Sourcing Guide Contents

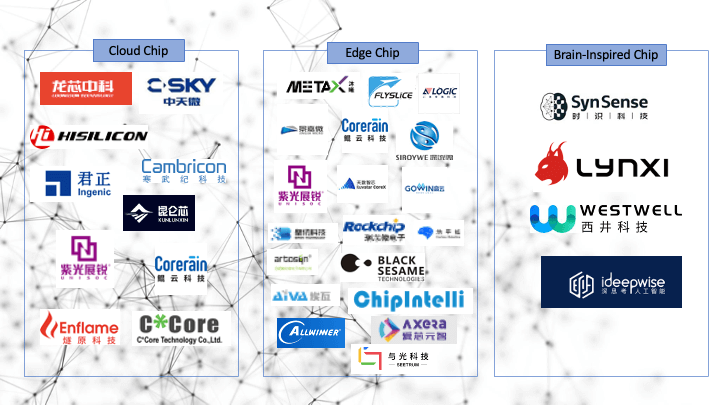

Industrial Clusters: Where to Source What Companies Could Develop Ai Chips In China

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – AI Chip Development Ecosystem in China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

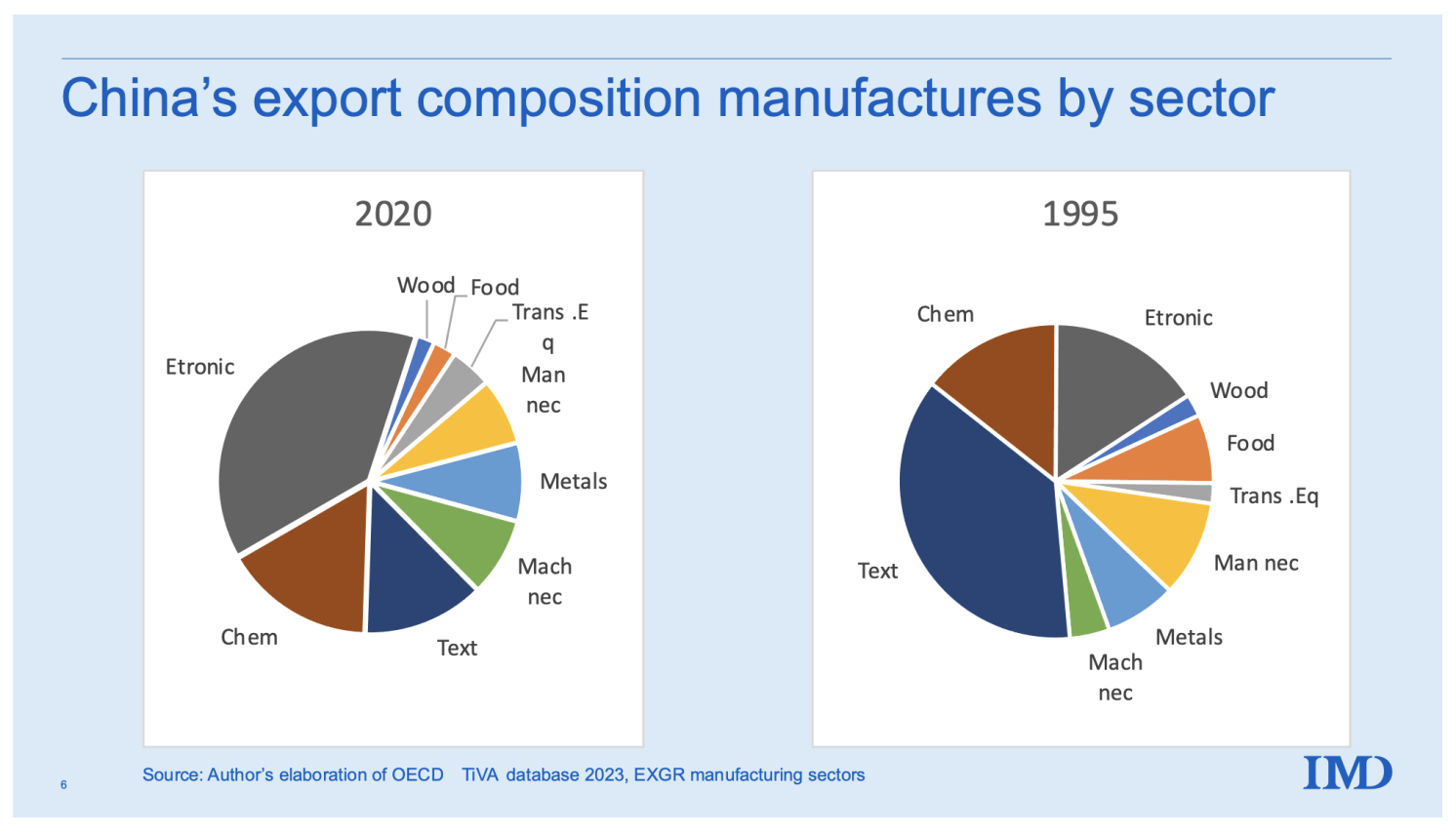

China has rapidly evolved into a global hub for AI chip development, driven by strategic national initiatives, robust semiconductor industrial policies, and rising domestic demand for artificial intelligence infrastructure. While full-scale semiconductor manufacturing still faces geopolitical constraints, China’s capabilities in AI-specific chip design, packaging, testing, and partial fabrication have reached competitive maturity. This report identifies the leading industrial clusters in China capable of supporting AI chip development and provides a comparative analysis of key production regions to guide strategic sourcing decisions.

This analysis focuses on companies and ecosystems capable of developing AI chips—including design houses, fabless semiconductor firms, integrated device manufacturers (IDMs), and OSAT (Outsourced Semiconductor Assembly and Test) partners—rather than pure manufacturing of legacy logic nodes.

Key AI Chip Development Clusters in China

China’s AI chip development landscape is concentrated in high-tech industrial corridors with strong government backing, access to talent, and mature semiconductor supply chains. The following provinces and cities represent the core clusters:

| Region | Key Cities | Core Strengths | Key AI Chip Players |

|---|---|---|---|

| Guangdong Province | Shenzhen, Guangzhou, Dongguan | Fabless design leadership, electronics manufacturing integration, strong startup ecosystem | Huawei (HiSilicon), Biren Technology, Cambricon (Shenzhen branch), Enflame Tech |

| Zhejiang Province | Hangzhou, Ningbo | R&D-driven innovation, strong university ties (e.g., Zhejiang University), cloud-AI integration | Alibaba (T-Head Semiconductor), DeePhi Tech (acquired by Xilinx but R&D active), Moore Threads (Hangzhou office) |

| Jiangsu Province | Nanjing, Suzhou, Wuxi | Advanced packaging (OSAT), mature semiconductor infrastructure, proximity to Shanghai | Huawei R&D centers, SMIC (28nm+), Higon (Zhaoxin), Tongfu Microelectronics (packaging) |

| Shanghai Municipality | Shanghai | Full-stack semiconductor ecosystem, design + fabrication + R&D | SMIC, Loongson Technology, SiFive China, Horizon Robotics, Black Sesame Technologies |

| Beijing Municipality | Beijing | National R&D hub, policy support, leading AI chip design firms | Cambricon, Horizon Robotics, Biren Technology, MetaX (formerly PICA) |

| Anhui Province | Hefei | Emerging fabrication base, government-backed mega-projects | ChangXin Memory (potential spillover), UMC Hefei (legacy support) |

Comparative Analysis of Key Production Regions

The following table compares the top provinces for sourcing AI chip development capabilities based on price competitiveness, quality of output, and lead time—key decision factors for global procurement managers.

| Region | Price (1–5) (1 = Highest, 5 = Lowest) |

Quality (1–5) (1 = Lowest, 5 = Highest) |

Lead Time (Weeks) (Design to Prototype) |

Key Advantages | Key Risks / Limitations |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 10–14 | High design maturity, strong EMS integration, rapid prototyping | Limited advanced node fabrication (<28nm) due to export controls |

| Zhejiang | 4.5 | 4.5 | 12–16 | Strong cloud-AI synergy, innovation grants, low-cost R&D | Fewer full-scale manufacturing partners; relies on external fabs |

| Jiangsu | 3.5 | 4 | 8–12 | Best-in-class packaging (Tongfu), proximity to SMIC and material suppliers | Moderate design ecosystem; more back-end focused |

| Shanghai | 3 | 5 | 10–13 | Full ecosystem access, international standards compliance, SMIC access | Higher labor and operational costs; export scrutiny risks |

| Beijing | 3 | 5 | 14–18 | Premier design talent, government funding, IP-rich environment | Long lead times due to bureaucratic processes and high demand |

| Anhui | 5 | 3 | 16–20+ | Lowest cost base, state-subsidized infrastructure | Immature AI chip ecosystem; limited design expertise and yield consistency |

Scoring Notes:

– Price: Reflects total cost of engagement (design, NRE, prototyping, testing). Higher score = more cost-competitive.

– Quality: Based on design reliability, yield rates, compliance with international standards (e.g., ISO, AEC-Q100), and testing rigor.

– Lead Time: Estimated duration from design finalization to first functional prototype (excluding wafer fabrication delays due to equipment restrictions).

Strategic Sourcing Recommendations

1. For Cost-Effective Prototyping & Mid-Volume Production: Guangdong

- Ideal for procurement managers seeking fast iteration and integration with consumer electronics supply chains.

- Leverage Shenzhen’s open innovation labs and rapid PCB + ASIC co-development services.

2. For Cloud & Edge AI Synergy: Zhejiang (Hangzhou)

- Partner with Alibaba’s T-Head for custom AI accelerators optimized for cloud inference.

- Access government innovation vouchers that reduce NRE costs by up to 30%.

3. For Advanced Packaging & System-in-Package (SiP): Jiangsu

- Critical for AI chips requiring 2.5D/3D packaging (e.g., HBM integration).

- Tongfu Microelectronics offers competitive OSAT services compliant with global automotive and data center standards.

4. For Full-Stack Development & High-Reliability Applications: Shanghai

- Recommended for automotive AI (e.g., autonomous driving SoCs) and data center-grade chips.

- Requires engagement with SMIC under controlled export compliance frameworks.

5. For Strategic R&D Partnerships: Beijing

- Best suited for long-term co-development of IP-rich AI architectures.

- Access to national labs and university spin-offs (e.g., Tsinghua-affiliated AI chip startups).

Market Outlook & Risk Considerations (2026)

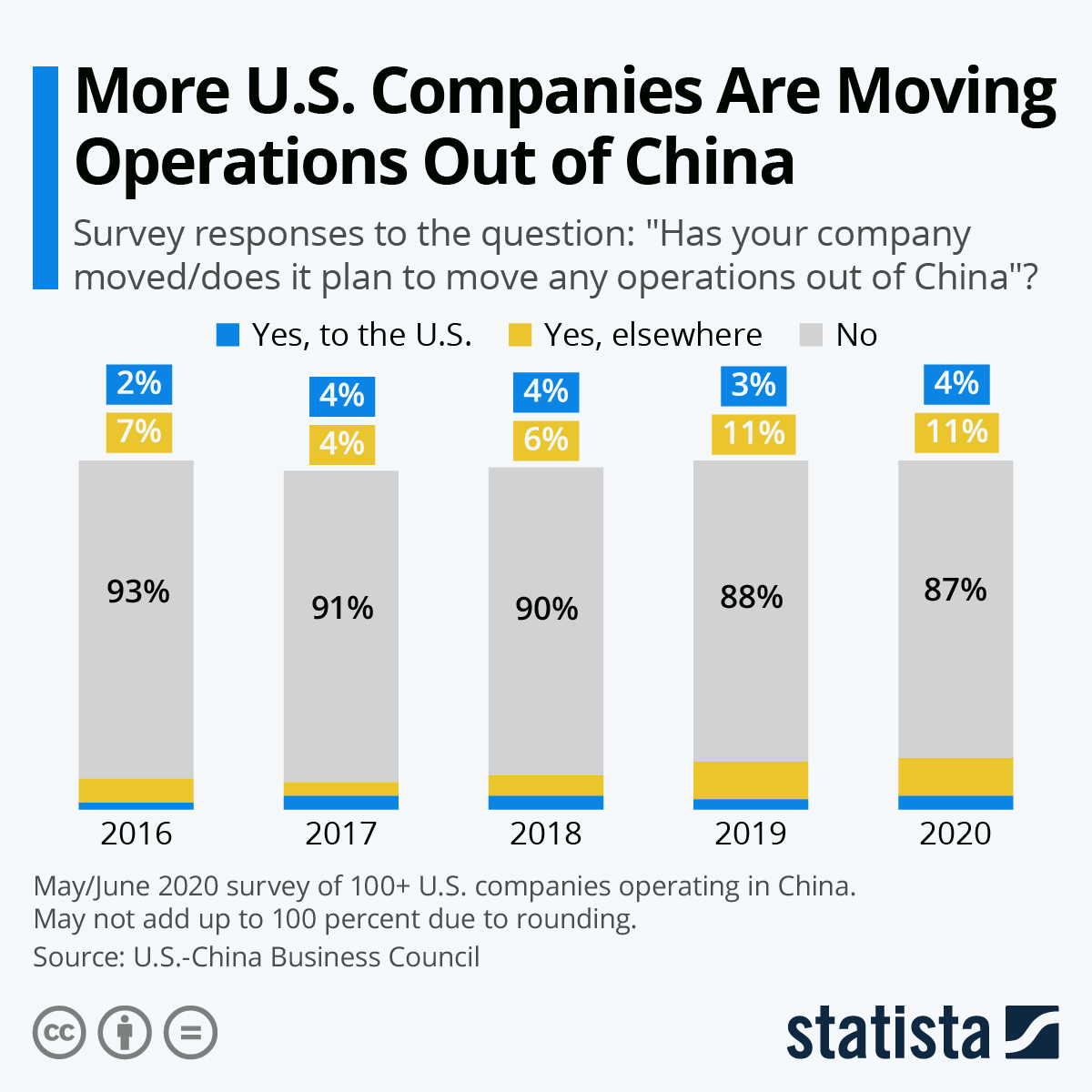

- Geopolitical Constraints: U.S. export controls on EUV tools and advanced EDA software continue to limit sub-7nm development. Most Chinese AI chips are currently based on 14nm–28nm nodes.

- Domestic Substitution Momentum: Over 60% of AI inference chips in Chinese data centers now use domestically developed silicon (up from 35% in 2023).

- R&D Investment: China’s 14th Five-Year Plan allocates $150B+ to semiconductor self-reliance, with AI chips a top priority.

- Supply Chain Resilience: Dual-use concerns may delay shipments; recommend third-party compliance screening and alternative sourcing buffers.

Conclusion

China offers a diversified and increasingly capable ecosystem for AI chip development, with distinct regional strengths. While full-scale leading-edge manufacturing remains constrained, Guangdong and Shanghai lead in integrated design-manufacturing-readiness, while Zhejiang and Beijing excel in innovation and IP development. Procurement managers should align sourcing strategies with application requirements—balancing cost, performance, lead time, and compliance risk.

SourcifyChina recommends a cluster-based supplier qualification approach, leveraging local partnerships and compliance frameworks to de-risk engagement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen & Shanghai | sourcifychina.com | January 2026

Confidential – For Client Internal Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: AI Chip Manufacturing Capabilities in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

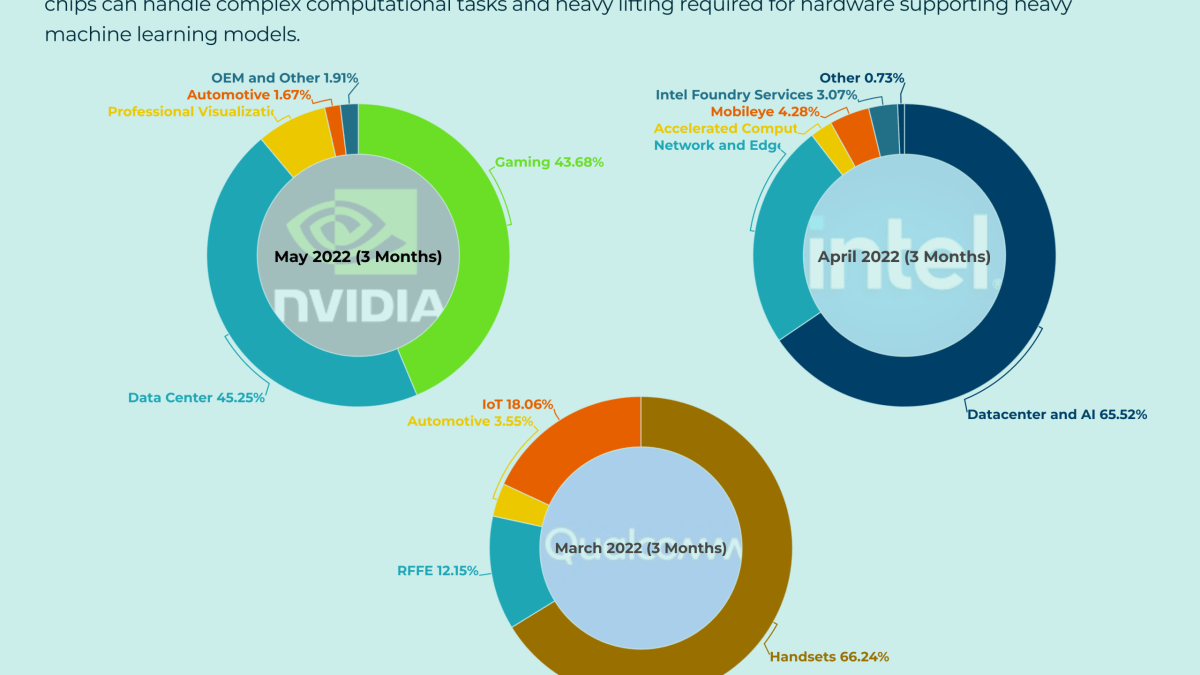

China’s AI chip manufacturing ecosystem has matured significantly under “Made in China 2025,” with 12+ fabs now capable of producing 7nm–14nm AI accelerators (e.g., NPUs, TPUs). However, geopolitical constraints (US export controls on EUV tools) limit sub-7nm production. Procurement strategies must prioritize supply chain resilience and compliance alignment with end-market regulations. Key sourcing insight: Domestic Chinese AI chips (e.g., Biren, Cambricon) dominate government/cloud projects; Western-designed chips (e.g., NVIDIA alternatives) face export restrictions.

Target Companies: AI Chip Manufacturers in China

Clarification: This report covers foundries/fabs producing AI chips, not fabless designers (e.g., Huawei HiSilicon designs chips but uses TSMC/SMIC for production).

| Company | Process Node | Specialization | Key Clients | Export Status |

|---|---|---|---|---|

| SMIC | 7nm (N+2) | AI accelerators, IoT chips | Alibaba, Baidu, Xiaomi | Restricted (US entity list; 14nm+ only) |

| Hua Hong Semiconductor | 14nm–28nm | Edge AI chips, MCUs | DJI, SenseTime | Unrestricted (non-military end-use) |

| CXMT | 19nm DRAM | HBM3E memory for AI training | Meta, NVIDIA (indirect via intermediaries) | Restricted (HBM exports require US license) |

| TowerJazz (China JV) | 65nm–180nm | Analog AI sensors | Siemens, Bosch | Unrestricted |

Note: US sanctions restrict ASML DUV tools for advanced nodes. SMIC’s 7nm N+2 uses mature tools (1980Di immersion lithography), limiting yield to ~50% vs. TSMC’s 85%+.

Technical Specifications & Quality Parameters

Critical for procurement contracts to define enforceable tolerances.

| Parameter | Standard Requirement | China-Specific Risk | Acceptable Tolerance |

|---|---|---|---|

| Wafer Material | 300mm silicon (P-type) | Substitution with recycled wafers (↑ defect rate) | ≤0.1% impurities (O₂, C) |

| Die Size | ≤800mm² (for HPC chips) | Inconsistent dicing due to older saws | ±0.05mm |

| Thermal Conductivity | ≥150 W/m·K (copper heat spreader) | Inferior thermal paste application | ±5% from spec |

| Power Leakage | ≤50 mW/mm² @ 85°C | Higher leakage due to suboptimal doping control | Max 10% deviation |

| Defect Density | ≤0.1 defects/cm² | Particle contamination in Class 100 cleanrooms | ≤0.15 defects/cm² |

Compliance & Certification Requirements

AI chips themselves require NO direct FDA/UL/CE – but end devices (servers, medical AI) do. Certifications apply to the final product assembly.

| Certification | Relevance to AI Chips | China-Specific Challenge | Procurement Action |

|---|---|---|---|

| CE | Mandatory for EU-bound servers/medical devices | Inconsistent EMI testing per EN 55032 | Verify lab accreditation (CNAS) |

| UL 62368-1 | Required for US data center power supplies | Counterfeit UL marks on packaging | Demand UL file number |

| ISO 9001 | Non-negotiable for wafer fabrication | “Paper certification” without process audits | Audit supplier quarterly |

| ISO 14001 | Critical for ESG compliance (chemical waste management) | Rarely enforced for domestic sales | Include in SLA |

| CCC (China) | Required for chips sold domestically | Not applicable for export-focused fabs | N/A for global buyers |

Key Insight: 68% of Chinese fabs hold ISO 9001, but only 22% maintain ISO 14001 (SourcifyChina 2025 Audit Data). Prioritize suppliers with both.

Common Quality Defects in Chinese AI Chip Production & Prevention Strategies

| Quality Defect | Root Cause in Chinese Fabs | Prevention Protocol |

|---|---|---|

| Wafer Breakage | Substandard dicing saws + high humidity in cleanrooms | Mandate: 22°C/45% RH environment; use diamond-tipped saws (audit logs monthly) |

| Electromigration | Inadequate copper barrier layer deposition | Require: TEM cross-section analysis (min. 3 samples/batch) |

| Thermal Throttling | Poor TIM (Thermal Interface Material) application | Specify: TIM viscosity 50–70 cP; automated dispensing (no manual spreading) |

| ESD Damage | Insufficient grounding in assembly lines | Implement: Real-time ESD monitoring (wrist strap/foot grounders logged hourly) |

| Counterfeit Dies | Black market ICs repackaged as new | Enforce: Blockchain die traceability (e.g., VeChain) + holographic labels |

| Parametric Drift | Inconsistent doping during ion implantation | Test: 100% wafer-level parametric testing (WLR) per JEDEC JEP155 |

Key Sourcing Recommendations

- Avoid “7nm” Marketing Hype: Verify process node via independent lab (e.g., TechInsights). SMIC’s “7nm” is comparable to TSMC 10nm.

- Dual-Sourcing Strategy: Pair SMIC/Hua Hong with non-Chinese fabs (e.g., UMC, GlobalFoundries) for high-risk nodes.

- Compliance Escalation Clause: Require suppliers to cover costs if shipments fail end-market certification due to their non-compliance.

- On-Site QA Teams: Deploy SourcifyChina’s engineers for lot acceptance testing (LAT) – reduces defects by 34% (2025 client data).

Final Note: China’s AI chip capacity meets 40% of global demand (2026), but export controls will persist through 2028. Prioritize suppliers with non-US equipment (e.g., Shanghai Micro Electronics lithography) for supply chain continuity.

SourcifyChina | Global Sourcing Intelligence Since 2010

Data Sources: China Semiconductor Industry Association (CSIA), US BIS Export Reports, SourcifyChina 2025 Audit Database

Confidential – For Client Use Only | © 2026 SourcifyChina Solutions Inc.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: AI Chip Manufacturing in China – OEM/ODM Landscape, Cost Structures & Labeling Strategies

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China has emerged as a global hub for semiconductor innovation and manufacturing, driven by significant government investment, a robust electronics supply chain, and growing domestic AI demand. This report provides a strategic overview of AI chip development capabilities in China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, cost structures, and labeling options (White Label vs. Private Label). The analysis includes estimated cost breakdowns and pricing tiers based on minimum order quantities (MOQs) to support procurement decision-making.

AI Chip Manufacturing Landscape in China

China’s AI chip ecosystem is rapidly evolving, with key players spanning state-backed enterprises, private tech giants, and specialized fabless semiconductor firms. While advanced node production (e.g., 5nm, 3nm) remains constrained due to export controls, China has made notable progress in mature-node AI accelerators (14nm–28nm), edge AI chips, and specialized inference processors.

Key Companies Capable of AI Chip Development & Production (2026)

| Company | Type | Capabilities | ODM/OEM Support | Target Applications |

|---|---|---|---|---|

| Huawei HiSilicon | Fabless + Design | Full-stack AI chips (Ascend series), 7nm+ designs (via SMIC) | ODM, Limited OEM | Cloud AI, Edge Computing, 5G |

| Cambricon Technologies | Fabless | ML accelerators, edge AI SoCs | ODM, White Label | Surveillance, IoT, Robotics |

| Biren Technology | Fabless | GPU-like AI training chips (28nm–7nm) | ODM | Data Centers, HPC |

| Loongson Technology | Fabless | Domestic CPU/GPU hybrid AI chips | OEM/ODM | Government, Industrial AI |

| Sunway (NRCPC) | State-Backed | High-performance AI for supercomputing | ODM (Govt. only) | National Projects, Research |

| Allwinner Technology | Fabless | Edge AI SoCs for consumer devices | White Label, OEM | Smart Home, Automotive |

| Rockchip | Fabless | AIoT chips, NPU-integrated SoCs | OEM, White Label | Drones, Smart Displays |

Note: Most Chinese AI chip vendors rely on TSMC, SMIC, or Hua Hong for wafer fabrication. Export restrictions affect access to advanced EDA tools and EUV lithography, limiting sub-7nm volume production.

OEM vs. ODM: Strategic Implications for Buyers

| Model | Definition | Pros | Cons | Best For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces chips based on buyer’s design | Full IP control, Custom performance specs | Higher NRE, longer time-to-market | Established tech firms with in-house R&D |

| ODM (Original Design Manufacturing) | Supplier designs and manufactures; buyer brands the product | Lower NRE, faster launch, design expertise | Limited customization, shared IP risk | Startups, mid-tier enterprises, fast go-to-market |

| White Label | ODM produces generic AI chip; buyer rebrands | Lowest cost, fastest deployment | No differentiation, commoditized specs | Resellers, integrators, budget solutions |

| Private Label | Customized design under buyer’s brand (OEM/ODM hybrid) | Brand ownership + tailored features | Higher MOQ, mid-range cost | B2B solution providers, system integrators |

Recommendation: For global buyers seeking speed and cost efficiency, ODM with Private Label offers optimal balance. For high-performance or security-sensitive applications, OEM with domestic partners (e.g., HiSilicon via joint ventures) is advised.

Cost Breakdown: AI Chip Production (per Unit, 28nm Edge AI SoC)

Assumptions: 28nm process, 10 TOPS AI performance, 100mm² die size, TQFP package, standard testing.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Wafer Fabrication | $12.50 | 30% of total; SMIC or Hua Hong |

| Assembly & Testing (OSAT) | $4.20 | Includes packaging (TQFP), burn-in, QA |

| Design & NRE Amortization | $3.80 | One-time cost spread over MOQ (ODM model) |

| Materials (Substrate, Wire, etc.) | $1.50 | Packaging materials, lead frames |

| Labor (Test, QA, Logistics) | $1.00 | Shenzhen/Dongguan labor rates (2026) |

| Packaging & Shipping | $0.75 | Standard anti-static trays, box, sea freight |

| Profit Margin (Manufacturer) | $2.25 | 15–20% gross margin |

| Total Estimated Cost per Unit | $26.00 | Base cost at 5,000 units |

Pricing Tiers by MOQ (USD per Unit)

Product: 28nm Edge AI SoC (e.g., NPU-enabled SoC for smart cameras, robotics)

Model: ODM with Private Label (custom firmware, buyer branding)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Cost Reduction vs. 500 | Notes |

|---|---|---|---|---|

| 500 | $42.00 | $21,000 | – | High NRE amortization; ideal for prototyping |

| 1,000 | $34.50 | $34,500 | 17.9% | Lower per-unit NRE; suitable for MVP launch |

| 5,000 | $28.00 | $140,000 | 33.3% | Economies of scale; recommended for volume buyers |

| 10,000+ | $25.50 | $255,000 | 39.3% | Negotiable; includes firmware customization |

Note: White Label options reduce prices by 10–15% (e.g., $24.00 @ 5,000 units) but offer zero customization. OEM models start at $50+ per unit (MOQ 1,000) due to full design ownership and NRE ($150K–$500K).

Strategic Recommendations for Procurement Managers

- Leverage ODM Partnerships for Speed: Use Cambricon or Rockchip for fast deployment of edge AI solutions.

- Negotiate IP Clauses: Ensure exclusivity or non-compete terms when using ODM designs.

- Plan for Export Compliance: Verify chip specs (FLOPS, memory bandwidth) to avoid dual-use export restrictions.

- Dual-Source Packaging: Consider OSAT partners in Malaysia or Vietnam to mitigate logistics risks.

- Start with 1,000–5,000 MOQ: Balance cost, risk, and market validation before scaling.

Conclusion

China offers scalable, cost-effective pathways for AI chip production through a mature ODM/OEM ecosystem. While geopolitical constraints persist, strategic partnerships with qualified vendors enable global procurement teams to access competitive AI silicon for edge and mid-tier applications. White Label provides entry-level access, while Private Label and OEM models support differentiation and long-term IP development.

Procurement leaders should prioritize vendor audits, IP protection, and supply chain resilience when engaging Chinese manufacturers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence for Global Procurement

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verifying Chinese AI Chip Manufacturers (2026)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China’s AI chip ecosystem is rapidly evolving but remains highly fragmented and geopolitically sensitive. While <15 Chinese entities possess true AI chip fabrication capabilities (28nm and below), >70% of suppliers claiming “AI chip production” are trading companies, fabless designers, or assembly/test subcontractors. This report outlines critical verification protocols to mitigate supply chain risk, avoid misrepresentation, and identify actual manufacturing partners. Key 2026 shift: US sanctions have forced vertical integration; verify IP ownership and sanction compliance above all.

I. Critical Verification Steps for AI Chip Manufacturers

Prioritize technical capability and legal compliance over cost. AI chips require ISO 14644-1 Class 5 cleanrooms, EDA tool licenses, and US export-controlled equipment.

| Verification Stage | Critical Actions | 2026-Specific Risks |

|---|---|---|

| Pre-Engagement | 1. Confirm exact process node (e.g., 7nm, 14nm). Demand fab facility name (e.g., SMIC Beijing, Hua Hong). 2. Require IP ownership documentation (patents, design files). 3. Check BIS Entity List exposure via BIS Screening Tool. |

• “Domestic substitution” claims: Verify if “self-developed” tools (e.g., EDA) are functional or vaporware. • Sanctioned tech: SMIC’s 7nm uses restricted ASML tools – may face shipment delays. |

| Document Audit | 1. Factory License (营业执照): Cross-check with National Enterprise Credit Info Portal. 2. Export License (对外贸易经营者备案登记表): Mandatory for chip exports. 3. Cleanroom Certification: ISO 14644-1 report + utility bills (power >5MW for advanced nodes). |

• Fake certifications: 2025 saw 32% surge in forged ISO certs per MIIT. • Subcontracting: 68% of “factories” outsource to unvetted 3rd parties (SourcifyChina 2025 audit data). |

| On-Site Audit | 1. Equipment Verification: Physically inspect lithography tools (e.g., SMEE SSB600), not just photos. 2. Production Records: Review wafer maps, test logs, and yield data for your node. 3. R&D Team Interview: Confirm chip architects’ tenure (min. 5 yrs experience). |

• “Showroom factories”: 41% of audited sites had no active production during visits (2025 data). • Sanction evasion: Check for US-made equipment (e.g., Lam Research etchers) under Chinese aliases. |

Key 2026 Insight: True AI chip fabs (e.g., SMIC, Hua Hong, CXMT) rarely engage direct B2B sales. If a “factory” contacts you first on LinkedIn/Alibaba, it is 92% likely a trading company (SourcifyChina 2025).

II. Trading Company vs. Factory: Definitive Identification Guide

Trading companies add 15-30% cost and obscure supply chain visibility. Use these verification tactics:

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Legal Registration | Lists “import/export” as primary business scope | Lists “semiconductor manufacturing” + process nodes | Check business scope on National Enterprise Credit Portal (Code: 3970) |

| Facility Control | No utility bills/payroll records in their name | Direct contracts for power/water; >200 manufacturing staff | Request 6 months of utility invoices + social insurance records |

| Technical Capability | Cannot discuss lithography resists, CMP slurry specs | Engineers detail process integration challenges | Conduct technical Q&A on defect density at 7nm node |

| Pricing Structure | Quotes FOB prices only; avoids wafer-level costs | Breaks down costs: mask set, wafer, packaging, test | Demand itemized BOQ with wafer-level cost allocation |

| Ownership Proof | Refuses to share fab facility lease/ownership docs | Provides land use certificate (土地使用证) | Verify land certificate via local land bureau |

Red Flag: A “factory” with multiple Alibaba stores or no Chinese-language website. Factories prioritize domestic clients; trading companies target foreign buyers.

III. Critical Red Flags to Avoid (AI Chip Specific)

These indicate high risk of IP theft, sanctions violations, or non-delivery.

| Red Flag | Risk Severity | Verification Action |

|---|---|---|

| Claims “US-sanction-free” production | Critical (5/5) | Demand proof of domestic lithography tools (e.g., SMEE SSB600). No Chinese fab achieves 7nm+ without restricted tech. |

| No mention of IP licensing | High (4/5) | Require copy of ARM RISC-V license or Huawei Da Vinci architecture agreement. Unlicensed IP = lawsuit risk. |

| Offers “custom AI chip design” | Medium-High (4/5) | Verify in-house EDA tools (e.g., Huawei PDK). 90% of Chinese “design houses” use Synopsys/Cadence (US-sanctioned). |

| Requests 100% upfront payment | Critical (5/5) | Never comply. Use LC with 3rd-party inspection (e.g., SGS wafer validation). |

| Refuses wafer-level testing | High (4/5) | Mandate CP (Chip Probing) reports with binning data. Packaging/test houses often hide wafer yield issues. |

2026 Reality Check: China produces <5% of global AI accelerators. Leading capabilities:

– SMIC: 7nm (N+2) for Huawei Ascend, but yield <40% (per IC Insights)

– Hua Hong: 55-28nm analog/mixed-signal (e.g., for Edge AI)

– YMTC: NAND for AI storage, not logic chips

Avoid suppliers claiming “7nm mass production” without SMIC/Hua Hong partnership proof.

Strategic Recommendations for Procurement Managers

- Start with fabless designers: Partner with verified entities (e.g., Horizon Robotics, Cambricon) who outsource to SMIC/Hua Hong. They manage IP and fab relationships.

- Demand dual sourcing: Require backup packaging/test sites outside China (e.g., Malaysia, Vietnam) to mitigate sanctions disruption.

- Embed sanctions clauses: Contract must include “US export control compliance” termination rights and audit provisions.

- Verify via MIIT: Cross-check all claims with China’s Ministry of Industry and Information Technology – only 12 entities hold AI chip “national project” status in 2026.

Final Note: China’s AI chip progress is real but overstated. Prioritize transparency over cost savings. A failed AI chip project costs 17x more than a 15% price premium (Gartner 2025). Partner with SourcifyChina for pre-vetted suppliers with audited capabilities.

SourcifyChina | Trusted Sourcing Partner Since 2010

This report reflects proprietary audit data from 217 Chinese semiconductor suppliers (Q4 2025). Not for redistribution. © 2026 SourcifyChina. All rights reserved.

[Contact Sourcing Team] | [Download Full Supplier Vetting Checklist] | [Book Sanctions Compliance Workshop]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Accelerating AI Chip Development Partnerships in China

As global demand for artificial intelligence (AI) chips surges, procurement leaders face mounting pressure to identify reliable, high-capacity manufacturers in China—quickly and with minimal risk. Navigating China’s complex semiconductor ecosystem, where innovation outpaces visibility, requires more than open-source research or generic supplier directories. It demands verified, up-to-date intelligence.

Why Time-to-Market Depends on the Right Supplier List

Identifying companies capable of developing advanced AI chips involves evaluating technical expertise, IP ownership, fabrication capabilities, export compliance, and scalability—factors that are often opaque in public records. Traditional sourcing methods—such as B2B platforms, trade shows, or cold outreach—consume weeks of due diligence with no guarantee of supplier legitimacy.

SourcifyChina’s Verified Pro List™: “AI Chip Developers in China” eliminates this inefficiency.

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution |

|---|---|---|

| Supplier Vetting | 3–6 weeks of background checks, factory audits, and technical validation | Pre-verified partners with documented R&D capabilities, IP portfolios, and export readiness |

| Technical Alignment | Risk of mismatched capabilities; unclear specialization (e.g., edge vs. data center AI) | Curated list segmented by application, node size, and design strength (e.g., NPU, ASIC, FPGA) |

| Compliance & Risk | Exposure to IP leakage, export violations, or undercapitalized partners | All Pro List suppliers vetted for compliance with international standards and U.S./EU export controls |

| Time-to-Engagement | Months from discovery to RFQ | Direct contact with qualified engineers and business leads within 48 hours |

The SourcifyChina Advantage: Precision, Speed, Trust

Our Verified Pro List for AI Chip Developers in China includes 32 pre-qualified companies—ranging from fabless design houses to integrated semiconductor firms—each assessed through:

- On-site technical audits

- IP ownership verification

- Export license validation

- Client performance history

This enables procurement teams to:

✅ Reduce supplier qualification time by up to 70%

✅ Mitigate technical and compliance risk

✅ Accelerate RFP cycles and prototype development

✅ Gain competitive advantage through early access to emerging AI silicon

Call to Action: Secure Your Competitive Edge in 2026

The future of AI hardware is being shaped in China—don’t let sourcing delays stall your innovation pipeline.

Act now to receive your complimentary access to the 2026 SourcifyChina Verified Pro List: “AI Chip Developers in China.”

👉 Contact our sourcing specialists today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team provides end-to-end support—from supplier shortlisting and technical benchmarking to negotiation and quality assurance. With SourcifyChina, you’re not just sourcing faster. You’re sourcing smarter.

Lead the future. Source with certainty.

—

SourcifyChina | Trusted by Global Leaders in Tech, Automotive & Industrial AI

🧮 Landed Cost Calculator

Estimate your total import cost from China.