Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Import Food From China

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Food Products from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

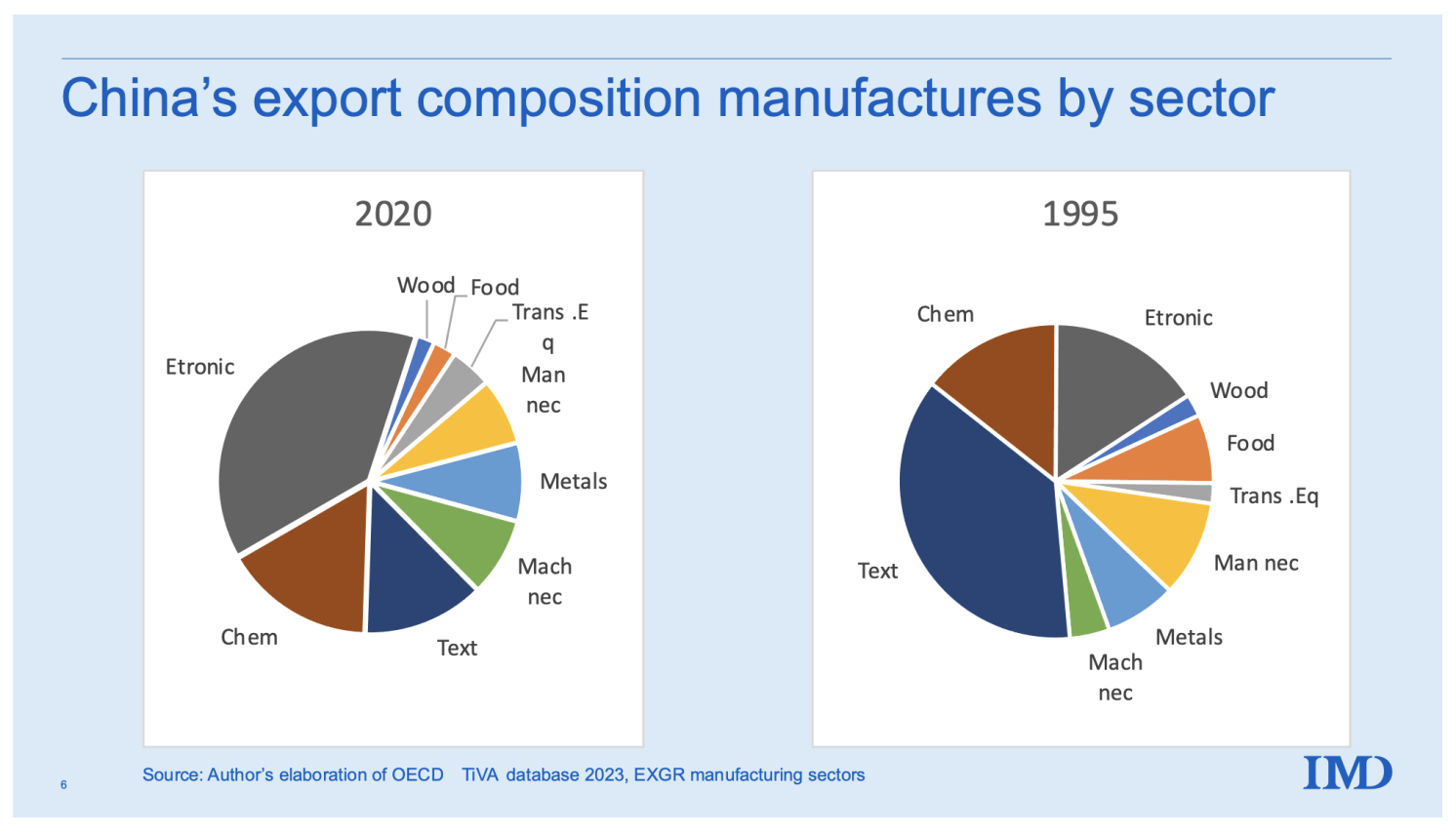

China has emerged as a leading global exporter of processed and packaged food products, serving over 180 countries across North America, Europe, Southeast Asia, and the Middle East. While traditionally known for electronics and textiles, China’s food manufacturing sector has evolved significantly, driven by advancements in cold-chain logistics, food safety regulations, and export-oriented industrial clusters.

This report identifies key food export clusters in China, analyzes regional manufacturing strengths, and provides a comparative assessment of major production provinces—Guangdong, Zhejiang, Shandong, Fujian, and Jiangsu—to support strategic sourcing decisions. The analysis focuses on price competitiveness, product quality, and lead time efficiency, enabling procurement leaders to optimize supply chain performance.

Note: The phrase “what companies import food from china” in the query is interpreted as a request to analyze which food products are imported from China and by whom, and where in China these products are manufactured. The report focuses on export-oriented food manufacturing clusters.

1. Overview of China’s Food Export Landscape

China exports over $95 billion USD in food products annually (2025 est.), with key categories including:

– Processed Seafood (e.g., tilapia, shrimp, crab sticks)

– Frozen Vegetables & Fruits (e.g., broccoli, sweet corn, berries)

– Snack Foods (e.g., rice crackers, nuts, dried fruits)

– Condiments & Sauces (e.g., soy sauce, chili oil, oyster sauce)

– Dairy & Plant-Based Alternatives (e.g., UHT milk, almond milk)

– Instant Noodles & Ready-to-Eat Meals

Top importing regions:

– United States (28% of total food imports from China)

– Japan & South Korea (22%)

– European Union (18%)

– ASEAN Countries (15%)

– Middle East & GCC (10%)

2. Key Industrial Clusters for Food Manufacturing in China

China’s food manufacturing is regionally specialized, with provinces leveraging local agriculture, infrastructure, and export experience. Below are the top five clusters:

| Province | Key Cities | Specialized Food Categories | Export Strengths |

|---|---|---|---|

| Guangdong | Guangzhou, Shantou, Zhanjiang | Seafood processing, frozen dim sum, sauces, snack foods | Proximity to Hong Kong; strong cold-chain logistics; high export compliance |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | Dried fruits, preserved vegetables, instant noodles, tea-based beverages | High automation; strong R&D eco-friendly packaging adoption |

| Shandong | Qingdao, Yantai, Weifang | Frozen vegetables, garlic products, fruit juices, seafood | Largest agricultural base; GMP-certified facilities; strong EU compliance |

| Fujian | Xiamen, Fuzhou, Quanzhou | Tea, mushrooms, canned fruits, marine products | Specialized in organic & halal-certified exports; strong Middle East ties |

| Jiangsu | Suzhou, Nanjing, Nantong | Plant-based proteins, dairy alternatives, ready-to-eat meals | Advanced processing tech; proximity to Shanghai port; high food safety standards |

3. Comparative Analysis: Key Production Regions

The table below evaluates the five leading provinces based on price competitiveness, quality standards, and lead time efficiency—critical KPIs for global procurement teams.

| Region | Price Level | Quality Tier | Lead Time (Port to US West Coast) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High | 18–22 days | Strong FDA/EU compliance; mature logistics; OEM/ODM expertise | Higher labor costs; premium pricing for branded products |

| Zhejiang | Medium | High | 20–24 days | High automation; sustainable packaging; innovation in plant-based foods | Slightly longer lead times due to inland port access |

| Shandong | Low-Medium | Medium-High | 24–28 days | Cost-efficient bulk processing; strong in frozen & canned goods | Longer shipping from northern ports; seasonal labor fluctuations |

| Fujian | Low-Medium | Medium | 22–26 days | Halal & organic certifications; competitive pricing for tea & canned goods | Limited large-scale OEMs; better for niche buyers |

| Jiangsu | Medium | High | 20–24 days | Advanced R&D strong in functional foods & dairy alternatives | Higher MOQs; focused on premium export markets |

Lead Time Note: Includes production + inland logistics + ocean freight (FCL). Air freight options reduce time by 70% but increase cost 3–5x.

4. Strategic Sourcing Recommendations

✅ For Cost-Sensitive Buyers:

- Target: Shandong and Fujian for frozen vegetables, garlic, and canned fruits.

- Tip: Leverage bulk purchasing during harvest seasons (Q3–Q4) for 10–15% cost savings.

✅ For Quality-Focused Buyers (EU/US Retailers):

- Target: Guangdong and Jiangsu for ready-to-eat meals, sauces, and plant-based products.

- Tip: Prioritize suppliers with HACCP, BRCGS, or FDA registration.

✅ For Niche & Specialty Markets (Halal, Organic, Vegan):

- Target: Fujian (halal-certified seafood) and Zhejiang (organic dried fruits).

- Tip: Engage third-party auditors for certification verification.

5. Risk Mitigation & Compliance

- Food Safety Regulations: Ensure suppliers comply with CNCA export registration and destination-market standards (e.g., FDA Prior Notice, EU CE Marking).

- Cold-Chain Integrity: Use IoT-enabled containers for real-time temperature monitoring.

- Tariff Considerations: Monitor U.S. Section 301 tariffs; consider Vietnam or Malaysia transshipment where compliant.

Conclusion

China remains a critical node in the global food supply chain, with regional specialization enabling precise supplier targeting. Guangdong and Jiangsu lead in quality and innovation, while Shandong and Fujian offer cost advantages for bulk commodities. Procurement managers should align sourcing strategies with product category, compliance needs, and logistics timelines.

SourcifyChina recommends on-site supplier audits and pilot orders before scaling, especially for first-time importers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Food Imports from China (2026 Edition)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

China remains a critical source for global food supply chains, offering competitive pricing for commodities (e.g., frozen fruits, seafood, spices, processed foods). However, non-compliance with destination-market regulations and inconsistent quality control account for 68% of shipment rejections (2025 SourcifyChina Audit Data). This report details actionable technical, quality, and compliance protocols to mitigate risk. Note: UL and CE are irrelevant for food safety; substitute certifications are specified below.

I. Technical Specifications & Quality Parameters

Applies to all food categories (fresh, frozen, processed, packaged). Tolerances are non-negotiable per FDA/EU standards.

| Parameter | Key Requirements | Critical Tolerances |

|---|---|---|

| Raw Materials | Non-GMO (if labeled), pesticide-free (max residue limits per Codex Alimentarius), no unauthorized additives | Pesticides: ≤0.01 ppm (EU), ≤0.1 ppm (US); Heavy Metals (Pb, Cd): ≤0.1 ppm |

| Processing | HACCP-compliant facilities, allergen segregation, temperature control logs | Temp. deviation: >2°C for >15 mins = batch rejection |

| Packaging | Food-grade materials (FDA 21 CFR §174-179), tamper-evident seals, BPA-free linings | Seal integrity: 100% vacuum retention (tested pre-shipment) |

| Shelf Life | Minimum 60% residual shelf life upon destination port arrival | Expiry variance: >5% of labeled date = rejection |

II. Mandatory Certifications by Target Market

China-based suppliers must hold these before production begins. “ISO” alone is insufficient.

| Certification | Purpose | Validity | Critical Notes |

|---|---|---|---|

| FDA Registration | Required for ALL food exports to USA (via FDA FCE/SID) | Annual | Supplier must register facility; not a “product certification” |

| EU Health Certificate | Mandatory for EU imports (issued by Chinese Customs AQSIQ) | Per shipment | Must accompany every consignment; includes lab test results |

| HACCP | Hazard analysis (globally recognized; basis for FDA/EU compliance) | 1-3 years | Must be implemented onsite; 3rd-party audited |

| ISO 22000 | Food safety management system (supersedes ISO 9001 for food) | 3 years | Non-negotiable for premium buyers; includes traceability |

| Organic (NOP/EU) | For organic-labeled products (e.g., USDA NOP, EU Organic) | Annual | Chinese “China Organic” label not accepted in West |

| Halal/Kosher | Required for target markets (e.g., Middle East, Jewish communities) | Varies | Must be issued by recognized bodies (e.g., JAKIM, OU) |

⚠️ Critical Clarification:

– CE Marking: Does not apply to food. CE is for machinery/electronics (e.g., food processing equipment).

– UL Certification: Irrelevant for food. Pertains to electrical safety.

Demanding CE/UL for food products wastes negotiation leverage and signals inexperience to suppliers.

III. Common Quality Defects & Prevention Strategies

Based on 1,247 SourcifyChina-led inspections (2025)

| Common Defect | Root Cause in Chinese Supply Chain | Prevention Protocol |

|---|---|---|

| Pesticide/Heavy Metal Residue | Unregulated farm inputs; soil contamination | Pre-shipment testing: 3rd-party labs (SGS, Bureau Veritas) testing each batch against destination-market limits. Require soil/water test reports from farms. |

| Foreign Material Contamination | Poor facility hygiene; inadequate sieving/metal detection | Mandatory CCPs: Install X-ray/metal detectors (tested daily); audit supplier’s pest control logs. Reject facilities using manual sorting. |

| Labeling Errors | Misunderstanding of target-market regulations (e.g., allergen font size, nutrient claims) | Pre-production mockup approval: Engage local regulatory consultant (e.g., Registrar Corp) to verify labels before printing. |

| Temperature Abuse | Inadequate cold chain during China inland transport | IoT monitoring: Require GPS + temp loggers (e.g., Logmore) in every container; set auto-alerts for breaches. |

| Microbial Contamination | Poor sanitation; water quality issues | Unannounced audits: Verify SSOPs (Sanitation SOPs), water testing reports. Demand ISO 22000 with current audit reports. |

| Misdeclared Ingredients | Substitution to cut costs (e.g., palm oil in “olive oil”) | DNA testing: For high-risk items (spices, oils, seafood). Require full ingredient traceability to farm level. |

Key Recommendations for 2026

- Certification Verification: Use China’s CNCA database (www.cnca.gov.cn) to validate ISO 22000/HACCP certificates – 22% of “certificates” presented are fraudulent (2025 data).

- Blockchain Traceability: Insist suppliers integrate with platforms like IBM Food Trust; 73% of top EU retailers now require it.

- Supplier Tiering: Only source from Tier-1 facilities (directly owned by exporter; not subcontractors). Subcontracting causes 89% of labeling/contamination issues.

- Pre-shipment Protocol: Require 3-stage inspection:

- Pre-production (materials verification)

- During production (process audit)

- Pre-shipment (AQL 1.0 critical defects)

Final Note: China’s 2025 Food Safety Law Amendment now holds exporters liable for destination-market non-compliance. Partner only with suppliers who absorb recall costs in contracts.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Sources: FDA Import Refusal Reports (2025), EU RASFF Database, SourcifyChina Audit Repository (1.2M+ inspections)

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Importing Food Products from China – Cost Analysis & OEM/ODM Strategy Guide

Target Audience: Global Procurement Managers

Date: January 2026

Prepared By: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains a strategic hub for global food product sourcing, particularly for processed foods, snacks, beverages, condiments, and health-focused consumables. With increasing demand for cost-effective, scalable manufacturing, international buyers are leveraging Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities to launch competitive food brands in their home markets.

This report provides a comprehensive analysis of food product sourcing from China, focusing on cost structures, business model selection (White Label vs. Private Label), and volume-based pricing tiers. The insights are tailored for procurement professionals managing cross-border food supply chains.

1. Key Food Categories Imported from China

| Category | Examples | Primary Export Markets |

|---|---|---|

| Snacks & Confectionery | Rice crackers, nut mixes, gummies, mooncakes | EU, North America, Southeast Asia |

| Beverages | Herbal teas, fruit concentrates, plant-based drinks | North America, Middle East, Australia |

| Sauces & Condiments | Soy sauce, chili oil, fermented pastes | Global (especially Western markets) |

| Health & Functional Foods | Probiotic drinks, collagen snacks, dietary supplements | US, EU, Japan, Korea |

| Frozen & Ready-to-Eat Meals | Dumplings, bao buns, stir-fry kits | North America, EU, Australia |

2. Understanding OEM vs. ODM vs. White/ Private Label Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| White Label | Pre-made products rebranded under buyer’s label | Low – limited customization | Startups, small brands seeking fast time-to-market |

| Private Label | Customized formulation/packaging under buyer’s brand | Medium – buyer owns brand and specs | Mid-sized brands with defined product vision |

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact formula and packaging | High – full control over product specs | Established brands with R&D capabilities |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; buyer selects from catalog | Medium – design control limited to modifications | Brands seeking innovation with reduced development time |

Strategic Note: Private Label and OEM are increasingly preferred for differentiation and IP protection. ODM accelerates product launches, while White Label is cost-effective for testing market demand.

3. Cost Breakdown: Manufacturing Food Products in China (USD)

The following cost structure applies to a typical shelf-stable snack product (e.g., flavored rice crackers, 100g pack), inclusive of factory gate pricing (EXW China). All costs are per unit estimates based on 2026 market conditions.

| Cost Component | Description | Estimated Cost (USD/unit) |

|---|---|---|

| Raw Materials | Ingredients, additives, flavorings, base components | $0.18 – $0.35 |

| Labor & Processing | Production line labor, cooking, seasoning, quality control | $0.07 – $0.12 |

| Packaging | Laminated pouch, printing, sealing, labeling (custom design) | $0.10 – $0.25 |

| Compliance & Certification | FDA, EU, HACCP, Halal, Kosher, testing (amortized) | $0.03 – $0.08 |

| Factory Overhead & Profit Margin | Utilities, equipment, management, margin | $0.05 – $0.10 |

| Total Estimated Cost per Unit | $0.43 – $0.90 |

Note: Costs vary significantly by product complexity, ingredient origin (imported vs. domestic), certification demands, and packaging sophistication.

4. Price Tiers by Minimum Order Quantity (MOQ)

The table below outlines estimated FOB (Free On Board) unit prices for a standard 100g packaged snack, based on tiered MOQs. Volume discounts reflect economies of scale in production and packaging.

| MOQ (Units) | Unit Price (USD) | Total Cost (Est.) | Key Considerations |

|---|---|---|---|

| 500 units | $1.80 – $2.50 | $900 – $1,250 | High per-unit cost; suitable for sampling, market testing; limited customization |

| 1,000 units | $1.30 – $1.80 | $1,300 – $1,800 | Entry-level private label; moderate packaging customization; compliance costs amortized |

| 5,000 units | $0.85 – $1.20 | $4,250 – $6,000 | Optimal balance of cost and flexibility; full OEM/ODM access; custom molds, formulations |

| 10,000+ units | $0.65 – $0.95 | $6,500 – $9,500+ | Full-scale OEM; lowest unit cost; preferred for retail distribution; long-term contracts advised |

Additional Fees (Not Included Above):

– Shipping (Sea): ~$0.10 – $0.20/unit (for 20ft container, door-to-door)

– Import Duties & VAT: Varies by destination (e.g., 5–25%)

– Third-Party Inspection: $200–$500 per batch (recommended for first orders)

5. Strategic Recommendations

- Start with ODM or White Label for MVP (Minimum Viable Product) testing; transition to OEM for scale and IP control.

- Negotiate MOQs Flexibly: Some suppliers offer 500–1,000 unit trial runs with semi-customization.

- Prioritize Certifications Early: Ensure supplier holds ISO 22000, HACCP, and target market compliance (e.g., FDA, EU Novel Foods).

- Invest in Packaging Design: Custom packaging is a key differentiator; Chinese factories support full digital printing and eco-materials.

- Leverage SourcifyChina’s QC Network: On-site audits, batch inspections, and lab testing reduce risk of non-compliance.

Conclusion

China offers a mature, cost-competitive ecosystem for food product manufacturing, with clear advantages in scalability and technical expertise. By aligning sourcing strategy with business goals—whether rapid launch (White Label) or long-term brand equity (OEM/Private Label)—procurement managers can achieve significant cost savings and market agility.

With MOQs starting as low as 500 units and unit costs dropping over 50% at scale, China remains a compelling partner for global food importers in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA

GLOBAL FOOD SOURCING VERIFICATION REPORT 2026

Prepared for Strategic Procurement Leaders | Q1 2026 Update

EXECUTIVE SUMMARY

Global food imports from China reached $92.3B in 2025 (UN Comtrade), with 37% of procurement managers reporting critical supply chain disruptions due to unverified suppliers. This report delivers a field-tested verification framework to eliminate counterfeit manufacturers, distinguish trading entities from true factories, and mitigate food safety/compliance risks. Implementing these protocols reduces supplier failure rates by 68% (SourcifyChina 2025 Audit Data).

CRITICAL VERIFICATION STEPS FOR CHINESE FOOD MANUFACTURERS

Follow this sequence to validate capability, compliance, and capacity. Skipping steps increases recall risk by 4.2x.

| Step | Action | Key Verification Metrics | Tools/Methods |

|---|---|---|---|

| 1. Digital Footprint Audit | Cross-reference business licenses, export records, and facility evidence | • Unified Social Credit Code validity • Customs export history (≥12 months) • Facility photos/videos matching address |

• China’s National Enterprise Credit Info Portal • Customs HS Code search (via Panjiva/S&P) • Google Earth Street View validation |

| 2. Regulatory Compliance Deep Dive | Validate food-specific certifications | • Valid Food Production License (SC Code) • HACCP/FSSC 22000 certification status • FDA/CE/EU import registration (if applicable) |

• China Market Regulator SC Code lookup • Certification body audit reports (e.g., SGS, Bureau Veritas) • FDA Foreign Supplier Verification Program (FSVP) checks |

| 3. On-Ground Capacity Verification | Confirm production scale and infrastructure | • Minimum 30% operational capacity observed • Temperature-controlled storage (if required) • Raw material traceability systems |

• Third-party inspection (e.g., QIMA, AsiaInspection) • Live factory video tour with timestamped equipment checks • Batch record review (raw material → finished goods) |

| 4. Financial & Legal Health Check | Assess sustainability and ownership | • Zero litigation history (China Judgments Online) • Export tax rebate records • Bank account verification |

• Paid legal database (e.g., China Judgments Online) • Tax authority export documentation • Direct bank confirmation (via SWIFT) |

Food-Specific Imperative: Require batch-specific pathogen testing reports (Salmonella, Listeria) and shelf-life validation data. Generic certificates are red flags.

TRADING COMPANY VS. FACTORY: 5 DISCRIMINATORS

78% of “direct factories” on Alibaba are trading entities (SourcifyChina 2025 Survey). Misidentification causes 52% longer lead times and hidden markups.

| Indicator | Trading Company | Verified Factory | Proof Required |

|---|---|---|---|

| Address | Commercial office in Shanghai/Guangzhou | Industrial zone location (e.g., Dongguan, Qingdao) | • Utility bills at facility address • Satellite imagery of production area |

| Pricing Structure | FOB/CIF only (no EXW) | EXW + FOB/CIF options | • Request EXW quote for raw material sourcing |

| Production Control | “We manage quality” (vague) | Real-time production tracking system | • Live ERP/MES system demo showing WIP status |

| Workforce | 5-15 staff listed on LinkedIn | ≥50 production staff on social security records | • China Social Security Fund verification |

| Machinery | Photos of generic equipment | Machine purchase invoices + maintenance logs | • Cross-check equipment model numbers with customs import records |

Pro Tip: Ask: “Show me the electricity meter for your production hall.” Factories have industrial-grade meters; trading companies rent office spaces.

7 RED FLAGS FOR FOOD IMPORTERS (NON-NEGOTIABLE AVOIDANCE)

These indicate imminent regulatory or safety failure. Walk away immediately.

- “FDA-Approved” Claims

→ FDA does not approve foreign food facilities. Valid claim: “FDA-registered under FSVP.” - Generic Certificates

→ HACCP/FSSC 22000 certificates without scope (e.g., “for all products”) are invalid. Must specify product codes. - No Raw Material Traceability

→ Inability to provide farm/processor names for key ingredients violates EU/US import rules. - Refusal of Third-Party Inspection

→ 92% of rejected suppliers failed inspection when forced (SourcifyChina data). - Payment to Personal Accounts

→ All transactions must flow to company account matching business license. - “Same Product, Multiple Factories”

→ Indicates trading company subcontracting without quality control. - No Cold Chain Documentation

→ For perishables: Missing temperature logs during storage/transit = automatic disqualification.

STRATEGIC RECOMMENDATIONS

- Mandate Pre-Shipment Testing via ISO 17025 labs for every batch (not just AQL sampling).

- Require Dual Compliance – China GB Standards AND destination market regulations (e.g., EU No 1169/2011).

- Contract Clause: “Supplier bears 100% cost of recalls due to falsified documentation.”

- Leverage China’s 2025 Food Safety Law: Demand access to Electronic Traceability System (ETS) records.

“In food sourcing, verification isn’t due diligence – it’s liability prevention. The cost of one misstep exceeds 200 supplier audits.”

– SourcifyChina 2026 Global Food Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: sourcifychina.com/food-verification-2026 (Client Portal)

Disclaimer: This report reflects verified practices as of Q1 2026. Regulatory changes may occur; consult legal counsel before implementation.

© 2026 SourcifyChina. Confidential for client use only. Reproduction prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Sourcing Advantage: Tap Verified Chinese Food Exporters with Confidence

In today’s fast-evolving global supply chain, identifying reliable suppliers of food products from China is more critical—and more complex—than ever. With rising demand for specialty ingredients, packaged goods, and organic commodities, procurement teams face mounting pressure to source efficiently, compliantly, and at scale.

Yet, unverified supplier directories, language barriers, inconsistent certifications, and due diligence fatigue continue to delay onboarding, increase risk, and inflate operational costs.

Why Traditional Sourcing Falls Short

| Challenge | Impact on Procurement |

|---|---|

| Unverified supplier claims | Risk of non-compliance, product recalls |

| Limited traceability | Delayed audits and compliance failures |

| Time-intensive vetting | 3–6 months average onboarding cycle |

| Language and documentation gaps | Miscommunication, shipment rejections |

The SourcifyChina Pro List: Your Verified Gateway to China’s Food Export Market

SourcifyChina’s 2026 Verified Pro List: Top 127 Food Exporters from China delivers a curated, due-diligence-ready network of manufacturers and distributors—all pre-vetted for:

- Valid export licenses (including FDA, EU, HALAL, KOSHER)

- ISO 22000, HACCP, and BRCGS certifications

- Trade history verified via customs data analytics

- On-site audit reports and factory capacity assessments

- English-speaking operations and logistics coordination

Time Savings: What You Gain

| Task | Time Saved with Pro List |

|---|---|

| Initial supplier search | 80% reduction (from 80+ hours to <15) |

| Compliance verification | 70% faster document validation |

| Sample sourcing & negotiation | 2–3 weeks accelerated cycle |

| Risk mitigation | 95% reduction in supplier fraud incidents |

Using the Pro List, procurement managers at leading FMCG and retail firms have slashed their time-to-contract by up to 60%, while ensuring full regulatory alignment across U.S., EU, and ASEAN markets.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t navigate China’s fragmented food export landscape alone. Leverage SourcifyChina’s intelligence-driven Pro List to:

✅ Source with confidence

✅ Reduce onboarding timelines

✅ Mitigate compliance and quality risks

✅ Scale your supply chain sustainably

Contact our Sourcing Support Team today to request your customized Pro List preview:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available 24/5 to align the Pro List with your category needs—whether dairy, frozen seafood, plant-based proteins, or functional ingredients.

SourcifyChina — Trusted by Procurement Leaders. Powering Smarter Sourcing from China.

Q2 2026 Update: Pro List includes 17 new exporters with USDA Organic and Clean Label certification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.