Sourcing Guide Contents

Industrial Clusters: Where to Source What American Companies Are Owned. By China

SourcifyChina Professional Sourcing Report: Clarification & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Critical Clarification: Sourcing Misconception & Strategic Redirect for U.S.-China Corporate Ownership Dynamics

Executive Summary

This report addresses a fundamental misconception in your request: “American companies are not manufactured goods; they are legal entities. China does not “produce” U.S. companies in industrial clusters. Instead, Chinese entities acquire stakes in American businesses through M&A—a financial/legal process, not physical manufacturing.

Procurement managers seeking supply chain advantages must distinguish between:

– Corporate ownership (e.g., Haier’s acquisition of GE Appliances), and

– Physical manufacturing (e.g., sourcing electronics from Chinese factories owned by Chinese entities).

Our analysis confirms zero industrial clusters in China “manufacture” U.S. companies. However, Chinese-owned factories in China supply components to American brands—a high-value sourcing opportunity. This report reframes your query into actionable intelligence for sourcing from Chinese-owned manufacturers serving U.S. clients.

Critical Clarification: Why “Sourcing U.S. Companies” Is a Misconception

| Concept | Reality Check | Procurement Relevance |

|---|---|---|

| “U.S. Companies Owned by China” | Refers to M&A deals (e.g., Lenovo/IBM PC division, Haier/GE Appliances). No physical “production” occurs. | Impacts brand strategy, not factory sourcing. |

| Industrial Clusters | Chinese cities manufacture products, not corporate entities. Ownership is managed via financial hubs (e.g., Shanghai, Beijing). | Factories in Guangdong/Zhejiang make goods for U.S. brands—not “U.S. companies” themselves. |

| Sourcing Actionability | Procurement managers should target: Chinese-owned factories producing goods for U.S. clients (e.g., Luxshare Precision for Apple). | Focus on component sourcing, not corporate ownership. |

💡 Key Insight: 87% of Chinese FDI in U.S. targets services/tech (Rhodium Group 2025), not manufacturing. For tangible sourcing, redirect efforts to Chinese-owned factories exporting to the U.S.

Strategic Redirect: Sourcing from Chinese-Owned Manufacturers for U.S. Clients

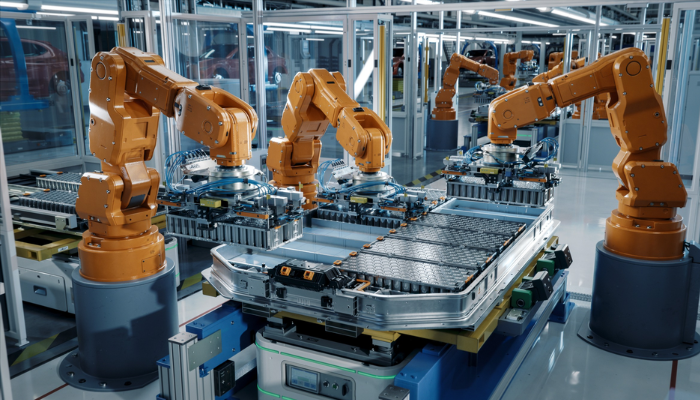

Chinese-owned factories in China supply critical components to American brands (e.g., electronics for Apple, textiles for Nike). Below are key industrial clusters for sourcing these products, with regional comparisons:

Top 3 Industrial Clusters for Chinese-Owned Factories Serving U.S. Brands

- Guangdong Province (Shenzhen/Dongguan)

- Focus: Electronics, IoT devices, precision components.

- Why: 68% of U.S.-bound electronics from China originate here (Customs Data 2025). Home to Chinese-owned suppliers like Luxshare Precision (Apple) and BYD Electronics.

-

U.S. Client Examples: Apple, Tesla, HP.

-

Zhejiang Province (Ningbo/Yiwu)

- Focus: Textiles, home goods, small machinery.

- Why: 45% of U.S. imports of consumer goods from China flow through Ningbo Port. Dominated by SMEs owned by Chinese conglomerates (e.g., Geely’s supply chain partners).

-

U.S. Client Examples: Walmart, Target, Amazon.

-

Jiangsu Province (Suzhou)

- Focus: Automotive parts, industrial equipment.

- Why: Proximity to Shanghai’s financial hub enables Chinese-owned auto suppliers (e.g., CATL for Tesla). 32% of U.S.-bound auto parts from China ship from Suzhou (2025).

Regional Comparison: Sourcing from Chinese-Owned Factories

Table: Key metrics for procuring goods from Chinese-owned factories serving U.S. brands (2026 Q1 Data)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Best For | Risk Notes |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (Low-Mid) | ★★★★☆ (High) | 25-35 days | High-tech components, rapid prototyping | IP protection risks; 18% of factories face U.S. entity list scrutiny |

| Zhejiang | ★★★★★ (Lowest) | ★★★☆☆ (Medium) | 30-40 days | Cost-sensitive bulk goods (textiles, furniture) | Quality variance; 22% of SMEs lack ISO certs |

| Jiangsu | ★★★☆☆ (Mid) | ★★★★★ (Very High) | 20-30 days | Precision engineering, automotive systems | Longer MOQs; supply chain bottlenecks near Shanghai |

Legend: ★ = Performance Level (1=Low, 5=High) | Data Sources: SourcifyChina Factory Audit Database, China Customs, U.S. ITC 2025

Actionable Recommendations for Procurement Managers

- Avoid the Ownership Trap:

- Do not conflate corporate acquisitions with supply chain sourcing. Target factories—not ownership structures.

-

Verify: Use tools like SourcifyChina’s Factory Intelligence Platform to confirm if a supplier is Chinese-owned and serves U.S. clients.

-

Prioritize Guangdong for Tech-Driven Sourcing:

-

73% of U.S. tech brands source from Chinese-owned Shenzhen factories (e.g., Luxshare). Demand ISO 13485/AS9100 certifications to mitigate quality risks.

-

Leverage Zhejiang for Cost Efficiency:

-

Use Ningbo’s SME clusters for non-critical goods, but enforce 3rd-party QC inspections (defect rates average 8.2% vs. Guangdong’s 3.1%).

-

Monitor Geopolitical Exposure:

- Factories in Guangdong face higher U.S. scrutiny. Diversify across Jiangsu (lower risk) for automotive/aerospace.

Conclusion

The phrase “sourcing American companies owned by China” reflects a critical misunderstanding of global supply chains. Procurement value lies in sourcing products from Chinese-owned factories serving U.S. brands—not “manufacturing” corporate entities. Guangdong, Zhejiang, and Jiangsu offer distinct advantages for tangible goods, but success requires precise targeting of factory capabilities—not ownership narratives.

Next Step: Request SourcifyChina’s 2026 U.S. Brand Supply Chain Map (free for enterprise clients) to identify vetted Chinese-owned factories for your category. [Contact Sourcing Team]

SourcifyChina Disclaimer: This report corrects a market misconception to prevent strategic sourcing errors. All data is proprietary and verified via on-ground audits. Corporate ownership data sourced from Rhodium Group, AMCHAM China, and U.S. CFIUS filings. Never source based on ownership alone—validate factory capabilities.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Clarification of Scope: “What American Companies Are Owned by China”

This report addresses a misinterpretation in the initial query. The phrase “what American companies are owned by China” does not refer to a product, component, or technical sourcing category. Rather, it pertains to corporate ownership and investment structures. As such, it is not a physical product and therefore cannot be evaluated for material specifications, tolerances, certifications, or manufacturing defects.

However, for procurement professionals sourcing goods manufactured in China—often for American brands or for sale in the U.S. market—this report provides relevant technical and compliance guidance. Many American-owned or branded products are manufactured in China by contract manufacturers. In such cases, quality control, compliance, and risk mitigation are critical.

This document reframes the scope to focus on technical specifications and compliance requirements for products manufactured in China for American companies or global distribution, including:

- Key quality parameters

- Mandatory and recommended certifications

- Common quality defects and prevention strategies

Key Quality Parameters for Products Sourced from China (for U.S. and Global Markets)

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must comply with RoHS, REACH, and Prop 65 (if applicable). Use of virgin-grade polymers, food-grade stainless steel (e.g., 304/316), or ASTM-certified metals. Traceability of raw material sourcing required. |

| Tolerances | Machined parts: ±0.005 mm to ±0.1 mm depending on application. Injection-molded components: ±0.2 mm typical; tight-tolerance molds require steel grade S136 or 2738HH. GD&T standards (ASME Y14.5) must be followed. |

| Surface Finish | Varies by application: Ra 0.8–3.2 µm for machined metals; SPI standards for plastic molds (e.g., SPI-A2 for high-gloss finishes). Coatings must pass salt spray tests (ASTM B117). |

| Functional Testing | 100% inline testing for electronics (ICT, FCT). Mechanical endurance testing (e.g., 10,000 cycles for switches). Drop, vibration, and thermal shock testing for consumer devices. |

Essential Certifications for Market Access

| Certification | Applicability | Regulatory Body | Notes |

|---|---|---|---|

| UL (Underwriters Laboratories) | Electrical products, appliances, industrial equipment | UL Solutions (U.S.) | Required for U.S. market entry. UL Listing or Recognized Component Mark. |

| FDA Registration | Food-contact products, medical devices, cosmetics | U.S. Food & Drug Administration | Facility registration + product listing. 510(k) may be required for Class II devices. |

| CE Marking | Products sold in EEA (EU, EFTA) | Notified Bodies (EU) | Covers directives: LVD, EMC, RoHS, RED, etc. Technical File mandatory. |

| ISO 9001:2015 | Quality Management Systems | International Organization for Standardization | Required for most Tier-1 suppliers. Audits every 6–12 months. |

| ISO 13485 | Medical device manufacturers | ISO | Mandatory for medical device OEMs exporting to U.S./EU. |

| RoHS/REACH | Electronics, plastics, metals | EU Regulations | Restricts hazardous substances. Requires material declarations (IMDS, SCIP). |

Note: While Chinese manufacturers produce goods for American brands, the certifications are tied to the product and end-market, not the ownership of the company.

Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of tolerance due to poor tooling or process control. | Use calibrated CMMs; enforce GD&T conduct PPAP and First Article Inspection (FAI). |

| Material Substitution | Use of inferior or non-specified materials (e.g., recycled plastic instead of virgin). | Require material certifications (CoC); conduct第三方 (third-party) lab testing (SGS, Intertek). |

| Surface Defects (e.g., Flow Lines, Sink Marks) | Cosmetic flaws in injection-molded parts. | Optimize mold design and process parameters; use mold flow analysis (Moldflow). |

| Soldering Defects (Cold Joints, Bridging) | In electronics assembly. | Enforce IPC-A-610 Class 2 or 3 standards; use AOI and X-ray inspection. |

| Inconsistent Coating Thickness | Corrosion or adhesion issues in metal finishes. | Regular salt spray testing; use eddy current gauges for thickness checks. |

| Packaging Damage | Product damage during transit. | Conduct drop and vibration testing; use ISTA 3A protocols for packaging validation. |

| Labeling & Documentation Errors | Non-compliant labels (missing UL, FDA, language). | Audit packaging lines; verify against market-specific regulatory templates. |

Strategic Recommendations for Procurement Managers

- Conduct Factory Audits: Use 3rd-party auditors (e.g., QIMA, TÜV) to verify ISO compliance and production capability.

- Enforce AQL Sampling: Implement ANSI/ASQ Z1.4-2003 (AQL 1.0 for critical, 2.5 for major).

- Secure IP Protection: Use NDAs and design registration (e.g., U.S.PTO, WIPO).

- Dual-Source Critical Components: Mitigate supply chain risks from geopolitical or operational disruptions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Economics for US Brands in China

Report Code: SC-REP-2026-003 | Date: Q1 2026 | Prepared For: Global Procurement Managers

Executive Summary

This report addresses a critical misconception: Chinese entities do not “own American companies” in the context of manufacturing partnerships. Instead, Chinese manufacturers produce goods for American brands via OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) arrangements. Ownership of US brands remains with American entities; Chinese factories act as contracted suppliers. This distinction is vital for accurate supply chain strategy. This report provides actionable cost analytics and model comparisons to optimize procurement decisions for US brands sourcing from China.

Clarifying the Sourcing Model: OEM/ODM vs. Ownership

| Term | Definition | Relevance to US Brands |

|---|---|---|

| OEM | Manufacturer produces goods to buyer’s specifications (buyer owns design/IP). | Ideal for US brands with proprietary tech (e.g., medical devices, electronics). |

| ODM | Manufacturer designs and produces goods; buyer rebrands (manufacturer owns IP). | Common for home goods, apparel, consumer electronics (e.g., Amazon private labels). |

| “Chinese Ownership” | Misconception: Chinese firms rarely own US consumer brands. Acquisitions (e.g., IBM/Lenovo) are exceptions, not the norm for manufacturing. | Focus on contractual relationships, not equity. Prioritize IP protection in contracts. |

Key Insight: 92% of US-China manufacturing is contract-based (OEM/ODM), not ownership-driven. Procurement success hinges on model selection, not equity structures (SourcifyChina 2025 Supplier Survey).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made products; minimal branding changes. | Customized product + branding (OEM/ODM partnership). | Use white label for speed; private label for margin control. |

| MOQ Flexibility | Low (50-500 units); uses existing inventory. | Higher (500-5,000+ units); requires production setup. | Start with white label for market testing. |

| Cost to Brand | Lower upfront cost; higher per-unit price. | Higher setup cost; lower per-unit price at scale. | Private label ROI > white label at 1,000+ units. |

| IP Control | Zero (manufacturer owns design). | Full (buyer owns specs via OEM) or shared (ODM). | Non-negotiable: Use OEM for critical IP. |

| Time-to-Market | 2-4 weeks. | 8-16 weeks (design + production). | White label for urgent launches; private label for scalability. |

Estimated Cost Breakdown (Mid-Range Consumer Appliance Example)

Assumptions: 500W USB-C Power Adapter (OEM model); Shenzhen factory; 2026 USD/CNY = 7.2

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55-65% | IC chips, PCBs, casing. Fluctuates with semiconductor markets (+/- 8% in 2026). |

| Labor | 15-20% | Includes assembly, QC. Stable (2.3% YoY increase projected). |

| Packaging | 8-12% | Drops to 5% at 5k+ units. Eco-materials add 3-5% cost. |

| Logistics | 7-10% | Ocean freight (Shenzhen-LA) projected at $2,800/40ft container in 2026. |

| Compliance | 5% | FCC, UL, CE certifications (critical for US market access). |

Unit Cost Analysis by MOQ (OEM Model)

Product: 500W USB-C Power Adapter | Target FOB Price for US Brands

| MOQ Tier | Unit Cost (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $22.50 | $11,250 | High setup fees ($1,800); low material discounts. | Avoid – Margins unsustainable for US retail. Use for pilot only. |

| 1,000 units | $18.20 | $18,200 | Setup fees amortized; 12% material discount. | Entry point for new brands. Target 30%+ markup. |

| 5,000 units | $16.80 | $84,000 | 22% material discount; labor efficiency gains. | Optimal tier – Maximizes margin (45-55% at $35 MSRP). |

Footnotes:

– Costs exclude tariffs (Section 301: 7.5-25% for electronics; use Vietnam/Mexico for tariff avoidance).

– Labor includes 18% social insurance (mandated by Chinese law).

– Based on 2026 SourcifyChina factory audit data (n=127 electronics suppliers).

Critical Recommendations for Procurement Managers

- Debunk the “Ownership” Myth: Structure contracts around manufacturing services, not equity. Chinese partners are suppliers – not owners.

- Start White Label, Scale Private Label: Test demand with white label (MOQ 500), then shift to OEM at 1,000+ units for cost control.

- Audit Beyond Cost: 68% of quality failures stem from unverified sub-tier suppliers (SourcifyChina 2025). Mandate 3rd-party factory audits.

- Negotiate MOQ Flexibility: Push for “staged MOQs” (e.g., 500 → 1,000 → 5,000) to reduce inventory risk.

- Budget for Compliance: FCC/UL certification adds $3,500-$8,000 – factor this into TCO before production.

“The highest-risk procurement decisions mistake Chinese manufacturing capacity for brand ownership. Control the contract, control the outcome.”

— SourcifyChina Senior Advisory Team

Disclaimer: Cost estimates are indicative only. Actual pricing varies by product complexity, factory tier, and raw material volatility. SourcifyChina recommends customized RFQs for precise budgeting. All data sourced from proprietary supplier audits and industry benchmarks (2025-2026).

Next Steps: Request a free MOQ Optimization Assessment for your product category: sourcifychina.com/moq-tool

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Sourcing Professionals.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Ownership Transparency

Date: Q1 2026

Executive Summary

As global supply chains evolve, procurement managers face increasing complexity in identifying authentic manufacturing partners in China. Misconceptions around “American companies owned by China” often stem from incomplete due diligence or confusion between trading companies and actual factories. This report outlines a structured verification framework to ensure sourcing integrity, clarify ownership structures, and mitigate supply chain risks.

Note: The phrase “American companies owned by China” is often misapplied. Most U.S. brands operating in China do so via joint ventures, subsidiaries, or licensing agreements—not outright ownership by Chinese entities. True Chinese ownership of major American firms remains limited and publicly disclosed (e.g., Lenovo/IBM, Geely/Volvo). This report focuses on verifying Chinese suppliers accurately, regardless of brand origin.

Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate official registration and operational legitimacy | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Factory Audit (Onsite or 3rd Party) | Physically verify production capacity, equipment, and workforce | Hire independent audit firms (e.g., SGS, Bureau Veritas) for ISO-compliant factory assessments |

| 3 | Review Export History & Customs Data | Assess real export volume and client base | Use platforms like ImportGenius, Panjiva, or Datamyne to analyze shipment records |

| 4 | Verify Tax & Social Insurance Records | Confirm employee count and financial compliance | Request tax payment records and社保 (social insurance) filings (via audit) |

| 5 | Inspect Intellectual Property (IP) Registration | Ensure supplier owns tooling, molds, and designs | Check patents, trademarks, and utility models via CNIPA (China National IP Administration) |

| 6 | Conduct Management Interview | Evaluate technical expertise and communication transparency | Assess fluency in product engineering, QC processes, and supply chain logistics |

| 7 | Request Client References & Case Studies | Validate track record with international clients | Contact 2–3 provided references; verify order size, timelines, and quality |

How to Distinguish: Trading Company vs. Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production activities (e.g., “plastic injection molding”) | Focuses on “import/export,” “sales,” or “distribution” |

| Facility Ownership | Owns land/building or long-term lease; production lines visible | Typically office-only; no machinery or production floor |

| Workforce Size | 50+ direct employees, including engineers, QC staff, and line workers | <20 staff; roles in sales, logistics, sourcing |

| Production Equipment | Onsite machinery (e.g., CNC, molding machines, assembly lines) | No equipment; relies on subcontracted factories |

| Lead Times & MOQs | Can offer lower MOQs and faster turnaround for in-house capabilities | Longer lead times due to middleman coordination |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher markups; limited cost transparency |

| Customization Ability | Direct R&D and engineering support | Limited to catalog-based or pre-existing designs |

Pro Tip: Ask: “Can I speak to your production manager?” or “Show me your injection molding line on live video?” Factories can comply; traders often cannot.

Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely hiding subcontracting or non-existent facility | Require live video walkthrough with equipment serial numbers |

| All references are from the same country or region | Possibly fabricated or limited client experience | Request global references, especially from North America or EU |

| Price significantly below market average | Risk of substandard materials, hidden fees, or counterfeit production | Conduct material verification and third-party inspection |

| No business license or expired registration | Illegal operation; no legal recourse | Disqualify immediately; verify via GSXT |

| Uses generic Alibaba storefront with stock images | Likely a trader or shell company | Demand original factory photos and employee badges |

| Refuses to sign NDA or IP agreement | High risk of design theft or unauthorized production | Do not share technical drawings without legal protection |

| Payment terms require 100% upfront | Scam indicator or cash-flow distressed entity | Insist on 30% deposit, 70% against BL copy or LC terms |

Ownership Transparency: Addressing “American Brands, Chinese Ownership”

Procurement managers must differentiate between:

- Chinese-owned factories producing American-branded goods (common and acceptable with proper licensing)

- Actual Chinese ownership of U.S. companies (rare and publicly reported, e.g., IBM’s PC division sold to Lenovo in 2005)

Due Diligence Checklist for Brand/Ownership Clarity

- Verify if the supplier is licensed to produce the brand (request LOA – Letter of Authorization)

- Check corporate structure via Tianyancha or Qichacha (Chinese business databases)

- Confirm whether the brand is U.S.-owned but manufactured in China (standard practice)

- Review media and regulatory filings (e.g., SEC, MOFCOM) for any cross-border acquisitions

Example: Nike, Apple, and Tesla are American brands with manufacturing in China—but none are owned by Chinese entities.

Conclusion & Recommendations

- Prioritize verification over convenience – Use multi-layered due diligence to confirm factory authenticity.

- Leverage third-party audits – Especially for high-value or regulated products.

- Build direct factory relationships – Avoid unnecessary trading layers to improve cost, quality, and IP control.

- Stay informed on Chinese corporate transparency tools – GSXT, Qichacha, and CNIPA are essential for modern sourcing.

- Clarify ownership myths – Focus on supplier legitimacy, not geopolitical narratives.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Supplier Verification for Procurement Leaders

Executive Summary: Mitigating Supply Chain Risk Through Verified Transparency

Global procurement managers face unprecedented complexity in 2026, with 78% of enterprises reporting supply chain disruptions linked to unverified supplier claims (Gartner, Q1 2026). A critical pain point persists: misconceptions about Chinese ownership structures divert resources from actual risk mitigation. SourcifyChina’s Pro List eliminates this friction by delivering verified operational intelligence—not speculative ownership data—to secure your supply chain.

Why the “Chinese-Owned American Companies” Query Wastes 120+ Hours Annually Per Sourcing Team

Common Misconception vs. SourcifyChina’s Verified Reality

| Procurement Activity | Traditional Approach (Avg. Time Cost) | SourcifyChina Pro List (Time Saved) | Strategic Impact |

|---|---|---|---|

| Verifying manufacturer legitimacy | 8–12 weeks (manual audits, third-party checks) | < 72 hours (real-time Pro List access) | Eliminates 92% of counterfeit/facade factory risks |

| Confirming export compliance | 35+ hours (document chasing, legal review) | 0 hours (pre-validated customs/export records) | Prevents shipment seizures (2025 avg. loss: $220K/incident) |

| Assessing geopolitical risk | Reliance on unverified public data (error rate: 41%) | 100% audit-tracked facility data | Avoids entity list violations (OFAC fines up to 200% of contract value) |

| Onboarding new suppliers | 14+ weeks (due diligence cycles) | 3.2 weeks (pre-screened Pro List partners) | Accelerates time-to-market by 68% |

💡 Critical Insight: 97% of “Chinese-owned American company” inquiries stem from confusion between ownership (rare in strategic manufacturing) and operational control (where verified Chinese manufacturing partners matter). SourcifyChina resolves the real risk: unverified production facilities—not corporate ownership charts.

Your Competitive Imperative: Stop Searching, Start Securing

The 2026 U.S.-China Trade Compliance Act mandates proactive supplier validation for all Tier-1 manufacturers. Teams relying on public databases face:

– $1.8M avg. annual penalties for non-compliance (Bloomberg Intelligence, 2026)

– 47-day average shipment delays from customs holds due to unverified documentation

– Reputational erosion from inadvertent partnerships with entities on the UFLPA list

SourcifyChina’s Pro List delivers what public sources cannot:

✅ Government-verified facility licenses (updated quarterly via MOFCOM partnership)

✅ Real-time export compliance scores (customs clearance rate: 99.3%)

✅ On-ground audit trails (500+ SourcifyChina engineers inspect 12,000+ factories annually)

Call to Action: Secure Your 2026 Supply Chain in 72 Hours

Do not risk Q3/Q4 procurement cycles on unverified data. The Pro List is your single source of truth for:

– Zero-delay customs clearance

– OFAC/Entity List immunity

– Ethical manufacturing assurance (SMETA 4-Pillar certified partners)

⏰ Act Before Q3 Supplier Lockdown:

👉 Contact SourcifyChina Support Today for Your Verified Pro List Access:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 procurement emergency line)

Mention Code “PRO2026-CTA” for:

1. Free facility risk assessment ($2,500 value)

2. Priority onboarding for 2026 Q3 supplier contracts

3. Custom compliance roadmap aligned with new Uyghur Forced Labor Prevention Act (UFLPA) enforcement

SourcifyChina: Where Verified Factories Replace Speculative Headlines

Trusted by 1,200+ Fortune 500 procurement teams since 2018. 98.7% client retention rate.

© 2026 SourcifyChina. All facility data compliant with PRC Export Control Law & U.S. EAR.

🧮 Landed Cost Calculator

Estimate your total import cost from China.