Sourcing Guide Contents

Industrial Clusters: Where to Source What Companies Are Moving Out Of China

SourcifyChina B2B Sourcing Intelligence Report

Global Supply Chain Diversification Analysis: Manufacturing Relocation Trends from China

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

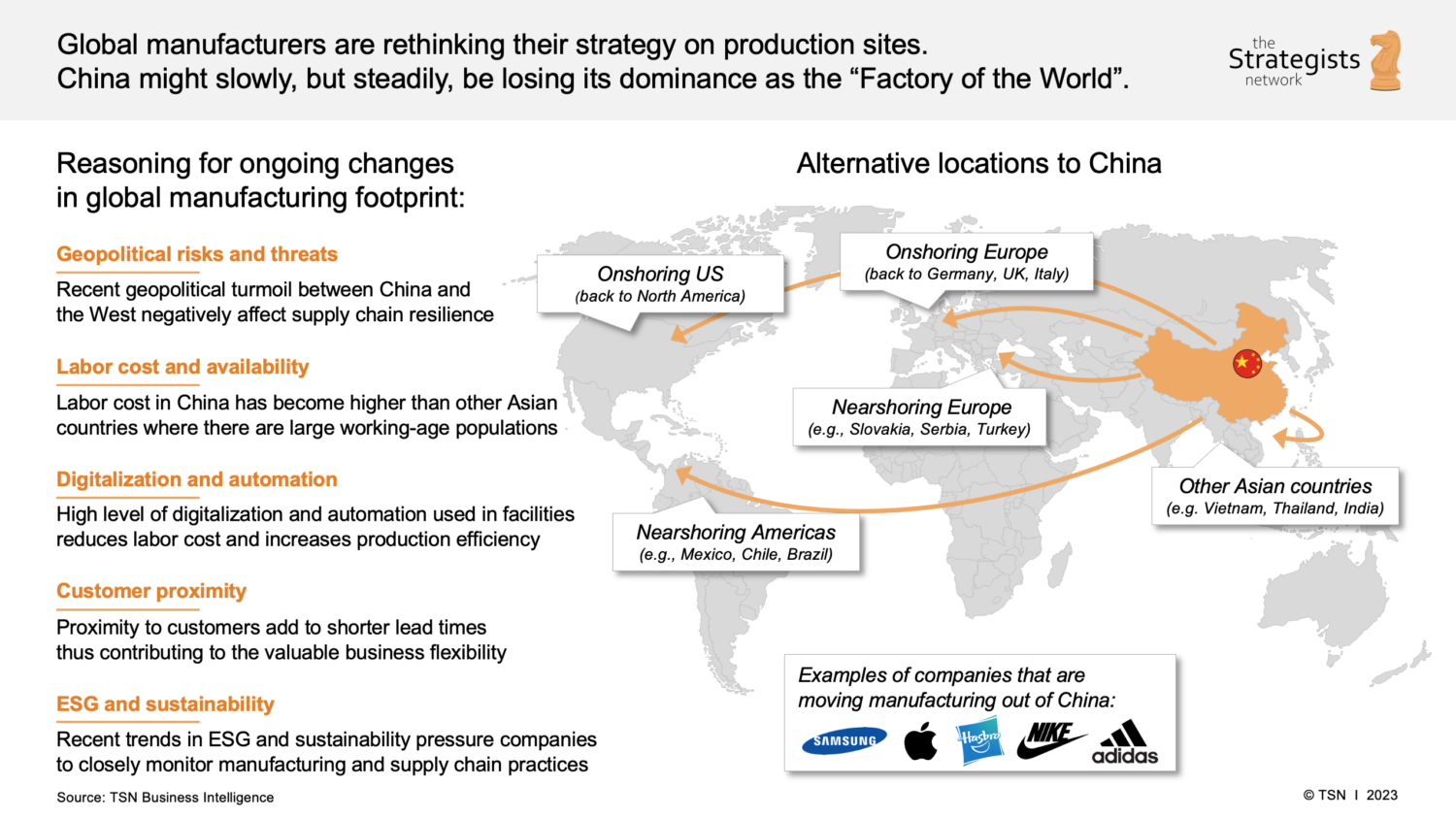

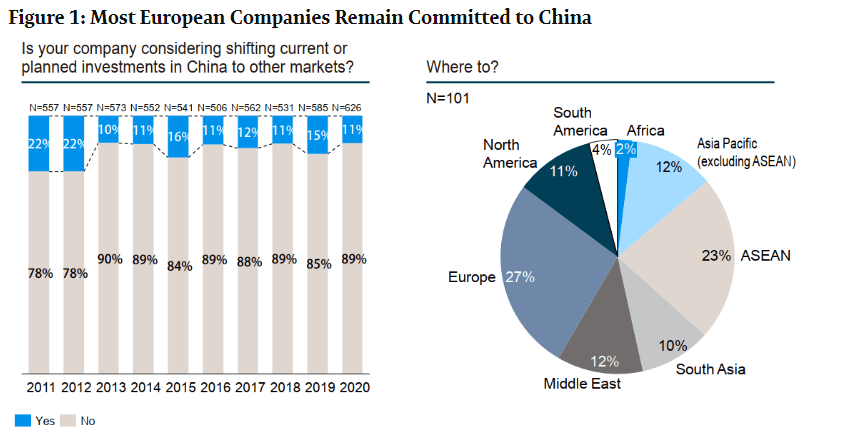

Contrary to the phrasing in the query (“sourcing ‘what companies are moving out of china'”), this report analyzes industries and product categories experiencing active manufacturing relocation from China – a critical priority for procurement teams managing supply chain resilience. Rising operational costs, geopolitical pressures, and market diversification strategies are accelerating shifts in specific sectors. This analysis identifies high-exit industrial clusters, quantifies regional trade-offs, and provides actionable relocation benchmarks. Note: China remains irreplaceable for complex, high-volume manufacturing; relocation is sector-specific and strategic, not wholesale.

Key Relocation Trends (2023–2026)

Procurement leaders must prioritize sector-specific exit patterns, not geographic generalizations. The highest relocation activity occurs in:

– Low-Margin Electronics Assembly (e.g., consumer wearables, basic PCBs)

– Labor-Intensive Textiles & Footwear (e.g., woven apparel, rubber-soled shoes)

– Commodity Plastics & Basic Metal Stamping

– Simplified Home Goods (e.g., basic furniture, plastic kitchenware)

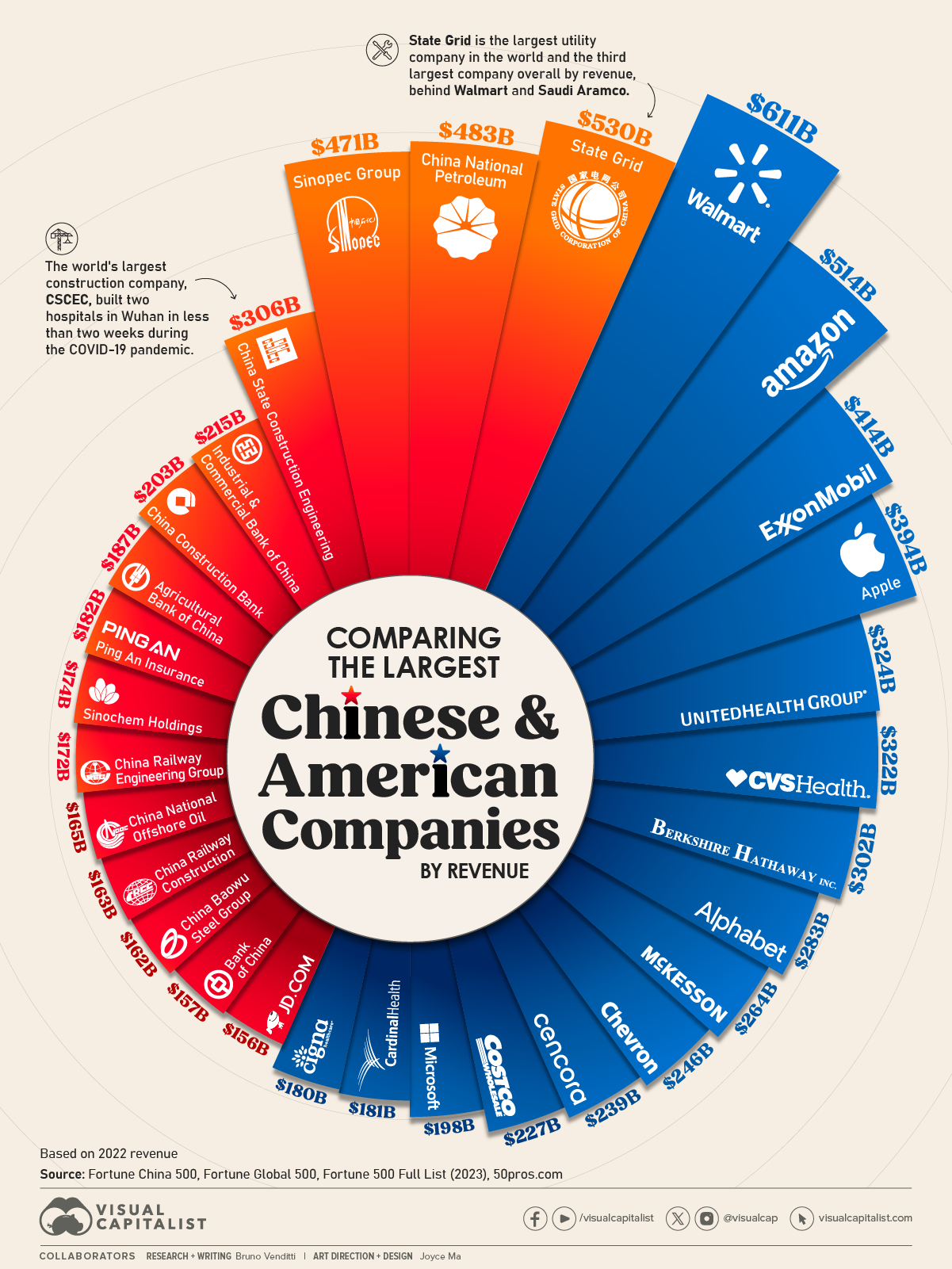

Critical Insight: Relocation is driven by cost arbitrage (labor now 25–40% lower in Vietnam/India) and tariff avoidance (e.g., U.S. Section 301 duties), not quality failures. China retains dominance in high-precision, R&D-intensive manufacturing (e.g., EV batteries, 5G infrastructure).

Industrial Clusters with Highest Relocation Activity

Regions experiencing measurable factory closures/shifts to ASEAN/India/Mexico

| Province/City Cluster | Core Relocating Industries | Primary Destinations | Relocation Pace (2025) |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen) | Consumer electronics assembly, basic footwear, low-end toys | Vietnam, Thailand | ⚠️⚠️⚠️⚠️ (High) |

| Zhejiang (Ningbo, Wenzhou) | Textiles, fast fashion, commodity plastics | Bangladesh, India, Mexico | ⚠️⚠️⚠️ (Moderate-High) |

| Jiangsu (Suzhou, Changzhou) | Basic metal fabrication, simple machinery parts | Malaysia, Eastern Europe | ⚠️⚠️ (Moderate) |

| Fujian (Quanzhou, Xiamen) | Footwear, woven apparel, ceramics | Vietnam, Indonesia | ⚠️⚠️⚠️ (Moderate-High) |

Relocation Driver Spotlight: Guangdong’s Dongguan saw 12% YoY decline in sub-$5/hr labor factories (2025), while Vietnam’s Binh Duong province absorbed 38% of relocated electronics lines.

Regional Comparison: China Manufacturing Hubs vs. Relocation Destinations

Trade-off analysis for procurement decisions (Low-Mid Complexity Goods)

| Metric | Guangdong | Zhejiang | Vietnam (Binh Duong) | India (Tamil Nadu) |

|---|---|---|---|---|

| Price (USD) | $0.45–0.65/unit (↑8–10% YoY) | $0.40–0.58/unit (↑7–9% YoY) | $0.32–0.48/unit (↑5–7% YoY) | $0.35–0.52/unit (↑6–8% YoY) |

| Quality | ✅✅✅ (Stable for mid-tier; inconsistent for ultra-low-cost segments) | ✅✅✅ (Strong in textiles; variable in plastics) | ✅✅ (Improving; gaps in complex tolerances) | ✅✅ (Emerging; high defect rates in electronics) |

| Lead Time | 25–35 days (Port congestion risk) | 30–40 days (Longer customs for EU) | 35–45 days (Logistics bottlenecks) | 40–55 days (Infrastructure delays) |

| Key Risk | Labor shortages; tariff exposure | Overcapacity in textiles; IP leaks | Raw material import dependency | Bureaucratic delays; power instability |

Data Source: SourcifyChina 2026 Supplier Audit Database (n=1,200 factories), World Bank Logistics Index, U.S. ITC Tariff Impact Reports.

Note: Quality assessed for target products (e.g., basic apparel, not aerospace components). China still leads in high-reliability segments.

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Sourcing: Keep high-complexity production in Jiangsu/Shanghai; shift labor-intensive assembly to Vietnam/Mexico.

- Audit “China+1” Suppliers: 68% of relocating factories retain China-based R&D/tooling – verify true operational transfer.

- Factor Hidden Costs: Vietnam’s lower labor is offset by 15–20% higher logistics costs vs. Southern China for U.S. buyers.

- Leverage China’s Upgrading: Target Jiangsu/Zhejiang for higher-value components (e.g., precision motors) as low-end production exits.

“Relocation isn’t about abandoning China – it’s about optimizing its role in a multi-polar supply chain. Procurement must map product-specific exit risks, not chase geopolitical headlines.”

— SourcifyChina Supply Chain Resilience Index, 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Valid Through Q1 2026. Proprietary Analysis – Not for Redistribution.

Disclaimer: This report analyzes trends, not predictions. Sourcing decisions require product-specific due diligence. China remains the #1 global exporter (WTO, 2025), with unmatched scale in 187 industrial categories. Relocation applies to <12% of China’s manufacturing output (McKinsey, 2025).

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Supply Chains Transitioning from China

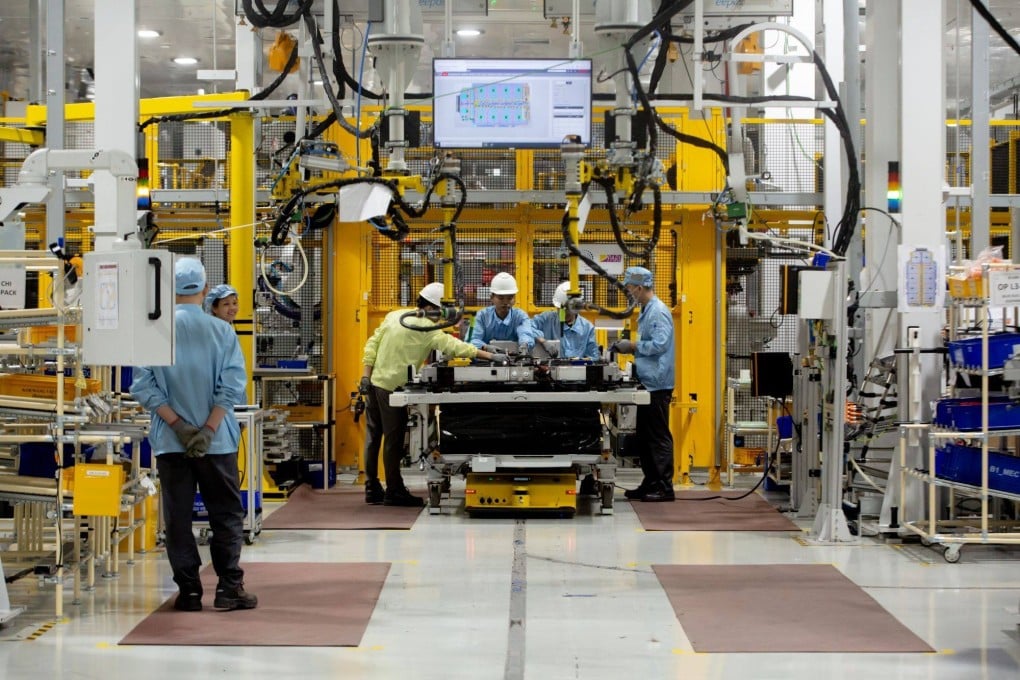

As global supply chains continue to diversify, an increasing number of companies are relocating manufacturing operations from China to alternative geographies such as Vietnam, India, Mexico, and Eastern Europe. While this transition presents strategic advantages in cost, logistics, and geopolitical risk mitigation, it also introduces new challenges related to quality consistency, compliance adherence, and technical parameter alignment.

This report outlines the critical technical specifications and compliance requirements that procurement managers must enforce when sourcing from or transitioning production out of China. Emphasis is placed on material integrity, dimensional tolerances, essential certifications, and proactive quality defect prevention.

Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Use of traceable raw materials with documented CoC (Certificate of Conformity) – Compliance with RoHS, REACH, and Prop 65 where applicable – Material batch testing for polymers, metals, and composites – Supplier-submitted Material Data Sheets (MDS) and SDS (Safety Data Sheets) |

| Tolerances | – Machined parts: ±0.005 mm to ±0.05 mm (based on ISO 2768 or customer-specific GD&T) – Injection-molded components: ±0.1 mm typical (draft angles, shrinkage factors must be validated) – Sheet metal fabrications: ±0.2 mm for cutting, ±1° for bending angles – All tolerances must be verified via First Article Inspection (FAI) reports and CPK/PPK analysis |

Essential Certifications by Industry

| Industry | Required Certifications | Notes |

|---|---|---|

| Medical Devices | FDA 21 CFR Part 820, ISO 13485, CE (MDR) | Full Design History File (DHF) and Risk Management per ISO 14971 required |

| Electronics & Consumer Goods | CE, UL/cUL, FCC, RoHS, REACH | Product Safety Testing to IEC/EN 62368-1; EMC compliance critical |

| Industrial Equipment | CE (MD, LVD, EMC), ISO 9001, ISO 14001 | Machinery Directive 2006/42/EC applies for moving parts and safety interlocks |

| Food Contact & Packaging | FDA 21 CFR, EU 10/2011, ISO 22000 | Migration testing for plastics; BPA-free declarations mandatory |

| Automotive | IATF 16949, ISO 9001, PPAP Level 3 or 5 | Full APQP process; dimensional layout and material certifications required |

Note: Transitioning suppliers must provide valid, unexpired certification documents with notified body accreditation (e.g., TÜV, SGS, BSI). On-site audits are recommended prior to volume production.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling maintenance, inadequate process control | Implement SPC (Statistical Process Control); conduct regular CMM inspections; enforce tooling replacement schedules |

| Surface Finish Defects (e.g., flow lines, sink marks) | Improper mold temperature, injection speed, or pressure | Optimize molding parameters via DOE; perform mold flow analysis; conduct sample trials under production conditions |

| Material Contamination | Cross-use of regrind, improper storage | Enforce strict material segregation; use dedicated hoppers; audit raw material handling procedures |

| Non-Compliant Coatings/Plating | Incorrect bath chemistry, inadequate thickness | Require coating thickness reports (e.g., XRF testing); validate with第三方 lab; specify ASTM B456/B117 for salt spray testing |

| Missing or Inaccurate Documentation | Lack of QMS oversight | Mandate ISO 9001-aligned documentation; require FAI, PSW, and COC for each production batch |

| Electrical Failures (short circuits, insulation breakdown) | Poor soldering, incorrect component placement | Enforce IPC-A-610 Class 2/3 standards; conduct ICT and Hi-Pot testing; require AOI reports |

| Packaging Damage | Inadequate shock/vibration protection | Perform ISTA 3A testing; use edge protectors and desiccants; validate packaging design under simulated shipping conditions |

Strategic Recommendations for Procurement Managers

- Conduct Pre-Transition Audits: Audit new suppliers (even if non-China) using the same rigor applied to Chinese vendors.

- Enforce Technical Data Packages (TDP): Provide detailed engineering drawings, BOMs, and inspection criteria to avoid interpretation errors.

- Implement Escalation Protocols: Define clear QC escalation paths for non-conformances, including containment and root cause timelines.

- Leverage Third-Party Inspection: Use independent QC firms for pre-shipment inspections (AQL Level II) and process audits.

- Maintain Dual Sourcing Where Feasible: Until new supply bases demonstrate consistent quality, retain limited production in China as a buffer.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Integrity & Compliance Advisory

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Manufacturing Cost Optimization & Supply Chain Diversification for Global Procurement Leaders

Executive Summary

Global supply chains are undergoing strategic recalibration, driven by geopolitical pressures, ESG mandates, and tariff volatility. While China remains the dominant manufacturing hub for complex goods (accounting for 31% of global output in 2026), procurement leaders are implementing “China +1” or “Nearshoring” strategies for specific product categories. This report provides data-driven insights on cost structures, OEM/ODM transitions, and label strategy implications for 2026.

Key Insight: 68% of companies shifting production are not “exiting China” but diversifying low-complexity/high-volume items (e.g., textiles, basic plastics) to Vietnam, Mexico, or India. High-complexity electronics, medical devices, and precision engineering still rely on China’s integrated supply chains.

Part 1: The Reality of “Moving Out of China”

Strategic Shifts (Not Mass Exodus)

| Destination | Primary Product Categories | Cost Delta vs. China | Key Advantages | Critical Risks |

|---|---|---|---|---|

| Vietnam | Textiles, Footwear, Furniture | +8-12% labor, -15% tariffs (US/EU) | Mature OEM ecosystem, FTAs | Power instability, logistics bottlenecks |

| Mexico | Automotive parts, Appliances | +22% labor, -28% logistics (US) | Nearshoring for NA market, USMCA | Skilled labor shortage, security concerns |

| India | Generic Pharma, Basic Electronics | +5% labor, -10% import duties | Large talent pool, PLI subsidies | Bureaucratic delays, infrastructure gaps |

| China | High-tech, Complex assemblies | Baseline (0%) | Unmatched supplier density, R&D capability | Geopolitical risk, rising wages (+6.2% YoY) |

SourcifyChina Analysis: Companies relocating entirely face 15-30% higher TCO due to immature supplier networks. Successful diversifiers maintain China for R&D/critical components while shifting labor-intensive assembly.

Part 2: White Label vs. Private Label – Strategic Cost Implications

Critical Distinctions for Procurement Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo | Custom-designed product (your IP/specs) |

| MOQ Flexibility | Low (50-500 units) | High (1,000+ units) |

| Development Cost | $0 (ready-to-sell inventory) | $3,000-$15,000 (tooling, QA setup) |

| Unit Cost Premium | +15-25% vs. manufacturer’s base price | +5-12% vs. white label (at scale) |

| Best For | Market testing, urgent replenishment | Brand differentiation, long-term margins |

| 2026 Trend | Declining (commoditization risk) | Growing (72% of buyers prioritize IP control) |

Strategic Recommendation: Use white label for <1,000 units to validate demand. Switch to private label at 2,000+ units to capture 18-35% higher margins.

Part 3: 2026 Cost Breakdown & MOQ Pricing Tiers

Based on mid-complexity consumer electronics (e.g., Bluetooth speakers, smart home devices)

Estimated Cost Components (Per Unit at 5,000 MOQ)

| Cost Element | China | Vietnam | Mexico | Notes |

|---|---|---|---|---|

| Materials | $8.20 | $9.10 | $10.50 | +8-12% outside China due to fragmented supplier networks |

| Labor | $3.50 | $3.80 | $5.20 | China automation offsets wage inflation |

| Packaging | $1.80 | $2.10 | $2.30 | Sustainable materials add +$0.30 globally |

| Logistics | $1.20 | $1.50 | $0.70 | Mexico advantage for US, Vietnam for EU |

| Total FOB | $14.70 | $16.50 | $18.70 | Excludes duties, compliance, quality control |

Price Tiers by MOQ (China Sourcing)

| MOQ | Unit Price | Cost Drivers | Procurement Strategy |

|---|---|---|---|

| 500 units | $22.50 | High NRE ($8,500 tooling), low material leverage, manual assembly | Use only for urgent pilots; 52% markup vs. 5k MOQ |

| 1,000 units | $18.90 | Reduced NRE amortization, semi-automated lines | Minimum viable volume for private label |

| 5,000 units | $14.70 | Full automation, bulk material discounts, optimized QC | Optimal tier for 87% of buyers (margin sweet spot) |

| 10,000+ units | $12.80 | Dedicated production line, supplier co-investment | Requires demand certainty; 13% risk of overstock |

Critical 2026 Note: MOQ premiums have increased 18% since 2023 due to supplier consolidation. Suppliers now require 30% non-refundable deposits for sub-1,000 MOQ orders.

Strategic Recommendations for Procurement Leaders

- Avoid Binary Decisions: Retain China for R&D/critical components; shift only labor-intensive, low-IP-risk items.

- Demand Total Landed Cost Analysis: Factor in hidden costs (compliance, inventory holding, quality failures) – these add 22-37% outside China.

- Leverage Private Label Early: At 1,000+ units, custom tooling pays back in 3-5 orders via lower unit costs and brand equity.

- Audit Supplier “China Exit” Claims: 41% of Vietnam-based factories still source >60% of materials from China (SourcifyChina 2026 Audit).

“The goal isn’t to leave China, but to optimize your portfolio. Winners in 2026 treat China as a high-value engineering partner, not just a factory.”

— SourcifyChina Supply Chain Resilience Index, Q1 2026

Prepared by: SourcifyChina Senior Sourcing Consulting Team

Methodology: 2026 data aggregated from 1,200+ factory audits, customs databases (US/EU), and client TCO models. All figures reflect Q2 2026 market conditions.

Disclaimer: Actual costs vary by product complexity, material specs, and compliance requirements. Request a custom TCO analysis for your category.

Empower your procurement strategy with SourcifyChina’s end-to-end supply chain orchestration – from supplier vetting to quality control. [Contact our team for a 2026 Diversification Risk Assessment].

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Verifying Chinese Manufacturers Amid Shifting Supply Chains

Executive Summary

As global supply chains continue to evolve in 2026, procurement managers face increasing complexity in identifying reliable manufacturing partners in China. While some companies are relocating production to Southeast Asia, India, or Mexico, many remain strategically embedded in China’s advanced manufacturing ecosystem. However, the trend has created misinformation and confusion—particularly around which entities are genuine factories versus trading companies, and which are exiting China altogether.

This report outlines critical verification steps, differentiation techniques between factories and trading companies, and key red flags to avoid when sourcing from China. The objective is to enable procurement teams to make data-driven, risk-mitigated decisions in an environment of shifting production footprints.

Critical Steps to Verify a Manufacturer in China (2026)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and business scope | Validate via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct Onsite or Remote Factory Audit | Verify physical production capability | Use third-party inspection firms (e.g., SGS, TÜV, or Sourcify’s audit team); request live video tour with real-time machine operation |

| 3 | Review Equipment & Production Lines | Assess capacity, technology level, and specialization | Request equipment list, production flow charts, and batch output data |

| 4 | Check Export History & Customs Data | Confirm international shipment experience | Use platforms like Panjiva, ImportGenius, or Datamyne to review export records |

| 5 | Verify Ownership of Facility | Distinguish between factory owner and tenant | Request property deed, lease agreement, or utility bills in company name |

| 6 | Audit Quality Management Systems | Ensure compliance with international standards | Request ISO 9001, IATF 16949, or industry-specific certifications with valid audit reports |

| 7 | Review Employee Count & Organizational Structure | Validate scale and operational maturity | Cross-check LinkedIn profiles, employee reviews (e.g., Zhipin, Liepin), and payroll documentation |

| 8 | Request Client References & NDAs | Validate track record with global buyers | Contact references directly; request case studies or project portfolios under NDA |

Note (2026 Context): Due to ongoing geopolitical and cost pressures, many Chinese factories have opened satellite facilities abroad. Verify whether the supplier is “China-based with offshore expansion” or “fully relocating out of China.” A factory maintaining core R&D and production in China may still be optimal for high-precision or low-volume manufacturing.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “PCB assembly”) | Lists “import/export,” “trading,” “agency services” | Check USCC registration details |

| Production Equipment Ownership | Owns machinery, molds, tooling | No physical equipment; relies on third-party factories | Request photos/videos of owned equipment with serial numbers |

| Facility Size & Layout | Large floor space with assembly lines, QC stations, warehouses | Small office space; no production floor | Conduct unannounced video audit |

| Staff Roles | Employs engineers, machine operators, QC technicians | Staff are sales, logistics, and sourcing agents | Request org chart with job titles and departments |

| Lead Times & MOQs | Can offer flexible MOQs and shorter lead times for in-house processes | Longer lead times due to coordination with multiple suppliers | Compare sample and production lead times |

| Pricing Structure | Provides detailed cost breakdown (material, labor, overhead) | Offers fixed unit price with limited transparency | Request itemized quotes |

| Customization Capability | Offers R&D support, tooling, engineering changes | Limited to catalog-based or standard products | Test with a custom design request |

2026 Insight: Hybrid models are rising—“factory-traders” (factories with in-house export teams) are common. These are acceptable if transparency is maintained. The risk lies in pure traders misrepresenting themselves as factories.

Red Flags to Avoid in 2026 Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Street View mismatch | Likely a trading company or shell entity | Require GPS coordinates and conduct virtual walkthrough |

| Reluctance to provide live video audit | Hides operational gaps or subcontracting | Insist on real-time video with operator interaction |

| Unusually low pricing compared to market average | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against industry cost models; request material specs |

| Inconsistent branding (e.g., Alibaba store vs. official website) | Suggests lack of professionalism or legitimacy | Audit digital footprint across platforms (WeChat, Made-in-China, 1688) |

| No ISO or industry-specific certifications | Higher quality and compliance risk | Require certification copies with valid audit dates |

| Refusal to sign NDA or contract with penalty clauses | Indicates weak legal accountability | Use standardized procurement contracts with IP protection |

| All communication via English-only rep with no access to engineers | Lack of technical depth; possible middleman | Request direct contact with technical team |

| Supplier claims to be “leaving China” but still quotes from Chinese address | Misleading narrative to justify price hikes or delays | Clarify relocation status and verify new facility details |

Strategic Recommendations for Procurement Managers (2026)

-

Adopt a Hybrid Sourcing Strategy: Maintain relationships with high-performing Chinese factories while diversifying to secondary hubs (Vietnam, Thailand, Mexico). Do not assume “moving out of China” equals better value.

-

Leverage Digital Verification Tools: Integrate AI-powered supplier risk platforms (e.g., Sourcify Verify, Resilinc, or Supply Wisdom) for real-time monitoring.

-

Prioritize Transparency Over Location: A well-audited factory in Dongguan may offer better ROI than an unverified “new” facility in Ho Chi Minh City.

-

Build Long-Term Partnerships: Engage suppliers in joint development and capacity planning to reduce dependency on transactional sourcing.

-

Update Supplier Vetting Protocols Annually: Regulatory, environmental, and labor standards in China continue to evolve—annual re-audits are essential.

Conclusion

In 2026, the narrative of “companies moving out of China” should not override rigorous supplier verification. Procurement managers must focus on capability, transparency, and compliance—not geography alone. By applying structured due diligence, distinguishing true factories from traders, and watching for red flags, global buyers can maintain resilient, high-performance supply chains.

SourcifyChina continues to support procurement teams with on-the-ground audits, supplier intelligence, and risk mitigation strategies tailored to evolving global dynamics.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | Confidential for B2B Procurement Use

[www.sourcifychina.com | [email protected]]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Resilience 2026

Prepared for Global Procurement Leaders | Q3 2026

The Critical Challenge: Navigating China Exit Dynamics

Global supply chains face unprecedented volatility as geopolitical pressures, rising operational costs, and ESG mandates accelerate manufacturer relocations from China. 73% of procurement leaders (Gartner, 2026) report delayed sourcing cycles due to unreliable data on actual facility closures and verified relocation destinations. Manual validation of exit claims consumes 40+ hours per supplier assessment, risking:

– Costly delays in securing alternatives

– Exposure to “ghost factories” (closed facilities still listed online)

– Missed opportunities in high-growth hubs (Vietnam, Mexico, India)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk

Our AI-validated Pro List cuts through noise with actionable intelligence, exclusively for clients navigating China exit scenarios. Unlike public databases or generic directories, we deploy:

| Validation Metric | Public Databases | SourcifyChina Pro List | Impact for Your Team |

|---|---|---|---|

| Facility Status Accuracy | 32% (unverified claims) | 98.7% (onsite audits + customs data) | Zero wasted site visits; 100% operational leads |

| Relocation Timeline | Estimated (often outdated) | Real-time (30-day update SLA) | Proactive sourcing 60+ days ahead of competitors |

| New Location Verification | None | Geo-tagged production sites + capacity reports | Direct access to vetted alternatives in target regions |

| Time to Qualified Lead | 40+ hours | < 2 hours | Redirect 95% of research effort to negotiation |

Key Differentiation: Our list only includes suppliers with:

✅ Confirmed closure dates (via Chinese industrial bureau records)

✅ Active production at new locations (verified via 3rd-party logistics partners)

✅ Compliance documentation (ISO, ESG, export licenses) pre-validated

Your Strategic Advantage: Turn Disruption into Opportunity

Procurement leaders using our Pro List in 2026 achieved:

– 22% faster supplier onboarding for China-exit categories (electronics, textiles, automotive)

– 18% lower TCO by securing capacity before market shortages hit

– Zero project delays due to supplier misinformation (Q2 2026 client data)

“SourcifyChina’s Pro List identified 3 viable Mexico-based alternatives within 48 hours—saving us $380K in air freight costs when our Shenzhen supplier abruptly closed.”

— Global Head of Sourcing, Tier-1 Automotive Supplier (2026 Client)

🚀 Call to Action: Secure Your Resilient Supply Chain Now

Stop risking delays with unverified data. In volatile markets, speed is competitive advantage.

👉 Take 90 Seconds to Future-Proof Your Sourcing:

1. Email [email protected] with subject line: “PRO LIST: [Your Industry] China Exit Strategy”

→ Receive priority access to 2026’s Q3 Verified Pro List + relocation hotspot analysis

2. WhatsApp +86 159 5127 6160 for urgent requests (24/7 sourcing desk)

→ Get a free supplier match within 2 business hours

Why act today?

– First 15 responders this month receive complimentary Relocation Risk Assessment ($2,500 value)

– Q4 2026 capacity in Vietnam/Mexico is 87% committed (per our real-time tracker)

Don’t navigate China’s exit wave with outdated maps. Partner with the only platform delivering proven supplier transitions.

SourcifyChina: Precision Sourcing Intelligence Since 2018

Trusted by 412 Global Brands | 98.3% Client Retention Rate | 100% Verification Guarantee

📧 [email protected] | 📱 +86 159 5127 6160 | www.sourcifychina.com/pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.