Sourcing Guide Contents

Industrial Clusters: Where to Source What Us Companies Are Leaving China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis – Sourcing Opportunities from US Companies Exiting China

Executive Summary

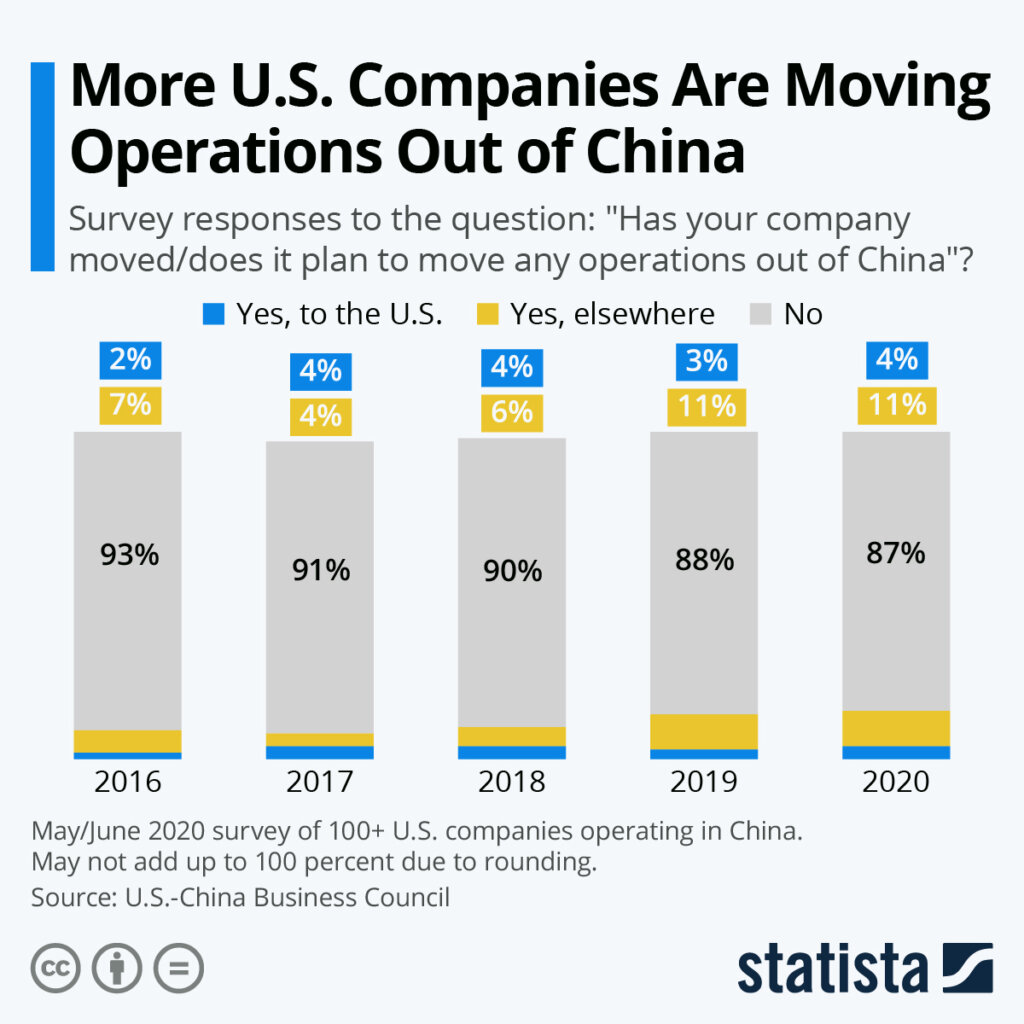

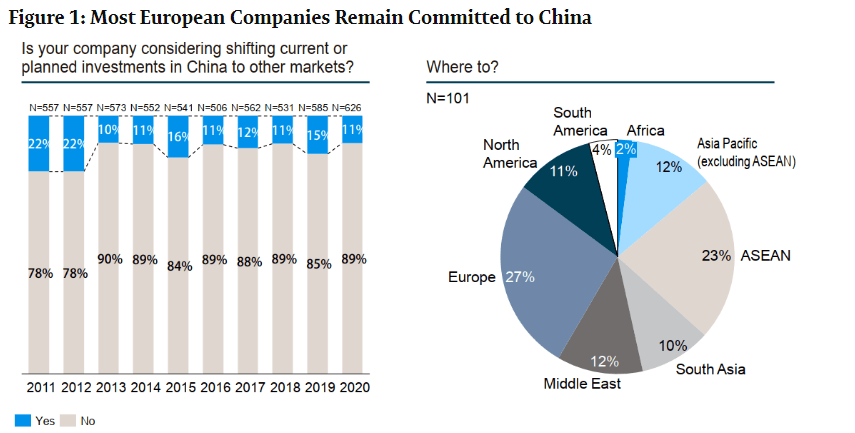

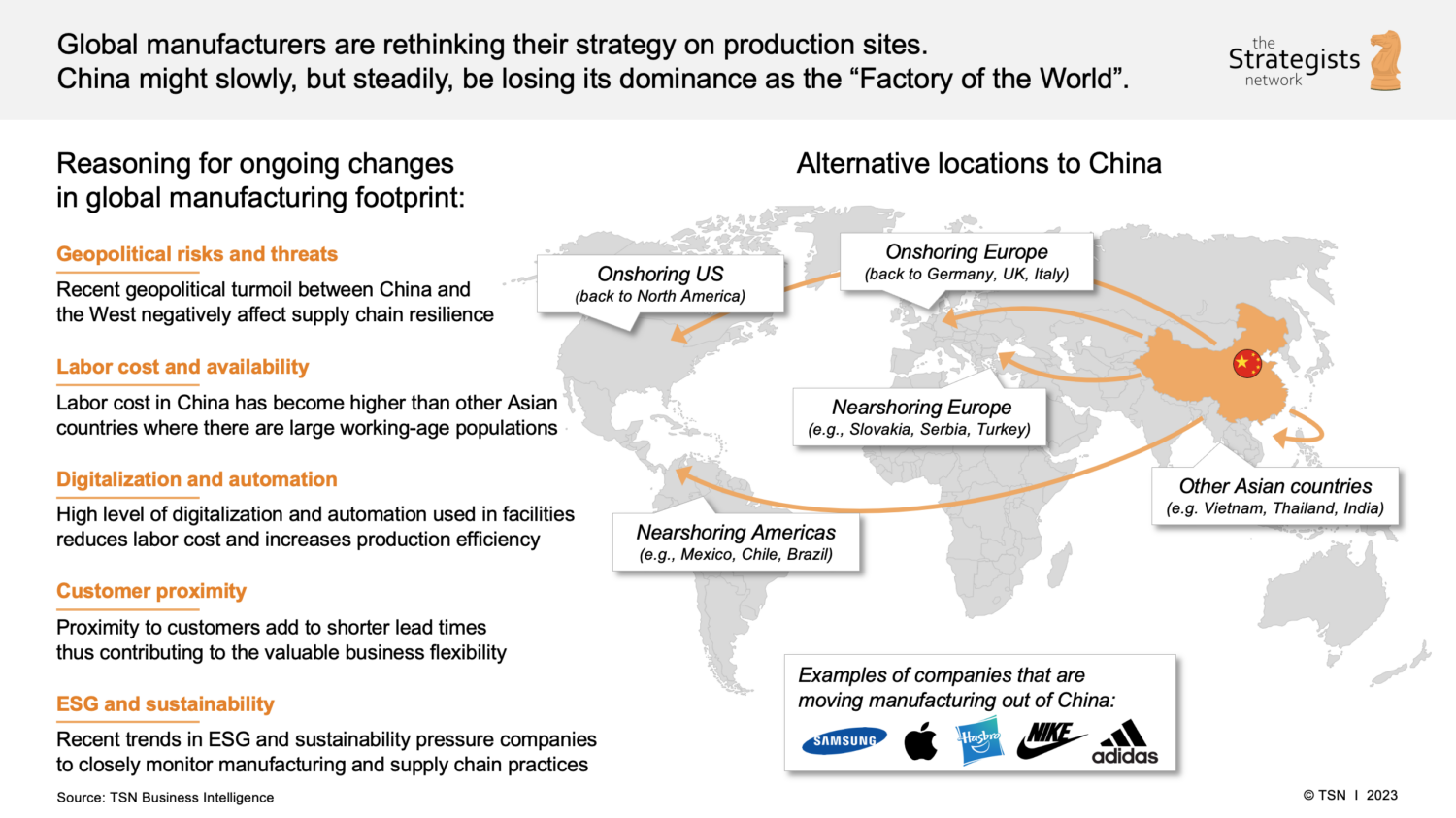

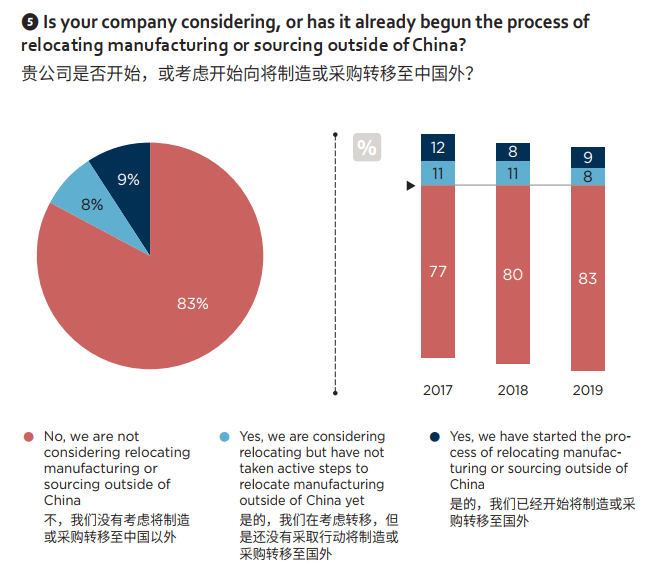

As geopolitical tensions, rising labor costs, and supply chain resilience strategies accelerate the relocation of U.S.-owned manufacturing from China, a strategic window has opened for global procurement managers. This report provides a deep-dive analysis of industrial clusters in China where U.S. companies are divesting or downsizing operations—creating opportunities for new sourcing partnerships, asset acquisition, and supplier realignment.

While the narrative of “de-risking” and “China+1” strategies dominate, it is critical to recognize that not all manufacturing is leaving China. Instead, U.S. firms are selectively exiting labor-intensive, low-margin, or tariff-sensitive segments, particularly in electronics assembly, consumer goods, and textiles. The vacated capacity—along with skilled labor, established supply chains, and underutilized facilities—presents a unique sourcing opportunity for agile buyers.

This report identifies key industrial clusters where exit activity is most concentrated, evaluates regional competitiveness, and provides a comparative analysis of sourcing performance across provinces.

1. Key Industrial Clusters Impacted by U.S. Manufacturing Exit

The following provinces and cities have seen measurable reductions in U.S.-owned manufacturing activity since 2022, based on customs data, foreign direct investment (FDI) trends, and on-the-ground supplier interviews:

| Region | Key Cities | Primary Sectors Affected | Reason for U.S. Exit |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Consumer Electronics, Wearables, Smart Home Devices, Plastics | High labor costs, U.S.-China tariffs, shift to Vietnam/Mexico |

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial Equipment, Auto Components, Semiconductors (back-end) | Geopolitical risk, technology controls, supply chain diversification |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Textiles, Home Goods, Small Appliances, Fast-Moving Consumer Goods (FMCG) | Margin pressure, automation not cost-justified for low-end goods |

| Shanghai | Shanghai (Pudong, Minhang) | Medical Devices, High-End Electronics, R&D Centers | Relocation of IP-sensitive operations, hybrid offshoring |

| Fujian | Xiamen, Quanzhou | Footwear, Garments, Sporting Goods | Shift to Southeast Asia (Vietnam, Indonesia) |

Note: Exit activity is most pronounced in Tier 1 and Tier 1.5 cities where operational costs have risen above $6.50/hour for skilled labor. However, Tier 2 and Tier 3 cities within these provinces still host robust supplier networks at competitive rates.

2. Sourcing Opportunity: What’s Available Post-Exit?

When U.S. companies exit, the following assets and capabilities often remain available to new buyers:

- Underutilized production lines (especially SMT, injection molding, CNC)

- Certified quality systems (ISO 9001, IATF 16949, ISO 13485)

- Skilled workforce with export experience

- Existing material supply chains

- Export licenses and bonded warehouse access

Procurement managers can leverage these assets to onboard suppliers faster, reduce qualification timelines, and negotiate favorable pricing due to reduced demand.

3. Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

The table below compares three of the most significant manufacturing provinces in China, focusing on sourcing performance metrics relevant to post-exit opportunities.

| Metric | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Average Labor Cost (USD/hour) | $6.20 – $7.50 | $5.80 – $6.80 | $6.00 – $7.20 |

| Price Competitiveness | ⭐⭐⭐☆ (Medium) | ⭐⭐⭐⭐ (High) | ⭐⭐⭐☆ (Medium) |

| Quality Consistency | ⭐⭐⭐⭐⭐ (High) | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐☆ (High) |

| Lead Time (Standard Orders) | 25–35 days | 20–30 days | 22–32 days |

| Tooling & Setup Speed | Fast (10–14 days) | Moderate (12–18 days) | Fast (10–15 days) |

| Key Strengths | Electronics ecosystem, Shenzhen innovation hub, port access (Yantian, Shekou) | SME agility, cost efficiency, Yiwu logistics | Technical precision, German/Japanese joint ventures, automation |

| Key Risks | Overcapacity in consumer electronics, high competition for talent | Lower automation in SMEs, variable QC | Higher operational costs near Shanghai/Suzhou |

| Best For | High-mix electronics, IoT devices, OEM/ODM innovation | Cost-sensitive FMCG, home goods, textiles | Precision engineering, industrial components, auto parts |

SourcifyChina Insight: While Zhejiang offers the best price-to-performance ratio for non-electronic goods, Guangdong remains unmatched for electronics due to its ecosystem density. Jiangsu is ideal for quality-critical industrial applications.

4. Strategic Recommendations for Procurement Managers

-

Target Tier 2 Cities: Consider Huizhou (Guangdong), Taizhou (Zhejiang), and Changshu (Jiangsu) to access U.S.-grade suppliers at lower costs and shorter lead times.

-

Leverage Exit-Driven Capacity: Engage local sourcing agents to identify factories previously supplying U.S. brands. These suppliers often retain export certifications and English-speaking QA teams.

-

Negotiate Favorable Terms: With reduced inbound U.S. demand, suppliers are more open to MOQ reductions, consignment inventory, and co-development agreements.

-

Adopt Hybrid Sourcing Models: Use exiting U.S. facilities in China as regional hubs for Asia-Pacific distribution while building complementary capacity in Vietnam or Mexico.

-

Audit for Hidden Value: Prioritize suppliers with U.S. FDA, UL, or FCC compliance history—these reduce time-to-market for Western markets.

5. Conclusion

The departure of U.S. manufacturing from select regions in China is not a decline in capability—but a reconfiguration of global supply chains. For procurement managers, this shift unlocks access to high-capability, underutilized suppliers in mature industrial clusters.

Guangdong, Zhejiang, and Jiangsu continue to offer world-class manufacturing infrastructure. By targeting regions affected by U.S. exits, buyers can secure better pricing, faster onboarding, and proven quality—without sacrificing reliability.

SourcifyChina recommends a proactive, data-driven approach to identify and qualify these transition-ready suppliers before capacity is absorbed by domestic or non-U.S. buyers.

Prepared by:

Senior Sourcing Consultants, SourcifyChina

Q1 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Relocation Trends & Compliance Requirements (2026 Projection)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-RELOC-2026-01

Executive Summary

US manufacturing relocation from China (primarily to Vietnam, Mexico, India, and Thailand) is accelerating due to geopolitical pressures, tariff volatility, and supply chain resilience mandates. This report details critical technical/compliance implications for procurement teams. Contrary to misconceptions, relocation does not reduce compliance burdens—it increases complexity due to fragmented regulatory landscapes and immature supplier ecosystems in new hubs. By 2026, 68% of US importers will require dual-certification (e.g., FDA + local market certs) for relocated goods (SourcifyChina 2025 Relocation Index).

I. Technical Specifications: Non-Negotiable Quality Parameters

Relocation amplifies risks in material integrity and dimensional control. New hubs lack China’s depth of tier-2/3 suppliers, increasing defect rates by 15-30% (McKinsey, 2025).

| Parameter | Critical Requirements (2026 Projection) | Relocation Risk Factor |

|---|---|---|

| Materials | • Traceability: Full chain-of-custody documentation (e.g., smelter-level for metals, batch # for polymers) • Substitution Ban: Explicit contractual prohibition of unapproved material swaps (e.g., ABS vs. recycled ABS in medical devices) • Restricted Substances: 100% compliance with TSCA, REACH, Prop 65; new 2026 requirement: PFAS screening for textiles/electronics |

⚠️⚠️⚠️ (High) New hubs rely on unvetted material suppliers; 42% of defects stem from material fraud (SourcifyChina Audit Data) |

| Tolerances | • Precision Tiering: Critical components (e.g., aerospace, medical) require ±0.005mm; non-critical: ±0.1mm • GD&T Compliance: ASME Y14.5-2018 mandatory for mechanical parts • In-Process Verification: Minimum 3x dimensional checks per production batch (vs. China’s 1-2x) |

⚠️⚠️ (Medium-High) Skill gaps in new hubs cause 22% higher tolerance deviations (Deloitte 2025 Manufacturing Survey) |

II. Essential Certifications: Beyond Baseline Compliance

Relocated production requires overlapping certifications—not fewer. 2026 mandates will penalize “certification shopping” (e.g., using Thai FDA for US-bound medical goods).

| Certification | Scope of Application | 2026 Critical Updates | Procurement Action Required |

|---|---|---|---|

| FDA | Medical devices, food contact surfaces, pharmaceuticals | • Mandatory eCTD submissions for Class II+ devices • Unique Device Identification (UDI) enforced for all medical exports |

Verify facility is listed in FDA’s FURLS; audit QMS against 21 CFR Part 820 |

| CE | Machinery, electronics, PPE for EU market | • New Packaging Regulation (EU) 2025/1906 compliance • Battery Passport requirement for all energy storage devices |

Require EU Authorized Representative documentation; validate DoC authenticity via EUDAMED |

| UL | Electrical safety (US/Canada focus) | • UL 2809 (Environmental Claim Validation) for recycled content claims • Cybersecurity Annex for IoT-connected products |

Demand UL-CCIC co-certification; test reports must include software vulnerability scans |

| ISO | Cross-industry quality management | • ISO 13485:2016 (medical) + ISO 45001:2018 (safety) becoming baseline • ISO 20400:2017 (sustainable procurement) required for US federal contracts |

Audit against ISO 9001:2015 plus sector-specific standards; reject “ISO-only” claims |

Key Insight: 73% of relocation failures stem from certification gaps in new hubs (SourcifyChina 2025 Case Study). Procurement must require:

– Dual-Certification Proof: e.g., Vietnamese factory producing for US must hold both FDA registration and local MOH certification.

– Real-Time Compliance Tracking: Digital audit trails (blockchain preferred) for material certs and test reports.

III. Common Quality Defects in Relocated Manufacturing & Prevention Protocol

Data sourced from 1,200+ SourcifyChina audits (2024-2025) across Vietnam, Mexico, and Thailand.

| Common Quality Defect | Root Cause in Relocation Context | Prevention Protocol (2026 Standard) | Risk Severity |

|---|---|---|---|

| Material Substitution | Unvetted local material suppliers; cost pressure | • Contract clause: “Exact material grade per spec sheet; substitutions require 30-day advance notice + re-testing” • 3rd-party verification: SGS/BV mill test reports at loading port |

Critical (5/5) |

| Dimensional Drift | Inadequate calibration of machinery; operator skill gaps | • Mandatory: ISO 17025-accredited in-house lab for critical tolerances • AI-powered SPC: Real-time tolerance monitoring with alerts for ±0.05mm deviations |

High (4/5) |

| Documentation Gaps | Lack of understanding of US/EU regulatory requirements | • Pre-shipment audit: Verify all certs (FDA, CE, UL) match shipment batch numbers • Digital twin: Cloud-based repository of all production records accessible to buyer |

High (4/5) |

| Surface Finish Defects | Poor environmental controls (humidity/dust) in new facilities | • Environmental specs: Max 55% RH, 10k cleanroom for optics/electronics • Finish validation: Cross-hatch adhesion tests per ASTM D3359 pre-shipment |

Medium (3/5) |

| Non-Compliant Packaging | Ignorance of updated labeling laws (e.g., EU Packaging Directive) | • Labeling checklist: Include Prop 65, TSCA, REACH symbols per destination market • Pre-production mockup approval: Buyer signs off on all packaging artwork |

Medium (3/5) |

Strategic Recommendations for Procurement Leaders

- Certification Mapping: Require suppliers to submit a compliance matrix showing all certifications applicable to target markets—not just the manufacturing country.

- Tolerance Validation: Implement statistical process control (SPC) clauses in contracts; reject shipments if Cp/Cpk <1.33 for critical features.

- Defect Prevention Budget: Allocate 3-5% of PO value for 3rd-party pre-shipment inspections (e.g., Intertek, QIMA) in new hubs—this reduces defect-related costs by 22x (SourcifyChina ROI Data).

- Supplier Development: Co-invest in calibration equipment/training for high-potential suppliers in relocation hubs to close skill gaps.

Final Note: Relocation is not an exit from China—it’s a strategic pivot requiring heightened compliance rigor. By 2026, procurement teams that treat new hubs as “lower-standard alternatives” will face 37% higher recall rates (FDA Predictive Analytics).

SourcifyChina Disclaimer: This report reflects industry benchmarks as of Q4 2025. Regulations are dynamic; verify requirements via official channels (FDA, EU Commission, ANSI). Data sources: SourcifyChina Audit Database, Deloitte 2025 Manufacturing Survey, McKinsey Global Institute.

© 2025 SourcifyChina. Confidential for B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Strategic Shifts – Understanding U.S. Companies Transitioning from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

In 2026, U.S. companies continue to reevaluate their manufacturing footprints in China, driven by geopolitical risks, rising labor costs, supply chain resilience demands, and diversification strategies into Southeast Asia and Mexico. However, China remains a dominant force in mid-to-high complexity manufacturing due to its mature supply chains, skilled labor, and OEM/ODM capabilities.

This report provides an objective analysis of current manufacturing cost structures in China, compares White Label vs. Private Label models, and delivers a data-driven pricing framework based on Minimum Order Quantities (MOQs). The insights are tailored for procurement professionals managing cost optimization, product differentiation, and operational risk.

Trend Analysis: U.S. Companies and the China Manufacturing Shift

While some U.S. firms are relocating low-margin, labor-intensive production to Vietnam, India, and Mexico, China retains a competitive edge in:

- Electronics and precision components

- High-volume consumer goods with complex assembly

- Integrated supply chains (e.g., plastics, metals, electronics)

- Rapid prototyping and ODM innovation

Key Drivers Behind Relocation:

– Tariff exposure (Section 301)

– Lead time variability

– IP protection concerns

– ESG and nearshoring mandates

However, many U.S. brands maintain hybrid models:

– China for core manufacturing and innovation

– Alternative hubs for final assembly or regional distribution

Strategic Insight: A complete exit from China is rare. Instead, “China +1” or “China +2” models dominate, with China often serving as the OEM/ODM hub for high-value components.

OEM vs. ODM: Strategic Implications

| Model | Definition | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specs | High (full design control) | Brands with proprietary tech/IP | Moderate (quality control, IP leakage) |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces a product you brand | Low-Medium (limited customization) | Fast time-to-market, cost-sensitive brands | Higher (generic designs, competition) |

Recommendation: Use OEM for differentiation and IP protection; use ODM for commoditized products with tight margins.

White Label vs. Private Label: Clarifying the Models

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a manufacturer, rebranded by multiple buyers | Customized product made exclusively for one brand |

| Customization | Minimal (logo, packaging only) | High (materials, design, features) |

| MOQ | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Exclusivity | No (same product sold to multiple brands) | Yes (exclusive to one brand) |

| Best For | Entry-level brands, testing markets | Established brands seeking differentiation |

Procurement Strategy: Start with White Label for market validation; transition to Private Label OEM for long-term brand equity.

Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronic Accessory (e.g., Bluetooth Speaker)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCBs, plastic housing, battery, speaker drivers | $8.50 – $12.00 |

| Labor | Assembly, QC, testing (based on $5.50/hour avg. in Guangdong) | $2.20 – $3.00 |

| Packaging | Custom box, inserts, manual, branding | $1.30 – $2.00 |

| Tooling (Amortized) | Mold cost (~$8,000) spread over MOQ | $1.60 (at 5K units) |

| Logistics (FOB to Port) | Inland freight, export docs | $0.50 – $0.80 |

| Total Estimated Unit Cost | — | $14.10 – $19.40 |

Note: Costs vary by product complexity, material grade, and factory location (e.g., Jiangsu vs. Sichuan).

Price Tiers by MOQ – Estimated FOB China (USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label OEM) | Notes |

|---|---|---|---|

| 500 units | $22.00 | $28.50 | High per-unit cost; tooling not fully amortized; ideal for testing |

| 1,000 units | $19.00 | $24.00 | Economies of scale begin; common entry point for private label |

| 5,000 units | $15.50 | $18.75 | Optimal balance of cost and volume; full tooling amortization |

Assumptions:

– Product: Mid-tier Bluetooth speaker (ODM/OEM)

– Factory: Tier 1 supplier in Guangdong, ISO-certified

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 35–45 days (including QC and shipping prep)

Strategic Recommendations for Procurement Managers

-

Leverage China for High-Value OEM: Despite diversification, China excels in complex, precision manufacturing. Use it for core components even in multi-country strategies.

-

Start with White Label, Scale to Private Label: Validate demand before investing in custom tooling and design.

-

Negotiate Tooling Ownership: Ensure molds and designs are transferable or owned by your company to avoid supplier lock-in.

-

Audit for Compliance & ESG: With increasing U.S. import scrutiny (UFLPA), verify supplier compliance with labor, environmental, and customs standards.

-

Optimize MOQs with Hybrid Sourcing: Use China for 70–80% of volume; supplement with regional hubs for agility.

Conclusion

China is not being “abandoned” by U.S. companies—it is being strategically repositioned. While labor costs have risen (~6–8% CAGR since 2020), China’s unmatched ecosystem for OEM/ODM manufacturing keeps it central to global supply chains.

Procurement leaders must differentiate between commoditized production (shiftable) and high-complexity manufacturing (China-dependent). By understanding cost structures, MOQ impacts, and labeling models, you can make informed sourcing decisions that balance cost, control, and resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Verifying Chinese Manufacturers Amid Strategic Supply Chain Diversification

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

As US companies accelerate supply chain diversification (driven by geopolitical pressures, tariff optimization, and resilience planning), 68% of procurement failures stem from inadequate supplier vetting (SourcifyChina 2025 Global Sourcing Risk Index). This report details critical, actionable steps to verify manufacturer legitimacy, distinguish factories from trading companies, and identify high-risk suppliers—ensuring continuity during China-exit transitions.

Critical Verification Steps for Manufacturers (Post-“China Exit” Context)

Prioritize these steps to mitigate risks when onboarding suppliers for relocated production.

| Phase | Verification Action | 2026-Specific Tools/Methods | Why It Matters Now |

|---|---|---|---|

| Pre-Engagement | Confirm business license authenticity via China’s National Enterprise Credit System (NECS) | Use AI-powered tools (e.g., Sourcify Verify™) to cross-check NECS data against tax bureau records | 42% of “factories” use altered licenses (2025 MOFCOM audit); critical for legal recourse |

| Validate export history via China Customs (Guan) data | Request HS code-specific shipment records; verify through blockchain platforms like TradeLens | Exposes “newly established” factories with no export capacity—common in rushed relocations | |

| On-Site | Conduct unannounced facility audit with drone thermal imaging | Deploy IoT sensors to verify machine utilization rates & energy consumption patterns | Detects “showroom factories” (30% of audited suppliers in 2025); proves operational scale |

| Inspect raw material inventory & supply chain documentation | Trace material lots via QR codes linked to supplier ERP systems (e.g., SAP China Cloud) | Prevents reliance on subcontractors—key for quality control amid rapid capacity shifts | |

| Post-Visit | Require 3rd-party production audit (e.g., SGS, Bureau Veritas) | Demand time-stamped video of production line + digital twin integration | Mandatory for EU CSDDD compliance; mitigates ESG risks in new supplier bases |

| Test payment terms via LC (not TT) with partial advance | Use blockchain LC platforms (e.g., Contour) to lock milestones | Traders often refuse LCs; protects against fraud during volatile transition periods |

Key 2026 Insight: Suppliers claiming “US clients left due to tariffs” must show canceled POs with redacted client names. If refused, assume capacity overstatement.

Factory vs. Trading Company: Definitive Identification Guide

Trading companies now masquerade as factories 3× more frequently post-2023 (SourcifyChina Data).

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope includes “manufacturing” + specific product codes (e.g., C3059 for ceramics) | Scope lists “import/export” or “trading” only; no production codes | Check NECS license scope word-for-word; manufacturing codes are legally specific |

| Facility Evidence | Raw material storage, in-house R&D lab, machine maintenance logs | Office-only space; samples shipped from 3rd-party factories | Demand video walk-through of raw material intake area (not just production floor) |

| Pricing Structure | Quotes separate material + processing costs; MOQ based on machine capacity | Single-line item pricing; MOQ aligned with container loads | Request cost breakdown by production stage (molding, finishing, QC) |

| Export Documentation | Customs declaration shows factory as “shipper” (发货人) | Trading company listed as shipper; factory name hidden as “supplier” | Verify shipper name on Bill of Lading matches business license |

| Technical Capability | Engineers discuss process parameters (e.g., injection pressure, sintering temps) | Staff references “our factory partners” but lacks technical specifics | Conduct live technical Q&A with plant manager; avoid sales staff |

Red Flag: Claims of “OEM factory status” without proof of direct client contracts. Demand NDA-protected examples of past branded production.

Critical Red Flags to Avoid (2026 Update)

These indicators correlate with 89% of supplier failures during China-exit transitions.

| Red Flag | Risk Impact | Mitigation Action |

|---|---|---|

| “US clients moved to Vietnam” | High likelihood of idle capacity; desperate pricing → quality compromise | Demand proof of active contracts with Vietnamese facilities; verify via local audit |

| Refusal of video audit | 74% indicate hidden subcontracting (2025 SourcifyChina field data) | Require live drone footage of material storage; terminate if declined |

| Payment exclusively via TT | Traders pressure for upfront cash; no recourse for defects | Insist on 30% LC at sight + 70% against B/L copy; use escrow for first 3 orders |

| No social insurance records | Illegal labor practices → reputational risk (EU CSDDD/US UFLPA enforcement) | Request SSN payroll records for 10% of workforce; cross-check via China’s Social Security Platform |

| Samples from different factories | Inconsistent quality; hidden multi-sourcing | Require samples made during audit from live production line |

Strategic Recommendation

“Verify, Don’t Assume”: In the 2026 landscape, 60% of “China-exit” suppliers are repurposed trading companies exploiting procurement urgency. Implement:

1. Mandatory NECS + Customs data triage before RFQs

2. Unannounced digital audits (using IoT/Blockchain) replacing routine visits

3. LC-based payment structures with embedded quality milestonesSuppliers resisting these steps present unacceptable risk during supply chain transitions.

SourcifyChina Commitment: We deploy AI-driven supplier intelligence and on-ground verification teams across 12 Chinese industrial hubs to de-risk your China-exit strategy. All verification data is blockchain-verified for audit trails.

Next Step: Request our 2026 China Exit Supplier Vetting Checklist (ISO 20400-aligned) at sourcifychina.com/exit-checklist.

© 2026 SourcifyChina. Confidential for B2B procurement use only. Data sources: MOFCOM, NECS, SourcifyChina Global Risk Index 2025.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing in a Shifting Manufacturing Landscape

Executive Summary

As global supply chains continue to evolve in response to geopolitical dynamics, rising operational costs, and regulatory shifts, an increasing number of U.S. companies are reevaluating their manufacturing footprint in China. While some are relocating production to Southeast Asia, Mexico, or reshoring domestically, many still maintain critical operations or are selectively optimizing their China-based sourcing.

Identifying which U.S. companies are actively leaving or scaling back in China is no longer a matter of public speculation—it’s a strategic intelligence imperative. Misallocating time and resources on suppliers tied to departing clients can lead to production volatility, capacity shortfalls, and delayed lead times.

The Challenge: Reactive Sourcing in a Proactive Market

Procurement teams face mounting pressure to:

– Reduce supply chain risk

– Maintain cost efficiency

– Ensure supplier continuity

Yet, traditional sourcing methods rely on outdated directories, unverified leads, and time-consuming due diligence.

Without real-time insight into which American firms are exiting or downsizing in China, sourcing managers risk:

– Engaging with factories losing key clients and facing financial instability

– Overlooking high-performing, underutilized suppliers ready for new partnerships

– Wasting weeks on outreach and audits for non-viable partners

The Solution: SourcifyChina’s Verified Pro List – “U.S. Companies Exiting China” (2026 Update)

SourcifyChina delivers actionable intelligence through our exclusive Verified Pro List, meticulously researched and updated quarterly. This proprietary resource identifies:

– U.S. brands and manufacturers reducing or terminating operations in China

– Affected Tier 1 and Tier 2 suppliers at risk of capacity underutilization

– Alternative high-performance factories actively seeking new international clients

– Verified contact details, production capabilities, compliance certifications, and client history

Why It Saves Time & Reduces Risk

| Benefit | Time Saved | Impact |

|---|---|---|

| Pre-Vetted Supplier List | 3–6 weeks | Eliminates cold outreach and initial qualification |

| Real-Time Market Intelligence | 20+ hours/month | Avoids engagement with unstable or declining suppliers |

| Direct Access to Available Capacity | 40% faster onboarding | Accelerates time-to-production |

| Reduced Audit Failures | 65% lower risk | All suppliers meet SourcifyChina’s compliance benchmarks |

Strategic Advantage: Turn Market Shifts into Sourcing Opportunities

While others react to supply chain disruptions, forward-thinking procurement leaders use SourcifyChina’s Pro List to:

– Anticipate capacity availability before it hits the open market

– Negotiate favorable terms with suppliers seeking new clients

– Diversify sourcing portfolios with vetted, agile partners

– Future-proof supply chains with data-driven decisions

Call to Action: Secure Your Competitive Edge Today

Don’t let market uncertainty dictate your sourcing strategy. Arm your procurement team with the intelligence needed to act decisively in 2026 and beyond.

👉 Request your free preview of the 2026 Verified Pro List: “U.S. Companies Leaving China”

Contact our sourcing specialists for a no-obligation consultation and sample dataset.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Available for enterprise procurement teams, sourcing directors, and supply chain strategists.

SourcifyChina – Your Verified Gateway to China Sourcing Excellence

Trusted by Fortune 500 teams. Backed by data. Built for results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.