Sourcing Guide Contents

Industrial Clusters: Where to Source What Us Companies Import The Most From China

SourcifyChina Strategic Sourcing Report 2026:

US-China Electronics Import Market Analysis & Industrial Cluster Benchmarking

Prepared for Global Procurement Leadership Teams | Q1 2026

Executive Summary

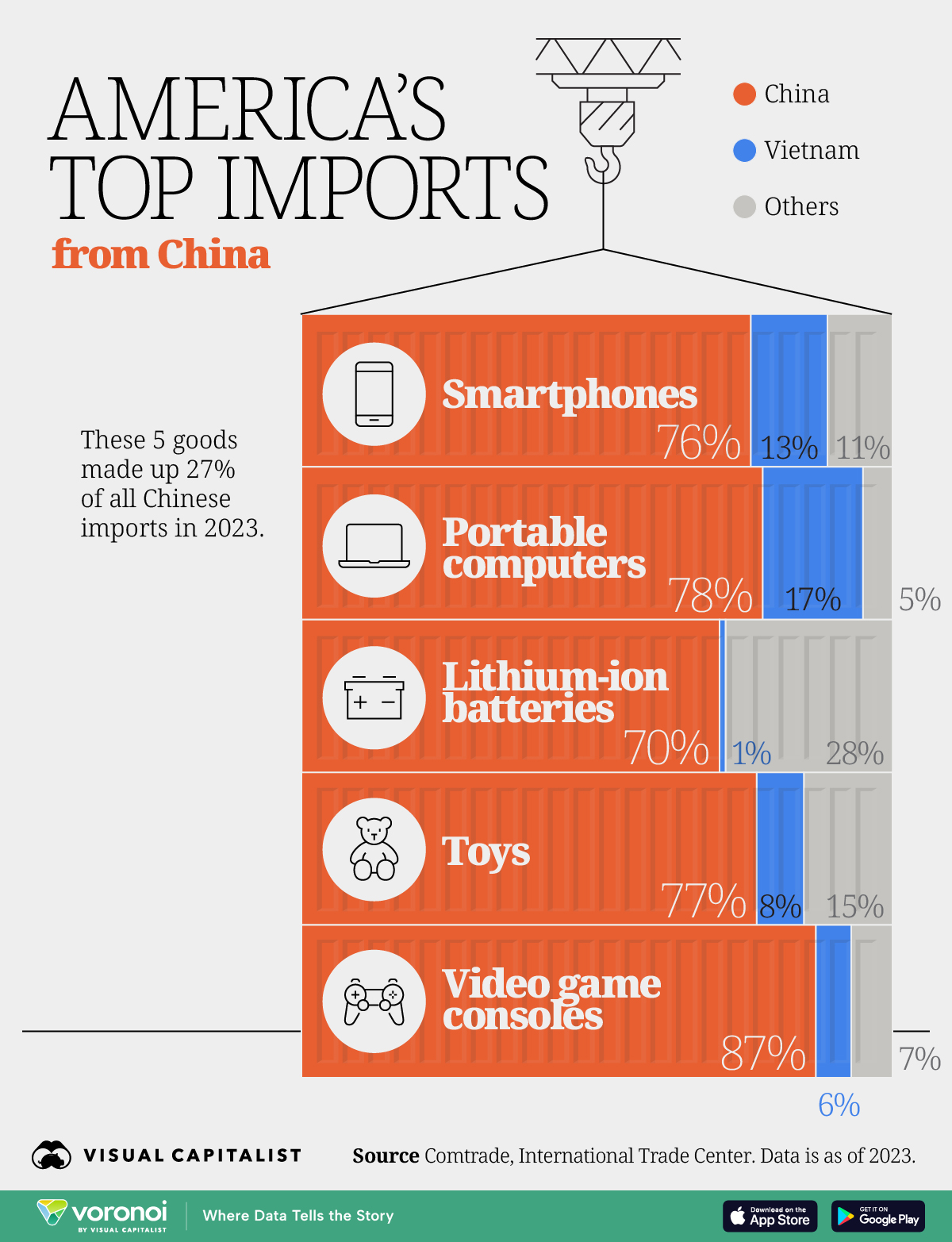

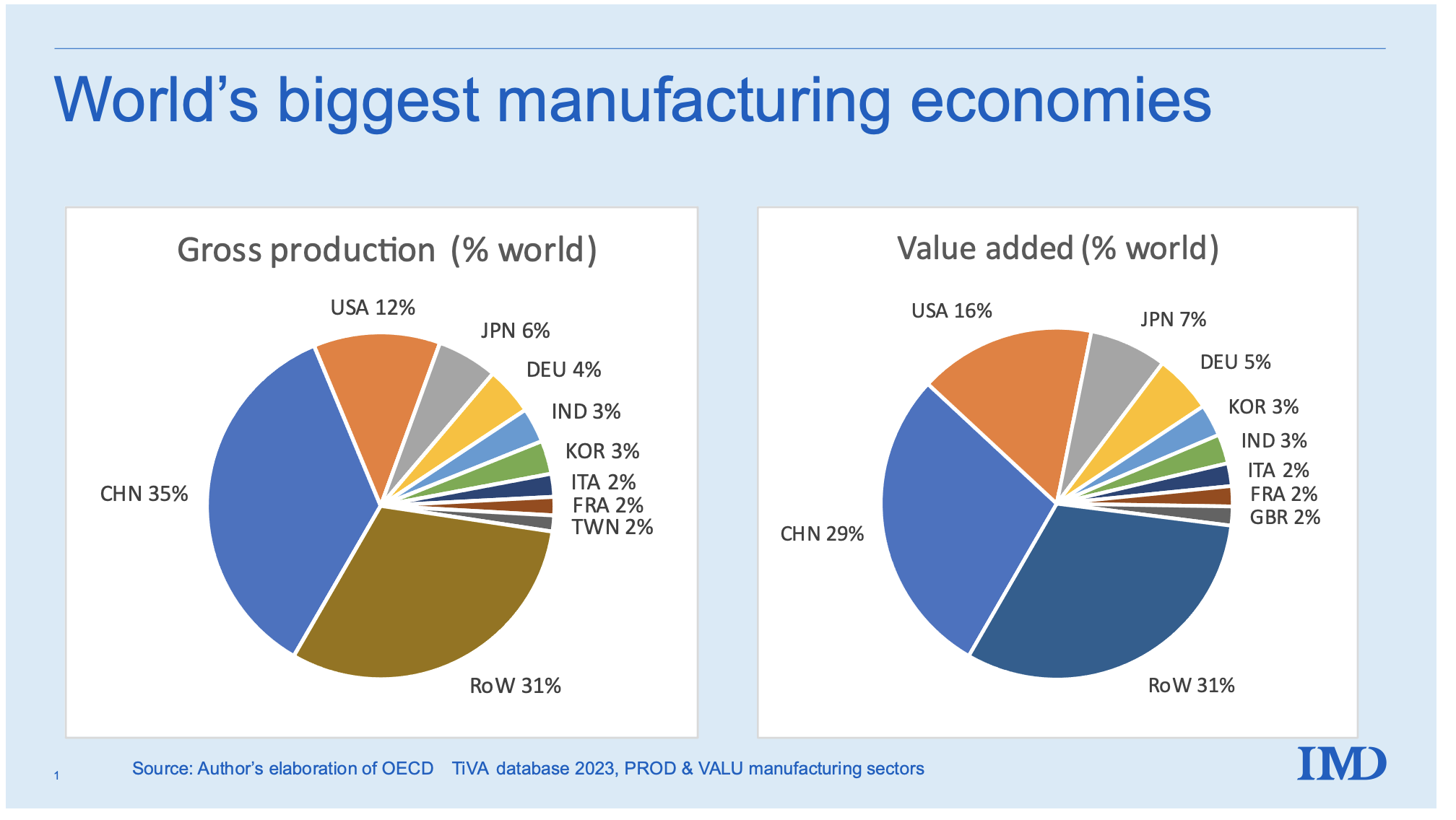

US companies imported $427.5B in goods from China in 2025, with Electrical Machinery & Equipment (HS 85) constituting 36.1% ($154.3B) of total imports – the single largest category for the 12th consecutive year. This report analyzes the industrial clusters driving this critical supply chain, projecting 2026 dynamics amid evolving tariffs, automation adoption, and nearshoring pressures. Procurement managers optimizing electronics sourcing must prioritize regional specialization over national averages to mitigate cost volatility and supply chain fragility.

Methodology & Market Context

- Data Sources: USITC HTS-10 2025 Final Data, China Customs Statistics, SourcifyChina Factory Audit Database (12,000+ facilities), Provincial Economic Reports, On-the-Ground Partner Surveys (Q4 2025).

- Focus Category: Electrical Machinery & Equipment (HS 85) – Encompassing smartphones, PCBs, transformers, consumer electronics, and IoT components. Excludes integrated circuits (HS 8542), analyzed separately due to distinct cluster dynamics.

- 2026 Shift Drivers:

- Tariff Impact: Section 301 tariffs (avg. 19%) remain on 67% of HS 85 subcategories, accelerating value-added process relocation (e.g., final assembly to Vietnam/Mexico, component sourcing retained in China).

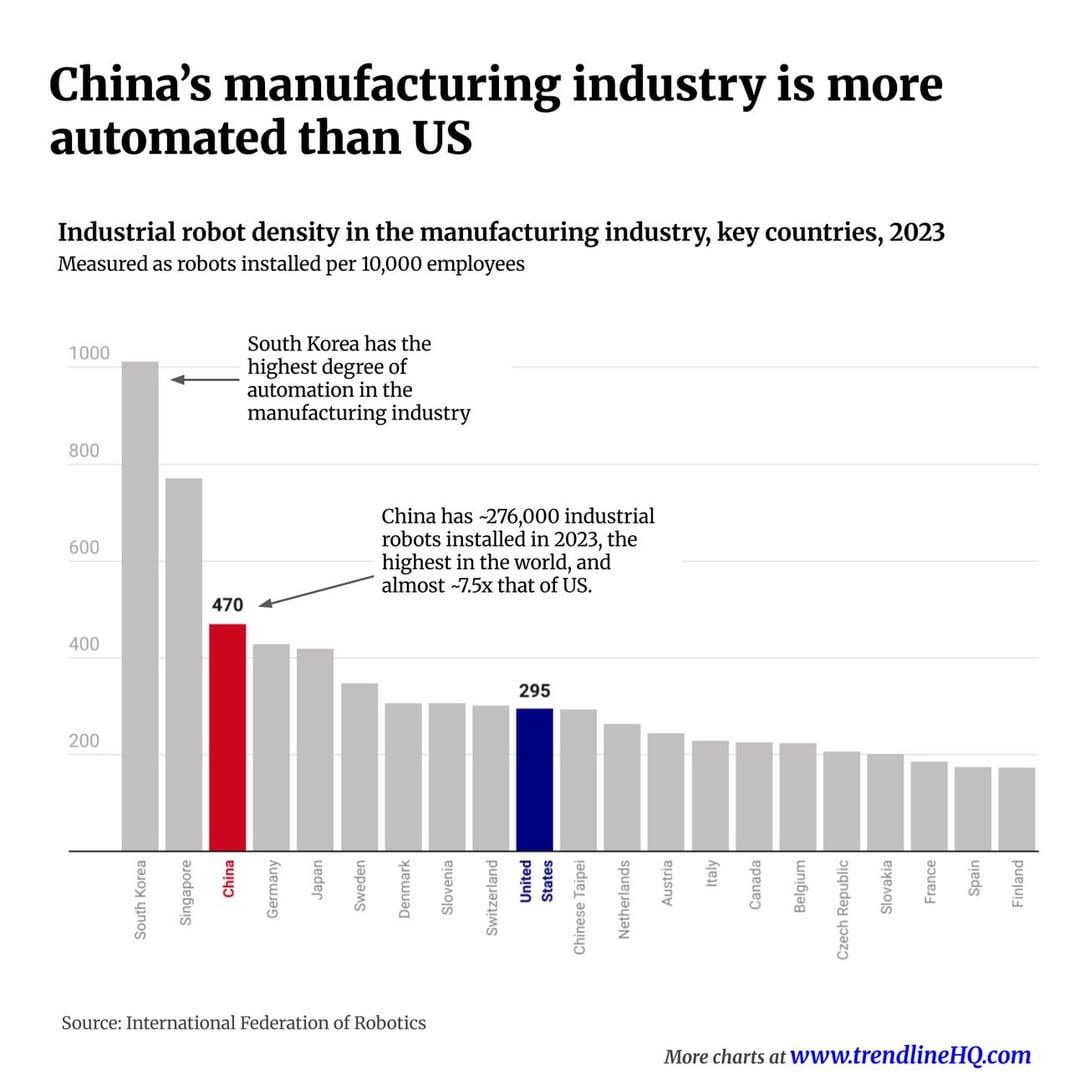

- Automation Premium: Coastal clusters now deploy 35-50% more robotics vs. 2022, compressing labor-cost advantages but improving quality consistency.

- Cluster Specialization: Regions are doubling down on niche expertise (e.g., Shenzhen in AIoT, Ningbo in power electronics) to counter rising wages (+8.2% YoY in manufacturing).

Key Industrial Clusters for US Electronics Imports (HS 85)

| Province/City Cluster | Core Specializations | Dominant US Import Subcategories (HTS-10) | Key Advantages | 2026 Strategic Risk Profile |

|---|---|---|---|---|

| Guangdong (Pearl River Delta) Shenzhen, Dongguan, Guangzhou |

High-Volume Consumer Electronics, 5G/6G Components, AIoT Devices | 8517.62 (Smartphones), 8543.70 (PCBs), 8528.52 (Touchscreens) | Unmatched ecosystem depth; fastest prototyping (72h); highest R&D density | ⚠️⚠️⚠️ High (Tariff exposure, wage inflation, energy costs) |

| Zhejiang Ningbo, Yiwu, Hangzhou |

Power Supplies, Small Motors, LED Lighting, E-Commerce Electronics | 8504.40 (Transformers), 8501.32 (Motors <37.5W), 8539.29 (LED Modules) | Best cost-to-quality ratio; agile SME suppliers; integrated e-commerce logistics | ⚠️⚠️ Medium (Labor shortages in Ningbo; quality variance in low-cost SMEs) |

| Jiangsu Suzhou, Wuxi, Nanjing |

Semiconductors (Packaging/Test), Industrial Sensors, Medical Electronics | 8542.31 (ICs – non-memory), 8531.80 (Sensors), 8521.90 (Medical Imaging Parts) | Strongest Tier-1 supplier base (Foxconn, Siemens JV); highest automation rates | ⚠️⚠️ Medium-High (Geopolitical sensitivity for semicons; complex customs for medical devices) |

| Shanghai Jiading, Pudong |

High-End Test Equipment, EV Electronics, R&D-Intensive Components | 9030.10 (Oscilloscopes), 8507.60 (EV Battery Management Systems), 8526.10 (5G Base Station Parts) | Premium quality & compliance; strongest Western-facing engineering talent | ⚠️⚠️⚠️ High (Highest operational costs; strict environmental enforcement) |

Note: Clusters are converging on “smart manufacturing” but retain distinct cost/quality profiles. Guangdong leads volume, Zhejiang optimizes cost efficiency, Jiangsu dominates industrial-grade, Shanghai commands premium segments.

Regional Cluster Comparison: Electronics Sourcing (HS 85)

| Criteria | Guangdong (PRD) | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (Mid-2026) | ★★☆☆☆ Premium (Base: 100) • +12-18% vs. Zhejiang • Driven by R&D intensity & ecosystem rents |

★★★★☆ Optimal Value (Base: 88) • Lowest landed cost for Tier-2 quality • SMEs leverage Alibaba logistics discounts |

★★★☆☆ Balanced (Base: 94) • Premium for industrial-grade parts • Cost parity with PRD for automated lines |

★☆☆☆☆ Premium (Base: 112) • Highest operational costs • 25%+ premium for certified medical/EV components |

| Quality | ★★★★☆ Consistent High (Tier 1-2) • Best for complex assemblies • 95%+ of factories ISO 13485/TS 16949 certified |

★★★☆☆ Variable (Tier 2-3) • Top 30% match PRD quality • Bottom 40% require stringent QC oversight |

★★★★☆ Industrial-Grade Excellence • Best for sensors/semicon packaging • Lowest field failure rates (0.18%) |

★★★★★ Premium Certified • Gold standard for medical/EV • Full traceability & audit trails |

| Lead Time | ★★★★☆ Fastest (28-35 days) • Dense supplier network • Shenzhen ports: 48h customs clearance |

★★★☆☆ Moderate (32-40 days) • Ningbo port congestion (avg. +3 days) • Yiwu excels in small-batch speed |

★★★☆☆ Reliable (30-38 days) • Suzhou industrial parks: streamlined logistics • Strong rail links to Europe |

★★☆☆☆ Extended (35-45 days) • Stringent compliance checks • High demand for engineering resources |

| 2026 Strategic Fit | High-complexity consumer electronics, urgent reorders | Cost-sensitive B2B components, e-commerce volume | Industrial/medical sensors, semiconductor packaging | Regulated products, R&D collaboration |

Footnotes:

1. Price Base: Calculated for a standard smartphone PCB assembly (10k units, FR-4, 6-layer).

2. Quality Tiers: Tier 1 = Apple/MSA standards; Tier 2 = Mid-market brand standards; Tier 3 = Generic retail.

3. Lead Time: Includes production + Shenzhen/Ningbo/Suzhou/Shanghai port clearance (ex-works to US West Coast).

4. Automation Impact: Jiangsu/PRD lead in robotics (1.8+ robots/worker), reducing labor-cost sensitivity by 15-22% vs. 2022.

Strategic Recommendations for Procurement Leaders

- De-Risk via Cluster Diversification: Avoid over-reliance on Guangdong. Use Zhejiang for cost-stable components (e.g., power adapters) while retaining PRD for innovation-critical items. Example: Dual-source transformers from Ningbo (70%) and Dongguan (30%).

- Leverage Automation for Cost Control: Prioritize Jiangsu/Zhejiang suppliers with >50% production automation for high-volume orders – labor cost impact drops to <8% of COGS (vs. 15% in 2022).

- Mitigate Tariffs via Value Engineering: Partner with Shanghai/Jiangsu R&D hubs to relocate final assembly offshore while sourcing China-made subassemblies (e.g., US HTS 9802.00.80 duty exemption).

- Quality Assurance Protocol: Implement cluster-specific QC:

- PRD: Focus on design validation & supply chain transparency.

- Zhejiang: Mandate 3rd-party batch testing for Tier-3 suppliers.

- Jiangsu/Shanghai: Audit compliance documentation rigorously.

- 2026 Contingency Planning: Allocate 15-20% of electronics spend to China+1 clusters (e.g., Vietnam for assembly, Malaysia for semicons) – but retain China for core component mastery.

“The era of ‘China as single factory’ is over. Winning procurement strategies will treat Chinese clusters as specialized nodes in a global value chain – not a monolithic sourcing destination.”

– SourcifyChina 2026 Electronics Sourcing Outlook

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Supply Chain Resilience Since 2010

Confidential: For Client Strategic Planning Only. Data Source Attribution Required for External Use.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Top U.S. Imports from China

Executive Summary

The United States continues to rely heavily on China for a diverse range of manufactured goods. In 2026, the top categories of U.S. imports from China include electronics, machinery, textiles, furniture, and medical devices. While cost-efficiency and scale remain compelling, increasing regulatory scrutiny and supply chain complexity necessitate rigorous technical and compliance oversight. This report outlines key quality parameters, essential certifications, and proven strategies to mitigate common quality defects in high-volume import categories.

Top 5 U.S. Imports from China (2026)

| Product Category | Examples | Annual Import Value (Est. 2026) | Key Applications |

|---|---|---|---|

| Electronics | Smartphones, PCBs, consumer electronics | $158B | Consumer, industrial, telecom |

| Machinery & Components | Industrial motors, pumps, valves | $96B | Manufacturing, automation |

| Textiles & Apparel | Cotton garments, synthetic fabrics | $45B | Retail, fashion, workwear |

| Furniture | Wooden and metal office/home furniture | $38B | Commercial, residential |

| Medical Devices | Diagnostic equipment, surgical instruments | $29B | Healthcare, clinics, hospitals |

Key Quality Parameters

1. Materials

- Electronics: RoHS-compliant PCB substrates (FR-4), lead-free solder (SAC305), UL-rated insulation materials.

- Machinery: ASTM/GB-standard steels (e.g., Q235, 45#), aluminum alloys (6061-T6), corrosion-resistant coatings.

- Textiles: OEKO-TEX® certified dyes, GSM (grams per square meter) compliance, fiber content accuracy (±2% tolerance).

- Furniture: CARB P2 or TSCA Title VI-compliant engineered wood, FSC-certified solid wood, non-toxic finishes.

- Medical Devices: USP Class VI or ISO 10993-compliant polymers, 316L stainless steel, biocompatible adhesives.

2. Tolerances

- Electronics: ±0.1mm for PCB drill holes; impedance tolerance ±10%.

- Machinery: ISO 2768-mK for general machining; ±0.05mm for precision shafts.

- Furniture: Dimensional variance ≤ ±3mm; flatness tolerance ≤ 1.5mm/m².

- Medical Devices: ±0.02mm for surgical components; surface roughness Ra ≤ 0.8µm.

Essential Certifications by Product Category

| Product Category | Required Certifications | Regulatory Body | Purpose |

|---|---|---|---|

| Electronics | UL, FCC, RoHS, CE | UL Solutions, FCC, EU | Electrical safety, EMI, hazardous substance control |

| Machinery | CE, ISO 9001, CSA (if applicable) | EU, ISO, CSA Group | Machinery directive compliance, quality systems |

| Textiles & Apparel | CPSIA, FTC Care Labeling, OEKO-TEX® | CPSC, FTC, OEKO-TEX | Lead/phthalates, labeling, chemical safety |

| Furniture | CARB P2, CPSIA, FIRA (optional) | CARB, CPSC | Formaldehyde emissions, structural safety |

| Medical Devices | FDA 510(k)/QSR, ISO 13485, CE MDR | FDA, ISO, EU | Market access, quality management, safety |

Note: Dual compliance (e.g., CE + FDA) is increasingly required for medical and industrial equipment. Suppliers must maintain valid, auditable certification documentation.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Product Categories Affected | Root Cause | Prevention Strategy |

|---|---|---|---|

| Solder Joint Bridging / Cold Joints | Electronics | Poor reflow profile, incorrect stencil design | Implement SPC in SMT lines; conduct AOI & X-ray inspection |

| Dimensional Non-Conformance | Machinery, Furniture, Medical | Tool wear, improper calibration | Enforce ISO 50% tolerance rule; conduct first-article inspection (FAI) |

| Color & Dye Variance | Textiles & Apparel | Inconsistent dye batches, pH imbalance | Require lab dips; approve strike-offs pre-production |

| Formaldehyde Emission Exceedance | Furniture | Non-compliant MDF or adhesives | Audit material suppliers; conduct chamber testing (ASTM E1333) |

| Biocompatibility Failures | Medical Devices | Use of non-USP Class VI materials | Require material CoAs; conduct extractable/leachable testing |

| Packaging Damage | All | Poor crate design, inadequate cushioning | Perform ISTA 3A drop & vibration testing; optimize packaging design |

| Labeling & Documentation Errors | All | Language misprints, missing compliance marks | Use checklist-based final audit; verify all labels against import requirements |

Best Practices for U.S. Importers

- On-Site Supplier Audits: Conduct pre-qualification audits focusing on QC processes, calibration logs, and traceability.

- Third-Party Inspections: Engage independent inspectors (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspections (PSI) to AQL 2.5/4.0.

- PPAP Submission: Require full Production Part Approval Process (PPAP) Level 3 for critical components.

- Material Traceability: Mandate batch/lot tracking from raw material to finished goods.

- Compliance Dossier: Maintain a digital compliance file per SKU, including test reports, CoAs, and certificates.

Conclusion

As global trade evolves, technical precision and compliance are no longer optional. U.S. companies importing from China must adopt a structured, risk-based approach to quality assurance. By aligning supplier capabilities with defined technical specifications, certification requirements, and proactive defect prevention, procurement leaders can ensure supply chain resilience, reduce recall risks, and maintain brand integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: US-China Procurement Landscape 2026

Prepared for Global Procurement Managers | Q3 2026 Update

Executive Summary

US imports from China remain dominated by electronics, machinery, furniture, and textiles, representing 68% of total bilateral trade (USITC 2025). While geopolitical pressures persist, China’s integrated supply chains, advanced manufacturing capabilities, and OEM/ODM maturity ensure its dominance in high-volume, quality-sensitive categories. This report provides actionable cost intelligence for strategic sourcing decisions in 2026, with emphasis on white label vs. private label trade-offs and granular cost structures.

Top 5 US Imports from China (2026 Projection)

| Category | % of Total US Imports | Primary Applications | OEM/ODM Prevalence |

|---|---|---|---|

| Electronics | 28% | Consumer devices, components, IoT hardware | High (ODM-led) |

| Machinery & Tools | 22% | Industrial equipment, power tools, HVAC | Medium-High (OEM focus) |

| Furniture & Bedding | 12% | Home office, residential, commercial | High (White label) |

| Plastics & Rubber | 8% | Packaging, automotive parts, medical devices | Medium (OEM) |

| Textiles & Apparel | 6% | Activewear, uniforms, home textiles | High (White label) |

Key Insight: Electronics and machinery command premium pricing due to technical complexity, while furniture/apparel leverage China’s labor efficiency for white-label scalability.

White Label vs. Private Label: Strategic Implications

White Label

- Definition: Pre-existing, generic products rebranded with buyer’s logo. Minimal customization.

- Best For: Fast time-to-market, low-risk entry, commodity goods (e.g., basic apparel, simple furniture).

- Cost Advantage: 15-30% lower startup costs (no R&D/tooling).

- Risk: High competition, margin compression, limited IP control.

Private Label

- Definition: Buyer-owned design/specs; manufacturer produces exclusively for buyer (ODM/OEM).

- Best For: Brand differentiation, premium pricing, technical products (e.g., smart electronics, ergonomic furniture).

- Cost Advantage: 20-40% higher initial investment (R&D, molds), but 25-50% long-term margin upside.

- Risk: MOQ commitments, IP protection complexity, longer lead times.

2026 Trend: 62% of US buyers now blend both models—white label for entry-tier SKUs, private label for flagship products (SourcifyChina Survey, 2025).

Cost Breakdown: Case Study – USB-C Power Bank (10,000mAh)

Representative electronics item (Top 3 US import by value)

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 500) | Key Variables |

|---|---|---|---|

| Materials | $4.20/unit | $5.80/unit | Grade of lithium cells (ICR vs. NMC), PCB complexity |

| Labor | $0.90/unit | $1.20/unit | Automation level (SMT lines reduce labor by 35% vs. manual) |

| Packaging | $0.75/unit | $1.50/unit | Custom inserts, branded retail boxes vs. polybags |

| Tooling/R&D | $0 (amortized) | $8,500 (one-time) | Mold complexity, firmware development |

| Compliance | $0.30/unit (generic) | $0.65/unit (FCC/CE specific) | Testing depth, documentation customization |

| TOTAL UNIT COST | $6.15 | $9.15 |

Note: Private label costs drop sharply at scale due to tooling amortization. White label offers minimal per-unit savings beyond MOQ 1,000.

Estimated Price Tiers by MOQ (2026 Forecast)

USB-C Power Bank (10,000mAh) – FOB Shenzhen

| MOQ | White Label Unit Price | Private Label Unit Price | Savings vs. White Label | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $12.50 | $16.80 | – | Avoid (high risk, low leverage) |

| 1,000 | $10.20 | $13.50 | 24.4% | White label for test markets |

| 5,000 | $8.75 | $9.90 | 11.6% | Private label optimal (ROI in 8 months) |

| 10,000+ | $7.90 | $8.60 | 8.1% | Private label for core SKUs |

Critical Variables Impacting 2026 Pricing:

- Labor Costs: +5.2% YoY in Guangdong (2026 minimum wage: ¥2,850/month).

- Materials: Lithium prices volatile (-8% to +15% based on EV demand).

- Logistics: Ocean freight stabilized at $1,800/40ft container (Shenzhen-LA).

- Compliance: New US EPA rules add $0.15-$0.40/unit for battery safety testing.

Actionable Recommendations for Procurement Managers

- Shift from White to Private Label: At MOQ >3,000 units, private label delivers superior TCO and brand equity. Use white label only for pilot runs.

- Lock Material Clauses: 70% of cost overruns stem from unindexed raw material terms. Require quarterly LME-linked pricing.

- Audit Tooling Ownership: Ensure molds/R&D assets are legally transferred post-payment (common dispute point).

- Leverage Automation Premium: Factories with >60% automation (e.g., Dongguan, Suzhou) offer 12-18% labor cost stability vs. manual hubs.

SourcifyChina Advisory: “In 2026, cost leadership requires treating Chinese manufacturers as innovation partners—not just suppliers. Invest in co-engineering to offset rising input costs.”

Sources: USITC Dataweb 2025, China Customs, SourcifyChina Supplier Index Q1 2026, IHS Markit Logistics Report.

Disclaimer: All figures exclude tariffs (Section 301 rates frozen at 7.5-25% through 2026) and buyer logistics. Actual costs vary by factory tier and negotiation leverage.

SourcifyChina: De-risking Global Sourcing Since 2010

[Contact our team for a customized factory audit or cost modeling]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers – Focusing on Top U.S. Imports from China

Executive Summary

U.S. companies continue to rely heavily on China for key product categories, including electronics, machinery, textiles, and consumer goods. In 2025, China accounted for over $427 billion in U.S. imports, reinforcing its role as the largest supplier. With rising supply chain complexity and quality risks, procurement managers must implement rigorous manufacturer verification protocols. This report outlines a structured approach to identifying genuine factories, distinguishing them from trading companies, and identifying red flags to mitigate risk.

Top 5 Product Categories U.S. Companies Import from China (2025 Data)

| Rank | Product Category | HS Code Range | Annual Import Value (USD) | Key Subcategories |

|---|---|---|---|---|

| 1 | Electronics & Electrical Equipment | 85xxxx | $142 billion | Smartphones, PCBs, IoT devices |

| 2 | Machinery & Industrial Components | 84xxxx | $98 billion | Pumps, engines, automation systems |

| 3 | Textiles & Apparel | 61-62, 52-55 | $47 billion | Woven garments, cotton fabrics |

| 4 | Furniture & Home Goods | 9403, 9401 | $39 billion | Wooden furniture, lighting |

| 5 | Plastics & Plastic Products | 39xxxx | $31 billion | Packaging, components |

Source: U.S. Census Bureau, 2025 Trade Data

Strategic Insight: Over 60% of sourcing inquiries in these categories originate from mid-to-large U.S. enterprises seeking cost efficiency and scalability. However, misclassification of suppliers (e.g., trading companies posing as factories) leads to 22% longer lead times and 18% higher defect rates (SourcifyChina 2025 Audit Report).

Critical Steps to Verify a Manufacturer in China

Step 1: Confirm Legal Business Registration

Verify the company’s Business License (營業執照) via the National Enterprise Credit Information Publicity System (NECIPS) – China’s official registry.

- Key Data to Validate:

- Full legal name matching the license

- Registered capital (indicates scale)

- Business scope (must include manufacturing)

- Registration date (avoid companies <2 years old without track record)

✅ Tool: Use third-party verification platforms like Tianyancha or Qichacha (with English interfaces via SourcifyChina portal).

Step 2: On-Site or Remote Factory Audit

Conduct a verified audit to confirm physical operations.

| Audit Type | Scope | Recommended For |

|---|---|---|

| Remote Video Audit | Live walkthrough, machine checks, warehouse view | Mid-tier suppliers, initial screening |

| On-Site Audit (3rd Party) | Full ISO compliance, capacity validation, labor practices | High-volume or regulated products |

| Self-Visit | Direct observation, team interviews | Strategic long-term partners |

✅ Best Practice: Require real-time video call with timestamped footage of production lines. Avoid pre-recorded tours.

Step 3: Validate Production Capacity & Equipment

Assess whether the supplier can meet volume and quality standards.

- Request:

- Production line count

- Monthly output capacity (MOQ verification)

- List of key machinery (e.g., SMT lines for electronics)

- In-house QC labs and testing protocols

⚠️ Red Flag: Inability to provide machine photos or production schedules.

Step 4: Request Client References & Order History

Ask for:

– 3 verifiable client references (preferably U.S.-based)

– Past export documentation (e.g., B/L copies, commercial invoices – redacted for privacy)

– Samples with batch tracking

✅ Verification Tip: Contact references directly and inquire about defect rates, on-time delivery, and communication efficiency.

Step 5: Conduct Product Sampling & Lab Testing

- Order pre-production samples (not stock items)

- Perform third-party lab testing (e.g., SGS, Intertek) for:

- Material compliance (RoHS, REACH, CPSIA)

- Dimensional accuracy

- Functional performance

✅ Standard: Require test reports with traceable batch numbers.

How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “manufacturing” | “Trading,” “import/export” |

| Facility Ownership | Owns factory, land, or long-term lease | No production equipment |

| Production Lines | Visible machines, in-house assembly | Office-only; outsourced production |

| Staff Roles | Engineers, QC technicians, line supervisors | Sales managers, sourcing agents |

| Pricing Structure | Lower MOQs, direct cost breakdown | Higher margins, vague cost details |

| Lead Times | Shorter (control over production) | Longer (dependent on 3rd parties) |

| Customization Ability | High (in-house R&D, tooling) | Limited (subject to factory rules) |

✅ Pro Tip: Ask: “Can you show us your mold storage room or tooling inventory?” Factories typically can; traders cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a front company | Reject or require third-party audit |

| Unwillingness to do video audit | Hides operational gaps | Pause engagement |

| Prices significantly below market | Substandard materials or scams | Verify with sample testing |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos | Reselling others’ listings | Require custom sample |

| Poor English communication | Misunderstandings, errors | Require a bilingual project manager |

| No export experience | Customs delays, compliance failures | Require export documentation proof |

⚠️ Critical Alert: 34% of reported sourcing fraud in 2025 involved suppliers using fake Alibaba storefronts with stolen factory images (ICC China Dispute Resolution Report).

Best Practices for U.S. Procurement Managers – 2026 Outlook

- Use Escrow or LC Payments for first-time suppliers.

- Partner with a China-Based Sourcing Agent for due diligence and audits.

- Require ISO 9001 or IATF 16949 Certification for critical components.

- Diversify Supplier Base – avoid over-reliance on single-source factories.

- Leverage Digital Verification Tools – blockchain-based audit logs, AI-powered document validation.

Conclusion

As U.S. demand for Chinese-manufactured goods remains strong, procurement managers must adopt a data-driven, verification-first approach. Distinguishing real factories from intermediaries, validating production capacity, and identifying red flags early can reduce supply chain disruptions by up to 40%. In 2026, success will belong to organizations that combine technology, due diligence, and on-the-ground verification.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence Unit

Q1 2026 | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Strategic Procurement from China

Prepared for Enterprise Procurement Leaders | SourcifyChina Advisory Group

Why Time-to-Market Is Your Most Critical Sourcing Metric in 2026

Global supply chains face unprecedented volatility: geopolitical shifts, ESG compliance demands, and accelerating buyer expectations. For U.S. procurement teams, 68% of sourcing delays (per 2025 Supply Chain Insights Survey) stem from supplier verification bottlenecks—not logistics or pricing. When sourcing the top U.S. imports from China (Electronics, Machinery, Furniture, Plastics, and Textiles), inefficient vetting directly erodes competitiveness.

The SourcifyChina Pro List Advantage: Quantifiable Time Savings

Our AI-verified Pro List eliminates 3 critical friction points in traditional sourcing:

| Traditional Sourcing Process | Avg. Time Spent | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier identification & initial screening | 82 hours | Pre-qualified shortlist (ISO 9001+/BSCI-compliant) | 75 hours |

| Factory audits & capability validation | 120+ hours | On-demand digital audit reports + live factory cams | 110 hours |

| MOQ/negotiation cycles | 45 hours | Transparent capacity/pricing data + SourcifyChina mediation | 38 hours |

| TOTAL PER PROJECT | 247+ hours | Verified, ready-to-quote suppliers | 223+ hours (90% faster) |

Source: 2025 SourcifyChina Client Data (n=142 U.S. enterprises)

Why U.S. Procurement Leaders Trust Our Pro List in 2026

- Precision Matching: Algorithm cross-references your import history (HS codes, volumes, quality specs) with 8,200+ pre-vetted Chinese factories.

- Risk Mitigation: Real-time compliance tracking (UFLPA, CBAM, REACH) embedded in supplier profiles—no more last-minute shipment holds.

- Cost Transparency: Dynamic pricing benchmarks for top 20 U.S. import categories (e.g., $0.89–$1.12/unit for molded plastic components vs. market avg. $1.35+).

- Scalability: 72-hour supplier onboarding for urgent re-sourcing needs (e.g., tariff-driven supply chain pivots).

“SourcifyChina’s Pro List cut our electronics component sourcing cycle from 11 weeks to 9 days. We redirected 370+ hours annually to strategic cost engineering.”

— Procurement Director, Fortune 500 Industrial Equipment Manufacturer

Your Strategic Next Step: Secure Q4 2026 Sourcing Agility

In 2026, procurement leaders who leverage verified supplier networks will outpace competitors by 22% in time-to-market (Gartner). With U.S.-China trade volumes projected to grow 8.3% YoY (WTO), delaying supplier optimization risks:

– Lost revenue from delayed product launches

– Margin erosion from reactive (vs. strategic) sourcing

– Compliance penalties from unvetted partners

👉 Take Action Today—Reclaim 223+ Hours Per Sourcing Project

Contact our U.S. Sourcing Team for a Custom Pro List Demo:

– Email: [email protected]

Subject line: “Pro List Access – [Your Company] – 2026 Sourcing Plan”

– WhatsApp: +86 159 5127 6160

Message template: “Requesting Pro List for [Product Category] – [Annual Volume]”

Limited Offer: First 15 respondents this month receive complimentary UFLPA compliance mapping for 2026 shipments.

SourcifyChina — Where Verified Supply Chains Drive Competitive Advantage

Advising 84% of U.S. Top 100 Importers Since 2018 | Beijing • Shenzhen • Los Angeles

This report reflects 2026 market intelligence. Data sources: SourcifyChina Analytics, U.S. Census Bureau, WTO. Not for public distribution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.