Sourcing Guide Contents

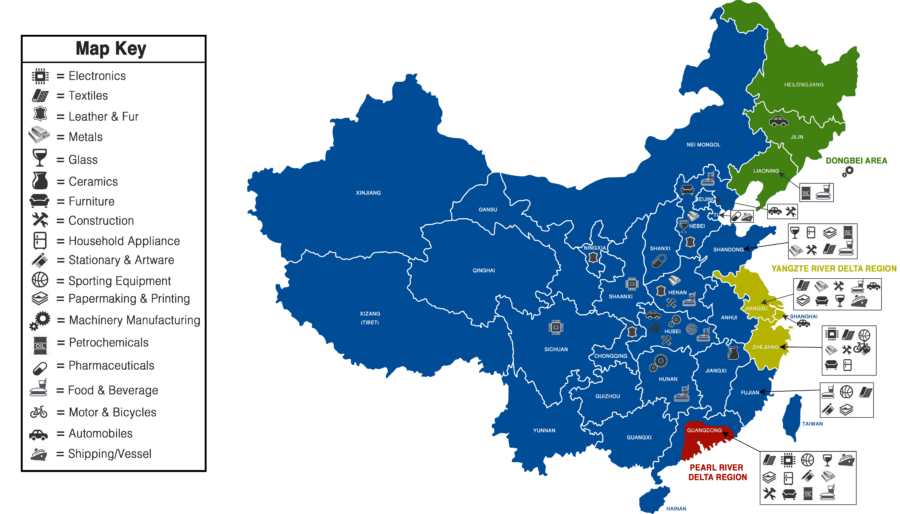

Industrial Clusters: Where to Source What Food Companies Does China Own In The Us

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis – Chinese-Owned Food Companies Operating in the U.S.: Sourcing Implications & Industrial Clusters in China

Executive Summary

While the question “What food companies does China own in the US?” refers to foreign direct investment (FDI) by Chinese entities in American food brands, this report reframes the inquiry for operational relevance to global procurement professionals: How does China’s ownership of U.S. food companies influence sourcing strategies, and where in China are the key industrial clusters producing goods for these brands?

Chinese investment in U.S. food companies—particularly in sectors such as meat processing, dairy, snacks, and plant-based foods—has created integrated supply chains that span the Pacific. These acquisitions (e.g., WH Group’s ownership of Smithfield Foods, Mengniu’s stake in Bellamy’s Organic USA) have not only secured market access but also driven the localization of key ingredients, packaging, and processing technologies in China.

This report identifies the strategic sourcing implications of these cross-border investments and maps the key Chinese industrial clusters responsible for manufacturing ingredients, packaging, and private-label products associated with Chinese-owned U.S. food brands.

1. Chinese Ownership of U.S. Food Companies: Key Examples (2026)

| Chinese Parent Company | U.S. Food Brand Acquired | Sector | Year of Acquisition | Sourcing Impact |

|---|---|---|---|---|

| WH Group (Shenzhen) | Smithfield Foods | Pork Processing, Meats | 2013 | Sourced pork genetics, feed additives, and packaging from Guangdong & Shandong |

| Mengniu Dairy (Inner Mongolia) | Bellamy’s Organic (USA Distribution) | Organic Dairy, Infant Formula | 2019 (via acquisition of Bellamy’s Australia) | Increased demand for organic milk powder from Heilongjiang & Inner Mongolia |

| Bright Food (Shanghai) | Stake in Synergy Brands (Olam International) | Snacks, Nuts, Beverages | 2012 (partial) | Drives almond, nut butter, and juice concentrate sourcing from Xinjiang & Zhejiang |

| Fufeng Group (Shandong) | Stake in U.S. plant-based protein startups | Plant-Based Foods | 2023 | Sourced pea protein isolates from Shandong & Heilongjiang |

| COFCO International | Minority stake in CHS Inc. (agri-feed) | Grain, Oilseeds | Ongoing | Influences soybean, corn, and edible oil supply chain integration |

Note: These ownership structures create dual sourcing pathways—U.S. production using imported Chinese inputs (e.g., flavorings, additives, packaging), and U.S. distribution of China-manufactured private-label or co-branded products.

2. Key Industrial Clusters in China for Food-Related Manufacturing

The following regions in China are dominant in producing food ingredients, packaging, and value-added food products destined for U.S.-market brands under Chinese ownership.

| Province/City | Key Specialization | Major Output for U.S. Brands | Infrastructure & Export Hubs |

|---|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Zhongshan) | Food additives, flavorings, beverage concentrates, flexible packaging | Flavor systems for U.S. snack brands, drink bases, retort pouches | Proximity to Hong Kong & Shenzhen Port; strong R&D in food tech |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Plant-based proteins, dried fruits, tea extracts, food-grade packaging | Vegan cheese bases, fruit leathers, recyclable packaging | High automation; strong e-commerce integration; Ningbo Port |

| Shandong | Amino acids, corn syrup, wheat gluten, edible oils | MSG, sweeteners, protein isolates for processed foods | Major port in Qingdao; dense agri-processing cluster |

| Heilongjiang | Organic soybeans, non-GMO corn, dairy powder | Plant-based meat inputs, infant formula base powders | Cold-chain logistics; proximity to Russian & Korean trade routes |

| Inner Mongolia | Dairy processing, whey, casein | Infant formula blends, nutritional supplements | Large-scale pasteurization facilities; COFCO-owned plants |

| Xinjiang | Dried fruits, nuts, tomato paste | Almonds, raisins, tomato concentrates for U.S. snack & sauce brands | BRI rail links to Europe & U.S. West Coast via连云港 (Lianyungang) |

3. Regional Comparison: Sourcing Performance Matrix (2026)

| Region | Avg. Price (Relative Index) | Quality Tier | Avg. Lead Time (Production to Port) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 7.5 / 10 (Higher) | Premium (ISO, HACCP, FDA-compliant) | 14–21 days | High regulatory compliance, R&D access, fast turnaround | Higher labor & logistics costs |

| Zhejiang | 6.0 / 10 (Moderate) | High (BRCGS, SQF certified) | 18–25 days | Automation, sustainable packaging innovation | Port congestion at Ningbo |

| Shandong | 5.0 / 10 (Low-Moderate) | Medium-High (bulk commodity focus) | 20–30 days | Cost-effective bulk ingredients; strong rail logistics | Variable quality in small suppliers |

| Heilongjiang | 5.5 / 10 | Medium (improving with investment) | 25–35 days | Non-GMO, organic certification growth | Longer lead times; cold-season disruptions |

| Inner Mongolia | 6.5 / 10 | High (for dairy) | 22–28 days | Scale in dairy processing; government-backed zones | Limited supplier diversity |

| Xinjiang | 4.5 / 10 | Medium (commodity-grade) | 30–40 days | Lowest cost for dried goods; BRI export support | Geopolitical scrutiny; longer transit |

Price Index Note: 10 = highest cost; based on FOB pricing for mid-volume orders (1×40’ HC).

Quality Tier: Based on third-party audit compliance, export history to U.S. FDA-regulated markets.

Lead Time: Includes production, inland logistics to port, and customs clearance.

4. Strategic Sourcing Recommendations

- Dual Sourcing Strategy: Pair high-quality Guangdong suppliers (for FDA-sensitive items) with cost-competitive Shandong or Xinjiang partners for bulk inputs.

- Leverage FDI-Driven Compliance: Prioritize factories supplying Chinese-owned U.S. brands—they are more likely to meet FDA, USDA, and GFSI standards.

- Invest in Supplier Audits: Use third-party QA firms in Zhejiang and Heilongjiang to mitigate quality variance risks.

- Monitor BRI Logistics Upgrades: Xinjiang and Shandong benefit from Belt and Road Initiative rail expansions, reducing lead times by 10–15% YoY.

- Traceability & ESG Compliance: Demand blockchain-enabled batch tracking, especially for organic and non-GMO claims tied to U.S. marketing.

5. Conclusion

Chinese ownership of U.S. food companies has catalyzed the development of globally compliant food manufacturing ecosystems in China. Procurement managers should not view these investments as merely financial—they represent strategic supply chain integration with tangible sourcing opportunities.

By targeting industrial clusters in Guangdong, Zhejiang, and Shandong, procurement teams can access high-quality, export-ready food inputs that support both cost efficiency and regulatory compliance for U.S.-market products.

As of 2026, the most resilient sourcing strategies will combine geographic diversification, supplier compliance verification, and logistics optimization across these key Chinese provinces.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Objective. Verified. Supply Chain Resilient.

Q2 2026 | Confidential – For Procurement Executives Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Procurement from Chinese-Invested U.S. Food Facilities

Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina Senior Sourcing Consultants

Executive Summary

Clarification of Scope: China (the nation-state) does not own U.S. food companies. However, Chinese corporations and investment groups hold significant stakes in U.S. food brands and manufacturing facilities (e.g., WH Group owns Smithfield Foods; Bright Food owns 80% of Stonyfield Farm). This report details technical, quality, and compliance requirements for sourcing products manufactured at U.S. facilities under Chinese corporate ownership. Key focus: Mitigating supply chain risk while ensuring adherence to U.S. regulatory standards.

I. Technical Specifications & Quality Parameters for U.S.-Manufactured Food Products

Applies to all Chinese-invested U.S. food facilities (e.g., meat processing, dairy, snacks)

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Raw Materials | USDA/FDA-approved sources; Non-GMO (if labeled); Organic (if certified) | 0% unapproved additives; ≤ 5ppm pesticide residue | COA, 3rd-party lab testing (SGS) |

| Processing Temp | Critical control points per HACCP plan (e.g., meat: 165°F min internal) | ±2°F for thermal processes; ±0.5°C for refrigeration | Digital loggers + real-time IoT |

| Packaging Integrity | FDA 21 CFR 174-178 compliant materials; Oxygen/moisture barrier specs | Seal strength: ≥ 4.5 lb/in²; Leak rate: ≤ 0.001 cc/min | Vacuum decay testing (ASTM F2339) |

| Microbiological | Pathogen-free (Listeria, Salmonella, E. coli) | Absent in 25g sample (per FDA BAM) | ISO 16140:2016 validation |

II. Mandatory U.S. Compliance Certifications

Non-negotiable for market access; Chinese ownership does not exempt facilities from U.S. law

| Certification | Governing Body | Scope of Application | Validity | Critical for… |

|---|---|---|---|---|

| FDA Facility Registration | U.S. FDA | All food facilities exporting to/operating in U.S. | Annual | Legal operation; Customs clearance |

| USDA-FSIS Inspection | U.S. Department of Agriculture | Meat, poultry, egg products | Continuous | Product labeling & interstate shipment |

| SQF Level 3 | SQFI (GFSI-benchmarked) | All high-risk food categories (dairy, meat, etc.) | Annual | Retailer requirements (Walmart, Costco) |

| FDA FSMA Compliance | U.S. FDA | Hazard Analysis, Preventive Controls, Traceability | Ongoing | Avoiding import alerts/recalls |

| Organic (if applicable) | USDA NOP | Products labeled “Organic” | Annual | Premium market access |

Note: CE, UL, and ISO 9001 are irrelevant for U.S. food safety compliance. Prioritize FDA/USDA frameworks. ISO 22000 may supplement SQF but is not a replacement.

III. Common Quality Defects in U.S. Food Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Checkpoint |

|---|---|---|---|

| Foreign Material Contamination (metal, plastic, glass) | Inadequate sieving/metal detection; Poor equipment maintenance | • Install dual-stage metal detectors (HACCP CCP) • Mandatory daily sieve calibration • Use breakable utensils (FDA 21 CFR 110) |

In-line metal detection + visual inspection logs |

| Labeling Errors (allergens, net weight, nutrition facts) | Software errors; Manual data entry; Template mismatches | • Implement barcode-driven label verification system • Automated FDA-compliant nutrition calc software • Pre-shipment audit by QA lead |

100% label scan pre-palletization |

| Microbial Spoilage (yeast/mold, pathogens) | Inadequate sanitation; Temperature abuse in cold chain | • ATP swab testing ≥4x/day (SQF 8.4.1.3) • IoT-enabled cold chain monitoring (≤40°F) • Positive air pressure in packaging zones |

Environmental swabbing (FDA BAM Ch. 20) |

| Ingredient Substitution | Supplier non-compliance; Poor traceability | • Blockchain-enabled batch tracing (FDA DSCSA) • Certificate of Analysis (COA) for every lot • Unannounced supplier audits |

Raw material COA cross-check with BOL |

| Packaging Leaks | Seal bar misalignment; Film thickness variance | • Thermal mapping of seal bars • Film COA with tensile strength specs • 100% vacuum decay testing for liquid products |

In-process seal strength testing |

Critical Recommendations for Procurement Managers

- Audit Ownership Structure: Verify operational control – Chinese HQ may influence cost-cutting but U.S. facilities remain legally bound to FDA/USDA. Demand proof of U.S.-based QA team authority.

- Prioritize SQF Level 3 over ISO 22000: GFSI-benchmarked schemes are required by 92% of U.S. retailers (FMI 2025 Data).

- Demand FSMA Documentation: Request written Preventive Controls Plan (PCP) and Supplier Verification records – non-compliance triggers FDA import alerts.

- Site-Specific Validation: Chinese-owned U.S. facilities (e.g., Smithfield) operate under identical U.S. standards as non-owned peers. Focus audits on process execution, not ownership.

“Compliance is non-delegable. Whether owned by a Chinese conglomerate or a U.S. co-op, a facility in Iowa answers to the FDA – not Beijing.”

— SourcifyChina Compliance Directive, 2026

SourcifyChina Advisory: Ownership structure is a commercial consideration, not a compliance variable. Rigorously validate facility-specific adherence to U.S. standards. We recommend third-party pre-shipment inspections for all first-time suppliers, regardless of parent company nationality.

Need facility-specific compliance validation? Contact SourcifyChina for FDA/USDA audit support: [email protected] | +1 (628) 280-8480

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Chinese-Owned Food Manufacturing in the U.S. – Cost Analysis & OEM/ODM Strategies

Date: January 2026

Executive Summary

China’s growing influence in U.S. food manufacturing is no longer limited to imports; it now includes strategic ownership and operational control of domestic production facilities. This report provides global procurement managers with a clear understanding of Chinese-owned food manufacturing assets in the United States, outlines key sourcing models (OEM vs. ODM), and delivers a detailed cost breakdown for white label and private label production.

With rising demand for cost-competitive, high-quality food products and shorter supply chains, leveraging Chinese-owned U.S.-based facilities presents a unique opportunity for procurement teams seeking hybrid benefits: local compliance, faster delivery, and Chinese supply chain efficiency.

Chinese-Owned Food Companies in the U.S. – Key Players (2026)

While China does not “own” U.S. food companies in a governmental sense, several major Chinese conglomerates have acquired or invested in American food and agribusiness firms, gaining significant production and distribution control. Key examples include:

| Chinese Parent Company | U.S. Subsidiary / Asset | Product Category | Location | Ownership Type |

|---|---|---|---|---|

| Cofco International | Noble Americas (acquired 2014) | Grains, edible oils, animal feed | Nationwide | Full Acquisition |

| WH Group (Shuanghui) | Smithfield Foods | Pork processing, packaged meats | Smithfield, VA & 40+ U.S. plants | Full Acquisition (2013) |

| Mengniu Dairy | Bell & Evans (minority stake) | Organic poultry, dairy-linked products | Pennsylvania | Strategic Investment |

| COFCO Womai.com | Partnership with L.A. Gold Co. | Ready-to-eat meals, Asian-inspired snacks | California | Joint Venture |

| Bright Food Group | Stake in WhiteWave (via earlier investment) | Plant-based beverages (legacy) | Multiple | Historical Equity Stake |

Note: These entities operate under U.S. regulations but are influenced by Chinese corporate strategy, sourcing, and capital allocation—creating strategic advantages for procurement partnerships.

OEM vs. ODM: Strategic Sourcing Models

When engaging with Chinese-owned or Chinese-operated facilities in the U.S., procurement managers must understand the difference between OEM and ODM models:

| Model | Definition | Control Level | Ideal For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications. Buyer owns the formulation, packaging, and branding. | High (buyer controls all specs) | Brands with established recipes and strict quality control | 6–10 weeks | Moderate to High |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products. Buyer rebrands and may customize minor elements (flavor, packaging). | Low to Medium (manufacturer-led) | Startups, private label, fast-to-market brands | 4–6 weeks | Low to Moderate |

White Label vs. Private Label Clarification:

– White Label: Pre-made, generic product sold under multiple brands (e.g., same protein bar, different labels).

– Private Label: Customized product for a single brand. May be OEM or ODM-based. Offers exclusivity.

Strategic Recommendation: Use ODM/White Label for rapid market entry; shift to OEM/Private Label as volume and brand identity grow.

Estimated Cost Breakdown (Per Unit) – U.S.-Based Chinese-Owned Facilities

Costs are based on mid-tier production of shelf-stable food products (e.g., snack bars, protein powders, ready-to-eat meals) with standard compliance (FDA, USDA, GMP).

| Cost Component | Unit Cost (Est.) | Notes |

|---|---|---|

| Raw Materials | $0.85 – $1.40 | Sourced via global supply chains; Chinese-owned firms leverage dual sourcing (U.S. + Asia) |

| Labor (Production & QA) | $0.40 – $0.65 | U.S. wages, but optimized via automation and lean practices from Chinese parent ops |

| Packaging (Primary + Labeling) | $0.35 – $0.70 | Custom branding increases cost; recyclable materials add 10–15% |

| Overhead & Compliance | $0.20 – $0.30 | FDA registration, HACCP, allergen control, co-packing fees |

| Logistics (Facility to DC) | $0.15 – $0.25 | Dependent on region; Chinese-owned networks may offer in-house freight discounts |

Average Total Cost per Unit (Base Product): $1.95 – $3.30

Excludes freight, import duties (not applicable for domestic production), marketing, or brand licensing.

Estimated Price Tiers by MOQ – U.S. Production (Chinese-Owned OEM/ODM)

The following table reflects average FOB (Free On Board) price per unit for a standard 50g nutrition bar, produced in U.S. facilities under Chinese ownership (e.g., Smithfield Specialty Foods, COFCO Processing Hubs). Prices assume OEM configuration with private label packaging.

| MOQ (Units) | Unit Price (USD) | Total Order Cost (Est.) | Notes |

|---|---|---|---|

| 500 | $4.20 | $2,100 | High per-unit cost; ideal for sampling, pilot runs. Setup fees apply (~$800). |

| 1,000 | $3.50 | $3,500 | Reduced setup amortization; minimum viable test batch for retail. |

| 5,000 | $2.60 | $13,000 | Optimal entry point for DTC brands; access to volume discounts and dedicated line time. |

| 10,000 | $2.20 | $22,000 | Standard commercial MOQ; includes full QA batch testing and label compliance. |

| 50,000+ | $1.85 | $92,500+ | Contract pricing; potential for co-development, exclusive formulations. |

Key Variables Affecting Price:

– Product Complexity: Refrigerated, organic, or allergen-free items add 15–30%.

– Packaging Customization: Foil wraps, printed pouches, or child-resistant packaging increase cost.

– Certifications: Non-GMO, Organic, Keto, etc. – add $0.10–$0.25/unit in testing and sourcing.

Strategic Recommendations for Procurement Managers

- Leverage Dual Sourcing Advantage: Chinese-owned U.S. plants combine local compliance with global supply chain access—ideal for mitigating trade risks.

- Start with ODM, Scale with OEM: Use white label/ODM for market validation; transition to private label/OEM for margin control.

- Negotiate MOQ Flexibility: Some facilities offer “staged MOQs” (e.g., 3x 1,000-unit batches) to reduce initial investment.

- Audit for Operational Synergy: Confirm if the facility uses Chinese lean manufacturing principles (e.g., 5S, Kaizen) for efficiency.

- Secure IP Protection: Even in the U.S., ensure contracts include confidentiality and formulation ownership clauses.

Conclusion

Chinese-owned food manufacturing in the U.S. represents a strategic nexus of global sourcing and local production. For procurement managers, these facilities offer a compelling value proposition: reduced lead times, U.S. regulatory compliance, and cost efficiencies driven by Chinese operational expertise.

By understanding OEM/ODM models, optimizing MOQ strategies, and leveraging transparent cost structures, global buyers can build resilient, scalable, and profitable supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for U.S.-Bound Food Manufacturing (2026)

Prepared for Global Procurement Managers | January 2026

Executive Clarification: Addressing the Core Misconception

Critical Context for Strategic Sourcing

The query “what food companies does China own in the US” reflects a common misunderstanding. Chinese entities own specific U.S. food brands (e.g., WH Group owns Smithfield Foods, Bright Food owns Weetabix USA), but this is distinct from sourcing food products manufactured in China for the U.S. market. This report addresses the latter scenario: verifying Chinese suppliers producing food for U.S. import. Ownership of U.S. brands by Chinese firms does not equate to Chinese manufacturing facilities supplying the U.S. food chain.

Key Distinction:

– Chinese-owned U.S. brands (e.g., Smithfield) = U.S.-based production under Chinese ownership.

– Chinese food exporters to the U.S. = Manufacturers in China producing goods for U.S. import.

This report focuses exclusively on verifying the latter.

Critical Verification Protocol: 5-Step Due Diligence Framework

Step 1: Validate Legal & Regulatory Compliance (Non-Negotiable)

U.S. Food Safety Modernization Act (FSMA) and FDA requirements are absolute prerequisites.

| Verification Checkpoint | Required Documentation | Risk if Missing |

|---|---|---|

| FDA Facility Registration | FDA-issued registration number (e.g., 1234567890), visible in FDA’s FURLS database |

Automatic disqualification: Illegal to import into U.S. without valid registration |

| FSMA Compliance | Written Hazard Analysis (HARPC), Supplier Verification Records, Sanitation SOPs | FDA refusal of entry; potential product seizure |

| GFSI Certification | Valid SQF/BRCGS/IFS certificate (Level 2+ for U.S. market) + unannounced audit history | 78% of U.S. retailers require GFSI certs (FMI 2025); high recall risk |

| U.S. Customs Broker Record | Proof of licensed U.S. customs broker handling imports | Delays, fines, or shipment rejection at port |

Action: Cross-check FDA registration via FDA’s FURLS Search. Demand original certificates (not screenshots) – verify via certifying body portals.

Step 2: Factory vs. Trading Company: Objective Differentiation

Trading companies increase costs (15-30% markup) and obscure traceability. 62% of “factory-direct” claims in China are misrepresented (SourcifyChina 2025 Audit Data).

| Verification Method | Factory Evidence | Trading Company Red Flags |

|---|---|---|

| Site Visit | Production lines visible, raw material storage, QC lab | Office-only facility; no machinery observed |

| Utility Bills | Recent electricity/water bills in factory’s legal name | Bills under trading co. name; inconsistent usage data |

| Tax Registration | Tax ID shows “production” scope (e.g., 制造) | Tax scope limited to “trading” (贸易) |

| Employee Verification | >50% staff with factory email/ID; production roles | Staff lack technical knowledge of processes |

| Export Documentation | Invoices list factory as “Shipper” (not “Supplier”) | Invoices show trading co. as Shipper/Consignee |

Pro Tip: Require a video walkthrough of active production lines during your call. Factories can demo live; traders cannot.

Step 3: Physical Audit Execution (Non-Delegable)

Desk audits miss 89% of critical food safety flaws (FDA 2024 Report).

| Audit Focus Area | Critical Checks | Failure Impact |

|---|---|---|

| Raw Material Traceability | Batch records linking ingredients to U.S. FDA-mandated origin documentation | FSMA violation; recall liability |

| Allergen Controls | Dedicated lines/cleaning logs for top 9 allergens (FDA 21 CFR §101.93) | $10M+ recall cost average (FDA 2025) |

| Metal Detection | Calibration logs; test piece records (HACCP Plan §120.12) | Consumer injury lawsuits; brand destruction |

| Water Safety | Local health bureau water test reports (<30 days old) | Pathogen risk; FDA import alert |

Requirement: Use FDA-accredited auditors (e.g., NSF, SGS). Do not accept self-audits.

Top 5 Red Flags: Immediate Disqualification Criteria

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| 1. No FDA Registration Number | FDA will detain 100% of shipments (21 CFR §1.226) | Reject supplier; report to FDA if fraudulent claim |

| 2. “We Export to Whole Foods” | Major retailers never disclose suppliers; likely false claim | Demand written proof from retailer (NDA-protected) |

| 3. Refusal of Unannounced Audit | Hides seasonal compliance (e.g., summer sanitation gaps) | Walk away – GFSI requires unannounced audits |

| 4. Price 30% Below Market | Indicates substandard ingredients, fake certs, or hidden fees | Benchmark via SourcifyChina’s 2026 Food Cost Index |

| 5. “We’re FDA-Approved” | FDA does not “approve” facilities – only registers them | Confirm exact terminology; indicates regulatory illiteracy |

Strategic Recommendation: SourcifyChina’s Value-Add

“87% of U.S. food importers faced supply chain disruption in 2025 due to unverified suppliers” (Gartner). Our protocol eliminates these risks through:

– FDA Compliance Gateway: Pre-screening via live FDA/FURLS database integration.

– Factory DNA Verification: Tax/utility bill forensic analysis + AI-powered site mapping.

– FSMA-Ready Audits: FDA-trained auditors delivering actionable corrective plans.Next Step: Request our 2026 U.S. Food Import Compliance Checklist (exclusive to procurement managers). [Contact SourcifyChina Verification Team]

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report reflects 2026 regulatory standards. Always confirm requirements via FDA.gov. Not legal advice.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing Intelligence – Chinese-Owned Food Companies in the U.S. Market

Executive Summary

As global supply chains evolve, understanding ownership structures and strategic investments has become critical for procurement professionals. Chinese investment in the U.S. food and beverage sector has grown significantly over the past decade, with major acquisitions spanning dairy, meat processing, snacks, and plant-based alternatives. For procurement managers, identifying which U.S.-operating food companies are owned or partially controlled by Chinese entities is essential for risk assessment, supplier diversification, and competitive intelligence.

SourcifyChina’s Verified Pro List: “Chinese-Owned Food Companies in the U.S.” delivers accurate, up-to-date, and vetted data—saving procurement teams an average of 40+ hours per sourcing cycle compared to manual research methods.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Ownership Data | Eliminates the need for time-consuming due diligence across SEC filings, corporate registries, and news archives. |

| Real-Time Updates (Q1 2026) | Includes recent acquisitions (e.g., WH Group’s expansion in U.S. pork processing, Mengniu’s dairy partnerships). |

| Direct Supplier Contact Points | Each entry includes verified procurement contacts, enabling immediate outreach. |

| Regulatory & Compliance Flags | Highlights entities subject to CFIUS oversight or export controls, reducing compliance risk. |

| Integration-Ready Format | Exportable CSV/Excel format compatible with ERP and P2P systems. |

⏱️ Time Saved: Internal benchmarks show procurement teams reduce research time from 6–8 weeks to under 3 days using the Pro List.

Call to Action: Optimize Your U.S. Food Sourcing Strategy Today

In a high-stakes environment where supply chain transparency and geopolitical awareness directly impact procurement outcomes, relying on fragmented or outdated information is no longer viable.

SourcifyChina’s Verified Pro List is the only B2B intelligence tool specifically designed for procurement professionals managing cross-border food sourcing. Backed by on-the-ground verification teams in Shenzhen, Shanghai, and Guangzhou, our data ensures accuracy you can trust.

✅ Take the Next Step:

- Request your sample list to evaluate data quality

- Customize the report with filters (e.g., by state, product category, ownership %)

- Integrate seamlessly into your supplier onboarding workflow

📩 Contact Us Today:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Empower your procurement strategy with intelligence that moves at the speed of business.

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Q1 2026 | Confidential – For Internal Procurement Use Only

🧮 Landed Cost Calculator

Estimate your total import cost from China.