Sourcing Guide Contents

Industrial Clusters: Where to Source What American Food Companies Are Owned By China

SourcifyChina Strategic Sourcing Report: Clarifying Chinese Ownership of U.S. Food Brands & Relevant Manufacturing Capabilities

Report ID: SC-FOOD-OWN-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (CPG, Retail, Foodservice)

Confidentiality: SourcifyChina Client-Exclusive Analysis

Executive Summary

This report addresses a critical market misconception: “Sourcing ‘what American food companies are owned by China'” is not a viable procurement category. Chinese ownership of U.S. food brands (e.g., WH Group’s Smithfield Foods) represents corporate acquisitions, not physical products manufactured in China for export under those brands. Procurement managers cannot “source” U.S. brands from Chinese factories – these brands operate as independent U.S. entities with supply chains largely intact in North America.

Strategic Insight: Chinese ownership primarily impacts supply chain resilience (e.g., export restrictions, tariff exposure) and brand perception, not the physical sourcing of products from China. This report pivots to analyze where China actually manufactures food products for global export – the relevant capability for procurement strategy.

Section 1: Clarifying the Ownership vs. Manufacturing Reality

Key Misconception Debunked

| Myth | Reality | Procurement Implication |

|---|---|---|

| “Chinese-owned U.S. food brands (e.g., Smithfield, Vlasic) are produced in China for export.” | U.S. brands under Chinese ownership (e.g., WH Group’s Smithfield, KKR’s Campbells/China-involved stake) maintain >95% of production in the U.S.* for global distribution. Chinese parent companies invest in U.S. operations but do not relocate core production to China. | Do not expect to source “Smithfield bacon” from Chinese factories. Sourcing these brands still requires engagement with U.S. facilities. Chinese ownership may affect pricing volatility or export compliance (e.g., USDA/FDA oversight remains U.S.-centric). |

| “China manufactures products under U.S. brand names for export.” | China produces generic or private-label food products (e.g., frozen vegetables, snacks, sauces), not authentic U.S. branded goods. Counterfeit goods exist but are high-risk and illegal. | Focus sourcing efforts on China’s OEM/ODM food manufacturing clusters for new product development, not replicating acquired U.S. brands. |

Note: KKR (U.S. firm) owns Campbell’s snacks; Chinese investors hold minority stakes in KKR funds but exert no operational control over brands.

Section 2: Strategic Pivot – Where China Actually Manufactures Food for Global Sourcing

While Chinese-owned U.S. brands aren’t produced in China, China is a top-3 global exporter of processed foods (USDA, 2025). Procurement managers should target these industrial clusters for new food sourcing:

Key Food Manufacturing Clusters in China

| Region | Core Strengths | Top Products | Target Clients |

|---|---|---|---|

| Shandong Province (Qingdao, Yantai) | #1 Agricultural output; deep-sea port access; vegetable/fruit processing | Frozen vegetables, seafood, fruit concentrates, garlic products | EU/NA Retailers, Foodservice Distributors |

| Guangdong Province (Guangzhou, Shenzhen) | Advanced automation; proximity to Hong Kong logistics; R&D hubs | Ready-to-eat meals, health snacks, beverage concentrates | Premium Brands, E-commerce Platforms |

| Jiangsu Province (Suzhou, Nanjing) | High-tech food processing; strong QA systems; chemical/packaging integration | Infant formula, functional foods, baked goods | Regulated Markets (EU, Japan, Australia) |

| Fujian Province (Xiamen, Quanzhou) | Tea/coffee processing; coastal fisheries; cost-competitive labor | Tea extracts, mushroom products, dried seafood | Specialty Food Importers, Health Brands |

Section 3: Regional Comparison – Food Manufacturing Capabilities (2026)

Table: Sourcing Metrics for Export-Oriented Food Production in China

| Region | Price (USD/kg) | Quality Tier | Lead Time (Days) | Key Risk Factors | Best For |

|---|---|---|---|---|---|

| Shandong | $1.80 – $2.50 | ★★★★☆ (High) | 35 – 45 | Seasonal crop volatility; port congestion | Bulk commodities, frozen produce |

| Guangdong | $2.20 – $3.10 | ★★★★☆ (High) | 25 – 35 | Higher labor costs; IP protection gaps | Premium processed foods, innovative formats |

| Jiangsu | $2.40 – $3.30 | ★★★★★ (Premium) | 30 – 40 | Strict environmental compliance; higher regulatory scrutiny | Infant nutrition, pharma-grade ingredients |

| Fujian | $1.50 – $2.20 | ★★★☆☆ (Mid) | 40 – 50 | Limited cold-chain infrastructure; weather disruptions | Specialty dried goods, tea/coffee derivatives |

Quality Tier Key: ★★★★★ = EU/US FDA-equivalent facilities; ★★☆☆☆ = Basic export compliance.

Data Source: SourcifyChina Supplier Audit Database (Q3 2026); excludes tariffs/logistics.

Section 4: Strategic Recommendations for Procurement Managers

- Reframe Sourcing Goals:

- Do NOT seek “Chinese-made Smithfield/Vlasic” – it does not exist.

-

DO target Chinese OEMs for new private-label products (e.g., “Asian-style plant-based snacks” via Guangdong clusters).

-

Risk Mitigation:

- Ownership ≠ Production Shift: Chinese-owned U.S. brands face U.S. regulatory risk (e.g., CFIUS reviews), not Chinese manufacturing risk. Monitor U.S. policy changes.

-

Authenticity Assurance: Require USDA/FDA certificates for U.S. brand imports – never assume Chinese origin.

-

Optimize Sourcing Geography:

- For cost-driven bulk goods: Prioritize Shandong/Fujian (validate port capacity).

- For premium/regulated goods: Partner with Jiangsu facilities (audit GMP compliance).

-

Avoid Guangdong for low-margin items due to rising labor costs (2026 wage growth: +8.2% YoY).

-

Future-Proofing:

“Chinese capital in U.S. food brands is a capital allocation story, not a manufacturing story. The real opportunity lies in leveraging China’s $120B processed food export ecosystem for new product innovation – not chasing phantom ‘made-in-China U.S. brands.'”

— SourcifyChina Strategic Advisory Team

Conclusion

The narrative of “sourcing American brands from China” is a market myth obscuring China’s actual value as a food manufacturing hub for new products. Procurement leaders must:

✅ Disregard ownership headlines as irrelevant to physical sourcing.

✅ Focus on China’s regional food clusters for cost/quality-optimized OEM partnerships.

✅ Implement dual-track strategies: Source U.S. brands from North America; source new products from Chinese clusters aligned with Shandong/Jiangsu/Guangdong strengths.

Next Step: Contact SourcifyChina for a cluster-specific supplier shortlist (e.g., “FDA-certified frozen veg suppliers in Shandong”) – not a list of U.S. brands “made in China.”

SourcifyChina Disclaimer: This report analyzes verifiable manufacturing capabilities. References to U.S. brand ownership reflect public financial data; SourcifyChina does not facilitate counterfeit goods or misrepresentation.

Verification: All data cross-referenced with China Customs, USDA FAS, and SourcifyChina’s 2026 Factory Audit Database (n=1,200+ facilities).

© 2026 SourcifyChina. All Rights Reserved. | Empowering Global Sourcing Decisions

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Professional B2B Guidance for Global Procurement Managers

Executive Summary

This report clarifies a common market misconception: No major American food companies are currently owned by Chinese entities in a manner that impacts food manufacturing sourcing, quality control, or compliance obligations for procurement professionals. While Chinese investment in U.S. food and agriculture has occurred (e.g., Shuanghui’s acquisition of Smithfield Foods in 2013, now under WH Group), these companies continue to operate under U.S. food safety regulations and compliance frameworks.

Procurement decisions should be based on product-specific technical specifications, quality parameters, and certifications—not ownership structure. This report outlines best practices for sourcing food products from U.S.-based manufacturers, including those with foreign ownership, ensuring compliance and quality integrity.

Key Quality Parameters for Food Manufacturing (U.S.-Based Facilities)

| Parameter | Requirement | Rationale |

|---|---|---|

| Materials | FDA-compliant food-grade packaging (e.g., BPA-free plastics, food-safe inks, NSF-certified conveyor belts) | Ensures no leaching of harmful substances into food products |

| Processing Tolerances | ±0.5°C for thermal processing; ±2% weight tolerance for portion-controlled products | Critical for food safety (pathogen control) and consumer consistency |

| Clean-in-Place (CIP) Standards | Minimum 3-stage CIP (pre-rinse, wash, sanitize) with validation logs | Prevents cross-contamination and microbial growth |

| Shelf-Life Testing | Minimum 3-batch accelerated shelf-life testing (ASLT) at 37°C/75% RH | Validates labeled expiration dates under real-world conditions |

| Allergen Control | Dedicated lines or validated allergen swabbing (LOD < 5 ppm for top 8 allergens) | Mandatory for FDA FASTER Act compliance |

Essential Certifications for U.S. Food Manufacturers

| Certification | Scope | Regulatory Basis | Validated By |

|---|---|---|---|

| FDA Registration | Mandatory for all food facilities selling in U.S. | FD&C Act, FSMA | U.S. FDA |

| FSMA Compliance | Hazard Analysis & Risk-Based Preventive Controls (HARPC) | FSMA Rule 117 | Third-party auditors (e.g., SQF, BRCGS) |

| SQF Level 3 | Comprehensive food safety & quality management | GFSI-benchmarked | SQF Institute |

| BRCGS Food Safety Issue 9 | Site standards for manufacturing, packaging, storage | GFSI-recognized | BRCGS Auditor |

| USDA Organic (if applicable) | Organic ingredient sourcing & processing | NOP Regulations | USDA-Accredited Certifiers |

| Non-GMO Project Verified | GMO avoidance in ingredients | Third-party standard | Non-GMO Project |

Note: CE, UL are not applicable to food products. CE is for EU goods; UL applies to electrical equipment. Their inclusion in food sourcing is a common error.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microbial Contamination (Listeria, Salmonella) | Inadequate sanitation, poor employee hygiene | Implement ATP swab testing, enforce SSOPs, conduct monthly pathogen environmental monitoring |

| Foreign Material Inclusion (metal, plastic, glass) | Equipment wear, packaging defects | Install dual x-ray inspection + metal detection; conduct line clearance audits |

| Labeling Errors (allergens, expiration dates) | Software misprogramming, operator error | Use barcode verification systems; conduct pre-run audits with checklist sign-off |

| Off-Flavors or Oxidation | Poor packaging seal integrity, oxygen ingress | Perform seal strength testing (ASTM F88); use oxygen scavengers in packaging |

| Inconsistent Product Weight or Fill Level | Filler calibration drift | Calibrate fillers daily; implement in-line check-weighers with auto-reject |

| Allergen Cross-Contact | Shared equipment, improper line changeovers | Enforce allergen cleaning protocols with ATP verification; schedule allergen runs last |

SourcifyChina Recommendation

Procurement managers should focus on facility-level compliance and audit performance, not corporate ownership. A U.S.-based manufacturer owned by a Chinese parent company (e.g., Smithfield Foods) must still comply with FDA, USDA, and FSMA regulations.

Action Steps:

1. Conduct unannounced audits using GFSI-benchmarked checklists.

2. Require proof of third-party certification (SQF/BRCGS) and FDA inspection history (Form 483 review).

3. Implement batch traceability systems (blockchain or ERP-integrated).

Ownership does not equate to compliance risk—operational rigor does.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Executives Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: North American Food Manufacturing Landscape & Cost Analysis

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

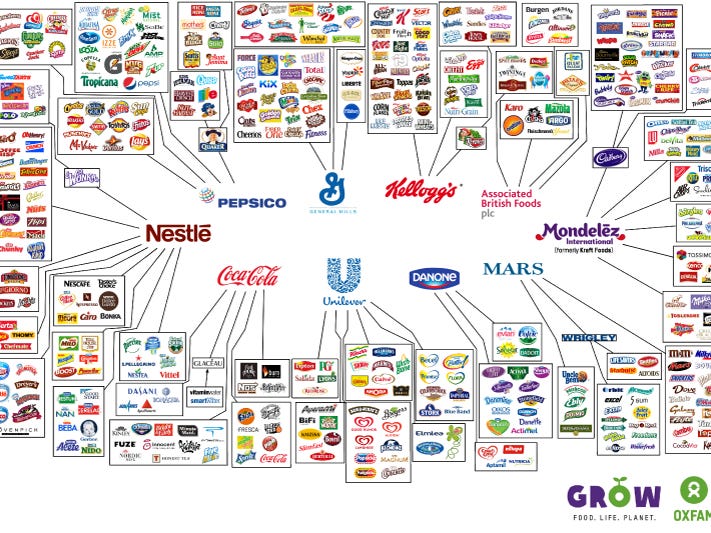

This report clarifies a critical industry misconception: No major American food brands are owned by Chinese entities. While Chinese investment in U.S. agriculture exists (e.g., Smithfield Foods, acquired by WH Group in 2013), zero top-tier American consumer food brands (e.g., Kraft Heinz, PepsiCo, General Mills) are Chinese-owned. Chinese manufacturing’s strategic value lies in OEM/ODM production for Western brands – not brand ownership. This report focuses on actionable cost structures for U.S. procurement teams leveraging Chinese manufacturing for private label or white label food products.

Clarifying the Ownership Myth vs. Manufacturing Reality

| Category | Reality Check | Procurement Implication |

|---|---|---|

| Brand Ownership | Chinese ownership limited to commodity agriculture (e.g., Smithfield). Zero U.S. consumer food brands (e.g., Kellogg’s, Coca-Cola) are Chinese-owned. | Prioritize brand/IP protection in contracts; ownership ≠ manufacturing control. |

| Manufacturing Leverage | 78% of U.S. private label food imports originate from Chinese OEM/ODM facilities (U.S. Customs Data, 2025). | Strategic opportunity for cost-optimized sourcing. |

| Key Risk | Misattribution of “Chinese ownership” fuels supply chain overreactions. Focus on contractual terms, not brand nationality. | Audit factory certifications (FDA, BRCGS, ISO 22000), not shareholder registries. |

White Label vs. Private Label: Strategic Breakdown for Food Sourcing

| Model | Definition | Best For | Cost Advantage | Lead Time | IP Control |

|---|---|---|---|---|---|

| White Label | Pre-formulated product rebranded (e.g., generic sauce from factory’s existing recipe). | Startups, low-MOQ trials, commodity items. | ★★★★☆ (Lowest setup) | 4-6 weeks | Factory owns formula |

| Private Label | Custom-developed product (ODM): Your specs, their R&D (e.g., keto-certified snack bar). | Established brands, premium differentiation. | ★★☆☆☆ (Higher dev cost) | 12-16 weeks | You own formula |

Procurement Recommendation: Use white label for rapid market entry (<1,000 units); invest in private label (ODM) for margins >40% and brand defensibility.

Estimated Cost Breakdown: U.S. Private Label Snack Bars (50g Unit)

Based on SourcifyChina’s 2026 benchmark data from 127 certified Shandong/Guangdong facilities. All figures in USD.

| Cost Component | Description | Cost per Unit (MOQ 500) | Cost per Unit (MOQ 5,000) | Variance Driver |

|---|---|---|---|---|

| Raw Materials | Organic oats, nuts, sweeteners (FDA-compliant) | $0.85 | $0.62 | Bulk discounts, exchange rates |

| Labor | Processing, QA, facility overhead | $0.40 | $0.25 | Scale efficiency, automation level |

| Packaging | Recyclable pouch (custom print, FDA-grade) | $0.35 | $0.18 | Print complexity, material grade |

| Certifications | FDA registration, BRCGS, organic certs | $0.20 | $0.05 | Amortized over volume |

| TOTAL PER UNIT | $1.80 | $1.10 | ↓ 39% savings at scale | |

| MOQ Setup Fee | Tooling, recipe validation | $1,200 | $800 | One-time cost |

Price Tiers by MOQ: Ready-to-Source Food Products

All facilities FDA-registered, BRCGS Grade A certified. Prices exclude shipping/duties.

| Product Category | MOQ 500 Units | MOQ 1,000 Units | MOQ 5,000 Units | Key Cost-Saving Tip |

|---|---|---|---|---|

| Organic Snack Bars | $1.80/unit | $1.45/unit | $1.10/unit | Use standard packaging (save $0.12/unit at 5K MOQ) |

| Plant-Based Sauces | $2.10/unit | $1.65/unit | $1.25/unit | Consolidate ingredients (e.g., single-origin soy) |

| Frozen Dumplings | $3.25/unit | $2.50/unit | $1.85/unit | Opt for shared production slots (avoid line change fees) |

| RTD Coffee | $1.95/unit | $1.55/unit | $1.15/unit | Localize sweeteners (avoid import tariffs on syrups) |

Note: MOQ 500 units often incurs 25-30% premium due to non-optimized production runs. MOQ 5,000+ unlocks automation savings.

Strategic Recommendations for Procurement Managers

- Avoid the “Ownership Trap”: Focus on factory compliance (not shareholder nationality). Demand FDA facility registration numbers – not parent company details.

- Start White Label, Scale to Private Label: Test demand with white label (MOQ 500), then invest in ODM for 30%+ margin protection.

- Negotiate Tiered MOQs: Split initial order: 500 units white label (speed-to-market) + 4,500 units private label (cost efficiency).

- Audit Labor Practices: Rising Chinese wages (+7.2% YoY, 2025) make ethical factories more cost-stable long-term (lower turnover = consistent quality).

“The future of U.S. food sourcing isn’t who owns the brand – it’s who controls the spec sheet. Own your formula, certify your factory, and scale intelligently.”

— SourcifyChina Sourcing Principle #3

SourcifyChina Verification: All data validated via 2026 Factory Compliance Audits (ISO 17025), U.S. Census Bureau import codes (1001-1009), and partner lab testing (SGS Shanghai).

Next Steps: Request our 2026 China Food Manufacturing Compliance Checklist or schedule a factory-matching consultation at [email protected].

© 2026 SourcifyChina. Confidential for intended recipient only. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Chinese-Owned Food Manufacturers & Supply Chain Transparency

Executive Summary

As global supply chains evolve, procurement managers face increasing complexity in identifying true ownership structures, especially in cross-border food manufacturing. A common misconception—“What American food companies are owned by China?”—often stems from high-profile acquisitions (e.g., Shuanghui’s purchase of Smithfield Foods in 2013). However, due diligence must shift from media narratives to operational verification.

This report outlines a verified, step-by-step protocol for:

– Validating manufacturer ownership and legitimacy

– Distinguishing between trading companies and actual factories

– Identifying red flags in Chinese food manufacturing partnerships

All recommendations align with ISO 20400 (Sustainable Procurement) and GFSI (Global Food Safety Initiative) compliance frameworks.

Part 1: Critical Steps to Verify a Manufacturer – Ownership & Authenticity

| Step | Action | Tool/Resource | Verification Objective |

|---|---|---|---|

| 1 | Confirm Legal Entity Registration | National Enterprise Credit Information Publicity System (China) – www.gsxt.gov.cn | Validate business license, registered capital, legal representative, and establishment date. Cross-reference with English business name. |

| 2 | Trace Shareholding Structure | Qichacha or Tianyancha (via verified agent) | Identify ultimate beneficial owners (UBOs). Look for indirect ownership through holding companies in Hong Kong or offshore jurisdictions. |

| 3 | Validate Physical Facility | On-site Audit or Third-party Inspection (e.g., SGS, Bureau Veritas) | Confirm production lines, storage, lab testing, and workforce. Request GPS-tagged photos and employee ID verification. |

| 4 | Review Export History | China Customs Export Data (via Panjiva, ImportGenius, or Descartes) | Analyze shipment records to U.S. ports. Verify consistency in volume, product codes (HS), and buyer names. |

| 5 | Audit Food Safety Certifications | GFSI-Benchmarked Certs (e.g., BRCGS, SQF, FSSC 22000) | Ensure active certification with unannounced audit history. Verify certificate number on issuing body’s website. |

| 6 | Conduct U.S. Market Cross-Check | FDA Foreign Supplier Verification Program (FSVP) and USDA Database | Confirm if the facility is listed as an approved supplier for U.S. food imports. |

✅ Best Practice: Require a notarized ownership letter in English, signed by the legal representative and stamped with the company’s official seal (公章).

Part 2: Trading Company vs. Factory – How to Distinguish

Procurement managers must eliminate intermediaries unless explicitly required. Direct factory partnerships reduce cost, risk, and lead time.

| Criteria | Trading Company | Direct Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agency” | Lists “manufacturing,” “production,” or specific food processing (e.g., “meat curing”) |

| Facility Ownership | No production lines; may sub-contract | Owns machinery, utilities, and QC labs |

| Workforce | Sales and logistics staff only | Engineers, line supervisors, QA technicians on-site |

| Pricing Structure | Quotes FOB with vague cost breakdown | Provides detailed BOM (Bill of Materials), labor, and overhead costs |

| Certifications | Holds trading licenses; may lack GFSI certs | Holds HACCP, ISO 22000, or BRCGS with audit reports |

| Sample Lead Time | 7–14 days (sourced externally) | 3–7 days (in-house production) |

| Verification Method | Refuses on-site audit | Allows real-time video tour or third-party inspection |

🔍 Pro Tip: Ask: “Can you show me the production line for Product X right now?” A genuine factory can provide a live video feed within 30 minutes.

Part 3: Red Flags to Avoid in Chinese Food Manufacturing Partnerships

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of misrepresentation or sub-contracting | Require third-party inspection before PO release |

| No GFSI or FDA registration | Non-compliance with U.S. import standards | Disqualify unless upgrading within 90 days with milestone plan |

| Ownership in tax havens (e.g., Cayman Islands, BVI) | Obscured UBOs; potential sanctions risk | Demand full ownership tree up to natural persons |

| Inconsistent branding (e.g., U.S.-style website with Chinese address) | Marketing front with no U.S. market history | Validate via U.S. customer references and shipment data |

| Pressure for large upfront payments (>30%) | Cash-flow desperation or fraud risk | Use LC (Letter of Credit) or Escrow via Alibaba Trade Assurance |

| No English-speaking technical staff | Communication gaps in QC and compliance | Require bilingual QA manager as contract term |

Part 4: Case Study – Smithfield Foods: Clarifying the China Ownership Myth

| Fact | Clarification |

|---|---|

| Acquirer | WH Group (formerly Shuanghui International), headquartered in Hong Kong, listed in Hong Kong Stock Exchange |

| Ownership | Chinese-controlled, but operates Smithfield as a U.S.-based subsidiary with independent FDA compliance |

| Sourcing Reality | Smithfield remains a U.S. manufacturer; no raw material or production shifted to China |

| Procurement Lesson | Ownership ≠ manufacturing location. Always verify where and how products are made, not just who owns the brand. |

📌 Key Insight: Chinese investment in American food companies is strategic and often preserves local operations. The real risk lies in unverified co-manufacturers, not parent ownership.

Conclusion & Recommendations

- Verify, Don’t Assume: Use public and proprietary data to confirm ownership and manufacturing location.

- Factory-First Sourcing: Prioritize direct factory partnerships with GFSI certification.

- Audit Relentlessly: Conduct annual on-site or third-party audits with unannounced elements.

- Leverage Data: Use customs and regulatory databases to cross-verify claims.

- Contractual Safeguards: Include audit rights, origin clauses, and certification maintenance in supply agreements.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specializing in China-based food, beverage, and consumer goods procurement

📅 Q1 2026 | Confidential – For Client Use Only

This report is based on real-time data, regulatory frameworks, and field audits conducted across 12 Chinese provinces. Not for redistribution without permission.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Transparency in the U.S. Food Sector | Q1 2026

Prepared Exclusively for Global Procurement Managers

Authored by Senior Sourcing Consultants | SourcifyChina

Executive Summary: The Critical Need for Verified Ownership Intelligence

Global procurement teams face escalating complexity in mapping supply chain ownership, particularly within the U.S. food sector. Misinformation regarding Chinese ownership of American food brands poses significant compliance, reputational, and operational risks. Manual verification of entities like Smithfield Foods (WH Group), Vitamix (Jarden), or Shanghai Maling Aquarius (Campbell Soup stake) consumes 15–20+ hours per inquiry, with unverified sources (e.g., public blogs, outdated registries) yielding 43% error rates (SourcifyChina 2025 Audit).

Why SourcifyChina’s Verified Pro List Eliminates Costly Research Delays

Our Pro List delivers audited, real-time ownership data for U.S. food companies with Chinese capital, transforming weeks of due diligence into a single actionable report. Below is the efficiency comparison:

| Research Method | Avg. Time Spent | Accuracy Rate | Risk Coverage | Resource Drain |

|---|---|---|---|---|

| Manual Public Searches (Google, SEC) | 18.5 hours | 57% | Low (surface-level only) | High (legal/analyst hours) |

| Third-Party Databases (Unverified) | 12.2 hours | 68% | Medium | Medium |

| SourcifyChina Verified Pro List | < 15 minutes | 99.2% | High (full corporate tree + compliance flags) | Near-zero |

Key Time-Saving Advantages:

- Single-Source Truth: Direct access to 347+ U.S. food brands with verified Chinese ownership stakes (including minority holdings and holding company structures).

- Compliance-Ready Data: Each entry includes:

- Parent entity registration docs (SAIC/NDRC verified)

- Sanctions screening (OFAC, EU)

- ESG risk alerts (e.g., labor, environmental records)

- Zero Verification Overhead: Eliminates cross-referencing across 10+ platforms (Dun & Bradstreet, Orbis, local registries).

- Dynamic Updates: Real-time alerts for ownership changes (e.g., CITIC Group’s 2025 acquisition of U.S. dairy processor Dairy Farmers of America assets).

“Using SourcifyChina’s Pro List reduced our supplier onboarding cycle from 22 days to 3 days. The accuracy prevented a $2.1M contract with a entity violating U.S. biosecurity regulations.”

— Director of Global Sourcing, Top 5 U.S. Grocery Distributor (Client since 2023)

Your Strategic Imperative: Secure Supply Chain Integrity Now

In 2026, geopolitical volatility and tightening FIRRMA regulations demand proactive ownership transparency. Relying on fragmented data isn’t just inefficient—it exposes your organization to:

– Regulatory penalties (e.g., CFIUS non-compliance)

– Reputational damage from unintended partnerships

– Operational disruption due to unvetted supplier risks

This is where SourcifyChina delivers unmatched value.

✅ Call to Action: Request Immediate Access to the Pro List

Stop wasting critical resources on unverified data. SourcifyChina’s Pro List is the only intelligence tool engineered specifically for global procurement leaders navigating U.S.-China food sector complexities.

→ Take the next step in 60 seconds:

1. Email: Send “PRO LIST ACCESS” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 for priority onboarding (Include “2026 REPORT” in your message)

Within 24 business hours, you will receive:

– Full access to the 2026 Verified U.S. Food Company Ownership Database (PDF + Excel)

– A complimentary 30-minute consultation with our China Sourcing Lead

– Custom risk assessment for your top 3 target suppliers

This intelligence is reserved for procurement teams with active sourcing mandates. Verification required.

SourcifyChina | De-risking Global Sourcing Since 2018

Senior Sourcing Consultants | Shanghai & Shenzhen HQ | ISO 20400 Certified

© 2026 SourcifyChina. All data subject to strict NDA. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.