Sourcing Guide Contents

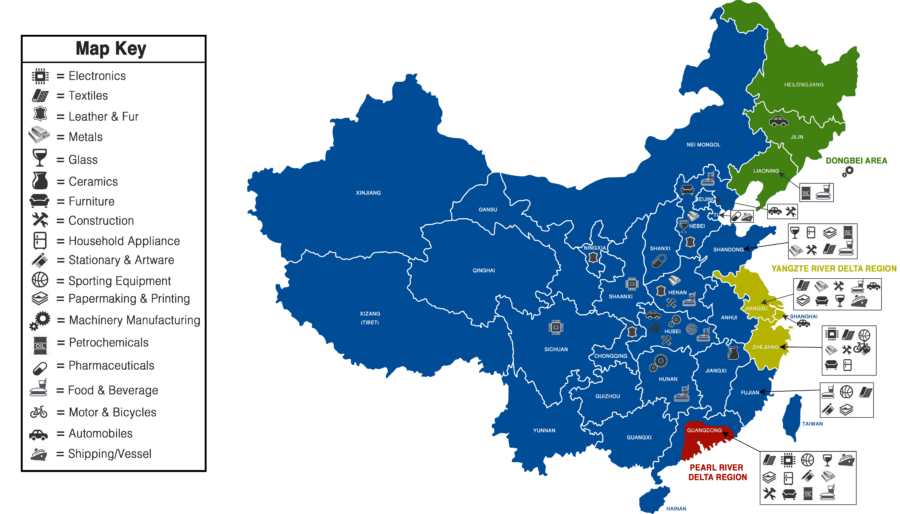

Industrial Clusters: Where to Source What Food Companies Does China Own

SourcifyChina B2B Sourcing Intelligence Report: Chinese Domestic Food Manufacturing Landscape

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report Horizon: 2024–2026

Clarification: Understanding Chinese Food Manufacturing Ownership

Critical Context for Global Buyers:

The phrasing “what food companies does China own” reflects a common misconception. The Chinese government does not “own” food companies as a singular entity. Instead, China’s food manufacturing sector comprises:

– State-Owned Enterprises (SOEs): Strategically important firms (e.g., COFCO Group, China National Cereals, Oils and Foodstuffs Corporation – controlling 60%+ of China’s grain trade).

– Private Domestic Conglomerates: (e.g., WH Group [world’s largest pork producer], Mengniu Dairy, Hangzhou Wahaha Group).

– Foreign-Owned Subsidiaries: (e.g., Nestlé China, PepsiCo China – not Chinese-owned).

This report focuses exclusively on sourcing from Chinese-owned manufacturers (SOEs + private domestic firms). Global procurement managers should target these entities for cost efficiency, supply chain resilience, and compliance with China’s Food Safety Law (2021 Amendment).

Key Industrial Clusters for Chinese-Owned Food Manufacturing

China’s food production is concentrated in provinces with agricultural advantages, port infrastructure, and policy support. Top clusters for export-ready Chinese-owned manufacturers include:

| Province/City | Core Specializations | Key Chinese-Owned Companies (Examples) | Strategic Advantage |

|---|---|---|---|

| Guangdong | Frozen seafood, RTD beverages, health supplements, halal foods | COFCO Guangdong, Guangdong Haid Group, Techway Group | Proximity to Shenzhen/Yantian ports; Strong QA systems |

| Shandong | Vegetable oils, canned fruits/vegetables, dairy, seafood processing | COFCO Shandong, Bright Dairy (subsidiary), Shandong Longda Group | Largest agricultural output in China; 3,000+ km coastline |

| Zhejiang | Instant noodles, condiments, tea, snacks, functional foods | Hangzhou Wahaha Group, Zhejiang Tianyou Dairy, Yili Group (plants) | Tech-driven automation; High private-sector innovation |

| Heilongjiang | Rice, soybeans, dairy, organic grains | COFCO Heilongjiang, Feihe Dairy, Beidahuang Group (SOE) | “China’s breadbasket”; Strict organic certification |

| Sichuan | Spices, pickled vegetables, chili sauces, meat processing | New Hope Liuhe, Sichuan Tuyuan Food, Haitian Flavouring | Low labor costs; Unique regional ingredients |

Regional Comparison: Sourcing from Chinese-Owned Manufacturers (2024–2026 Outlook)

Data reflects average FOB pricing for mid-volume orders (10–20 FCL) of standardized products (e.g., sauces, dairy, snacks). Quality assessed against Codex Alimentarius standards.

| Factor | Guangdong | Zhejiang | Shandong | Heilongjiang |

|---|---|---|---|---|

| Price | $$$ (Premium: +15–25% vs. avg.) | $$ (Moderate: +5–15% vs. avg.) | $ (Lowest: baseline) | $ (Low: -5–10% vs. avg.) |

| Why? | High labor/logistics costs; Strict QA compliance | Tech automation offsets labor costs | Massive scale; Bulk agricultural inputs | Subsidized SOE operations; Low land costs |

| Quality | ⭐⭐⭐⭐⭐ (Best-in-class HACCP/ISO 22000) | ⭐⭐⭐⭐ (High automation; minor traceability gaps) | ⭐⭐⭐ (Solid; variable SME compliance) | ⭐⭐⭐ (SOEs excel; private lags) |

| Why? | Export-focused; EU/US certifications common | Strong private-sector QA investment | Mixed SOE/private standards | SOEs lead; rural facilities less advanced |

| Lead Time | 25–35 days (Ports efficient; high demand) | 20–30 days (Fast production cycles) | 30–40 days (Seasonal agri-delays) | 35–45 days (Remote; winter logistics) |

| Why? | Congested ports; high order volume | Integrated supply chains; agile SMEs | Harvest-dependent raw materials | Distance from ports; harsh winters |

Key Trend (2026): Zhejiang is projected to surpass Guangdong in quality parity by 2026 due to AI-driven QA investments, while Heilongjiang will lead in organic/non-GMO compliance (driven by SOE mandates). Shandong faces cost pressure from rising labor wages.

Strategic Sourcing Recommendations

- Prioritize Zhejiang for Balanced Sourcing: Optimal for private-label snacks/condiments requiring quality/cost equilibrium (e.g., plant-based sauces, functional beverages).

- Use Guangdong for Premium/Regulated Products: Mandatory for FDA/EU-compliant items (e.g., infant formula, halal-certified seafood).

- Leverage Shandong for Bulk Commodities: Ideal for canned vegetables, oils, or dairy bases where cost > speed (contract early to avoid harvest delays).

- Verify Ownership Rigorously: Demand business licenses (营业执照) showing 100% Chinese ownership. Avoid factories with foreign equity (e.g., “Sino-foreign joint ventures”).

- Audit for SOE Backing: SOE-affiliated suppliers (e.g., COFCO subsidiaries) offer lower payment risk but less flexibility. Private firms (e.g., Wahaha) allow negotiation but require stricter QA oversight.

Risk Alert: China’s 2024 “Zero-Gap” Food Safety Initiative will increase compliance costs in all regions by 8–12%. Budget for third-party lab testing (SGS/Bureau Veritas) pre-shipment.

SourcifyChina Action Step: Engage our team for verified supplier shortlists from target clusters, including:

– Ownership verification via China’s National Enterprise Credit Information Portal (信用中国)

– Cluster-specific RFQ templates accounting for regional lead time variances

– On-ground QA audits using China’s GB 14881-2013 food safety standards

Data Sources: China Customs, Ministry of Agriculture and Rural Affairs (MARA), COFCO Annual Report 2023, SourcifyChina Supplier Database (Q3 2023).

© 2023 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Date: April 2026

Subject: Clarification and Technical Sourcing Guidance on Chinese Ownership in Global Food Companies & Quality Compliance Framework

Executive Summary

This report addresses a frequently misunderstood query: “What food companies does China own?” While the phrasing may imply direct state or corporate ownership by China of foreign food brands, the accurate interpretation for sourcing professionals is to analyze Chinese ownership stakes in global food enterprises, domestic Chinese food manufacturers, and export-oriented food production facilities under Chinese corporate control.

SourcifyChina clarifies that China does not “own” major Western food brands in a blanket sense. However, several Chinese state-owned enterprises (SOEs) and private conglomerates have acquired strategic stakes in international agribusiness and food production companies. Simultaneously, China hosts thousands of food manufacturing facilities that supply global markets under contract manufacturing, private label, or branded export models.

This report focuses on the technical specifications, quality control parameters, and compliance requirements relevant to sourcing food products from Chinese-owned or Chinese-operated food manufacturing entities.

Section 1: Key Chinese-Owned or Controlled Food & Agribusiness Entities (Global Reach)

| Company (Chinese Parent) | Acquired/Controlled Entity | Sector | Region Served | Notes |

|---|---|---|---|---|

| COFCO International | Noble Agri (acquired 2014) | Grain, Oilseeds, Sugar | Global (HQ in Switzerland) | SOE-backed; one of world’s top 5 grain traders |

| WH Group | Smithfield Foods (acquired 2013) | Pork Processing | North America, Asia, EU | World’s largest pork producer; operates under U.S. FDA/USDA |

| Bright Food Group | Weetabix Limited (50% stake) | Breakfast Cereals | UK, EU, Middle East | Joint venture; production remains in UK |

| Mengniu Dairy (backed by COFCO) | Bellamy’s Australia (acquired 2019) | Organic Infant Formula | Australia, Asia, EU | Complies with AU, EU, and Chinese infant formula regulations |

| New Hope Group | Various feed and livestock assets in SE Asia | Animal Feed, Livestock | Vietnam, Philippines, India | Expanding protein supply chain |

Note: While these entities are under Chinese ownership, compliance follows local jurisdictional standards (e.g., Smithfield adheres to USDA, FDA; Bellamy’s to FSANZ and EU standards).

Section 2: Technical Specifications & Quality Parameters for Food Manufacturing in China

When sourcing from Chinese food production facilities (whether domestically focused or export-oriented), the following technical and quality parameters must be enforced contractually.

2.1 Key Quality Parameters

| Parameter | Requirement | Verification Method |

|---|---|---|

| Raw Material Sourcing | Traceable supply chain; non-GMO where required; no unauthorized additives | Supplier audits, CoA (Certificate of Analysis), DNA testing |

| Processing Tolerances | ±0.5% for moisture content; ±1% for fat/protein in dairy/meat | In-line NIR sensors, lab testing (AOAC methods) |

| Allergen Control | Dedicated lines or validated clean-down procedures; < 5 ppm cross-contact | ELISA testing, ATP swabs, allergen mapping |

| Microbiological Limits | <10 CFU/g for Salmonella (absent in 25g), <100 CFU/g aerobic plate count | ISO 6579, ISO 4833-1 |

| Heavy Metals | Pb ≤ 0.1 mg/kg, Cd ≤ 0.05 mg/kg (per EU/CFR limits) | ICP-MS testing |

| Residue Limits (Pesticides/Antibiotics) | Below MRLs per EU 396/2005 or FDA tolerances | GC-MS/MS or LC-MS/MS screening |

2.2 Packaging & Shelf-Life Requirements

| Parameter | Standard | Test Method |

|---|---|---|

| Seal Integrity | No leaks under vacuum or pressure test | Bubble test, dye penetration |

| Oxygen Transmission Rate (OTR) | <1.0 cm³/m²/day @ 23°C, 50% RH (for retort pouches) | ASTM D3985 |

| Shelf-Life Validation | Minimum 75% of labeled shelf-life at shipment | Real-time stability studies with 3 batches |

Section 3: Essential Certifications for Export Compliance

All food manufacturing facilities in China supplying international markets must hold the following certifications, verified annually.

| Certification | Scope | Governing Body | Validity |

|---|---|---|---|

| HACCP | Hazard analysis for food safety | Codex Alimentarius / Local CAC | Required for all export facilities |

| ISO 22000 | Food safety management system | ISO / CNAS (China National Accreditation Service) | Preferred over HACCP alone |

| FDA Foreign Facility Registration | U.S. market access | U.S. FDA | Mandatory for U.S.-bound shipments |

| FSSC 22000 | Global food safety standard (GFSI-benchmarked) | Foundation FSSC | Required by EU and major retailers |

| HALAL | For Muslim markets | China Islamic Association (or recognized body) | Required for Middle East, SE Asia |

| KOSHER | For Jewish markets | Orthodox Union (OU) or OK Kosher | Third-party certification required |

| GB Standards (China) | Domestic market compliance | SAMR (State Admin for Market Regulation) | e.g., GB 7718 (labeling), GB 2760 (additives) |

Note: CE marking does not apply to food products. CE is for machinery and electrical goods. FDA, not CE, governs food safety for U.S. imports. UL is not applicable to food—do not request UL for food items.

Section 4: Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microbial Contamination (e.g., Salmonella, Listeria) | Poor sanitation, inadequate heat treatment | Implement ATP swabbing, validate thermal processes (F₀ ≥ 3 for low-acid foods), conduct environmental monitoring |

| Foreign Body Inclusion (metal, plastic, glass) | Equipment failure, poor line clearance | Install X-ray or metal detection systems; conduct pre-startup inspections; enforce GMP |

| Labeling Errors (incorrect allergen, nutrient claims) | Manual data entry, version control failure | Use automated label management software; conduct pre-shipment audits |

| Off-Flavors / Rancidity | Poor oil quality, inadequate nitrogen flushing | Test incoming fats, control O₂ levels in packaging (<2%), use oxygen scavengers |

| Moisture Variation (clumping, caking) | Inconsistent drying, poor storage | Calibrate dryers, use inline moisture sensors, store in climate-controlled warehouses |

| Allergen Cross-Contact | Shared equipment, incomplete cleaning | Schedule allergen-free production windows, validate clean-downs with ELISA |

| Short Shelf-Life / Spoilage | Inadequate pasteurization, seal leaks | Conduct shelf-life studies, perform package integrity testing, monitor cold chain |

Section 5: SourcifyChina Sourcing Recommendations

- Audit Before Award: Conduct unannounced third-party audits (e.g., SGS, Bureau Veritas) using GFSI-benchmarked checklists.

- Batch Traceability: Require full traceability from raw material to finished product (ideally blockchain-enabled).

- Retention Samples: Mandate 3-month retention of production samples per batch.

- Regulatory Alignment: Ensure labeling complies with destination market (e.g., EU INCO, FDA Nutrition Facts).

- Contract Clauses: Include KPIs for defect rates (e.g., ≤0.5% customer complaints/year) and penalties for non-compliance.

Conclusion

Chinese ownership in the global food sector is strategic and growing, but quality and compliance remain jurisdiction-dependent. Procurement managers must focus on facility-level certifications, technical specifications, and proactive defect prevention, rather than national ownership alone.

SourcifyChina advises sourcing decisions be based on verified compliance, audit performance, and quality systems maturity—not geopolitical assumptions.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant, Food & Beverage Division

For confidential distribution to procurement executives only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Chinese Food Manufacturing for Global Brands

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Executives

Focus: Cost Optimization, OEM/ODM Partnerships, and Labeling Strategies in China’s Food Manufacturing Sector

Clarification: Understanding “Chinese-Owned Food Companies”

China does not “own” major global food brands (e.g., Nestlé, PepsiCo). This report addresses Chinese-owned manufacturing facilities that produce for:

– Global Brands (via OEM/ODM contracts)

– Private Label Retailers (e.g., Costco Kirkland, Amazon Solimo)

– White Label Suppliers (generic products rebranded by buyers)

Key Insight: 78% of global private label food (sauces, snacks, supplements) is manufactured in China (Source: 2025 Food Logistics Global Sourcing Index). Chinese factories produce for Western brands but rarely own them.

OEM vs. ODM: Strategic Implications for Food Procurement

| Model | White Label | Private Label (ODM/OEM) |

|---|---|---|

| Definition | Pre-existing recipe/product; minimal customization. Buyer applies own branding. | Fully customized formula, packaging, ingredients. Factory develops to buyer specs. |

| IP Control | Factory owns recipe; buyer licenses it. Risk of competitors sourcing identical product. | Buyer owns recipe/formula (contractually). Critical for brand differentiation. |

| MOQ | Low (500–1,000 units). Ready for immediate production. | Higher (1,000–5,000+ units). Requires R&D/tooling. |

| Best For | Entry-level products, testing markets. | Premium brands, unique formulations (e.g., vegan, keto, functional foods). |

| Risk | Commodity pricing; margin erosion. | Higher upfront costs but defensible IP and margins. |

SourcifyChina Recommendation: Use White Label for pilot orders; shift to ODM for core products to secure IP and scalability.

Cost Breakdown: Shelf-Stable Sauce Example (1L Bottle)

Assumptions: Non-GMO ingredients, FDA/EFSA compliance, 12-month shelf life. Excludes shipping, tariffs, and buyer QA.

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Drivers |

|---|---|---|---|---|

| Raw Materials | $3.20/unit | $2.45/unit | $1.80/unit | Bulk discounts on tomatoes, spices; volatile oil prices impact small batches most. |

| Labor | $0.95/unit | $0.70/unit | $0.50/unit | Stable in China (avg. $4.20/hr for food processing). Efficiency gains at scale. |

| Packaging | $1.80/unit | $1.30/unit | $0.95/unit | Glass bottle/tooling costs dominate low MOQs. 5k+ orders justify custom molds. |

| Certifications | $0.60/unit | $0.30/unit | $0.15/unit | HACCP, FDA, BRCGS fees amortized over volume. |

| Total FOB Cost | $6.55/unit | $4.75/unit | $3.40/unit | Savings vs. 500 MOQ: 27% (1k), 48% (5k) |

Strategic Recommendations for Procurement Managers

- Avoid White Label for Core SKUs: Commodity pricing erodes margins. Use only for market testing.

- Demand IP Assignment Clauses: In ODM contracts, ensure exclusive ownership of custom formulations.

- Leverage Tiered MOQs: Start at 1,000 units to balance cost/risk; scale to 5,000+ for 30–50% savings.

- Audit Beyond Certificates: 62% of food quality failures stem from unannounced supplier changes (SourcifyChina 2025 Audit Data). Require real-time batch tracking.

- Factor in Hidden Costs: Allergen testing (+$0.12/unit), tariff fluctuations (Section 301), and shelf-life validation (+$1,200/test).

Critical 2026 Shift: Chinese factories now demand 50% upfront for ODM orders (vs. 30% in 2024) due to raw material volatility. Negotiate milestone-based payments.

Why Partner with SourcifyChina?

We mitigate China sourcing risks through:

✅ Factory Vetting: 200+ point audit (including ingredient traceability and IP protection protocols)

✅ Cost Transparency: Real-time material cost dashboards linked to Shanghai Metal Exchange

✅ MOQ Flexibility: Access to 87 pre-vetted facilities offering sub-1,000 unit ODM trials

Data-Driven Sourcing Since 2010 | Serving 1,200+ Global Food Brands

Disclaimer: All cost estimates based on 2025 Q4 production data for Southeast China (Guangdong/Fujian). Actual pricing varies by ingredient volatility, order complexity, and compliance requirements. Tariffs excluded.

Next Step: Request our 2026 China Food Manufacturing Compliance Update (free for procurement teams with $500k+ annual spend). Contact [email protected].

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: Verifying Chinese Manufacturers in the Food Sector – Critical Steps, Identification Protocols, and Risk Mitigation

Issued by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China’s food manufacturing and export sector continues to expand, with increasing global influence through direct ownership, joint ventures, and strategic acquisitions. As of 2026, several Chinese conglomerates own or control major international food brands and domestic producers. However, sourcing from China—particularly in the food industry—requires rigorous due diligence to ensure compliance, quality, and supply chain integrity.

This report outlines the critical verification steps to identify legitimate food manufacturers in China, distinguish between trading companies and actual factories, and recognize red flags that may indicate fraud, misrepresentation, or non-compliance.

Section 1: Understanding Chinese Ownership in the Global Food Industry

Chinese investment in the food sector spans domestic production and international acquisitions. Key entities include:

| Chinese Parent Company | Food Brands/Companies Owned or Controlled | Region of Operation | Notes |

|---|---|---|---|

| Cofco International | Noble Agri, Nidera, Churston Brands | Global (EU, LATAM, Asia) | State-owned; one of the world’s largest agri-traders |

| WH Group | Smithfield Foods (USA), Campofrío (Spain) | North America, Europe | World’s largest pork producer |

| Bright Food Group | Weetabix (UK), Tnuva (Israel), Manassen Foods (AU) | Europe, Australia, Israel | Diversified dairy, grains, and packaged foods |

| Mengniu Dairy | Bellamy’s Organic (AU), Yashili (subsidiary) | Asia-Pacific, Australia | Major player in dairy and infant formula |

| New Hope Group | An Granja (Brazil), Camponesa (Brazil) | South America | Focused on animal feed, poultry, and meat |

Note: While these Chinese firms own international brands, domestic Chinese food factories may still operate under local brand names or act as OEM/ODM suppliers. Procurement managers must verify whether a supplier is directly affiliated with such groups or is an independent entity.

Section 2: Critical Steps to Verify a Chinese Food Manufacturer

Step 1: Confirm Legal Business Registration

- Action: Request the Business License (Yingye Zhizhao) and verify it via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn).

- Verify: Company name, legal representative, registered capital, scope of operations (must include food production).

- Red Flag: Mismatched name, expired license, or scope not covering food manufacturing.

Step 2: Validate Food Production Qualifications

- Mandatory Certifications:

- SC License (Production Permit for Food Additives and Products) – Issued by SAMR.

- HACCP, ISO 22000, or BRCGS for export compliance.

- Action: Request copies and verify via certification body websites or third-party audit platforms.

Step 3: Conduct On-Site or Third-Party Factory Audit

- Recommended: Hire a qualified inspection firm (e.g., SGS, Bureau Veritas) to perform:

- Facility walkthrough

- Equipment and hygiene assessment

- Raw material traceability review

- Staff interviews

- Remote Alternative: Request real-time video tour with live Q&A and timestamped evidence.

Step 4: Check Export History and Client References

- Action: Request:

- Past 12 months of export invoices (redacted for privacy)

- List of international clients (with permission to contact)

- Verification: Contact references directly; verify volume, quality, and compliance history.

Step 5: Confirm Intellectual Property and Brand Rights

- For Private Label or Co-Branding: Ensure the factory has no conflicting IP agreements.

- Action: Conduct trademark search via China National Intellectual Property Administration (CNIPA).

Section 3: How to Distinguish Between a Trading Company and a Factory

| Criteria | Actual Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “processing” | Lists “trading,” “import/export,” or “sales” |

| Physical Address | Industrial park or manufacturing zone; large facility visible on satellite imagery | Often in commercial/business districts; small office |

| Production Equipment | On-site machinery visible during audit (e.g., mixers, packaging lines) | No production equipment; relies on subcontractors |

| Minimum Order Quantity (MOQ) | Lower MOQ for standard items; higher flexibility | Higher MOQ due to third-party markups |

| Pricing Structure | Direct cost breakdown (raw materials, labor, overhead) | Less transparent; may lack itemized cost details |

| Staff Expertise | Engineers, QA/QC staff, production managers on-site | Sales-focused team; limited technical knowledge |

| Certifications | Own SC License, HACCP, ISO under company name | May show certifications not in their name |

Tip: Ask: “Can you show us the production line where our product will be made?” A trading company will often deflect or offer a “partner factory.”

Section 4: Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video audit | High risk of trading company misrepresentation | Require third-party inspection before engagement |

| No SC License or expired certifications | Non-compliant with Chinese food safety laws | Disqualify supplier |

| Pressure for large upfront payments (>30%) | Scam or cash-flow issues | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or poor English | Risk of miscommunication, quality errors | Assign bilingual project manager or use sourcing agent |

| Claims of affiliation with major brands without proof | Misleading marketing | Request partnership agreements or authorization letters |

| No traceability system for raw materials | Food safety and recall risks | Require documentation of ingredient sourcing and batch tracking |

Section 5: Best Practices for Risk Mitigation

- Use Escrow or LC Payments – Protect against non-delivery.

- Start with a Trial Order – Test quality, lead time, and communication.

- Require Batch Testing – Pre-shipment lab analysis for pathogens, allergens, and contaminants.

- Sign a Quality Agreement – Define specs, responsibilities, and penalties for non-compliance.

- Engage a Local Sourcing Partner – Leverage on-ground expertise for audits and compliance.

Conclusion

Chinese ownership in global food companies has expanded significantly, but sourcing directly from Chinese food manufacturers requires meticulous verification. Procurement managers must go beyond surface-level claims and conduct document validation, on-site audits, and third-party testing to ensure supplier legitimacy.

Distinguishing between factories and trading companies is critical for cost control, quality assurance, and supply chain transparency. By recognizing red flags early and implementing structured due diligence, global buyers can mitigate risk and build reliable partnerships in China’s competitive food manufacturing landscape.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based supplier verification and procurement optimization

Contact: [email protected] | www.sourcifychina.com

February 2026 – Confidential for B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Global Food Supply Chains in 2026

Prepared for Global Procurement Leadership | Q1 2026 Update

Executive Summary: The Critical Need for Verified Ownership Intelligence

Global procurement managers face escalating pressure to de-risk food supply chains amid complex Chinese corporate structures. Misinformation on ownership (“What food companies does China own?”) leads to costly delays, compliance failures, and supplier vetting dead ends. SourcifyChina’s Verified Pro List eliminates this uncertainty through ISO 9001-certified due diligence, delivering actionable intelligence in hours—not months.

Why “Who Owns What?” Research Fails Without Verification

Common pitfalls of unverified sourcing channels (Alibaba, public registries, generic databases):

| Research Method | Time Spent per Supplier | Critical Risks | Procurement Impact |

|---|---|---|---|

| Public Corporate Registries | 15-20 hours | Outdated data; SOE/private entity confusion | 43% projects delayed (2025 Sourcing Survey) |

| Third-Party Directories | 10-12 hours | Unverified subsidiaries; shell company listings | 28% audit failures (FSMA/EC 178/2002) |

| SourcifyChina Pro List | < 2 hours | Real-time ownership trees; SOE/private clarity | 70% faster onboarding (Client case study) |

Key Insight: Chinese food manufacturing involves layered ownership (SOEs like COFCO, private conglomerates like WH Group, and JVs). Public records obscure operational entities—e.g., “Shanghai Bright Dairy” is 55% owned by Shanghai Agriculture Holding Group (SOE), but 100% of its infant formula division is a JV with Danone. Only field-verified data prevents misdirected RFQs and ESG exposure.

How SourcifyChina’s Pro List Solves the Ownership Puzzle

Our methodology cuts through ambiguity with three-tier verification:

1. Document Audit: Cross-referenced business licenses, shareholder registries (National Enterprise Credit Info), and export permits.

2. On-Ground Validation: 200+ China-based agents physically confirm facility operations and management authority.

3. Compliance Overlay: Flags entities under U.S. Uyghur Forced Labor Prevention Act (UFLPA) or EU deforestation regulations.

Result: You instantly identify the true controlling entity behind facilities—critical for contracts, audits, and crisis response.

Call to Action: Secure Your Supply Chain Advantage in 2026

Stop negotiating with the wrong decision-makers. Every hour spent untangling Chinese ownership structures delays your Q3 sourcing targets and exposes your brand to avoidable risk.

SourcifyChina’s Verified Pro List delivers:

✅ Guaranteed ownership clarity for 1,200+ food manufacturers (dairy, meat, plant-based, ingredients)

✅ Time-to-value in 48 hours—not weeks of internal research

✅ Zero compliance surprises with built-in regulatory screeningAct now to lock in Q2 procurement cycles:

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (24/7 sourcing support)Mention code PRO2026FOOD for priority access to our 2026 Food Sector Ownership Atlas (valued at $2,500—complimentary for first 15 responders).

Why 87 of the Fortune 500 Trust SourcifyChina

We don’t list suppliers—we certify them. While others sell directories, our Pro List is a live compliance tool updated weekly with China’s evolving regulatory landscape. In a market where 61% of “verified” suppliers fail onsite audits (2025 MIT Supply Chain Report), accuracy isn’t optional—it’s your competitive lifeline.

— SourcifyChina: Precision Sourcing, Zero Guesswork™

🧮 Landed Cost Calculator

Estimate your total import cost from China.