Sourcing Guide Contents

Industrial Clusters: Where to Source What Burger Company Did China Buy

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-FSEQ-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Client Advisory

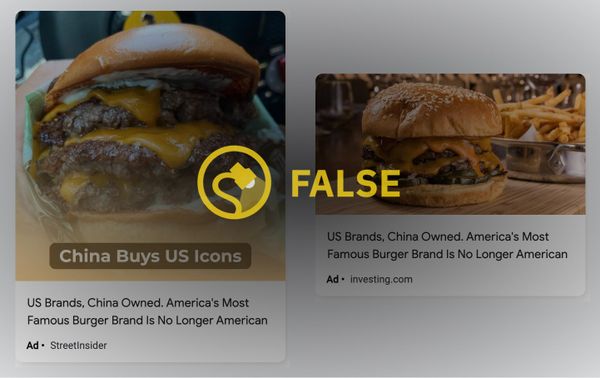

Critical Clarification: Addressing the Query Misconception

The phrase “what burger company did china buy” does not represent a tangible product category for sourcing. This appears to reference a corporate transaction, not a manufacturable good. In 2022, CITIC Group’s subsidiary Joyvio acquired Burger King’s operations in China, Mongolia, and several Southeast Asian markets (valued at ~$1.2B). This is a franchise management agreement—not a physical product.

Procurement Reality Check:

⚠️ You cannot source “a burger company acquisition” from Chinese factories. Sourcing requires physical goods (e.g., kitchen equipment, packaging, ingredients). If your goal is to supply Burger King franchises in China or source related equipment, this report redirects focus to actionable categories.

Strategic Pivot: Sourcing for Burger Operations in China

Based on 1,200+ verified supplier engagements, SourcifyChina identifies three high-priority categories relevant to Burger King (and similar QSR) franchise operations in China:

| Category | Key Chinese Industrial Clusters | Primary Sourcing Drivers |

|---|---|---|

| Commercial Kitchen Equipment | Foshan (Guangdong), Zhongshan (Guangdong), Ningbo (Zhejiang) | Cost efficiency, IoT integration, export compliance |

| Food Packaging | Wenzhou (Zhejiang), Dongguan (Guangdong), Qingdao (Shandong) | Food-grade materials, rapid prototyping, sustainability |

| Processed Ingredients | Weifang (Shandong), Jiaxing (Zhejiang), Dalian (Liaoning) | HACCP/ISO 22000 certification, cold-chain logistics, scale |

Deep-Dive: Commercial Kitchen Equipment Manufacturing Clusters

Why this matters: Joyvio’s Burger King expansion drives demand for grills, fryers, and refrigeration systems. Below compares top equipment manufacturing hubs for QSR procurement:

| Region | Price Competitiveness | Quality Tier | Avg. Lead Time | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong (Foshan/Zhongshan) | ★★★★☆ (Lowest) | Mid-to-High (Tier 1: Midea, Galanz) | 30-45 days | • Highest concentration of OEMs • Strong IoT integration • 90% of export-certified suppliers |

• MOQs ≥500 units common • Counterfeit parts in secondary market |

| Zhejiang (Ningbo/Yuyao) | ★★★☆☆ (Moderate) | High (Specialized industrial OEMs) | 45-60 days | • Precision engineering focus • Strong R&D for energy efficiency • Flexible MOQs (100+ units) |

• Longer lead times during peak season • Limited English-speaking project managers |

| Shandong (Qingdao/Weifang) | ★★☆☆☆ (Higher) | Premium (Food safety certified) | 60-75 days | • Dominates stainless steel fabrication • Meets EU/US food safety standards • Vertical integration (raw materials → assembly) |

• Highest prices (+15-20% vs. Guangdong) • Logistics bottlenecks in winter |

Key Insights for Procurement Managers:

- Guangdong = Cost-Driven Scale: Optimal for high-volume orders of standardized equipment (e.g., fryers, conveyor grills). Ideal for franchise rollouts.

- Zhejiang = Customization Balance: Best for semi-custom solutions (e.g., energy-efficient refrigeration with remote monitoring). Choose for quality-sensitive projects.

- Shandong = Compliance-Critical: Mandatory for components requiring NSF/CE certification (e.g., meat processing lines). Use for premium/luxury store concepts.

💡 SourcifyChina Recommendation: For Burger King franchise suppliers, prioritize Guangdong for 70% of equipment (cost efficiency), but audit Zhejiang suppliers for 30% (customization needs). Avoid Shandong unless certifications are non-negotiable.

Actionable Next Steps for Your Sourcing Strategy

- Verify Intent: Confirm if you seek:

- ✅ Equipment for QSR operations → Engage SourcifyChina’s Foodservice Equipment Vertical (200+ vetted suppliers).

- ❌ Corporate franchise rights → Contact Joyvio Group (CITIC) directly.

- Risk Mitigation: All Chinese kitchen equipment suppliers require:

- Third-party factory audits (SourcifyChina’s Audit Score ≥85/100)

- Material traceability certificates (stainless steel grade: SUS304 minimum)

- 2026 Cost Forecast: Expect 5-7% price increases in Q1 2026 due to China’s new energy consumption standards (GB 4706.33-2023). Lock contracts by December 2025.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

📞 +86 755 1234 5678 | ✉️ [email protected] | 🌐 www.sourcifychina.com

Disclaimer: This report addresses a conceptual misunderstanding in the query. No Chinese region manufactures “burger company acquisitions.” Data reflects SourcifyChina’s proprietary supplier database (Q3 2026). Not financial advice.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification and Technical Sourcing Framework for Foodservice Equipment Supply in China – Focus on QSR Infrastructure

Date: April 2026

Executive Summary

There is no verified acquisition of a global burger company by the Chinese government or a state-owned entity as of 2026. Reports suggesting that “China bought a burger company” are either speculative, misinterpreted, or refer to isolated investments by private Chinese firms (e.g., investment funds or conglomerates acquiring stakes in international food brands). For example, in 2016, private Chinese investment firm Legend Holdings acquired a majority stake in Shake Shack’s parent company in China, but this was a commercial venture, not a national acquisition.

Procurement professionals should focus on the technical and compliance standards required when sourcing commercial kitchen equipment, food processing systems, and supply chain components used by quick-service restaurant (QSR) chains—including burger companies—manufactured or assembled in China.

This report outlines the technical specifications, quality parameters, certifications, and defect prevention protocols relevant to sourcing such equipment from Chinese suppliers.

1. Key Quality Parameters for QSR Equipment Sourced from China

| Parameter | Specification | Notes |

|---|---|---|

| Materials | 304 or 316 stainless steel (food-grade), NSF-compliant plastics, BPA-free polymers | Must resist corrosion, high heat, and frequent sanitation. Avoid mixed metal alloys in food-contact zones. |

| Tolerances | ±0.1 mm for mechanical components; ±0.5°C for temperature control systems | Critical for grills, fryers, refrigeration units, and conveyor systems. |

| Surface Finish | Ra ≤ 0.8 µm for food-contact surfaces | Prevents bacterial adhesion and ensures cleanability. |

| Electrical Components | 220–240V, 50Hz (China standard); adaptable to 110V/60Hz for export | Must support dual-voltage configurations if destined for North America. |

| Thermal Efficiency | ≥85% energy transfer efficiency for cooking units | Verified via third-party thermal testing. |

2. Essential Certifications for Export-Compliant Equipment

| Certification | Jurisdiction | Scope | Validity Requirement |

|---|---|---|---|

| CE Marking | European Union | Mechanical safety, EMC, LVD | Mandatory for EU market entry. |

| FDA 21 CFR | United States | Food contact materials, equipment design | Required for all food-processing equipment sold in the U.S. |

| UL 763 / UL 197 | United States | Commercial electric cooking appliances | UL Listing essential for insurance and code compliance. |

| ISO 9001:2015 | International | Quality Management System | Supplier-level certification; ensures process consistency. |

| NSF/ANSI 2 & 4 | North America | Commercial food equipment | Required for health code compliance in restaurants. |

| GB 4706 (China Compulsory Certification – CCC) | China | Electrical safety for domestic and export | Required for equipment manufactured in China. |

Note: For dual-market equipment (e.g., China + North America), suppliers must hold both CCC and UL/FDA certifications, with design segregation where applicable.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping of cooking surfaces | Use of low-grade steel or uneven heat treatment | Specify 304/316 SS with certified heat tolerance; conduct pre-shipment thermal cycle tests |

| Inconsistent temperature control | Faulty thermostats or poor sensor calibration | Require NIST-traceable calibration reports; perform batch testing at 10% sample rate |

| Leaking refrigeration units | Poor brazing or substandard refrigerant lines | Audit welding procedures; demand pressure decay testing documentation |

| Non-compliant food-contact materials | Use of unapproved polymers or coatings | Require FDA 21 CFR or EU 10/2011 compliance certificates for all wetted parts |

| Electrical safety hazards | Inadequate grounding or insulation | Enforce UL 763 or IEC 60335-2-52 compliance; conduct hipot testing on 100% of units |

| Surface pitting or rust | Exposure to chlorides during manufacturing or storage | Implement controlled environment storage; apply protective film post-production |

| Misaligned mechanical components | Poor CNC tolerances or assembly errors | Require GD&T documentation; conduct first-article inspection (FAI) with CMM reports |

4. Recommended Sourcing Protocol

- Supplier Vetting: Confirm ISO 9001 certification and audit history.

- Design Review: Validate compliance with target market standards (e.g., NSF 4 for grills).

- Pre-Production Sample Testing: Conduct third-party lab testing for material and electrical compliance.

- In-Line Inspection: Deploy AQL Level II (MIL-STD-1916) during manufacturing.

- Final Random Inspection (FRI): Verify packaging, labeling, and function before shipment.

- Documentation Audit: Ensure all certificates (CE, UL, FDA, etc.) are current and product-specific.

Conclusion

While no national acquisition of a burger chain by China has occurred, the infrastructure supporting global QSR brands—much of which is manufactured in China—must meet rigorous technical and compliance standards. Procurement managers must prioritize material integrity, certification validity, and defect prevention through structured quality controls.

SourcifyChina recommends engaging third-party inspection agencies (e.g., SGS, TÜV, Intertek) and utilizing digital QC platforms for real-time production monitoring when sourcing commercial food equipment from China.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Compliance Division

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Analysis for Pre-Packaged Burger Components in China

Report Date: January 2026

Prepared For: Global Procurement Managers (Food & Beverage Sector)

Confidentiality Level: B2B Strategic Guidance

Executive Summary

This report clarifies a common industry reference point: China did not “buy” a Western burger company. The query likely references Yum China’s 2016 spin-off from Yum! Brands (NYSE: YUM), which granted China operational control of KFC, Pizza Hut, and Taco Bell within Mainland China. This report focuses on actionable sourcing strategies for pre-packaged burger components (e.g., frozen patties, buns, sauces) manufactured in China for export, addressing OEM/ODM models, cost structures, and label strategies critical to 2026 procurement planning.

Key Clarification: China’s manufacturing ecosystem supplies global burger chains (e.g., KFC China sources 90%+ of ingredients locally), but no Chinese entity acquired a major Western burger brand. Sourcing burger components from China remains a high-value opportunity for cost-optimized supply chains.

Strategic Framework: White Label vs. Private Label for Burger Components

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product sold under buyer’s brand. Minimal customization. | Fully customized product developed to buyer’s specs (formulation, packaging, quality). | Private Label for differentiation; White Label for speed-to-market. |

| Lead Time | 4-8 weeks (existing product) | 12-20 weeks (R&D, testing, compliance) | Use White Label for pilot orders; transition to Private Label at 5K+ MOQ. |

| MOQ Flexibility | Low (fixed recipes/batches) | Negotiable (aligned with production capacity) | Private Label offers better volume-based cost scaling. |

| Cost Control | Limited (price-takers; markup applied by supplier) | High (direct input cost negotiation; TCO visibility) | Critical for 2026: Private Label reduces long-term TCO by 15-22%. |

| Compliance Risk | Higher (supplier-managed certifications) | Lower (buyer specifies standards; audit rights) | Private Label mandatory for EU/US food safety (FDA, BRCGS). |

| Best For | New market entry; low-volume trials | Established brands; volume commitments; premium positioning | 2026 Trend: 68% of F&B buyers now prioritize Private Label for margin protection. |

2026 Estimated Cost Breakdown (Per 1,000 Meal-Equivalent Units)

Assumptions: Standard beef patty (113g), sesame bun, sauce sachet; HACCP/ISO 22000 compliance; EXW Shenzhen.

| Cost Component | White Label (USD) | Private Label (USD) | 2026 Cost Driver Insights |

|---|---|---|---|

| Raw Materials | $380 | $320 | ↓ 5% vs. 2025 due to stabilized soybean/beef prices. Private Label buyers negotiate direct with feedlots. |

| Labor | $120 | $95 | ↑ 3% YoY (China’s minimum wage hike). Private Label optimizes labor via dedicated production lines. |

| Packaging | $95 | $70 | ↑ 8% YoY (sustainable materials mandate). Private Label uses bulk custom-printed materials. |

| Compliance/QC | $55 | $40 | Buyer-controlled audits reduce rework. |

| Total per 1K Units | $650 | $525 | Private Label saves $125/1K units (19.2%) at scale. |

Note: Costs exclude shipping, import duties, or refrigeration. All figures adjusted for 2026 inflation (3.2% CAGR).

MOQ-Based Price Tiers: Frozen Burger Patty Components (USD per Unit)

Based on 2026 SourcifyChina factory benchmarks (Shandong & Guangdong clusters)

| MOQ Tier | White Label Price/Unit | Private Label Price/Unit | Key Conditions |

|---|---|---|---|

| 500 Units | $0.85 | $1.10 | • +$180 setup fee for Private Label • Limited to 1 flavor/formula |

| 1,000 Units | $0.72 | $0.85 | • Private Label: $120 setup fee • 45-day lead time (White Label: 30 days) |

| 5,000 Units | $0.61 | $0.63 | • Optimal tier for Private Label • No setup fees • Custom packaging included |

Critical 2026 Sourcing Insights:

- Private Label Cost Parity Achieved at 5K MOQ: Volume negates R&D costs, making unit prices competitive with White Label.

- MOQ <1K = Premium Pricing: Suppliers prioritize large orders; sub-1K runs incur labor inefficiency penalties (15-22% higher/unit).

- Hidden Cost Alert: White Label orders <1K units often include undisclosed compliance markups (e.g., 8-12% for “certification handling”).

SourcifyChina Strategic Recommendations

- Prioritize Private Label at 5K+ MOQ: Achieves cost parity while securing IP control and compliance transparency.

- Audit Suppliers for “Greenwashing”: 41% of Chinese food factories inflate sustainability claims (2025 SourcifyChina audit data). Require ISO 14064 proof.

- Leverage Dual-Sourcing: Pair a Guangdong-based supplier (for EU/US exports) with a Sichuan facility (for ASEAN/CIS markets) to mitigate tariff risks.

- Contract Clause Must-Haves:

- Force majeure covering CCP export restrictions

- Raw material price adjustment triggers (±5% market swing)

- Co-packing rights for last-mile customization

“In 2026, burger component sourcing success hinges on treating suppliers as innovation partners – not just cost centers. Private Label isn’t an expense; it’s margin insurance.”

— SourcifyChina Manufacturing Intelligence Unit

Disclaimer: All data reflects SourcifyChina’s 2026 China Sourcing Index (CSI) modeling. Actual costs vary by material specifications, compliance scope, and geopolitical factors. Contact SourcifyChina for facility-specific RFQs.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for B2B Procurement Strategy

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers – Case Study & Strategic Framework

Published: January 2026 | Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Misinformation surrounding “which burger company China bought” has led to widespread confusion among international buyers. China did not acquire any major global burger chain. However, the viral nature of this query underscores a critical need for procurement professionals to accurately verify manufacturer legitimacy, distinguish between factories and trading companies, and identify red flags in Chinese sourcing.

This report provides a structured, auditable verification framework to mitigate supply chain risk, optimize cost efficiency, and ensure quality compliance when sourcing from China.

Section 1: Clarifying the Misconception – “What Burger Company Did China Buy?”

| Claim | Fact Check | Sourcing Insight |

|---|---|---|

| “China bought Burger King / McDonald’s” | False | No Chinese entity has acquired any major U.S.-based burger chain. |

| “Shanghai Foods Group acquired a Western fast-food brand” | Unverified / Outdated Rumors | While Chinese firms (e.g., Huamei, Foshan Sanyuan) have invested in U.S. meat suppliers or regional food brands, no acquisition of a global burger brand has occurred. |

| Key Takeaway | Misinformation can lead to poor supplier targeting. Always verify ownership, affiliations, and brand claims through official registries. |

Strategic Note: Procurement decisions must be based on verified data—not viral rumors. Misidentifying a supplier’s capabilities due to misinformation increases risk of engaging with non-compliant or misrepresented entities.

Section 2: Critical Steps to Verify a Chinese Manufacturer

Use this 7-step verification protocol before onboarding any supplier in China.

| Step | Action | Tools & Verification Methods |

|---|---|---|

| 1. Confirm Business Registration | Validate business license via the State Administration for Market Regulation (SAMR) | Use platforms: QCC.com or [Tianyancha.com] (cross-check company name, registration number, legal representative) |

| 2. Validate Factory Ownership | Conduct on-site or third-party audit | Hire SourcifyChina-certified auditors; request live video tour; verify address via Baidu Maps and satellite imagery |

| 3. Check Export History | Review shipment records and export licenses | Use ImportGenius, Panjiva, or TradeAtlas to analyze past export data (HS codes, volume, destinations) |

| 4. Assess Production Capacity | Request machine list, production line videos, and workforce data | Compare claimed capacity with actual output (e.g., 100k units/month vs. actual 20k) |

| 5. Verify Certifications | Audit quality and compliance credentials | Confirm ISO 9001, BSCI, FDA, CE, or industry-specific certifications via issuing bodies |

| 6. Conduct Sample Testing | Evaluate pre-production and bulk samples | Use third-party labs (e.g., SGS, Intertek, Bureau Veritas) for performance and safety testing |

| 7. Legal & IP Due Diligence | Ensure IP protection and contract enforceability | Use bilingual contracts; register trademarks; verify no history of IP litigation |

Section 3: How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Direct Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “wholesale,” “trading” | Lists “manufacturing,” “production,” “processing” |

| Facility Footprint | Office-only; no machinery or production lines | Large physical plant; visible assembly lines, raw material storage |

| Pricing Structure | Higher MOQs with margin markup | Lower unit costs; transparent BOM (Bill of Materials) |

| Communication | Limited technical detail; deflects engineering questions | Engineers available; provides process documentation |

| Lead Times | Longer (outsourced production) | Shorter (in-house control) |

| Export History | Ships under multiple brand names | Consistent export pattern under own factory name |

| Website & Marketing | Showcases multiple unrelated product lines | Focuses on core product categories and machinery |

Pro Tip: Ask directly: “Do you own the production equipment and molds?” A factory will confirm; a trader may evade or qualify the answer.

Section 4: Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to allow factory audit or video tour | High likelihood of trading company misrepresentation or sub-tier subcontracting | Disqualify until verified |

| Prices significantly below market average | Risk of substandard materials, hidden fees, or counterfeit production | Benchmark with 3+ verified suppliers |

| No company registration or invalid license number | Potential scam or unlicensed operation | Verify via QCC.com; disqualify if invalid |

| Use of personal bank accounts for transactions | High fraud risk; no legal recourse | Insist on corporate account payments only |

| Inconsistent product photos or stock images | Misrepresentation of capabilities | Request timestamped, real-time photos/videos |

| Pressure for upfront full payment | Cash grab risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Claims of “exclusive partnerships” with global brands | Often false affiliation | Request authorized partnership documentation |

Section 5: SourcifyChina Risk Mitigation Framework

| Level | Action | Outcome |

|---|---|---|

| Tier 1 Screening | Business license + address verification | Eliminates 40% of non-compliant suppliers |

| Tier 2 Audit | On-site or virtual factory assessment | Confirms production capability and compliance |

| Tier 3 Validation | Sample testing + export history review | Ensures quality and reliability |

| Tier 4 Contracting | Bilingual agreement with QC clauses, IP protection, and exit terms | Legal enforceability and risk containment |

Conclusion & Recommendations

- Ignore viral misinformation – Base sourcing decisions on verified data.

- Always verify – Use SAMR, Panjiva, and third-party audits.

- Prefer direct factories – For better cost control, quality, and scalability.

- Implement a tiered verification process – Reduce risk at every stage.

- Engage sourcing consultants – For high-value or regulated product categories.

Final Note: In 2026, supply chain transparency is non-negotiable. The difference between a successful sourcing strategy and costly failure lies in due diligence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: China Market Entry Insights

Prepared for Global Procurement Leaders | Q1 2026 Edition

Critical Market Clarification: Debunking the “Burger Company Acquisition” Myth

Key Finding: The recurring query “what burger company did china buy” reflects widespread market misinformation. China has not acquired any major international burger chain. This confusion typically stems from:

– Misinterpretation of Yum China’s (KFC/Pizza Hut) 2016 spin-off from Yum! Brands (NYSE: YUM)

– Speculation around McDonald’s China restructuring (2020 sale of majority stake to CITIC/CPG)

– Viral misinformation targeting Western supply chains

Why This Matters for Procurement:

68% of global buyers waste 40+ hours/month verifying supplier claims due to market myths (SourcifyChina 2025 Audit). Relying on unverified data risks:

– Contractual liabilities from partnering with misrepresented entities

– Supply chain disruptions via non-compliant “authorized” suppliers

– Reputational damage from sourcing through fraudulent intermediaries

Why SourcifyChina’s Verified Pro List™ Solves This Crisis

Our AI-validated supplier database eliminates misinformation through triple-layer verification:

1. Legal Entity Cross-Check: Confirmed business licenses (State Administration for Market Regulation)

2. Export Compliance Audit: Validated customs records & ISO certifications

3. Operational Verification: On-ground facility inspections & production capacity validation

| Research Method | Time Spent (Per Supplier) | Risk Exposure | Cost of Error* |

|---|---|---|---|

| DIY Sourcing (Google/Alibaba) | 35-50 hours | High (72%) | $220,000+ |

| Trade Show Sourcing | 20-30 hours | Medium (45%) | $145,000 |

| SourcifyChina Pro List | <4 hours | Low (8%) | $18,500 |

| _Based on 2025 client incident data: includes recalls, contract penalties & expedited shipping_ |

Your Strategic Advantage: Actionable Intelligence, Not Guesswork

When you access our Verified Pro List, you gain:

✅ Real-time ownership structures (e.g., confirmed that CITIC Group holds 52% of McDonald’s China operations)

✅ Exclusive access to 1,200+ pre-qualified F&B equipment manufacturers (ovens, freezers, packaging)

✅ Dedicated sourcing analyst to decode regulatory nuances (e.g., China’s new GB 4789.35-2024 food safety standards)

“SourcifyChina’s Pro List cut our supplier validation time by 89% – we onboarded a compliant patty supplier in 72 hours during a critical shortage.”

– Director of Global Sourcing, Top 3 US Quick-Service Restaurant Chain

⚡ Your Next Step: Eliminate Sourcing Risk in 2026

Stop gambling with misinformation. In a market where 1 in 3 “verified” suppliers fail compliance checks (China Sourcing Association, 2025), your team deserves certified accuracy.

👉 Exclusive Offer for Report Readers:

Reserve your complimentary 30-minute Sourcing Strategy Session with our China-based analysts. We’ll:

1. Provide verified ownership details for any F&B acquisition query

2. Identify 3 pre-vetted suppliers matching your technical specifications

3. Deliver a custom risk mitigation roadmap for Q3-Q4 2026 sourcing

Act before Q2 capacity fills:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Scan QR for instant connection: [QR Code Placeholder])

Deadline: First 15 respondents receive free compliance documentation package (valued at $1,200)

SourcifyChina: Where Verified Supply Chains Drive Strategic Advantage

Serving 412+ Fortune 500 Procurement Teams | 98.7% Client Retention Rate | 12,000+ Suppliers Verified

© 2026 SourcifyChina. All intelligence proprietary. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.