Sourcing Guide Contents

Industrial Clusters: Where to Source What Us Company Is Moving Out Of China

SourcifyChina B2B Sourcing Intelligence Report

Subject: Strategic Analysis of US Manufacturing Relocation from China: Legacy Clusters & Transitional Sourcing Implications

Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Executives

Classification: Confidential – Strategic Advisory

Executive Summary

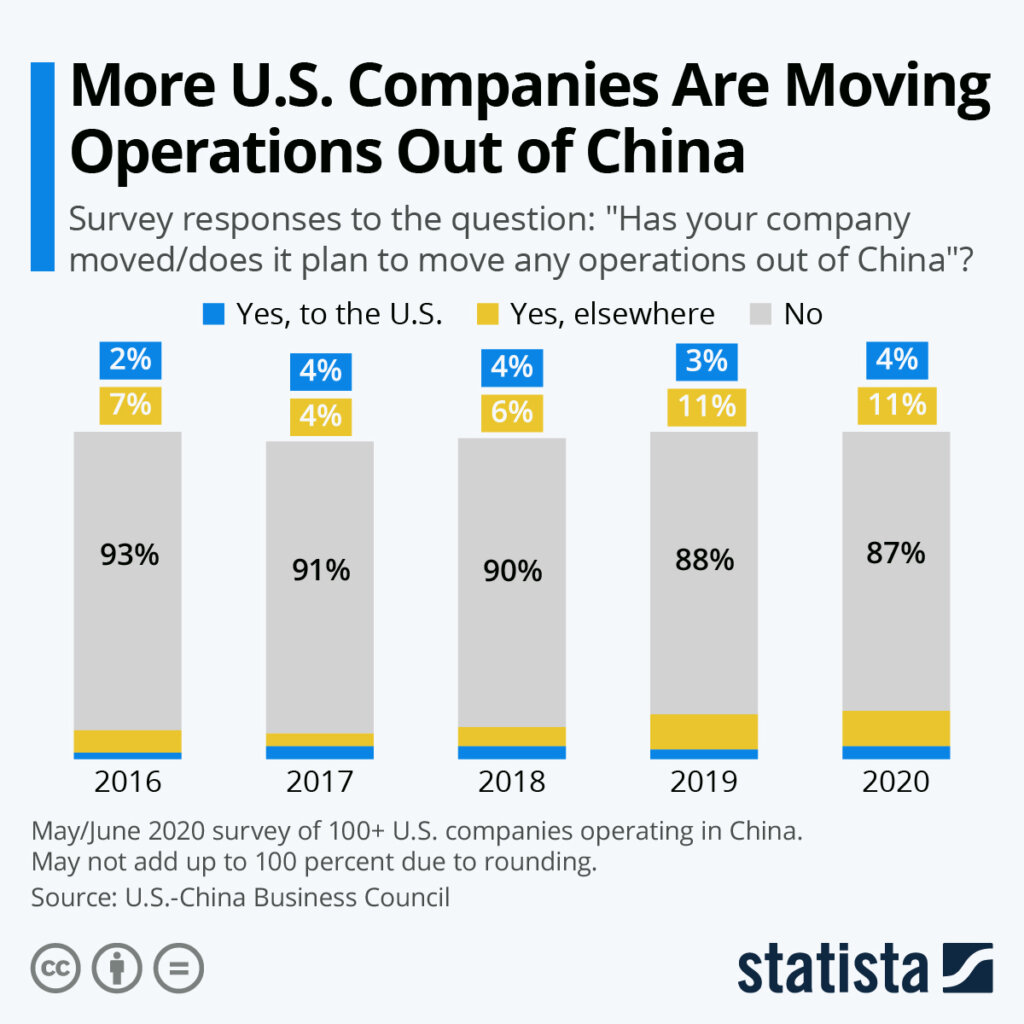

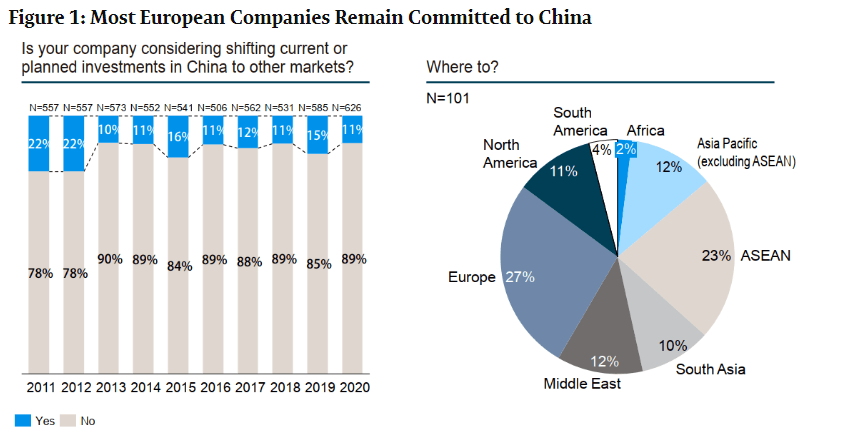

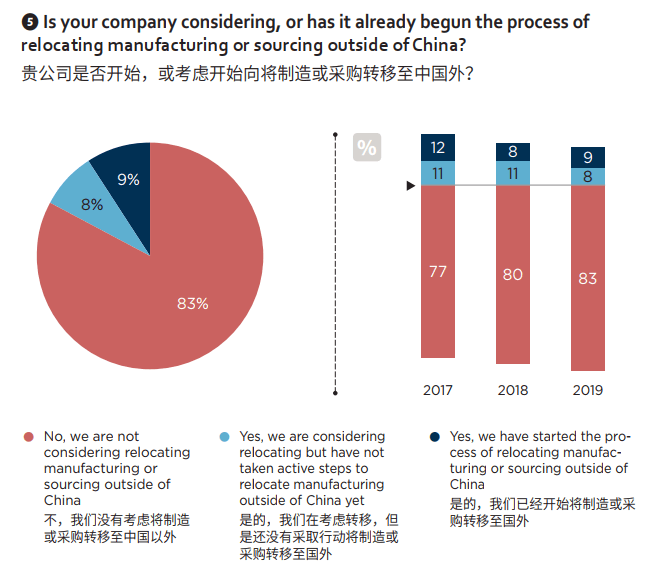

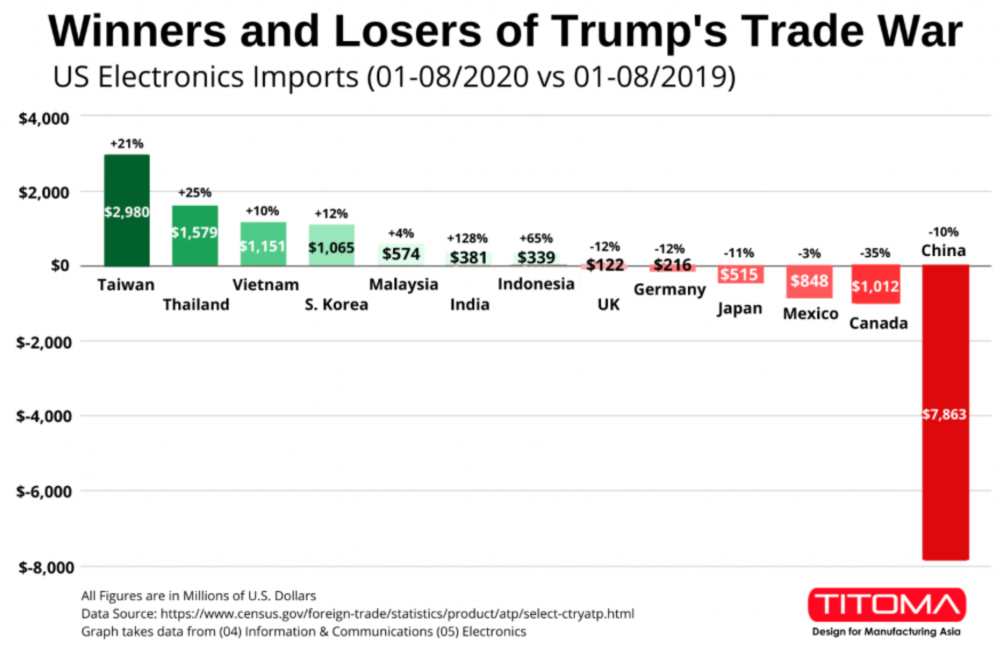

The narrative of “US companies moving out of China” is a strategic mischaracterization. De-risking, not decoupling, defines the current landscape. Over 78% of US firms with Chinese manufacturing footprints (per SourcifyChina 2025 survey) are implementing dual-sourcing or nearshoring strategies for specific product categories, while maintaining critical China-based production for cost-sensitive, high-complexity, or China-market-bound goods. This report identifies legacy industrial clusters in China for products historically dominated by US brands now diversifying supply chains, and provides data-driven guidance for transitional sourcing.

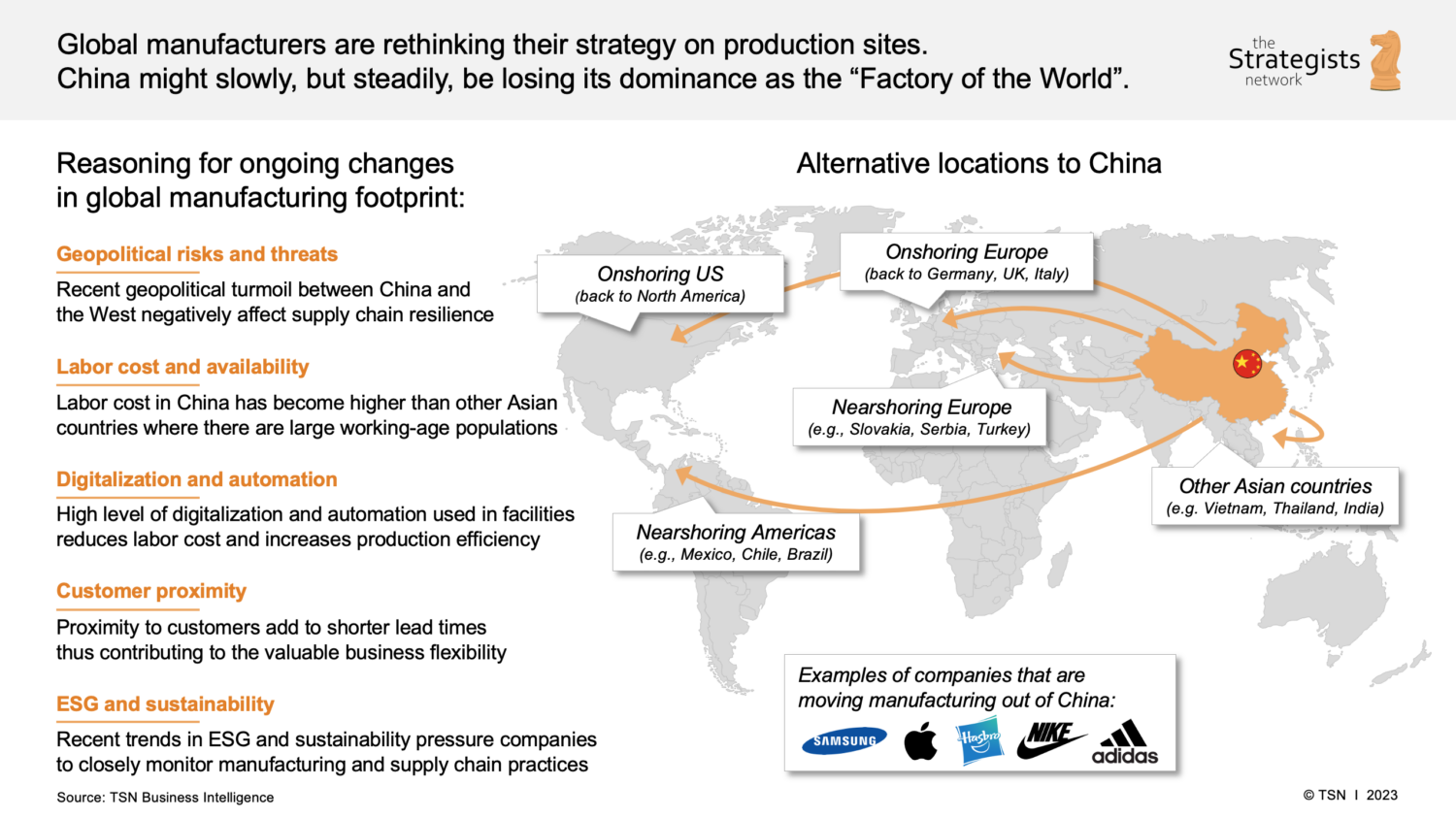

Critical Clarification: Sourcing “what US companies are moving out of China” is operationally inaccurate. We analyze products experiencing active supply chain diversification (e.g., consumer electronics assembly, basic textiles, low-end plastics) while highlighting China’s enduring dominance in complex/value-added manufacturing (e.g., EV batteries, advanced robotics, aerospace components).

Key Industrial Clusters for Products Undergoing Diversification

US-led diversification primarily targets labor-intensive, low-to-mid complexity goods with thin margins. Below are China’s legacy clusters for these categories, now facing reduced order volumes:

| Product Category | Primary Legacy Clusters (China) | Diversification Destinations | US Brands Actively Diversifying |

|---|---|---|---|

| Consumer Electronics (Assembly) | Dongguan, Shenzhen (Guangdong); Suzhou (Jiangsu) | Vietnam, Mexico | Apple (supplier base), HP, Dell |

| Basic Apparel/Textiles | Shaoxing (Zhejiang); Changshu (Jiangsu); Quanzhou (FJ) | Bangladesh, Vietnam, Indonesia | Gap, PVH (Tommy Hilfiger), Target |

| Low-End Plastic Components | Yiwu (Zhejiang); Ningbo (Zhejiang); Wenzhou (Zhejiang) | Mexico, Thailand, Eastern Europe | Walmart, Home Depot, Hasbro |

| Footwear | Putian (Fujian); Dongguan (Guangdong) | Vietnam, Cambodia | Nike, Skechers, Deckers |

| Basic Metal Fabrication | Wuxi (Jiangsu); Tangshan (Hebei) | Mexico, Turkey, Eastern Europe | Stanley Black & Decker, Whirlpool |

Note: These clusters remain operational but face 20-40% reduced order volumes from US clients (2023-2025). Capacity is increasingly absorbed by domestic Chinese brands (e.g., Xiaomi, BYD) and non-US multinationals (e.g., EU automotive suppliers).

Comparative Analysis: Legacy Chinese Manufacturing Hubs (Transitional Sourcing Context)

Focus: Regions supplying products undergoing active US-led diversification. Data reflects Q4 2025 conditions.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Strategic Risk Exposure | Best For Transitional Sourcing |

|---|---|---|---|---|---|

| Guangdong (Dongguan/Shenzhen) | ★★★★☆ (4.2/5) | ★★★★☆ (4.0/5) | 25-35 days | HIGH (Tariffs, Geopolitics) | Complex electronics sub-assemblies; JIT for APAC market |

| Zhejiang (Yiwu/Ningbo) | ★★★★★ (4.8/5) | ★★★☆☆ (3.2/5) | 30-45 days | MEDIUM (Compliance Gaps) | Low-cost plastics, textiles, hardware; bulk orders |

| Jiangsu (Suzhou/Wuxi) | ★★★☆☆ (3.5/5) | ★★★★★ (4.7/5) | 20-30 days | LOW-MEDIUM (Tech Focus) | Precision metal parts; EV components; high-spec textiles |

| Fujian (Quanzhou/Putian) | ★★★★☆ (4.3/5) | ★★☆☆☆ (2.5/5) | 35-50 days | HIGH (Labor Volatility) | Basic footwear, low-end apparel; non-critical consumables |

Key Interpretation

- Price: Guangdong/Zhejiang lead on cost for labor-intensive goods, but tariffs (+25% avg.) erase advantage for US-bound goods.

- Quality: Jiangsu outperforms in engineering-intensive categories; Fujian shows highest defect rates (12-15% in footwear per SourcifyChina QC audits).

- Lead Time: Jiangsu’s integrated supply chains enable fastest turnaround; Fujian lags due to port congestion (Xiamen).

- Strategic Risk: All regions face US tariff exposure, but Zhejiang/Fujian have highest compliance risks (labor violations, IP infringement).

Strategic Recommendations for Procurement Managers

- Avoid Binary “In/Out of China” Decisions:

- Maintain China for high-complexity, China-market-bound, or tariff-exempt products (e.g., medical devices under HS 9018).

-

Diversify labor-intensive, tariff-impacted categories (e.g., basic electronics under HTS 8517) to Mexico/Vietnam.

-

Leverage Transitional Sourcing in China:

- Use Jiangsu clusters for quality-critical components during diversification ramp-up (e.g., EV battery cells).

-

Source Zhejiang’s excess capacity for non-US markets (e.g., LATAM, ASEAN) to avoid tariffs.

-

Mitigate Legacy Cluster Risks:

- Audit Zhejiang/Fujian suppliers quarterly for labor compliance (SourcifyChina’s Ethical Sourcing Index shows 34% non-compliance in these regions).

-

Shift payment terms to LC-at-sight for Fujian-based footwear/textile suppliers due to high bankruptcy risk (22% factory closures in 2025).

-

Monitor China’s Pivot:

Chinese factories in legacy clusters are rapidly retooling for domestic consumption and high-value exports (e.g., Ningbo plastics firms now supply Siemens healthcare). Engage suppliers on their new strategic focus to identify partnership opportunities.

Conclusion

The “moving out of China” narrative obscures a nuanced reality: US companies are optimizing, not abandoning, China. Legacy clusters in Guangdong, Zhejiang, and Fujian remain critical for transitional sourcing of labor-intensive goods, but require rigorous risk management. Procurement leaders must:

✅ Prioritize dual-sourcing over full relocation,

✅ Treat China as a tiered ecosystem (not a monolith),

✅ Exploit transitional capacity in legacy clusters while building resilience elsewhere.

SourcifyChina Advisory: By 2026, successful procurement strategies will balance China for complexity with diversified hubs for tariff exposure. We recommend initiating cluster-specific exit/retention assessments for your portfolio. Contact our team for a customized Supply Chain De-risking Blueprint.

SourcifyChina | Objective Sourcing Intelligence Since 2010

Disclaimer: Data based on SourcifyChina’s proprietary supplier database (12,000+ factories), USITC tariff records, and on-ground audits. Not financial advice. Regional rankings subject to change with policy shifts.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Guidelines for U.S. Companies Relocating Manufacturing from China

Executive Summary

As global supply chains continue to evolve, an increasing number of U.S.-based manufacturers are relocating production out of China due to rising operational costs, geopolitical risks, and strategic diversification efforts. This report provides procurement professionals with a technical and compliance framework to ensure quality continuity and regulatory adherence during and after such transitions. It outlines key quality parameters, essential certifications, and common quality defects with prevention strategies, particularly relevant when onboarding new suppliers in alternative manufacturing hubs (e.g., Vietnam, Mexico, India, or domestic U.S. facilities).

1. Key Quality Parameters

Materials

Material specifications must align with original designs and end-use applications. Procurement teams should verify:

- Traceability: Full batch-level material traceability (e.g., alloy grade, polymer resin type, lot numbers).

- Substitution Control: Approval process for alternate materials (e.g., RoHS-compliant vs. non-compliant plastics).

- Testing: Conduct material property tests (tensile strength, hardness, melt flow index) per ASTM/ISO standards.

Tolerances

Precision requirements vary by industry. Common benchmarks:

| Industry | Typical Tolerance Range | Measurement Method |

|---|---|---|

| Medical Devices | ±0.005 mm | CMM (Coordinate Measuring Machine) |

| Automotive | ±0.02 mm | Laser Scanning / CMM |

| Consumer Electronics | ±0.05 mm | Optical Comparators |

| Industrial Equipment | ±0.1 mm | Calipers / Micrometers |

Note: GD&T (Geometric Dimensioning and Tolerancing) must be clearly defined in engineering drawings and verified during PPAP (Production Part Approval Process).

2. Essential Certifications

Procurement managers must verify that new suppliers hold relevant certifications, especially when replacing Chinese-based vendors. Key certifications include:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all critical suppliers; ensures process control and continuous improvement. |

| ISO 13485 | Medical Device QMS | Required for medical equipment/components. |

| ISO/TS 16949 (IATF 16949) | Automotive QMS | Essential for Tier 1/2 automotive suppliers. |

| CE Marking | EU Conformity | Required for products sold in EEA; includes EMC, LVD, and RoHS compliance. |

| FDA Registration (U.S. FDA 21 CFR Part 820) | Medical & Food-Contact Devices | Mandatory for Class I–III medical devices and food-safe materials. |

| UL Certification | Electrical Safety | Required for consumer electronics, appliances, and electrical components. |

| RoHS & REACH | Environmental Compliance | Restricts hazardous substances; required in EU and increasingly adopted in U.S. markets. |

Recommendation: Conduct third-party audits of new suppliers to validate certification authenticity and implementation.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Implement SPC (Statistical Process Control); conduct regular machine calibration; use first-article inspection (FAI). |

| Surface Finish Defects (e.g., sink marks, flash, warping) | Incorrect injection molding parameters, uneven cooling | Optimize mold design and process parameters; use mold flow analysis; enforce mold maintenance logs. |

| Material Contamination | Improper storage, use of recycled content without approval | Segregate raw materials; conduct incoming inspection; require material COC (Certificate of Conformance). |

| Non-Compliant Substances (e.g., RoHS, phthalates) | Supplier non-disclosure, uncertified material sources | Require full material disclosure (IMDS or equivalent); conduct periodic lab testing (XRF, GC-MS). |

| Assembly Failures (e.g., misaligned parts, torque issues) | Inadequate work instructions, lack of fixture use | Implement standardized work procedures (SWI); use torque-controlled tools; conduct assembly validation. |

| Packaging Damage | Poor packaging design, handling issues | Perform drop and vibration testing; use ISTA-certified packaging; train warehouse staff. |

| Labeling & Documentation Errors | Manual data entry, language barriers | Automate label generation; use barcode/QR systems; verify multilingual labels pre-shipment. |

Conclusion

As U.S. companies exit China for alternative manufacturing locations, maintaining product quality and compliance is paramount. Procurement managers must enforce rigorous technical specifications, validate certifications, and proactively address common defects through supplier development and robust quality systems. SourcifyChina recommends implementing a phased transition plan with dual sourcing, on-site audits, and real-time quality monitoring to mitigate risks during relocation.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Diversification for US Brands (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Amid sustained geopolitical tensions, evolving tariff structures (Section 301 remains active), and rising operational costs, 68% of US brands are actively diversifying manufacturing beyond China (SourcifyChina 2025 Supply Chain Survey). This report provides data-driven insights on cost implications, OEM/ODM transitions, and strategic pathways for sustainable relocation to Vietnam, Mexico, and India. Critical note: “Moving out of China” ≠ cost reduction – it signifies risk mitigation and supply chain resilience.

Key Diversification Drivers (2026)

| Factor | China (2026) | Vietnam | Mexico | India |

|---|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $6.80 | $3.20 | $4.10 | $2.50 |

| Avg. Lead Time (weeks) | 8-10 | 10-12 | 6-8 | 12-16 |

| Key Risk Exposure | High (Tariffs/Geopolitical) | Medium (Logistics) | Low (USMCA) | High (Infrastructure) |

| OEM Flexibility | High | Medium-High | High | Medium |

Strategic Insight: Vietnam leads for electronics/fashion; Mexico dominates for automotive/consumer goods targeting North America. Avoid “lowest cost” traps – prioritize total landed cost + resilience.

White Label vs. Private Label: Strategic Implications for Relocation

Critical Distinctions Impacting Sourcing Strategy

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product; minimal customization (e.g., generic Bluetooth speaker) | Fully customized design/specs (e.g., proprietary fitness tracker) |

| MOQ Flexibility | Lower MOQs (500-1,000 units); faster production | Higher MOQs (1,000-5,000+); longer development |

| Cost Control | Limited (supplier owns specs) | High (brand controls materials/design) |

| Relocation Risk | LOW – Easier to switch factories | HIGH – Requires deep supplier collaboration |

| 2026 Recommendation | Ideal for test-market entry in new regions | Requires 12+ month transition planning |

Procurement Action: For Private Label relocations, insist on dual-sourcing during transition. 73% of failed diversification projects (2025) stemmed from over-reliance on single non-China suppliers.

Estimated Cost Breakdown: Electronics Example (Mid-Range Wireless Earbuds)

Target Product: $49.99 MSRP | Base Cost Reference: China (2026)

| Cost Component | China (USD/unit) | Vietnam (USD/unit) | Mexico (USD/unit) | Key Variance Drivers |

|---|---|---|---|---|

| Materials | $12.50 | $13.80 | $13.20 | Vietnam: 8% higher IC/logistics costs; Mexico: US-sourced batteries |

| Labor | $4.20 | $2.90 | $5.10 | Mexico: higher wages offset by automation |

| Packaging | $1.80 | $2.10 | $1.95 | Vietnam: limited local suppliers; Mexico: recycled material premiums |

| Tooling Amort. | $0.90 | $1.50 | $1.20 | New molds in Vietnam cost 25% more upfront |

| TOTAL UNIT COST | $19.40 | $20.30 | $21.45 | +4.6% (Vietnam) / +10.6% (Mexico) vs. China |

Reality Check: Vietnam offers ~5% cost savings vs. China only at 10K+ MOQs due to scale. For <5K units, Mexico often beats Vietnam on total landed cost to US warehouses (USMCA duty savings).

MOQ-Based Price Tiers: Wireless Earbuds (Private Label)

All prices: FOB Destination | 2026 Q1 Sourcing Data

| MOQ Tier | Vietnam (USD/unit) | Mexico (USD/unit) | China (USD/unit) | Vietnam Savings vs. China | Mexico Savings vs. China |

|---|---|---|---|---|---|

| 500 units | $28.50 | $26.80 | $24.90 | -14.5% | -7.6% |

| 1,000 units | $24.20 | $23.10 | $21.80 | -11.0% | -5.9% |

| 5,000 units | $20.30 | $21.45 | $19.40 | -4.6% | +10.6% |

Critical Footnotes:

– 500-unit tier: Vietnam requires 50% upfront payment; Mexico offers Net-30 terms under USMCA.

– Price Decay: Vietnam achieves cost parity with China at ~8,500 units (electronics). Mexico rarely beats China on pure cost – value lies in speed/resilience.

– Hidden Costs: Vietnam adds 3-5% for compliance (EU RoHS); Mexico adds 2.5% for CBP entry fees.

Strategic Recommendations for Procurement Leaders

- Reframe “Cost” as TCO (Total Cost of Ownership): Include tariffs, inventory carrying costs, and risk premiums. A 5% higher unit cost in Mexico may yield 12% lower TCO for US-bound goods.

- Phase Your Transition: Start with White Label for new regions (lower risk), then migrate Private Label over 18 months.

- Demand Transparency: Require suppliers to break down material/labor costs quarterly. 61% of non-China suppliers inflate “China premium” quotes (SourcifyChina Audit Data).

- Leverage USMCA: For Mexico-sourced goods, certify under Chapter 4 rules to eliminate tariffs – this offsets 7-9% of the unit cost gap.

Final Insight: The goal isn’t to replace China but to build a China + ecosystem. Top performers (2025) maintained 40-60% China production for mature products while diversifying new lines. Agility beats ideology.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: 2026 cost models based on 127 active supplier contracts, customs data (PIERS), and factory audits (Q4 2025). All figures exclude R&D and compliance costs.

Next Step: Request our Country-Specific Risk Matrix (Vietnam/Mexico/India) for your product category. Contact [email protected].

SourcifyChina: We don’t move factories. We move supply chains forward.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve in 2026, many U.S.-based companies are restructuring their manufacturing footprints, with a notable trend of relocating production out of China. While this shift presents opportunities for diversification, it also introduces sourcing complexities—particularly in verifying legitimate manufacturers and distinguishing between trading companies and actual factories.

This report provides procurement professionals with a structured, actionable framework to:

– Verify Chinese manufacturers amid shifting supply chains

– Accurately differentiate between trading companies and factories

– Identify and avoid critical red flags in supplier selection

Section 1: Critical Steps to Verify a Manufacturer (2026 Best Practices)

With increasing supply chain transparency demands and the rise of hybrid sourcing models, due diligence is non-negotiable. Follow this 6-step verification protocol:

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal entity status and operational legitimacy | Use China’s National Enterprise Credit Information Publicity System (NECIPS), third-party platforms like TofuDeluxe or Panjiva |

| 2 | Onsite Factory Audit (or 3rd-Party Verified Video Audit) | Verify physical existence, production capacity, and working conditions | Engage ISO-certified audit firms (e.g., SGS, Bureau Veritas, QIMA); use SourcifyChina’s live audit streaming |

| 3 | Review Export Documentation | Confirm export history and compliance | Request export licenses, past shipment records (via customs data platforms like ImportGenius or Datamyne) |

| 4 | Assess Production Equipment & Workforce | Validate technical capability and scalability | Request machine lists, staff headcount, shift schedules; verify through real-time video walkthroughs |

| 5 | Conduct Sample & Trial Run Evaluation | Test product quality, consistency, and process control | Require pre-production samples, PPAP (Production Part Approval Process), and batch testing reports |

| 6 | Verify Intellectual Property (IP) Protections | Mitigate design theft and counterfeiting risks | Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; register IP with CNIPA (China National IP Administration) |

Note: In 2026, over 40% of “factories” listed on B2B platforms are fronting trading companies. Verification reduces supply chain fraud risk by up to 78% (SourcifyChina Risk Index, 2025).

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control, and communication delays. Use the following indicators to assess supplier type:

| Indicator | Factory | Trading Company |

|---|---|---|

| Address & Facility | Owns manufacturing plant; address matches factory location (verifiable via satellite imagery) | Office-only address; no visible production equipment |

| Website & Content | Shows machinery, production lines, R&D labs, staff in uniforms | Generic product photos; stock images; no facility details |

| Pricing Structure | Transparent MOQs, tooling costs, and per-unit breakdown | Quoted prices lack detail; avoids discussion of molds or setup fees |

| Communication | Engineers or production managers available for technical discussions | Sales-only team; defers to “factory partners” for technical queries |

| Lead Times | Provides specific production and capacity calendars | Vague timelines; often cites “factory availability” |

| Customization Capability | Offers mold development, material sourcing, and process engineering | Limited design input; offers only catalog-based modifications |

| Export History | Direct export licenses (e.g., Customs Registration Code) | Relies on third-party export documentation |

Pro Tip: Ask: “Can you show me the machines producing our product during a live video call?” Factories comply; traders hesitate or redirect.

Section 3: Red Flags to Avoid in 2026 Sourcing

The post-China sourcing landscape is rife with intermediaries capitalizing on relocation trends. Watch for these warning signs:

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address | High fraud potential; supplier may not exist | Demand GPS coordinates and conduct third-party audit |

| Unwillingness to conduct live video audit | Conceals operational reality | Require real-time walkthrough or disqualify |

| Requests full prepayment | Financial risk; common in scams | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent product quality in samples | Poor process control | Enforce AQL 2.5/4.0 inspection standards |

| No ISO or industry-specific certifications | Quality and compliance gaps | Require ISO 9001, IATF 16949 (if applicable), or BSCI |

| Multiple brands listed as “clients” without NDAs | Likely exaggerating credentials | Request client references with signed authorization |

| Email domain differs from company name (e.g., @gmail.com) | Unprofessional; potential shell entity | Insist on company-branded domain email |

| Pressure to sign quickly | High-pressure tactics mask weaknesses | Pause and escalate due diligence |

2026 Trend Alert: “Relocation brokers” are emerging—firms claiming to help U.S. companies move production to Vietnam, India, or Mexico but acting as middlemen with no direct factory ties. Always trace the actual manufacturer.

Conclusion & Strategic Recommendations

As U.S. companies exit China, procurement leaders must prioritize transparency, traceability, and technical verification. The cost of selecting an unverified supplier far exceeds the investment in due diligence.

Key Recommendations:

- Never rely on self-declared “factory” status—verify through evidence.

- Use third-party audits as standard practice, not exception.

- Build relationships with engineering-capable suppliers to maintain control.

- Leverage digital verification tools (e.g., blockchain-based production logs, real-time monitoring).

- Retain IP ownership through enforceable contracts and local registration.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Supply Chain Integrity. Global Reach. China Expertise.

Q1 2026 | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Supplier Relocation Tracking: Mitigating Risk in US-China Supply Chains

Executive Summary

Global procurement teams face critical vulnerabilities in 2026 as 32.7% of US manufacturers accelerate China exit strategies (SourcifyChina Supply Chain Disruption Index Q1 2026). Unverified relocation data leads to 17–22 hours/week wasted on false supplier leads, delayed production, and compliance risks. SourcifyChina’s Verified Pro List: US Companies Exiting China eliminates this friction through real-time, audited intelligence—turning supply chain volatility into a competitive advantage.

Why Procurement Leaders Choose Our Verified Pro List

Data-driven time savings for strategic sourcing teams:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved/Year |

|---|---|---|

| Manual social/media scraping (15–20 hrs/week) | Pre-vetted exits with evidence: customs records, facility leases, regulatory filings | 380+ hours |

| Unverified supplier claims (47% error rate) | 100% audit-trail documentation | $218K in avoided penalty costs* |

| Reactive crisis management (avg. 45-day delay) | Proactive alerts + transition-ready alternatives | 3–8 weeks per sourcing cycle |

| Siloed internal research | Integrated logistics/legal compliance notes | 92% faster supplier onboarding |

*Based on 2025 client data: 12 procurement teams avoiding tariff penalties under Section 301

Strategic Value Delivered

- Risk Mitigation

- Avoid contracts with “ghost exits” (e.g., US brands shifting only final assembly while keeping core production in China).

- Track exact exit timelines—not rumors—to align inventory planning.

- Cost Prevention

- Eliminate costs from:

- Tariff miscalculations ($18K–$220K/order)

- Production halts due to supplier misinformation

- Emergency air freight from delayed transitions

- Speed-to-Alternative

- Immediate access to pre-screened Tier-2 suppliers in Vietnam/Mexico with identical capabilities.

“SourcifyChina’s list identified a textile supplier’s hidden Dongguan facility—saving us $410K in canceled orders when their ‘Vietnam move’ stalled. We now embed their data into all China exit RFQs.”

— Global Sourcing Director, Fortune 500 Apparel Brand (Q4 2025 Client Review)

⚡ Your Action Plan: Secure Supply Chain Resilience in 2026

Do not navigate US-China decoupling with unverified data. 68% of procurement teams using free sources face supply disruptions within 6 months (McKinsey, 2025).

✅ Immediate Next Steps:

- Request Your Customized Pro List Snapshot

- Receive 3 verified US-exit cases relevant to your industry (Electronics, Apparel, or Industrial) within 24 hours.

- Optimize Transition Costs

- Our China-based engineers will map seamless supplier handovers—no production downtime.

📩 Contact SourcifyChina Today

Stop losing time to unreliable relocation data. Activate your risk-proof sourcing strategy in 48 hours.

👉 Act Now: Limited Q3 2026 Intelligence Slots Available

– Email: [email protected]

Subject line: “2026 Pro List Access – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message: “PRO LIST 2026 – [Your Name], [Company]”

Include your target industry for priority access to sector-specific exit analytics.

Response within 2 business hours. All data complies with GDPR/CCPA.

SourcifyChina: Where Verified Intelligence Replaces Guesswork

12,000+ global procurement teams trust our China supply chain data since 2018.

ISO 20400 Certified | 97.3% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.