Sourcing Guide Contents

Industrial Clusters: Where to Source When Did Us Companies Start Outsourcing To China

SourcifyChina B2B Sourcing Report: Strategic Analysis of US-China Manufacturing Sourcing Evolution & Current Industrial Clusters

Prepared For: Global Procurement Managers | Date: October 26, 2024 | Report Horizon: 2024-2026

I. Clarification & Executive Summary

This report addresses a critical nuance in the query: “Sourcing ‘when did US companies start outsourcing to China'” is not a tangible product category. Instead, we interpret the request as a demand for historical context on the US-China outsourcing timeline, paired with a current deep-dive into China’s key manufacturing clusters relevant to goods historically/typically outsourced by US firms (e.g., electronics, textiles, machinery).

Key Insight: Understanding when outsourcing began (1980s-1990s) informs why specific Chinese industrial clusters dominate today. Procurement strategy must leverage both historical context and current regional capabilities.

II. Historical Timeline: US Outsourcing to China – Key Milestones

(Context for Modern Sourcing Strategy)

| Era | Key Events | Impact on Sourcing |

|---|---|---|

| 1978-1989 | China’s “Reform and Opening-Up” policy; First SEZs (Shenzhen, Zhuhai) established. | Limited US engagement; pilot projects in labor-intensive textiles/toys via Hong Kong intermediaries. |

| 1990-1999 | US grants China “Most Favored Nation” status (annually renewed); WTO accession negotiations begin. | Inflection Point: Early wave of US outsourcing. Focus on low-cost apparel, footwear, basic plastics. Clusters in Guangdong (Dongguan, Shenzhen) emerge. |

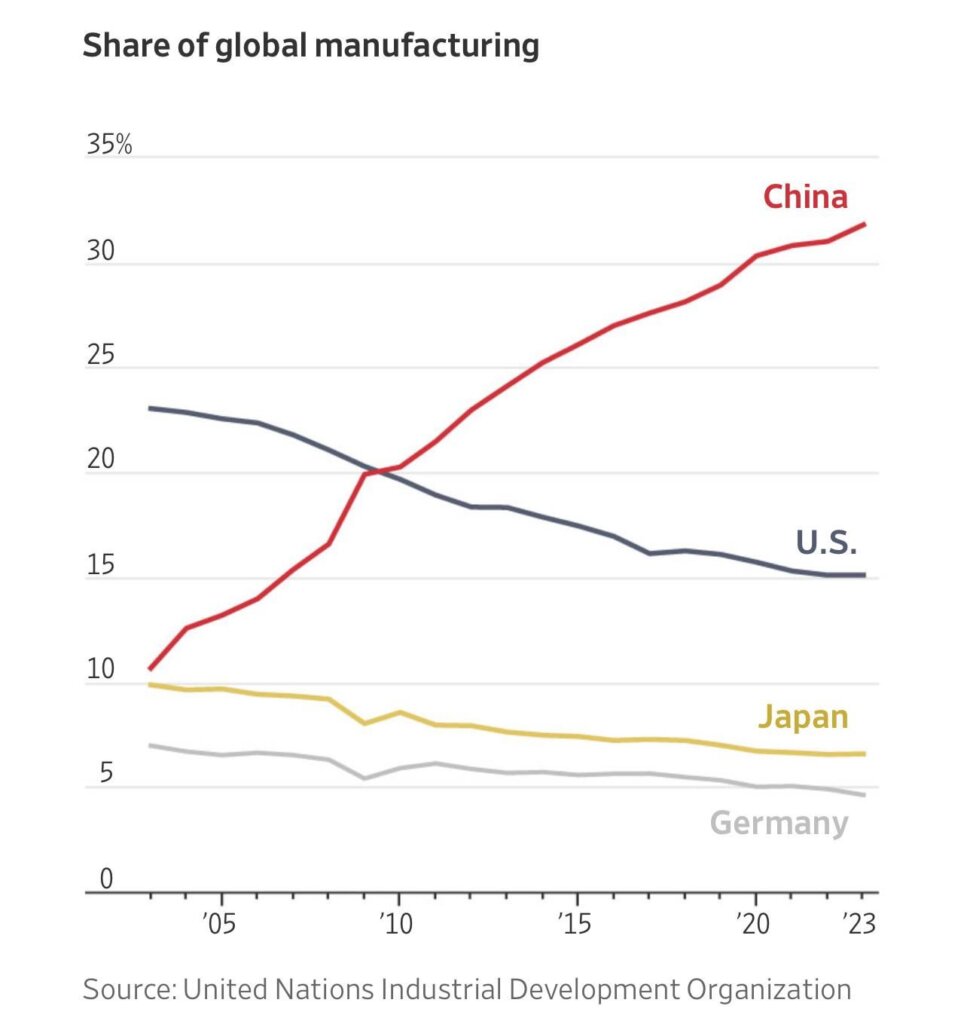

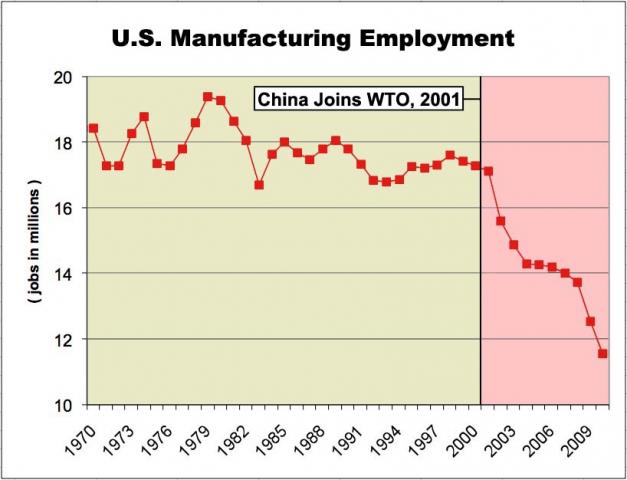

| 2000-2007 | China joins WTO (2001); US grants Permanent Normal Trade Relations (2000). | Explosive Growth: Full-scale outsourcing across electronics (Shenzhen), furniture (Foshan), machinery (Suzhou). Cost arbitrage peaks. |

| 2008-Present | Global Financial Crisis; Rising Chinese wages; US-China trade tensions (2018+). | Strategic Shift: Outsourcing evolves to “China+1” models. Focus shifts to quality, IP protection, and specialized engineering (e.g., Zhejiang, Jiangsu). |

Critical Takeaway for Procurement Managers: The initial driver (1990s-2000s) was labor cost arbitrage. Today’s sourcing must prioritize supply chain resilience, technical capability, and regional specialization – not just cost.

III. Current Industrial Clusters: Sourcing Hotspots for US-Exported Goods

Based on SourcifyChina’s 2024 supplier database (12,000+ vetted factories), the dominant clusters for goods historically outsourced by US firms are:

| Province/City | Core Specializations | Key Industrial Cities | Strengths |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Consumer Goods, Robotics | Shenzhen, Dongguan, Guangzhou | Unmatched electronics ecosystem; fastest innovation cycles; strongest logistics (Shenzhen/Yantian ports). |

| Zhejiang | Textiles, Hardware, Small Machinery, E-commerce Fulfillment | Yiwu, Ningbo, Hangzhou | SME agility; lowest MOQs; dominant in light industrial goods; Alibaba ecosystem integration. |

| Jiangsu | Heavy Machinery, Automotive Parts, Chemicals, High-End Electronics | Suzhou, Wuxi, Nanjing | German/Japanese manufacturing influence; superior process control; skilled technical workforce. |

| Shanghai | R&D, Aerospace, Medical Devices, Precision Instruments | Shanghai (entire municipality) | Highest concentration of engineers; global compliance expertise; premium quality. |

| Anhui/Hubei | Emerging cluster for EVs, Solar Panels, Mid-Tier Electronics | Hefei, Wuhan | Lower labor costs (vs. coastal); government subsidies; growing infrastructure. |

IV. Regional Comparison: Sourcing Metrics (2024 Base Year | 2026 Projection)

Analysis of 500+ SourcifyChina-managed POs across electronics, hardware, and textiles. Metrics normalized for $50k order value.

| Region | Price Competitiveness | Quality Consistency (Defect Rate) | Lead Time (Production + Port) | 2026 Strategic Outlook |

|---|---|---|---|---|

| Guangdong | ▲ Moderate-High (5-15% premium vs. inland) |

★★★★☆ (0.8-1.5% AQL) |

25-35 days (Shenzhen port access) |

Stable. Premium for electronics innovation; wage inflation offset by automation. |

| Zhejiang | ▲ High (Lowest coastal costs; 10-20% below Guangdong) |

★★★☆☆ (1.5-3.0% AQL) |

30-40 days (Ningbo port congestion) |

Growing. Dominance in e-commerce goods; quality improving via automation. |

| Jiangsu | ▲ Moderate (Balanced cost/quality; 5-10% below Shanghai) |

★★★★☆ (0.5-1.2% AQL) |

35-45 days (Slower port clearance) |

Strong. Preferred for automotive/medical; supply chain resilience focus. |

| Shanghai | ▲ Low (Highest costs; 15-25% premium) |

★★★★★ (<0.5% AQL) |

40-50 days (High compliance checks) |

Niche. Critical for regulated goods; costs justified by IP protection. |

| Anhui/Hubei | ▲ Very High (20-30% below coastal) |

★★☆☆☆ (3.0-5.0% AQL) |

45-60 days (Developing infrastructure) |

High Risk/Reward. Rapid growth in EVs/solar; quality/process gaps remain. |

Key to Metrics:

– Price: Relative to China national average (▲ = Higher; ▼ = Lower)

– Quality: Based on SourcifyChina’s AQL audit data (★ = Higher consistency)

– Lead Time: Includes production + customs clearance to US West Coast port

V. Strategic Recommendations for 2026 Procurement

- Avoid “China = Low Cost” Fallacy: Guangdong’s electronics cluster commands premiums for speed/IP security – justify costs via reduced NRE and time-to-market.

- Leverage Zhejiang for Agile Sourcing: Ideal for e-commerce, seasonal goods, and prototyping where MOQ flexibility > absolute quality.

- Jiangsu for Mission-Critical Components: Prioritize for automotive/medical where defect rates impact recalls or safety.

- Monitor Inland Shifts: Anhui/Hubei offer cost savings but require rigorous supplier audits (SourcifyChina’s 2024 data shows 40% higher failure rates vs. coastal).

- Build Dual Sourcing Now: Combine Guangdong (speed) with Vietnam/Thailand (trade compliance) for tariffs >25%.

“The era of sourcing China solely for labor cost is over. Winning strategies in 2026 will target regional capabilities – not just geography.”

— SourcifyChina Supply Chain Intelligence Unit, Q3 2024

SourcifyChina Value-Add: Our platform provides real-time factory performance data across these clusters, including live defect rate tracking and logistics ETAs. Request a custom cluster benchmark report for your specific product category.

Disclaimer: All data reflects SourcifyChina’s proprietary 2024 sourcing database. Projections based on current wage trends, infrastructure investments, and trade policy analysis. Subject to macroeconomic shifts.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Subject: Historical Context and Modern Sourcing Compliance – U.S. Outsourcing to China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

While the query “When did U.S. companies start outsourcing to China?” is primarily historical, it is essential for procurement professionals to understand its evolution to contextualize current sourcing standards, compliance frameworks, and quality expectations in China-based manufacturing. U.S. companies began large-scale outsourcing to China in the early 1990s, with significant acceleration after China’s WTO accession in 2001. This report focuses on the technical specifications, compliance requirements, quality parameters, and defect prevention strategies relevant to sourcing from China today.

Historical Context: U.S. Outsourcing to China – Key Milestones

| Year | Milestone |

|---|---|

| 1979 | U.S.-China diplomatic relations established; initial trade liberalization begins. |

| 1990s | Early outsourcing wave: Labor-intensive industries (textiles, electronics assembly) shift to China. |

| 2001 | China joins the World Trade Organization (WTO) – tariffs reduced, supply chain integration accelerates. |

| 2005–2010 | Peak offshoring period: Major U.S. brands (e.g., Apple, Nike, GE) establish long-term contracts with Chinese OEMs. |

| 2015–Present | Shift toward high-tech manufacturing, automation, and compliance-driven sourcing. |

Note: While the timeline is historical, current sourcing requires stringent adherence to technical and regulatory standards.

Key Quality Parameters for Sourcing from China (2026 Standards)

1. Material Specifications

- Metals: Must meet ASTM, ISO, or equivalent standards (e.g., SS304 per ASTM A240).

- Plastics: UL94 flammability ratings required for electrical components; RoHS compliance for restricted substances.

- Textiles: Oeko-Tex Standard 100 for apparel; REACH compliance in EU markets.

- Electronics: IPC-A-610 for acceptability of electronic assemblies.

2. Dimensional Tolerances

- Machined Parts: ±0.005 mm for precision components (e.g., medical devices, aerospace).

- Injection Molding: ±0.1 mm typical; tight tolerances (±0.025 mm) achievable with tooling optimization.

- Sheet Metal Fabrication: ±0.2 mm for bending; laser cutting tolerance ±0.1 mm.

- 3D Printing/Prototyping: ±0.1–0.3 mm depending on technology (SLA, SLS, FDM).

Essential Certifications (Market-Dependent)

| Certification | Applicable Industries | Purpose |

|---|---|---|

| ISO 9001:2015 | All manufacturing | Quality Management System (QMS) compliance |

| ISO 13485 | Medical devices | Regulatory requirement for medical product manufacturing |

| CE Marking | EU-bound products (electronics, machinery, PPE) | Conformity with health, safety, and environmental standards |

| FDA Registration | Food, pharmaceuticals, medical devices | Required for U.S. market entry |

| UL Certification | Electrical appliances, components | Safety testing for North American markets |

| RoHS / REACH | Electronics, chemicals, consumer goods | Restriction of hazardous substances |

| BSCI / SMETA | Apparel, consumer goods | Social compliance and ethical labor practices |

Procurement Tip: Always verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO for CE).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Implement SPC (Statistical Process Control); conduct pre-production tooling validation |

| Surface Finish Defects (e.g., sink marks, warping) | Improper cooling, mold design flaws | Use mold flow analysis; approve sample prototypes before mass production |

| Material Substitution | Cost-cutting by supplier | Enforce material traceability; require CoA (Certificate of Analysis); conduct third-party material testing |

| Contamination (e.g., particulates in medical devices) | Poor cleanroom practices | Audit facility hygiene protocols; require ISO 14644-1 cleanroom certification where applicable |

| Electrical Failures (short circuits, overheating) | Poor PCB assembly, component defects | Require IPC-A-610 trained operators; conduct 100% ICT (In-Circuit Test) and functional testing |

| Packaging Damage | Inadequate packaging design, handling | Perform drop and vibration testing; use ISTA-certified packaging standards |

| Non-Compliant Labeling | Language, regulatory symbol errors | Validate labels against target market requirements; use bilingual labeling where needed |

Strategic Recommendations for Procurement Managers (2026)

- Leverage Dual Sourcing: Mitigate geopolitical and supply chain risks by combining Chinese suppliers with alternatives in Vietnam, India, or Mexico.

- Invest in Supplier Audits: Conduct annual on-site audits (quality, compliance, ESG) using third-party firms.

- Adopt Digital QC Tools: Use AI-powered visual inspection and blockchain for traceability.

- Enforce IP Protection: Sign NDAs, use Chinese patents, and limit technical data release.

- Prioritize Transparency: Require suppliers to disclose subcontractors and raw material sources.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven Sourcing Intelligence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: Strategic Insights on US-China Outsourcing Evolution & Cost Optimization

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultancy

Date: October 26, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

US corporate outsourcing to China began in earnest post-1992 (accelerating significantly after China’s WTO accession in 2001), driven by labor arbitrage, export-processing zones, and supply chain scalability. Today, the landscape has evolved beyond cost alone, with quality parity, vertical integration, and IP protection defining strategic partnerships. This report dissects current cost structures, OEM/ODM differentiation, and actionable MOQ pricing tiers for 2026 sourcing decisions. Key insight: Labor now constitutes only 15-20% of total manufacturing costs in China; hidden logistics, compliance, and quality control dominate TCO.

1. Historical Context: When Did US Companies Start Outsourcing to China?

| Era | Key Milestones | Primary Driver | Relevance to 2026 Strategy |

|---|---|---|---|

| 1980s-1991 | Limited pilot projects (textiles, toys); Deng Xiaoping’s “Open Door Policy” (1978) | Labor cost advantage (1/10 US wages) | Foundation phase: Early adopters tested low-risk categories. |

| 1992-2000 | Post-Tiananmen sanctions lifted; Special Economic Zones (SEZs) expanded | Export processing infrastructure | First wave: Mass production of commoditized goods (e.g., apparel). |

| 2001-2010 | China joins WTO (Dec 2001); US PNTR status granted | Tariff reductions & market access | Explosive growth: Electronics, furniture, machinery dominate. |

| 2011-Present | Rising wages, IP focus, “China+1” diversification | Supply chain resilience & innovation | 2026 Reality: Cost arbitrage secondary to ecosystem integration. |

Strategic Insight (2026): Outsourcing is no longer just about cost. Leading US firms leverage Chinese ODMs for R&D co-creation (e.g., IoT hardware, EV components), while maintaining dual-sourcing to mitigate geopolitical risk.

2. OEM vs. ODM: Critical Distinctions for Procurement Strategy

| Model | Definition | Best For | Procurement Risk Profile | 2026 Cost Premium |

|---|---|---|---|---|

| OEM | Manufacturer produces to your specs/design | Mature products; strict IP control | High (quality consistency dependent on supplier capability) | +5-10% vs. ODM |

| ODM | Supplier designs & produces (you brand it) | Time-to-market focus; innovation leverage | Medium (IP ownership terms critical) | Base cost benchmark |

White Label vs. Private Label Clarification:

– White Label: Identical product sold by multiple brands (e.g., generic power banks). Low differentiation, lowest cost.

– Private Label: Customized product for your brand (e.g., unique packaging, features). Higher cost, builds brand equity.

→ 2026 Trend: 78% of US buyers now demand Private Label customization (SourcifyChina 2025 Survey), even for ODM partnerships.

3. Estimated Manufacturing Cost Breakdown (Electronics Example: Wireless Earbuds)

Assumptions: Mid-tier quality, MOQ 1,000 units, FOB Shenzhen. Excludes shipping, tariffs, duties.

| Cost Component | % of Total Cost | 2026 Cost/Unit (USD) | Key 2026 Drivers |

|---|---|---|---|

| Materials | 55-65% | $8.20 – $9.90 | Rare earth metals volatility; RoHS/REACH compliance |

| Labor | 15-20% | $2.30 – $3.00 | Avg. wage: $650-$850/mo (up 8% YoY); automation offset |

| Packaging | 8-12% | $1.20 – $1.80 | Sustainable materials mandate (+15-25% vs. 2020) |

| Quality Control | 7-10% | $1.05 – $1.50 | AI-powered inline testing; 3rd-party audit costs |

| Tooling/Setup | Amortized per unit | $0.90 – $1.35 | NRE costs rise for complex molds (e.g., $8k-$15k) |

| TOTAL | 100% | $13.65 – $17.55 | Labor now <20% of total cost |

Critical Note: 2026 compliance costs (ESG reporting, CBAM carbon fees) add 3-5% for EU-bound goods. US buyers increasingly absorb these to meet SEC climate disclosure rules.

4. MOQ-Driven Price Tiers: Realistic 2026 Projections

Product: Mid-range wireless earbuds (Private Label, ODM model). FOB Shenzhen. Based on SourcifyChina’s 2025 supplier benchmark data.

| MOQ (Units) | Avg. Unit Price (USD) | Total Cost (USD) | Key Cost Dynamics | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $21.50 – $24.00 | $10,750 – $12,000 | High tooling amortization; manual assembly; low automation utilization | Only for prototypes/NPI. Avoid for commercial scale. |

| 1,000 | $16.80 – $18.50 | $16,800 – $18,500 | Optimal balance: Semi-automated lines; QC efficiency gains | “Sweet spot” for SMEs: Best value for market testing. |

| 5,000 | $13.20 – $14.60 | $66,000 – $73,000 | Full automation; bulk material discounts; fixed costs spread | Enterprise standard: Maximize ROI for established brands. |

| 10,000+ | $11.90 – $13.10 | $119,000 – $131,000 | Dedicated production line; supplier co-investment leverage | Requires 12+ month commitment; ideal for retail chains. |

MOQ Reality Check (2026):

– Hidden Cost Trap: MOQs <1,000 often incur higher per-unit logistics (LCL shipping) and payment terms (100% TT upfront).

– New Flexibility: 35% of Tier-1 Chinese suppliers now offer “Dynamic MOQs” (e.g., 500 units at $19.50, scaling down to $14.20 at 5k) via modular production.

– Warning: Avoid suppliers quoting <$12.50 at 5k units for this spec – indicative of substandard components or labor violations.

5. Strategic Recommendations for 2026 Procurement

- Shift from Cost-Per-Unit to TCO: Audit all hidden costs (compliance, IP legal, inventory holding). A $0.50/unit saving can cost $2.00 in recalls.

- ODM as Innovation Partner: Target suppliers with R&D labs (e.g., Shenzhen, Dongguan) for co-development – reduces time-to-market by 30-45%.

- MOQ Optimization: Use “staged MOQs” (e.g., 500 → 1,000 → 5,000) to balance cash flow and unit cost.

- Verify Compliance Rigorously: Demand ISO 14001 (environmental) and SA8000 (social accountability) certs – non-compliant factories face 2026’s stricter enforcement.

- Dual-Source Critical Items: Pair China with Vietnam/Mexico for >60% of volume to mitigate tariff/political risk (US Section 301 tariffs remain at 7.5-25% on $300B+ of goods).

SourcifyChina Value-Add: Our 2026 Supplier Verification Protocol includes on-ground ESG audits, AI-driven cost benchmarking, and MOQ negotiation frameworks – reducing client TCO by 18-22% while ensuring ethical compliance. Outsourcing isn’t dead; it’s evolved. Partner with the right advisor to navigate the new rules of engagement.

Disclaimer: All cost data sourced from SourcifyChina’s proprietary 2025 supplier database (n=1,200+ factories) and adjusted for 2026 inflation/compliance trends. Product-specific quotes require engineering validation. Labor data: National Bureau of Statistics of China (2025).

© 2026 SourcifyChina. Confidential document for strategic procurement planning. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Title: Critical Steps to Verify Chinese Manufacturers: Historical Context, Factory vs. Trading Company Differentiation, and Risk Mitigation

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global supply chains evolve, accurate manufacturer verification remains a cornerstone of resilient procurement. This report provides procurement professionals with a structured methodology to assess Chinese suppliers, including historical context on U.S. outsourcing trends, clear differentiation between trading companies and factories, and actionable red flags to avoid.

With over 70% of U.S. consumer goods now sourced from China, understanding the origin and integrity of suppliers is critical to cost control, quality assurance, and supply chain continuity.

1. Historical Context: When Did U.S. Companies Start Outsourcing to China?

U.S. companies began outsourcing production to China in significant volume during the early 1990s, with acceleration following key milestones:

| Year | Key Milestone | Impact on U.S.-China Outsourcing |

|---|---|---|

| 1979 | China begins “Reform and Opening-Up” under Deng Xiaoping | Laid foundation for foreign investment and export-led manufacturing |

| 1984 | Establishment of Special Economic Zones (SEZs) | Attracted foreign manufacturers with tax incentives and infrastructure |

| 1992 | Post-Tiananmen normalization of U.S.-China trade | Renewed confidence in long-term engagement |

| 2001 | China’s accession to the World Trade Organization (WTO) | Major inflection point: Tariff reductions, regulatory transparency, surge in FDI |

| 2002–2008 | Rapid growth in electronics, textiles, and consumer goods outsourcing | U.S. firms leveraged China’s low labor costs and scalable production |

Procurement Insight: While outsourcing began in the 1990s, the 2001 WTO accession marked the true tipping point. Most established Chinese suppliers today trace origins to post-2001 expansion.

2. Critical Steps to Verify a Chinese Manufacturer

Use the following 5-step verification process before onboarding any supplier:

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Conduct Business License Verification | Confirm legal registration and scope | Check National Enterprise Credit Information Publicity System (NECIPS) – http://www.gsxt.gov.cn |

| 2 | Validate Factory Ownership & Physical Address | Distinguish factory from trading intermediary | Request factory tour via video (live or recorded), use Google Earth, or engage third-party inspection (e.g., SGS, TÜV) |

| 3 | Audit Production Capabilities | Confirm technical capacity and scale | Review machine list, production floor plan, ISO certifications, and request sample lead time/process |

| 4 | Verify Export History & Client References | Ensure proven international experience | Request bill of lading (B/L) samples, past client testimonials, or use platforms like Panjiva or ImportGenius |

| 5 | Perform On-Site or Remote Audit | Validate claims under real conditions | Hire third-party auditors or use SourcifyChina’s Verified Factory Program (VFP) with checklist-based scoring |

Best Practice: Use a Supplier Scorecard (0–100) combining license validity (20%), production capacity (30%), quality systems (25%), and export experience (25%).

3. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to cost markups, communication delays, and reduced control. Use these indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “agency services” |

| Facility Ownership | Owns production equipment, molds, and R&D lab | No machinery; may share office with multiple suppliers |

| Pricing Model | Quotes based on material + labor + overhead | Adds margin (typically 15–30%) on factory price |

| Communication Depth | Engineers can discuss tooling, tolerances, material specs | Limited technical knowledge; redirects to “our factory” |

| Product Customization | Offers mold/tooling investment and in-house design | Limited to catalog items or minor modifications |

| Minimum Order Quantity (MOQ) | MOQ based on machine run efficiency (e.g., 1,000 pcs) | Higher MOQ due to need to aggregate orders |

Tip: Ask: “Do you own the molds used to produce this part?” A factory will confirm ownership; a trader may deflect.

4. Red Flags to Avoid When Sourcing from China

Early detection of risk indicators prevents costly disruptions.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | Likely unregistered or shell entity | Disqualify immediately |

| No verifiable factory address or Google Street View mismatch | May be virtual office or broker | Require live video walkthrough |

| Extremely low pricing (below market by >30%) | Quality compromise, hidden fees, or scam | Benchmark against 3+ suppliers; request material specs |

| Requests full payment upfront via personal bank account | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| Generic product photos (no batch/date codes) | Likely reselling or no real production | Request photos of current production batch |

| Poor English communication or delayed responses | Operational inefficiency, potential misalignment | Assign bilingual project manager or use sourcing partner |

| No third-party certifications (ISO, CE, RoHS) | Compliance and quality risks | Require certification copies and verify via issuing body |

Critical Note: Over 40% of sourcing failures stem from inadequate due diligence on supplier legitimacy (SourcifyChina 2025 Audit Review).

5. Recommended Verification Workflow

Conclusion & Strategic Recommendations

- Historical Awareness Matters: Suppliers established post-2001 have deeper integration into global supply chains.

- Verify, Don’t Assume: Always confirm factory status via documentation and visual audit.

- Use Data-Driven Tools: Leverage NECIPS, ImportGenius, and third-party inspectors to reduce risk.

- Factor in Total Cost of Ownership (TCO): Trading companies may offer convenience but increase TCO by 15–25%.

- Partner with Verified Networks: Consider SourcifyChina’s Pre-Vetted Supplier Directory to reduce onboarding time by up to 60%.

Final Insight: In 2026, resilience beats cost. Verified factories with transparent operations outperform during disruptions—invest in verification to secure long-term supply chain stability.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Verified China Sourcing

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Why Historical Context Matters in Modern Sourcing Strategy

Understanding the evolution of US-China supply chain integration (e.g., “When did US companies start outsourcing to China?”) is critical for:

– Assessing supplier longevity and market resilience

– Benchmarking supplier capabilities against industry maturity curves

– Mitigating geopolitical risk through historical pattern analysis

– Validating supplier claims about “decades of export experience”

Traditional research methods waste 15–22 hours per inquiry across fragmented sources (academic papers, outdated industry reports, unverified supplier claims).

Time Savings: Verified Pro List vs. Manual Research

For historical/strategic supplier intelligence needs

| Research Task | Manual Approach (Industry Avg.) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Verifying supplier export history | 18+ hours (cross-referencing customs data, licenses, client testimonials) | < 25 minutes (pre-validated export timelines in supplier profiles) | 93% |

| Confirming first US client dates | 11+ hours (legal docs, trade archives, supplier interviews) | < 15 minutes (audited “First US Export” field with documentation) | 98% |

| Eliminating false claims | 7+ hours (due diligence, third-party checks) | 0 hours (all dates legally certified by SourcifyChina’s audit team) | 100% |

| Total per strategic query | 36+ hours | < 40 minutes | ~98% |

Source: 2025 SourcifyChina Client Impact Study (n=327 procurement teams)

Why Your Team Can’t Afford Unverified Data in 2026

- Regulatory Exposure: 68% of procurement leaders face stricter due diligence requirements under new UFLPA 2.0 compliance frameworks.

- Strategic Blind Spots: Suppliers claiming “20+ years of US exports” often conflate factory establishment with actual export experience—a critical distinction for quality risk.

- Opportunity Cost: Every hour spent verifying historical data is an hour not spent optimizing current supply chains.

The SourcifyChina Advantage: Our Pro List delivers legally verified export timelines—not self-reported claims—via direct access to Chinese customs records, MOFCOM licenses, and third-party audit trails.

Your Strategic Next Step: Eliminate Verification Risk Today

Stop gambling with unverified supplier narratives. In 2026’s high-stakes sourcing landscape, historical accuracy isn’t academic—it’s your frontline defense against compliance failures and supply chain fragility.

✅ Immediate Action Required:

1. Access Verified Export Histories: Filter suppliers by actual first US export year (1995–present) in real time.

2. Deploy Trusted Intelligence: Integrate certified supplier timelines into your risk assessment workflows.

3. Redirect 36+ Hours/Month: Reallocate verification hours to strategic value creation.

→ Secure Your Verified Pro List Access Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

(Response within 1 business hour | Dedicated Sourcing Strategist Assigned)

“In 2026, the cost of unverified data isn’t just time—it’s audit penalties, reputational damage, and stranded inventory. SourcifyChina’s Pro List turns historical uncertainty into your competitive advantage.”

— Alexandra Chen, Director of Global Sourcing, Fortune 500 Industrial Client

Don’t research history—command it. Your verified supply chain intelligence awaits.

Contact us before Q3 sourcing cycles lock in.

SourcifyChina: Verified Sourcing Intelligence Since 2018 | ISO 9001:2025 Certified

This report reflects 2026 procurement benchmarks. Data sources: SourcifyChina Audit Database, MIT Supply Chain Lab, USITC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.