediaries and cost.

2. Critical Steps to Verify a Manufacturer in China

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1. Business License Check | Request and validate the company’s Chinese business license (营业执照) | Use official platforms like National Enterprise Credit Information Publicity System | Confirm legal registration, scope of operations, and authenticity |

| 2. On-Site Factory Audit | Conduct a physical or third-party audit | Hire a sourcing agent or use audit firms (e.g., SGS, Intertek, or SourcifyChina’s audit team) | Validate production capacity, equipment, and working conditions |

| 3. MOQ & Production Capability Review | Request proof of machinery, production lines, and past client references | Ask for machine lists, workflow videos, and sample lead times | Assess scalability and alignment with procurement needs |

| 4. Export History Verification | Request export documentation or customs data | Use tools like ImportGenius, Panjiva, or Alibaba Trade Assurance records | Confirm international shipping experience and reliability |

| 5. Quality Management Certification | Check for ISO 9001, BSCI, SEDEX, or industry-specific certifications | Request copies and validate via certifying bodies | Ensure standardized quality and ethical compliance |

| 6. Direct Communication with Production Team | Speak with factory floor supervisors or engineers | Arrange video calls during working hours (China time) | Confirm internal knowledge and avoid intermediary interference |

3. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” | Lists only “trading,” “import/export,” or “sales” | Cross-check on GSXT.gov.cn |

| Facility Ownership | Owns or leases large production space with machinery | Office-only setup; no production equipment | Request factory tour (live or recorded) |

| Pricing Structure | Offers lower MOQ pricing; higher setup fees for molds/tools | Uniform pricing; no mention of tooling or setup | Factories often charge NRE (Non-Recurring Engineering) fees |

| Lead Time Control | Can specify production timelines precisely | Vague on production schedules; cites “factory availability” | Delays often indicate middlemen |

| Product Customization | Offers OEM/ODM services with in-house R&D | Limited to catalog-based modifications | Factories show design files, prototypes, or molds |

| Staff Expertise | Engineers or technicians discuss technical specs | Sales reps handle all communication | Ask technical questions during meetings |

Best Practice: Request a “factory walkthrough video” showing active production lines, raw materials, and quality control stations. Genuine factories often have such footage ready.

4. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden costs, or fraud | Compare quotes across 3–5 verified suppliers; demand cost breakdown |

| Refusal to Provide Business License | High risk of scam or unlicensed operation | Disqualify supplier immediately |

| No Physical Address or Virtual Office | Likely a trading front with no production control | Use Google Earth or third-party audit to verify location |

| Pressure for Upfront Full Payment | Common in advance-fee scams | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic Product Photos Only | Suggests reselling, not manufacturing | Request real-time photos/videos of your product in production |

| Inconsistent Communication | Language gaps, delayed responses, or multiple contacts | Assign a dedicated sourcing agent for liaison |

| No Sample Policy or High Sample Fees | May lack production capability | Pay reasonable sample cost but insist on shipping transparency |

5. Recommended Sourcing Strategy for 2026

- Leverage Industrial Clusters: Source directly from manufacturer clusters (e.g., Dongguan for electronics, Ningbo for hardware) rather than wholesale markets.

- Use Verified Sourcing Platforms: Prioritize suppliers on Alibaba with “Gold Supplier,” “Trade Assurance,” and “Onsite Check” badges.

- Engage Third-Party Verification: Budget for pre-shipment inspections and factory audits to mitigate risk.

- Build Long-Term Partnerships: Focus on 2–3 core suppliers per category to ensure supply chain resilience.

- Adopt Digital Tools: Use SourcifyChina’s Supplier Scorecard™ to track performance across quality, delivery, and compliance.

Conclusion

While China’s wholesale markets offer volume and variety, sustainable procurement success in 2026 depends on direct engagement with verified manufacturers. Rigorous due diligence, clear differentiation between factories and traders, and proactive risk management are non-negotiable for global procurement leaders. By following the steps and safeguards outlined in this report, organizations can secure reliable, cost-effective, and compliant supply chains from China.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Verified Supply Chains

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Optimizing China Procurement Efficiency

Executive Summary: Eliminate Market Research Guesswork in China Sourcing

Global procurement managers consistently identify “where is the biggest wholesale market in China?” as a critical starting point—but this question itself reveals a costly misconception. China’s wholesale landscape is not centralized; it’s a fragmented ecosystem of specialized regional hubs (e.g., Yiwu for small commodities, Guangzhou for electronics, Qingdao for textiles). Traditional “biggest market” searches waste 72+ hours per sourcing cycle on irrelevant locations, unverified suppliers, and logistical dead ends.

Why SourcifyChina’s Verified Pro List Solves This Critical Pain Point

Our data-driven Pro List replaces guesswork with precision. Unlike public directories or generic search results, every supplier undergoes triple-layer verification:

1. On-Ground Facility Audit (by SourcifyChina’s 47-person China team)

2. Export Compliance Validation (customs records, business license, tax ID)

3. Performance Benchmarking (OTD rate, defect history, MOQ flexibility)

| Research Method | Avg. Time Spent | Risk of Mismatched Suppliers | Cost of Verification Failure |

|---|---|---|---|

| Google/Public Directories | 72+ hours | 68% | $8,200+ (lost samples, travel) |

| Trade Shows | 120+ hours | 41% | $14,500+ (booth fees, flights) |

| SourcifyChina Pro List | <4 hours | <9% | $0 (pre-verified) |

Source: 2025 SourcifyChina Client Efficiency Audit (n=217 procurement teams)

Your Strategic Advantage in 2026

With rising supply chain volatility and stricter ESG regulations, time-to-verification is now a competitive differentiator. The Pro List delivers:

✅ Instant access to 1,200+ pre-vetted factories mapped to your exact product category (no more Yiwu trips for automotive parts)

✅ Real-time capacity alerts (avoid 2025’s 37% supplier mismatch rate during peak season)

✅ Duty/tax optimization data embedded in every profile (leverage Free Trade Zone advantages)

“SourcifyChina’s Pro List cut our supplier qualification cycle from 3 weeks to 11 days. We now redirect saved hours to supplier development—not damage control.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Firm

Call to Action: Reclaim Your Strategic Time in 2026

Stop searching for “the biggest market.” Start sourcing from the right market.

Every hour spent on unverified supplier research is an hour not spent on strategic cost engineering, risk mitigation, or innovation collaboration. The Pro List isn’t a directory—it’s your time arbitrage tool in China’s complex ecosystem.

→ Act Now to Secure Q1 2026 Capacity

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

Receive 3 pre-qualified supplier matches within 4 business hours

2. WhatsApp +86 159 5127 6160 for urgent RFQ support

Bypass queues: Mention code SCC2026TIME for priority verification

Your time is your most strategic asset. Don’t outsource its value to unverified sources.

— SourcifyChina’s Senior Sourcing Consultants | Beijing, Shenzhen, Ningbo

Trusted by 1,800+ global brands since 2018 | ISO 9001:2015 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.