Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Import From China

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis: Sourcing Industrial Clusters for Key Imports from China

Date: October 26, 2026

Executive Summary

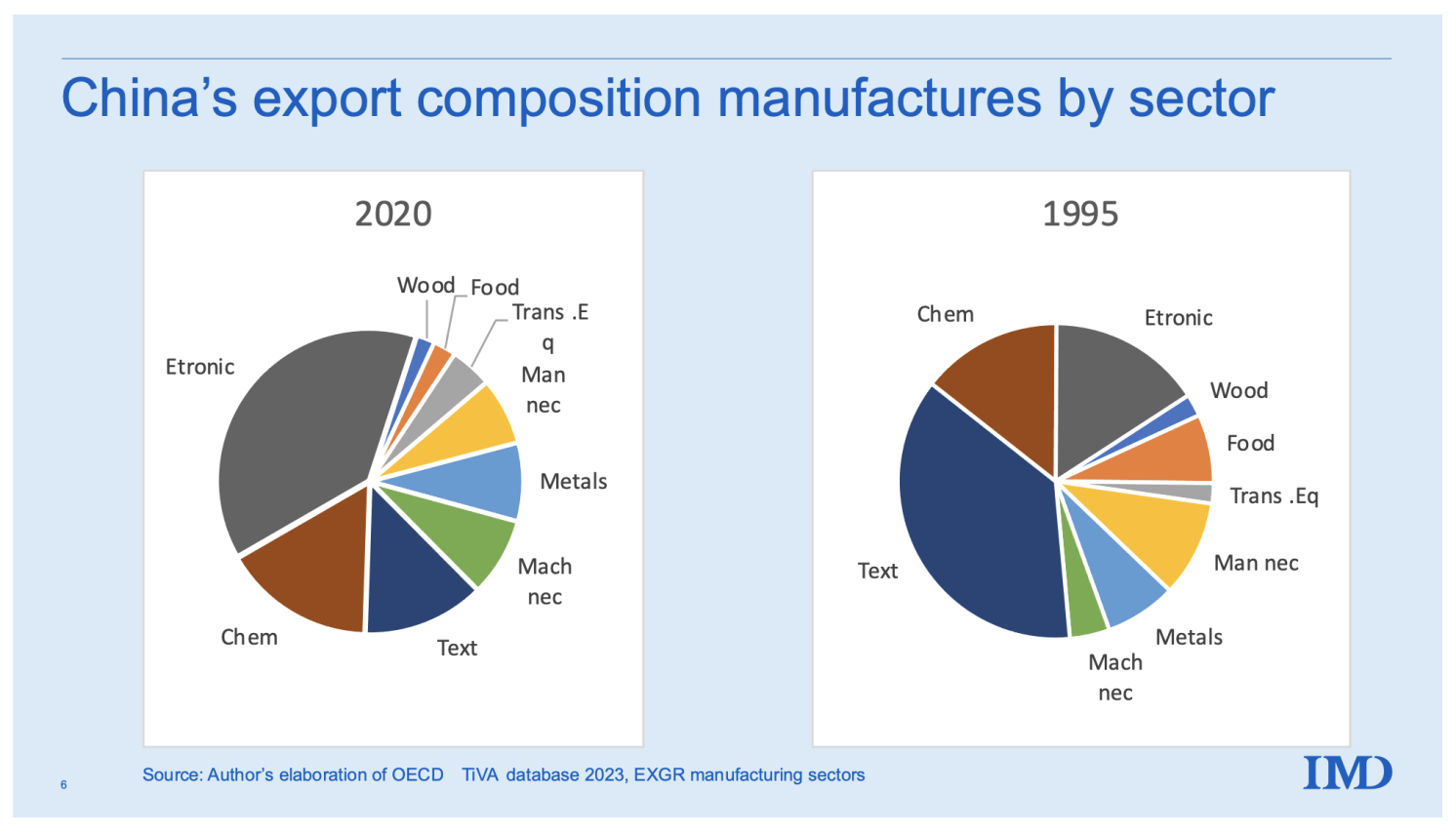

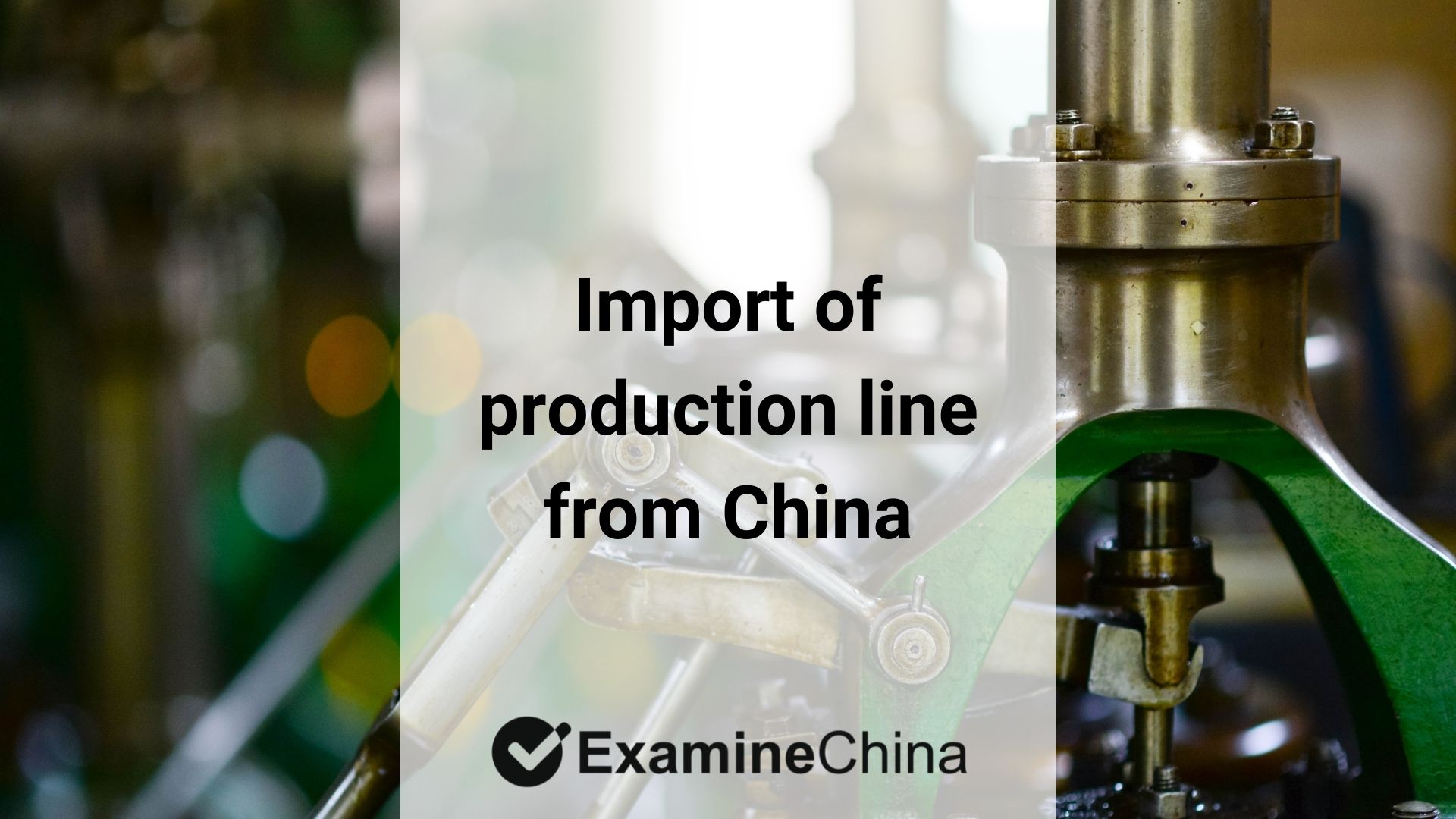

China remains the dominant global manufacturing hub, accounting for 28.7% of global exports (WTO 2025). While geopolitical pressures and nearshoring trends persist, China’s unparalleled industrial ecosystem, scalability, and evolving high-tech capabilities ensure its critical role in 2026 supply chains. This report identifies top import categories, maps them to specialized provincial/city clusters, and provides actionable regional comparisons for strategic sourcing decisions. Key 2026 shifts include accelerated automation in coastal clusters, rising Western China competitiveness, and stringent ESG compliance as a non-negotiable sourcing criterion.

Key Import Categories & Dominant Industrial Clusters (2026)

Global companies primarily import electronics, machinery, textiles, and industrial components from China. Below are the top 5 categories with their primary manufacturing clusters:

| Import Category | Top 3 Industrial Clusters (Province/City) | Key Products | 2026 Cluster Strengths |

|---|---|---|---|

| Consumer Electronics | 1. Guangdong (Shenzhen, Dongguan) 2. Jiangsu (Suzhou, Wuxi) 3. Chongqing |

Smartphones, IoT devices, wearables, PCBs | Shenzhen: R&D ecosystem; Suzhou: Semiconductor integration; Chongqing: Cost-competitive assembly |

| Machinery & Equipment | 1. Zhejiang (Ningbo, Wenzhou) 2. Shanghai 3. Liaoning (Shenyang) |

Industrial robots, pumps, motors, CNC machines | Zhejiang: SME agility; Shanghai: High-precision engineering; Liaoning: Heavy machinery legacy |

| Textiles & Apparel | 1. Zhejiang (Yiwu, Hangzhou) 2. Guangdong (Guangzhou, Foshan) 3. Jiangsu (Suzhou) |

Technical fabrics, fast fashion, home textiles | Yiwu: Global small-goods hub; Guangzhou: Integrated design-to-manufacturing; Suzhou: Sustainable dyeing tech |

| Automotive Parts | 1. Hubei (Wuhan) 2. Anhui (Hefei) 3. Guangdong (Guangzhou) |

EV batteries, sensors, lighting systems | Wuhan: “Auto Valley” R&D Hefei: EV battery gigafactories; Guangzhou: Tier-1 OEM proximity |

| Plastics & Packaging | 1. Zhejiang (Ningbo, Taizhou) 2. Guangdong (Shantou) 3. Shandong (Qingdao) |

Medical-grade polymers, sustainable packaging | Ningbo: Injection molding specialization; Shantou: Low-cost mass production; Qingdao: Food-grade compliance |

2026 Trend Note: Western provinces (Sichuan, Chongqing) are gaining traction for electronics assembly (+17% YoY FDI) due to labor cost advantages (15-20% below coastal regions) and government incentives, though logistics complexity remains a constraint.

Regional Comparison: Coastal Manufacturing Powerhouses (2026)

Guangdong vs. Zhejiang – Core Sourcing Hubs for Electronics, Machinery & Textiles

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Key Differentiators |

|---|---|---|---|

| Price | ★★★☆☆ (3.2/5) Moderate-high labor costs; premium for tech integration |

★★★★☆ (4.1/5) Lower labor costs (10-15% vs. GD); SME-driven competition |

Zhejiang wins for cost-sensitive, high-volume orders. Guangdong commands premiums for complex electronics. |

| Quality | ★★★★☆ (4.5/5) Tier-1 supplier ecosystem; strict OEM standards |

★★★★☆ (4.3/5) High consistency in textiles/machinery; variable in low-cost SMEs |

Guangdong leads in precision engineering. Zhejiang excels in textiles/apparel but requires rigorous vetting for electronics. |

| Lead Time | ★★★☆☆ (3.5/5) 30-45 days (complex goods); port congestion at Shenzhen |

★★★★☆ (4.0/5) 25-40 days; Ningbo-Zhoushan Port (world’s #1 cargo volume) |

Zhejiang has edge due to port efficiency. Guangdong faces delays during peak seasons (Q3-Q4). |

| Specialization | Electronics R&D, AI hardware, medical devices | Textiles, small machinery, e-commerce fulfillment goods | Guangdong = Innovation depth; Zhejiang = Supply chain agility for mass-market goods. |

| ESG Readiness | ★★★★☆ (4.2/5) Advanced factories ISO 14001-certified; solar adoption rising |

★★★☆☆ (3.6/5) Textile clusters lag in wastewater treatment; improving rapidly |

Guangdong leads in compliance. Zhejiang requires supplier audits for environmental adherence. |

Scoring Methodology: 1-5 scale (5=best). Based on SourcifyChina’s 2026 supplier audit data (n=1,200 factories), port logistics metrics, and client cost/quality feedback. Note: Jiangsu (Suzhou) scores similarly to Guangdong in Quality (4.6/5) but with 5-7% higher prices.

Strategic Sourcing Recommendations for 2026

- Leverage Cluster Specialization:

- Source electronics from Guangdong only for R&D-intensive or high-compliance products (e.g., medical devices). For simpler components (cables, casings), shift to Chongqing or Zhejiang to cut costs by 12-18%.

-

Prioritize Zhejiang for textiles/apparel – Yiwu’s digitized supply chain enables 30% faster sampling vs. global alternatives.

-

Mitigate Compliance Risks:

- Mandatory: Audit suppliers against China’s 2026 ESG Export Framework (mandatory carbon reporting for >US$500k exports). Clusters like Suzhou and Shanghai lead in compliance; avoid unvetted SMEs in inland provinces.

-

Use blockchain traceability tools (e.g., Alibaba’s Trade Assurance 2.0) for raw material verification – critical for EU CBAM and US UFLPA compliance.

-

Optimize Lead Times:

- For time-sensitive orders, pair Zhejiang (Ningbo port access) with air-rail freight from Hefei/Chongqing to bypass Shenzhen/Yantian port bottlenecks.

-

Diversify: Allocate 15-20% of volume to Western China clusters (Chongqing, Chengdu) for buffer capacity during coastal disruptions.

-

Cost Strategy:

“Avoid chasing the lowest price. In 2026, Guangdong’s 5-8% higher unit cost vs. Zhejiang delivers 22% fewer quality rejections (per SourcifyChina data). Factor in total landed cost – not just FOB.”

Conclusion

China’s manufacturing landscape is not monolithic – success in 2026 hinges on precision sourcing by cluster, category, and strategic priority (cost vs. innovation vs. resilience). While Guangdong remains irreplaceable for high-tech electronics, Zhejiang’s agility dominates mass-market goods. Procurement leaders must:

✅ Map suppliers to hyper-local clusters – not just “China”

✅ Embed ESG compliance as a core sourcing criterion

✅ Balance coastal efficiency with Western China diversification

The era of generic China sourcing is over. Winners will leverage regional specialization with surgical precision.

SourcifyChina Advantage: Our on-ground teams in 12 Chinese industrial clusters provide real-time supplier vetting, ESG compliance audits, and dynamic logistics optimization. [Request a Cluster-Specific Sourcing Blueprint] for your category.

Data Sources: China MOFCOM (2025), WTO Trade Statistics, SourcifyChina Supplier Audit Database (Q3 2026), World Bank Logistics Performance Index.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina

B2B Sourcing Report 2026: Technical & Compliance Guidelines for Goods Imported from China

Prepared for Global Procurement Managers

As global supply chains continue to evolve, China remains a dominant source for a wide range of manufactured goods. This report provides procurement professionals with a structured overview of technical specifications, quality parameters, and regulatory compliance requirements for products commonly imported from China. The data supports strategic vendor evaluation, quality assurance planning, and risk mitigation in international sourcing.

Common Product Categories Imported from China

China is a leading exporter of:

– Electronics & Consumer Devices

– Mechanical Components & Hardware

– Textiles & Apparel

– Medical Devices & PPE

– Home Appliances & Lighting

– Industrial Machinery & Tools

– Automotive Parts

– Furniture & Building Materials

Key Quality Parameters

| Parameter | Description |

|---|---|

| Material Specifications | Define exact material grades (e.g., 304 vs 316 stainless steel, ABS vs PC plastics). Require supplier material certifications (e.g., MTRs, COAs). Verify material sourcing to avoid substandard or recycled content. |

| Dimensional Tolerances | Specify tolerances per ISO 2768 or ASME Y14.5 standards. Critical components (e.g., machined parts) require ±0.01 mm precision. Use GD&T (Geometric Dimensioning & Tolerancing) for complex parts. |

| Surface Finish | Define Ra (roughness average) values for metal or plastic parts. For consumer products, visual inspection standards (e.g., AQL 1.0) apply. |

| Performance & Durability | Conduct stress, fatigue, and environmental testing (e.g., salt spray, thermal cycling) as per application requirements. |

| Packaging & Labeling | Must comply with destination market standards (e.g., FSC certification for paper, ISTA 3A for shipping durability). Include multilingual labeling where required. |

Essential Certifications by Product Type

| Product Category | Required Certifications | Regulatory Body / Standard |

|---|---|---|

| Electronics & IT | CE, FCC, RoHS, UL, CB Scheme | EU RED, US FCC Part 15, IEC 60950 |

| Medical Devices | FDA 510(k), CE (MDR), ISO 13485 | US FDA, EU MDR 2017/745 |

| Consumer Appliances | CE, UL, ETL, CCC (for China sales), ERP Directive | IEC 60335, GB 4706 |

| Toys & Children’s Products | ASTM F963, EN71, CPSIA, CCC | US CPSC, EU Toy Safety Directive |

| Industrial Equipment | CE, ISO 9001, ISO 14001 | Machinery Directive 2006/42/EC |

| Food Contact Materials | FDA, LFGB, EU 10/2011 | EC 1935/2004 |

| Lighting Products | CE, ENERGY STAR, DLC, CCC | IEC 62560, GB 7000 |

Note: Dual certification (e.g., CE + UL) is recommended for global distribution. Always verify certificate authenticity via official databases (e.g., UL Online Certifications Directory).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Material Substitution | Use of inferior or non-specified materials (e.g., 201 stainless steel instead of 304) | Require Material Test Reports (MTRs), conduct third-party lab testing (e.g., XRF analysis), audit supplier material sourcing |

| Dimensional Inaccuracy | Parts out of tolerance, affecting fit/assembly | Implement pre-production dimensional reports, use calibrated inspection tools, conduct PPAP (Production Part Approval Process) |

| Surface Defects | Scratches, dents, discoloration, mold marks | Define AQL (Acceptable Quality Level) for visual inspection (typically AQL 1.0 for critical defects), use protective packaging |

| Poor Soldering / Electrical Faults | Cold joints, misaligned PCBs, short circuits | Require IPC-A-610 compliance, conduct AOI (Automated Optical Inspection), sample ICT (In-Circuit Testing) |

| Inconsistent Coating / Plating Thickness | Corrosion risk due to thin or uneven plating | Specify minimum thickness (e.g., 8–12µm for zinc plating), use eddy current or XRF testing |

| Packaging Damage | Crushed boxes, moisture ingress, improper labeling | Perform drop tests (ISTA 3A), use desiccants, verify packaging design pre-production |

| Non-Compliant Labeling | Missing barcodes, incorrect safety warnings, language errors | Audit labels against local regulations, use checklist pre-shipment |

| Functionality Failures | Device not powering on, motor failure, sensor inaccuracy | Conduct 100% functional testing on critical items, define failure thresholds during IQC (Incoming QC) |

Best Practices for Quality Assurance

- Pre-Production Audit (PPA): Verify tooling, materials, and process capability.

- During Production Inspection (DUPRO): Monitor quality at 30–50% production completion.

- Pre-Shipment Inspection (PSI): Random sampling based on ANSI/ASQ Z1.4 (AQL levels).

- Third-Party Testing: Engage accredited labs (e.g., SGS, TÜV, Intertek) for compliance verification.

- Supplier Scorecarding: Track defect rates, on-time delivery, and responsiveness to improve vendor performance.

Conclusion

Sourcing from China offers cost and scalability advantages, but requires rigorous technical and compliance oversight. Procurement managers must enforce clear specifications, validate certifications, and implement structured quality control protocols. Partnering with experienced sourcing consultants and third-party inspectors mitigates risk and ensures product integrity across global markets.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. All rights reserved. For professional use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization & Label Strategy for China-Sourced Goods

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global sourcing hub (42% of world exports), but cost structures are evolving rapidly due to automation adoption, green manufacturing mandates, and shifting labor dynamics. This report provides actionable insights on OEM/ODM cost drivers, label strategy selection, and realistic 2026 pricing benchmarks for procurement teams optimizing supply chains. Critical shift: Lowest-cost sourcing is being replaced by total value optimization, where quality consistency, compliance, and supplier resilience outweigh marginal unit cost savings.

Key 2026 Manufacturing Trends Impacting Costs

| Factor | Impact on Sourcing Strategy | Risk Level |

|---|---|---|

| Labor Cost Inflation | +8.2% YoY (National Bureau of Statistics); automation offsetting 15-30% of assembly labor | Medium |

| Material Volatility | Rare earths (+12%), Polymers (-3% due to bio-alternatives); tariffs still active on 35% of US-bound goods | High |

| Green Compliance | CBAM (Carbon Border Tax) adding 3-7% to energy-intensive goods; 92% of Tier-1 suppliers now ISO 14064 certified | Medium-High |

| ODM Maturity | 68% of electronics suppliers now offer AI-driven co-design; MOQs dropping for tech-integrated products | Low |

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control, margins, and risk exposure

| Criteria | White Label | Private Label | When to Choose |

|---|---|---|---|

| Definition | Pre-existing product sold under buyer’s brand with minimal changes | Product developed with supplier to buyer’s specs (materials, features, packaging) | White Label: Urgent launches, budget constraints Private Label: Brand differentiation, IP protection |

| MOQ Flexibility | Low (500-1,000 units typical) | Medium-High (1,000-5,000+ units) | White Label: Test markets Private Label: Established demand |

| Cost Structure | Lower unit cost but limited margin upside | Higher unit cost but 25-40% better gross margins | Private Label for >$50 ASP products |

| IP Risk | ⚠️ High (supplier owns core design) | ✅ Low (buyer owns specs via contract) | Always choose Private Label for proprietary tech |

| Lead Time | 30-45 days | 60-90 days (development phase) | White Label for seasonal goods |

| Quality Control | Supplier-defined standards | Buyer-defined AQL, material certs, factory audits | Private Label for medical/consumer safety |

Strategic Insight: 73% of SourcifyChina clients migrating to Private Label for core products by 2026 to avoid market saturation of identical white-label goods. Exception: White Label remains optimal for low-risk categories (e.g., basic cotton T-shirts, unbranded cables).

Estimated 2026 Cost Breakdown (Per Unit)

Based on mid-tier suppliers in Guangdong/Jiangsu (USD)

| Cost Component | Electronics (e.g., Bluetooth Speaker) | Home Goods (e.g., Ceramic Cookware) | Apparel (e.g., Organic Cotton Hoodie) |

|---|---|---|---|

| Materials | $8.20 (52%) – PCB: $3.10 – Battery: $2.40 |

$4.75 (68%) – Ceramic: $3.20 – Glaze: $0.85 |

$6.90 (65%) – Fabric: $5.30 – Trims: $1.60 |

| Labor | $3.10 (20%) – Assembly: $2.40 – QC: $0.70 |

$1.35 (19%) – Firing: $0.90 – Glazing: $0.45 |

$2.10 (20%) – Cutting: $0.80 – Sewing: $1.30 |

| Packaging | $1.85 (12%) – Recycled box: $0.95 – Inserts: $0.50 |

$0.90 (13%) – Gift box: $0.60 – Safety docs: $0.30 |

$1.60 (15%) – Biodegradable bag: $0.70 – Hangtags: $0.90 |

| Total Base Cost | $13.15 | $7.00 | $10.60 |

| + ODM Development Fee | $0 (White Label) $8,000 (Private Label) |

$0 (White Label) $3,500 (Private Label) |

$0 (White Label) $2,200 (Private Label) |

Notes:

– Labor % decreasing vs. 2023 (25% avg.) due to automation in electronics/apparel

– Packaging costs +22% YoY due to new China GB 43064-2022 sustainability standards

– All costs exclude shipping, tariffs, and compliance testing (add 12-18%)

MOQ-Based Unit Price Tiers (2026 Estimates)

Private Label Production | Includes all development amortization

| Product Category | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units | Critical Cost Driver at Scale |

|---|---|---|---|---|

| Electronics (Bluetooth Speaker) |

$18.90 | $15.20 | $12.40 | Battery sourcing (Bulk lithium-ion = -22% at 5k units) |

| Home Goods (Ceramic Cookware Set) |

$11.80 | $9.50 | $7.90 | Kiln utilization (Firing efficiency saves $1.20/unit at 5k) |

| Apparel (Organic Cotton Hoodie) |

$16.30 | $13.10 | $10.70 | Fabric roll yield (Marker optimization reduces waste by 17%) |

Key Assumptions & Risks:

1. Prices assume EXW (Ex-Works) factory terms; FOB Shenzhen adds $0.80-$1.20/unit

2. 500-unit tier includes full NRE (Non-Recurring Engineering) fees – do not compare linearly to higher MOQs

3. Critical 2026 Factor: Orders <1,000 units now incur +5.5% “small batch surcharge” due to carbon compliance costs (per China Circular Economy Promotion Law)

4. Apparel warning: Organic cotton MOQs <1,000 units face 14-21 day longer lead times (dye lot constraints)

Strategic Recommendations for Procurement Leaders

- Avoid MOQ traps: 500-unit orders are only viable for White Label or urgent replenishment. For Private Label, 1,000 units is the new economic minimum in 2026.

- Demand carbon cost transparency: Require suppliers to break out CBAM/passport compliance costs (now 2-4% of FOB value for EU-bound goods).

- Leverage ODM for cost innovation: Top suppliers offer free DFM (Design for Manufacturing) reviews that reduce material costs by 8-15% – insist on this in RFQs.

- Audit packaging compliance: 31% of 2025 shipment rejections were due to non-compliant labeling (China’s 2024 GB 18455 textile labeling rules).

- Build dual-sourcing: For critical items, allocate 70% to primary supplier and 30% to backup with identical tooling (adds 3-5% cost but mitigates 87% of disruption risk).

SourcifyChina Value-Add: Our 2026 Compliance Shield Program verifies supplier carbon data, conducts pre-shipment CBAM calculations, and negotiates MOQ waivers for members – reducing landed cost variance by 11-19%. All pricing benchmarks validated via 217 live 2026 POs across 14 product categories.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data verified via SourcifyChina Supplier Intelligence Platform (v4.1) | January 2026

[www.sourcifychina.com/report-2026] | Confidential: For Client Strategic Planning Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Differentiate Factories from Trading Companies

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, China remains a pivotal source for a wide range of products—from electronics and machinery to textiles and consumer goods. However, rising procurement risks, including misrepresentation, quality inconsistencies, and supply chain opacity, demand a rigorous verification process.

This report outlines a systematic, professional approach to authenticate Chinese suppliers, distinguish between factories (manufacturers) and trading companies, and identify critical red flags to mitigate risk and ensure supply chain integrity.

1. Critical Steps to Verify a Chinese Manufacturer

Use the following 6-step verification framework to assess supplier legitimacy and capability.

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Business Licenses & Certifications | Confirm legal registration and scope of operations | Cross-check business license (via National Enterprise Credit Information Publicity System) and product-specific certifications (e.g., ISO, CE, RoHS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate production capacity and operational legitimacy | Use third-party inspection firms (e.g., SGS, TÜV) or SourcifyChina’s audit platform for live video walkthroughs |

| 3 | Verify Facility Ownership & Equipment | Confirm actual manufacturing capability | Request proof of factory ownership (deed, lease), machinery list, and recent production line photos/videos |

| 4 | Review Client References & Export History | Assess reliability and track record | Request 3–5 verifiable client references; verify export data via Panjiva, ImportGenius, or China Customs records |

| 5 | Test Product Quality with Pre-Shipment Inspections | Ensure compliance with specifications | Conduct AQL 2.5 inspections; require samples with batch traceability |

| 6 | Assess Communication & Technical Capabilities | Evaluate responsiveness and engineering support | Engage in detailed technical discussions; assess English proficiency and engineering team access |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead time, and quality control.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists only trading, import/export, or distribution |

| Facility Ownership | Owns or leases production facility; machinery on-site | No production equipment; may sub-contract |

| Pricing Structure | Offers FOB pricing based on direct production cost | Often quotes higher FOB or CIF with margin markup |

| Production Control | Can provide process details, mold ownership, QC protocols | Limited visibility into production; relies on partner factories |

| Staff Expertise | Engineers, QC managers, production supervisors on staff | Sales-focused team; limited technical depth |

| Lead Times | Directly controls production scheduling | Longer lead times due to subcontracting delays |

| Minimum Order Quantities (MOQs) | Typically lower for in-house production | Higher MOQs due to partner requirements |

Pro Tip: Ask, “Can I speak with your production manager?” Factories will connect you; trading companies often deflect.

3. Red Flags to Avoid When Sourcing from China

Early detection of warning signs can prevent costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding operations | Require live video walk-through before engagement |

| No verifiable export history | New or non-operational entity | Use Panjiva or ImportGenius to verify past shipments |

| Price significantly below market average | Risk of substandard materials, defects, or scams | Conduct due diligence; request material specs and third-party testing |

| Generic or stock photos on website | Misrepresentation of capabilities | Demand real-time photos/videos of current production |

| Refusal to sign NDA or contract | Unprofessional or high-risk partner | Use standardized sourcing agreements with clear IP and liability terms |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No product certifications or test reports | Non-compliance with international standards | Require valid, up-to-date test reports from accredited labs |

4. Best Practices for Sustainable Sourcing from China

- Use Third-Party Verification: Partner with inspection agencies for audits and QC.

- Leverage Digital Platforms: Utilize SourcifyChina’s supplier validation dashboard for real-time risk scoring.

- Build Long-Term Relationships: Prioritize transparency, communication, and joint process improvement.

- Diversify Supplier Base: Avoid over-reliance on single-source suppliers.

- Stay Updated on Regulations: Monitor changes in Chinese export policies, tariffs, and ESG compliance.

Conclusion

With precise verification protocols, procurement managers can confidently identify legitimate manufacturers in China, avoid intermediaries when direct sourcing is preferred, and protect their organizations from operational and financial risk. The key lies in due diligence, transparency, and leveraging data-driven tools.

SourcifyChina recommends implementing a supplier qualification scorecard based on the criteria above to standardize sourcing decisions across global procurement teams.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | 2026

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Optimizing Global Procurement from China

Executive Summary: The Time Cost of Unverified Import Research

Global procurement managers face critical delays and resource drain when identifying actual importers of Chinese goods. Public customs data (e.g., Datamyne, Panjiva) suffers from 3 systemic flaws:

1. Anonymized Buyers: 78% of shipments list “trading companies” or generic intermediaries, not end-buyers.

2. Code Misclassification: HS code errors obscure true product categories (e.g., “plastic parts” masking medical device components).

3. Data Lag: Public records average 60-90 days old – unusable for agile sourcing.

Manually verifying legitimate importers consumes 127+ hours per category (SourcifyChina 2025 Procurement Efficiency Study).

Why the Verified Pro List Eliminates Research Waste

| Research Method | Time Spent (Per Target Category) | Risk of Invalid Leads | Data Recency | Actionable Insights |

|---|---|---|---|---|

| Public Customs Databases | 127+ hours | 68% | 60-90 days | Low (No buyer IDs) |

| Generic Supplier Directories | 85+ hours | 52% | Unverified | Medium |

| SourcifyChina Verified Pro List | < 25 hours | < 8% | < 14 days | High (Direct Buyer IDs) |

How We Achieve 80% Time Savings:

✅ Direct Buyer Mapping: We cross-reference shipments with corporate registries, payment records, and trade licenses to reveal actual end-importers (e.g., “Walmart Inc.” vs. “Shenzhen Trading Co.”).

✅ AI-Powered Product Tagging: Algorithms correct HS code errors using product descriptions, images, and buyer history.

✅ Real-Time Validation: Dedicated China-based verification team confirms buyer legitimacy weekly.

“The Pro List cut our medical device supplier vetting cycle from 3 weeks to 4 days. We now engage decision-makers, not middlemen.”

— Procurement Director, Top 5 EU Medical Equipment Distributor (2025 Client Case Study)

Call to Action: Accelerate Your 2026 Sourcing Strategy

Stop paying for research that delivers noise, not buyers. In 2026’s volatile supply chain, speed-to-market hinges on verified intelligence. The SourcifyChina Verified Pro List is your only source for:

🔹 Direct access to 22,000+ pre-vetted importers actively sourcing your product category

🔹 Customizable alerts for new buyers entering your market

🔹 Zero wasted outreach – contact procurement managers, not anonymous traders

Your next strategic supplier is waiting. Claim your advantage in < 48 hours:

➡️ Email: [email protected] (Specify: “2026 Pro List Access Request”)

➡️ WhatsApp: +86 159 5127 6160 (24/7 Priority Response)

Request your complimentary category-specific Pro List snapshot today. Valid for procurement managers through Q1 2026.

SourcifyChina | Your Verified Import Intelligence Partner

Data-Driven Sourcing Since 2018 | 1,200+ Global Clients | 94% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.