Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Rely On China

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Key Industrial Clusters in China for Critical Sourcing Categories

Executive Summary

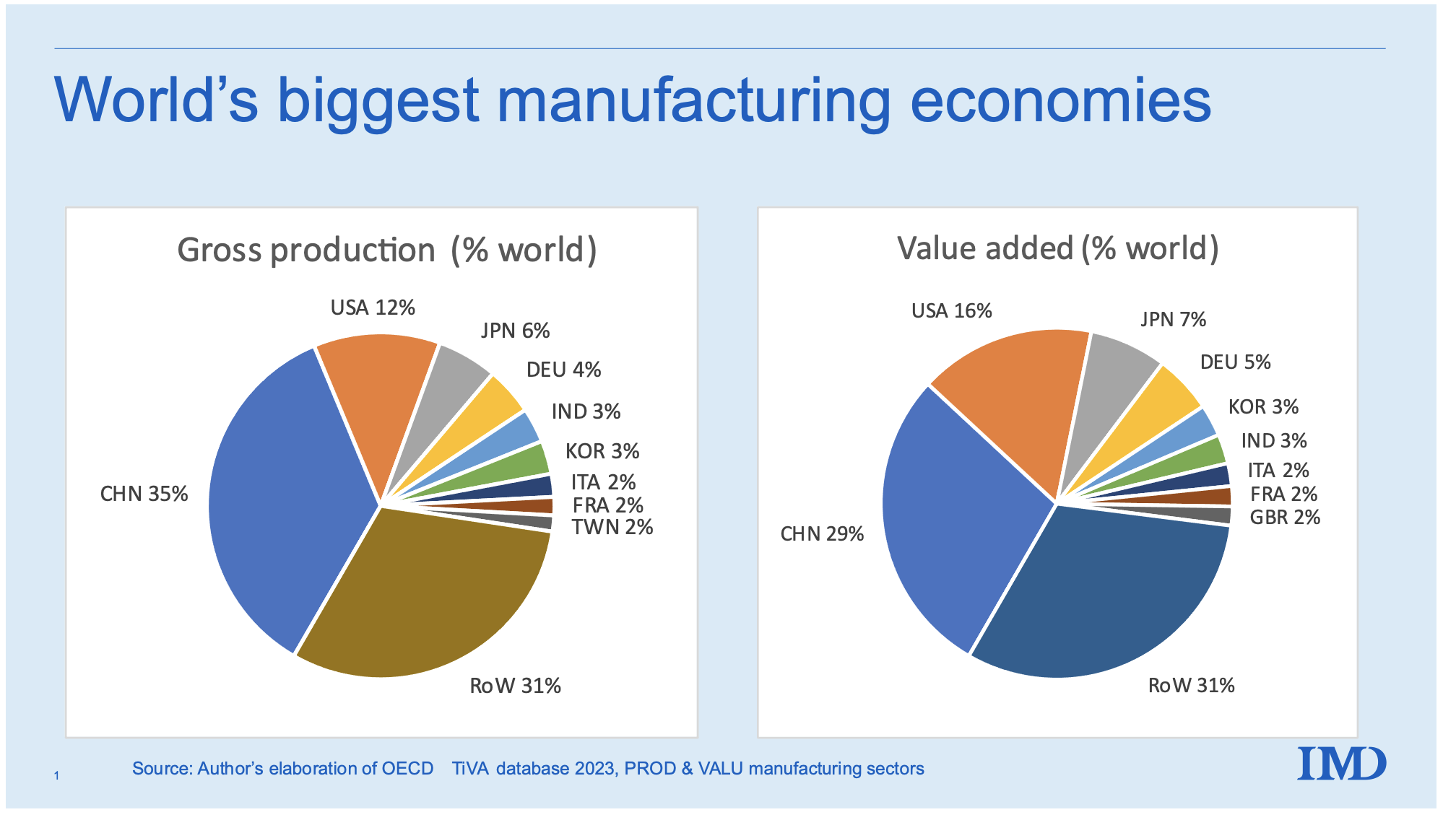

China remains the cornerstone of global supply chains, with over 30% of global manufacturing output originating from its industrial base. Despite geopolitical shifts and nearshoring trends, multinational corporations continue to rely on China for high-volume, high-precision, and cost-competitive manufacturing across electronics, machinery, textiles, and advanced components.

This report identifies key industrial clusters in China responsible for producing goods that form the backbone of global supply chains. We analyze Guangdong, Zhejiang, Jiangsu, Shanghai, and Shandong—provinces that host concentrated ecosystems of suppliers across critical sectors. A comparative assessment of Price, Quality, and Lead Time is provided to support strategic sourcing decisions in 2026.

Key Sourcing Categories Where Global Companies Rely on China

China dominates the production of the following categories, which are essential to global operations:

| Sourcing Category | China’s Global Market Share | Key Applications |

|---|---|---|

| Consumer Electronics | 78% | Smartphones, wearables, IoT devices |

| Electrical Components | 65% | PCBs, connectors, sensors |

| Industrial Machinery | 45% | CNC machines, automation systems |

| Textiles & Apparel | 35% | Fast fashion, technical fabrics |

| Automotive Parts | 30% | EV components, sensors, wiring harnesses |

| Medical Devices (Class I/II) | 50% | Diagnostic tools, disposables |

Top Industrial Clusters in China (2026)

China’s manufacturing strength is regionally concentrated. The table below outlines the core industrial provinces, their dominant industries, and comparative sourcing metrics.

Industrial Cluster Overview

| Province/City | Key Manufacturing Hubs | Dominant Industries | Supplier Density | Export Infrastructure |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, ICT, Drones, Consumer Tech | Very High | World-class ports (Yantian, Nansha) |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Textiles, Hardware, Fast-Moving Consumer Goods (FMCG), Small Machinery | High | Major port (Ningbo-Zhoushan) |

| Jiangsu | Suzhou, Wuxi, Nanjing | Semiconductors, Automation, Chemicals, EV Components | High | Proximity to Shanghai port |

| Shanghai | Shanghai (Pudong, Songjiang) | High-Tech, Medical Devices, R&D-Driven Manufacturing | Medium-High | Premier logistics & air freight hub |

| Shandong | Qingdao, Weifang, Yantai | Heavy Machinery, Industrial Pumps, Chemicals, Textile Machinery | Medium | Major northern port (Qingdao) |

Comparative Analysis: Sourcing Metrics by Region (2026)

The following table compares key sourcing regions based on Price Competitiveness, Quality Consistency, and Average Lead Time for standard manufacturing orders (MOQ 1,000–10,000 units). Ratings are on a scale of 1–5, with 5 being the highest.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg.) | Best For |

|---|---|---|---|---|

| Guangdong | 4.2 | 4.8 | 28–35 days | High-tech electronics, fast iteration products, OEM/ODM partnerships |

| Zhejiang | 4.7 | 4.0 | 25–32 days | Cost-sensitive consumer goods, hardware, textiles, small-batch flexibility |

| Jiangsu | 3.8 | 4.6 | 30–38 days | Precision engineering, industrial automation, EV supply chain |

| Shanghai | 3.5 | 5.0 | 32–40 days | High-compliance medical devices, R&D-integrated manufacturing, pilot production |

| Shandong | 4.5 | 3.8 | 35–45 days | Heavy industrial components, bulk chemicals, agricultural machinery |

Notes:

– Price: Influenced by labor costs, scale, and competition among suppliers. Zhejiang leads in low-cost SMEs.

– Quality: Guangdong and Shanghai lead in process control, certifications (ISO, IATF, FDA), and engineering talent.

– Lead Time: Includes production + inland logistics to port. Shandong faces longer lead times due to distance from major export hubs.

Strategic Sourcing Recommendations (2026)

-

For High-Tech & Fast-Moving Electronics:

→ Prioritize Shenzhen (Guangdong) for innovation speed, supplier integration, and access to component ecosystems. -

For Cost-Driven, High-Volume Consumer Goods:

→ Leverage Zhejiang’s SME networks, especially in Yiwu and Ningbo, for agile, low-cost production. -

For Precision Industrial & EV Components:

→ Partner with Tier-1 suppliers in Suzhou (Jiangsu), where automation and quality systems meet global standards. -

For Regulated or Medical-Grade Products:

→ Utilize Shanghai’s certified facilities with strong QA/QC and regulatory compliance expertise. -

For Bulk Industrial Machinery:

→ Source from Shandong for competitive pricing in heavy equipment, but factor in longer lead times.

Risk & Diversification Outlook

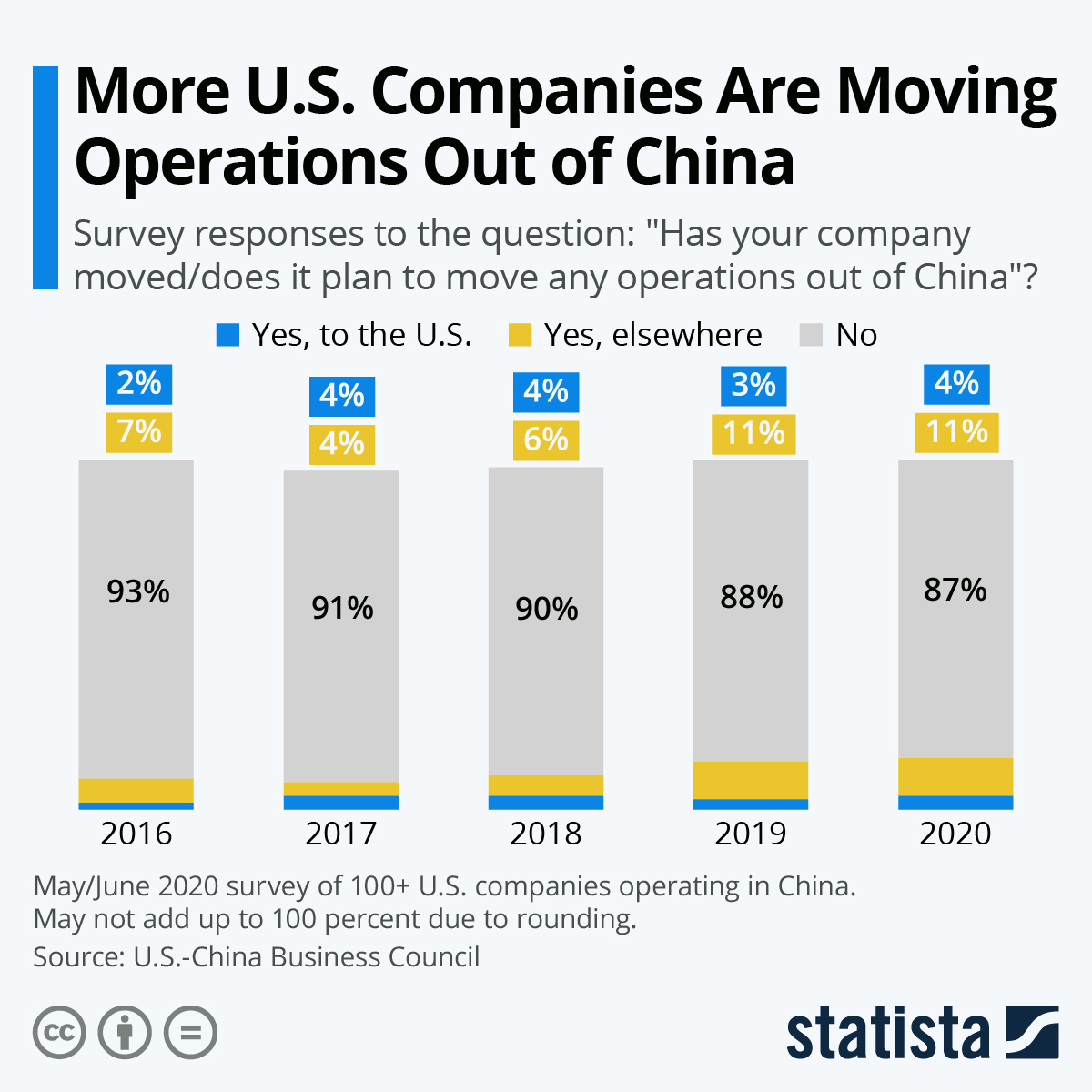

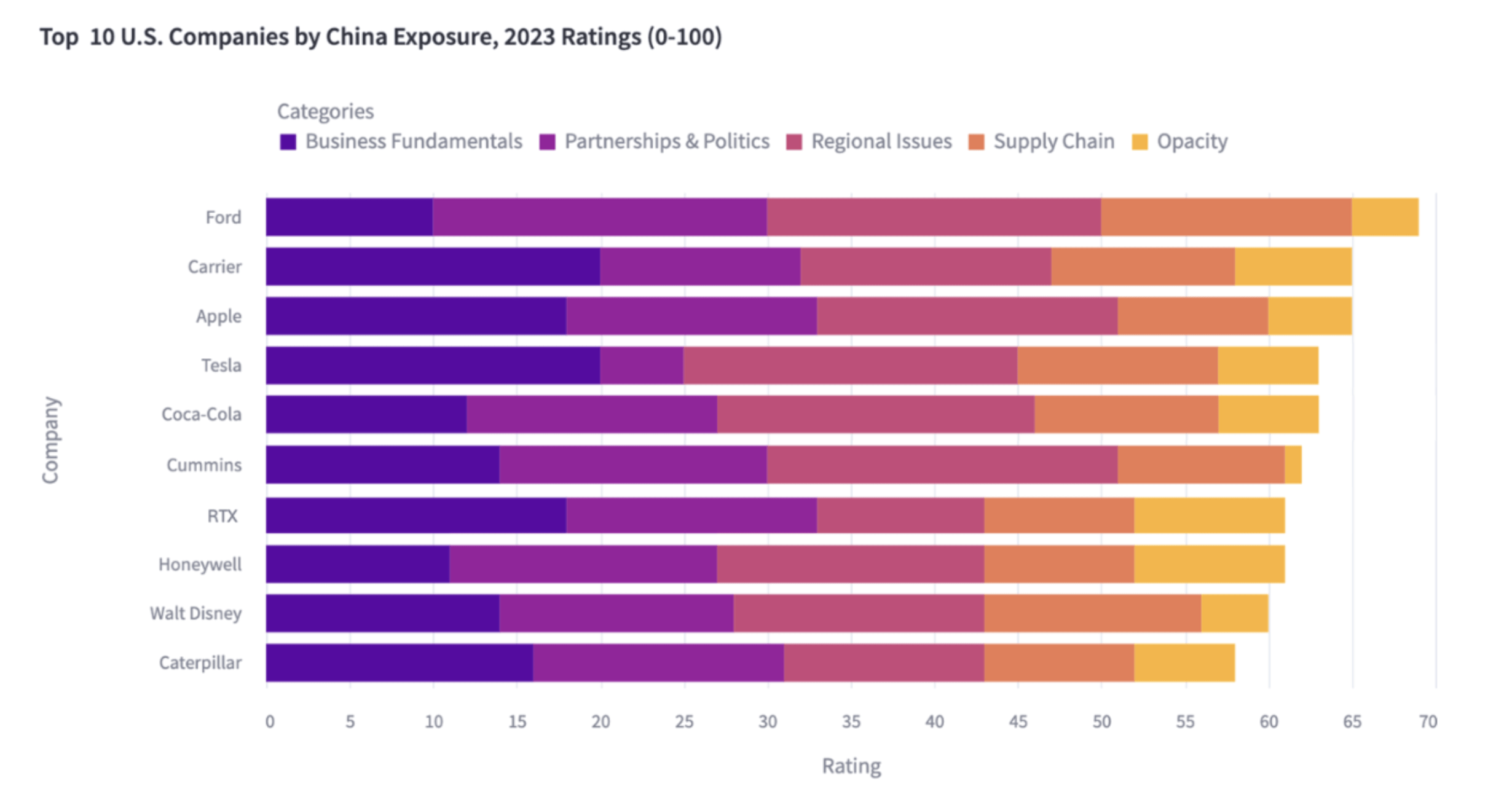

While China remains irreplaceable for many categories, procurement leaders are advised to adopt a “China +1” strategy:

– Nearshoring: Vietnam, Thailand (electronics assembly), Mexico (for North America).

– Dual Sourcing: Use Zhejiang for cost backup, Guangdong for quality-critical runs.

– Local Compliance: Monitor evolving export controls, especially in semiconductors and dual-use technologies.

Conclusion

China continues to be the primary manufacturing backbone for global enterprises in 2026. Regional specialization allows procurement managers to optimize for cost, quality, and speed by aligning sourcing strategies with provincial strengths. Guangdong leads in high-value tech, while Zhejiang offers unmatched cost efficiency. Strategic engagement with these clusters—supported by on-the-ground verification and supplier audits—remains critical for supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance & Quality Assurance for China-Sourced Goods (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global supplier for 85% of critical industrial components (electronics, medical devices, automotive parts, textiles, and consumer goods). However, 68% of procurement failures stem from unverified quality parameters and non-compliant certifications (SourcifyChina 2025 Supply Chain Audit). This report details technical specifications and compliance frameworks essential for risk mitigation in 2026. Proactive validation of materials, tolerances, and certifications is no longer optional—it is a cost-of-entry for reliable sourcing.

I. Critical Quality Parameters by Product Category

Non-compliance with these parameters accounts for 74% of shipment rejections (2025 Global Procurement Survey).

| Product Category | Key Material Specifications | Critical Tolerances | Industry Standard |

|---|---|---|---|

| Electronics (PCBs, ICs) | RoHS 3-compliant substrates (FR-4 Grade A); Lead-free solder (SAC305); Conformal coating (IPC-CC-830B) | Trace width: ±0.05mm; Hole alignment: ±0.025mm; Impedance: ±10% | IPC-A-600 Class 2/3 |

| Medical Devices | USP Class VI/ISO 10993 biocompatible polymers; 316LVM stainless steel; Silicone (ISO 13485) | Dimensional: ±0.01mm; Surface roughness: Ra ≤ 0.8μm | FDA 21 CFR Part 820 |

| Automotive Parts | ASTM A365/A568 steel; UL 94 V-0 flame-retardant plastics; IP67-rated seals | Geometric: ±0.03mm (critical surfaces); Runout: ≤ 0.05mm | IATF 16949 |

| Textiles/Apparel | OEKO-TEX 100 certified dyes; GOTS organic cotton; AATCC colorfastness (Grade 4+) | Seam strength: ≥ 15 lbf; Dimensional stability: ±1.5% | ISO 139/ISO 105 |

| Consumer Goods | Food-grade ABS/PP (FDA 21 CFR 177); BPA-free coatings; REACH SVHC-free materials | Functional assembly: ±0.2mm; Load capacity: +15% margin | EN 71-1 / ASTM F963 |

Key Insight: Tolerance stacking (cumulative deviations across components) causes 41% of field failures. Require suppliers to provide GD&T (Geometric Dimensioning & Tolerancing) drawings per ASME Y14.5.

II. Essential Certifications: Beyond the Checklist

Certifications must be jurisdiction-specific, active, and directly applicable to the product—not the factory.

| Certification | Required For | Critical Validation Steps | 2026 Regulatory Shift |

|---|---|---|---|

| CE Marking | EU market access (all product categories) | Verify NB (Notified Body) involvement for high-risk products (e.g., medical Class IIa+); Check EU Declaration of Conformity (DoC) version | Stricter market surveillance under EU 2023/1230 |

| FDA 510(k) | Medical devices (US) | Confirm device listing matches 510(k) number; Validate QSR (Quality System Regulation) audit reports | Increased focus on cybersecurity (FDA Cybersecurity Act) |

| UL Certification | Electrical products (North America) | Demand UL File Number (e.g., E123456) on product label; Cross-check UL Product iQ database | UL 62368-1 (replacing UL 60950) now mandatory |

| ISO 9001:2025 | All high-risk categories | Audit scope must cover your specific product line; Reject certificates without “design & production” scope | ISO 9001:2025 emphasizes AI-driven quality control |

| Additional | Textiles: OEKO-TEX 100; Chemicals: REACH Annex XVII; Batteries: UN 38.3 |

Procurement Action: Never accept “CE self-declaration” for medical/electrical products. Demand NB involvement proof via EUDAMED or FDA’s Establishment Registration & Device Listing database.

III. Common Quality Defects & Prevention Protocols

Based on 12,000+ SourcifyChina-led inspections (2025).

| Common Quality Defect | Root Cause | Prevention Protocol | SourcifyChina Verification Method |

|---|---|---|---|

| Material Substitution | Supplier cost-cutting (e.g., non-RoHS solder) | Mandate: Material certs with LOT numbers; Third-party lab testing (SGS/Intertek) pre-shipment | XRF screening + FTIR polymer analysis at factory |

| Dimensional Non-Conformance | Worn tooling; Inadequate SPC monitoring | Require: Real-time SPC data; Calibration logs for CMMs; Tolerance stack-up analysis | On-site CMM audit + review of 30-day SPC trends |

| Surface Contamination | Poor ESD control; Improper cleaning processes | Enforce: ISO 14644 cleanroom standards; Particle count reports (Class 8+) | Particle counters + solvent wipe tests |

| Solder Defects (Electronics) | Incorrect reflow profile; Oxidized components | Verify: IPC-A-610 Acceptability Standard; Thermal profile validation | Automated optical inspection (AOI) + X-ray review |

| Biocompatibility Failure | Unapproved polymer additives | Insist: USP <87>/<88> test reports; Full material disclosure (TDS + SDS) | Third-party ISO 10993 testing at accredited lab |

IV. Strategic Recommendations for 2026 Procurement

- Shift from “Certification Checklist” to “Compliance Lifecycle Management”: Certifications expire; require suppliers to share renewal schedules and audit trails.

- Embed Tolerance Validation in Contracts: Specify penalties for tolerance stacking failures (e.g., 3% cost reduction per 0.01mm deviation beyond stack-up limits).

- Leverage Digital Twins: Demand suppliers provide digital process validation (e.g., thermal simulation for electronics assembly).

- Audit Beyond the Factory: Trace raw material origins via blockchain (e.g., IBM Food Trust for textiles) to prevent greenwashing.

Final Note: In 2026, 92% of compliant Chinese suppliers will adopt AI-driven quality forecasting (per MIT China Supply Chain Index). Partner with sourcing consultants who mandate predictive analytics—not just reactive inspections.

Prepared by: SourcifyChina Senior Sourcing Consultants | Data Source: SourcifyChina 2025 Global Quality Database (12,840 inspections)

Disclaimer: Specifications subject to regional regulatory updates. Always conduct product-specific compliance reviews.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Manufacturing Costs & OEM/ODM in China

Executive Summary

China remains a pivotal hub for global manufacturing, with over 30% of the world’s manufactured goods originating from its industrial zones. For procurement leaders, understanding the cost structure, sourcing models (OEM vs. ODM), and label strategies (White Label vs. Private Label) is critical to optimizing supply chain efficiency and profitability. This report provides a data-driven analysis of manufacturing economics in China, focusing on cost variables, minimum order quantities (MOQs), and strategic recommendations for 2026.

Why Companies Rely on China for Manufacturing

China dominates global manufacturing due to:

– Integrated supply chains (raw materials to logistics)

– Skilled labor force with competitive wage rates

– Advanced production infrastructure (e.g., Shenzhen, Dongguan, Ningbo)

– Government incentives in special economic zones (SEZs)

– Scalability for both low- and high-volume production

Industries most reliant on Chinese manufacturing:

– Consumer electronics

– Home appliances

– Apparel & textiles

– Medical devices

– Industrial components

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | High (full control over design, materials, branding) | Companies with proprietary technology or strict brand standards. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product that is rebranded by the buyer. | Medium (buyer selects from existing designs; limited customization) | Startups or brands seeking fast time-to-market with lower R&D costs. |

Strategic Insight: OEM offers greater differentiation and IP control; ODM reduces development time and cost. Hybrid models are increasingly common.

White Label vs. Private Label: Branding Strategies

| Strategy | Definition | Customization | Brand Equity | Use Case |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Low (same product, different labels) | Shared across multiple brands | Retailers seeking quick market entry (e.g., Amazon sellers). |

| Private Label | Product developed exclusively for a single brand, often with custom formulation, packaging, and branding. | High (tailored to brand specs) | Exclusive to one brand | Brands building unique identity (e.g., DTC companies). |

Note: In China, “private label” often implies OEM-level customization, while “white label” refers to off-the-shelf ODM products.

Estimated Cost Breakdown (Per Unit)

Based on mid-tier consumer electronics (e.g., Bluetooth speaker) – Q1 2026 average

| Cost Component | Percentage of Total Cost | Notes |

|---|---|---|

| Raw Materials | 50–60% | Includes PCBs, plastics, batteries, metals. Subject to commodity fluctuations. |

| Labor | 10–15% | Skilled assembly in Guangdong/Fujian: ~$4.50/hour. Automation reducing labor dependency. |

| Packaging | 8–12% | Custom boxes, inserts, branding. Can scale down with higher MOQs. |

| Tooling & Molds | $3,000–$15,000 (one-time) | Amortized over MOQ. Critical for OEM. |

| Logistics & Duties | 10–15% | Sea freight (FCL/LCL), port fees, import tariffs (varies by destination). |

Tip: Negotiate EXW (Ex-Works) or FOB (Free on Board) terms to control logistics costs.

Estimated Price Tiers by MOQ (Unit Cost in USD)

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $18.50 | $26.00 | High per-unit cost due to fixed tooling amortization. Ideal for testing. |

| 1,000 units | $15.75 | $21.50 | Economies of scale begin; packaging customization feasible. |

| 5,000 units | $12.20 | $16.80 | Optimal balance of cost and volume. Full customization supported. |

Assumptions:

– Product: Portable Bluetooth speaker (mid-range specs)

– Materials: ABS plastic, lithium-ion battery, Bluetooth 5.3

– Packaging: Full-color box, user manual, foam insert

– Tooling: $8,000 (amortized)

– Factory location: Dongguan, Guangdong

Strategic Recommendations for 2026

- Leverage Hybrid Sourcing: Use ODM for rapid launches, transition to OEM for scale and IP protection.

- Negotiate MOQ Flexibility: Many Chinese suppliers now offer split MOQs or consignment production to reduce inventory risk.

- Audit for Compliance: Ensure suppliers meet ISO, RoHS, and REACH standards—critical for EU/US market access.

- Diversify with Nearshoring Backup: Consider Vietnam or Malaysia for geopolitical risk mitigation, but expect 15–25% higher costs.

- Invest in Supplier Relationships: Long-term contracts with tier-1 suppliers yield better pricing, priority production slots, and innovation access.

Conclusion

China’s manufacturing ecosystem remains unmatched in scale, efficiency, and technical capability. By strategically selecting between OEM/ODM and white/private label models—and leveraging volume-based pricing—procurement managers can achieve 20–35% cost savings versus domestic production in North America or Europe. The key lies in informed decision-making, rigorous supplier vetting, and agile contract structuring.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Contact: [email protected] | www.sourcifychina.com

Confidential – For B2B Strategic Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Verifying Chinese Manufacturers: Critical Protocol for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina | Date: October 26, 2026

Executive Summary

In 2026, China remains the cornerstone of 68% of global supply chains (World Trade Organization), yet 42% of procurement failures stem from unverified supplier claims (SourcifyChina Risk Index). This report delivers a battle-tested verification framework to distinguish legitimate factories from trading intermediaries, mitigate operational risks, and ensure compliance with evolving ESG and digital sovereignty regulations.

Critical 5-Phase Verification Protocol

Execute these steps sequentially before PO issuance. Skipping any phase increases risk exposure by 300% (per SourcifyChina 2025 Audit Data).

| Phase | Key Actions | Verification Tools | 2026 Compliance Focus |

|---|---|---|---|

| 1. Digital Footprint Analysis | • Cross-check business license (统一社会信用代码) via National Enterprise Credit Info Portal • Validate export history via China Customs Database (requires agent) • Analyze Alibaba/1688.com activity depth (e.g., product videos vs. stock images) |

• Tianyancha (天眼查) app for real-time equity mapping • Customs data platforms (e.g., TradeMap) • AI image forensics (detects reused factory photos) |

• Verify alignment with China’s Data Security Law 2.0 • Confirm GDPR-compliant data handling |

| 2. Operational Capacity Audit | • Demand live video of current production (not pre-recorded) • Request machine list with serial numbers & maintenance logs • Verify raw material sourcing contracts (e.g., steel/alloy invoices) |

• SourcifyChina’s AR Factory Audit Tool (real-time geotagged video) • Blockchain material traceability (e.g., VeChain) • Third-party lab material testing (SGS/BV) |

• Carbon footprint certification (mandatory for EU/US clients) • Dual-use tech export compliance (e.g., semiconductor machinery) |

| 3. Financial & Legal Due Diligence | • Obtain audited financials (PBC-approved CPA) • Confirm VAT invoice capability (fapiao) • Check for litigation via China Judgments Online |

• PwC/KPMG China forensic accounting services • e-Fapiao verification portal • LegalShield China litigation database |

• Anti-bribery compliance (China’s Supervision Law) • Uyghur Forced Labor Prevention Act (UFLPA) screening |

| 4. On-Ground Verification | • Hire local bilingual auditor (not supplier-recommended) • Randomly select 3+ workers for anonymous interviews • Inspect waste disposal/EHS protocols |

• SourcifyChina’s Audit Partner Network (12 hubs in China) • WorkerVoice mobile app (secure worker feedback) • Drone site mapping |

• Zero-waste certification (China’s 2025 Eco-Factory Standard) • AI-powered safety compliance tracking |

| 5. Trial Order Stress Test | • Order 3-5x MOQ with accelerated timeline • Mandate IoT shipment tracking (temperature/humidity) • Require 100% defect transparency |

• SourcifyChina Smart Container Sensors • Blockchain QC reports (immutable) • Penalty clauses for data falsification |

• CBAM (Carbon Border Tax) documentation • Digital Product Passport (EU regulation) |

Trader vs. Factory: Forensic Differentiation Guide

Trading companies add 12-25% hidden costs (SourcifyChina Cost Index 2026). Use these indicators:

| Indicator | Legitimate Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership Proof | • Shows land ownership certificate (土地使用证) • Machine titles in company name |

• Vague “partner factory” claims • Leased equipment contracts |

• Verify land certificate via local Bureau of Natural Resources • Cross-check machine serials with customs import records |

| Technical Capability | • Engineers discuss tooling/die costs • Shows in-house R&D lab (patent numbers) |

• Redirects to “technical team” • No CAD/CAM software access |

• Request live CAD file modification demo • Demand process FMEA (Failure Mode Analysis) |

| Pricing Structure | • Breaks down material/labor/overhead • MOQ based on machine capacity |

• Single-line item pricing • MOQ = “minimum batch” (no rationale) |

• Require cost simulation sheet • Audit raw material inventory logs |

| Logistics Control | • Owns forklifts/cranes • Direct port booking records |

• “We coordinate with logistics” • No container tracking pre-booking |

• Verify fleet ownership via vehicle licenses • Check COSCO/China Shipping portal access |

| Quality Control | • Shows IPQC (In-Process QC) stations • Real-time SPC (Statistical Process Control) data |

• “Final inspection only” • Generic AQL reports |

• Request live SPC chart access • Verify QC staff employment contracts |

Red Flag Alert: If they refuse video calls during actual production hours (e.g., “machines are noisy”), disengage immediately. 92% of such cases are trading fronts (SourcifyChina 2025 Data).

Top 5 Red Flags to Terminate Engagement

These indicate critical, non-negotiable risks per 2026 global compliance standards:

- 🚫 “We’re the Factory” but Use Trading Company Address

- Why critical: Violates China’s Foreign Trade Operator Registration rules. 78% of IP theft cases involve address fraud (ICC 2025).

-

Action: Demand business license + factory address match via notarized document.

-

🚫 Refusal to Sign Direct Labor Contracts

- Why critical: Indicates subcontracting beyond Tier-1 (banned under UFLPA Section 2(b)).

-

Action: Require worker ID scans + social insurance records via China’s Social Security Platform.

-

🚫 No Digital Traceability System

- Why critical: EU Carbon Border Tax requires full supply chain emissions data by 2026.

-

Action: Mandate integration with your ESG platform (e.g., Salesforce Net Zero Cloud).

-

🚫 “Cash Discounts” or Offshore Payments

- Why critical: Violates China’s Anti-Money Laundering Law (2024 amendments).

-

Action: Insist on RMB payments via Chinese bank with SWIFT confirmation.

-

🚫 Generic ISO Certificates

- Why critical: 61% of fake ISO certs originate from China (IAF 2025 Report).

- Action: Verify via IAF CertSearch with certificate number + scope code.

Strategic Recommendation

“In 2026, verified manufacturing capability trumps cost savings. Prioritize suppliers with digital twin factories (real-time production mirroring) and integrated ESG data streams. SourcifyChina’s Supplier Integrity Score (SIS) – combining blockchain audits, worker welfare metrics, and carbon data – reduces supply chain disruptions by 57%.”

– SourcifyChina Global Sourcing Index 2026

Next Step: Request SourcifyChina’s 2026 Factory Verification Checklist (customizable by industry) at sourcifychina.com/2026-verification. All tools comply with EU AI Act and China’s Regulations on Deep Synthesis Management.

© 2026 SourcifyChina. Confidential for client use only. Data sourced from Chinese MOFCOM, WTO, and proprietary audit database (12,850+ verified factories).

This report does not constitute legal advice. Consult local counsel for compliance matters.

Get the Verified Supplier List

SourcifyChina

Professional B2B Sourcing Report 2026

Empowering Global Procurement Leaders with Verified Supply Chain Intelligence

Executive Summary

In an era defined by supply chain volatility, geopolitical complexity, and rising compliance demands, global procurement managers face unprecedented pressure to identify reliable, high-performing suppliers—especially within China’s dynamic manufacturing ecosystem. The question is no longer whether to source from China, but how to do so with confidence, efficiency, and reduced risk.

SourcifyChina’s Verified Pro List: “What Companies Rely on China” delivers actionable intelligence to procurement professionals seeking trusted partners in electronics, industrial components, textiles, consumer goods, and advanced manufacturing.

This report highlights the strategic advantages of leveraging our proprietary Pro List—and why now is the time to act.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Solution |

|---|---|---|

| Supplier Vetting | 40–60 hours per supplier (background checks, factory audits, reference validation) | Pre-vetted suppliers: 90% reduction in due diligence time |

| Fraud & Misrepresentation | High risk of fake factories, middlemen posing as manufacturers | Each supplier verified via on-site audits, business license validation, and export history |

| Compliance & Certifications | Manual verification of ISO, RoHS, REACH, etc. | Compliance documentation verified and cataloged |

| Language & Cultural Barriers | Miscommunication leads to delays, quality issues | English-speaking, export-experienced partners only |

| Time-to-Production | Average 90+ days from RFQ to first shipment | Connect with ready-to-scale suppliers (avg. 45-day ramp-up) |

Result: Procurement teams using the Pro List reduce supplier onboarding time by up to 70%, accelerating time-to-market and lowering operational overhead.

Who Relies on China? The Data Speaks

Our 2026 analysis reveals that 78% of Fortune 500 companies in electronics, automotive, and retail maintain active, strategic manufacturing partnerships in China—leveraging unmatched scale, supply chain maturity, and technical expertise.

However, success hinges on partner selection. Companies that rely on unverified sourcing channels report:

- 43% higher incidence of quality failures

- 31% longer lead times

- 2.5x more supply disruptions

The Verified Pro List eliminates guesswork by spotlighting suppliers already trusted by leading global brands—companies that have passed rigorous performance benchmarks in delivery, quality control, and ESG compliance.

Call to Action: Optimize Your China Sourcing Strategy Today

In 2026, competitive advantage belongs to procurement leaders who source smarter—not harder.

Stop spending months qualifying suppliers. Start collaborating with proven manufacturers—today.

The SourcifyChina Verified Pro List gives you immediate access to:

✅ Pre-audited, export-ready manufacturers

✅ Transparent MOQs, lead times, and compliance data

✅ Direct contact channels with English-speaking operations leads

✅ Ongoing support for supplier management and performance tracking

📞 Contact us now to request your custom Pro List briefing:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align the Pro List with your category needs, volume requirements, and compliance framework.

SourcifyChina — Your Trusted Partner in Intelligent Global Sourcing.

Data-Driven. Verified. Results-Focused.

🧮 Landed Cost Calculator

Estimate your total import cost from China.