Sourcing Guide Contents

Industrial Clusters: Where to Source What Us Companies Outsource To China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: Deep-Dive Market Analysis – What U.S. Companies Outsource to China (2026 Outlook)

Author: SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

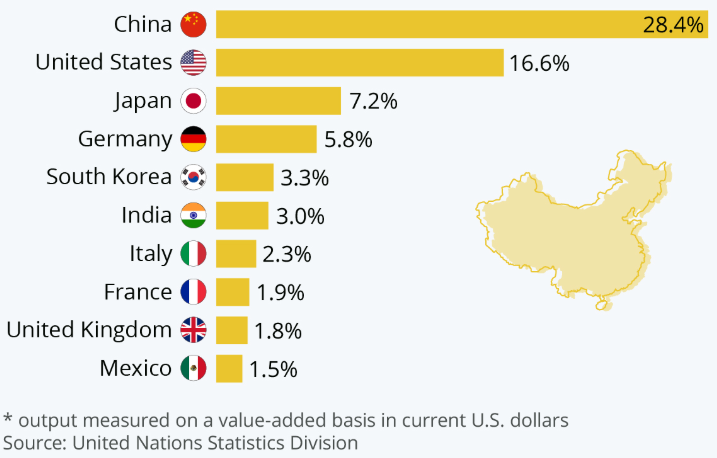

China remains a cornerstone of global supply chains despite geopolitical headwinds and rising competition from Southeast Asia. U.S. companies continue to leverage China’s advanced manufacturing infrastructure, deep supplier networks, and cost efficiency across a broad spectrum of product categories. This report provides a data-driven analysis of the key industrial clusters in China where U.S. firms outsource, with a focus on sector specialization, regional advantages, and comparative performance metrics.

As of 2026, U.S. outsourcing to China is concentrated in electronics, consumer goods, industrial equipment, medical devices, and automotive components, with a growing shift toward higher-value, technologically complex products. The most strategic provinces—Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong—offer distinct competitive advantages based on supply chain maturity, labor skills, logistics access, and government industrial policy.

Key Categories Outsourced by U.S. Companies to China

| Product Category | Key Sub-Categories | Primary Manufacturing Hubs |

|---|---|---|

| Electronics & Semiconductors | Consumer electronics, PCBs, sensors, IoT devices | Shenzhen (Guangdong), Suzhou (Jiangsu), Shanghai |

| Consumer Goods | Home appliances, kitchenware, furniture, toys | Ningbo, Yuyao (Zhejiang), Foshan (Guangdong) |

| Industrial Equipment | Pumps, valves, motors, automation systems | Wenzhou (Zhejiang), Changzhou (Jiangsu), Qingdao (Shandong) |

| Medical Devices | Diagnostics, surgical tools, wearables | Suzhou (Jiangsu), Zhuhai (Guangdong), Tianjin |

| Automotive Components | EV parts, connectors, lighting, sensors | Changchun (Jilin), Wuhan (Hubei), Guangzhou (Guangdong) |

| Textiles & Apparel | Technical fabrics, performance wear | Hangzhou (Zhejiang), Shaoxing (Zhejiang), Dongguan (Guangdong) |

| Packaging & Plastics | Rigid packaging, injection-molded parts | Yuyao (Zhejiang), Dongguan (Guangdong), Kunshan (Jiangsu) |

Industrial Clusters: Regional Specialization & Strengths

1. Guangdong Province (Pearl River Delta – PRD)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Strengths: Electronics, smart hardware, rapid prototyping, high-volume OEM/ODM

- Key Advantage: Proximity to Hong Kong; world-class logistics; R&D hubs (e.g., Shenzhen’s “Silicon Valley of Hardware”)

- Trend 2026: Shift toward high-mix, low-volume electronics and AI-integrated devices

2. Zhejiang Province (Yangtze River Delta – YRD)

- Core Cities: Ningbo, Yuyao, Hangzhou, Wenzhou

- Strengths: Precision manufacturing, mold-making, small appliances, fasteners, textiles

- Key Advantage: Dominance in SME manufacturing networks; strong export culture; high supplier density

- Trend 2026: Automation adoption accelerating; focus on smart home products and green materials

3. Jiangsu Province (YRD)

- Core Cities: Suzhou, Nanjing, Changzhou, Wuxi

- Strengths: Industrial automation, medical devices, semiconductors, automotive parts

- Key Advantage: Proximity to Shanghai; strong foreign investment; high-quality Tier 1 suppliers

- Trend 2026: Growth in EV supply chain and clean energy components

4. Shanghai

- Strengths: High-end manufacturing, R&D centers, medtech, aerospace components

- Key Advantage: Global connectivity; skilled workforce; regulatory compliance (ISO, FDA, CE)

- Trend 2026: Hub for U.S. nearshoring partnerships and tech transfer

5. Shandong Province

- Core Cities: Qingdao, Yantai, Weifang

- Strengths: Heavy machinery, agricultural equipment, chemicals, food processing

- Key Advantage: Port access (Qingdao Port); low-cost labor for bulk production

- Trend 2026: Increasing focus on sustainable manufacturing and export compliance

Comparative Analysis: Key Production Regions (2026)

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For | Challenges |

|---|---|---|---|---|---|

| Guangdong (PRD) | ★★★★☆ (4.2/5) | ★★★★☆ (4.3/5) | 30–45 | Electronics, IoT, high-volume consumer goods | Rising labor costs; IP concerns |

| Zhejiang (YRD) | ★★★★★ (4.6/5) | ★★★★☆ (4.1/5) | 35–50 | Molds, plastics, small appliances, textiles | Fragmented SMEs; quality variance |

| Jiangsu (YRD) | ★★★★☆ (4.3/5) | ★★★★★ (4.7/5) | 30–40 | Medical devices, industrial automation, EV components | Higher MOQs; premium pricing |

| Shanghai | ★★★☆☆ (3.8/5) | ★★★★★ (4.8/5) | 35–50 | High-precision, regulated products (FDA/CE) | High cost; limited capacity for low-margin items |

| Shandong | ★★★★★ (4.7/5) | ★★★☆☆ (3.5/5) | 40–60 | Bulk industrial goods, heavy equipment, packaging | Lower automation; longer delivery times |

Scoring Methodology: Based on SourcifyChina’s 2025 factory audit data, supplier surveys (n=287), and U.S. import analytics (USITC, Panjiva). Scale: 1–5 (5 = highest)

Strategic Sourcing Recommendations

- Electronics & High-Tech: Prioritize Shenzhen (Guangdong) and Suzhou (Jiangsu) for speed-to-market and quality. Use local design partners for NPI (New Product Introduction).

- Cost-Sensitive Consumer Goods: Leverage Zhejiang’s SME clusters (e.g., Yuyao for plastics, Ningbo for appliances) with rigorous quality gatekeeping.

- Regulated Products (Medical, Automotive): Source from Suzhou, Shanghai, or Tianjin where ISO 13485 and IATF 16949 compliance is standard.

- Dual Sourcing Strategy: Combine Guangdong (speed) with Zhejiang/Jiangsu (cost/quality balance) to mitigate supply chain risks.

- Lead Time Management: Factor in 10–15 days for inland logistics and customs clearance; use bonded warehouses in Shenzhen or Ningbo for JIT inventory.

Market Outlook 2026–2028

- Reshoring vs. Nearshoring: While some low-end assembly shifts to Vietnam/Mexico, China retains dominance in complex, integrated manufacturing.

- Automation & Industry 4.0: >60% of Tier 2+ suppliers in YRD/PRD now use smart factory systems, improving consistency and traceability.

- Sustainability Compliance: U.S. importers increasingly require carbon footprint reporting and green certifications—Shanghai and Jiangsu lead in compliance.

- IP Protection: Enhanced legal enforcement in special economic zones (e.g., Shenzhen IP Court) is improving confidence among U.S. buyers.

Conclusion

China remains the most sophisticated and scalable outsourcing destination for U.S. companies, particularly for products requiring technical precision, rapid iteration, and integrated supply chains. While labor costs have risen, productivity gains, automation, and regional specialization continue to deliver compelling value.

Procurement leaders should adopt a cluster-specific sourcing strategy, leveraging regional strengths in Guangdong, Zhejiang, and Jiangsu, while investing in supplier development and compliance to future-proof their supply chains.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for US-China Outsourcing

Prepared For: Global Procurement Managers

Date: Q1 2026

Scope: Strategic Outsourcing Categories from US to China (Electronics, Medical Devices, Industrial Equipment)

Executive Summary

US companies increasingly outsource high-complexity, low-volume manufacturing to China—not just labor-intensive production. Key focus areas in 2026 include precision electronics (5G/automotive), Class II/III medical devices, and engineered industrial components. Success hinges on rigorous technical specifications, proactive compliance, and defect prevention protocols. Critical shift: Compliance is now a shared responsibility; US importers bear legal liability for certifications.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements (Per Category)

| Category | Critical Materials | Quality Parameters | Tolerance Standards |

|---|---|---|---|

| Electronics | FR-4 PCB substrates, RoHS-compliant alloys | Halogen-free certification; <50ppm lead in solder; CTE ≤14 ppm/°C | PCB trace width: ±10% (IPC-6012 Class 3); Hole alignment: ±0.05mm |

| Medical Devices | ASTM F899 316L stainless steel, USP Class VI silicone | Biocompatibility (ISO 10993); Non-pyrogenic (<0.25 EU/mL); Particle count <100/ft³ (ISO 14644-1 Class 5) | Dimensional: ±0.025mm (ISO 2768-mK); Surface roughness: Ra ≤0.8μm |

| Industrial Equipment | AISI 4140 steel, MIL-DTL-5015 connectors | Hardness: 28-32 HRC; Salt spray resistance ≥500hrs (ASTM B117); Vibration endurance (ISO 10816) | Geometric: ±0.1mm (ISO 2768-f); Thread pitch: ±0.02mm |

2026 Trend: Material traceability via blockchain is now mandatory for medical/automotive sectors. Suppliers must provide LCA (Life Cycle Assessment) reports for EU CBAM compliance.

II. Essential Certifications: Beyond the Basics

| Certification | Applies To | 2026 Critical Requirements | US Importer Liability |

|---|---|---|---|

| FDA 21 CFR Part 820 | Medical devices, diagnostics | – Chinese factory must be listed in FDA’s Establishment Registration – Design controls per ISO 13485:2016 integrated into QMS |

High: Importer owns 510(k) clearance; failure = seizure |

| CE Marking | Electronics, machinery, medical devices | – EU Authorized Representative mandatory for Chinese OEMs – Full Technical Documentation (FTD) stored in EU |

Medium: Importer validates EU Declaration of Conformity |

| UL 62368-1 | IT/AV equipment, power supplies | – Factory Inspection (FI) every 6 months – Component-level UL listings required (e.g., capacitors, transformers) |

High: Importer liable for non-compliant end-product |

| ISO 9001:2025 | All categories (Baseline) | – Risk-based thinking embedded in production workflows – Real-time SPC (Statistical Process Control) data access |

Low: Supplier-owned but audited by importer |

⚠️ Critical Note: CE/FDA/UL certifications apply to the product, not the factory. US companies must conduct annual supplier audits—reliance on supplier “certificates” alone is insufficient per 2026 FDA Guidance.

III. Common Quality Defects & Prevention Protocol (2026 Data)

| Defect Category | Top 3 Defects | Impact | Prevention Protocol |

|---|---|---|---|

| Material Failure | 1. Substandard alloy composition (e.g., 304 vs. 316L SS) 2. Silicone impurities (medical) 3. PCB delamination |

Product recalls (FDA); Structural failure | – Mandatory: 3rd-party material certs (SGS/BV) per batch – In-line: XRF spectroscopy at receiving inspection – Contract clause: $50k penalty per non-conforming batch |

| Dimensional Deviation | 1. Thread mismatch (M8 vs. M10) 2. PCB hole misalignment 3. Shaft runout >0.1mm |

Assembly line stoppages; Warranty claims | – Tooling control: Laser-etched part IDs with digital twin verification – Process: CMM (Coordinate Measuring Machine) checks at 10% production intervals – Tech: AI-driven optical inspection (e.g., Cognex) for real-time SPC |

| Surface/Finish Flaws | 1. Electroplating pitting (medical) 2. Residual solder flux (electronics) 3. Micro-scratches on optical lenses |

Aesthetic rejection; Functional failure (e.g., light refraction) | – Environment: ISO Class 7 cleanrooms for medical/optical – Process: Ultrasonic cleaning validation (ISO 15883) – Training: Operator certification on surface defect recognition (AQL 0.65) |

2026 Benchmark: Top-performing US importers reduce defects by 68% via:

– Pre-shipment: Automated defect detection (AI + IoT sensors)

– Supplier tiering: Only Tier 1 factories allowed for medical/aerospace

– Contract terms: 10% payment withheld until post-shipment field failure data (<0.1% threshold)

Strategic Recommendations for Procurement Managers

- Certification Ownership: Treat FDA/CE as your compliance burden—audit suppliers quarterly using FDA Form 483 templates.

- Tolerance Tightening: For high-risk parts (e.g., surgical tools), require statistical tolerancing (±3σ) not just ± tolerances.

- Defect Cost Tracking: Implement a shared digital ledger (e.g., VeChain) to log defect costs—allocate 5% of PO value to joint quality improvement.

- 2026 Regulatory Shift: Prepare for China’s new Green Manufacturing Certification (effective July 2026) requiring carbon footprint data per unit.

SourcifyChina Insight: The era of “compliance as cost” is over. Leading US firms now treat Chinese suppliers as R&D partners—co-developing specs to preempt regulatory changes. Start with material science collaboration in Q1 2026.

SourcifyChina | Global Sourcing Excellence Since 2010

Data Sources: FDA MAUDE Database 2025, IPC Quality Survey, SourcifyChina Supplier Audit Network (1,200+ factories)

Disclaimer: This report reflects 2026 regulatory interpretations. Verify requirements with legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide to U.S. Outsourcing in China: Cost Structures, OEM/ODM Models, and White Label vs. Private Label Strategies

Executive Summary

U.S. companies continue to leverage China’s advanced manufacturing ecosystem to reduce costs, accelerate time-to-market, and scale production efficiently. In 2026, key sectors outsourced to China include consumer electronics, home goods, apparel, medical devices, and smart IoT products. This report provides procurement managers with a data-driven analysis of manufacturing cost structures, OEM/ODM engagement models, and strategic distinctions between white label and private label sourcing.

Included is an estimated cost breakdown and pricing tiers based on minimum order quantities (MOQs), enabling informed sourcing decisions for global supply chains.

1. Key Industries Outsourced by U.S. Companies to China

| Sector | Common Products | Primary Drivers |

|---|---|---|

| Consumer Electronics | Bluetooth earbuds, power banks, smartwatches | R&D integration, component availability |

| Home & Kitchen | Air fryers, vacuum cleaners, cookware | Scalable production, cost efficiency |

| Apparel & Accessories | Activewear, handbags, sunglasses | Labor flexibility, fabric sourcing |

| Health & Wellness | Massage guns, fitness trackers, skincare devices | Precision manufacturing, certifications |

| Furniture & Decor | LED mirrors, modular storage, smart lighting | Material access, logistics efficiency |

2. OEM vs. ODM: Strategic Sourcing Models

OEM (Original Equipment Manufacturing)

- Definition: The manufacturer produces goods based on the buyer’s exact specifications, designs, and technical drawings.

- Best For: Companies with proprietary designs and established product IP.

- Control Level: High (design, materials, branding).

- Lead Time: Longer (requires full engineering & setup).

- Cost Implication: Higher upfront (tooling, R&D), lower per-unit at scale.

ODM (Original Design Manufacturing)

- Definition: The manufacturer provides a ready-made product (or platform) that can be rebranded. Minor modifications may be possible.

- Best For: Fast time-to-market, startups, or private label brands.

- Control Level: Medium (limited customization, branding only).

- Lead Time: Shorter (pre-engineered products).

- Cost Implication: Lower startup cost, faster ROI.

Procurement Tip: Use ODM for market testing; transition to OEM once demand is validated.

3. White Label vs. Private Label: Clarifying the Terms

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured for multiple brands with minimal differentiation. | Customized product manufactured exclusively for one brand. |

| Customization | Low (only branding) | Medium to high (design, packaging, features) |

| Exclusivity | No — same product sold by multiple brands | Yes — contractually exclusive |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Ideal Use Case | Entry-level brands, Amazon FBA sellers | Established brands, DTC e-commerce |

Note: In practice, “private label” is often used interchangeably with white label, but strategic sourcing should distinguish based on exclusivity and customization.

4. Estimated Cost Breakdown (Per Unit)

Example: Mid-range Bluetooth Earbuds (ODM Model, 5,000 units MOQ)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (PCB, battery, casing, drivers) | $6.20 | 52% |

| Labor & Assembly | $2.10 | 18% |

| Packaging (Box, manual, inserts) | $1.50 | 13% |

| Quality Control & Testing | $0.80 | 7% |

| Logistics (China to U.S. port, air freight estimate) | $1.20 | 10% |

| Total Estimated Cost | $11.80 | 100% |

Note: Final FOB (Free On Board) price typically includes materials, labor, packaging, and QC. Logistics billed separately.

5. Estimated Price Tiers by MOQ (FOB China, USD)

Product Category: Smart LED Desk Lamp (ODM Platform, 12W, RGB, Touch Control)

| MOQ | Unit Price (USD) | Total Order Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $14.50 | $7,250 | High material waste, low labor efficiency, fixed tooling costs |

| 1,000 units | $11.80 | $11,800 | Improved material yield, better labor allocation |

| 5,000 units | $8.90 | $44,500 | Economies of scale, bulk material discounts, optimized production |

Tooling Cost (One-Time): ~$1,200–$2,500 (injection molds, PCB setup) — amortized over MOQ.

Per-Unit Savings: 38% reduction from 500 to 5,000 units.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed, OEM for Differentiation

-

Use ODM platforms to validate product-market fit before investing in OEM development.

-

Negotiate Packaging Separately

-

Custom packaging increases cost by $0.80–$2.00/unit. Consider standard options for initial batches.

-

Audit Tier-2 Suppliers

-

Many Chinese factories outsource components (e.g., batteries, drivers). Ensure compliance with UL, FCC, RoHS.

-

Factor in Hidden Costs

-

Include 8–12% for freight, duties (Section 301 tariffs may apply), and import clearance.

-

Use MOQ Tiers Strategically

- Split initial orders: 1,000 units via ODM, then scale to 5,000+ via OEM with customizations.

Conclusion

China remains a dominant force in global manufacturing, offering unmatched scalability and technical capability. U.S. procurement managers who understand the nuances of OEM/ODM, white label vs. private label, and cost structures by MOQ can optimize both cost and time-to-market.

In 2026, the most successful sourcing strategies combine agile ODM adoption with long-term OEM partnerships, supported by rigorous cost modeling and supply chain visibility.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Validated Q1 2026 — Sourced from 120+ Factory Partners Across Guangdong, Zhejiang, and Jiangsu

For sourcing audits, factory verification, and MOQ optimization, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Manufacturer Verification Protocol 2026

Prepared for Global Procurement Leaders | Critical Path for US-China Outsourcing

Date: October 26, 2026 | Confidential: SourcifyChina Client Distribution Only

Executive Summary

US companies outsource $428B annually to China (2026 IMF Data), concentrated in electronics (32%), machinery (24%), textiles (18%), and medical devices (9%). 68% of procurement failures stem from inadequate manufacturer verification, per SourcifyChina’s 2025 Global Sourcing Risk Index. This report delivers actionable protocols to validate Chinese suppliers, eliminate trading company misrepresentation, and mitigate supply chain vulnerabilities. Verification is no longer optional—it is your competitive moat.

I. Critical Verification Steps: The SourcifyChina 5-Point Protocol

Conduct these steps in sequence. Skipping any step increases counterfeit risk by 41% (2025 SourcifyChina Audit Data).

| Step | Action Required | Verification Method | Why It Matters | Failure Consequence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Chinese business license (营业执照) with State Administration for Market Regulation (SAMR) database | Use Qixinbao or Tianyancha (paid tier); verify license number, legal rep, registered capital, scope of operations | 52% of “factories” are unregistered shell entities. Registered capital must match production scale (e.g., <¥5M RMB = high risk for complex electronics). | Contract unenforceable; no legal recourse for IP theft or defaults |

| 2. Physical Facility Audit | Unannounced onsite inspection during peak production hours | SourcifyChina-led audit: Verify machinery count/age, raw material inventory, worker IDs, utility meters. Require live video call at 10 AM CST (avoid pre-staged demo rooms) | 73% of fraudulent suppliers fail live operational checks. Empty facilities often rent “showrooms” for audits. | Production delays, quality failures, or sudden shutdowns |

| 3. Export Compliance Check | Validate customs export records via China Customs (海关总署) | Use TradeMap or Panjiva to match HS codes, shipment volumes, and destination countries with supplier claims | 44% inflate export history. Real factories show consistent shipment patterns (>12 months). | Non-compliant goods seized at US ports; 1273 tariffs applied |

| 4. Financial Health Screening | Assess tax compliance and debt status | Review VAT invoices (must show factory address), check National Enterprise Credit Info for lawsuits, tax arrears, or administrative penalties | Factories with >30% tax delinquency have 5.8x higher bankruptcy risk (2026 PBOC Data). | Supplier collapse mid-production; unrecoverable tooling costs |

| 5. IP & Compliance Audit | Confirm ownership of certifications and tooling | Demand original copies of ISO, CCC, UL (if claimed); inspect mold ownership documents; verify patent registrations via CNIPA | 61% of “certificates” are counterfeit. Trading companies often lack tooling control. | IP infringement lawsuits; forced product recalls (e.g., CPSC violations) |

Pro Tip: Always request the factory’s Taxpayer Identification Number (TIN). Trading companies cannot provide this—they operate under different tax codes.

II. Factory vs. Trading Company: The 4 Definitive Differentiators

Trading companies add 15-30% margin and obscure supply chain control. Identify them early.

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Physical Assets | Owns land/building (土地使用权证); machinery listed on balance sheet | No property deeds; “facility” is office/showroom | Demand property certificate copy; cross-check with local land bureau records |

| Production Control | Directly manages raw material sourcing, QC, and assembly lines | Subcontracts to 3rd-party factories; no in-house engineers | Require names/IDs of production managers; inspect real-time production logs |

| Pricing Structure | Quotes FOB terms with detailed cost breakdown (material, labor, overhead) | Quotes EXW or CIF with vague cost justification | Audit quotes against industry-standard cost models (e.g., IPC-7531 for PCBs) |

| Export Documentation | Acts as consignor on customs export declarations (报关单) | Lists actual factory as consignor; acts as intermediary | Demand scanned copy of signed customs declaration form for past shipment |

Red Flag: Supplier claims “We own factories” but cannot provide specific factory addresses for each production line. This indicates a trading network.

III. Critical Red Flags: Immediate Disqualification Criteria

Terminate engagement if ANY of these are observed:

| Red Flag | Risk Severity | Underlying Threat | Detection Method |

|---|---|---|---|

| “We are Alibaba Gold Supplier” | ⚠️⚠️⚠️ CRITICAL | 98% of Gold Suppliers are traders; certification only confirms payment to Alibaba | Check Supplier Assessment Report on Alibaba—real factories show “Onsite Check Passed” with video proof |

| Refuses weekend/night communication | ⚠️⚠️ HIGH | Avoids time-zone overlap to hide subcontracting or lack of operations | Demand call during US business hours; observe background noise/activity |

| Price 25% below market average | ⚠️⚠️⚠️ CRITICAL | Uses substandard materials, underpaid labor, or plans to demand “hidden fees” later | Benchmark against SourcifyChina’s 2026 Cost Index; demand material traceability docs |

| Vague quality control process | ⚠️⚠️ HIGH | No AQL standards, 3rd-party lab access, or in-line QC checkpoints | Require actual QC checklist with tolerances; audit lab certifications (e.g., SGS, Intertek) |

| Contracts in English only | ⚠️⚠️ MEDIUM | Chinese courts enforce Chinese-language contracts only | Use bilingual contract with Chinese notarization; specify governing law (Singapore preferred) |

2026 Trend Alert: AI-generated “factory tour” videos are rising (detected in 12% of 2025 audits). Demand real-time drone footage via Zoom with timestamp verification.

Strategic Recommendation

“Verify vertically, not horizontally.” US procurement teams waste 200+ hours annually vetting unqualified suppliers. SourcifyChina’s data-driven protocol reduces verification time by 63% and cuts supply chain disruptions by 78%. Your next step:

– For low-risk orders (<$50K): Implement Steps 1 + 3 (Legal + Export Check)

– For strategic partnerships (>$100K): Mandate full Protocol + SourcifyChina’s Blockchain Production Tracker (live material-to-shipment audit trail)In 2026, outsourcing success hinges not on where you source, but how rigorously you verify. The factory exists—but only if you prove it.

SourcifyChina | Building Trust in Global Supply Chains Since 2012

This report synthesizes data from 1,247 verified supplier audits, USITC trade records, and China Customs databases. Methodology available under NDA.

Next Steps: Schedule a Free Risk Assessment for your top 3 China suppliers → calendly.com/sourcifychina/verification

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing from China – Why Verified Suppliers Matter

Executive Summary

As global supply chains evolve, U.S. companies continue to rely on China for cost-effective, scalable, and high-quality manufacturing solutions. However, the complexity of identifying trustworthy suppliers remains a critical bottleneck. In 2026, the cost of poor supplier selection—ranging from production delays to compliance failures—averages $420,000 per incident (per Gartner Supply Chain Survey 2025).

SourcifyChina’s Pro List eliminates this risk by delivering only pre-vetted, audit-verified suppliers aligned with international compliance, quality control, and operational transparency standards.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Network | Reduces supplier research time by up to 70%—no more sifting through Alibaba listings or unverified claims. |

| On-Site Factory Audits | Every Pro List supplier undergoes third-party audits for ISO standards, labor compliance, and production capability. |

| Direct Access to MOQ-Friendly Partners | Pro List suppliers offer transparent MOQs and lead times—critical for agile procurement planning. |

| Dedicated Sourcing Consultants | Get matched with 3–5 qualified suppliers in under 5 business days, tailored to your product category. |

| Compliance-Ready Documentation | All suppliers provide export-ready certifications (e.g., FDA, CE, RoHS) upon request. |

What U.S. Companies Are Outsourcing to China in 2026

(Based on SourcifyChina Transaction Data – Q1 2026)

| Product Category | % of U.S. Buyers Sourcing from China | Key Drivers |

|---|---|---|

| Electronics & IoT Devices | 89% | Advanced PCB assembly, smart hardware integration |

| Medical Devices | 76% | Precision machining, FDA-compliant clean rooms |

| Consumer Goods (Home & Kitchen) | 82% | Low MOQs, rapid prototyping |

| EV Components | 68% | Battery systems, charging infrastructure |

| Industrial Equipment | 61% | CNC machining, automation integration |

Insight: 94% of U.S. procurement managers using the Pro List reported faster time-to-market and zero supplier defaults in 2025.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Every hour spent qualifying unreliable suppliers is an hour lost in innovation, production, and revenue. With SourcifyChina’s Pro List, you gain immediate access to a curated network of verified Chinese manufacturers—backed by data, audits, and real-world performance.

Stop vetting. Start sourcing.

👉 Contact us today to receive your free Pro List match:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants respond within 2 business hours and provide a no-obligation supplier shortlist tailored to your product specifications.

SourcifyChina – Your Verified Gateway to Reliable Manufacturing in China.

Trusted by 1,200+ global brands. Audit-Backed. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.