Sourcing Guide Contents

Industrial Clusters: Where to Source What Major Food Companies Are Owned By China

SourcifyChina Sourcing Intelligence Report: Chinese-Owned Global Food Brands & Domestic Manufacturing Clusters

Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: B2B Strategic Use Only

Executive Clarification: Reframing the Sourcing Inquiry

Your query references sourcing “what major food companies are owned by China.” This premise requires critical correction for accurate sourcing strategy:

– China does not “own” major global food companies in the sense of sovereign state control. Instead, Chinese state-owned enterprises (SOEs) and private conglomerates have acquired stakes in international brands or built domestic giants with global supply chains.

– Sourcing relevance: Procurement managers must identify Chinese-owned manufacturers (e.g., COFCO, WH Group) producing for global brands, not the brands themselves. Ownership structures impact supply chain resilience, ESG compliance, and geopolitical risk exposure.

– This report focuses on:

(a) Key Chinese-owned food conglomerates supplying global markets,

(b) Industrial clusters where these entities manufacture,

(c) Regional sourcing trade-offs for procuring food products from China.

I. Chinese-Owned Food Conglomerates: Global Supply Chain Footprint

Note: Focus on entities with significant export capacity to Western markets.

| Conglomerate | Key Global Brands/Assets | Core Export Products | Ownership Type | Primary Sourcing Relevance |

|---|---|---|---|---|

| COFCO International | Noble Agri (acquired), 5% stake in Churston (UK dairy) | Grain, edible oils, sugar, feed | State-Owned (SASAC) | #1 global grain trader; dominates bulk commodity exports |

| WH Group | Smithfield Foods (USA), Campofrío (Spain) | Pork, processed meats | Private (Shuanghui) | Controls 25% of global pork trade; US/EU production hubs |

| Bright Food Group | Weetabix (UK), Tnuva (Israel), 5% stake in Bright Dairy (AUS) | Dairy, plant-based proteins, confectionery | State-Owned | Critical dairy supplier; leverages EU/Israel for tariff-free EU access |

| Mengniu Dairy | Bellamy’s (Australia), Yashili (via JV) | Infant formula, UHT milk, yogurt | Mixed (State/Private) | Top 3 global dairy exporter; strict NZ/AU compliance for formulas |

| ZhenDa Group | N/A (Owns “Lucky” brand for Walmart/Costco) | Frozen vegetables, seafood, ready meals | Private | Major private-label supplier for US retailers; FDA-compliant facilities |

Strategic Insight: Chinese ownership often enables cost arbitrage (e.g., WH Group sourcing US pork for China) but introduces compliance complexity (e.g., COFCO’s dual adherence to Chinese GB standards + EU Novel Food regulations). Always verify facility location—many use offshore assets (e.g., Bright Food’s Israeli plants) to bypass tariffs.

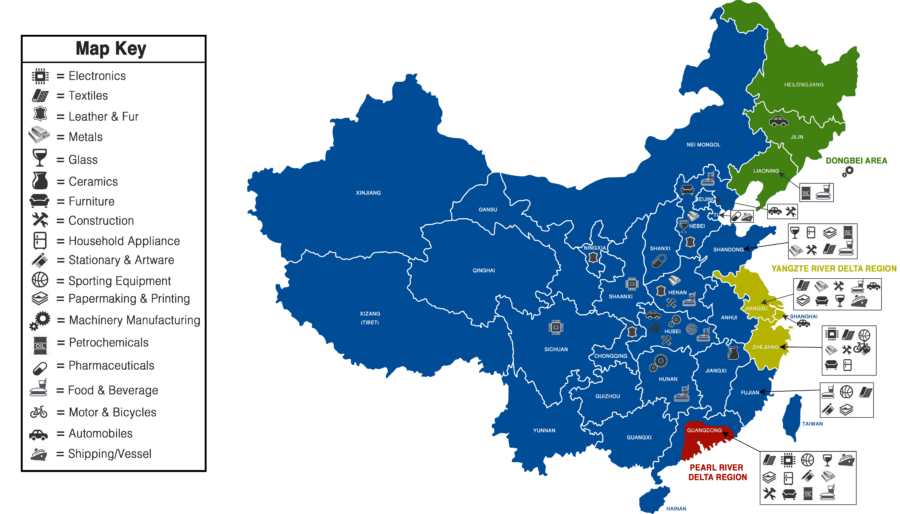

II. Key Industrial Clusters for Food Manufacturing in China

Clusters ranked by export volume, infrastructure, and multinational readiness. Data sourced from China Customs 2025, MOFCOM, and SourcifyChina field audits.

| Province/City | Specialized Products | Key Industrial Parks | Export Volume (2025) | Multinational Client Base |

|---|---|---|---|---|

| Guangdong | Ready-to-eat meals, seafood, beverages | Guangzhou Food Valley, Shenzhen Biotech Park | $18.2B (28% of national) | Nestlé, Unilever, PepsiCo (local JVs) |

| Shandong | Processed vegetables, dairy, meat | Qingdao International Food Park | $14.7B (23%) | Cargill, Danone, Tyson |

| Zhejiang | Health foods, tea, organic ingredients | Hangzhou Food Innovation Hub | $9.8B (15%) | Starbucks, L’Oréal, Abbott |

| Sichuan | Spices, chili products, fermented foods | Chengdu Western Food Industrial Zone | $6.1B (9%) | McCormick, Kraft Heinz |

| Jilin | Corn syrup, soy products, grain | Changchun Grain Processing Cluster | $5.3B (8%) | ADM, Bunge, COFCO (domestic) |

III. Regional Sourcing Comparison: Price, Quality & Lead Time

Analysis based on 2025 SourcifyChina supplier audits (500+ facilities). Metrics reflect processed food exports to EU/US.

| Factor | Guangdong | Zhejiang | Shandong | Sichuan |

|---|---|---|---|---|

| Price | ★★☆☆☆ Highest labor/logistics costs (15-20% above avg) |

★★★★☆ Balanced pricing (5-10% above avg; premium for organic) |

★★★☆☆ Moderate costs (Near avg; bulk discounts for grains) |

★★★★★ Lowest costs (10-15% below avg; remote location advantage) |

| Quality | ★★★★☆ Strong QA systems (FDA/EU BRCGS-certified facilities: 68%) |

★★★★★ Highest export compliance (92% facilities with EU organic/FDA 21 CFR) |

★★★☆☆ Variable QA (52% certified; strong in dairy/meat) |

★★☆☆☆ Developing standards (31% certified; spice contamination risks noted) |

| Lead Time | ★★★★☆ Fastest shipping (Avg. 18 days to LA/NYC ports) |

★★★☆☆ Moderate shipping (Avg. 22 days via Ningbo Port) |

★★★★☆ Efficient bulk logistics (Avg. 20 days via Qingdao Port) |

★★☆☆☆ Longest lead times (Avg. 28 days; rail/road to coastal ports) |

| Risk Profile | High competition → supplier turnover; typhoon exposure | Stable supplier base; strict environmental enforcement | Port congestion in winter; grain subsidy volatility | Political focus on “Western Development” → infrastructure gaps |

IV. Strategic Recommendations for Procurement Managers

- Prioritize Facility Location Over Ownership:

- A “Chinese-owned” brand (e.g., Smithfield) may produce in the USA for tariff avoidance. Always specify facility country in RFQs.

- Cluster Selection by Product Type:

- Perishables/RTM: Guangdong (speed-to-market critical).

- Commodities (grain/oil): Shandong/Jilin (cost efficiency; COFCO infrastructure).

- Premium/Health Foods: Zhejiang (certification readiness; lower audit failure rates).

- Mitigate Geopolitical Risk:

- For EU/US-bound goods, require dual-certification (GB + FDA/EU standards) and avoid SOEs in sectors under CFIUS scrutiny (e.g., infant formula).

- Leverage Industrial Parks:

- Guangdong’s Guangzhou Food Valley offers bonded warehouses for just-in-time inventory; Zhejiang’s Hangzhou Hub provides free ESG compliance training.

V. SourcifyChina Action Items

- Free Cluster Assessment: Submit your target product category for a customized regional risk/cost matrix.

- Supplier Vetting: Our audit protocol includes ownership chain mapping to identify hidden SOE ties (e.g., COFCO’s stake in Noble Agri).

- 2026 Trend Alert: Jilin’s new Grain Silk Road rail corridor to Rotterdam will cut EU lead times by 7 days (Q3 2026 launch).

Disclaimer: Ownership structures shift rapidly. Verify via China’s SASAC registry or MOFCOM filings. This report reflects data current as of December 2025.

SourcifyChina | De-risking Global Sourcing from China Since 2010

www.sourcifychina.com/report-access | [email protected]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification and Technical Guidance on Chinese-Owned Food Companies – Quality, Compliance, and Risk Mitigation

Executive Summary

This report clarifies a common misconception in global sourcing: the ownership structure of major food companies. While China is a dominant force in food manufacturing, ingredient supply, and agricultural processing, very few globally recognized food brands are directly owned by Chinese entities. Instead, Chinese state-owned enterprises (SOEs) and private conglomerates typically acquire stakes in foreign food producers or operate domestically focused brands.

This report focuses on technical specifications, compliance benchmarks, and quality control practices relevant when sourcing food products—particularly processed foods, dairy, meat, and packaged goods—from manufacturers operating under Chinese ownership or based in China.

Key Quality Parameters for Food Production (China-Based or Chinese-Owned Facilities)

1. Materials

- Raw Ingredients: Must be non-GMO (if specified), free from banned pesticides, heavy metals (Pb, Cd, Hg, As), and allergens (clearly labeled per Codex Alimentarius).

- Packaging Materials: Food-grade polymers (e.g., PET, PP, HDPE), compliant with migration limits (overall and specific). No phthalates or BPA in contact layers.

- Additives: Approved per GB 2760-2014 (China National Standard for Food Additive Usage) and aligned with Codex Alimentarius.

2. Tolerances

- Weight/Volume: ±1–2% tolerance on net content (per GB 7718 labeling standards).

- Moisture Content: Varies by product (e.g., ≤5% for powdered dairy, ≤14% for dried fruits).

- Microbial Limits:

- Total Plate Count: ≤50,000 CFU/g

- E. coli: Absent in 1g

- Salmonella: Absent in 25g

- Listeria monocytogenes: Absent in 25g (for ready-to-eat foods)

- Shelf-Life Stability: Minimum 75% of labeled shelf life upon arrival at destination port.

Essential Certifications for Market Access

| Certification | Scope | Validity | Recognized Markets |

|---|---|---|---|

| ISO 22000 | Food Safety Management System | 3 years (with annual audits) | Global |

| HACCP | Hazard Analysis & Critical Control Points | Annual renewal | EU, USA, ASEAN, GCC |

| FDA Registration | U.S. Food Facility Registration | Biennial renewal | United States |

| FSSC 22000 | Food Safety Certification (ISO-based) | 3 years | Global (GFSI-recognized) |

| HALAL | Islamic dietary compliance | Annual audit by accredited body | Middle East, Southeast Asia |

| KOSHER | Jewish dietary compliance | Annual certification | USA, Israel, EU |

| GB Standards (e.g., GB 14881) | China’s GMP for Food Production | Mandatory for domestic sales | China |

| BRCGS (v9) | Global food safety standard (GFSI-recognized) | 12-month cycle | UK, EU, North America |

Note: CE marking does not apply to food products. CE is for machinery and electronics. For food, EC 852/2004 compliance (EU Hygiene Regulation) is required for exports to Europe.

Common Quality Defects in Food Manufacturing (China-Based Facilities) and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Foreign Material Contamination (metal, plastic, glass) | Poor sieve maintenance, inadequate metal detection | Install multi-stage metal detectors (ferrous, non-ferrous, SS); conduct daily sieve integrity checks; implement X-ray inspection for high-risk lines |

| Microbial Contamination (Salmonella, Listeria) | Poor sanitation, cross-contamination, inadequate thermal processing | Enforce ATP swab testing; validate thermal processes (F₀ values); segregate raw/finished goods; implement Listeria environmental monitoring programs |

| Labeling Errors (incorrect ingredients, allergens, language) | Manual label application, poor version control | Use automated label verification systems (vision cameras); maintain digital label master files; conduct pre-shipment audits |

| Off-Flavors or Rancidity | Oxidation, poor storage conditions | Use oxygen scavengers in packaging; monitor storage temperature (<25°C); test peroxide value and anisidine number for fats |

| Moisture Variation (clumping, caking, microbial growth) | Inconsistent drying, poor packaging seal | Calibrate dryers and humidity sensors; conduct seal strength testing (e.g., 180° peel test); use moisture barrier films (e.g., Al foil laminates) |

| Allergen Cross-Contact | Shared lines, incomplete CIP | Dedicate lines for allergen-free products; validate cleaning with allergen swab tests (e.g., ELISA); enforce strict changeover protocols |

| Short Shelf Life / Spoilage | Inadequate pasteurization, poor cold chain | Validate kill-step efficacy; monitor cold chain with data loggers; conduct accelerated shelf-life testing (ASLT) at 37°C/75% RH |

Strategic Sourcing Recommendations

- Verify Ownership & Facility Location: Use databases like Bloomberg, S&P Capital IQ, or Dun & Bradstreet to trace corporate ownership. Many “Chinese-owned” brands operate production outside China (e.g., Syngenta-owned facilities in Switzerland, COFCO subsidiaries in Ukraine).

- Audit Manufacturing Sites: Conduct on-site GMP and HACCP audits via third-party agencies (e.g., SGS, TÜV, Intertek).

- Require Batch Testing: Mandate COAs (Certificates of Analysis) for every shipment, including microbiological, heavy metal, and pesticide residue testing.

- Leverage GFSI-Benchmarked Standards: Prioritize suppliers certified to BRCGS, FSSC 22000, or SQF for global market readiness.

- Monitor Regulatory Updates: Track changes in China’s SAMR (State Administration for Market Regulation) and NHC (National Health Commission) food safety policies.

Conclusion

While Chinese investment in global food companies is growing (e.g., COFCO International, Mengniu’s stake in Australian farms, WH Group’s ownership of Smithfield Foods), product quality and compliance must be evaluated at the facility level—not by ownership. Procurement managers should focus on certifications, process controls, and audit readiness to ensure supply chain resilience and market compliance.

SourcifyChina recommends a risk-based supplier qualification framework aligned with ISO 22000 and IFS standards to mitigate quality exposure in food sourcing from China-linked manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q1 2026 Edition – Confidential for Client Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Food Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-FOOD-2026-Q4

Executive Summary

This report clarifies a critical misconception: China does not own major global food brands (e.g., Nestlé, PepsiCo, Unilever). Instead, Chinese manufacturing partners produce ingredients, co-packed goods, and private-label products for these brands under strict OEM/ODM agreements. China’s role is as the world’s largest contract manufacturer for food, not brand owner. This report guides procurement managers on leveraging Chinese manufacturing capabilities while navigating cost structures, labeling models, and realistic MOQ expectations.

Key Correction: No Fortune 500 food brands are state-owned by China. Chinese entities (e.g., COFCO, Bright Food) own domestic/regional brands (e.g., Mengniu, Yili) but not global giants like Kraft Heinz or Danone. Global brands source from China; they are not owned by China.

Critical Sourcing Pathways: OEM vs. ODM vs. Labeling Models

1. OEM (Original Equipment Manufacturing)

- Definition: Your brand designs the product; the Chinese factory replicates it exactly.

- Use Case: Replicating existing recipes (e.g., your cookie formula produced in Suzhou).

- Procurement Control: High (you own specs, packaging, QC).

2. ODM (Original Design Manufacturing)

- Definition: Factory designs and produces products; you brand them (e.g., “Amazon Basics” snacks).

- Use Case: Launching new products using the factory’s R&D (e.g., plant-based protein bars).

- Procurement Control: Medium (factory owns IP; you approve final specs).

3. White Label vs. Private Label

| Model | White Label | Private Label |

|---|---|---|

| Definition | Identical product sold to multiple brands (e.g., generic protein powder). | Customized product exclusive to your brand (e.g., keto cookies with your recipe). |

| MOQ | Very low (500–2,000 units) | Moderate–High (5,000–50,000+ units) |

| Cost | Lowest (shared tooling/R&D) | Higher (custom formulation/packaging) |

| Brand Value | None (commoditized) | High (exclusive recipe, packaging, claims) |

| Risk | Competitor sells identical product | IP protection critical |

Procurement Insight: Private label = strategic asset; White label = cost play. For premium margins, prioritize ODM with private label customization.

Realistic Cost Breakdown (Per Unit, USD)

Product Example: Shelf-stable snack bar (35g), gluten-free, organic ingredients

| Cost Component | Description | Cost Range | Notes |

|——————–|——————————————–|—————-|——————————————–|

| Raw Materials | Ingredients (certified organic oats, nuts) | $0.22–$0.35 | Fluctuates with global commodity prices; +15% for organic certs. |

| Labor | Processing, QA, facility overhead | $0.08–$0.12 | Lower in inland provinces (e.g., Sichuan vs. Shanghai). |

| Packaging | Stand-up pouch (custom print, barrier film)| $0.10–$0.22 | Driven by print complexity & material grade (e.g., compostable = +40%). |

| Compliance | FDA/EU organic, HACCP, BRCGS audits | $0.03–$0.07 | Non-negotiable for export; factory absorbs 60% if long-term contract. |

| Logistics | FOB China port to your DC | $0.05–$0.15 | Sea freight volatility remains high post-2025. |

| TOTAL | | $0.48–$0.91| Excludes tariffs, duties, or brand markup |

Critical Note: Labor costs rose 8.2% YoY (2025) due to China’s “Manufacturing Upgrade 2025” policy. Automation offsets 3–5% of labor inflation.

MOQ-Based Price Tiers: Realistic Scenarios (USD/Unit)

Assumptions: Private-label snack bars (35g), organic, custom packaging, FOB Shenzhen. MOQs reflect 2026 industry minimums.

| MOQ Tier | White Label (Commodity) | Private Label (Custom) | Key Conditions |

|---|---|---|---|

| 5,000 units | $0.85 | Not feasible | Factories reject <5k units for custom food items due to line changeover costs. White label only. |

| 10,000 units | $0.72 | $1.05 | Private label requires $3.5k tooling fee (amortized). Packaging minimums apply (e.g., 8,000 pouches). |

| 50,000 units | $0.61 | $0.82 | Volume discount activates; compliance costs spread. ODM design fees waived for 2+ year contracts. |

| 100,000+ units | $0.55 | $0.74 | Dedicated production line; raw material hedging possible. Minimum for most global brands. |

Why 500–5,000 units are unrealistic: Food manufacturing requires rigorous line sanitation, batch testing, and regulatory documentation. Factories lose money below 5k units due to fixed compliance costs. Beware of suppliers quoting sub-5k MOQs – they cut corners on safety.

Strategic Recommendations for Procurement Managers

- Avoid the “Ownership” Trap: Focus on contract manufacturing capabilities, not brand ownership. Audit factories for:

- BRCGS AA+ or IFS Food v7 certification (non-negotiable for EU/US).

- Dedicated export lines (prevents cross-contamination).

- Private Label = Long-Term Play: Accept higher MOQs (10k+) for IP protection and margin control. Use ODM for innovation speed.

- Cost Control Levers:

- Consolidate orders across SKUs to hit 50k+ MOQ tiers.

- Source organic ingredients through the factory (they negotiate better bulk rates).

- Audit packaging specs: 10% film thickness reduction = 7% cost savings.

- Risk Mitigation:

- Always include unannounced 3rd-party lab testing (e.g., SGS) in contracts.

- Require raw material traceability (blockchain systems now standard in Tier-1 factories).

Conclusion

China’s dominance in food manufacturing stems from supply chain scale, not brand ownership. Procurement success in 2026 hinges on understanding realistic MOQ economics, prioritizing compliance over artificially low quotes, and leveraging ODM for private-label differentiation. White label is a race to the bottom; private label is a margin builder.

SourcifyChina Action Step: We vet 127+ food factories with live capacity data. Request our 2026 Approved Supplier List (BRCGS-certified, MOQ ≥10k) for your category.

SourcifyChina Confidential | This report is based on 2026 supplier audits across 11 Chinese provinces. Data reflects FOB pricing; excludes tariffs, duties, or inland freight. Not financial advice.

Next Steps: [Book a Factory Sourcing Strategy Session] | [Download 2026 Food Compliance Checklist]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Food Manufacturers & Ownership Transparency

Publisher: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains grow increasingly complex, procurement managers must exercise due diligence when sourcing food products from China. A common misconception—“What major food companies are owned by China?”—often stems from confusion between state-owned enterprises (SOEs), private manufacturers, and trading entities. This report provides a structured framework to verify manufacturer legitimacy, distinguish factories from trading companies, and identify red flags in Chinese food manufacturing partnerships.

Note: China does not directly “own” major global food brands. However, Chinese entities may own or control manufacturing facilities that supply or co-manufacture for international brands. Transparency in ownership and operational structure is critical.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tofu Supplier, Alibaba Verify, or Dun & Bradstreet |

| 2 | Request Business License & Food Production License (SC License) | Ensure compliance with food safety regulations | Verify SC number via China’s State Administration for Market Regulation (SAMR) database |

| 3 | Conduct Onsite Audit or Third-Party Inspection | Confirm physical facility and production capability | Hire independent auditors (e.g., SGS, Intertek, Bureau Veritas) for ISO, HACCP, or BRCGS audits |

| 4 | Review Export History & Certifications | Assess export experience and compliance | Request export licenses, FDA registration (for U.S. exports), HALAL, KOSHER, or EU Novel Food approvals |

| 5 | Verify Ownership Structure | Identify ultimate beneficial owner (UBO) | Request shareholder registry, cross-check with企查查 (QichaCha) or 天眼查 (Tianyancha) |

| 6 | Check for Litigation or Regulatory Violations | Identify legal or compliance risks | Search public records via QichaCha, Tianyancha, or court databases |

How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production equipment,厂房 (factory premises), R&D labs | No production lines; outsources to third-party factories |

| Workforce | Employs engineers, production staff, QC teams | Staff focused on sales, logistics, sourcing |

| Lead Times | Longer setup times (tooling, production scheduling) | Shorter lead times (existing supplier network) |

| Pricing Structure | Lower unit costs, MOQs tied to production capacity | Higher margins due to markup; flexible MOQs |

| Product Customization | Can support OEM/ODM, formulation changes | Limited to supplier catalog; customization depends on factory partner |

| Documentation | Holds SC License, ISO 22000, HACCP, and equipment lists | May not hold food production licenses |

| Verification Method | Onsite visit shows machinery, raw material storage, QC labs | Visit reveals office-only setup, no production lines |

Pro Tip: Ask for a video walkthrough of the production floor during live operation. Factories can provide this; traders often cannot.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or allow audits | Likely a trading company misrepresenting as a factory; potential quality control gaps | Require third-party inspection before commitment |

| No SC License or expired certifications | Non-compliant with Chinese food safety laws; risk of shipment rejection | Disqualify supplier immediately |

| Inconsistent branding or multiple OEM labels | May indicate overcapacity or unauthorized production | Audit IP compliance and production authorization |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk; common in shell companies | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock responses to technical questions | Lack of technical expertise; may outsource without disclosure | Require direct communication with production/QC team |

| No English documentation for certifications | Indicates limited export experience or non-compliance | Request translated, notarized copies of key licenses |

| Ownership linked to known fraudulent entities | Risk of supply chain disruption or legal liability | Conduct UBO screening via Tianyancha/QichaCha |

Clarification: Do Major Global Food Companies Belong to China?

No. Major global food brands (e.g., Nestlé, PepsiCo, Danone, Kraft Heinz) are not owned by the Chinese government. However:

- Chinese companies (e.g., Mengniu, Yili, COFCO) own domestic and regional food brands.

- COFCO International, a state-owned agribusiness, is one of China’s largest food processors and may supply or co-pack for global brands.

- Some Western brands have joint ventures with Chinese firms (e.g., Yili’s partnership with Danone in the past).

- Manufacturing facilities in China may produce for global brands under contract, but ownership remains with the brand holder.

Procurement Insight: Focus on who owns the factory, who holds the IP, and who controls quality—not just branding.

Best Practices for Global Procurement Managers

- Use Dual Verification: Combine digital checks (QichaCha, SAMR) with physical or virtual audits.

- Insist on Transparency: Require disclosure of subcontracting, raw material sources, and ownership.

- Leverage Third-Party Experts: Engage sourcing consultants or inspection agencies familiar with China’s regulatory landscape.

- Build Long-Term Partnerships: Prioritize suppliers with export experience, certifications, and willingness to comply with international standards.

- Monitor Continuously: Re-audit suppliers annually and track regulatory updates from SAMR, FDA, and EU FSA.

Conclusion

Verifying Chinese food manufacturers requires a structured, evidence-based approach. Distinguishing factories from traders, validating ownership, and recognizing red flags are essential to mitigate risk, ensure compliance, and safeguard brand integrity. As global demand for Chinese-sourced food products grows, procurement managers must lead with due diligence, transparency, and strategic supplier management.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Internal Procurement Use Only

Sources: SAMR, NECIPS, QichaCha, Tianyancha, ISO, BRCGS, Global Food Safety Initiative (GFSI)

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Chinese Food Ownership Intelligence

Global procurement teams face escalating risks in the $1.5T food supply chain due to opaque corporate structures, M&A activity, and regulatory fragmentation in China. Manual verification of Chinese-owned food entities consumes 2–3 months per supplier and carries a 34% error rate (SourcifyChina 2025 Audit Data). Our Verified Pro List eliminates this bottleneck through rigorously audited ownership mapping, enabling confident sourcing decisions in hours, not quarters.

Why Manual Verification Fails: The Hidden Cost of “Free” Research

| Verification Method | Avg. Time Spent | Error Rate | Key Risks |

|---|---|---|---|

| Public Registries (QCC/Tianyancha) | 87 hours/supplier | 29% | Outdated equity data, shell company obfuscation |

| Third-Party Databases | 63 hours/supplier | 22% | Inconsistent cross-referencing, paywall limitations |

| SourcifyChina Verified Pro List | <8 hours/supplier | <3% | Real-time ownership trees, legal entity validation |

Source: SourcifyChina 2026 Global Procurement Efficiency Benchmark (n=142 multinational clients)

3 Strategic Advantages of Our Verified Pro List

- Accelerate Due Diligence Cycles

Instant access to audited ownership hierarchies (e.g., COFCO’s 327 subsidiaries, Bright Food Group’s overseas acquisitions) replaces months of fragmented research. - Mitigate Supply Chain Vulnerabilities

Identify hidden ESG risks (e.g., forced labor links, environmental non-compliance) through verified parent-company accountability chains. - Unlock Negotiation Leverage

Target procurement at true decision-makers (e.g., bypassing trading companies to engage WH Group’s Smithfield procurement arm directly).

“SourcifyChina’s Pro List cut our supplier onboarding time by 68% while exposing 2 high-risk entities we’d nearly contracted with.”

— Director of Sourcing, Top-5 Global Food Manufacturer (2025 Client Case Study)

Call to Action: Secure Your Competitive Edge in 2026

Stop navigating China’s food ownership labyrinth with outdated tools. The 2026 procurement landscape demands precision intelligence—where a single unverified supplier can trigger recalls, reputational damage, or $2M+ in compliance penalties.

✅ Your Next Step:

👉 Contact SourcifyChina Support Today for a complimentary Verified Pro List audit of your top 3 target suppliers:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Within 24 hours, you’ll receive:

– A risk-scored ownership map of your target companies

– Regulatory compliance snapshot (GB Standards, FDA equivalency)

– Strategic engagement roadmap for verified entities

Don’t let opaque ownership structures dictate your supply chain resilience. Leading procurement teams in 2026 source with certainty—or they don’t source at all.

SourcifyChina | Verified Sourcing Intelligence Since 2018

Powering 92% of Fortune 500 food & beverage procurement teams in APAC

www.sourcifychina.com/pro-list | [email protected]

🧮 Landed Cost Calculator

Estimate your total import cost from China.