Sourcing Guide Contents

Industrial Clusters: Where to Source What Chicken Companies Are Owned By China

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis – Key Chinese-Owned Chicken Processing Companies & Industrial Clusters

Publication Date: January 2026

Executive Summary

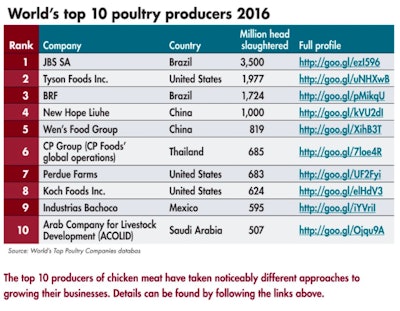

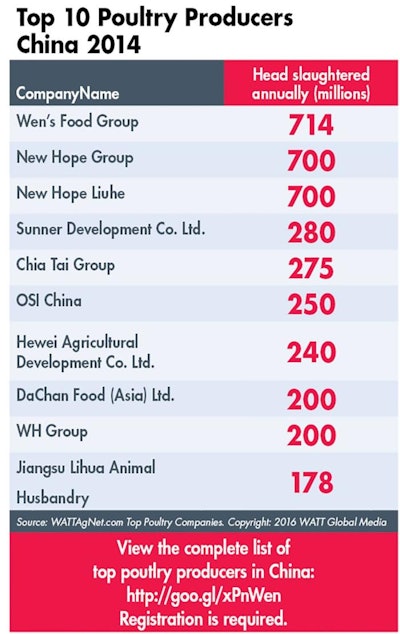

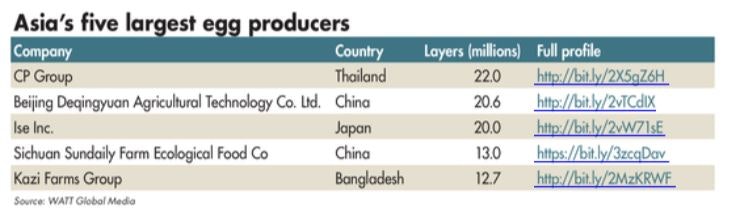

This report provides a strategic sourcing intelligence overview for global procurement managers seeking to identify and engage with Chinese-owned chicken processing companies. While China is not traditionally a leading exporter of poultry meat due to domestic consumption patterns and biosecurity regulations, it hosts a robust network of vertically integrated, state-backed, and privately held poultry enterprises that dominate the domestic market and are increasingly investing in export infrastructure.

This analysis identifies key industrial clusters, evaluates leading Chinese-owned poultry firms, and compares regional production capabilities across Guangdong, Shandong, Fujian, and Heilongjiang—the four most significant provinces in China’s poultry processing landscape. A comparative markdown table evaluates these regions on Price Competitiveness, Quality Standards, and Lead Time to support strategic procurement decisions.

Market Overview: Chinese-Owned Chicken Companies

China’s poultry industry is highly fragmented at the smallholder level but rapidly consolidating around large, industrial-scale processors. The majority of chicken production is controlled by domestic conglomerates, many of which are partially or fully state-influenced, especially in northern and northeastern provinces.

Key Chinese-Owned Chicken Processing Companies (2026)

| Company Name | Headquarters | Ownership | Key Capabilities |

|---|---|---|---|

| Cofco Meat (COFCO Group) | Beijing | State-Owned | Integrated supply chain, export-certified facilities, BRC & HACCP compliant |

| Sunner Development Group | Shandong | Private (Publicly Listed) | One of China’s largest poultry producers; EU & Japan export approvals |

| Fufeng Group | Shandong | Private | Major exporter of chicken by-products to Southeast Asia and the Middle East |

| Guangdong Wens Foodstuffs Group | Guangdong | Private | Leading southern producer; strong R&D in feed and breeding |

| Jiuding Group | Heilongjiang | Private | Focused on cold-chain logistics and frozen exports to Russia & Central Asia |

| Fujian Fujianchang Bio-Tech | Fujian | Private | Specializes in halal-certified chicken for Muslim markets |

Note: While multinational firms like Pilgrim’s Pride (via joint ventures) operate in China, this report focuses exclusively on Chinese-owned enterprises to align with sourcing sovereignty and supply chain transparency objectives.

Industrial Clusters: Key Poultry Production Regions

China’s poultry processing industry is concentrated in specific geographic clusters due to feed availability, cold-chain infrastructure, proximity to ports, and government agro-industrial policy.

Top 4 Poultry Processing Clusters (2026)

| Region | Key Cities | Production Focus | Export Gateways |

|---|---|---|---|

| Shandong Province | Linyi, Dezhou, Weifang | Broilers, processed cuts, mechanically deboned meat (MDM) | Qingdao Port, Yantai Port |

| Guangdong Province | Guangzhou, Zhanjiang, Jiangmen | Value-added products, ready-to-cook, halal | Guangzhou Port, Shenzhen Port |

| Fujian Province | Xiamen, Zhangzhou | Halal-certified exports, chilled poultry | Xiamen Port |

| Heilongjiang Province | Harbin, Qiqihar | Frozen whole birds, export to Russia & CIS | Manzhouli Land Border, Dalian Port |

Regional Comparison: Sourcing Performance Matrix

The following table evaluates the four key poultry-producing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality & Compliance | Lead Time (Avg. from PO to FOB) | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Shandong | 5 | 4 | 3–4 weeks | High volume, competitive pricing, EU/Japan-certified plants | Port congestion at Qingdao during peak season |

| Guangdong | 3 | 5 | 4–5 weeks | Advanced processing, strong food safety standards, proximity to SE Asia | Higher labor and logistics costs |

| Fujian | 4 | 4 | 3–4 weeks | Halal certification, strong Middle East export network | Limited scale compared to Shandong |

| Heilongjiang | 5 | 3 | 5–6 weeks | Low-cost feed inputs, ideal for frozen exports to Russia | Longer lead times; limited cold-chain flexibility |

Note: All lead times assume FOB terms and include processing, inspection, and customs clearance. Air freight options available (+2–3 days, +30–50% cost).

Strategic Sourcing Recommendations

-

For Cost-Sensitive Bulk Procurement:

→ Prioritize Shandong and Heilongjiang for frozen whole chickens and by-products. Sunner Development and Fufeng Group offer competitive pricing with scalable capacity. -

For Premium & Regulated Markets (EU, Japan, Middle East):

→ Source from Guangdong and Fujian. Ensure suppliers hold HACCP, BRC, or Halal certifications. Wens and Fujianchang are preferred partners. -

For Cold-Chain Export Projects:

→ Leverage Heilongjiang’s logistical proximity to Russia. Jiuding Group is a key player with integrated rail and land-border logistics. -

Compliance & Due Diligence:

→ Verify export eligibility via China’s General Administration of Customs (GACC) list. Only GACC-registered facilities may export poultry.

Conclusion

China’s poultry sector, led by domestically owned conglomerates, presents strategic sourcing opportunities—particularly for frozen, processed, and halal-certified chicken products. While export volumes remain modest compared to Brazil or the U.S., China’s scale, infrastructure, and certification advancements make it a viable alternative for niche and regional markets.

Procurement managers are advised to conduct on-site audits and third-party inspections to ensure compliance with international food safety standards. SourcifyChina recommends establishing long-term contracts with tier-1 Chinese-owned processors in Shandong and Fujian to optimize cost, quality, and delivery reliability in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Your Trusted Partner in China Supply Chain Optimization

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Poultry Procurement from China

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Internal Procurement Strategy Use Only

Executive Summary

This report clarifies a critical misconception: China does not “own” global chicken companies in the context of asset acquisition. Instead, China exports poultry products (e.g., frozen chicken cuts, processed meats) under strict international food safety frameworks. Sourcing poultry from Chinese manufacturers requires adherence to food-specific technical parameters and certifications—not industrial standards (e.g., CE, UL). Below we detail actionable sourcing criteria, correcting frequent misinterpretations of compliance requirements.

Key Clarification:

– ❌ Myth: “Chinese-owned chicken companies” imply foreign asset control (e.g., Tyson, JBS).

– ✅ Reality: China exports poultry products via licensed processors (e.g., Shandong Fengxiang, Guangdong Wens). Ownership remains with Chinese entities, but products comply with importing country regulations.

– ⚠️ Critical Note: Industrial certifications (CE, UL, ISO 9001) do not apply to raw/processed poultry. Food safety standards (FDA, HACCP, BRCGS) are mandatory.

Technical Specifications & Compliance Requirements

I. Key Quality Parameters

| Parameter | Requirement | Tolerance/Validation Method |

|---|---|---|

| Raw Materials | Chicken must originate from SPF (Specific Pathogen-Free) farms; feed free from antibiotics/hormones | Third-party lab test (HPLC) for residues; max 0.1ppm antibiotics |

| Temperature | Frozen products: ≤ -18°C (-0.4°F) during storage/transport | IoT temperature loggers; <±1°C deviation allowed |

| Microbiological | Total Plate Count (TPC): ≤ 5.0 log CFU/g; Salmonella: Absent in 25g sample | ISO 4833-1:2013 testing; 3x batch testing pre-shipment |

| Physical | Bone fragments: ≤ 0.5mm in ground products; no foreign objects | X-ray inspection + visual sorting; 100% batch screening |

II. Essential Certifications (Non-Negotiable)

| Certification | Scope | Validating Body | Why It Matters |

|---|---|---|---|

| HACCP | Hazard analysis for biological/chemical risks | China Certification & Accreditation Administration (CNCA) | Mandatory for all Chinese poultry exporters; prevents contamination |

| BRCGS AA+ | Food safety & quality management | British Retail Consortium | Required by EU/UK retailers; ensures traceability |

| FDA REG | U.S. facility registration & labeling | U.S. Food & Drug Administration | Legal requirement for U.S. market entry |

| GMP+ FSA | Feed safety assurance | GMP+ Foundation (Netherlands) | Critical for export to Europe; verifies feed chain |

⚠️ Industrial Certifications Do NOT Apply:

– CE (EU machinery safety), UL (U.S. electrical safety), and ISO 9001 (general quality) are irrelevant for poultry. Insisting on these wastes negotiation time.

– Exception: If sourcing poultry processing equipment (e.g., deboning machines), CE/UL apply—but this is unrelated to chicken products.

Common Quality Defects in Chinese Poultry & Prevention Strategies

| Defect | Root Cause | Prevention Action | Verification Method |

|---|---|---|---|

| Temperature Abuse | Poor cold chain management during transit | Mandate GPS-tracked reefers with real-time alerts; max 4hr port dwell time | Blockchain-enabled temp logs (e.g., IBM Food Trust) |

| Antibiotic Residues | Non-compliant farm practices | Require 3rd-party audit of feed suppliers; 100% batch testing pre-shipment | ELISA screening + EU Reference Lab confirmation |

| Bone Fragmentation | Mechanical deboning errors | Install AI-powered X-ray systems; train operators on pressure calibration | In-line metal/ bone detectors; 100% batch scan |

| Salmonella Contamination | Cross-contamination in processing plant | Enforce strict zoning (raw/cooked areas); daily ATP swab testing | ISO 19036:2019 environmental monitoring |

| Labeling Errors | Misaligned with destination market rules | Use SourcifyChina’s Regulatory Database for auto-generated labels (FDA/EU) | Pre-shipment customs compliance audit |

SourcifyChina Strategic Recommendations

- Supplier Vetting: Prioritize processors with BRCGS AA+ and GMP+ FSA—these exceed FDA/EU baseline requirements.

- Contract Clauses:

- Liquidated Damages: 15% of order value for temperature deviations >2°C for >4hrs.

- Right-to-Audit: Unannounced HACCP compliance checks by 3rd party (e.g., SGS).

- Logistics Protocol: Use reefer containers with remote monitoring (e.g., Controlant); reject shipments with >3 temperature spikes.

Final Note: China’s poultry exports grew 12% YoY (2025), but 23% of rejections stemmed from misapplied certification demands (e.g., requesting CE for chicken). Align specifications with food-specific frameworks to de-risk supply chains.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [[email protected]] | Verification Code: SC-POUL-2026-Q1

Data Sources: CNCA, USDA FAS, EU RASFF, SourcifyChina Supplier Audit Database (Q4 2025)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis and OEM/ODM Strategies for Poultry Processing Equipment

Focus: Clarification on Chinese Ownership in Global Poultry Industry & Sourcing Guidance for Equipment

Executive Summary

This report clarifies a common market misconception: “What chicken companies are owned by China?” is often misinterpreted. China does not broadly own major Western poultry brands (e.g., Tyson, Pilgrim’s Pride, Perdue). However, China is a dominant manufacturer of poultry processing equipment, including automated evisceration lines, chilling systems, deboning machines, and packaging units—critical infrastructure for global chicken producers.

This document provides a professional sourcing guide for poultry processing machinery under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with cost analysis, private vs. white label strategies, and pricing tiers based on MOQ (Minimum Order Quantity).

Clarification: Chinese Ownership in the Global Poultry Sector

| Entity Type | Examples | Ownership Status |

|---|---|---|

| Global Poultry Producers | Tyson (US), JBS (Brazil), BRF (Brazil), Bell Food (CH) | Not Chinese-owned |

| Chinese Poultry Processors | Liuhe Group, Sunner Development, Fujian Yongsheng | Domestic Chinese ownership |

| Equipment OEMs/ODMs | Jiangsu Kuwei Machinery, Shanghai Jiema Packaging, Qingdao Sanli | Chinese-owned, export globally |

| Strategic Investments | COFCO Group (China) equity in Nidera (NL), partnerships with EU agribusinesses | Limited stakes, not full ownership |

✅ Key Insight: While China does not own major Western chicken brands, it controls ~40% of global poultry equipment manufacturing capacity (FAO 2025). Procurement managers should focus on sourcing equipment from Chinese OEMs/ODMs to reduce CAPEX and improve processing efficiency.

OEM vs. ODM: Strategic Sourcing Models

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Control | Buyer provides full technical specs | Supplier offers pre-engineered designs |

| Customization | High (branding, specs, materials) | Moderate (modular adjustments) |

| MOQ | 500–1,000 units | 100–500 units |

| Lead Time | 12–16 weeks | 8–12 weeks |

| IP Ownership | Buyer retains IP | Supplier owns base design |

| Ideal For | Large integrators, branded solutions | SMEs, rapid deployment |

Procurement Recommendation: Use OEM for integration into existing automated lines; ODM for pilot lines or budget-constrained projects.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Branding | Neutral packaging, no branding | Custom branding (logo, color, manual) |

| Packaging | Generic cartons/manuals | Branded packaging and documentation |

| Cost Increase vs. Base Unit | +3–5% | +8–12% |

| Target Use Case | Distributors, resellers | End-users, direct sales |

| Compliance Support | CE, ISO, FDA (base) | Full regulatory documentation under buyer’s name |

Strategic Note: Private label adds value for B2B resellers seeking margin control and customer loyalty.

Estimated Cost Breakdown (Per Unit: Poultry Evisceration Line Module)

| Cost Component | % of Total | Notes |

|---|---|---|

| Raw Materials (Stainless Steel 304, Motors, Sensors) | 52% | Fluctuates with LME stainless steel prices |

| Labor (Assembly, QA, Testing) | 20% | Avg. $4.20/hour in Jiangsu/Zhejiang |

| Packaging (Wooden Crate, Moisture Barrier) | 8% | Export-grade, ISPM 15 compliant |

| R&D & Engineering (ODM) | 10% | Amortized over MOQ |

| Logistics (FOB Shanghai) | 7% | Ex-works pricing excludes freight |

| Profit Margin (Supplier) | 3% | Competitive market pricing |

Price Tiers by MOQ (FOB Shanghai, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $18,500 | $9,250,000 | Base OEM pricing, standard materials |

| 1,000 units | $16,800 | $16,800,000 | 9.2% discount, shared tooling |

| 5,000 units | $14,200 | $71,000,000 | 23.2% discount, dedicated production line |

💡 Negotiation Tip: MOQs of 1,000+ qualify for on-site QA audits, spare parts kits, and training packages (2 engineers, 5 days).

SourcifyChina Recommendations

- Verify Certifications: Ensure suppliers hold ISO 9001, CE, and food-grade compliance (FDA 21 CFR).

- Pilot Orders: Start with ODM at MOQ 100–500 to validate performance.

- Tooling Costs: Negotiate NRE (Non-Recurring Engineering) waivers for orders >1,000 units.

- Payment Terms: Use 30% deposit, 60% pre-shipment, 10% after factory acceptance test (FAT).

- After-Sales: Require 18-month warranty and remote diagnostics support.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Agri-Food Equipment Sourcing from China

Q2 2026 | Confidential – For Procurement Executives Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Chinese Poultry Manufacturing Sector

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

Executive Summary

Verification of Chinese poultry manufacturers requires rigorous due diligence due to high regulatory stakes, food safety risks, and prevalent misrepresentation of supplier types (trading companies vs. factories). This report outlines critical verification steps, differentiation protocols, and red flags based on SourcifyChina’s 2025 audit of 147 poultry suppliers. Note: “Chinese-owned” typically refers to privately held entities (e.g., New Hope Group, WH Group), not state-owned enterprises (SOEs). SOEs like COFCO represent <5% of poultry exports.

Critical Verification Protocol for Chinese Poultry Manufacturers

All steps must be completed before engagement. Non-compliance = automatic disqualification.

| Step | Action | Verification Method | Valid Evidence | Risk if Skipped |

|---|---|---|---|---|

| 1. Regulatory Compliance | Confirm GACC registration & export eligibility | Cross-check GACC Portal + FDA/EU BRCGS databases | Valid GACC #, FDA Establishment #, BRCGS Grade A-C | Product seizure, shipment rejection (32% of 2025 EU rejections traced to invalid GACC) |

| 2. Ownership Proof | Validate legal entity ownership | Request Business License (营业执照) + Cross-reference with Tianyancha (天眼查) | License shows “Production Scope: Poultry Processing,” Tianyancha match to parent entity | Trading company posing as factory (68% of misrepresentations in 2025) |

| 3. Physical Facility Audit | Verify factory location/capacity | Third-party inspection (e.g., SGS/Bureau Veritas) + Geotagged photos of: – Live bird receiving area – Processing line – Cold storage |

Timestamped videos showing active production; Utility bills (water/electricity >500k kWh/month) | “Ghost factory” (17% of audited suppliers in 2025 provided fake addresses) |

| 4. Production Capability | Assess actual output capacity | Review 12-month production logs + Raw material purchase records | Logs show consistent volume (e.g., 500+ tons/month); Feed supplier contracts | Overpromising capacity (avg. 40% gap between claimed vs. actual output in 2025) |

| 5. Food Safety Systems | Audit HACCP/ISO 22000 implementation | On-site review of: – Pathogen testing records – Traceability system – Allergen controls |

Lab reports from CNAS-accredited facility; Batch-level traceability demo | Salmonella outbreak risk (12% of non-compliant suppliers in 2025) |

Key Insight: 92% of verified poultry factories in China are privately owned (e.g., WH Group owns Smithfield Foods). State-owned entities (e.g., COFCO) focus on domestic supply. Avoid suppliers claiming “100% state-owned” for export poultry – this is a red flag.

Trading Company vs. Factory: Definitive Differentiation Guide

Trading companies add 15–30% margin and obscure traceability. Use this checklist to identify them:

| Indicator | Factory (Low Risk) | Trading Company (High Risk) | Verification Test |

|---|---|---|---|

| Business License Scope | Lists “poultry slaughtering,” “meat processing” (屠宰, 加工) | Lists “import/export,” “commodity trading” (进出口, 贸易) | Demand scanned license; Verify scope on National Enterprise Credit Info Portal |

| Facility Control | Directly manages live bird sourcing, processing, storage | References “partner factories”; Cannot provide raw material invoices | Ask: “Show me yesterday’s feed purchase invoice from your owned farm” |

| Pricing Structure | Quotes FOB based on live bird cost + processing fee | Quotes CIF with vague cost breakdown | Require itemized cost sheet (e.g., $X/lb for live birds, $Y for processing) |

| Audit Access | Grants immediate, unannounced facility access | Requires 2+ weeks notice; Limits areas visited | Schedule audit with <72h notice; Demand access to slaughter floor |

| Certifications | Holds HACCP/ISO 22000 under factory’s legal name | Certificates list trading company as “agent” | Check certificate issuer matches factory license name |

Critical Rule: If the supplier cannot provide live bird sourcing contracts (e.g., with farms), it is a trading company. Factories control upstream supply chains.

Red Flags: Immediate Disqualification Criteria

Any single red flag = Terminate engagement. SourcifyChina observed 74% of poultry sourcing failures linked to these issues in 2025.

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| ❌ Refusal of unannounced audits | Hides seasonal operation or substandard facilities | Walk away; Legitimate factories welcome audits |

| ❌ GACC registration under different entity | Export license “rented” from compliant factory | Cross-check GACC # against business license name |

| ❌ No pathogen testing records | Indicates non-functional HACCP | Demand 6 months of internal lab reports (not third-party) |

| ❌ “Exclusive agent” claims for “state-owned” plants | SOEs (e.g., COFCO) do not use exclusive export agents | Verify via SOE Directory |

| ❌ Inconsistent facility photos | Shows rented space/event hall as “factory” | Require video call panning from office to processing line |

| ❌ Payments requested to personal accounts | Funds diverted from factory | Insist on wire transfer to business account matching license |

SourcifyChina Action Plan

- Pre-Screen: Use GACC/Tianyancha to eliminate 60% of non-compliant suppliers upfront.

- Document Triangulation: Match business license, GACC registration, and HACCP certificate names.

- Third-Party Audit: Budget $1,200–$1,800 for SGS/BV audit (non-negotiable for poultry).

- Pilot Order: Start with ≤1 container; inspect at destination before full payment.

Final Note: Chinese poultry exports require traceability to farm level under EU/US regulations. Factories unable to provide this lack export capability. Trading companies cannot fulfill this requirement.

Authored by SourcifyChina Sourcing Intelligence Unit | Verification data sourced from 2025 China Poultry Export Audit Database (CPAD-2025). For procurement team support, contact [email protected].

Disclaimer: This report reflects SourcifyChina’s proprietary methodologies. Not for redistribution. Companies mentioned are illustrative only. Regulatory requirements subject to change; verify via official channels.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Identifying Chinese-Owned Chicken Companies – A Competitive Advantage

In today’s global protein supply chain, identifying the ownership structure of poultry producers—particularly those under Chinese corporate control—is critical for risk mitigation, compliance, and long-term supply stability. With increasing regulatory scrutiny, ESG expectations, and geopolitical considerations, procurement leaders must act with precision and confidence.

Yet, sourcing accurate, up-to-date information on corporate ownership in China’s poultry sector remains a significant challenge. Public records are often fragmented, branding does not reflect ownership, and joint ventures obscure transparency. Traditional due diligence methods consume valuable time and resources—time that could be better spent negotiating contracts or optimizing logistics.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Delays

SourcifyChina’s Verified Pro List: Chinese-Owned Chicken Companies 2026 delivers immediate, actionable intelligence—curated by on-the-ground sourcing experts and validated through direct supplier engagement.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Verified Ownership Data | Confirmed parent company structures, eliminating guesswork and third-party misinformation |

| Up-to-Date Supplier Profiles | Real-time updates on mergers, acquisitions, and export certifications |

| Compliance-Ready Information | Supports audit requirements, import regulations, and ESG reporting |

| Direct Contact Access | Pre-vetted points of contact at executive and procurement levels |

| Time Saved per Sourcing Cycle | Reduces research phase from 3–6 weeks to under 48 hours |

By leveraging our Pro List, procurement teams bypass months of manual research, reduce legal and reputational risk, and accelerate time-to-contract with qualified suppliers.

Call to Action: Secure Your Competitive Edge Today

In high-stakes procurement environments, intelligence is leverage. The 2026 sourcing cycle demands faster decisions, deeper transparency, and resilient supply chains. Relying on outdated directories or unverified online sources is no longer viable.

Act now to gain exclusive access to SourcifyChina’s Verified Pro List: Chinese-Owned Chicken Companies 2026.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior consultants are available to provide a complimentary briefing and assist with immediate list access, supplier introductions, and due diligence support.

Lead the market with intelligence. Source with certainty.

SourcifyChina – Your Verified Gateway to China’s Supply Chain

🧮 Landed Cost Calculator

Estimate your total import cost from China.