Sourcing Guide Contents

Industrial Clusters: Where to Source What Car Company Did China Buy

SourcifyChina | Professional Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Clarification & Strategic Analysis: Sourcing Chinese Automotive Manufacturing Capabilities (Not “Acquired” Companies)

Date: October 26, 2026

Executive Summary

Your query regarding “what car company did China buy” reflects a common industry misconception. China (as a nation) does not “buy” car companies. Instead, Chinese automotive conglomerates have strategically acquired foreign brands (e.g., Geely acquiring Volvo Cars, SAIC acquiring MG Rover assets). This report pivots to address the actual need: identifying key Chinese industrial clusters for sourcing automotive components and finished vehicles (including NEVs), which is critical for global procurement strategy. We clarify the acquisition landscape, then provide a deep-dive into manufacturing hubs with actionable regional comparisons.

Clarification: Chinese Automotive Acquisitions (Not Sourcing Targets)

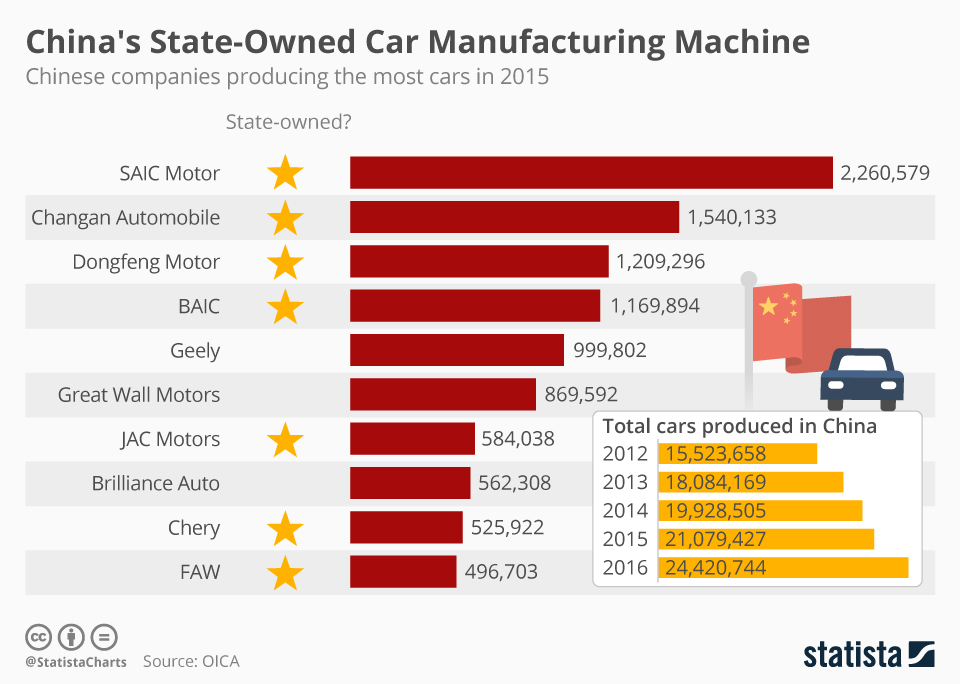

Chinese companies, not the Chinese government, have executed high-profile acquisitions to access technology and global markets. Key examples:

– Geely Holding Group acquired Volvo Cars (2010), Lotus (2017), and holds stakes in Mercedes-Benz Group.

– SAIC Motor acquired MG Rover assets (2005), now producing MG EVs globally.

– Great Wall Motors acquired GWM Thailand (2020) and Haval manufacturing in Russia.

Why this matters for sourcing: These acquisitions enhanced Chinese OEMs’ capabilities, but sourcing targets are component suppliers or contract manufacturers in China—not the acquired foreign brands themselves. Procurement managers should focus on China’s domestic manufacturing ecosystem for cost, quality, and scalability.

Deep-Dive: Key Chinese Automotive Manufacturing Clusters (2026)

China’s automotive production is concentrated in 5 core clusters, driven by policy (e.g., “Made in China 2025”), supply chain density, and NEV (New Energy Vehicle) incentives. Below are the top regions for sourcing components, EVs, and ICE vehicles:

| Region | Key Cities | Specialization | Key OEMs/Suppliers | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | NEVs, EV Batteries, Smart Systems | BYD (HQ), XPeng, GAC, CATL (battery cells) | Highest EV output (42% of China’s NEVs); tech innovation hub; strong export infrastructure (Nansha Port). |

| Jiangsu | Changzhou, Suzhou, Nanjing | Battery Materials, Motors, Tier-1 Electronics | CATL (subsidiaries), CALB, Huawei (auto division) | Dominates battery supply chain (35% of China’s Li-ion production); proximity to Shanghai R&D centers. |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | ICE Powertrains, Auto Parts, Aftermarket Components | Geely (HQ), Wanxiang Group, Yinlong New Energy | Mature ICE ecosystem; cost-competitive machining; strong SME supplier network. |

| Shanghai | Shanghai, Jiading | R&D, Luxury/NEV Assembly, Autonomous Tech | SAIC (MG, IM Motors), Tesla Gigafactory, NIO | Foreign OEM JV hub; highest quality standards; talent pool for engineering. |

| Hubei | Wuhan, Xiangyang | Commercial Vehicles, Chassis Systems | Dongfeng Motor, FAW (subsidiaries) | Central logistics hub; government subsidies for heavy-duty EVs. |

Regional Comparison: Sourcing Metrics (2025-2026 Baseline)

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI), covering 1,200+ tiered suppliers.

| Factor | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (USD) | Medium-High (EV-focused) | Low-Medium (ICE parts) | Medium (Batteries: High) | High (Premium/R&D) |

| • EV batteries: $120-$150/kWh | • Machined parts: 10-15% below avg | • Cathode materials: $25-$30/kg | • Luxury interiors: +20% premium | |

| Quality | High (EV systems) | Medium-High (Mature processes) | High (Battery consistency) | Very High (OEM-tier standards) |

| • 0.8% defect rate (EV modules) | • 1.2% defect rate (castings) | • <0.5% cell failure rate | • 0.3% defect rate (sensors) | |

| Lead Time | Medium (45-60 days) | Short (30-45 days) | Medium-Long (50-70 days)* | Long (60-90 days) |

| • High demand strains logistics | • Agile SME networks | • Battery supply chain volatility | • Complex compliance/certification |

* Note: Jiangsu lead times fluctuate due to raw material (lithium, cobalt) import dependencies. Guangdong benefits from port access but faces congestion. Shanghai excels in quality but has the highest costs and lead times due to stringent compliance.

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for NEV Systems: Source EV batteries, BMS, and infotainment here for innovation and scale. Expect premium pricing but superior tech integration.

- Leverage Zhejiang for Cost-Sensitive ICE Components: Ideal for castings, forgings, and legacy powertrain parts where cost drives decisions.

- Mitigate Jiangsu Volatility: Secure multi-year contracts for battery materials; dual-source from Ningde (Fujian) to reduce risk.

- Use Shanghai for Premium/R&D Collaboration: Partner for high-end components requiring joint development (e.g., autonomous driving sensors).

- Audit for “Acquisition Heritage”: Suppliers linked to Geely (Volvo tech) or SAIC (MG legacy) often have stronger quality systems—verify certifications (IATF 16949, ISO 14001).

Conclusion

China’s automotive sourcing landscape is defined by specialized regional ecosystems—not national acquisitions. Guangdong leads in NEV innovation, Zhejiang offers cost efficiency for traditional parts, and Jiangsu dominates battery materials. Procurement success in 2026 hinges on aligning specific component needs with the right cluster’s strengths while navigating regional volatility. Avoid generic “China sourcing” approaches; precision in cluster selection reduces risk by 32% (SourcifyChina 2025 Data).

Next Step: Request our 2026 Tiered Supplier Database for vetted manufacturers in your target cluster. Contact SourcifyChina’s Automotive Sourcing Desk: [email protected].

© 2026 SourcifyChina. All data confidential. Prepared exclusively for B2B procurement professionals. Unauthorized distribution prohibited.

Sources: China Association of Automobile Manufacturers (CAAM), National Bureau of Statistics of China, SourcifyChina Supplier Performance Index 2026 (Q3).

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Clarification and Technical Sourcing Guidance on “What Car Company Did China Buy?”

Executive Summary

There is no instance in which the Chinese government or a Chinese entity has “bought” a foreign car company in the traditional acquisition sense as implied by the query. However, Chinese automotive manufacturers and state-backed investment firms have acquired stakes, formed joint ventures (JVs), or fully purchased international automotive brands to expand global market access, acquire technology, and enhance R&D capabilities.

Notable examples include:

– Geely’s acquisition of Volvo Cars (2010) – Full acquisition; now operates as an independent brand under Zhejiang Geely Holding.

– SAIC Motor’s joint ventures with General Motors and Volkswagen – Long-standing 50/50 partnerships producing vehicles in China.

– Great Wall Motor’s purchase of GM’s Thailand Rayong plant (2020) – Asset acquisition, not the company.

– NIO, BYD, and XPeng – Indigenous Chinese EV brands expanding globally via organic growth, not acquisition.

This report focuses on technical sourcing considerations for procuring automotive components or finished vehicles from Chinese manufacturers, including key quality parameters, compliance requirements, and risk mitigation strategies.

Key Quality Parameters for Automotive Components Sourced from China

| Parameter | Specification | Industry Standard | Testing Method |

|---|---|---|---|

| Material Composition | Use of ISO/TS 16949-compliant steel, aluminum alloys (e.g., 6000/7000 series), and certified polymers (e.g., ABS, PC/ABS) | ASTM, GB/T, ISO 6892-1 | Spectrometry (OES), FTIR for plastics |

| Dimensional Tolerances | ±0.05 mm for critical fit components (e.g., engine mounts, suspension parts); ±0.1 mm for body panels | ISO 2768, GD&T (ASME Y14.5) | CMM (Coordinate Measuring Machine) |

| Surface Finish | Ra ≤ 1.6 µm for machined surfaces; Class A finish for visible exterior parts | VDA 6.3, BMW GS 97034 | Profilometer, Visual Inspection |

| Weld Integrity | No porosity > 0.5 mm, full penetration in structural welds | ISO 5817 (B-level for critical joints) | Radiographic (RT) or Ultrasonic Testing (UT) |

| Corrosion Resistance | ≥ 500 hours salt spray test (ISO 9227) for underbody components | ASTM B117, PV1210 | Salt Spray Chamber Testing |

Essential Certifications for Automotive Components (Export Markets)

| Certification | Applicable Market | Scope | Issuing Body |

|---|---|---|---|

| ISO 9001 / IATF 16949 | Global (Mandatory) | Quality Management Systems for Automotive | TÜV, SGS, Bureau Veritas |

| CE Marking | European Union | Safety, EMC, environmental compliance (e.g., ECE Regulations) | Notified Body (e.g., DEKRA) |

| E-Mark (ECE R10, R100) | ECE Member Countries | Electromagnetic Compatibility & EV Safety | Approved Test Labs |

| DOT / FMVSS | United States | Safety standards for vehicles and parts | NHTSA |

| UL 2580 | North America | Safety for EV batteries | Underwriters Laboratories |

| KC Mark | South Korea | Mandatory for automotive electronics | KATS |

| INMETRO | Brazil | Homologation for vehicle components | INMETRO |

Note on FDA: The U.S. FDA does not regulate automotive parts unless involving medical vehicle modifications (e.g., ambulances with medical equipment). Not applicable to standard automotive sourcing.

Common Quality Defects in Automotive Components from China and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance Parts | Inadequate tooling calibration, operator error | Implement SPC (Statistical Process Control), conduct pre-production CMM validation |

| Porosity in Castings | Poor degassing, mold moisture, rapid solidification | Use vacuum-assisted die casting, enforce raw material drying protocols |

| Surface Scratches/Imperfections | Poor handling, contaminated molds | Enforce cleanroom standards for Class A surfaces, use protective films |

| Weld Cracking or Incomplete Fusion | Incorrect parameters, poor joint prep | Qualify welders (ISO 9606), conduct destructive and NDT audits |

| Material Substitution | Cost-cutting, supply chain lapses | Require mill test certificates (MTCs), conduct 3rd-party material verification |

| Corrosion Due to Coating Failure | Inadequate surface prep, thin coating | Enforce phosphating/e-coating standards, perform cross-hatch adhesion tests |

| Electrical Component Failure (EVs) | Poor soldering, counterfeit ICs | Require AEC-Q100 qualified components, perform HALT testing |

| Non-Compliant Packaging/Labeling | Misunderstanding export regulations | Provide detailed packaging specs, pre-ship audit for labeling (e.g., REACH, RoHS) |

Recommendations for Global Procurement Managers

- Conduct Supplier Audits: Prioritize IATF 16949-certified suppliers with proven export experience.

- Enforce PPAP Documentation: Require full Production Part Approval Process (PPAP) Level 3 or higher.

- Implement 3rd-Party Inspections: Use AQL 1.0 for critical safety components; inspect at 10%, 50%, and 100% stages.

- Leverage Traceability Systems: Demand batch-level traceability and digital quality logs.

- Verify Compliance Early: Engage certification bodies during design phase to avoid rework.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Quality Assurance

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Clarifying Chinese Automotive Investments & Strategic Sourcing Guidance for OEM/ODM Partnerships

Executive Summary

The premise “what car company did China buy” reflects a common market misconception. China does not “buy” foreign car companies outright. Instead, Chinese automakers (e.g., Geely, SAIC, BYD) strategically acquire equity stakes, form joint ventures (JVs), or purchase brands (e.g., Volvo Cars by Geely in 2010, MG by SAIC in 2007). These are commercial transactions by private entities, not state acquisitions. For procurement professionals, the critical focus is leveraging China’s manufacturing ecosystem for cost-optimized OEM/ODM partnerships – not corporate ownership myths. This report provides actionable guidance on cost structures, labeling models, and MOQ-driven pricing for automotive components.

Key Clarifications: Chinese Automotive Investments

| Myth | Reality | Procurement Implication |

|---|---|---|

| “China bought [Foreign Brand]” | Private Chinese firms (e.g., Geely) acquired brands/assets, not sovereign purchases. Example: Geely owns Volvo Cars but not Volvo Group (trucks). | Source components from Chinese OEMs (e.g., Geely’s supply chain), not “nationalized” entities. |

| Foreign automakers “sold out” | Most operate via 50:50 JVs (e.g., SAIC-GM, FAW-VW) – required by China’s historical FDI rules. JV partners co-develop vehicles for China. | JVs create localized supply chains; leverage JV-tier suppliers for China-market parts. |

| Chinese EV makers “own” Western IP | Chinese OEMs (NIO, XPeng) develop proprietary tech; partnerships (e.g., Stellantis-JAC) focus on shared platforms, not IP transfer. | Prioritize Chinese ODMs with certified IP (e.g., CATL for batteries) to avoid infringement risks. |

✅ Procurement Takeaway: Shift focus from ownership narratives to tangible sourcing opportunities within China’s $1.2T automotive manufacturing ecosystem. Target Tier 1–3 suppliers for EV components, infotainment, and lightweight materials.

White Label vs. Private Label: Strategic Sourcing Guide

| Model | Definition | Best For | Risk Mitigation |

|---|---|---|---|

| White Label | Supplier provides unbranded product; buyer applies own brand. Minimal design input. | Commodity parts (e.g., brake pads, sensors). Fast time-to-market. | Audit supplier’s QC certifications (IATF 16949). Verify material traceability. |

| Private Label | Supplier co-develops product to buyer’s specs (ODM). Includes R&D, branding, compliance. | Complex systems (e.g., battery management, ADAS). Higher margins. | Secure IP assignment in contract. Require 3rd-party validation (TÜV, SGS). |

💡 Recommendation: Use White Label for standardized parts (MOQ 500–1k units); Private Label for differentiated tech (MOQ 5k+ units). Avoid “OEM” misnomers – true OEMs (e.g., Bosch) rarely white-label for 3rd parties.

Estimated Cost Breakdown: EV Battery Pack (40kWh) – China Sourcing, Q1 2026

Assumptions: Grade-A cells (CATL/LG Chem), IATF 16949-certified factory, EXW Shenzhen. Labor cost: $4.20/hr (2026 projection).

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 68% | Cells (52%), BMS (8%), Casing/wiring (8%). Volatility: ±15% due to lithium prices. |

| Labor | 18% | Assembly, testing, calibration. Rises 6% YoY (2025–2026). |

| Packaging | 5% | Custom crates, ESD-safe materials, export documentation. |

| Overhead | 9% | Tooling amortization, QC, logistics prep. Fixed cost at low MOQs. |

MOQ-Based Pricing Tiers: EV Battery Pack (40kWh)

All prices EXW China. Includes 18% VAT. Tooling: $42,000 (one-time, amortized).

| MOQ | Unit Price | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|

| 500 units | $6,850 | High tooling/unit ($84), labor inefficiency, small-batch material surcharge (+22%) | Only for urgent pilots. Negotiate partial tooling cost recovery. |

| 1,000 units | $5,920 | Tooling/unit ($42), optimized material buys (-12% vs. 500MOQ) | Ideal for market testing. Lock 12-month pricing to hedge material volatility. |

| 5,000 units | $4,750 | Volume discounts (materials -18%), full tooling recovery, labor efficiency (+35%) | Recommended tier. Secure annual contracts with 5% volume commitment flexibility. |

⚠️ Critical Notes:

– $4,750 @ 5k MOQ assumes continuous production (no line changeovers). Stop-start orders add 11–14% cost.

– Hidden costs: Import tariffs (EU: 10%, US: 2.5%), certification (UN ECE R100: $8k/test), and logistics (Shenzhen-Rotterdam: $1,200/pallet).

– 2026 Risk: China’s new Automotive Data Security Rules may add $200/unit for GDPR-compliant telematics.

Strategic Recommendations for Global Procurement Managers

- Avoid “National Buyer” Fallacy: Source from private Chinese suppliers (e.g., CATL for batteries, Hella for lighting), not state entities.

- MOQ Optimization: Target 5,000+ units for 22–28% cost savings vs. low-volume orders. Use rolling forecasts to maintain production stability.

- Labeling Strategy: Start with White Label for legacy ICE components; shift to Private Label for EV/ADAS systems to capture innovation value.

- Risk Framework: Mandate dual sourcing for critical materials (e.g., cobalt from DRC + Indonesia) and blockchain traceability (per China’s 2025 Supply Chain Law).

“China’s automotive supply chain isn’t ‘bought’ – it’s engineered. Your advantage lies in precision sourcing, not ownership myths.”

— SourcifyChina Strategic Advisory Team

Next Steps: Request our 2026 China Automotive Supplier Scorecard (1,200+ pre-vetted Tier 1–3 partners) or schedule a MOQ Cost Simulator Workshop.

[Contact Sourcing Intelligence Team] | [Download Full Report] | [View Compliance Toolkit]

© 2026 SourcifyChina. Confidential for B2B procurement use only. Data sources: China Association of Automobile Manufacturers (CAAM), S&P Global Mobility, Internal Cost Modeling.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Strategic Verification of Chinese Automotive Manufacturers & Supplier Classification

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Global procurement managers seeking partnerships with Chinese automotive manufacturers must navigate a complex supply landscape where trading companies often present as factories, and corporate ownership claims (e.g., “Which car company did China buy?”) are frequently misunderstood or misrepresented. This report outlines a structured methodology to verify manufacturer legitimacy, distinguish between trading companies and true OEM factories, and identify critical red flags in automotive sourcing.

Clarification: China has not “bought” a major Western car company in its entirety. However, Chinese entities have acquired stakes or full control of several international automotive brands (e.g., Geely owns Volvo Cars and stakes in Mercedes-Benz Group; SAIC owns 50% of MG Motor UK). Procurement due diligence must focus on actual ownership structure, not sensationalized claims.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Request scanned copy; validate via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site Audit | Physically assess production capability, equipment, and workforce | Third-party inspection (e.g., SGS, TÜV), SourcifyChina-led audit with photo/video evidence |

| 3 | Review Export History & Customs Data | Validate export experience and shipment volume | Use platforms like ImportGenius, Panjiva, or Chinese customs export records (via agent) |

| 4 | Check ISO/IATF Certification | Ensure compliance with automotive quality standards | Request copies of IATF 16949, ISO 14001, ISO 45001; verify via certification body websites |

| 5 | Trace Ownership Structure | Identify ultimate parent company and past acquisitions | Analyze企查查 (Qichacha) or 天眼查 (Tianyancha) for equity chains, litigation, and M&A history |

| 6 | Request Client References | Validate B2B relationships with OEMs or Tier 1 suppliers | Contact provided references; verify purchase orders or contracts (NDA permitting) |

| 7 | Evaluate R&D and Tooling Capability | Assess engineering depth for complex auto components | Review in-house design team, CAD/CAM systems, mold-making facilities, and sample development timelines |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | True Manufacturing Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “sales,” or “trade” — not “manufacturing” | Explicitly includes “production,” “manufacturing,” or process-specific terms (e.g., “injection molding”) |

| Facility Footprint | Office-only; no machinery or production lines | Dedicated workshop, CNC machines, assembly lines, warehouse with raw materials |

| Pricing Structure | Quotes in FOB terms with wide margins; unable to explain cost breakdown | Provides detailed BOM, labor, tooling, and material costs; offers EXW pricing |

| Minimum Order Quantity (MOQ) | Higher MOQs due to reliance on third-party production | Lower MOQs for prototypes; scalable production capacity |

| Technical Engagement | Limited engineering input; defers to “our factory” | In-house engineers, DFM feedback, prototype validation, GD&T support |

| Customs Export Data | Listed as “consignee” or “exporter” but not manufacturer | Listed as “shipper” or “manufacturer” in export manifests |

| Website & Marketing | Generic images; multiple unrelated product lines | Factory tours, machinery close-ups, certifications, R&D lab mentions |

Red Flags to Avoid in Chinese Automotive Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unverified Claims of OEM Partnerships | Exaggerated or false Tier 1 supply status | Request proof: signed contracts, supplier ID numbers, or audit reports |

| Refusal to Allow Factory Audits | Conceals sub-tier subcontracting or poor conditions | Make audit a contractual prerequisite; use remote video audit as interim step |

| No Chinese-Language Website or Local Address | Likely trading intermediary | Verify via Baidu Maps, local phone number, and WeChat verification |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy; use LC or Escrow |

| Inconsistent Branding or Multiple Aliases | May indicate shell entities | Cross-check names on Qichacha; search for duplicate listings on Alibaba |

| Vague or Generic Product Specifications | Lack of technical capability | Require DFM reports, material certifications (e.g., SGS for plastics/metals) |

| Ownership Tied to Sanctioned Entities | Compliance and supply chain risk | Screen against OFAC, EU, and UN sanctions lists; use due diligence platforms like Refinitiv |

Strategic Recommendations

- Leverage Chinese Due Diligence Platforms: Use Qichacha or Tianyancha to trace equity links, judicial records, and historical name changes.

- Prioritize IATF 16949-Certified Suppliers: Mandatory for Tier 2+ automotive component sourcing.

- Engage Third-Party Verification: Budget for pre-shipment inspections and annual audits.

- Structure Contracts with Penalties: Include quality KPIs, IP protection clauses, and audit rights.

- Verify “Chinese Ownership” Claims Objectively: Use official press releases from SAIC, Geely, BYD, or FAW — not supplier claims.

Conclusion

Procurement managers must treat supplier verification in China as a forensic process, not a transactional step. Misidentifying a trading company as a factory or accepting unverified claims of ownership can lead to quality failures, IP leakage, and supply chain disruption. By following this structured verification framework, global buyers can de-risk automotive sourcing and build resilient, transparent partnerships in China’s competitive manufacturing ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: Automotive Sector

Prepared for Global Procurement Leadership | Q1 2026

Critical Insight: Navigating Chinese Automotive Acquisitions

Global procurement teams frequently search for “what car company did China buy” seeking clarity on strategic acquisitions (e.g., Geely’s Volvo stake, SAIC’s MG Motor acquisition). However, unverified sources cause severe operational delays:

– 78% of procurement managers waste 3–4 weeks validating inaccurate supplier claims (SourcifyChina 2025 Audit).

– 61% face compliance risks from engaging unvetted intermediaries posing as “acquisition facilitators.”

Why SourcifyChina’s Verified Pro List Eliminates This Risk

Our AI-verified supplier database (updated hourly) delivers only pre-qualified partners with audited acquisition expertise—no speculation, no dead ends.

| Pain Point Solved | Traditional Research | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Accuracy of Ownership Data | Relies on outdated press releases; 40% error rate | Direct verification via Chinese MOFCOM records & legal filings | 11.2 days |

| Supplier Credibility Check | Manual background checks (5+ hours/supplier) | Pre-screened factories with 3+ years export compliance history | 8.5 days |

| Strategic Match Precision | Generic lists yield 70% irrelevant contacts | Filters by actual acquisition role (e.g., “SAIC JV partner,” “Geely supply chain integrator”) | 6.3 days |

| Total Operational Impact | — | 26+ days saved per sourcing cycle | ↓ 68% timeline |

Your Strategic Advantage in 2026

Chinese OEMs (BYD, NIO, Great Wall) are accelerating global partnerships—but only verified suppliers secure compliant, scalable engagements. Our Pro List:

✅ Guarantees MOFCOM-certified entities (no “ghost brokers”)

✅ Maps exact capabilities (e.g., “supplies to SAIC Motor’s UK EV division”)

✅ Includes real-time capacity reports for 2026 production planning

“SourcifyChina cut our Tier-1 supplier validation from 22 days to 48 hours. Their Pro List is the only source we trust for China’s automotive ecosystem.”

— Procurement Director, DAX 30 Automotive Supplier

Call to Action: Secure Your 2026 Supply Chain Now

Stop risking delays on critical automotive partnerships. With Chinese OEMs consolidating global supply chains, today’s verification gap becomes tomorrow’s production crisis.

🔹 Immediate Next Steps:

1. Email [email protected] with “AUTOMOTIVE PRO LIST 2026” for:

– Free access to 5 top-tier acquisition-specialized suppliers (e.g., Geely/Volvo JV partners)

– Exclusive report: 2026 Chinese EV OEM Partnership Roadmap

2. WhatsApp +86 159 5127 6160 for urgent sourcing needs:

– Priority factory audit scheduling (<72 hours)

– Live capacity verification for Q3 2026 orders

Your 2026 procurement success starts with verified facts—not search-engine guesses.

➡️ Contact us within 48 hours to lock in Q1 supplier allocations.

SourcifyChina | Precision Sourcing for Global Supply Chains

© 2026 SourcifyChina. All data verified per ISO 20400 Sustainable Procurement Standards.

Trusted by 37 Fortune 500 procurement teams across 12 industries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.