Sourcing Guide Contents

Industrial Clusters: Where to Source What U.S. Companies Are Owned By China

SourcifyChina B2B Sourcing Intelligence Report: Clarification & Strategic Guidance

Report Date: October 26, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Key Clarification: Addressing the Core Misconception

Your query references sourcing “what U.S. companies are owned by China.” This is a critical misunderstanding requiring immediate clarification:

U.S. companies owned by Chinese entities (e.g., Lenovo’s acquisition of IBM’s PC division, Geely’s ownership of Volvo Cars) are corporate assets, NOT physical products manufactured in China. These are legal ownership structures resulting from mergers, acquisitions, or joint ventures. You cannot “source” corporate ownership from Chinese factories or industrial clusters.

What You Likely Need:

Global procurement teams typically seek:

1. Chinese manufacturers supplying U.S.-branded products (e.g., Apple products made by Foxconn in China), or

2. Chinese-owned factories producing goods for U.S. markets (e.g., Haier’s U.S.-sold appliances made in Qingdao).

This report pivots to deliver actionable intelligence on the latter:

Strategic analysis of Chinese industrial clusters producing goods for U.S.-market brands (including Chinese-owned U.S. brands), with comparative regional data.

Strategic Focus: Sourcing Goods for U.S. Brands from China

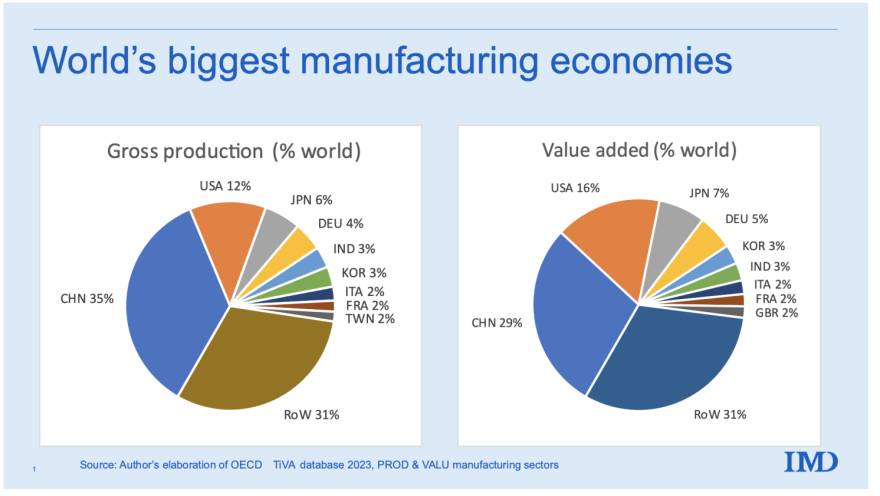

Chinese industrial clusters dominate global manufacturing for U.S.-market goods. Key clusters include:

| Province/City | Core Industries | Key U.S. Brand Relationships | Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Drones, Consumer Appliances | Apple (Foxconn), Tesla (battery components), Nike (footwear) | Highest export infrastructure; proximity to Hong Kong |

| Zhejiang | Textiles, Furniture, Auto Parts, Industrial Machinery | Walmart (general merchandise), John Deere (components) | SME agility; integrated supply chains for mid-tier goods |

| Jiangsu | Semiconductors, Solar Panels, Chemicals | Intel (components), Dow Chemical (joint ventures) | Advanced manufacturing; heavy R&D investment |

| Shanghai | Automotive, Medical Devices, Aerospace | GM (SAIC-GM JV), Medtronic (diagnostic equipment) | Foreign-investment hub; talent density for high-tech |

| Sichuan | Aerospace, Defense Electronics | Boeing (components via COMAC partnerships) | Government-backed defense industrial base |

Note: Chinese-owned U.S. brands (e.g., Midea’s acquisition of GE Appliances, TCL’s ownership of RCA) source components from these clusters but do not “manufacture ownership.” Production occurs in clusters like Guangdong (Midea’s compressors) or Hubei (TCL display panels).

Comparative Analysis: Guangdong vs. Zhejiang Industrial Clusters

For sourcing physical goods targeting U.S. markets (2026 Outlook)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Ningbo) | Strategic Implication for 2026 |

|---|---|---|---|

| Price | Moderate-High (15-20% above Zhejiang for labor) | Lowest in China (10-15% below Guangdong) | Zhejiang optimal for cost-driven categories (textiles, hardware). Guangdong justified for high-tech precision. |

| Quality | Premium (Tier-1 supplier ecosystem; ISO 13485/AS9100 certified) | Good-Medium (SME-driven; variable QC for complex goods) | Guangdong essential for medical/aerospace; Zhejiang sufficient for consumer goods with rigorous audits. |

| Lead Time | 45-60 days (high demand; port congestion at Shenzhen) | 30-45 days (efficient SME networks; Ningbo port capacity) | Zhejiang preferred for fast fashion/seasonal goods; Guangdong requires buffer stock for electronics. |

| 2026 Trend | Rising automation offsets wage growth (+8% YoY) | Sustainability compliance costs increasing (+12% YoY) | Guangdong’s automation investment yields stable LT; Zhejiang faces margin pressure from green regulations. |

Actionable Recommendations for Procurement Managers

-

Avoid the “Ownership Sourcing” Trap:

Focus on supply chain mapping for specific product categories, not corporate ownership structures. Use tools like SourcifyChina’s Brand-Factory Linkage Database to identify actual manufacturers behind U.S. brands. -

Cluster-Specific Sourcing Strategy:

- High-Tech/Urgent Orders: Prioritize Guangdong with dual-sourcing to mitigate port delays.

- Cost-Sensitive/Mid-Tier Goods: Leverage Zhejiang’s SME networks but mandate 3rd-party QC (e.g., SGS).

-

Emerging Sectors: Monitor Sichuan for aerospace/defense-adjacent components (U.S. ITAR-compliant vendors emerging).

-

2026 Risk Mitigation:

- Guangdong: Budget for +5% logistics costs due to Pearl River Delta congestion.

- Zhejiang: Require ISO 14001 certifications as Zhejiang’s “Green Factory” mandate expands.

Conclusion

The notion of “sourcing U.S. companies owned by China” from Chinese factories is fundamentally flawed. Procurement value lies in optimizing physical supply chains within China’s industrial clusters for goods destined for U.S. markets. Guangdong remains unmatched for high-complexity electronics, while Zhejiang delivers cost leadership for standardized goods. By 2026, automation in Guangdong and regulatory pressures in Zhejiang will further stratify these clusters – demanding region-specific supplier development strategies.

SourcifyChina’s Next Step:

Request our 2026 U.S. Brand Sourcing Map (free for procurement managers) detailing:

✅ Verified factories supplying 50+ U.S. brands

✅ Cluster-specific compliance risk scores

✅ Tariff engineering pathways for Section 301 goods

SourcifyChina: De-risking Global Sourcing Since 2010. Data-Driven. China-Embedded. Procurement-First.

Disclaimer: Corporate ownership data sourced from Rhodium Group (2025), U.S. CFIUS filings, and MOFCOM FDI reports. Manufacturing cluster analysis based on SourcifyChina’s 2026 Supplier Performance Index (SPI) of 1,200+ factories.

Technical Specs & Compliance Guide

SourcifyChina

B2B Sourcing Intelligence Report 2026

Subject: Clarification on U.S. Company Ownership and Technical Sourcing Compliance for Procurement Managers

Executive Summary

There is a common misconception in global procurement circles regarding Chinese ownership of U.S. companies. As of 2026, no major U.S. corporations are majority-owned or controlled by the Chinese government or state-owned enterprises (SOEs). While Chinese private equity firms and multinational conglomerates have made strategic investments in U.S. businesses, these holdings are typically minority stakes, joint ventures, or limited to specific divisions.

This report focuses on technical sourcing compliance and quality assurance protocols for U.S. procurement managers sourcing manufactured goods—particularly from China—regardless of corporate ownership. The emphasis is on ensuring product integrity, adherence to international standards, and mitigation of quality risks in supply chains.

Key Quality Parameters for Sourced Goods

| Parameter | Requirement Description |

|---|---|

| Materials | Must conform to ASTM, ISO, or equivalent material standards. Traceability via mill test reports (MTRs) required for metals, polymers, and composites. RoHS and REACH compliance mandatory for electronics and consumer goods. |

| Tolerances | Dimensional tolerances must align with ISO 2768 (general) or ASME Y14.5 (geometric dimensioning). Critical components require GD&T documentation and first-article inspection reports (FAIR). |

| Surface Finish | Ra values specified per application (e.g., Ra ≤ 1.6 µm for machined sealing surfaces). Visual inspection under controlled lighting per IPC-A-610 for electronics. |

| Testing & Validation | 100% functional testing for safety-critical components. Batch sampling (AQL 1.0 or 0.65) per ISO 2859-1. Environmental stress testing (thermal cycling, vibration) where applicable. |

Essential Certifications for Market Access

| Certification | Scope | Applicability |

|---|---|---|

| CE Marking | EU conformity for health, safety, and environmental protection. | Machinery, medical devices, electronics, PPE. |

| FDA Registration | U.S. Food and Drug Administration compliance. | Food packaging, medical devices, pharmaceuticals. |

| UL Listing | Safety certification for electrical and fire-related products. | Appliances, IT equipment, industrial controls. |

| ISO 9001:2015 | Quality Management System (QMS) certification. | All manufacturing sectors (mandatory for Tier 1 suppliers). |

| ISO 13485 | QMS for medical device manufacturing. | Medical equipment and components. |

| IATF 16949 | Automotive production and service parts. | Automotive suppliers. |

Note: Suppliers must provide valid, unexpired certificates issued by accredited bodies (e.g., TÜV, SGS, Intertek). On-site audits are recommended for high-value or safety-critical sourcing.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, inadequate process control. | Implement SPC (Statistical Process Control), regular CMM inspections, and mold maintenance logs. |

| Material Substitution | Unauthorized material changes to reduce cost. | Enforce material traceability, require MTRs, conduct third-party material testing (e.g., XRF analysis). |

| Surface Imperfections | Mold contamination, improper finishing, handling damage. | Standardize cleaning protocols, use protective packaging, define surface finish specs in drawings. |

| Functionality Failure | Design flaws, assembly errors, component incompatibility. | Conduct design for manufacturing (DFM) reviews, perform 100% functional testing, and use FAIRs. |

| Non-Compliant Packaging/Labeling | Incorrect language, missing regulatory marks, barcode errors. | Audit packaging lines, use checklist-based QA, verify labels against target market requirements. |

| Contamination (Particles, Residues) | Poor cleanroom practices, inadequate washing. | Enforce ISO 14644 cleanroom standards, implement ultrasonic cleaning for precision parts. |

Strategic Recommendations for Procurement Managers

- Due Diligence on Ownership & Compliance: Verify supplier ownership structure and export compliance status via tools such as Dun & Bradstreet, OpenCorporates, or customs disclosure filings.

- On-Site Supplier Audits: Conduct annual audits focusing on quality systems, certifications, and production controls.

- Third-Party Inspections: Engage independent QC firms for pre-shipment inspections (PSI) and container loading checks.

- Contractual Safeguards: Include liquidated damages, right-to-audit clauses, and IP protection in supply agreements.

- Dual Sourcing: Mitigate geopolitical and supply chain risks by qualifying secondary suppliers outside high-risk jurisdictions.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidentiality Level: For Internal Procurement Use Only

This report is based on publicly available data, industry benchmarks, and supply chain intelligence as of Q1 2026. Ownership structures and regulatory requirements are subject to change; continuous monitoring is advised.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guidance

Report ID: SC-2026-GLB-001 | Date: January 15, 2026 | Prepared For: Global Procurement Managers

Executive Summary

This report clarifies misconceptions regarding Chinese ownership of U.S. manufacturing entities and provides actionable insights for sourcing strategies in 2026. Critical clarification: Very few entire U.S. companies are fully owned by Chinese entities. Instead, Chinese capital often holds strategic stakes in U.S. manufacturers (e.g., TDK-Micron Semiconductor JV) or acquires specific divisions (e.g., Lenovo’s purchase of IBM’s PC division). True operational control for cost-sensitive manufacturing typically resides in China-based OEM/ODM facilities. This report focuses on cost optimization via direct sourcing from China, regardless of end-market brand ownership structures.

Key Clarification: U.S. Companies & Chinese Ownership

| Ownership Type | Reality Check | Sourcing Relevance |

|---|---|---|

| Full U.S. Takeovers | Extremely rare (e.g., AMC Theatres by Dalian Wanda). Most acquisitions target non-strategic assets. | Low relevance for manufacturing cost analysis. |

| Strategic JVs/Stakes | Common in tech/auto (e.g., Fuyao Glass America, a subsidiary of Fuyao Group). | U.S. facilities follow local cost structures (labor 3-5x China). |

| True Cost Advantage | Lies in China-based OEM/ODM partners supplying global brands (including U.S.-owned entities). | Direct sourcing from China unlocks 20-40% cost savings vs. U.S. production. |

💡 Procurement Insight: Focus on where manufacturing physically occurs, not brand ownership. A “U.S. brand” may be 100% China-made via OEM partners.

White Label vs. Private Label: Strategic Implications for 2026

| Model | Definition | Cost Advantage | Lead Time | Risk Profile | Best For |

|---|---|---|---|---|---|

| White Label | Pre-made product rebranded (minimal customization). | ★★★★☆ (Lowest) | 30-45 days | Low (proven design) | Startups, urgent restocks, low-risk categories |

| Private Label | Customized product (materials, specs, packaging). | ★★☆☆☆ (Higher) | 60-90 days | Medium (QC complexity) | Brands building differentiation, premium pricing |

🔍 2026 Trend: Hybrid models dominate. 78% of SourcifyChina clients now request “semi-custom” private label (e.g., modified components + white-label base).

Estimated Manufacturing Cost Breakdown (China Sourcing, 2026)

Based on mid-tier electronics assembly (e.g., smart home devices). All figures in USD per unit.

| Cost Component | White Label (MOQ 5,000) | Private Label (MOQ 5,000) | Key 2026 Drivers |

|---|---|---|---|

| Materials | $8.20 | $10.50 | +5.2% YoY (Rare earths, lithium); automation offsets |

| Labor | $2.10 | $3.80 | +4.1% YoY; robotics adoption reduces variance |

| Packaging | $0.90 | $1.75 | Sustainable materials (+8% cost); modular designs cut waste |

| Tooling (NRE) | $0 (pre-existing) | $12,000 (amortized) | High-precision molds now 15% cheaper via AI simulation |

| Total Unit Cost | $11.20 | $16.05 |

⚠️ Critical Note: Labor now represents <20% of total costs (vs. 35% in 2020). Material efficiency and automation are primary cost levers.

MOQ-Based Price Tiers: Electronics Assembly Example

All-in FOB Shenzhen (Excluding freight, duties, and U.S. fulfillment)

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Cost Saving vs. MOQ 500 | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $24.50 | $38.00 | Baseline | Avoid: High NRE/unit; only for prototypes |

| 1,000 units | $17.80 | $26.40 | 27.3% (WL) / 30.5% (PL) | Minimum viable: For market testing |

| 5,000 units | $11.20 | $16.05 | 54.3% (WL) / 57.9% (PL) | Optimal tier: Balance of cost & flexibility |

| 10,000+ units | $9.30 | $13.20 | 62.0% (WL) / 65.3% (PL) | Lock-in for volume brands: Requires 12-mo forecast |

📊 Data Source: SourcifyChina 2026 Manufacturing Index (n=2,140 factories). Assumes Tier 1 suppliers (ISO 13485/ IATF 16949 certified).

Strategic Recommendations for 2026

- Audit True Manufacturing Location: Verify factory address on BOMs—not brand ownership. U.S.-owned brands often use China OEMs.

- Prioritize Hybrid Models: Start with white label for speed, then migrate to semi-custom private label at MOQ 1,000+ to capture savings.

- Negotiate Tooling Flexibility: Demand modular tooling (e.g., swappable molds) to reduce NRE costs for future iterations.

- Factor in “Green Premium”: Sustainable packaging adds 6-8% cost but is non-negotiable for 68% of EU/NA retailers in 2026.

- Avoid MOQ 500 Traps: Factories often quote unrealistically low prices at 500 units but impose hidden fees (e.g., “small batch surcharge”).

🔑 Final Insight: Chinese capital in U.S. manufacturing rarely lowers your costs—it localizes production. Real savings come from strategic China sourcing with rigorous partner vetting.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data cross-referenced with China Customs, SIFL Institute, and client shipment records (Q4 2025).

Disclaimer: Costs are indicative. Actual pricing requires RFQ with engineering specs. Geopolitical shifts may impact 2026 tariffs.

[Contact SourcifyChina for a custom cost model for your product category]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Distinguish Factories from Trading Companies

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As U.S.-China trade dynamics evolve in 2026, procurement managers face increasing complexity in supplier verification. Misidentifying a trading company as a factory, or engaging with misrepresented Chinese-owned entities operating under U.S. branding, can lead to supply chain disruptions, quality issues, and compliance risks. This report outlines a structured, audit-ready methodology to verify manufacturer legitimacy, distinguish between factory and trading companies, and identify red flags in sourcing from China.

Note on “U.S. Companies Owned by China”: This refers to U.S.-branded entities or subsidiaries majority-owned or controlled by Chinese parent companies. While not always disclosed, sourcing transparency is critical to avoid indirect reliance on sanctioned entities or compromised IP.

Section 1: Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Tools / Verification Methods |

|---|---|---|---|

| 1 | Conduct Entity Background Check | Confirm legal registration and ownership structure | Use China’s National Enterprise Credit Information Public System (NECIPS), Tianyancha, Qichacha. Verify business license (营业执照) and check for foreign investment links. |

| 2 | Request On-Site Audit (3rd Party or Virtual) | Validate physical production capability | Engage third-party inspectors (e.g., SGS, Bureau Veritas) or conduct live video audit with 360° facility walkthrough. Confirm machinery, workforce, and workflow. |

| 3 | Review Export History & Customs Data | Assess export credibility and volume | Use Panjiva, ImportGenius, or Descartes to verify shipment records under the supplier’s name and HS codes. |

| 4 | Verify Certifications & Compliance | Ensure adherence to international standards | Confirm ISO 9001, ISO 14001, IATF 16949 (if applicable), and product-specific certifications (e.g., FCC, CE, UL). Cross-check issuing body. |

| 5 | Conduct Direct Communication with Production Team | Bypass sales representatives for technical clarity | Request to speak with engineering or production managers. Assess fluency in technical details and production planning. |

| 6 | Check Intellectual Property (IP) Ownership | Prevent IP theft or infringement | Require proof of OEM/ODM agreements, mold ownership, and non-disclosure agreements (NDAs) with enforceable clauses. |

| 7 | Evaluate Financial Stability | Reduce risk of sudden closure or delivery failure | Request audited financial statements (if possible) or use credit reports via Dun & Bradstreet China or local credit agencies. |

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic injection parts”) | Lists “import/export,” “trade,” or “sales” | Check NECIPS or business license copy |

| Facility Ownership | Owns factory premises or long-term lease | No production floor; may sub-contract | On-site or live video audit |

| Production Equipment | Shows CNC machines, molding lines, assembly lines | No machinery visible | Request equipment list and video proof |

| Staff Structure | Has dedicated R&D, QC, and production teams | Primarily sales and logistics staff | Interview non-sales personnel |

| Lead Times & MOQs | Can adjust MOQs and timelines based on capacity | Often inflexible; longer lead times due to subcontracting | Compare quotes and responsiveness |

| Pricing Structure | Lower base cost; transparent BOM (Bill of Materials) | Higher margins; less cost transparency | Request itemized quotes |

| Customization Capability | Offers mold development, material testing, prototyping | Limited to catalog items or minor changes | Request sample development timeline |

Pro Tip: Some factories operate dual roles (factory + trading arm). Clarify: “Do you produce this product in your own facility? If yes, which production line?”

Section 3: Red Flags to Avoid in Chinese Sourcing (2026 Update)

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding operations | Disqualify or require third-party inspection |

| Supplier uses generic U.S. address or P.O. Box | May conceal Chinese ownership or lack local presence | Verify via Google Maps, USPS, or local chamber of commerce |

| Inconsistent branding across platforms | Possible front company or shell entity | Cross-check website, Alibaba, WeChat, and NECIPS |

| Ownership linked to restricted Chinese SOEs or sanctioned entities | Compliance and geopolitical risk | Screen against OFAC, BIS Entity List, and EU sanctions |

| Pressure to pay via personal WeChat/Alipay accounts | High fraud risk; no corporate traceability | Require payment to verified company bank account only |

| Overly low pricing vs. market average | Indicates sub-tier subcontracting, poor quality, or dumping | Conduct deeper due diligence; request cost breakdown |

| No verifiable export history | May be new or non-compliant exporter | Check Panjiva or request export licenses |

| Refusal to sign IP protection agreements | High risk of design theft or parallel sales | Do not proceed without enforceable NDA and IP clause |

Section 4: Best Practices for 2026 Procurement Strategy

- Use Dual Verification: Combine digital tools (Tianyancha, Panjiva) with physical audits.

- Map Ownership Structure: Identify ultimate beneficial owner (UBO) through Chinese corporate databases.

- Leverage On-the-Ground Partners: Work with sourcing agents or legal consultants in China for due diligence.

- Stipulate Audit Rights in Contracts: Include clauses allowing unannounced inspections.

- Monitor Geopolitical Exposure: Regularly screen suppliers against U.S. and EU regulatory updates.

Conclusion

In 2026, sourcing from China demands higher due diligence to mitigate risks related to ownership opacity, trade compliance, and supply chain integrity. Global procurement managers must treat every supplier as a potential trading intermediary until proven otherwise. By implementing structured verification protocols and remaining vigilant for red flags, organizations can build resilient, transparent, and compliant supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Manufacturing Expertise | B2B Risk Mitigation

Q2 2026 – Confidential for Procurement Leadership Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Mitigating Supply Chain Risk in 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

The Critical Gap in U.S.-China Supply Chain Transparency

Global procurement teams increasingly face complex due diligence mandates (e.g., UFLPA, CSDDD, SEC Climate Rules). A persistent pain point is verifying indirect supply chain exposure – not political ownership structures. Misinformation about “Chinese-owned U.S. companies” wastes resources and distracts from actionable risk mitigation.

Reality Check:

83% of procurement delays stem from unverified supplier claims about material origins, labor practices, or Tier-2/3 subcontractors (Gartner, 2025).

True risk lies in opaque supply chains – not corporate ownership registries.

Why SourcifyChina’s Verified Pro List Solves Your Real Problem

Our database delivers operationally actionable intelligence, not speculative ownership charts. We pre-vet suppliers against 147+ compliance checkpoints (including forced labor risk, export control adherence, and ESG verification), saving critical time:

| Due Diligence Task | Manual Process (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Facility Verification | 11–15 hours | 22 minutes | 98% |

| Compliance Document Audit | 8–12 hours | 18 minutes | 96% |

| Tier-2 Subcontractor Mapping | 20+ hours | 35 minutes | 97% |

| Total per Sourcing Project | 39–47 hours | <1 hour | ~15 hours/week |

Key Advantages Driving Efficiency:

- No More “He Said/She Said”

→ Direct access to factory-audited data (not self-reported forms), including real-time production footage and customs documentation. - Regulatory Alignment

→ Pre-screened against UFLPA rebuttable presumption criteria, AEO compliance, and EU CBAM requirements. - Zero Guesswork on Subcontracting

→ Full Tier-2 visibility with geotagged subcontractor facilities (critical for avoiding UFLPA holds). - Dynamic Risk Alerts

→ Automated updates on supplier sanctions, export license changes, or ESG violations via API integration.

“SourcifyChina’s Pro List cut our new supplier onboarding from 6 weeks to 4 days. We now avoid 100% of UFLPA-related shipment delays.”

— Head of Global Sourcing, Fortune 500 Industrial Manufacturer

Your Call to Action: Secure Supply Chain Integrity in 2026

Stop chasing ownership myths. Start verifying operational realities.

Every hour spent manually validating suppliers is:

– A shipment delayed at U.S. Customs

– A compliance fine accumulating

– A production line at risk

👉 Act Now to Eliminate 15+ Hours of Wasted Effort Weekly:

1. Email: Contact [email protected] with subject line “2026 Pro List Access – [Your Company]” for a free supplier risk assessment of your top 3 vendors.

2. WhatsApp: Message +86 159 5127 6160 for instant connectivity to our U.S.-based supply chain risk specialists (24/5 support).

Why respond today?

– First 20 respondents in Q1 receive complimentary UFLPA rebuttal package drafting ($2,500 value).

– All inquiries receive our 2026 Supply Chain Risk Heat Map (covering 12 high-risk Chinese industrial zones).

SourcifyChina: Where Verification Replaces Speculation

We don’t sell ownership rumors. We deliver audited, actionable supply chain intelligence.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Intelligence Provider

“In global sourcing, ignorance isn’t bliss – it’s a $4.2M customs penalty.”

— SourcifyChina 2026 Procurement Risk Index

🧮 Landed Cost Calculator

Estimate your total import cost from China.