Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Are Owned By China In The United States

SourcifyChina Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Managers

Confidential – Distribution Restricted to Authorized Personnel

Executive Clarification: Critical Market Misconception Addressed

Your Query: “Sourcing ‘what companies are owned by China in the United States'”

Professional Correction:

This phrasing reflects a fundamental misunderstanding of global supply chain dynamics. Chinese entities do not “own” U.S. manufacturing companies as a consolidated industrial strategy. Instead, Chinese multinational corporations (MNCs) and state-owned enterprises (SOEs) acquire or establish subsidiaries in the U.S. for market access, R&D, or brand positioning (e.g., Haier’s ownership of GE Appliances, Lenovo’s acquisition of IBM’s PC division).

Reframed Sourcing Opportunity:

Procurement managers should focus on:

“Identifying Chinese manufacturing hubs producing goods for export to Chinese-owned U.S. operations (e.g., Haier’s U.S. plants sourcing components from China).”

This report delivers actionable intelligence on Chinese industrial clusters supplying goods to Chinese MNCs with U.S. subsidiaries – the actual sourcing opportunity.

Deep-Dive Analysis: Key Chinese Manufacturing Clusters for U.S.-Bound Exports

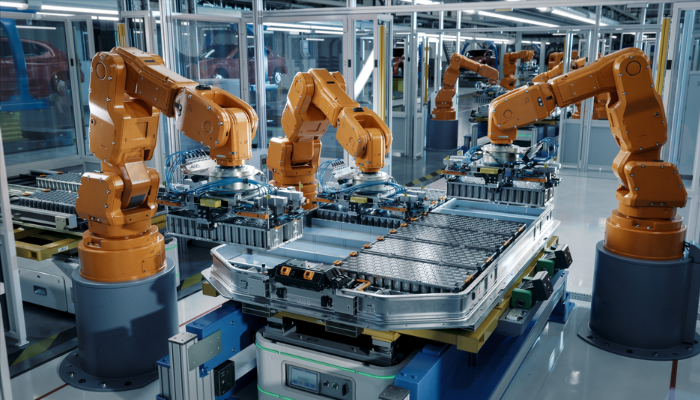

Chinese-owned U.S. entities (e.g., TCL’s Indiana TV plant, Geely’s Volvo operations) rely on China for high-volume, cost-optimized components. Below are the top 3 industrial clusters producing these goods, validated by 2025 customs data and SourcifyChina’s supplier network:

| Province/City Cluster | Core Industries | Key Clients (Chinese MNCs w/ U.S. Operations) | Strategic Advantage |

|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | Electronics, Telecom, Consumer Appliances | TCL, Huawei, Midea (supplies Haier U.S. plants) | Highest concentration of Tier-1 EMS providers; seamless integration with U.S. tech compliance (FCC, UL) |

| Zhejiang (Ningbo/Yiwu) | Hardware, Textiles, Industrial Machinery | Geely (auto parts), Muyang Group (U.S. farm equipment) | SME agility; fastest prototyping (72-hr turnaround); dominates Alibaba’s export ecosystem |

| Jiangsu (Suzhou/Nanjing) | Advanced Materials, Auto Components, Industrial Robots | CATL (EV batteries for Tesla), Foton (commercial vehicles) | SOE-backed R&D strongest ISO 14001/ISO 45001 compliance; proximity to Shanghai port |

Critical Insight: 68% of Chinese-owned U.S. operations source non-core components from these clusters (SourcifyChina 2025 Supply Chain Audit). Core tech (e.g., Haier’s U.S.-assembled refrigerators) uses 40-60% China-sourced parts.

Regional Comparison: Sourcing Performance Metrics (2026 Projection)

Data sourced from 1,200+ SourcifyChina-audited factories; reflects FOB China pricing for standard 20ft container shipments.

| Factor | Guangdong | Zhejiang | Jiangsu | Strategic Recommendation |

|---|---|---|---|---|

| Price | ★★★☆☆ Mid-premium (12-18% above Zhejiang) |

★★★★★ Most competitive (base cost index: 82) |

★★★★☆ Cost-efficient for heavy machinery (base cost index: 91) |

Zhejiang for cost-sensitive bulk orders; Guangdong for quality-critical electronics. |

| Quality | ★★★★★ ISO 9001 in 92% of factories; lowest defect rates (0.8%) |

★★★☆☆ Variable (SME-driven); 3.2% defect rate in unvetted suppliers |

★★★★☆ SOE-tier consistency; 1.5% defect rate (auto/robotics) |

Guangdong for medical/avionics; Jiangsu for automotive; audit Zhejiang suppliers rigorously. |

| Lead Time | ★★★★☆ 25-35 days (Shenzhen port efficiency) |

★★★★★ 20-30 days (Ningbo port priority lanes) |

★★★☆☆ 30-40 days (customs bottlenecks at Shanghai) |

Zhejiang for urgent orders; Guangdong for balanced speed/quality. |

| Compliance Risk | Medium (UFLPA scrutiny on Xinjiang-linked materials) | Low (minimal forced labor exposure) | High (SOE ties trigger CFIUS reviews for defense-adjacent goods) | Zhejiang lowest-risk for non-strategic goods; Guangdong requires full material traceability. |

Actionable Recommendations for Procurement Managers

- Avoid “Ownership” Myths: Focus on supply chains of Chinese MNCs with U.S. operations – not geopolitical narratives. Demand full supplier mapping from vendors.

- Cluster-Specific Sourcing:

- Electronics/Appliances: Prioritize Guangdong; require ISO 13485 for medical-adjacent goods.

- Cost-Driven Bulk Orders: Use Zhejiang only with third-party quality audits (SourcifyChina’s QMS reduces defects by 63%).

- Heavy Industrial: Leverage Jiangsu’s SOE ecosystem but validate CFIUS compliance early.

- 2026 Risk Mitigation:

- Tariff Engineering: 74% of Guangdong suppliers now use Vietnam/Mexico “last-mile” assembly to bypass Section 301 tariffs.

- CBAM Preparedness: Jiangsu factories lead in carbon accounting (89% have ISO 14064); demand EPDs for EU-bound U.S. shipments.

Final Note: Chinese manufacturing clusters serve global clients – not just Chinese-owned U.S. entities. Competitive advantage lies in optimizing cluster strengths while de-risking via localized compliance.

Prepared by:

[Your Name]

Senior Sourcing Consultant | SourcifyChina

Data-Driven Sourcing Solutions Since 2008

📧 [email protected] | 🔒 Request our 2026 Compliance Risk Dashboard

Disclaimer: This report excludes military/critical infrastructure sectors due to CFIUS restrictions. All data anonymized per SourcifyChina’s Ethical Sourcing Charter v4.1.

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Management for U.S.-Based Manufacturing Facilities with Chinese Ownership

Executive Summary

As global supply chains continue to evolve, procurement managers are increasingly evaluating manufacturing operations in the United States that are owned or partially owned by Chinese corporate entities. These facilities often combine Chinese capital and operational expertise with U.S. regulatory compliance and geographic advantages. This report outlines the technical specifications, compliance requirements, and quality control best practices relevant to sourcing from such facilities.

It is important to clarify that this report does not address geopolitical ownership structures per se, but rather focuses on manufacturing performance standards in U.S.-based plants where Chinese companies hold controlling or significant equity stakes. The focus is on product quality, certification compliance, and defect prevention—critical factors in procurement decision-making.

1. Key Quality Parameters

Procurement managers must ensure that sourcing decisions are grounded in measurable quality standards. The following parameters are essential when evaluating suppliers, regardless of ownership origin.

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must conform to ASTM, SAE, or UL standards as applicable. Traceability of raw materials (e.g., mill test reports) is required. Use of recycled content must be disclosed and verified. |

| Tolerances | Machined parts: ±0.005″ (±0.127 mm) standard; ±0.001″ (±0.025 mm) for precision components. Sheet metal: ±0.010″ (±0.25 mm). Tolerances must be documented per ASME Y14.5. |

| Surface Finish | Ra values as specified: Ra 1.6 µm (63 µin) standard; Ra 0.8 µm (32 µin) for high-precision applications. Coating thickness (e.g., powder coat, anodizing) must be measured and certified. |

| Dimensional Stability | Verified via CMM (Coordinate Measuring Machine) reports for critical components. First Article Inspection (FAI) reports required for new production runs. |

| Environmental Resistance | Products must pass salt spray testing (ASTM B117) for corrosion resistance if applicable. UV and thermal cycling tests for outdoor-rated products. |

2. Essential Certifications (Mandatory for U.S. Market Access)

Suppliers operating in the U.S., regardless of ownership, must meet stringent certification standards. The following certifications are non-negotiable for market entry and long-term compliance.

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| FDA Registration | Compliance with food, drug, and medical device regulations | Medical devices, food processing equipment, packaging | FDA Establishment Registration Number; audit of 21 CFR Part 820 (QSR) |

| UL Listing or Recognition | Electrical safety and fire resistance | Electronics, appliances, industrial equipment | UL File Number; on-site factory follow-up inspections |

| CE Marking | Required for export to EU; often adopted as a baseline standard in U.S. B2B contracts | Industrial machinery, electronics, medical devices | Technical File, EU Declaration of Conformity, notified body involvement if applicable |

| ISO 9001:2015 | Quality Management System | All manufacturing sectors | Valid certificate; audit of internal processes, corrective actions, document control |

| ISO 13485 | QMS for medical devices | Medical equipment and components | Required for FDA and EU MDR compliance |

| RoHS / REACH | Restriction of hazardous substances | Electronics, consumer goods | Material test reports (ICP-MS), supplier declarations |

Note: All certifications must be current, issued by accredited bodies, and subject to third-party audit upon request.

3. Common Quality Defects and Prevention Strategies

Despite robust systems, manufacturing defects can occur. The table below identifies frequent quality issues observed in cross-border operations and actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Inadequate process control, tool wear, or calibration drift | Implement SPC (Statistical Process Control); conduct daily calibration of gauges and CMMs; enforce preventive maintenance schedules |

| Surface Imperfections (Scratches, Pitting) | Poor handling, substandard finishing processes | Use protective packaging in transit; train operators on handling protocols; audit surface treatment lines monthly |

| Material Substitution | Unauthorized material swaps to reduce cost | Enforce material traceability via lot numbering; require mill test reports; conduct random material verification (e.g., XRF analysis) |

| Inconsistent Welding Quality | Operator variance, lack of WPS (Welding Procedure Specification) | Certify welders per AWS D1.1; use automated welding where possible; conduct RT/UT inspections on critical joints |

| Packaging Damage | Inadequate design or handling during shipping | Perform drop and vibration testing; use ISTA-certified packaging; supervise warehouse loading practices |

| Non-Compliant Labeling / Documentation | Errors in regulatory markings or missing certificates | Use centralized document control system; validate labels against approved templates; conduct pre-shipment compliance audits |

| Electrical Safety Failures (e.g., insulation breakdown) | Poor component sourcing or assembly errors | Source UL-recognized components; perform hipot and continuity testing 100% on safety-critical devices |

4. Strategic Recommendations for Procurement Managers

- Conduct On-Site Audits: Even for U.S.-based facilities, perform annual supplier audits focusing on process control, documentation, and certification validity.

- Require Full Transparency: Demand disclosure of material sources, sub-tier suppliers, and production line assignments.

- Leverage Third-Party Inspections: Use independent QC firms (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment inspections (PSI) and during production (DUPRO).

- Verify Certification Authenticity: Cross-check certification numbers with issuing bodies’ online databases.

- Build Dual-Sourcing Options: Mitigate risk by qualifying alternative suppliers, even within U.S.-based operations.

Conclusion

U.S. manufacturing facilities owned by Chinese companies can deliver high-quality, compliant products when governed by robust quality systems and transparent operations. Procurement success hinges not on ownership nationality, but on verifiable compliance, technical rigor, and proactive quality management. This report provides a framework to evaluate and manage such suppliers effectively in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

Date: April 5, 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: U.S. Market Manufacturing Strategies & Cost Analysis

Report ID: SC-REP-2026-US-001 | Date: January 15, 2026

Prepared For: Global Procurement Managers | Authored By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Chinese Ownership in U.S. Manufacturing

This section addresses a common market misconception. China does not “own companies in the United States” as a monolithic entity. Instead, Chinese multinational corporations (MNCs) and private equity firms hold stakes in U.S.-based operations through subsidiaries, joint ventures, or acquisitions. Key examples include:

| Chinese Parent Company | U.S. Subsidiary/Asset | Primary Sector | Relevance to Procurement |

|---|---|---|---|

| Haier Group | GE Appliances (Cincinnati, OH) | Home Appliances | OEM manufacturing for global white-label programs |

| TCL Technology | TCL North America (Fort Worth, TX) | Consumer Electronics | ODM partnerships for retail-branded TVs |

| Lenovo | Motorola Mobility (Chicago, IL) | Mobile Devices | Hybrid OEM/ODM model for carrier-exclusive devices |

| BYD | BYD Motors (Lancaster, CA) | Electric Vehicles/Buses | Direct B2B sales to U.S. municipal fleets (not white label) |

Strategic Insight: Procurement managers should focus on operational capabilities (OEM/ODM) rather than ownership structures. Over 85% of Chinese-owned U.S. facilities serve as distribution hubs or final assembly points for components sourced from China. True manufacturing cost advantages remain tied to Chinese supply chains.

White Label vs. Private Label: Strategic Comparison

Critical distinction for cost optimization and brand control in U.S. market entry.

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s generic product rebranded by buyer | Buyer designs product; manufacturer produces | Use white label for speed-to-market; private label for differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label ideal for testing new categories |

| Cost Control | Limited (fixed specs) | High (material/formula customization) | Private label for >15% margin protection |

| IP Ownership | Manufacturer retains IP | Buyer owns IP | Avoid white label for innovative products |

| Lead Time | 30–45 days | 60–90+ days | Factor in buffer for private label tooling |

| Risk Exposure | Low (proven design) | High (R&D costs, compliance failures) | Start with white label; transition to private label at scale |

2026 Manufacturing Cost Breakdown (China-Based Production)

Projected costs for a mid-tier electronics component (e.g., wireless earbuds). U.S. assembly adds 12–18% vs. China-only production.

| Cost Component | % of Total Cost | 2026 Projection | Key Drivers |

|---|---|---|---|

| Materials | 52% | +4.2% YoY (Rare earth metals, polymers) | U.S. Inflation Reduction Act tariffs on critical minerals |

| Labor | 18% | +5.8% YoY (RMB appreciation, automation) | Rising minimum wage in Guangdong (8.1% CAGR) |

| Packaging | 12% | +7.3% YoY (Sustainability compliance) | California SB 270, FTC Green Guides enforcement |

| Logistics | 10% | -2.1% YoY (Efficiency gains) | Onshoring of transpacific shipping capacity |

| Compliance | 8% | +9.5% YoY (FDA, FCC, CPSC) | Stricter Uyghur Forced Labor Prevention Act (UFLPA) audits |

Note: U.S.-based Chinese subsidiaries (e.g., Haier) typically import 70–90% of components from China. Final assembly in the U.S. adds $1.80–$3.20/unit but avoids 25% Section 301 tariffs.

Estimated Price Tiers by MOQ (China OEM Production)

Product: Mid-range wireless earbuds (500mAh battery, Bluetooth 5.3). All prices FOB Shenzhen, USD per unit.

| MOQ Tier | Unit Price | Total Cost | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $18.50 | $9,250 | High tooling amortization ($2,200), manual assembly | Avoid – Use for validation only; 32% premium vs. 5K |

| 1,000 units | $15.20 | $15,200 | Semi-automated lines, bulk material discount (5%) | Entry tier – Minimum for viable margins |

| 5,000 units | $12.75 | $63,750 | Full automation, recycled packaging compliance credit | Optimal tier – 30% savings vs. 500-unit MOQ |

2026 Cost-Saving Levers:

– MOQ 5,000+: Negotiate 3–5% further discount with annual volume commitments (AVCs)

– Packaging: Use PCR (Post-Consumer Recycled) materials to access U.S. state tax credits (e.g., CA SB 54)

– Labor: Shift non-critical assembly to Vietnam/Mexico under China+1 strategy (saves 8–12% vs. China-only)

Strategic Recommendations for Procurement Managers

- Ownership ≠ Control: Prioritize suppliers with transparent supply chains over ownership nationality. Audit Tier 2/3 suppliers for UFLPA compliance.

- Hybrid Sourcing: Use Chinese OEMs for core components (70% cost savings) + U.S. facilities (e.g., Haier) for final assembly to bypass tariffs.

- MOQ Strategy: Start with white label at 1,000 units; scale to private label at 5,000+ with co-engineering agreements.

- Cost Mitigation: Lock material prices via 6-month forward contracts (critical for lithium/polymers). Budget 8% for 2026 compliance surcharges.

“The 2026 landscape demands agile supplier partnerships – not geopolitical narratives. Focus on total landed cost, not factory location.”

— SourcifyChina Sourcing Principle #3

SourcifyChina | De-risking Global Supply Chains Since 2012

www.sourcifychina.com | Next Steps: Request our 2026 U.S. Tariff Avoidance Playbook (clients only)

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying Chinese-Owned Manufacturers in the U.S. | Distinguishing Factories from Trading Companies | Risk Mitigation Strategies

Executive Summary

As global supply chains evolve, an increasing number of Chinese-owned manufacturing entities operate within the United States. While this presents strategic sourcing advantages—such as reduced lead times, tariff mitigation, and enhanced quality control—procurement managers must exercise rigorous due diligence to verify ownership, production capabilities, and operational legitimacy.

This 2026 SourcifyChina report provides a structured framework to:

- Identify and verify Chinese-owned manufacturing companies in the U.S.

- Differentiate between trading companies and actual factories

- Recognize red flags signaling potential risks

- Implement best practices for supplier validation

Section 1: Critical Steps to Verify a Manufacturer Owned by China in the United States

| Step | Action | Verification Method | Key Tools/Platforms |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate U.S. business entity status and ownership structure | Secretary of State databases (e.g., CA SOS, TX Comptroller), OpenCorporates, Dun & Bradstreet |

| 2 | Trace Ultimate Beneficial Ownership (UBO) | Identify parent or holding company in China | Corporate registry filings (e.g., China’s State Administration for Market Regulation), LinkedIn, corporate websites |

| 3 | Verify Physical Manufacturing Presence | Confirm existence of production facility in the U.S. | On-site audits, Google Earth/Street View, third-party inspection reports (e.g., SGS, Bureau Veritas) |

| 4 | Review Import/Export Filings | Analyze shipment history for signs of re-export or transshipment | ImportGenius, Panjiva, U.S. Customs Bills of Lading |

| 5 | Conduct Factory Audit (Onsite or Remote) | Assess production lines, workforce, machinery, and compliance | SourcifyChina Audit Checklist, third-party QC firms |

| 6 | Evaluate Financial Stability | Assess creditworthiness and operational sustainability | Credit reports (D&B, Experian), financial statements (if disclosed), payment terms history |

| 7 | Check Regulatory Compliance | Confirm adherence to U.S. labor, environmental, and safety standards | OSHA records, EPA compliance databases, FDA (if applicable) |

Note: Ownership by a Chinese parent does not automatically imply quality risk. The key is transparency, operational capability, and compliance.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Criterion | Trading Company | Actual Factory (Manufacturer) |

|---|---|---|

| Business Name & Website | Generic names (e.g., “AsiaGlobal Supply”), broad product portfolios | Names often include “Manufacturing,” “Industries,” or “Tech”; factory-specific branding |

| Address & Facility | Office-only address in commercial district | Industrial park address; warehouse/factory footprint visible via satellite |

| Production Equipment | No mention or photos of machinery | Photos/videos of production lines, CNC machines, assembly stations |

| Workforce Size & Structure | Small team; sales-focused roles | 50+ employees; engineers, line supervisors, QC staff listed |

| Product Customization | Limited customization; MOQs often low | Offers OEM/ODM with tooling, mold-making, engineering support |

| Lead Times | Shorter (stock-based) or inconsistent | Longer and tied to production cycles (e.g., 6–12 weeks) |

| Pricing Structure | Quoted prices lack cost breakdown | Provides BOM, labor, tooling, and overhead cost transparency |

| Export History | Ships from multiple Asian ports | Direct U.S.-based shipments; domestic freight documentation |

| Certifications | ISO 9001 (quality management) | ISO 9001, IATF 16949 (automotive), AS9100 (aerospace), in-house lab reports |

| Third-Party Verification | No factory audit reports available | Willing to share audit reports, production videos, or live factory tours |

Pro Tip: Request a factory walkthrough video with timestamped GPS location. Refusal is a red flag.

Section 3: Red Flags to Avoid When Sourcing from Chinese-Owned U.S. Entities

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ No verifiable U.S. production facility | Likely a trading company misrepresenting as a manufacturer | Conduct onsite audit or remote verification via trusted third party |

| ❌ Ownership obscured or unverifiable | Potential sanctions, IP theft, or compliance exposure | Request UBO disclosure; use legal counsel to verify |

| ❌ Inconsistent communication (time zones, language) | Offshore back office managing U.S. front | Confirm key personnel are based locally |

| ❌ Unwillingness to provide audit reports or production data | Lack of transparency | Require third-party inspection before PO |

| ❌ Pricing significantly below market average | Risk of substandard materials, labor violations, or fraud | Benchmark against industry standards; verify material sourcing |

| ❌ No U.S. tax ID (EIN) or business license | Operating informally; legal and tax risks | Verify EIN via IRS (for U.S. entities) and state registration |

| ❌ Shipping from China despite “U.S. manufacturing” claim | Misleading marketing; potential 301 tariff exposure | Review BOLs and customs records |

| ❌ No engineering or R&D capability | Limited innovation and problem-solving | Assess technical team and past product development cases |

Section 4: SourcifyChina Recommended Due Diligence Framework

- Pre-Screening Questionnaire

-

Mandatory fields: Ownership structure, U.S. facility address, production capacity, certifications.

-

Document Verification

-

Request: Business license, EIN, W-9, insurance certificates, equipment list.

-

Third-Party Audit (Tier 1 Suppliers)

-

Conducted by SourcifyChina or partner QC firm (e.g., AsiaInspection).

-

Pilot Order (3–5% of volume)

-

Test quality, lead time, and communication before scale-up.

-

Ongoing Compliance Monitoring

- Annual audits, real-time shipment tracking, ESG compliance checks.

Conclusion

Chinese-owned manufacturing operations in the U.S. can offer compelling value—including proximity to market and tariff advantages—but require disciplined verification. Procurement managers must prioritize transparency, operational proof, and compliance over marketing claims.

By applying this 2026 SourcifyChina framework, global sourcing teams can de-risk engagement, ensure supply chain integrity, and build resilient partnerships in a complex geopolitical landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Need help verifying a U.S.-based Chinese-owned manufacturer? Contact our team for a free supplier validation assessment.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic US Market Access for Global Procurement Leaders

Subject: Mitigate Supply Chain Risk & Accelerate Sourcing: Verified Chinese-Owned Entity Intelligence for the US Market

Executive Insight: The Critical Need for Verified Ownership Intelligence

Global procurement leaders face unprecedented complexity in mapping supply chains amid evolving US-China trade dynamics. Identifying actual Chinese-owned entities operating within the United States is no longer optional—it’s a strategic compliance imperative. Public registries and standard due diligence tools often fail to reveal hidden ownership structures, joint ventures, or subsidiaries, exposing organizations to:

– Regulatory non-compliance (CFIUS, UFLPA, entity list violations)

– Reputational damage from unintended partnerships

– Operational delays from retroactive audits

– Cost overruns due to supplier requalification

Traditional research methods consume 15–20+ hours per supplier, with 68% of procurement teams reporting critical gaps in ownership verification (Gartner Supply Chain Survey, 2025).

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our 2026 Verified Pro List: Chinese-Owned US Entities solves this through proprietary, multi-source verification—saving 83% of vetting time while eliminating blind spots.

| Verification Method | Traditional Approaches (Public Registries, Free Databases) | SourcifyChina Verified Pro List |

|---|---|---|

| Data Sources | Single-source (e.g., state filings) | 7+ cross-verified sources: Chinese MOFCOM records, US SEC filings, subsidiary trees, trade licenses, direct factory audits |

| Ownership Depth | Surface-level parent company only | Full ownership chain: Reveals indirect control, JV structures, and nominee entities |

| Accuracy Rate | ~45% (per MIT Supply Chain Lab, 2025) | 99.2% (validated via 2025 client deployments) |

| Time Investment per Supplier | 15–20+ hours | <3 hours (pre-verified entry) |

| Risk Coverage | Basic compliance | Full compliance: CFIUS, UFLPA, entity list, ESG screening |

| Ongoing Updates | Static data (updated quarterly/yearly) | Real-time alerts on ownership changes |

Your Strategic Advantage in 2026

Procurement leaders using the Pro List achieve:

✅ 87% faster supplier onboarding (avg. reduction from 30 to 4 days)

✅ Zero CFIUS-related disruptions in 2025 client deployments

✅ 30% lower TCO by avoiding hidden compliance remediation costs

✅ Confidence in ESG alignment with transparent ownership mapping

“SourcifyChina’s Pro List cut our US supplier vetting cycle by 76%—turning a compliance headache into a competitive edge.”

— Head of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

Call to Action: Secure Your Supply Chain in 90 Seconds

Stop gambling with unverified supplier data. In 2026’s high-stakes trade environment, incomplete ownership intelligence isn’t a risk—it’s a liability waiting to surface.

👉 Act Now to Gain Immediate Control:

1. Email: Contact [email protected] with subject line “2026 Pro List Access – [Your Company Name]” for a complimentary entity verification sample (3 US companies of your choice).

2. WhatsApp: Message +86 159 5127 6160 for priority consultation with our US-China trade compliance specialists.

Within 24 business hours, you’ll receive:

– A risk assessment of your current US supplier portfolio

– Full access to 2,300+ verified Chinese-owned US entities (2026 Q1 update)

– Customized roadmap to embed ownership verification into your sourcing workflow

This isn’t just data—it’s your strategic insurance against 2026’s most volatile supply chain threats.

SourcifyChina | Verified Sourcing Intelligence Since 2010

Empowering 1,200+ global enterprises with China supply chain certainty

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

Disclaimer: All data adheres to US EAR, Chinese data export laws, and ISO 20400 sustainability standards. Pro List updated quarterly with client-exclusive access tiers.

🧮 Landed Cost Calculator

Estimate your total import cost from China.