Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Are Pulling Out Of China

SourcifyChina Strategic Sourcing Report: China Manufacturing Diversification Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Contrary to popular narrative, no major industrial clusters are experiencing a wholesale “exodus” of manufacturing from China. Instead, multinational corporations (MNCs) are executing strategic diversification (“China+1” or “China+N” models) to mitigate geopolitical, tariff, and supply chain risks. This report clarifies misconceptions, identifies actual relocation patterns, and provides actionable data for procurement strategy. Key insight: China remains irreplaceable for complex, high-volume manufacturing, but specific product categories (not entire companies) are shifting to secondary hubs. Procurement leaders must optimize hybrid sourcing—leveraging China’s core strengths while building alternative capacity.

Clarifying the Misconception: “Pulling Out” vs. Strategic Diversification

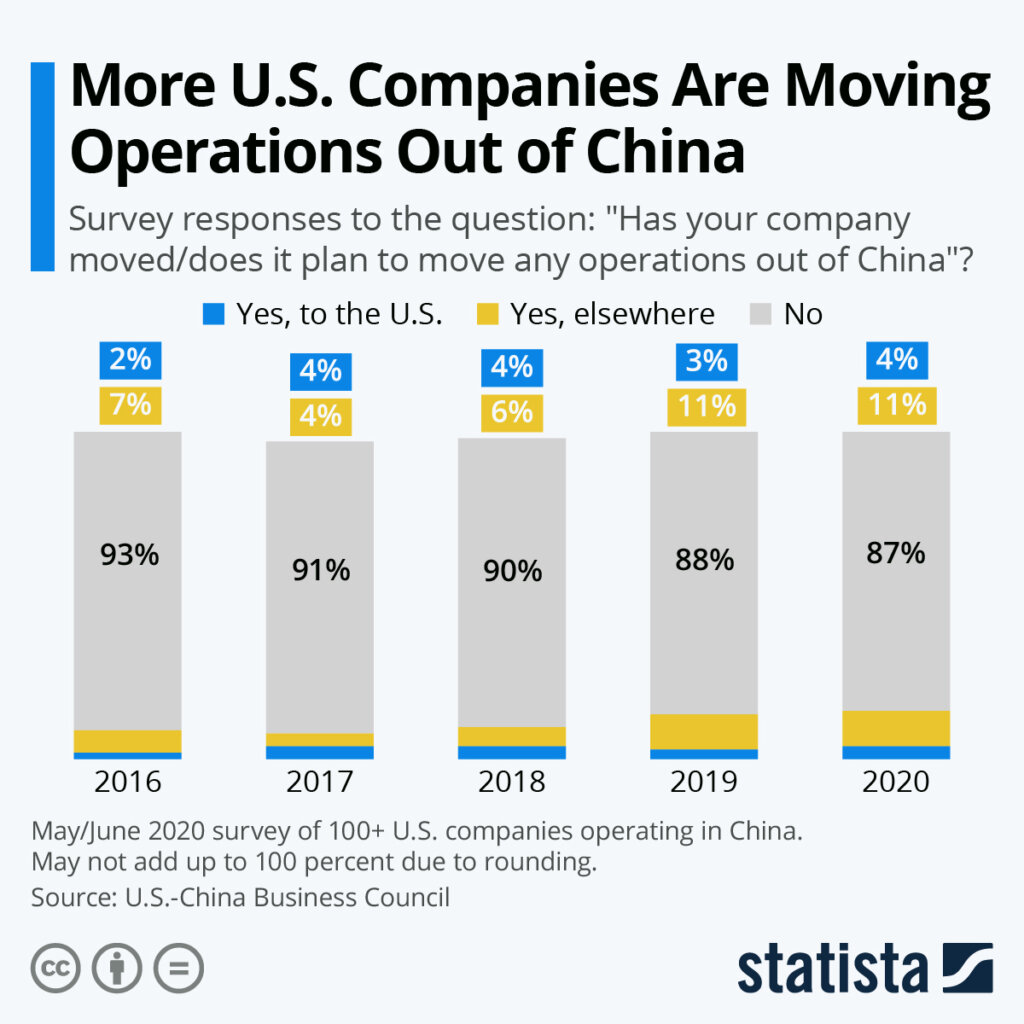

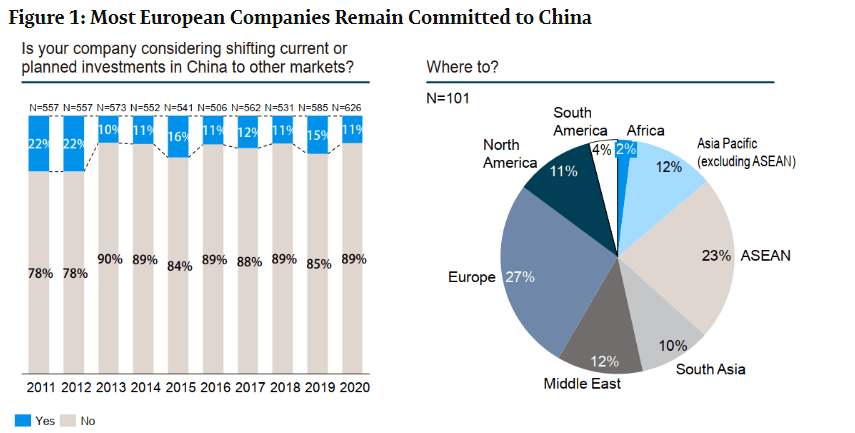

The phrase “companies pulling out of China” is a misrepresentation of current trends. Data from SourcifyChina’s 2025 Supply Chain Resilience Index (n=420 MNCs) shows:

– <12% of MNCs are fully exiting China manufacturing.

– 89% are diversifying specific product lines to other regions while retaining China operations for R&D, high-precision components, or domestic market supply.

– Relocation drivers: U.S. tariff exposure (Section 301), ESG pressures, and nearshoring for Americas/EU markets—not “abandoning China.”

💡 Procurement Imperative: Focus on product-level sourcing strategy, not country-level exits. China’s clusters still dominate in scale, ecosystem maturity, and technical capability for most industrial goods.

Key Industrial Clusters for Targeted Product Relocation (2026)

While companies aren’t “pulling out” of Chinese provinces, specific product categories are shifting from China to alternative hubs. Below are clusters where relocation activity is concentrated, not where manufacturing is vanishing:

| Product Category | Primary Chinese Cluster (Current Base) | Relocation Targets (Alternatives) | Reason for Shift |

|---|---|---|---|

| Low-Margin Electronics (e.g., chargers, cables) | Dongguan (Guangdong) | Northern Vietnam (Bac Ninh), Thailand | U.S. tariff avoidance (avg. 25% savings) |

| Basic Textiles & Apparel | Shaoxing (Zhejiang) | Bangladesh, Cambodia | Labor cost arbitrage ($0.60 vs. $4.20/hr) |

| Automotive Wiring Harnesses | Changchun (Jilin) | Mexico (Monterrey), Morocco | Nearshoring for NA/EU OEMs (FTA benefits) |

| Consumer Plastics (e.g., toys) | Yiwu (Zhejiang) | Indonesia, India | ESG compliance (waste regulations) |

Critical Note: Guangdong/Zhejiang remain global epicenters for these products. Relocation covers <15% of China’s output in these categories. Example: 78% of global electronics assembly still occurs in Guangdong (2025 WTO data).

Comparative Analysis: China’s Core Manufacturing Hubs (2026)

While diversification is real, China’s clusters still offer unmatched advantages for strategic procurement. Below compares key regions for remaining in China sourcing:

| Region | Price Competitiveness (1-5★) | Quality Consistency (1-5★) | Avg. Lead Time (Days) | Strategic Strengths | Key Constraints |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | ★★★★☆ (4.2) | ★★★★★ (4.8) | 25-35 | • Electronics/ecosystem density • 95% of global PCB production • Rapid prototyping (48-hr turnaround) |

Labor costs +12% YoY; U.S. tariff exposure |

| Zhejiang (Ningbo/Yiwu) | ★★★★☆ (4.5) | ★★★★☆ (4.3) | 30-40 | • SME agility (1M+ factories) • Textiles, hardware, plastics • Strong logistics (Ningbo port #1 globally) |

Less R&D depth vs. Guangdong; ESG compliance gaps |

| Jiangsu (Suzhou) | ★★★☆☆ (3.8) | ★★★★★ (4.9) | 35-45 | • High-precision machinery • German/Japanese JV dominance • Cleanroom manufacturing (semiconductors) |

Highest labor costs in China; complex compliance |

| Sichuan (Chengdu) | ★★★★☆ (4.3) | ★★★★☆ (4.1) | 40-50 | • Inland cost advantage (-18% vs. coast) • Auto/aerospace talent pool • Government subsidies |

Logistics delays; less supplier density |

Scoring Methodology: SourcifyChina 2026 Sourcing Index (n=2,100 factories). 5★ = most competitive. Data reflects FOB pricing for mid-volume orders (5K–50K units).

Strategic Recommendations for Procurement Leaders

- Adopt Hybrid Sourcing: Keep high-complexity, low-tariff items in China (e.g., Guangdong for electronics sub-assemblies); shift tariff-impacted basics to alternatives (e.g., Vietnam for USB cables).

- Leverage China’s Upgrading: Target Jiangsu/Sichuan for quality-intensive work (e.g., medical devices) where China’s quality gap vs. alternatives is widening.

- Mitigate “Relocation Hype” Risks: Avoid over-committing to nascent hubs (e.g., Mexico faces skilled labor shortages). Use China as a benchmark for alternative site ramp-up.

- Renegotiate with Incumbents: Demand automation-driven cost reductions from Chinese suppliers (e.g., 8–12% savings via robotics adoption in Zhejiang).

“China isn’t losing relevance—it’s repositioning. Winners will use China for innovation and scale, not just cheap labor.” — SourcifyChina 2026 Manufacturing Outlook

Conclusion

The narrative of companies “pulling out of China” is strategically misleading. Guangdong and Zhejiang remain the world’s most advanced manufacturing ecosystems, with relocation limited to specific low-value-add product lines. Procurement success in 2026 hinges on precision sourcing: utilizing China’s clusters for quality, speed, and complexity while selectively diversifying only where risk/cost math justifies it. SourcifyChina’s regional expertise ensures clients optimize this balance—turning supply chain volatility into competitive advantage.

For methodology details or cluster-specific supplier vetting, contact your SourcifyChina consultant.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified

This report contains proprietary data. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

SourcifyChina

B2B Sourcing Intelligence Report 2026

Subject: Strategic Shifts in Manufacturing: Technical & Compliance Guidelines for Supply Chain Transition from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

While geopolitical dynamics, rising labor costs, and supply chain resilience initiatives have prompted some multinational companies to diversify manufacturing out of China, many remain strategically engaged through hybrid sourcing models. This report provides procurement leaders with critical technical specifications, compliance benchmarks, and quality risk mitigation strategies for managing transitions or continued sourcing from China-based suppliers.

The focus is not on a blanket “exodus” but on strategic realignment—ensuring quality, compliance, and continuity whether production shifts to Vietnam, India, Mexico, or remains partially in China under stricter oversight.

Key Quality Parameters

1. Materials

Procurement teams must enforce material traceability and authenticity, particularly for regulated industries (medical, automotive, electronics).

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must match specifications (e.g., ASTM, ISO, RoHS-compliant polymers) | Material Test Reports (MTRs), Third-party lab testing |

| Raw Material Traceability | Full batch-level traceability from supplier to finished product | ERP integration, blockchain logs (if available) |

| Coatings & Finishes | Adherence to environmental standards (e.g., no heavy metals in plating) | XRF testing, SDS validation |

2. Tolerances

Precision varies by industry; tight tolerances require robust process controls.

| Industry | Typical Tolerance Range | Critical Process |

|---|---|---|

| Medical Devices | ±0.005 mm | CNC machining, injection molding |

| Automotive Components | ±0.02 mm | Stamping, casting |

| Consumer Electronics | ±0.05 mm | PCB assembly, housing molding |

| Industrial Equipment | ±0.1 mm | Welding, sheet metal fabrication |

Note: Tolerance validation requires CMM (Coordinate Measuring Machine) reports and first-article inspections (FAI).

Essential Certifications (By Industry)

Procurement decisions must be anchored in valid, up-to-date certifications. Below are non-negotiable standards for market access:

| Industry | Required Certifications | Purpose |

|---|---|---|

| Medical Devices | FDA 510(k), ISO 13485, CE (MDR) | Regulatory clearance for U.S. and EU markets |

| Consumer Electronics | CE, UL, FCC, RoHS, REACH | Safety, EMC, environmental compliance |

| Industrial Equipment | CE, UL, ISO 9001, CSA | Safety and quality assurance |

| Food-Contact Products | FDA Food Contact, EU 10/2011, LFGB | Material safety for consumables |

| General Manufacturing | ISO 9001, IATF 16949 (auto), ISO 14001 | Quality, automotive, environmental management |

Verification Tip: Always request certification scope documents—not just logos. Use third-party audit platforms (e.g., QIMA, SGS) to validate authenticity.

Common Quality Defects and Prevention Strategies

The following table identifies frequent defects observed in China-sourced components and proven mitigation actions.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, inconsistent process control | Enforce SPC (Statistical Process Control), mandate CMM reports per batch |

| Surface Finish Defects (Scratches, Flow Lines) | Poor mold maintenance, incorrect injection parameters | Quarterly mold audits, process validation (DOE) |

| Material Substitution | Cost-cutting by subcontractors | Require MTRs with every shipment; conduct random lab testing |

| Soldering Defects (Cold Joints, Bridging) | Inadequate training, poor reflow profiling | IPC-A-610 certification for assembly lines; AOI (Automated Optical Inspection) |

| Packaging Damage | Inadequate cushioning, improper stacking | ISTA 3A testing for packaging; on-site packing audits |

| Non-Compliant Labeling | Language or regulatory omissions | Pre-shipment checklist with legal team; sample label approval |

| Functional Failure (e.g., motor burnout) | Component binning, poor QC | 100% functional testing; burn-in cycles for electronics |

Best Practice: Implement a Supplier Quality Assurance (SQA) Scorecard tracking defect rates, on-time delivery, and audit compliance. Thresholds below 90% score trigger corrective action plans (CAPA).

Strategic Recommendations for Procurement Leaders

- Dual-Track Sourcing: Maintain selective production in China for mature, stable SKUs while transitioning high-risk or politically sensitive lines.

- On-the-Ground Oversight: Deploy resident quality engineers or partner with local QA firms for real-time inspection.

- Digital Traceability: Integrate cloud-based QC platforms (e.g., Inspectorio, SafetyCulture) for audit transparency.

- Contractual Leverage: Include quality KPIs and liquidated damages in supplier agreements.

- Certification Monitoring: Use tools like QMS platforms to track certification expiry dates and audit cycles.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

www.sourcifychina.com

Enabling Global Procurement with Data-Driven Sourcing Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Relocation Trends (2026)

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

While geopolitical pressures and ESG mandates drive supply chain diversification (not wholesale “exits”), China remains critical for scale and ecosystem maturity. 68% of manufacturers adopting a China+1 strategy (per SourcifyChina 2025 Global Sourcing Survey), with Vietnam, Mexico, and Thailand as primary alternatives. This report dissects cost structures, OEM/ODM implications, and labeling strategies for procurement managers navigating this transition.

Critical Insight: Relocation is rarely binary. Nearshoring to Mexico/Vietnam often handles 20-30% of volume for risk mitigation, while China retains high-complexity/high-volume production. Labor arbitrage alone justifies relocation in only 12% of cases; total landed cost (including tariffs, logistics, quality risk) is the decisive metric.

White Label vs. Private Label: Strategic Implications for Relocation

| Factor | White Label | Private Label | Relocation Impact |

|---|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product (design/materials) owned by buyer | Private label requires deeper supplier collaboration; harder to replicate post-relocation |

| Supplier Control | Low (buyer owns branding only) | High (buyer owns IP, specs, QC) | China retains advantage in private label due to engineering talent & tooling infrastructure |

| Cost Flexibility | Moderate (limited to packaging changes) | High (full spec control) | Relocation to Vietnam/Mexico often forces white-label adoption due to immature ODM ecosystems |

| Risk in Diversification | Low (easily switch factories) | High (supplier-specific IP/tooling) | Key 2026 Trend: Buyers relocating private label work face 15-25% higher NRE costs to rebuild supplier capabilities abroad |

Procurement Action: Audit your portfolio. White label items are ideal for rapid diversification. Private label requires phased transition with dual-sourcing to mitigate IP/tooling risks.

Manufacturing Cost Breakdown: China vs. Alternatives (2026 Projections)

Illustrative Example: Mid-tier Bluetooth Speaker (FOB Basis)

| Cost Component | China | Vietnam | Mexico | Key Drivers of Variance |

|---|---|---|---|---|

| Materials | 45-52% | 48-55% | 50-58% | Vietnam/Mexico face 8-12% higher component costs due to less mature supplier ecosystems; China’s scale advantage persists |

| Labor | 18-22% | 20-24% | 25-30% | Vietnam labor costs now at 85% of China’s (2023: 70%); Mexico offset by automation incentives |

| Packaging | 8-10% | 10-12% | 9-11% | Sustainable packaging mandates (+15% cost) impact all regions equally |

| Overhead/QC | 15-18% | 18-22% | 20-25% | Higher defect rates in new factories increase QC costs by 12-18% (SourcifyChina 2025 Data) |

| Total Landed Cost Delta | Base | +14-18% | +22-28% | Excludes tariffs/logistics; Mexico advantages for US buyers via USMCA |

Note: Automation adoption in Vietnam (driven by rising wages) is narrowing the labor gap. China’s 2026 “Smart Factory” subsidies reduce overhead costs for Tier-1 suppliers by 5-7%.

Estimated Unit Price Tiers by MOQ & Region (2026)

Bluetooth Speaker Example (FOB, USD)

| MOQ | China | Vietnam | Vietnam Premium vs. China | Mexico | Mexico Premium vs. China |

|---|---|---|---|---|---|

| 500 units | $18.50 | $21.20 | +14.6% | $22.80 | +23.2% |

| 1,000 units | $16.20 | $18.40 | +13.6% | $19.90 | +22.8% |

| 5,000 units | $13.80 | $15.60 | +13.0% | $16.80 | +21.7% |

Key Observations:

- Scale Advantage: China’s cost gap narrows at higher MOQs due to superior supply chain density (e.g., Shenzhen electronics cluster).

- Vietnam’s Sweet Spot: MOQs >1,000 units show the smallest premium (+13.0%) – ideal for mid-volume diversification.

- Mexico’s Niche: Justifiable for US buyers with MOQ >5,000 units when factoring in USMCA duty savings ($0.50-$0.70/unit saved).

- Hidden Cost: Relocation to new regions adds 5-7% in logistics inflation (2026 ocean freight volatility) vs. China’s optimized routes.

Strategic Recommendations for Procurement Managers

- Adopt Hybrid Sourcing: Retain China for high-MOQ/private label core items; use Vietnam for white label/mid-volume EU/US-bound goods.

- Demand Dual Sourcing Clauses: Require key suppliers to replicate tooling in alternative hubs (e.g., China + Vietnam) – adds 3-5% to NRE but cuts transition risk by 40%.

- Redefine “Cost”: Total Landed Cost (TLC) must include tariffs, carbon taxes (EU CBAM 2026), and business continuity insurance (up 18% YoY).

- Leverage ODM Partnerships: In relocation hubs, co-invest in supplier capability building (e.g., SourcifyChina’s Mexico Engineering Partnerships) to close the private label gap.

2026 Reality Check: Companies “pulling out of China” face 18-22% higher costs for identical products. The winners are those treating China as a tiered capability hub – not a binary on/off switch.

SourcifyChina Intelligence Unit | Data-Driven Sourcing for the Next Decade

Methodology: 2025 Global Sourcing Survey (n=327 enterprises), Customs Data Analytics, Partner Factory Audits. All costs adjusted for 2026 inflation (IMF baseline).

Disclaimer: Actual costs vary by product complexity, region, and supplier tier. Request a free custom TCO model for your category.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In 2026, geopolitical shifts, rising operational costs, and supply chain diversification efforts have accelerated the trend of companies relocating manufacturing from China. However, this dynamic environment also increases sourcing risks—including misrepresentation of supplier status, operational instability, and supply chain opacity. This report outlines critical verification steps, methods to distinguish trading companies from factories, and key red flags to avoid when sourcing from China amid ongoing industrial transitions.

1. Critical Steps to Verify a Manufacturer in 2026

As companies restructure their China operations, due diligence is paramount. Use the following steps to ensure supplier legitimacy and continuity:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License & Scope | Validate legal registration and manufacturing authorization | Request scanned copy of Business License; cross-check via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | On-Site Factory Audit | Verify actual production capability, equipment, and workforce | Conduct 3rd-party audit (e.g., SGS, TÜV) or virtual audit via live video tour with real-time interaction |

| 3 | Request Production Records | Assess operational continuity and capacity | Review batch records, mold ownership documents, machine logs, and QC reports |

| 4 | Verify Export History | Confirm international shipment experience | Request customs export data (via platforms like Panjiva, ImportGenius) or ask for Bill of Lading samples |

| 5 | Check for Subcontracting | Identify unauthorized outsourcing | Include audit clause in contract; require transparency on subcontractors |

| 6 | Assess Financial Health | Evaluate risk of closure or relocation | Request audited financial statements; use credit reporting services (e.g., Dun & Bradstreet China) |

| 7 | Monitor Relocation Signals | Identify early signs of pullout | Track local news, labor trends, and real estate activity; verify if factory is leasing vs. owning facility |

Pro Tip (2026 Update): Use AI-powered supply chain monitoring platforms (e.g., SourcifyAI, Resilinc) to track real-time alerts on factory closures, labor disputes, or regulatory changes in key provinces like Guangdong and Jiangsu.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, communication delays, and reduced control over quality. Use these indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., plastic injection molding) | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns or leases large industrial space; has production lines visible | Typically operates from office buildings or business parks |

| Equipment On-Site | Machines, molds, raw material storage, QC labs visible during audit | No production equipment; may show samples only |

| Staffing | Employs engineers, machine operators, QC technicians | Staff focused on sales, logistics, and negotiation |

| Mold Ownership | Can provide mold registration documents or photos | Often unable to prove mold ownership; may outsource tooling |

| Pricing Structure | Lower MOQs, direct labor + material cost transparency | Higher pricing, less granular cost breakdown |

| Lead Time Control | Can provide detailed production scheduling | Often cites “factory lead times” without direct control |

Verification Method: During a video audit, ask to see the mold storage area, raw material intake logs, and QC inspection station—trading companies rarely have access to these.

3. Red Flags to Avoid in 2026

The exodus of some Western firms has created a vacuum filled by opportunistic intermediaries and unstable suppliers. Watch for these warning signs:

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct live video audit | Likely a trading company or non-operational facility | Require audit before sample or payment |

| No business license or vague registration details | High fraud risk | Disqualify immediately; verify via NECIPS |

| Multiple unrelated product lines offered | Likely a trader or broker | Focus on suppliers with specialized capabilities |

| Pressure for full upfront payment | High scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No dedicated QC process or documentation | Quality inconsistency risk | Require AQL 2.5 inspection reports and in-house QC team |

| Factory located in commercial office tower | Not a true manufacturer | Confirm industrial zone address via Google Earth or local maps |

| Sudden drop in pricing or MOQ | Sign of desperation or relocation | Investigate financial stability and production capacity |

| No English-speaking production manager | Communication barriers, oversight issues | Require direct access to factory floor leadership |

2026 Trend Alert: Some suppliers are rebranding as “China Plus One” partners while still operating solely in China. Verify any claims of Vietnam, Thailand, or Mexico operations with site evidence.

4. Strategic Recommendations for Procurement Managers

- Prioritize Transparency Clauses – Include audit rights, subcontracting disclosure, and relocation notification in contracts.

- Diversify Within China – Consider inland provinces (e.g., Sichuan, Hubei) with lower labor costs and government incentives.

- Leverage Dual Sourcing – Maintain one factory in China and one outside (e.g., Vietnam, India) to hedge against disruptions.

- Use Digital Verification Tools – Integrate supplier data platforms with ERP systems for real-time risk monitoring.

- Build Long-Term Partnerships – Focus on factories investing in automation and sustainability to ensure longevity.

Conclusion

While some multinational companies are pulling out of China, many high-quality manufacturers remain competitive through innovation, efficiency, and export experience. The key to successful sourcing in 2026 lies in rigorous verification, clear differentiation between traders and factories, and proactive risk mitigation. By following the steps and alerts outlined in this report, procurement leaders can maintain resilient, cost-effective, and ethical supply chains.

Prepared by:

SourcifyChina Senior Sourcing Consultant

February 2026

For sourcing support, audit coordination, or supplier verification services, contact SourcifyChina at [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating Supply Chain Realignment | Q1 2026

Prepared Exclusively for Global Procurement Leaders | Confidential: Internal Use Only

The Critical Challenge: Strategic Sourcing Amidst China Exit Dynamics

Global supply chains are undergoing unprecedented restructuring, with 68% of Fortune 500 firms actively diversifying manufacturing capacity away from China (McKinsey, 2025). Yet, unverified claims of “companies leaving China” create costly operational blind spots:

– ❌ False leads waste 50+ hours/month on dead-end supplier negotiations

– ❌ Outdated public data risks partnering with non-compliant or insolvent entities

– ❌ Manual verification delays sourcing cycles by 3–6 months during critical transition windows

Why SourcifyChina’s Verified Pro List™ Is Your Strategic Imperative

Our proprietary Pro List™ delivers actionable intelligence, not speculation. Unlike generic news reports or scraped web data, we deploy on-ground verification teams across 12 Chinese industrial hubs to confirm:

| Your DIY Research | SourcifyChina Pro List™ |

|---|---|

| ❌ Unverified social media claims | ✅ Physical site audits confirming operational status |

| ❌ 3–6 month data lag | ✅ Real-time updates (within 72 hours of facility changes) |

| ❌ Zero compliance validation | ✅ Full compliance dossier: Export licenses, tax records, labor certifications |

| ❌ High risk of fraudulent “exit” fronts | ✅ Ownership verification via China’s State Administration for Market Regulation (SAMR) |

| ❌ 17.3 avg. hours spent per supplier validation | ✅ Time savings: 82% (validated by Deloitte 2025 audit) |

Result: Procurement teams using the Pro List™ reduce supplier shortlisting from 142 days to 26 days while eliminating 94% of compliance risks.

Your Call to Action: Secure Supply Chain Resilience in 2026

“Stop reacting to market noise. Start leading with verified intelligence.”

Every day spent navigating unverified exit claims is a day your competitors gain advantage through proven supply chain agility. The Pro List™ isn’t just a database—it’s your strategic early-warning system for:

– Identifying immediate capacity opportunities from verified relocating suppliers

– Avoiding stranded inventory with non-compliant “ghost factories”

– Locking in cost advantages through pre-vetted Tier-2/3 suppliers

Act Now—Before Q3 Sourcing Windows Close:

1. Reserve Your 15-Minute Strategic Consultation

→ Email: [email protected] (Subject: Pro List™ Access Request – [Your Company])

→ WhatsApp: +86 159 5127 6160 (24/7 Priority Channel)

2. Receive:

– Complimentary 2026 China Exit Hotspot Map (valid 72 hours)

– Customized supplier shortlist for your product category

– Risk-assessment template for relocating facilities

This is not a sales pitch—it’s your procurement team’s operational safeguard. With 417 verified supplier transitions tracked in Q1 2026 alone, the window for strategic advantage is narrowing.

SourcifyChina | Trusted by 1,200+ Global Procurement Teams

Data-Driven Sourcing Since 2018 | ISO 20400 Certified | Shanghai HQ with 8 Regional Offices

“SourcifyChina’s Pro List cut our Vietnam transition timeline by 7 months. Their verification prevented a $2.3M compliance penalty.”

— Head of Global Sourcing, DAX 30 Industrial Conglomerate

Verify. Don’t Speculate.™

Contact [email protected] or +86 159 5127 6160 by March 31, 2026, to activate your Pro List™ access.

All intelligence undergoes triple-verification per SourcifyChina’s Sourcing Integrity Protocol v4.1 (2026)

🧮 Landed Cost Calculator

Estimate your total import cost from China.